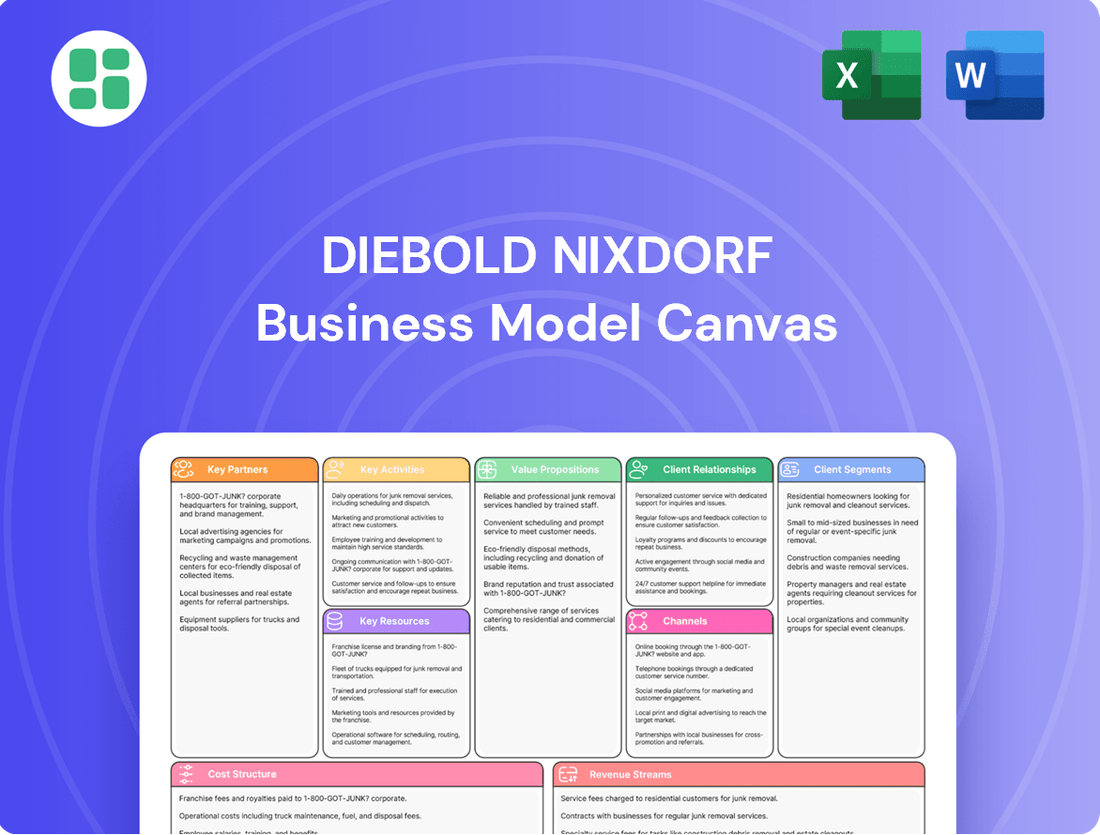

Diebold Nixdorf Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diebold Nixdorf Bundle

Unlock the strategic blueprint of Diebold Nixdorf's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear picture of their market dominance. Discover the key partnerships and cost structures that fuel their operations.

Partnerships

Diebold Nixdorf collaborates with diverse technology providers to source essential hardware components, robust software platforms, and specialized solutions. These partnerships are crucial for integrating innovations like AI-powered recognition systems into their retail offerings, thereby maintaining a competitive edge in self-service technologies.

These strategic alliances ensure that Diebold Nixdorf's product portfolio, including ATMs, point-of-sale (POS) systems, and physical security devices, benefits from the latest advancements. For example, in 2024, the company continued to emphasize partnerships for advanced sensor technologies and secure payment processing modules to enhance the functionality and security of their hardware.

Diebold Nixdorf's collaborations with global payment networks like Visa and Mastercard, alongside financial transaction processors such as Adyen and Fiserv, are fundamental. These partnerships ensure their ATMs and point-of-sale (POS) terminals can process transactions securely and efficiently. For instance, in 2024, the global digital payments market was projected to reach over $10 trillion, highlighting the immense transaction volume these networks handle.

Diebold Nixdorf relies heavily on its network of resellers and distributors to broaden its market presence, especially in areas where direct sales are less practical or local knowledge is crucial. These partners are instrumental in accessing niche customer groups and specific geographic territories, thereby enhancing the global distribution and support for Diebold Nixdorf's offerings.

Service and Maintenance Partners

Diebold Nixdorf relies on a robust network of local service and maintenance partners to deliver comprehensive global support for its self-service systems. These collaborations are essential for ensuring high system availability and rapid response times for critical operations. In 2024, Diebold Nixdorf continued to expand its reach through these partnerships, aiming to improve on its already strong service delivery metrics.

These partnerships are crucial for executing installations, performing necessary repairs, and conducting preventative maintenance, all of which directly impact client operational continuity. The effectiveness of this network directly contributes to Diebold Nixdorf's ability to meet its service level agreements and maintain high levels of customer satisfaction across diverse markets.

- Global Reach: Local partners provide on-the-ground expertise for installations and repairs worldwide.

- Rapid Response: Partnerships enable quick service calls, minimizing downtime for clients.

- Operational Continuity: Essential for ensuring ATMs and other self-service systems remain functional.

- Service Level Agreements: Vital for meeting contractual obligations and maintaining client trust.

