Dick's Sporting Goods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dick's Sporting Goods Bundle

Curious about Dick's Sporting Goods' product portfolio performance? Our BCG Matrix analysis reveals which categories are booming Stars, steady Cash Cows, underperforming Dogs, or promising Question Marks. Understand the strategic implications of these placements to make informed decisions.

Don't just guess where Dick's Sporting Goods is headed – know it. Purchase the full BCG Matrix report for a comprehensive breakdown of each product category's market share and growth rate, along with actionable insights to optimize your investment strategy.

Ready to unlock the full potential of Dick's Sporting Goods' product line? Get the complete BCG Matrix to gain a clear, data-driven roadmap for resource allocation and future growth, ensuring you stay ahead of the competition.

Stars

The House of Sport concept stores are Dick's Sporting Goods' Stars in the BCG Matrix. These experiential locations, boasting features like batting cages and climbing walls, are a significant growth engine. Dick's plans to expand these stores considerably in 2025, aiming to capture more market share.

Dick's Sporting Goods is heavily investing in its e-commerce operations and mobile app, aiming to boost growth and capture more online market share. Digital sales are outperforming the company's overall growth, a trend fueled by technological advancements and targeted marketing. This strategic push towards omnichannel capabilities is designed to offer customers a convenient and integrated shopping experience across all channels.

The footwear category is a major growth engine for Dick's Sporting Goods, representing a strategic priority. The company has achieved significant market share gains in footwear recently, underscoring its importance to every athlete. Dick's is investing in unique and fashionable footwear options to sustain this strong growth trajectory.

Private Label Brands (e.g., DSG, Calia, VRST)

Dick's Sporting Goods' private label brands, such as DSG, Calia, and VRST, are experiencing robust growth, outperforming the company's overall sales trajectory. This strong performance signifies increasing customer acceptance and a clear preference for these exclusive offerings. In 2023, private label sales represented a significant portion of Dick's revenue, growing at a rate of 15% year-over-year, which was notably higher than the company's total sales growth of 5%.

These brands are crucial differentiators for Dick's, providing unique products that capture consumer interest and drive market share gains. The company's strategic focus on expanding and innovating within its private label portfolio is a key factor in its competitive advantage. For instance, the Calia by Carrie Underwood line saw a 20% increase in sales in the first half of 2024, demonstrating strong consumer engagement with curated lifestyle apparel.

- Private label sales growth outpaced total company sales in 2023.

- Brands like DSG, Calia, and VRST offer differentiated products.

- Calia by Carrie Underwood experienced 20% sales growth in H1 2024.

- These brands contribute to Dick's competitive edge and market share.

GameChanger App and DICK'S Media Network

The GameChanger app, a cornerstone of Dick's Sporting Goods' strategy, is experiencing robust, profitable growth. This proprietary mobile platform for youth sports boasts millions of active users, underscoring its significant market penetration and engagement.

GameChanger is instrumental in Dick's long-term vision, fostering deeper community connections and building a rich database of customer preferences. This data is a critical asset for future growth initiatives.

- GameChanger's User Base: Millions of active users demonstrate strong adoption and engagement within the youth sports community.

- Strategic Value: Enhances community engagement and provides valuable customer preference data.

- DICK'S Media Network: Leverages this data for future sales and gross margin expansion.

- Profitability: The app is contributing to strong, profitable growth for the company.

Dick's Sporting Goods' private label brands, including DSG, Calia, and VRST, are performing exceptionally well, exceeding the company's overall sales growth. These brands are key differentiators, offering unique products that attract consumers and expand market share. For example, Calia by Carrie Underwood saw a 20% sales increase in the first half of 2024, highlighting strong customer appeal.

The GameChanger app, a vital part of Dick's strategy, is experiencing profitable growth with millions of active users. This platform strengthens community ties and provides valuable customer data, which Dick's Media Network utilizes for future sales and margin enhancement.

| Business Unit | BCG Category | Key Growth Drivers | Market Position | 2023 Performance Highlight |

|---|---|---|---|---|

| Private Label Brands (DSG, Calia, VRST) | Stars | Product differentiation, brand loyalty, expanded offerings | Growing market share in key apparel categories | 15% year-over-year sales growth, outpacing total company growth |

| GameChanger App | Stars | High user engagement, data analytics, community building | Dominant platform in youth sports management | Millions of active users, contributing to profitable growth |

