Diebold Nixdorf Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diebold Nixdorf Bundle

Curious about Diebold Nixdorf's strategic product portfolio? Our BCG Matrix analysis reveals their Stars, Cash Cows, Dogs, and Question Marks, offering a crucial snapshot of their market position. Don't just guess where their future growth lies; purchase the full report for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

The DN Series® Self-Service Checkouts with AI Integration are positioned as Stars in the BCG Matrix. Diebold Nixdorf holds the second-largest global share in self-service checkouts, with a commanding 40% in the EMEA region. This strong market presence in a rapidly expanding sector, fueled by retailer investments in automation, highlights their Star status.

The integration of AI, such as Vynamic Smart Vision, for tasks like shrink reduction and age verification, further solidifies their position. This innovation taps into the growing demand for retail automation and loss prevention solutions, with European and North American retailers actively increasing deployments of these advanced technologies.

Diebold Nixdorf's Next-Generation DN Series® ATMs are positioned as Stars in the BCG Matrix. While the broader ATM market sees moderate expansion, these advanced machines, featuring cash recycling, contactless capabilities, and biometric security, are driving significant growth within the banking technology sector.

The company's success is evident in major contract wins across the U.S., Asia-Pacific, Brazil, and the Middle East for these innovative ATMs. This widespread adoption highlights their strong market reception and Diebold Nixdorf's leadership in this high-potential niche, crucial for banks modernizing their customer service channels.

Diebold Nixdorf's Vynamic Retail Platform is a cloud-native software solution designed to unify retail operations, from customer interactions to back-office processes. This platform is strategically positioned within a burgeoning retail cloud market, which is projected to grow at a compound annual growth rate of 13.6% for cloud platforms specifically for point-of-sale systems.

Given the accelerated digital transformation among retailers, Diebold Nixdorf's significant investments in cloud-based software, including advanced AI functionalities, firmly place the Vynamic Retail Platform as a high-potential offering. This positions the company to capitalize on the expanding demand for integrated, intelligent retail solutions in a dynamic market landscape.

AI-Powered Retail Anti-Shrink and Efficiency Solutions

Diebold Nixdorf is making significant strides in the retail technology sector with its AI-powered anti-shrink and efficiency solutions. Their Vynamic Smart Vision is a prime example, designed to tackle critical issues like shoplifting and ensure compliance through age verification. This focus positions them squarely in a high-growth segment of the market.

The company's commitment to these innovative solutions is underscored by their active pilot programs. Over 60 retail partners globally are currently testing these AI-based checkout systems, signaling substantial market demand and early adoption. This widespread testing highlights the practical application and potential impact of their technology on retail operations.

- Market Focus: AI-driven solutions for shrink reduction and operational efficiency in retail.

- Pilot Program Scale: Engaged with over 60 retail partners worldwide for AI-based checkout solutions.

- Competitive Advantage: Integration capabilities with existing in-store retail infrastructure.

- Growth Area: Targeting the expanding market for loss prevention and efficiency technologies.

Strategic Service Agreements for New Deployments

Strategic service agreements for new deployments are crucial for Diebold Nixdorf's growth, particularly as they roll out their DN Series ATMs and self-checkout systems. These multi-year contracts for maintenance, monitoring, and software support are designed to generate consistent, high-margin revenue. This focus is expected to drive significant gross margin expansion in 2025, building on the sequential improvement seen in Q4 2024 service revenue.

- Recurring Revenue Stream: Multi-year service agreements provide a predictable and stable income source, enhancing financial forecasting.

- High Profitability: These contracts typically carry higher gross margins compared to hardware sales, directly contributing to profitability.

- Customer Retention: Bundling service with new hardware fosters deeper customer relationships and reduces churn.

- Market Leadership: Supporting advanced technologies with robust service solidifies Diebold Nixdorf's position in the banking and retail sectors.

Diebold Nixdorf's AI-powered retail solutions, like Vynamic Smart Vision, are positioned as Stars. These systems address critical retail challenges such as shrink reduction and age verification, tapping into a high-growth market segment. With over 60 retail partners globally engaged in pilot programs, the demand and adoption of these AI-driven technologies are clearly demonstrated.

