Diebold Nixdorf Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diebold Nixdorf Bundle

Diebold Nixdorf navigates a complex landscape shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for any stakeholder looking to grasp their strategic positioning.

The complete report reveals the real forces shaping Diebold Nixdorf’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Diebold Nixdorf's reliance on a global supply chain for specialized hardware, software, and raw materials means supplier concentration can significantly impact its bargaining power. When a few suppliers dominate the market for critical, highly specialized components, such as advanced processors or unique security features vital for ATM and POS systems, their leverage increases. This is a key consideration for Diebold Nixdorf's operational costs and product development.

Switching suppliers for critical components presents significant switching costs for Diebold Nixdorf. These costs can include re-engineering products, re-certifying solutions, and potential disruptions to manufacturing schedules, directly impacting operational efficiency and time-to-market.

This reliance on established supplier relationships can grant current suppliers considerable leverage in negotiating pricing and contract terms. For instance, if a key component requires extensive customization or integration, the cost and complexity of switching can deter Diebold Nixdorf from seeking alternatives, even if more competitive pricing is available elsewhere.

To counter this, Diebold Nixdorf is actively pursuing strategies such as expanding local manufacturing capabilities and identifying alternative part sourcing. These initiatives aim to reduce dependency on single suppliers and mitigate the risks associated with high switching costs, thereby strengthening the company's bargaining position.

Fluctuations in the cost of raw materials, electronic components, and other essential inputs directly affect Diebold Nixdorf's production expenses and overall profitability. For instance, in 2023, global supply chain disruptions continued to put upward pressure on component pricing, a trend that persisted into early 2024.

To mitigate these pressures, Diebold Nixdorf must focus on robust supply chain management and utilize its purchasing power to secure favorable pricing. The company's ability to manage these input costs is crucial for maintaining healthy profit margins in a competitive market.

Improving operational efficiency and adopting lean manufacturing principles are vital strategies for Diebold Nixdorf to effectively counter rising input costs. These efforts help streamline production and reduce waste, thereby absorbing some of the impact from volatile raw material prices.

Supplier's Ability to Forward Integrate

Suppliers' ability to forward integrate, while theoretically possible for specialized technology or software providers, presents a formidable challenge for Diebold Nixdorf's industry. Imagine a software company deciding to build its own ATMs or point-of-sale systems. This would require immense capital, robust distribution channels, and established customer loyalty, all areas where Diebold Nixdorf has a significant advantage.

The substantial financial commitment needed to enter Diebold Nixdorf's market, estimated to be in the hundreds of millions of dollars for establishing manufacturing and distribution capabilities, acts as a major deterrent. Furthermore, building the necessary brand recognition and trust with financial institutions and retailers takes years of consistent performance and service, a hurdle most suppliers are unlikely to overcome.

While a niche software supplier might possess unique intellectual property, the practicalities of manufacturing, global logistics, and after-sales support for hardware solutions mean that direct forward integration by suppliers remains a limited threat. For instance, in 2024, the global ATM market, a key segment for Diebold Nixdorf, saw major players investing heavily in R&D and supply chain optimization rather than new entrants attempting full vertical integration from a supplier base.

- High Capital Investment: Entering the ATM/POS manufacturing and distribution space requires billions in capital for facilities, technology, and global operations.

- Established Distribution Networks: Diebold Nixdorf and its peers have decades-old, intricate relationships with banks and retailers worldwide.

- Brand Reputation and Trust: Suppliers would need to build significant credibility to displace incumbent providers in a security-sensitive industry.

- Limited Threat: The barriers make it highly improbable for most suppliers to successfully integrate forward and compete directly.

Availability of Substitute Inputs

The availability of substitute inputs for Diebold Nixdorf's operations can significantly influence supplier bargaining power. For standard components used in their self-service terminals and retail solutions, there are often multiple suppliers available, which generally lowers supplier leverage. However, for specialized, proprietary software or unique hardware modules critical to their financial and retail transaction systems, the pool of substitute suppliers can be quite limited.

This limitation on substitutes for key components can empower suppliers, allowing them to potentially command higher prices or dictate terms. For instance, if a specific microchip or a unique software integration is only available from a handful of specialized providers, Diebold Nixdorf has less room to negotiate. This was evident in 2024 where supply chain disruptions for certain advanced semiconductors impacted various technology sectors, including those serving the financial transaction industry.