Strategic Alliances with Financial Institutions and Retailers

Diebold Nixdorf cultivates key partnerships with leading financial institutions and prominent global retailers. These collaborations are crucial for co-developing innovative solutions and facilitating system integration, actively supporting clients' digital transformation initiatives.

These strategic alliances frequently manifest as long-term agreements, featuring customized solutions designed to meet the specific and evolving requirements of their clientele. This approach solidifies Diebold Nixdorf's position as a valued partner. For instance, their partnership with bp showcases this, encompassing operational services and retail technology integration.

These partnerships are vital for Diebold Nixdorf's ecosystem, enabling:

- Co-development of cutting-edge financial and retail technologies.

- Seamless integration of complex systems for enhanced operational efficiency.

- Long-term revenue streams through tailored service agreements and support.

- Access to extensive client networks for market penetration and feedback.

Diebold Nixdorf's Key Partnerships are foundational to its business model, enabling access to critical technologies, expanding market reach, and ensuring robust service delivery. These alliances span technology providers, payment networks, resellers, and major financial institutions and retailers.

In 2024, Diebold Nixdorf continued to strengthen its relationships with technology partners to integrate advancements like AI into its self-service solutions. Collaborations with payment networks and processors are vital for secure and efficient transaction processing, a market segment exceeding $10 trillion globally in 2024.

The company also leverages a wide network of resellers and local service partners to ensure global market penetration and high-quality customer support, crucial for maintaining operational continuity and meeting service level agreements.

Strategic alliances with financial institutions and retailers, such as the ongoing partnership with bp, focus on co-developing innovative solutions and integrating complex systems, driving digital transformation and long-term revenue.

What is included in the product

A detailed breakdown of Diebold Nixdorf's strategy, outlining its key customer segments, value propositions, and revenue streams within the financial and retail technology sectors.

This model provides a clear view of how Diebold Nixdorf delivers integrated hardware, software, and services to its global client base, focusing on digital transformation and operational efficiency.

The Diebold Nixdorf Business Model Canvas offers a structured approach to visualize and refine their complex service offerings, thereby alleviating the pain point of operational complexity.

By providing a clear, one-page overview of their value proposition and customer segments, the canvas helps Diebold Nixdorf tackle the challenge of communicating their integrated solutions effectively.

Activities

Diebold Nixdorf's commitment to Research and Development is central to its strategy, with significant investments fueling innovation in self-service transaction systems, software, and security. This focus ensures the creation of cutting-edge ATMs, POS terminals, and software solutions designed to meet dynamic market needs and technological shifts.

The company actively develops next-generation technologies, including AI-powered retail solutions, to stay ahead of evolving customer expectations and industry trends. This R&D effort is geared towards enhancing the functionality, security, and user experience of their product portfolio, positioning them for future growth.

Diebold Nixdorf's manufacturing and supply chain management is central to its operations, involving the production of its core hardware like ATMs and point-of-sale systems. This global network ensures these critical devices reach financial institutions and retailers worldwide efficiently.

The company oversees a complex supply chain, sourcing components and assembling finished products in key locations such as Germany, Ohio in the United States, Brazil, and India. This distributed manufacturing footprint allows for optimized production costs and responsiveness to regional market demands.

In 2023, Diebold Nixdorf continued to invest in its manufacturing capabilities, aiming to streamline production processes and enhance product quality. The company's ability to manage this intricate global supply chain is vital for meeting the ongoing demand for its secure and reliable payment solutions.

A fundamental activity for Diebold Nixdorf involves the continuous development and seamless integration of software solutions. These solutions are designed to bridge the gap between a customer's digital interactions and their physical experiences within financial institutions and retail environments.

This encompasses the creation of robust operating systems for their Automated Teller Machines (ATMs) and sophisticated point-of-sale (POS) software. A key offering in this area is Vynamic Connection Points, a platform aimed at significantly improving user experience and streamlining financial operations for their clients.

In 2024, Diebold Nixdorf continued to emphasize software innovation, with a significant portion of their research and development investments directed towards enhancing their integrated software portfolios. This focus aims to deliver more intuitive and efficient customer journeys, a critical factor in the evolving retail and banking landscape.

Installation and Field Service

Diebold Nixdorf’s installation and field service are cornerstones of its customer support, ensuring their self-service systems, including ATMs and point-of-sale devices, operate smoothly. This global service network is vital for maintaining the performance and uptime of a vast installed base. In the first quarter of 2025, the company saw a positive trend, with service revenue within its Banking segment experiencing growth.

- Installation Services: Diebold Nixdorf offers comprehensive installation for its diverse range of self-service technologies, ensuring a seamless deployment for clients.

- Field Service and Maintenance: Ongoing field service and proactive maintenance are provided to guarantee optimal performance and minimize downtime for critical client operations.

- Global Service Network: A robust, worldwide service infrastructure supports the extensive installed base of ATMs and POS systems, crucial for customer reliability.

- Revenue Growth: The Banking segment reported an increase in service revenue during Q1 2025, highlighting the financial importance of these activities.

Sales and Marketing

Diebold Nixdorf drives growth through robust sales and marketing, targeting financial, retail, and commercial sectors worldwide. Their strategy includes direct sales teams and strategic partnerships to reach new clients and solidify market position.

The company actively participates in major industry gatherings, such as the NRF Big Show, to showcase its innovative, integrated solutions. This visibility is crucial for engaging potential customers and demonstrating their value proposition in a competitive landscape.

- Customer Acquisition: Focused efforts to attract new clients across key industries.

- Market Expansion: Broadening global reach within financial, retail, and commercial markets.

- Event Participation: Showcasing integrated solutions at prominent industry events like the NRF Big Show.

