Dick's Sporting Goods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dick's Sporting Goods Bundle

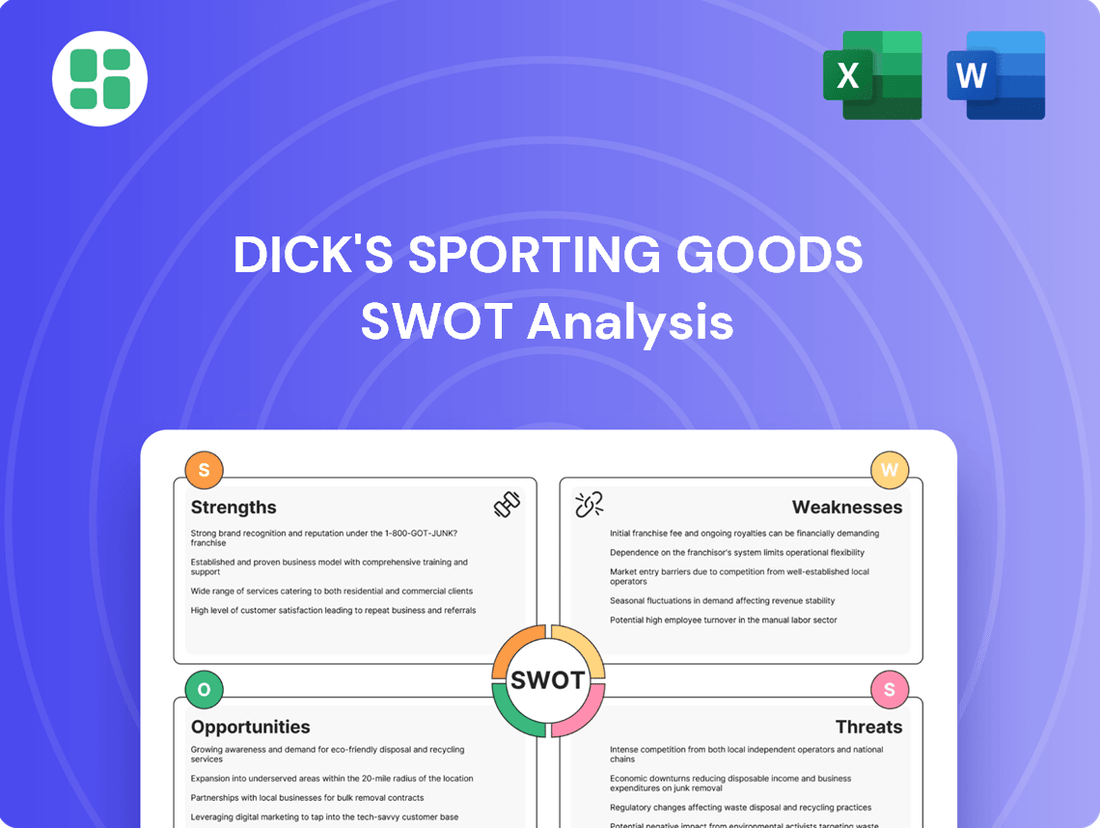

Dick's Sporting Goods leverages its strong brand recognition and vast store footprint as key strengths, but faces challenges from intense online competition and shifting consumer preferences. Understanding these dynamics is crucial for anyone looking to capitalize on the sporting goods market.

Want the full story behind Dick's Sporting Goods' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dick's Sporting Goods boasts the largest U.S. full-line omnichannel retail presence in its sector. This strength is built on a substantial network of physical stores complemented by a robust digital platform, offering customers flexibility through options like buy-online-pick-up-in-store.

This integrated strategy significantly enhances customer experience, driving strong comparable sales growth. For instance, in the first quarter of 2024, Dick's reported a 5.3% increase in same-store sales, demonstrating the effectiveness of its omnichannel approach in capturing market share.

Dick's Sporting Goods boasts a broad and varied product selection, featuring authentic, high-quality gear, apparel, and accessories. This includes sought-after national brands alongside strong private label offerings like CALIA, DSG, and VRST, differentiating their market position.