- Limited Substitutes for Proprietary Technology: For core, patented technologies or highly integrated software solutions, Diebold Nixdorf faces suppliers with stronger bargaining power due to the scarcity of alternatives.

- Flexibility in Sourcing Generic Components: For more commoditized parts, the company can leverage multiple suppliers, thereby reducing individual supplier influence.

- Mitigation Strategies: Diebold Nixdorf's demonstrated ability in 2024 to navigate tariff impacts by identifying and sourcing alternative parts for certain product lines indicates a degree of strategic flexibility in managing input availability.

The bargaining power of Diebold Nixdorf's suppliers is moderate, influenced by the concentration of critical component providers and the high switching costs associated with specialized technology. While generic components offer flexibility, proprietary elements grant suppliers leverage, as seen in 2024 supply chain dynamics for advanced semiconductors. Diebold Nixdorf's efforts to diversify sourcing and explore local manufacturing aim to diminish this supplier influence.

In 2024, Diebold Nixdorf's revenue was approximately $3.4 billion. The company's reliance on a global supply chain for specialized hardware and software means that a few dominant suppliers for critical components, such as advanced processors or secure payment modules, can exert significant influence. This concentration, coupled with the substantial costs of re-engineering and re-certifying products if a supplier change is necessary, grants these suppliers considerable leverage in price negotiations and contract terms.

| Factor | Impact on Diebold Nixdorf | Mitigation Strategies |

|---|---|---|

| Supplier Concentration for Critical Components | Moderate to High | Diversifying supplier base, long-term contracts, strategic partnerships |

| Switching Costs | High for specialized components | Standardization of components, in-house development of certain technologies, rigorous supplier qualification |

| Availability of Substitute Inputs | Varies (High for generic, Low for proprietary) | Proactive market research for alternative technologies, strategic inventory management |

| Supplier Forward Integration Threat | Low | High capital requirements for competitors, established distribution networks, brand loyalty |