The company's strategic focus on multi-year service agreements for its advanced ATMs and self-checkout systems is also a key driver of its Star positioning. These agreements, encompassing maintenance, monitoring, and software support, are designed to generate consistent, high-margin revenue. This strategy is expected to significantly boost gross margins, building on the positive trends observed in late 2024.

| Product/Service | BCG Category | Market Growth | Market Share | Key Differentiator |

|---|---|---|---|---|

| DN Series® Self-Service Checkouts (AI Integrated) | Star | High (Retail Automation) | 2nd Largest Global Share, 40% EMEA | AI for shrink reduction, age verification |

| Next-Generation DN Series® ATMs | Star | Moderate (Banking Tech) | Strong Adoption (Global Contracts) | Cash recycling, contactless, biometrics |

| Vynamic Retail Platform | Star | High (Retail Cloud) | Significant Investment | Cloud-native, AI-enabled, unified operations |

| AI-Powered Anti-Shrink & Efficiency Solutions (Vynamic Smart Vision) | Star | High (Loss Prevention) | 60+ Pilot Partners | AI for shoplifting and compliance |

| Strategic Service Agreements | Star | High (Recurring Revenue) | Growing Focus | Multi-year support, high-margin |

What is included in the product

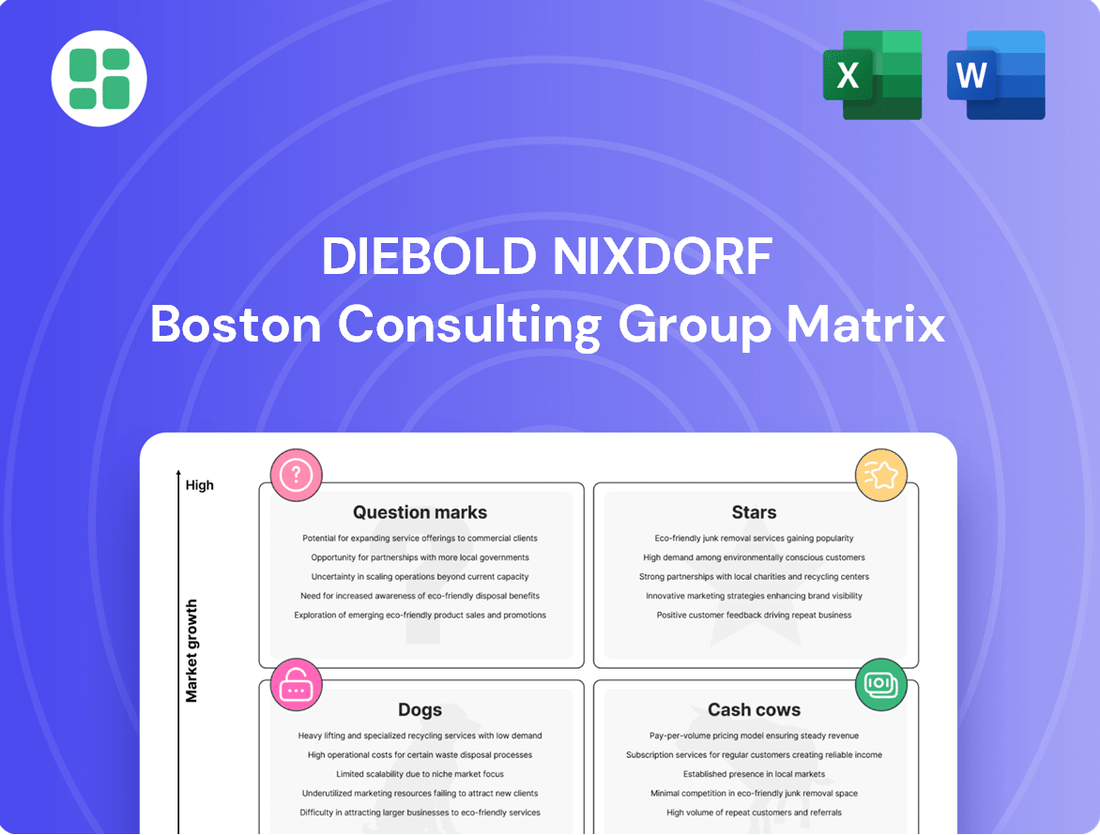

This overview details Diebold Nixdorf's product portfolio across the BCG Matrix, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

A clear BCG Matrix visualizes Diebold Nixdorf's portfolio, easing the pain of resource allocation and strategic decision-making.