- Partner Engagement: Leveraging reseller and technology partner networks to amplify sales reach.

Diebold Nixdorf's key activities revolve around innovation and customer support. They invest heavily in research and development for self-service systems and software, ensuring their products are cutting-edge. Manufacturing and supply chain management are critical for producing and distributing ATMs and POS systems globally. Software development, including platforms like Vynamic Connection Points, enhances customer experience. Finally, installation and field services are vital for maintaining system uptime and customer satisfaction, with Q1 2025 showing growth in service revenue for their Banking segment.

Full Document Unlocks After Purchase

Business Model Canvas

The Diebold Nixdorf Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the final deliverable, showcasing the exact structure and content. Upon completing your order, you will gain full access to this comprehensive Business Model Canvas, ready for your strategic analysis and application.

Resources

Diebold Nixdorf holds a significant portfolio of intellectual property, encompassing patents for innovative hardware designs and proprietary software platforms such as DN Series and Vynamic. This robust intellectual capital is a cornerstone of their competitive edge, facilitating the creation of distinct and cohesive product suites.

These advanced technologies are fundamental to the value Diebold Nixdorf delivers to its customers, particularly in areas like self-service solutions and enhanced security. The company's investment in R&D, which stood at $323 million in 2023, directly fuels the development and protection of this critical intellectual property.

Diebold Nixdorf's global manufacturing footprint, including key sites in Germany, Ohio, Brazil, and India, underpins its ability to produce ATMs, POS terminals, and physical security solutions efficiently. This network enables localized production, reducing lead times and transportation costs for its diverse customer base.

These strategically positioned facilities are crucial for the company's large-scale production capacity and bolster its supply chain resilience, a vital component for meeting global demand. In 2024, Diebold Nixdorf continued to leverage this infrastructure to ensure timely delivery and maintain operational flexibility in a dynamic market.

Diebold Nixdorf's extensive global service network is a crucial asset, featuring a large pool of skilled field technicians and support staff. This network is instrumental in deploying and maintaining their technology across more than 100 countries, directly impacting product uptime and customer loyalty.

The company's workforce, numbering around 21,000 employees globally as of recent reports, underpins this service capability. This substantial human capital is vital for providing the necessary expertise for installation, ongoing maintenance, and responsive support, ensuring seamless operation of their banking and retail solutions worldwide.

Software Platforms and Digital Infrastructure

Diebold Nixdorf leverages sophisticated software platforms and a robust digital infrastructure to deliver its integrated banking and retail solutions. These platforms are the backbone for their cloud-based offerings and point-of-sale systems, enabling connected commerce.

The company's digital assets are crucial for creating seamless experiences across both physical and digital touchpoints for its clients. This infrastructure supports the development and ongoing management of their diverse product portfolio.

- Cloud-Native Architecture: Diebold Nixdorf's platforms are increasingly built on cloud-native principles, allowing for scalability and agility in deploying new features and services.

- Data Analytics Capabilities: The digital infrastructure supports advanced data analytics, providing insights for financial institutions and retailers to optimize operations and customer engagement.

- Security and Compliance: Ensuring the security and compliance of its software platforms is paramount, especially given the sensitive nature of financial transactions and customer data.

- Integration Services: The platforms facilitate seamless integration with existing systems, enabling clients to adopt Diebold Nixdorf's solutions without major disruptions.

Strong Brand Reputation and Established Customer Base

Diebold Nixdorf's strong brand reputation, built over decades as a leader in banking and retail automation, is a critical asset. This long-standing presence fosters trust and recognition, making it a preferred partner for many businesses.

The company's established customer base is a cornerstone of its business model. A significant portion of the world's top financial institutions and major retailers rely on Diebold Nixdorf's solutions. This deep penetration into key markets provides a predictable stream of recurring revenue through service agreements and ongoing technology upgrades.

- Brand Reputation: Decades of leadership in banking and retail automation technologies.

- Customer Base: Serves a majority of the world's top 100 financial institutions and top 25 global retailers.

- Revenue Stability: Established relationships ensure recurring revenue from services and ongoing technology adoption.

Diebold Nixdorf's key resources include a substantial intellectual property portfolio, a global manufacturing network, an extensive service organization, and robust digital platforms. These elements are crucial for developing, producing, and supporting their innovative banking and retail solutions. The company's brand reputation and established customer relationships further solidify its market position, ensuring a stable revenue base.

| Resource Category | Key Assets | 2023/2024 Data Points |

|---|---|---|

| Intellectual Property | Patents for hardware and software (DN Series, Vynamic) | R&D investment: $323 million (2023) |

| Manufacturing & Infrastructure | Global production sites (Germany, Ohio, Brazil, India) | Continued leverage of infrastructure for timely delivery (2024) |

| Human Capital & Service Network | Skilled field technicians, support staff, ~21,000 employees | Service operations in over 100 countries |

| Digital Assets | Cloud-native platforms, data analytics, security infrastructure | Enabling connected commerce and seamless customer experiences |

| Brand & Customer Relationships | Strong brand recognition, loyal customer base | Serving top global financial institutions and retailers |

Value Propositions

Diebold Nixdorf's solutions are designed to make banking and shopping smoother and more convenient for everyone. They focus on creating a seamless experience, whether you're interacting online or in a physical store.

Think about their advanced ATMs that can handle bulk cash deposits, or self-checkout systems in supermarkets. These technologies cut down on waiting times and make everyday transactions much quicker and more user-friendly.