What is included in the product

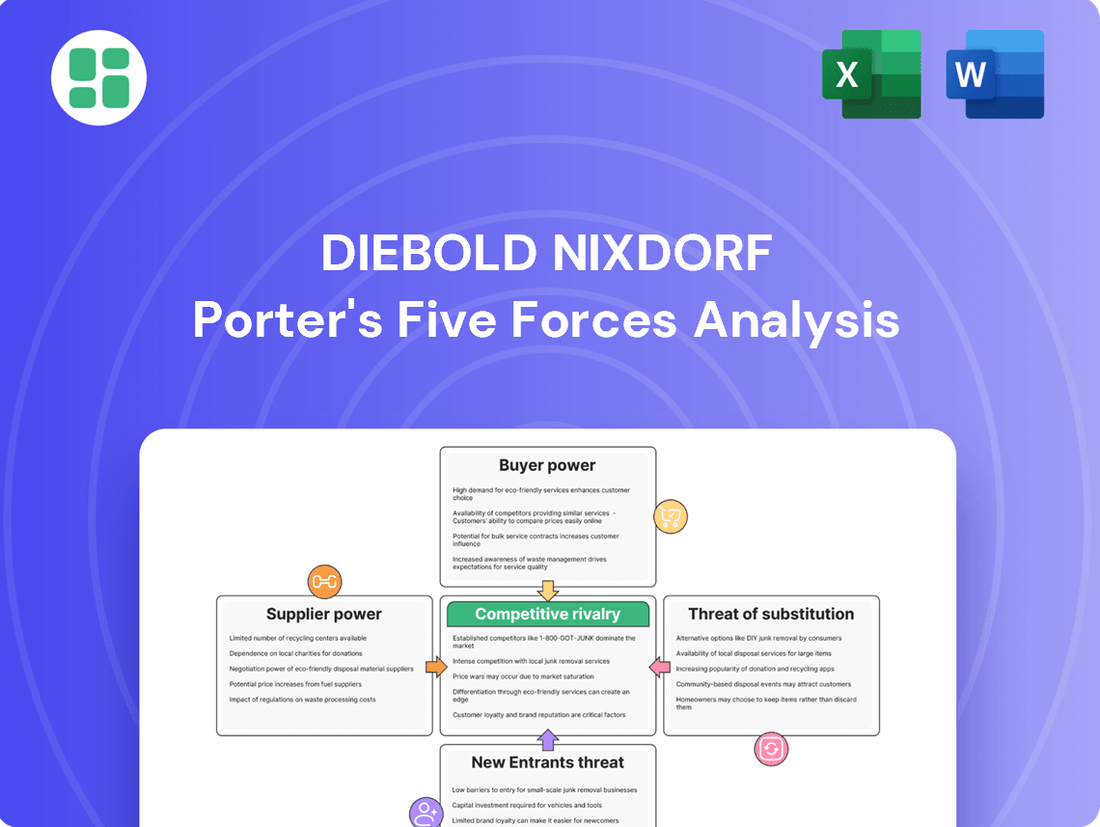

This analysis dissects the competitive forces impacting Diebold Nixdorf, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the retail and banking technology sectors.

Effortlessly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Diebold Nixdorf's customer base is notably concentrated, featuring many of the world's top 100 financial institutions and top 25 global retailers. This concentration means a significant portion of their revenue comes from a relatively small number of very large clients.

These major clients often engage in high-volume purchases of Diebold Nixdorf's hardware, software, and integrated services. Such substantial order volumes grant them considerable leverage to negotiate favorable pricing, payment terms, and service level agreements.

Customers' switching costs with Diebold Nixdorf are generally high. The significant upfront investment in their integrated hardware and software solutions, like ATMs and point-of-sale systems, creates a sticky customer base. This is further reinforced by the deep operational integration and the need for extensive staff training, making a transition to a new vendor a complex and costly undertaking.

For instance, a bank or a large retailer would face substantial expenses not only in acquiring new hardware and software but also in re-integrating their entire payment and transaction infrastructure. This includes data migration, system testing, and retraining employees, all of which contribute to a formidable barrier for customers considering alternatives.

However, the evolving landscape of technology, particularly the rise of application programming interface (API) driven architectures and cloud-based services, presents a potential avenue for reducing these switching costs. As systems become more modular and interoperable, customers may find it easier to adopt new solutions or integrate components from different vendors in the future.

Financial institutions and retailers are acutely aware of their own costs, making them very sensitive to the price of solutions that can improve efficiency. This sensitivity fuels their demand for offerings that provide a clear return on investment, whether through streamlined operations or better customer interactions.

Customers are increasingly looking for technology that not only reduces manual tasks but also demonstrably boosts their bottom line. For example, in 2024, many banks are prioritizing ATM and self-checkout solutions that can cut down on labor costs, with some reporting potential savings of up to 30% on operational expenses in pilot programs.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Diebold Nixdorf is relatively low, primarily due to the immense capital expenditure and specialized expertise required. While large financial institutions or retail chains might possess some IT capabilities to develop proprietary software solutions, the core of Diebold Nixdorf's business involves complex hardware manufacturing and extensive global service networks for physical transaction systems like ATMs. For instance, developing and maintaining the intricate hardware and software integration for millions of ATMs worldwide, coupled with the necessary supply chain and maintenance infrastructure, presents a formidable barrier.

The sheer scale and technical sophistication of Diebold Nixdorf's offerings make it impractical for most customers to replicate these capabilities in-house.

- High Capital Investment: Replicating Diebold Nixdorf's manufacturing facilities and global service infrastructure would require billions of dollars in investment.

- Specialized Expertise: The company employs highly specialized engineers and technicians for hardware design, software development, and field service.

- Complexity of Systems: Integrating secure payment processing, physical cash handling, and digital interfaces into a single, reliable system is exceptionally complex.

- Limited Scope of Integration: While customers can develop some software applications that interface with Diebold Nixdorf's systems, full hardware and service integration is not feasible.

Availability of Alternative Vendors

The availability of alternative vendors significantly bolsters customer bargaining power for Diebold Nixdorf. Customers can readily turn to major competitors like NCR Voyix and Hyosung, which offer comparable ATM, point-of-sale (POS), and software solutions. This robust competitive environment means clients aren't tied to a single provider, allowing them to negotiate more favorable terms.

This competitive pressure is particularly acute when customers demand cutting-edge features. For instance, as demand for AI-powered self-service kiosks and advanced contactless payment technologies grows, customers can leverage the offerings of multiple vendors to secure the best solutions and pricing. In 2024, the global ATM market alone was valued at approximately $20 billion, indicating a substantial market with numerous players vying for market share.