Cash Cows

Traditional ATM hardware sales and installation represent a significant Cash Cow for Diebold Nixdorf. The company holds a commanding 32% share of the global ATM market, a sector experiencing steady, albeit moderate, annual growth of approximately 4.2%. This dominance in a mature market translates into a reliable and substantial revenue stream.

Even with slower growth in new installations, Diebold Nixdorf benefits from a large existing customer base. This installed base drives consistent demand for replacement hardware and essential upgrades, ensuring a predictable and robust cash flow for the company.

Legacy Point-of-Sale (POS) terminal hardware represents a significant Cash Cow for Diebold Nixdorf. The global POS terminal market is projected to reach USD 121.35 billion by 2025, indicating its substantial size.

Despite the shift towards newer technologies, the demand for traditional, fixed POS terminals remains robust in many established retail environments. Diebold Nixdorf's strong market position in this mature segment allows it to generate stable, predictable revenue streams with relatively low investment needs.

Diebold Nixdorf's vast global network of installed ATMs and point-of-sale (POS) systems is a significant source of recurring revenue. This revenue stream comes from essential maintenance contracts, cash management solutions, and other managed services that financial institutions and retailers rely on daily.

These service offerings are highly profitable and provide stable cash flow because they address the continuous operational requirements of their clientele. For instance, in 2024, the company continued to emphasize its managed services portfolio, aiming to solidify its position as a reliable partner for businesses.

While the market for new installations might not be experiencing explosive growth, Diebold Nixdorf is strategically focusing on enhancing the efficiency of these existing services. The goal for 2025 is to boost gross margins and overall profitability by streamlining operations within this established business segment.

Standard On-Premise Banking Software Solutions

Diebold Nixdorf's standard on-premise banking software solutions represent a significant cash cow. These established systems, while not experiencing rapid market expansion, are crucial for the daily operations of a vast number of financial institutions. In fact, a substantial portion of the world's top 100 banks rely on these deeply integrated platforms.

The revenue generated from these solutions is remarkably stable, stemming from ongoing licensing agreements, essential support services, and regular update packages. This consistent income stream requires very little additional capital investment for Diebold Nixdorf to maintain its market position, allowing it to function as a reliable profit engine.

- Established Market Presence: Embedded in the operations of a majority of the world's top 100 banks.

- Stable Revenue Streams: Consistent income from licensing, support, and software updates.

- Low Investment Needs: Minimal new capital required for market maintenance and expansion.

- Profit Generation: Acts as a steady and reliable generator of cash for the company.

Physical Security Products (Traditional Safes and Vaults)

Diebold Nixdorf holds a significant position in the physical security products market, specifically in traditional safes and vaults. This segment operates within a mature industry, characterized by more modest growth compared to their cutting-edge technology offerings. Despite slower growth, the company's long-standing presence and strong relationships with financial institutions and businesses mean there's a consistent need for their physical security solutions, generating reliable income.

- Market Position: Diebold Nixdorf is a key player in the safes and vaults sector.

- Market Characteristics: This segment is mature with lower growth rates.

- Revenue Stability: Established client relationships ensure steady demand for physical security infrastructure.

- Financial Contribution: This area provides stable revenue and contributes to overall cash flow with minimal need for new investment.

Diebold Nixdorf's managed services for its extensive installed base of ATMs and POS systems are prime cash cows. These services, including maintenance, cash management, and software support, generate predictable, recurring revenue. In 2024, the company continued to emphasize these offerings, solidifying its role as a critical operational partner for financial institutions and retailers.