In 2024, the demand for frictionless customer journeys continued to grow, with many consumers expecting instant service. Diebold Nixdorf's investment in these self-service technologies directly addresses this trend, aiming to boost customer satisfaction and loyalty.

Diebold Nixdorf's automated systems, software, and managed services are designed to significantly enhance operational efficiency for financial institutions and retailers. These solutions streamline processes, reducing the need for manual intervention and thereby lowering overall operating expenses. For example, their cash recycler technology directly contributes to this by automating cash handling, a typically labor-intensive task.

This focus on efficiency translates directly into improved financial performance. By optimizing workflows and minimizing manual tasks, Diebold Nixdorf's offerings help clients achieve better gross margins. In 2023, the company continued to emphasize these lean initiatives, aiming to drive greater cost-effectiveness across the value chain.

Diebold Nixdorf's robust security and compliance value proposition centers on safeguarding financial transactions, sensitive data, and physical assets. Their offerings include advanced physical security products, integrated software, and comprehensive services tailored to meet stringent industry regulations.

In 2024, the company continued to innovate in areas like biometric security for ATMs, safes, and vaults, addressing the increasing demand for secure, yet convenient, access. This focus is crucial as financial institutions and retailers grapple with evolving cyber threats and the need to maintain customer trust.

Their solutions are designed to ensure adherence to a complex web of global and local compliance standards, a critical factor for clients operating in highly regulated banking and retail environments. This commitment to security and compliance underpins their role as a trusted partner in protecting valuable assets and maintaining operational integrity.

Digital Transformation Enablement

Diebold Nixdorf acts as a crucial strategic partner, guiding clients in seamlessly integrating their physical and digital operations. This is achieved through a suite of interconnected solutions and software-defined technologies, allowing businesses to effectively navigate changing consumer demands and unlock new avenues for expansion.

They empower businesses to adapt to evolving consumer preferences and leverage digital capabilities for growth. For instance, in 2024, Diebold Nixdorf's focus on omnichannel solutions helped retailers improve customer engagement, with many reporting a 15% uplift in digital sales conversions post-implementation.

- Bridging Physical and Digital: Diebold Nixdorf offers integrated hardware and software to connect in-store experiences with online platforms.

- Software-Defined Technologies: This approach allows for greater flexibility and customization in digital transformation initiatives.

- Adapting to Consumer Preferences: Their solutions help businesses meet the demand for seamless, personalized customer journeys across all touchpoints.

- Driving Growth through Digitalization: By enabling digital capabilities, Diebold Nixdorf supports clients in expanding their market reach and revenue streams.

Global Scalability and Reliable Support

Diebold Nixdorf's value proposition of Global Scalability and Reliable Support is a cornerstone for its clients. With operations spanning over 100 countries, the company provides a robust service network. This extensive reach allows multinational corporations, particularly in the financial and retail sectors, to deploy and manage their technology solutions seamlessly across various international markets.

This global infrastructure is crucial for businesses aiming for consistent brand experience and operational efficiency worldwide. Diebold Nixdorf's commitment to ongoing support ensures that these complex systems remain functional and up-to-date, minimizing downtime and maximizing client productivity.

- Global Reach: Presence in over 100 countries.

- Service Network: Comprehensive and reliable support infrastructure.

- Scalability: Enables multinational deployment of solutions.

- Consistency: Ensures uniform system performance across diverse markets.

Diebold Nixdorf's core value proposition centers on enhancing customer convenience and operational efficiency through innovative self-service and automation technologies. They streamline everyday banking and shopping experiences, reducing wait times and improving user-friendliness. In 2024, this focus on frictionless journeys met a market demand for instant service, boosting customer satisfaction.

Their solutions drive significant operational efficiencies by automating labor-intensive tasks, such as cash handling with advanced recyclers, directly contributing to lower operating expenses for clients. This emphasis on lean operations helped clients achieve better gross margins, a trend Diebold Nixdorf continued to champion in 2023 through cost-effectiveness initiatives.

Security and compliance are paramount, with offerings protecting financial transactions, data, and assets through advanced physical security and integrated software. By 2024, innovations like biometric security for ATMs addressed growing concerns over cyber threats, ensuring client trust and regulatory adherence.

Diebold Nixdorf acts as a strategic partner, integrating physical and digital operations with software-defined technologies to help businesses adapt to consumer shifts and grow. Their omnichannel solutions, for example, aided retailers in 2024, with some reporting up to a 15% increase in digital sales conversions.

| Value Proposition | Key Features | Impact/Benefit | 2024 Data Point |

|---|---|---|---|

| Customer Convenience & Efficiency | Advanced ATMs, Self-Checkout Systems | Reduced wait times, improved user experience | Continued growth in demand for instant service |

| Operational Efficiency | Cash Recyclers, Automated Systems | Lower operating expenses, improved gross margins | Focus on lean initiatives for cost-effectiveness |

| Security & Compliance | Biometric Security, Data Protection | Safeguarded transactions, adherence to regulations | Innovation in biometric security for ATMs |

| Strategic Digital Integration | Omnichannel Solutions, Software-Defined Tech | Enhanced customer engagement, digital sales growth | Up to 15% uplift in digital sales conversions |

Customer Relationships

Diebold Nixdorf cultivates robust customer connections via dedicated account management. These teams offer tailored support and strategic direction, ensuring client needs are consistently addressed throughout the lifecycle of their solutions, from implementation to ongoing enhancements. For instance, in 2024, the company reported a significant increase in customer satisfaction scores directly correlated with the proactive engagement of these account managers.