The company's diverse assortment spans key categories such as footwear, team sports, and outdoor recreation. This wide appeal allows Dick's to connect with a large and varied customer base, from serious athletes to casual enthusiasts, bolstering its brand reputation.

This extensive product mix, particularly the exclusive private label brands, provides a competitive edge by offering unique items not easily found elsewhere. For instance, in fiscal year 2023, Dick's reported net sales of $10.3 billion, demonstrating the market's strong reception to its differentiated offerings.

Dick's Sporting Goods has showcased impressive financial strength, with recent quarters featuring record sales and robust comparable sales growth that have outpaced industry averages. This strong performance underscores the company's effective operational strategies and its ability to resonate with consumers.

The company has successfully expanded its market footprint, now holding close to 9% of the U.S. sporting goods market. This significant market share gain is a direct result of diligent operational execution, prudent cost management, and strategic investments in key areas of the business.

Strategic Store Formats and Expansion

Dick's Sporting Goods is strategically enhancing its physical retail presence by expanding innovative store formats. The company is investing in experiential concepts like House of Sport and Field House, which offer unique attractions such as climbing walls and batting cages. This focus on immersive experiences is a cornerstone of their growth strategy, aiming to attract a broader customer base and deepen engagement.

The expansion of Golf Galaxy Performance Centers further solidifies this approach, providing specialized, high-touch environments for golf enthusiasts. This multi-format strategy is designed to differentiate Dick's from competitors and drive traffic and sales as they look towards 2025 and beyond. For instance, the company has been increasing the number of these enhanced locations, with plans to continue this rollout.

- Investment in Experiential Retail: Dick's is actively rolling out House of Sport and Field House formats.

- Enhanced Customer Engagement: These stores feature interactive elements to create memorable shopping experiences.

- Strategic Growth Pillar: The expansion of these premium formats, including Golf Galaxy Performance Centers, is central to the company's growth plans for 2025.

Strong Brand Recognition and Customer Engagement

Dick's Sporting Goods enjoys robust brand recognition, consistently earning high marks in customer satisfaction within the athletic and outdoor retail space. This strong reputation is a significant asset, attracting and retaining customers.

The company actively cultivates customer loyalty and engagement through its Scorecard rewards program and the GameChanger mobile application. These initiatives not only foster repeat business but also provide critical data on consumer preferences and buying habits.

- Brand Strength: Dick's consistently ranks high in customer satisfaction surveys.

- Loyalty Programs: The Scorecard program drives repeat purchases and customer retention.

- Digital Engagement: The GameChanger app enhances customer interaction and data collection.

- Customer Insights: Loyalty programs provide valuable data on purchasing behavior, informing strategy.

Dick's Sporting Goods possesses a dominant omnichannel retail presence, integrating its extensive physical store network with a robust online platform. This allows for flexible fulfillment options like buy-online-pick-up-in-store, enhancing customer convenience and driving comparable sales. In Q1 2024, same-store sales rose 5.3%, a testament to this effective strategy.

The company offers a wide array of authentic, high-quality products, including popular national brands and exclusive private label lines such as CALIA, DSG, and VRST. This diverse assortment across footwear, team sports, and outdoor recreation appeals to a broad customer base and strengthens brand differentiation. Fiscal year 2023 net sales reached $10.3 billion, reflecting strong market acceptance of its differentiated offerings.

Dick's demonstrates significant financial strength, consistently achieving record sales and outperforming industry averages in comparable sales growth. This financial health is supported by an expanding market footprint, now capturing nearly 9% of the U.S. sporting goods market, a result of operational excellence and strategic investments.

The company is actively investing in innovative store formats like House of Sport and Field House, which feature experiential elements such as climbing walls. This strategy, including the expansion of Golf Galaxy Performance Centers, aims to differentiate Dick's and attract a wider customer demographic, with ongoing rollout plans for these enhanced locations.