The company's legacy on-premise banking software also functions as a cash cow. These deeply integrated platforms, relied upon by many top global banks, provide stable income through licensing, support, and updates with minimal new investment. This segment acts as a consistent profit engine for Diebold Nixdorf.

Traditional ATM hardware sales and installation, despite moderate market growth of around 4.2% annually, remain a significant cash cow due to Diebold Nixdorf's 32% global market share. The large installed base also fuels demand for upgrades and replacement parts, ensuring a predictable revenue stream.

| Business Segment | BCG Category | Key Characteristics | 2024/2025 Outlook |

| ATM Hardware & Installation | Cash Cow | 32% global market share, steady 4.2% annual growth, mature market. | Continued stable revenue from existing installed base and replacement parts. |

| Managed Services (ATM/POS) | Cash Cow | Recurring revenue from maintenance, support, cash management. High profitability. | Emphasis on strengthening this portfolio for reliable cash flow. |

| Legacy On-Premise Banking Software | Cash Cow | Stable income from licensing, support, updates. Low investment needs. | Reliable profit engine, essential for top global banks. |

| POS Terminals (Traditional) | Cash Cow | Robust demand in established retail. Global POS market projected USD 121.35B by 2025. | Stable, predictable revenue with low investment requirements. |

What You See Is What You Get

Diebold Nixdorf BCG Matrix

The Diebold Nixdorf BCG Matrix preview you are viewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive document, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis of Diebold Nixdorf's product portfolio.

Dogs

Obsolete or phasing-out hardware models, such as older ATM and POS units, represent the Dogs in Diebold Nixdorf's BCG Matrix. These products are increasingly being superseded by the company's DN Series® and cloud-connected solutions, indicating a decline in their market relevance and future potential.

These legacy systems often face diminishing demand in new installations, holding a low market share for current deployments. Furthermore, their ongoing support and maintenance costs can outweigh the revenue they generate, making them less profitable compared to newer offerings.

Diebold Nixdorf's strategic focus on modernizing its product lines, including investments in new production for advanced self-service technologies, underscores the company's move away from these older hardware models. This strategic shift is a key indicator of their classification as Dogs within the BCG framework.

Within Diebold Nixdorf's portfolio, niche, non-strategic physical security offerings represent products that are highly specialized or commoditized. These items often struggle to differentiate themselves in a crowded market, facing significant pressure from smaller, agile competitors. For instance, certain basic CCTV systems or traditional lock mechanisms might fit this description.

These offerings typically exhibit low market share and minimal growth potential, acting as potential drains on resources. In 2024, the physical security market, while growing, is increasingly driven by integrated solutions and smart technology. Products that don't align with these trends, such as standalone, older-generation hardware, could be categorized here, potentially contributing less than 5% to Diebold Nixdorf's overall revenue stream if they are indeed considered 'Stars' or 'Cash Cows' in other segments.

Unsupported Legacy Software Suites represent Diebold Nixdorf's Dogs. These are older, proprietary applications not integrated into the strategic Vynamic platform or slated for replacement by cloud-native solutions. For instance, as of 2024, Diebold Nixdorf continues its multi-year plan to migrate customers from these older systems, a process that involves significant investment and customer support.

These legacy systems often serve a shrinking customer base, demanding substantial maintenance for minimal returns. Their continued operation hinders Diebold Nixdorf's strategic focus on digital transformation and cloud enablement, creating a drag on resources and innovation efforts.

Geographic Markets with Declining Infrastructure Investment

Certain geographic markets are characterized by declining infrastructure investment, particularly in areas where financial institutions and retailers are scaling back on physical branches and traditional self-service technologies. These regions often present limited growth prospects for companies like Diebold Nixdorf, especially if their market share is already low. For instance, some developed European nations have seen a slowdown in ATM deployment as digital banking gains traction. In 2023, ATM cash withdrawal volumes in several European countries continued a downward trend, signaling a reduced need for new physical infrastructure.