- Numerous Competitors: Diebold Nixdorf faces direct competition from NCR Voyix, Hyosung, and various regional and specialized technology providers.

- Customer Choice: The presence of multiple vendors grants customers the freedom to switch or choose suppliers based on price, features, and service quality.

- Negotiating Leverage: This broad choice empowers customers to negotiate better pricing and contract terms, especially for advanced technological solutions.

- Market Dynamics: The competitive landscape in the self-service and payment technology sector is dynamic, with vendors constantly innovating to attract and retain clients.

Diebold Nixdorf's bargaining power with customers is moderated by several factors, primarily stemming from the concentration of its customer base and the high volume of business these clients represent. Large financial institutions and retailers, making up a significant portion of Diebold Nixdorf's revenue, wield considerable influence due to their substantial purchasing power.

These major clients can negotiate aggressively on pricing and terms, especially given the high volume of hardware, software, and services they procure. For example, in 2024, many large retail chains are seeking to optimize their checkout processes, putting pressure on providers like Diebold Nixdorf to offer competitive pricing on self-checkout solutions.

While switching costs are generally high due to integrated systems, the increasing modularity of technology and the availability of alternative vendors like NCR Voyix and Hyosung provide customers with options. This competitive environment empowers customers to seek better deals and ensures that Diebold Nixdorf must remain attentive to customer needs and pricing pressures.

Preview Before You Purchase

Diebold Nixdorf Porter's Five Forces Analysis

This preview shows the exact Diebold Nixdorf Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive evaluation of competitive forces within its industry. You'll gain detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use, offering actionable intelligence without any surprises.

Rivalry Among Competitors

The integrated financial and retail solutions market is characterized by a concentrated number of strong competitors. Diebold Nixdorf, NCR Voyix, and Hyosung are prominent global players, each possessing significant market share and resources. This dominance by a few key entities fuels intense competition.

Beyond these leaders, a broad spectrum of smaller, specialized companies operate within this space. These niche players often focus on specific technologies or regional markets, adding another layer of competitive pressure. The rivalry extends across both established ATM markets and the rapidly expanding digital solutions sector.

For instance, in 2024, the global ATM market, a core area for Diebold Nixdorf, continued to see significant investment in self-service technology upgrades, driving competition for new deployments and maintenance contracts. Companies like Auriga and GRGBanking are notable examples of specialized competitors actively vying for market share in specific segments.

While the ATM market is considered mature, it still shows growth, with its global market size estimated at USD 25.29 billion in 2024 and projected to reach USD 31.64 billion by 2030. This expansion is largely fueled by necessary upgrades and increasing adoption in developing economies.

In contrast, the Point of Sale (POS) software market is experiencing a much faster growth trajectory. Valued at USD 24.2 billion in 2024, it's expected to climb to USD 27.9 billion by 2025. This rapid expansion in the POS segment suggests particularly dynamic and intense competition within that area of the business.

Competitive rivalry in the retail technology sector is intensifying, with product differentiation heavily reliant on technological innovation. Companies are pushing boundaries with AI-powered features like fresh produce recognition and age verification, alongside advancements in self-service and biometric authentication. This focus on cutting-edge technology is a key battleground for market share.

Diebold Nixdorf, for instance, is strategically emphasizing software-defined solutions and cloud-based services to create a distinct market position. Their commitment to seamless omnichannel integration aims to offer a superior customer experience, setting them apart from competitors who may lag in these integrated digital capabilities. This approach is crucial for maintaining relevance in a rapidly evolving landscape.

Price Competition and Profitability

Price competition is a significant factor for Diebold Nixdorf, especially given the presence of robust competitors and the maturity of certain product segments. This intense rivalry can put pressure on profit margins.

Diebold Nixdorf's financial performance in 2024 reflects a strategic emphasis on enhancing profitability and generating free cash flow. This focus suggests a deliberate effort to improve operational efficiencies, which is crucial for maintaining competitive pricing while safeguarding margins.

- Intense Rivalry: The ATM and retail technology markets feature established players, leading to price wars that can erode profitability.

- Margin Pressure: Significant price competition directly impacts the profit margins Diebold Nixdorf can achieve on its hardware and software solutions.