What is included in the product

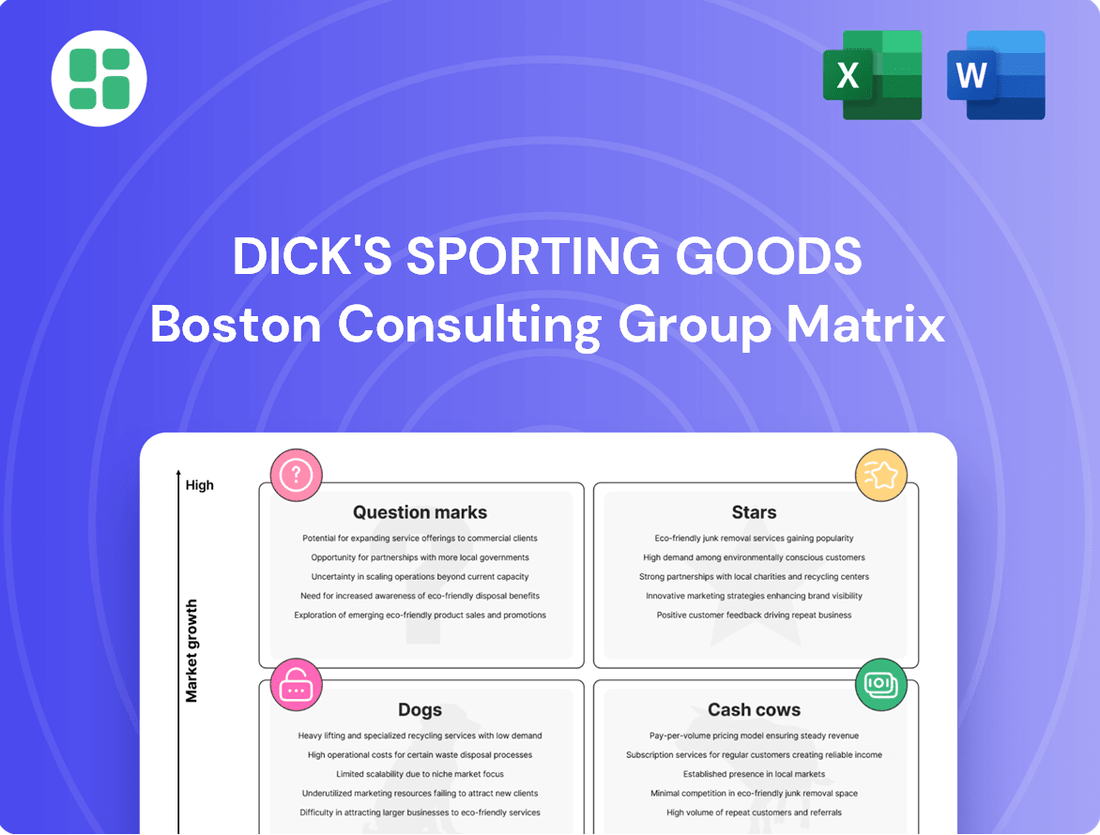

Dick's Sporting Goods' BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, focusing on units with high growth potential and those that generate stable cash flow.

Dick's Sporting Goods BCG Matrix provides a clear, one-page overview of each business unit's position, alleviating the pain of strategic uncertainty.

Cash Cows

Traditional sporting goods equipment, like baseball gloves, basketballs, and footballs, are Dick's Sporting Goods' cash cows. This segment represents a mature market where the company has a strong foothold and consistent demand.

These core categories are reliable revenue generators, requiring minimal new investment due to their established popularity. Dick's benefits from its extensive store network and brand recognition, allowing these products to consistently deliver high cash flow.

For instance, in fiscal year 2023, Dick's Sporting Goods reported net sales of $12.3 billion, with a significant portion attributed to these foundational product lines that continue to perform steadily.

General athletic apparel, encompassing everyday sportswear and team uniforms, represents a significant high-volume, high-market-share category for Dick's Sporting Goods. This segment enjoys consistent consumer demand, making it a stable revenue generator.

Unlike more volatile fashion-driven athletic wear, basic athletic apparel typically experiences lower market growth expectations. This stability contributes to strong and predictable profit margins for Dick's.

In 2024, Dick's Sporting Goods reported that their apparel segment, which includes these foundational items, remained a key driver of their overall sales performance. The company continues to leverage this category as a core component of its business strategy.

The extensive network of Standard Stores for Dick's Sporting Goods acts as a primary cash cow. These established locations, distinct from newer formats, are proven revenue generators with a strong, loyal customer base and streamlined operations, ensuring consistent income.

While the growth trajectory for these traditional stores might be moderate, their substantial market share solidifies their position as reliable profit centers. For instance, in fiscal year 2023, Dick's Sporting Goods reported net sales of $10.01 billion, with the majority of this revenue stemming from their established brick-and-mortar footprint.

ScoreCard Loyalty Program

Dick's Sporting Goods' ScoreCard loyalty program is a prime example of a cash cow within its business portfolio. With more than 25 million active members, this program is instrumental in driving a substantial portion of the company's overall sales.