Diebold Nixdorf heavily relies on long-term service contracts and support agreements to maintain strong customer relationships. These agreements are crucial for providing essential maintenance, software updates, and technical assistance, ensuring their installed systems operate smoothly and reliably.

These ongoing service contracts are a cornerstone of Diebold Nixdorf's revenue generation strategy, creating a predictable stream of recurring income. This focus on continuous support also significantly contributes to high levels of customer satisfaction and loyalty, as clients can depend on the company for the upkeep of their critical retail and banking technology.

Diebold Nixdorf provides expert professional services and consulting to guide clients through the planning, implementation, and optimization of their technology. This crucial element of their business model positions them as a strategic partner, offering advice on digital transformation, seamless system integration, and the adoption of operational best practices.

These tailored services are designed to address the complexities inherent in diverse client environments, ensuring that technology solutions are not just deployed but are optimized for maximum impact and efficiency. For instance, in 2024, Diebold Nixdorf reported significant growth in its services segment, driven by demand for its end-to-end support capabilities.

Customer Training and Education

Diebold Nixdorf offers extensive training and educational materials to ensure clients' teams can proficiently operate and manage their systems. This focus on education helps customers unlock the full potential of their technology investments and fosters greater operational autonomy.

- Hardware Operation Training: Covers the physical setup, maintenance, and troubleshooting of Diebold Nixdorf's retail and banking hardware solutions.

- Software Functionality Training: Delves into the effective use of their various software platforms, including point-of-sale systems, back-office management tools, and self-service solutions.

- Maximizing System Value: Training aims to equip staff with the knowledge to optimize system performance and leverage advanced features for improved efficiency and customer experience.

- Operational Independence: By empowering client staff with the necessary skills, Diebold Nixdorf supports customers in reducing reliance on external support for day-to-day operations.

Online Portals and Self-Service Support

Diebold Nixdorf leverages online portals and self-service support to empower its clients, offering a digital avenue for documentation access, service request tracking, and troubleshooting common issues. This digital infrastructure is crucial for enhancing customer support efficiency and providing convenient, immediate assistance.

- Enhanced Accessibility: Clients can access a wealth of information and support resources 24/7 through user-friendly online portals.

- Streamlined Operations: Self-service options allow customers to resolve queries independently, reducing reliance on direct support and speeding up issue resolution.

- Cost Efficiency: Digital support channels contribute to operational cost savings by automating many routine customer service tasks.

- Customer Empowerment: These platforms equip customers with the tools and information needed to manage their interactions and solutions effectively.

Diebold Nixdorf prioritizes strong customer relationships through dedicated account management and long-term service contracts. These agreements ensure ongoing system reliability and foster customer loyalty. In 2024, the company saw a notable uplift in customer satisfaction, directly linked to the proactive engagement of its account management teams.

The company also offers expert professional services and comprehensive training programs. These services help clients optimize their technology investments and empower their staff for operational independence. In 2024, Diebold Nixdorf experienced substantial growth in its services division, reflecting the demand for its end-to-end support capabilities.

Online portals and self-service support further enhance customer engagement, providing 24/7 access to information and efficient issue resolution. This digital infrastructure is key to improving support efficiency and customer empowerment.

| Aspect | Description | 2024 Impact/Focus |

| Dedicated Account Management | Tailored support and strategic direction for clients. | Increased customer satisfaction scores. |

| Service Contracts | Long-term agreements for maintenance and support. | Predictable recurring revenue, high customer loyalty. |

| Professional Services | Consulting for planning, implementation, and optimization. | Growth in services segment driven by end-to-end support demand. |

| Training Programs | Empowering client staff with system operation skills. | Maximizing technology investment value, fostering operational independence. |

| Digital Support | Online portals and self-service for documentation and issue resolution. | Enhanced accessibility, streamlined operations, cost efficiency. |

Channels

Diebold Nixdorf leverages a direct sales force to cultivate relationships with key clients, including major financial institutions and large retail enterprises. This approach facilitates in-depth understanding of client needs and the development of customized solutions, crucial for securing complex, high-value contracts. In 2024, Diebold Nixdorf continued to emphasize this channel for its strategic accounts, recognizing the importance of direct engagement in a competitive market.

Diebold Nixdorf relies on a broad network of partners and distributors to reach a wider customer base and enter new markets. These relationships are crucial for extending their geographical presence and tapping into specialized local knowledge. For instance, in 2024, Diebold Nixdorf continued to strengthen its channel partnerships, aiming to increase sales of its retail and banking solutions across emerging economies.

Diebold Nixdorf leverages a robust online presence, featuring its corporate website, a dedicated investor relations portal, and specialized microsites for its diverse product portfolio. These digital platforms are crucial for sharing company news, financial reports, and product information, ensuring accessibility for customers and stakeholders alike.

In 2024, Diebold Nixdorf's digital channels are central to its customer engagement and market outreach. The company’s website acts as a primary hub for solutions, support, and corporate information, driving lead generation and brand awareness in the competitive fintech and retail technology sectors.

Industry Trade Shows and Conferences

Industry trade shows and conferences are a vital communication and sales channel for Diebold Nixdorf. These events allow the company to directly present its latest innovations in retail technology and financial self-service solutions to a targeted audience of potential clients and partners.

Participation in key events like the NRF Big Show provides a platform for live demonstrations, fostering direct engagement and feedback from customers. Diebold Nixdorf also leverages investor days to communicate its strategic direction and financial performance, building confidence with the investment community.

In 2024, Diebold Nixdorf continued its active presence at major industry gatherings, showcasing advancements in areas like AI-powered checkout solutions and secure payment terminals. These appearances are critical for generating leads and reinforcing brand visibility within the competitive landscape.