Dick's Sporting Goods benefits from strong brand recognition and high customer satisfaction, bolstered by its Scorecard rewards program and the GameChanger mobile app. These initiatives foster loyalty and provide valuable consumer insights, driving repeat business and informing strategic decisions.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Omnichannel Presence | Largest U.S. full-line omnichannel retailer | Q1 2024 same-store sales up 5.3% |

| Product Assortment | Broad range of national and private label brands | FY 2023 Net Sales: $10.3 billion |

| Market Share | Significant U.S. market penetration | Holds ~9% of U.S. sporting goods market |

| Retail Innovation | Investment in experiential store formats | Expansion of House of Sport and Field House formats |

| Brand Equity | High customer satisfaction and loyalty programs | Scorecard rewards program, GameChanger app |

What is included in the product

Offers a full breakdown of Dick's Sporting Goods’s strategic business environment, examining its internal strengths and weaknesses alongside external opportunities and threats.

Provides a clear, actionable SWOT analysis for Dick's Sporting Goods, highlighting key areas to address competitive pressures and leverage market opportunities.

Weaknesses

Dick's Sporting Goods' reliance on major national brands like Nike and Adidas, while a strength, also poses a significant weakness. This dependence means a substantial portion of their inventory is tied to these brands' product availability and strategic decisions. For example, if Nike or Adidas were to significantly increase their direct-to-consumer sales efforts, it could directly impact Dick's sales volume and product selection.

Dick's Sporting Goods operates in a fiercely competitive market. Intense rivalry comes from online giants like Amazon, mass merchandisers such as Walmart and Target, and a growing number of direct-to-consumer (DTC) brands. This crowded landscape puts significant pressure on pricing, potentially squeezing profit margins.

To combat this, Dick's must continually innovate and find ways to differentiate itself. For instance, in fiscal year 2023, while net sales grew, the company faced rising costs, highlighting the ongoing challenge of maintaining profitability amidst competitive pressures and inflationary environments.

While Dick's Sporting Goods has shown robust financial health, there's a potential for declining margins. This can stem from intense competition, especially from online retailers and discount brands, which often forces price adjustments. For instance, in the first quarter of 2024, while net sales increased, the company navigated a challenging retail environment that can put pressure on profitability.

Vulnerability to Economic Fluctuations

Dick's Sporting Goods' reliance on discretionary spending makes it susceptible to economic downturns. For instance, during periods of high inflation or recessionary fears, consumers often cut back on non-essential purchases like sporting equipment and apparel, directly impacting the company's revenue and profit margins. This sensitivity was evident in the retail sector throughout 2023, with cautious consumer spending patterns persisting as inflation remained a concern.

The company's performance is closely tied to the health of the broader economy. Factors such as:

- Consumer confidence levels

- Unemployment rates

- Disposable income availability

can significantly influence demand for Dick's products. As of early 2024, while some economic indicators showed resilience, persistent inflation continued to put pressure on household budgets, a key consideration for retailers like Dick's.

Supply Chain Vulnerabilities and Costs

Dick's Sporting Goods, like many in the retail sector, grapples with inherent supply chain vulnerabilities. These can manifest as disruptions from global events, leading to inventory shortages or delays. For instance, in 2023, ongoing global shipping challenges continued to put pressure on delivery times and costs, impacting inventory levels for seasonal goods.

Rising operational costs, including transportation and labor, also present a significant weakness. These increased expenses can erode profit margins if not effectively passed on to consumers or offset by efficiency gains. The company's reliance on international sourcing, while common, also exposes it to geopolitical risks such as tariffs, which can directly inflate the cost of goods sold.

While Dick's has implemented strategies like diversifying its supplier base to mitigate these risks, these factors remain a persistent challenge. The ability to effectively manage inventory and maintain operational efficiency is directly tied to the stability and cost-effectiveness of its supply chain. For example, a 10% increase in shipping costs, a plausible scenario in 2024 due to fuel price volatility, could significantly impact the company's bottom line.

- Supply Chain Disruptions: Global events can lead to delays and shortages, impacting inventory availability.

- Rising Operational Costs: Increased expenses in transportation and labor can squeeze profit margins.