These 'Dog' segments within the BCG matrix represent markets where Diebold Nixdorf’s investment in physical infrastructure solutions may yield minimal returns due to reduced customer spending. The effort required to maintain a competitive presence in these declining markets could outweigh the potential benefits, leading to a drain on resources.

- Declining ATM Deployments: Some mature markets in Western Europe experienced a net decrease in ATM installations in 2023, with reports indicating a reduction of over 2% year-on-year.

- Shift to Digital Banking: Increased adoption of mobile banking and contactless payments reduces the reliance on physical touchpoints, impacting demand for traditional self-service hardware.

- Low Market Share: In regions with a strong incumbent presence or where Diebold Nixdorf has not historically focused its efforts, market share is likely to be low, exacerbating the challenge of growth.

Non-Upgradable First-Generation Self-Service Units

Non-Upgradable First-Generation Self-Service Units, in the context of Diebold Nixdorf's BCG Matrix, represent products with low market share and low market growth. These are essentially legacy systems, such as early ATMs or point-of-sale terminals, that are no longer cost-effective to update with current technologies like AI or contactless payment capabilities. Their inability to adapt to evolving consumer demands and industry trends significantly limits their future growth potential.

These units often require continued investment for maintenance and support, yet they fail to generate substantial revenue or contribute to the company's strategic objectives. This makes them potential cash traps. For instance, Diebold Nixdorf's 2023 annual report highlighted ongoing efforts to manage its installed base of older hardware, with a focus on migrating customers to newer, more capable solutions.

- Limited Future Growth: Due to technological obsolescence, these units cannot be enhanced with AI or contactless features.

- High Support Costs: Ongoing maintenance for these older systems can become disproportionately expensive relative to their revenue generation.

- Strategic Disconnect: They do not align with the industry's shift towards connected commerce and advanced self-service solutions.

- Potential Cash Traps: Continued investment in these units drains resources without contributing to future growth or innovation.

Diebold Nixdorf’s legacy hardware, such as older ATM and POS units, are classified as Dogs. These products have low market share and low growth potential, often superseded by newer, cloud-connected solutions. For example, in 2023, Diebold Nixdorf continued efforts to migrate customers from these older systems, as noted in their annual reports.

These legacy systems are costly to maintain and generate diminishing returns, representing potential cash traps. Their inability to integrate with modern technologies like AI or contactless payments limits their future viability, making them a strategic disconnect from the company's focus on digital transformation.

The market for basic physical security items, like standalone CCTV systems, can also be considered Dogs if they lack integration or smart technology. In 2024, this segment faces pressure from more advanced solutions, and products not aligning with this trend could hold a minimal market share, potentially less than 5% of revenue.

Diebold Nixdorf's strategic shift towards advanced self-service technologies and cloud solutions means these older hardware models are being phased out, reflecting their low market relevance and future potential.

Question Marks

Emerging digital banking solutions from Diebold Nixdorf, extending beyond traditional ATMs, are positioned as potential stars or question marks in a BCG-like matrix. These innovations, such as advanced Interactive Teller Machines (ITMs) and streamlined digital onboarding platforms, aim to fundamentally change customer interactions, reflecting the broader surge in digital banking adoption.

While the digital banking sector is booming, Diebold Nixdorf's specific advanced offerings in this space, like sophisticated ITMs or comprehensive digital onboarding tools, may currently hold a relatively low market share. This is despite their high growth potential as financial institutions increasingly prioritize digital transformation and customer experience.

These forward-looking digital solutions represent key investment areas for Diebold Nixdorf, characterized by uncertain but potentially substantial future returns. Strategic decisions regarding significant investment to capture market share or a more cautious approach are crucial for navigating this high-growth, high-potential segment of the financial technology market.

Diebold Nixdorf's new cloud-based ATM management platforms, launched in May 2024, represent a significant technological advancement. These platforms offer real-time monitoring and optimization capabilities, a key feature in the evolving ATM managed services sector.

While the overall ATM managed services market is robust, the specific market share for these newly introduced cloud-based solutions is still developing. This positions them as potential Stars within the BCG Matrix, contingent on future adoption rates.