- NRF Big Show: A premier event for retail technology, offering Diebold Nixdorf opportunities to connect with retailers and demonstrate new products.

- Investor Days: Essential for transparent communication with financial stakeholders, highlighting company progress and future strategies.

- Direct Customer Engagement: Trade shows facilitate face-to-face interactions, crucial for understanding customer needs and closing deals.

- Industry Leadership: Consistent presence at conferences positions Diebold Nixdorf as a thought leader in the evolving retail and banking technology sectors.

Service and Support Centers

Diebold Nixdorf's global network of service and support centers functions as a crucial direct channel for customer engagement. These centers are the frontline for providing technical assistance and resolving operational challenges, ensuring seamless functionality for their clients' systems.

This extensive network is fundamental to delivering timely and effective post-sales support, which is paramount for maintaining high system uptime and fostering customer loyalty. For instance, in 2023, Diebold Nixdorf reported a significant portion of its revenue derived from services, underscoring the importance of these support functions.

- Global Reach: Operates a vast network of service centers worldwide.

- Customer Assistance: Provides direct support for technical issues and operational queries.

- System Uptime: Focuses on minimizing downtime for client systems.

- Client Relationships: Reinforces long-term partnerships through reliable support.

Diebold Nixdorf utilizes a direct sales force for high-value engagements, fostering deep client relationships and customized solutions, particularly with major financial institutions and large retailers. This direct approach remained a key strategy in 2024 for securing complex contracts in a competitive market.

Customer Segments

Large financial institutions, encompassing global banks and credit unions, represent a core customer segment for Diebold Nixdorf. These entities rely heavily on Diebold Nixdorf's extensive suite of banking solutions, including advanced ATMs, efficient cash recyclers, and sophisticated digital banking software. For instance, in 2024, major banks continued to invest in modernizing their branch infrastructure and self-service technology to enhance customer experience and operational efficiency, directly benefiting Diebold Nixdorf's product demand.

These institutions operate at a massive scale, serving millions of consumers daily and therefore demand solutions that are not only robust and reliable but also highly scalable and secure. The need for uninterrupted service and data protection is paramount. The global financial services market, valued at trillions of dollars, underscores the critical importance of dependable technology providers like Diebold Nixdorf for these large players.

Diebold Nixdorf's major retail chain customers include large supermarket, department, and convenience store operators. These businesses are looking for ways to streamline operations, elevate the customer journey, and seamlessly blend their in-store and online sales channels. For instance, in 2024, major retailers continued to invest heavily in self-checkout technology to address labor shortages and speed up transactions, with self-checkout penetration in grocery stores in North America reaching over 30% by the end of the year.

Diebold Nixdorf's customer base extends beyond major corporations to include small to medium-sized businesses (SMBs) within the retail and finance sectors. These clients, often operating with tighter budgets, seek dependable and affordable solutions for managing customer interactions and transactions.

For these SMBs, Diebold Nixdorf provides tailored offerings, focusing on standardized self-service technology and efficient payment processing systems. In 2023, the SMB segment represented a significant portion of the company's revenue, with many of these businesses leveraging Diebold Nixdorf's solutions to improve operational efficiency and customer experience.

The company's strategy for reaching these smaller entities involves a robust network of channel partners and distributors. This approach ensures that independent retailers and smaller financial institutions receive accessible support and solutions that are appropriately scaled to their operational needs and financial capacity, facilitating their digital transformation.

Commercial Enterprises Across Various Sectors

Diebold Nixdorf serves a wide array of commercial enterprises beyond traditional banking and retail. Their physical security solutions and self-service kiosks are vital for businesses needing secure transaction processing and enhanced customer engagement. This includes sectors like transportation, hospitality, and government services, demonstrating a broad global reach.

These diverse commercial clients benefit from Diebold Nixdorf's expertise in integrating physical and digital touchpoints. For instance, in 2024, the company continued to see strong demand for its automated solutions in sectors requiring efficient, secure customer interactions, such as airport check-in kiosks and secure payment terminals in entertainment venues.

- Diversified Commercial Reach: Diebold Nixdorf's solutions extend to transportation hubs, hospitality providers, and public sector entities, addressing needs for secure transactions and automated customer service.

- Physical and Digital Integration: Clients leverage the company's core strength in seamlessly blending physical security with digital self-service technologies.

- Global Market Presence: The company's customer base spans numerous commercial markets worldwide, adapting its offerings to varied regional requirements and business models.

- Focus on Security and Automation: Demand remains high for reliable, secure, and automated systems that streamline operations and improve customer experience across different industries.

Government and Public Sector Organizations

Government and public sector organizations are key customers for Diebold Nixdorf, particularly those requiring secure and reliable cash management and self-service solutions. These entities often operate with stringent compliance requirements and a need for high transaction volumes, making Diebold Nixdorf's robust security features and dependable technology essential for their operations.

These clients, such as national postal services or public transportation authorities, rely on specialized self-service terminals for citizen engagement and service delivery. For instance, in 2024, many governments continued to invest in digital transformation initiatives, seeking secure and efficient ways to manage public funds and provide citizen services, areas where Diebold Nixdorf's offerings are well-suited.

- Security and Compliance: Public sector clients demand solutions that meet rigorous security standards and regulatory compliance, such as those related to data protection and financial transaction integrity.

- Reliability for Public Services: Essential public services often depend on uninterrupted operation of self-service terminals and cash handling systems, making Diebold Nixdorf's proven reliability a critical factor.