- Geopolitical Risks: Tariffs and trade disputes can directly increase the cost of imported goods.

- Inventory Management Challenges: Supply chain volatility makes precise inventory planning more difficult.

Dick's Sporting Goods' heavy reliance on major national brands, while beneficial, creates a significant weakness. If these key suppliers, like Nike or Adidas, shift their strategies towards direct-to-consumer sales, Dick's could face reduced product availability and sales volume. This dependence was highlighted in their 2023 performance, where brand relationships remained a critical factor.

The company operates in a highly competitive retail environment, facing pressure from online retailers such as Amazon and mass-market players like Walmart. This intense competition, as noted in their Q1 2024 results, can lead to price wars that squeeze profit margins, especially when combined with rising operational costs.

Dick's is also vulnerable to economic downturns due to the discretionary nature of its products. During periods of high inflation or economic uncertainty, consumers tend to cut back on non-essential purchases. This sensitivity was observed throughout 2023, with cautious consumer spending impacting the entire retail sector.

Supply chain disruptions remain a persistent challenge, impacting inventory availability and increasing costs. For instance, global shipping challenges in 2023 led to delivery delays and higher expenses. Furthermore, rising operational costs, including transportation and labor, directly affect profitability if not effectively managed or passed on to consumers.

| Weakness | Impact | Supporting Data/Context |

| Brand Dependence | Reduced product availability and sales if key brands prioritize DTC | Critical for inventory mix; brand strategies directly influence Dick's sales. |

| Intense Competition | Pressure on pricing, potentially eroding profit margins | Q1 2024 results showed navigation of a challenging retail environment, impacting profitability. |

| Economic Sensitivity | Vulnerability to reduced discretionary spending during downturns | Inflation in 2023 pressured household budgets, impacting non-essential purchases. |

| Supply Chain Vulnerabilities | Inventory shortages, delays, and increased operational costs | Global shipping challenges in 2023; rising transportation and labor costs impacting margins. |

Same Document Delivered

Dick's Sporting Goods SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Dick's Sporting Goods. The complete, in-depth report becomes available immediately after checkout, allowing you to leverage its insights for your strategic planning.

Opportunities

Dick's Sporting Goods has a substantial runway for growth by expanding its private label and vertical brands like CALIA, DSG, and VRST. These exclusive offerings already contribute significantly to overall sales and, importantly, boast higher gross margins compared to national brands.

By strategically investing in the development and marketing of these in-house brands, Dick's can sharpen its competitive edge, boost profitability, and lessen its dependence on external vendors. For example, private label penetration for the company was reported to be around 20% of total sales in early 2024, a figure poised for further growth.

Dick's Sporting Goods is well-positioned to capitalize on the booming e-commerce sector. The company has been aggressively investing in its digital infrastructure, including technology upgrades and mobile app improvements, to enhance the online shopping experience. This focus is crucial as consumer preference for digital channels continues to surge.

In the first quarter of 2024, Dick's reported a 5% increase in same-store sales and a 22% rise in net sales, with a significant portion of this growth attributed to its e-commerce operations. By further refining its digital platforms and utilizing data analytics to offer personalized recommendations, Dick's can attract and retain more online customers, thereby capturing a larger share of the growing digital retail market.

Dick's Sporting Goods' innovative 'House of Sport' and 'Field House' store formats present a significant opportunity to deepen customer relationships. These experiential retail concepts, which focus on community engagement and interactive experiences, have shown strong performance, indicating a clear path to transforming more locations into vibrant hubs for athletes and families. For instance, the company reported that its specialty concepts, including House of Sport, saw sales growth in the high single digits during fiscal year 2023, outperforming the broader retail segment.

By actively hosting events, workshops, and local sports league meetups within these enhanced retail spaces, Dick's can cultivate a loyal customer base that values more than just product purchases. Integrating platforms like GameChanger, which serves millions of youth sports participants, allows the company to connect with families at a crucial touchpoint, fostering brand affinity from an early age. This strategy not only drives foot traffic and sales but also positions Dick's as an indispensable partner in the sports community, appealing to a wider demographic.