The ScoreCard program effectively fosters customer loyalty and encourages repeat business, thereby securing a steady and predictable revenue stream for Dick's. This consistent performance is a hallmark of a cash cow, which generates more cash than it consumes.

The ongoing investment required to maintain the ScoreCard program is relatively low, especially when contrasted with the significant returns it generates through enhanced customer retention and valuable data insights. This efficiency further solidifies its position as a cash cow.

- 25+ Million Active Members: This vast membership base directly contributes to a significant percentage of Dick's Sporting Goods' total sales.

- Drives Repeat Purchases: The loyalty program incentivizes customers to return, creating a reliable revenue stream.

- Low Ongoing Investment: The program requires minimal capital to sustain its operations, maximizing its profitability.

- High Returns: Customer retention and data analytics derived from the program yield substantial financial benefits.

Core Athletic Footwear Brands

Core athletic footwear brands like Nike and Adidas continue to be Dick's Sporting Goods' cash cows. These established lines, known for their enduring popularity and consistent demand, represent a stable revenue stream for the company. Dick's strong relationships with these key manufacturers, coupled with significant market share, solidify their position in this mature but reliable segment of the athletic wear market.

- Established Market Dominance: Core brands like Nike and Adidas hold substantial market share, contributing significantly to Dick's overall revenue.

- Consistent Profitability: The mature nature of these product categories ensures predictable sales volumes and steady profitability, even without rapid growth.

- Strong Brand Partnerships: Dick's Sporting Goods leverages its deep partnerships with leading athletic footwear manufacturers to maintain a strong presence and access to popular products.

Dick's Sporting Goods' cash cows are primarily its foundational product categories, such as traditional sporting goods equipment and general athletic apparel. These segments benefit from consistent consumer demand and a strong market position, requiring minimal new investment to maintain their revenue generation.

The company's extensive network of established Standard Stores and its highly successful ScoreCard loyalty program also function as cash cows. These elements leverage existing infrastructure and customer loyalty to deliver predictable cash flow with relatively low ongoing investment needs.

Key athletic footwear brands, like Nike and Adidas, represent another significant cash cow category. Dick's strong partnerships and substantial market share in these mature, high-demand segments ensure steady profitability and contribute significantly to overall sales.

| Category | Market Share | Growth Rate | Cash Flow Contribution |

|---|---|---|---|

| Traditional Sporting Goods Equipment | High | Low | High |

| General Athletic Apparel | High | Low | High |

| Standard Stores | High | Low | High |

| ScoreCard Loyalty Program | N/A (Internal) | Low | High |

| Core Athletic Footwear Brands | High | Low | High |

Full Transparency, Always

Dick's Sporting Goods BCG Matrix

The preview of the Dick's Sporting Goods BCG Matrix you are currently viewing is precisely the document you will receive upon purchase. This comprehensive analysis, detailing each product category's position as a star, cash cow, question mark, or dog, is delivered in its final, unwatermarked format, ready for immediate strategic application. You'll gain access to the complete, professionally formatted report, enabling you to make informed decisions about resource allocation and future investments for Dick's Sporting Goods. This is not a sample; it's the actual, ready-to-use strategic tool you'll download, empowering your business planning with actionable insights.

Dogs

Certain Golf Galaxy locations within Dick's Sporting Goods portfolio are exhibiting concerning trends, with notable declines in comparable sales. This performance suggests a weak position in a market segment that may not be expanding rapidly or is facing intense competition, characteristic of a "Dog" in the BCG Matrix.

Dick's Sporting Goods has acknowledged these challenges, implementing strategic restructuring that includes evaluating lease renewals and potential closures for these underperforming Golf Galaxy stores. This move is a direct response to their function as potential cash traps, consuming capital without generating adequate returns.

For instance, in Q1 2024, Dick's Sporting Goods reported that its golf segment, which includes Golf Galaxy, experienced a net sales decrease of 1.6% compared to the prior year. This data point underscores the difficulties faced by some of these outlets, reinforcing their classification as Dogs.

Certain highly specialized or seasonal sporting goods, like niche hunting gear or specific winter sports equipment, can fall into the dog category of the BCG matrix. These products often serve a limited customer base or experience demand fluctuations, leading to low sales volumes and a small market share.

For instance, specialized ice fishing equipment might only see significant sales during a few months of the year. This seasonality, coupled with a limited enthusiast market, can make inventory management challenging and marketing efforts less efficient for the returns generated.

In 2023, Dick's Sporting Goods reported net sales of $10.5 billion. While the company generally performs well, specific product categories with these niche or seasonal characteristics could struggle to contribute significantly to overall growth, potentially representing a drag on resources if not managed carefully.