- High Transaction Volumes: Agencies managing large volumes of cash or citizen transactions, like tax collection or public utility payments, require systems capable of high throughput and efficient processing.

- Specialized Terminal Needs: Governments may require custom-built self-service terminals for specific public services, such as ticketing, information kiosks, or secure payment collection points.

Diebold Nixdorf's customer segments are diverse, primarily encompassing large financial institutions and major retail chains. These core clients require robust, scalable, and secure solutions for their extensive operations. In 2024, both sectors continued to prioritize digital transformation and enhanced customer experiences, driving demand for Diebold Nixdorf's advanced ATMs, self-checkout systems, and digital banking software.

Additionally, the company serves small to medium-sized businesses (SMBs) in retail and finance, offering more tailored and budget-friendly solutions. These SMBs leverage Diebold Nixdorf's technology to boost efficiency and customer interaction. The company also caters to a broad range of commercial enterprises, including transportation, hospitality, and government sectors, providing physical security and self-service kiosks.

Government and public sector organizations represent another key segment, seeking secure, reliable cash management and self-service solutions that meet stringent compliance requirements. These clients, such as postal services or transit authorities, utilize specialized terminals for citizen engagement and service delivery, with governments actively investing in digital transformation initiatives in 2024.

| Customer Segment | Key Needs | 2024 Trends/Data | Example Solutions |

| Large Financial Institutions | Scalability, Security, Reliability, Digital Transformation | Continued investment in ATM modernization and digital banking platforms. | Advanced ATMs, Cash Recyclers, Digital Banking Software |

| Major Retail Chains | Operational Efficiency, Customer Journey Enhancement, Omnichannel Integration | Increased adoption of self-checkout technology; North American grocery self-checkout penetration exceeded 30% in 2024. | Self-Checkout Systems, POS Terminals, Payment Processing |

| SMBs (Retail & Finance) | Affordability, Dependability, Operational Efficiency | SMB segment represented a significant portion of company revenue in 2023; focus on digital transformation. | Standardized Self-Service Technology, Payment Processing Systems |

| Commercial Enterprises (Non-Banking/Retail) | Secure Transactions, Customer Engagement, Automation | Strong demand for automated solutions in transportation (e.g., airport kiosks) and hospitality in 2024. | Self-Service Kiosks, Secure Payment Terminals |

| Government & Public Sector | Security, Compliance, High Transaction Volumes, Public Service Delivery | Governments invested in digital transformation for secure fund management and citizen services in 2024. | Specialized Self-Service Terminals, Secure Cash Management Systems |

Cost Structure

Diebold Nixdorf dedicates substantial resources to research, development, and engineering. These investments are vital for creating innovative hardware and software, improving current offerings, and investigating new technologies such as artificial intelligence. For instance, in 2023, the company reported R&D expenses of $340 million, reflecting its commitment to staying at the forefront of technological advancement in the financial and retail sectors.

Manufacturing and production costs are a significant component of Diebold Nixdorf's cost structure. These expenses encompass the raw materials and components needed for ATMs, point-of-sale (POS) terminals, and other banking and retail technology hardware. In 2023, the company reported cost of sales of $3.3 billion, reflecting these substantial manufacturing outlays.

Labor and factory overhead also contribute heavily to these production expenses. Diebold Nixdorf's commitment to efficient supply chain management and lean manufacturing principles is crucial for controlling these costs and maintaining competitive pricing for its hardware solutions.

Diebold Nixdorf's cost structure heavily relies on expenses for its global sales force, marketing initiatives, and distribution networks. These are essential for acquiring new customers and maintaining brand presence across various international markets.

In 2024, the company continued to invest in reaching its diverse customer base. While specific figures for this category are often consolidated, similar technology and services companies typically allocate a significant portion of their revenue to these functions to drive growth and market penetration.

Service and Support Network Costs

Diebold Nixdorf's commitment to a robust global service and support network represents a substantial cost. This includes the salaries and training for field technicians who handle installations and on-site repairs, as well as the operational expenses for call centers that provide remote assistance. In 2024, managing this extensive infrastructure, which also encompasses maintaining a critical spare parts inventory across various regions, was a key financial consideration.

These expenditures are not merely operational overhead; they are foundational to delivering the high-quality, timely service customers expect. This proactive approach to maintenance and technical support is vital for ensuring the reliability of Diebold Nixdorf's solutions and directly contributes to customer retention and the generation of predictable, recurring revenue streams through service contracts.

- Field Technicians: Costs associated with a global workforce of trained professionals for on-site service.

- Call Centers: Expenses for operating customer support hubs providing remote technical assistance.

- Spare Parts Inventory: Investment in maintaining readily available components to minimize downtime.

- Training and Development: Ongoing costs to ensure technical staff remain proficient with evolving technology.

Software Licensing and Development Costs

Diebold Nixdorf's cost structure is significantly influenced by its investments in software. This includes the substantial expenses associated with developing its own proprietary software platforms, which are crucial for its integrated retail and banking solutions. For instance, in 2023, the company continued to invest in its cloud-native DN Series™ platform, aiming to enhance functionalities and user experience.

Acquiring third-party software licenses also represents a notable cost. These licenses are often necessary to integrate specialized functionalities or leverage existing technologies, ensuring a comprehensive offering for clients. The ongoing commitment to software maintenance and regular updates further adds to these operational expenditures, ensuring the security and performance of their deployed systems.

- Software Development: Costs for creating and refining proprietary platforms like the DN Series™.

- Third-Party Licenses: Expenses incurred for integrating external software solutions.

- Maintenance & Updates: Ongoing spending to ensure software security and functionality.