Currently, these innovative platforms require substantial investment for development and market penetration, indicating they are in a cash-consuming phase. Their future classification as Stars depends on their ability to capture significant market share and generate substantial revenue growth in the coming years.

Diebold Nixdorf is actively investing in advanced technologies such as AI, Machine Learning, and the Internet of Things (IoT) to drive digital transformation within the retail sector. These investments are aimed at developing solutions for sophisticated retail analytics, proactive equipment maintenance, and creating more personalized customer journeys.

Solutions that harness these cutting-edge, data-centric capabilities represent a high-growth segment for Diebold Nixdorf. For instance, the global retail analytics market was projected to reach over $10 billion by 2024, indicating substantial potential.

Despite this potential, Diebold Nixdorf's current market share in these specialized, data-driven areas may still be relatively modest when compared to established analytics firms. This positions these advanced retail analytics and IoT solutions as potential stars, requiring substantial investment to build a stronger market presence and capitalize on their high growth prospects.

Expansion into New Niche Retail Verticals (e.g., Healthcare POS)

Expanding into niche retail verticals like healthcare presents a significant opportunity for Diebold Nixdorf. The point-of-sale (POS) market within healthcare is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 14.1%.

If Diebold Nixdorf is actively developing and deploying its POS or self-service solutions in these specialized areas, such as healthcare, these initiatives would be classified as Stars or Question Marks in the BCG Matrix, depending on their current market share and growth trajectory within those specific niches.

- Healthcare POS Market Growth: The healthcare sector's POS market is a high-growth area, demonstrating a 14.1% CAGR.

- Strategic Expansion: Entering and scaling in these niche markets signifies a strategic move towards future revenue streams.

- BCG Matrix Classification: Successful penetration into these high-growth, potentially low-market-share verticals positions these ventures as potential Stars or Question Marks.

- Adaptation is Key: Diebold Nixdorf's ability to tailor its existing POS and self-service technologies to the unique demands of healthcare will be crucial for success.

Mobile POS Systems

Mobile POS systems represent a burgeoning segment within the broader payments landscape. The global mobile POS market is expected to experience robust growth, with projections indicating a compound annual growth rate (CAGR) of 28.3% between 2025 and 2033. This expansion is largely fueled by the increasing consumer preference for digital and contactless payment methods.

While Diebold Nixdorf operates within the overall POS market, its specific penetration and strategic focus on the rapidly evolving mobile POS sector, particularly for small and medium-sized businesses (SMBs), may currently be limited. This presents a significant growth opportunity.

- Market Growth: The mobile POS market is poised for substantial expansion, with a projected CAGR of 28.3% from 2025 to 2033.

- Key Driver: Demand for digital and contactless payment solutions is the primary catalyst for this market's growth.

- Diebold Nixdorf's Position: The company's market share and investment in this high-growth mobile POS segment, especially for SMBs, could be relatively nascent.

- Strategic Opportunity: This segment offers a clear avenue for strategic investment to capture significant market share.

Question Marks in Diebold Nixdorf's BCG Matrix represent business units or product lines with low market share in high-growth markets. These ventures require careful consideration regarding investment, as their future success is uncertain but potentially significant. Diebold Nixdorf's emerging digital banking solutions and advanced retail analytics, for example, fit this description, demanding strategic capital allocation to foster growth and market penetration.

| Business Unit/Product Line | Market Growth Rate | Relative Market Share | BCG Classification | Strategic Implication |

| Emerging Digital Banking Solutions | High | Low | Question Mark | Requires significant investment to gain market share. |

| Advanced Retail Analytics (AI/ML/IoT) | High | Low | Question Mark | Potential for high returns if market penetration is achieved. |

| Mobile POS Systems (for SMBs) | High | Low | Question Mark | Opportunity to capture a growing segment with focused investment. |

BCG Matrix Data Sources

Our Diebold Nixdorf BCG Matrix leverages a blend of financial reports, market share data, industry growth rates, and competitor analysis to provide a comprehensive view of their product portfolio.