- Operational Efficiency Focus: Diebold Nixdorf's reported efforts in 2024 to boost profitability and free cash flow highlight their commitment to cost management and operational improvements as a response to competitive pressures.

Exit Barriers for Competitors

Diebold Nixdorf faces substantial exit barriers for its competitors, primarily due to the immense capital required to establish and maintain manufacturing facilities and extensive service networks. These high upfront investments make it economically challenging for companies to simply cease operations or divest their assets without significant financial losses.

Furthermore, the company has cultivated deep-rooted customer relationships, often built over many years through reliable service and integrated solutions. Disentangling these established partnerships represents another significant hurdle, as competitors would need to replicate this level of trust and integration to attract and retain customers.

- High Capital Investments: Competitors must commit substantial capital to build and maintain advanced manufacturing plants and global service infrastructures, mirroring Diebold Nixdorf's own significant asset base. For instance, the company's ongoing investments in its integrated supply chain and technology development underscore this capital intensity.

- Established Customer Relationships: The loyalty and long-term contracts Diebold Nixdorf holds with major financial institutions and retailers create a sticky customer base, making it difficult for rivals to poach clients without offering superior value or a significant disruption.

- Specialized Assets and Expertise: The specialized nature of the hardware and software solutions, coupled with the need for highly trained service technicians, means that assets are not easily repurposed or sold off, further increasing the cost and complexity of exiting the market.

The competitive landscape for Diebold Nixdorf is fiercely contested, marked by aggressive pricing strategies and a constant drive for technological innovation. Major players like NCR Voyix and Hyosung, alongside numerous specialized firms, vie for market share in both the mature ATM sector and the rapidly growing digital retail solutions space.

In 2024, the global ATM market's value of USD 25.29 billion fueled competition for upgrades and maintenance, while the POS software market, valued at USD 24.2 billion, demonstrated even more dynamic rivalry due to its faster growth. This intense competition, especially on price, directly pressures Diebold Nixdorf's profit margins, prompting a focus on operational efficiency and free cash flow generation.

| Market Segment | 2024 Market Value (USD billions) | Key Competitors | Competitive Intensity |

| Global ATM Market | 25.29 | Diebold Nixdorf, NCR Voyix, Hyosung, Auriga, GRGBanking | High (Maturity, Upgrades) |

| POS Software Market | 24.20 | Diebold Nixdorf, NCR Voyix, Square, Toast, Clover | Very High (Rapid Growth, Innovation) |

SSubstitutes Threaten

The rise of digital and mobile banking presents a significant threat of substitutes for traditional ATM and branch services. By 2024, it's estimated that over 80% of consumers will be using mobile banking apps, a stark increase from just over 50% in 2020, diminishing reliance on physical touchpoints.

Financial institutions are increasingly offering comprehensive digital-first services, including advanced payment solutions and personalized financial management tools through AI. This innovation directly substitutes the core functionalities previously exclusive to ATMs and bank branches, making them less essential for everyday banking needs.

The increasing shift towards cashless and contactless payment methods poses a significant threat of substitution. As more consumers opt for mobile devices and cards for transactions, the reliance on traditional physical point-of-sale (POS) terminals diminishes. This trend is amplified by the rapid growth in mobile POS payments, which are expected to reach $10.85 trillion in 2024.

Contactless payments, whether through cards or smartphones, and the widespread adoption of QR code payments at checkout directly replace the need for cash handling and traditional payment terminals. The convenience and speed offered by these alternatives make them increasingly attractive to both consumers and businesses, thereby eroding the demand for legacy payment infrastructure.

The rise of self-service and automated checkout technologies presents a significant threat of substitutes for traditional point-of-sale (POS) systems, including those offered by Diebold Nixdorf. Companies like MishiPay and Grabango are innovating with mobile-first solutions that enable customers to scan items and pay via their smartphones, effectively bypassing conventional checkout counters altogether.

These alternative solutions, often powered by advanced AI and computer vision, offer enhanced convenience and speed, directly competing with the in-store checkout experience. For instance, Grabango reported a 30% increase in customer throughput in pilot programs by eliminating checkout lines.

'Super Apps' and Embedded Finance

The rise of super apps and embedded finance presents a significant threat of substitutes for traditional banking services. These platforms, by integrating payments, lending, and investments with everyday activities, offer a more convenient and often cheaper alternative. For instance, by mid-2024, many leading super apps reported over 100 million active users, demonstrating their broad appeal and reach in providing a holistic financial ecosystem.