- Growing Prominence: These costs are increasingly central as the company emphasizes software-defined solutions.

Diebold Nixdorf's cost structure is heavily weighted towards the manufacturing and delivery of its hardware solutions, as seen in its 2023 cost of sales reaching $3.3 billion. This encompasses raw materials, components, and the labor involved in producing ATMs and POS systems. Beyond production, significant investments are made in research and development, with $340 million spent in 2023 to drive innovation in areas like AI.

The company also incurs substantial costs for its global service and support network, including field technicians and spare parts inventory, crucial for maintaining customer satisfaction. Furthermore, expenditures on software development and third-party licenses are increasingly important as Diebold Nixdorf emphasizes software-defined solutions.

| Cost Category | 2023 Data | Notes |

| Cost of Sales (Manufacturing) | $3.3 billion | Includes raw materials, components, labor for hardware. |

| Research & Development | $340 million | Investment in hardware and software innovation, including AI. |

| Sales, Marketing & Distribution | Significant allocation | Essential for customer acquisition and market presence. |

| Service & Support | Substantial operational costs | Field technicians, call centers, spare parts, and training. |

| Software Development & Licensing | Growing prominence | Development of proprietary platforms and third-party licenses. |

Revenue Streams

Diebold Nixdorf's hardware sales are a core revenue driver, encompassing the sale of ATMs, cash recyclers, and point-of-sale systems. These sales are directly tied to the ongoing need for physical transaction infrastructure in banking and retail environments. In 2024, the company continued to see demand for these solutions, particularly as businesses upgrade aging equipment and expand their self-service capabilities.

Diebold Nixdorf generates revenue through licensing its specialized software, including the Vynamic suite, which supports banking and retail operations. This model also encompasses subscription-based access to their cloud services, crucial for managing integrated digital and physical customer touchpoints and leveraging data analytics.

Diebold Nixdorf generates significant revenue through its managed services and outsourcing offerings, where the company takes on the operational and maintenance responsibilities for clients' self-service networks. These long-term contracts provide a stable, predictable stream of recurring income for Diebold Nixdorf, allowing them to forecast revenue more effectively. This model also enables their clients to offload complex IT management and concentrate on their primary business objectives.

Installation and Professional Services

Diebold Nixdorf generates revenue through the installation of new hardware systems, a foundational service for their clients. This is complemented by a suite of professional services designed to ensure smooth and effective system deployment. These services are vital for successful implementation and client adoption of their technology solutions.

These professional services encompass a range of offerings, including expert consulting to tailor solutions, system integration to connect new hardware with existing infrastructure, and comprehensive project management for complex, large-scale deployments. This multifaceted approach ensures clients can fully leverage their new systems.

For instance, in 2024, Diebold Nixdorf continued to emphasize these value-added services as a significant revenue driver. While specific segment breakdowns vary, such services are typically recognized as a crucial component of their overall financial performance, contributing to recurring revenue streams and strengthening client relationships.

- Hardware Installation Revenue: Direct income from setting up new ATMs, POS systems, and related retail technology.

- Consulting Services: Fees for advising clients on technology strategy, system optimization, and digital transformation.

- System Integration: Revenue from connecting new Diebold Nixdorf solutions with existing IT environments and third-party software.

- Project Management: Charges for overseeing complex deployments, ensuring timely and efficient implementation.

Maintenance and Support Contracts

Maintenance and support contracts represent a cornerstone of Diebold Nixdorf's financial stability, generating a substantial portion of their annual revenue. These agreements, often long-term, ensure customers receive ongoing technical assistance, software updates, and hardware upkeep for their deployed systems.

This recurring revenue model is crucial, providing a predictable income stream that underpins the company's operational planning and investment strategies. In fact, approximately 70% of Diebold Nixdorf's annual revenue is derived from these recurring services, highlighting their importance to the business.

- Recurring Revenue: Approximately 70% of Diebold Nixdorf's annual revenue is generated from ongoing maintenance and support contracts.

- Customer Retention: These contracts foster long-term customer relationships and ensure continued engagement with Diebold Nixdorf's product ecosystem.

- Service Reliability: They guarantee the operational uptime and performance of critical banking and retail technology solutions for clients.

- Predictable Income: The stable, recurring nature of these contracts provides a reliable financial foundation for the company.

Diebold Nixdorf's revenue streams are diverse, encompassing hardware sales, software licensing, and a significant portion from managed services and maintenance contracts. These recurring revenue streams, making up roughly 70% of their annual income, provide a stable financial base. The company also generates income from installation and professional services, including consulting and system integration, which are crucial for client adoption and system optimization.

| Revenue Stream | Description | 2024 Relevance |

| Hardware Sales | Sale of ATMs, POS systems, and cash recyclers. | Continued demand for self-service upgrades. |

| Software Licensing & Cloud Services | Vynamic suite and subscription-based cloud access. | Supports digital integration and data analytics. |

| Managed Services & Outsourcing | Operational and maintenance responsibilities for client networks. | Provides stable, recurring income. |

| Installation & Professional Services | Setup of new systems, consulting, integration, and project management. | Value-added revenue, crucial for successful deployments. |

| Maintenance & Support Contracts | Ongoing technical assistance, software updates, and hardware upkeep. | Approximately 70% of annual revenue, ensuring customer retention and service reliability. |

Business Model Canvas Data Sources

The Diebold Nixdorf Business Model Canvas is built upon a foundation of financial reports, market intelligence, and competitive analysis. These diverse data sources ensure a comprehensive and accurate representation of the company's strategic framework.