Capitalizing on Health, Wellness, and Outdoor Trends

Consumers are increasingly prioritizing active lifestyles, health, wellness, and outdoor pursuits, creating a significant market expansion for sporting goods. Dick's Sporting Goods is well-positioned to leverage this shift by broadening its product assortment in these high-demand areas. This aligns with evolving consumer identities, where investing in well-being is becoming a core value.

Capitalizing on these trends can be achieved through strategic product expansion and marketing. Dick's can highlight its offerings as integral to a healthy lifestyle, rather than mere discretionary purchases. For instance, in 2023, the athleisure market alone was valued at over $326 billion globally and is projected to grow further, demonstrating the scale of this opportunity.

- Expanded Product Lines: Increase inventory in yoga, mindfulness, home fitness, and sustainable outdoor gear.

- Targeted Marketing: Position products as essential for personal health and well-being, emphasizing long-term benefits.

- Partnerships: Collaborate with fitness influencers and wellness brands to reach a wider audience.

- In-Store Experiences: Create dedicated zones for wellness and outdoor activities, offering expert advice and community events.

Strategic Acquisitions and Partnerships

Dick's Sporting Goods has opportunities to pursue strategic acquisitions and partnerships. These could involve complementary sectors or innovative challenger brands to broaden market reach, diversify product lines, or boost technological capabilities. For example, the potential acquisition of Foot Locker, which was reportedly considered in early 2024, signals a significant move to accelerate global presence and unlock substantial value, aligning with the company's strategy to strengthen its position in the athletic footwear and apparel market.

These strategic moves can also tap into emerging trends and consumer preferences. By integrating new technologies or expanding into adjacent markets, Dick's can enhance its competitive edge. The company's focus on its own brands, like DSG, also presents partnership opportunities with manufacturers or technology providers to further differentiate its private label offerings and improve supply chain efficiency.

Specifically, opportunities exist to partner with or acquire companies in areas such as:

- Direct-to-consumer (DTC) technology platforms to enhance online customer experience and data analytics.

- Sustainable and ethical sourcing companies to align with growing consumer demand for eco-friendly products.

- Innovative fitness technology providers to integrate smart wearables and connected fitness solutions into their offerings.

Dick's Sporting Goods can significantly boost profitability and brand loyalty by expanding its successful private label and vertical brands like CALIA, DSG, and VRST. These exclusive offerings, which already contribute substantially to sales, boast higher gross margins than national brands, with private label penetration reaching approximately 20% of total sales in early 2024.

The company is strategically enhancing its digital infrastructure to capitalize on the booming e-commerce sector, as evidenced by a 22% rise in net sales in Q1 2024, partly driven by online operations. Further investment in technology and mobile app improvements will allow Dick's to offer more personalized experiences and capture a larger share of the digital market.

Innovative store formats like 'House of Sport' and 'Field House' present a prime opportunity to deepen customer engagement through community events and interactive experiences, with these specialty concepts showing high single-digit sales growth in fiscal year 2023. Integrating platforms like GameChanger connects the brand with youth sports participants, fostering early brand affinity.

Capitalizing on the growing consumer focus on active lifestyles and wellness, Dick's can expand its product assortment in these high-demand areas, such as athleisure, a market valued at over $326 billion globally in 2023. Strategic marketing and partnerships with fitness influencers can further position these products as essential for personal well-being.

Threats

The sporting goods sector is seeing a surge in competition, particularly from online-only players like Amazon and direct-to-consumer (DTC) channels of major brands such as Nike and Adidas. These competitors frequently leverage competitive pricing and specialized product assortments to attract customers, directly impacting Dick's market position.

In 2023, online retail sales in the US continued to grow, with e-commerce accounting for a significant portion of overall retail spending, a trend that benefits digitally native brands. Furthermore, the direct sales of athletic apparel and footwear companies, bypassing traditional retailers, reached billions in 2023, indicating a strong shift towards DTC models that can offer more tailored customer experiences and potentially higher margins.