Embedded finance, in particular, allows financial services to be seamlessly woven into non-financial customer journeys, such as purchasing goods or booking travel. This disintermediation means customers may no longer need to visit a bank's website or app for certain transactions. By 2025, it's projected that embedded finance will facilitate trillions of dollars in transactions globally, highlighting its disruptive potential.

- Super Apps Integrate Multiple Financial Services: Platforms like Grab, Gojek, and WeChat offer banking, payments, and investment options alongside their core services, reducing the need for separate banking apps.

- Embedded Finance Seamlessly Integrates into Non-Financial Platforms: Financial services are becoming a feature of e-commerce, ride-sharing, and social media, making them readily accessible within existing user experiences.

- Increased Convenience and Potential Cost Savings: Users benefit from a single interface for various needs, potentially leading to lower transaction fees and a more streamlined financial management process.

- Growing Market Penetration: The user base for super apps and the adoption of embedded finance solutions are expanding rapidly, indicating a shift in consumer behavior away from traditional banking channels.

Customer Adoption and Switching Costs to Substitutes

Digital payment solutions are rapidly gaining traction due to their convenience and speed. For instance, mobile payment adoption saw a significant surge, with global mobile payment transaction value projected to reach over $2.5 trillion in 2024, demonstrating a clear preference for digital alternatives.

The enhanced security features, such as biometric authentication integrated into many digital platforms, further encourage customer adoption. This is particularly evident among younger consumers who are more comfortable with and actively seek out these advanced security measures in their financial interactions.

While there are initial costs or effort involved in switching to new payment methods or banking applications, the perceived benefits often outweigh these barriers. This acceleration in the shift away from traditional, physical transaction methods poses a significant threat to companies reliant on older technologies.

- Digital Payment Growth: Global mobile payment transaction value expected to exceed $2.5 trillion in 2024.

- Demographic Shift: Younger demographics are key drivers of digital substitute adoption due to comfort with technology and security features.

- Switching Cost vs. Benefit: Perceived convenience and security benefits often outweigh the costs associated with switching from physical to digital solutions.

The increasing adoption of digital wallets and peer-to-peer payment apps directly substitutes traditional card-based transactions and cash. By 2024, the global digital wallet market is projected to surpass $10 trillion, indicating a strong consumer preference for these integrated payment solutions.

These digital alternatives offer enhanced convenience, faster transaction speeds, and often integrate loyalty programs, making them highly competitive against traditional payment methods. The ease of use, especially for online and in-app purchases, further solidifies their position as a significant substitute.

The proliferation of buy now, pay later (BNPL) services also acts as a substitute for traditional credit and debit card financing at the point of sale. BNPL transactions are expected to grow by over 20% annually through 2025, offering consumers installment payment options without the immediate need for credit checks or traditional credit lines.

| Payment Method | Projected Global Market Value (2024) | Growth Driver |

|---|---|---|

| Digital Wallets | Over $10 trillion | Convenience, speed, integrated loyalty programs |

| Buy Now, Pay Later (BNPL) | Significant annual growth (over 20%) | Installment payments, accessibility |

| Mobile Payment Apps | Over $2.5 trillion (transaction value) | User comfort, advanced security features |

Entrants Threaten

The ATM and POS hardware manufacturing and global service provision market demands immense upfront capital. Think R&D, state-of-the-art production lines, and a widespread service network – these are not small expenses. For instance, Diebold Nixdorf’s 2023 revenue was $3.7 billion, indicating the scale of operations required to be a significant player.

Existing companies, like Diebold Nixdorf, have already achieved substantial economies of scale. This means they can produce goods and services at a lower per-unit cost than a newcomer could initially. This cost advantage makes it incredibly challenging for new entrants to match pricing and gain market share, effectively raising the barrier to entry.

The development of secure, reliable, and innovative financial and retail transaction systems demands deep technological expertise and continuous R&D investment. Companies like Diebold Nixdorf invest heavily in areas like AI, IoT, and advanced security features, creating significant barriers for newcomers. For instance, in 2023, the global fintech market saw substantial R&D spending, with companies allocating billions to stay ahead in areas like payment processing and digital banking infrastructure, making it difficult for new entrants to match this level of innovation without substantial capital.