Economic uncertainties, including persistent inflation and the specter of recession, are a significant threat. These factors often lead consumers to curb spending on discretionary items, and sporting goods frequently fall into this category. For Dick's Sporting Goods, this means a potential slowdown in sales as shoppers prioritize essentials.

A dip in consumer confidence, a common byproduct of economic instability, directly impacts discretionary spending. If consumers become more budget-conscious, they may delay purchases or opt for less expensive alternatives. This could force Dick's to implement price reductions to move inventory, thereby squeezing profit margins. For instance, during periods of high inflation, consumers might postpone buying new athletic shoes or outdoor gear.

Global supply chain vulnerabilities, exacerbated by geopolitical tensions, continue to present significant threats to Dick's Sporting Goods. Potential tariff increases and trade disputes could directly impact the cost of goods, as a substantial portion of sporting goods are manufactured overseas. For instance, in 2023, the U.S. saw continued discussions around tariffs on goods from various Asian countries, a risk that remains relevant for 2024 and 2025.

These disruptions can lead to increased operational costs and inventory management challenges. Delays in production or shipping can result in stockouts, impacting sales and customer satisfaction. Dick's Sporting Goods, like many retailers, relies on efficient logistics; a disruption could mean higher freight costs and difficulty meeting demand, potentially affecting profit margins by as much as 1-2% on affected product lines.

Changing Consumer Preferences and Brand Loyalty

Evolving consumer preferences, particularly a growing demand for sustainable and ethically sourced products, pose a significant threat to traditional sporting goods retailers like Dick's. A notable trend is the increasing consumer willingness to pay a premium for environmentally friendly options, a segment Dick's must actively address to remain competitive. Furthermore, the rise of niche brands offering highly specialized or personalized gear can erode brand loyalty from established players.

Dick's Sporting Goods faces the challenge of adapting to rapid shifts in consumer tastes, which could impact its ability to retain existing customers and attract new demographics. For instance, a surge in demand for athleisure wear that blends performance with casual style requires constant product assortment updates. Failure to anticipate and respond quickly to these evolving preferences could undermine brand loyalty, especially among younger consumers who are often early adopters of new trends.

- Sustainability Focus: A 2024 report indicated that 65% of consumers consider sustainability when making purchasing decisions, a figure that is likely to grow.

- Niche Brand Appeal: The direct-to-consumer (DTC) model has empowered niche brands to capture market share, with some reporting double-digit growth in 2024.

- Personalization Demand: Consumers increasingly expect personalized product recommendations and experiences, with 71% of consumers expecting personalization from brands.

Cybersecurity Risks and Data Breaches

As a prominent omnichannel retailer, Dick's Sporting Goods, with its extensive online footprint, faces significant cybersecurity risks. The company's vast collection of customer data makes it a prime target for malicious actors. A successful cyberattack could result in substantial financial penalties and severe damage to its brand image.

The potential consequences of a data breach are far-reaching. Beyond immediate financial losses, such incidents can erode customer confidence, leading to a decline in sales and long-term brand loyalty. Dick's Sporting Goods must remain vigilant in protecting its digital assets and customer information.

- Financial Impact: Data breaches can incur costs related to investigation, remediation, legal fees, and regulatory fines. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, according to IBM's Cost of a Data Breach Report.

- Reputational Damage: Negative publicity following a breach can deter new customers and alienate existing ones, impacting sales and market share.

- Legal and Regulatory Scrutiny: Companies are subject to strict data protection regulations, such as GDPR and CCPA, with significant penalties for non-compliance.

Intensified competition from online retailers and direct-to-consumer brands presents a significant threat, as these players often offer competitive pricing and specialized assortments. Furthermore, economic headwinds, including inflation and potential recessionary pressures, could dampen consumer spending on discretionary items like sporting goods, impacting sales volumes and potentially forcing price adjustments that squeeze margins.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Dick's Sporting Goods' official financial statements, comprehensive market research reports, and expert analyses of industry trends and consumer behavior.