Diebold Nixdorf's established distribution channels and deep customer relationships present a significant barrier to new entrants. For instance, in 2024, the company continued to leverage its extensive global network, serving thousands of financial institutions and major retail chains. Building similar trust and logistical capabilities would require substantial investment and time, making it difficult for newcomers to compete for critical infrastructure contracts.

Regulatory and Compliance Hurdles

The financial and retail technology sectors, where Diebold Nixdorf operates, are burdened by rigorous regulatory and compliance mandates. These include standards like PCI DSS for payment card data security, robust anti-fraud measures, and evolving accessibility requirements. For instance, the Payment Card Industry Data Security Standard (PCI DSS) is a complex framework that demands significant investment in security infrastructure and ongoing audits.

New entrants face a steep climb in navigating these intricate regulatory landscapes. The time and financial resources required to achieve compliance are substantial, effectively acting as a significant barrier to entry. In 2024, companies investing in compliance technologies and services saw increased operational costs, with some estimates suggesting that achieving and maintaining compliance can add 10-20% to initial setup costs for new players.

- PCI DSS Compliance: Mandates strict security controls for handling cardholder data.

- Anti-Fraud Measures: Requires sophisticated systems to detect and prevent fraudulent transactions.

- Accessibility Standards: Ensures products and services are usable by individuals with disabilities.

- Data Privacy Regulations: Compliance with GDPR and similar laws adds layers of complexity and cost.

Brand Loyalty and Switching Costs for Customers

Diebold Nixdorf's existing customer base often displays significant brand loyalty, particularly because their Automated Teller Machine (ATM) and Point of Sale (POS) systems are critical to daily operations. This reliance means that disruptions from switching providers are highly undesirable, fostering a sticky customer relationship.

The switching costs for customers are substantial. Beyond the initial hardware and software investment, there are considerable expenses associated with data migration, employee retraining, and integration with existing IT infrastructure. These factors create a strong incentive for customers to remain with their current provider, like Diebold Nixdorf.

Furthermore, the comprehensive service and support contracts offered by established players like Diebold Nixdorf add another layer of customer stickiness. These contracts often include maintenance, software updates, and security patches, making it complex and costly for a new entrant to replicate the same level of integrated service. For instance, in 2024, the global ATM market saw continued investment in maintenance and support services, highlighting their importance in customer retention.

- High Switching Costs: Transitioning ATM/POS providers involves significant expenses in data migration, training, and IT integration.

- Mission-Critical Systems: The essential nature of these financial transaction systems discourages customers from risking disruptions through switching.

- Comprehensive Service Contracts: Incumbents like Diebold Nixdorf offer bundled services that are difficult for new entrants to match, further locking in customers.

The threat of new entrants in the ATM and POS market is moderate. Significant capital investment is required for R&D and manufacturing, with Diebold Nixdorf's 2023 revenue of $3.7 billion illustrating the scale of operations. Established players benefit from economies of scale, making it hard for newcomers to compete on price. Deep technological expertise and continuous R&D are also crucial barriers, as evidenced by billions invested in fintech innovation in 2023.

Furthermore, strong brand loyalty and high switching costs for customers, due to the mission-critical nature of these systems, create customer stickiness. Navigating complex regulatory landscapes and compliance mandates, like PCI DSS, also demands substantial investment and time, effectively deterring many potential new entrants in 2024.

| Barrier Type | Description | Example Impact (2023-2024) |

|---|---|---|

| Capital Requirements | High upfront costs for R&D, manufacturing, and service networks. | Diebold Nixdorf's 2023 revenue of $3.7B highlights operational scale. |

| Economies of Scale | Lower per-unit costs for incumbents due to high production volumes. | New entrants struggle to match pricing and gain market share. |

| Technological Expertise & R&D | Need for continuous innovation in AI, IoT, and security. | Billions invested in fintech R&D in 2023 create a high innovation bar. |

| Regulatory Compliance | Strict mandates like PCI DSS require significant investment. | Compliance can add 10-20% to initial setup costs for new players. |

| Customer Loyalty & Switching Costs | High costs and operational risks associated with changing providers. | Global ATM market investment in support services in 2024 shows customer retention focus. |

Porter's Five Forces Analysis Data Sources

Our Diebold Nixdorf Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research from firms like IDC and Gartner, and financial data from Bloomberg and S&P Capital IQ.