Older fitness equipment lines at Dick's Sporting Goods, such as basic treadmills or older elliptical models that haven't been updated with smart technology, often become 'dogs'. These products struggle to compete with newer, more feature-rich alternatives, leading to low sales volumes.

In 2024, the market for advanced connected fitness equipment continued to grow, further marginalizing traditional, non-connected machines. This shift means that older, outdated equipment at Dick's likely has a very small market share and low growth prospects, representing a drain on resources.

Specific Apparel Sub-categories with Declining Trends

Certain apparel sub-categories within Dick's Sporting Goods might be classified as dogs in their BCG matrix. These are typically items that have lost their appeal due to shifting fashion trends or face intense competition where Dick's doesn't have a standout advantage. Such products would show sluggish sales growth and a small slice of the market, thus contributing little to the company's bottom line.

For instance, consider the performance of certain athleisure wear styles that were popular a few years ago but have since been superseded by newer trends. If Dick's has a significant inventory of these older styles, they would likely experience low sales volume and low market share. In 2023, the athleisure market continued to evolve, with a greater emphasis on sustainable materials and versatile designs, potentially leaving older, less differentiated styles behind.

- Declining Fashion Relevance: Specific styles of athletic leggings or tracksuits that are no longer in vogue due to changing fashion cycles.

- High Competition, Low Differentiation: Basic t-shirts or shorts from brands that offer little unique selling proposition, leading to price sensitivity and low margins.

- Low Market Share & Growth: Categories like retro-inspired athletic footwear or specific niche sports apparel that have not gained traction, showing minimal sales increases and a small customer base.

- Contribution to Profitability: These segments would likely have low inventory turnover and minimal impact on overall revenue, potentially even incurring carrying costs.

Early Public Lands Locations Facing Closure/Relocation

While Public Lands, Dick's Sporting Goods' outdoor-focused retail concept, is generally categorized as a Question Mark due to its ongoing development and market penetration, some of its earlier locations have reportedly encountered challenges. These issues have manifested as closures or necessary relocations, suggesting that initial market adoption or profitability expectations were not met in certain geographical areas.

These specific underperforming stores, if they are not demonstrating the anticipated growth trajectory, could be temporarily viewed as 'dogs' within the BCG matrix framework. Such 'dog' classifications imply that these locations may require divestment or a substantial strategic reevaluation to improve their performance or to cut losses.

- Early Public Lands store closures or relocations indicate potential market adoption issues.

- Underperforming stores may be classified as 'dogs' if growth expectations are not met.

- A 'dog' classification suggests a need for divestment or significant strategic overhaul.

Certain Golf Galaxy locations within Dick's Sporting Goods portfolio are exhibiting concerning trends, with notable declines in comparable sales. This performance suggests a weak position in a market segment that may not be expanding rapidly or is facing intense competition, characteristic of a "Dog" in the BCG Matrix.

Dick's Sporting Goods has acknowledged these challenges, implementing strategic restructuring that includes evaluating lease renewals and potential closures for these underperforming Golf Galaxy stores. This move is a direct response to their function as potential cash traps, consuming capital without generating adequate returns.

For instance, in Q1 2024, Dick's Sporting Goods reported that its golf segment, which includes Golf Galaxy, experienced a net sales decrease of 1.6% compared to the prior year. This data point underscores the difficulties faced by some of these outlets, reinforcing their classification as Dogs.

Question Marks

Public Lands, Dick's Sporting Goods' newer outdoor-focused concept, is positioned as a Question Mark in the BCG Matrix. While the outdoor recreation market is expanding, Public Lands is still in its early stages of establishing market share. The company is investing heavily in growth, with plans for numerous new store openings throughout 2024 and into 2025, aiming to capture a larger piece of this burgeoning sector.

Dick's Sporting Goods' Field House concept, like its Field & Stream stores, is positioned as a Star in the BCG Matrix. These are newer, high-growth initiatives that are performing well but still require significant investment to expand their market share. For instance, by the end of 2023, Dick's had opened 10 Field House locations, a notable expansion from its initial rollout.

The Field House format is designed to offer an elevated in-store experience with specialized assortments, aiming to capture a larger share of the premium sporting goods market. While these stores are currently a smaller percentage of Dick's overall footprint, their strong performance and strategic importance in redefining the customer experience justify the ongoing investment.

Investing in equipment and apparel for emerging sports or highly niche activities could position Dick's Sporting Goods as a leader in future growth areas. These markets often exhibit rapid expansion, but Dick's would likely begin with a relatively small market share. This necessitates substantial investment in marketing to build brand awareness and in inventory management to meet the demands of new customer segments.

For instance, the pickleball market has seen explosive growth, with participation rates soaring. In 2023, the Sports & Fitness Industry Association reported that pickleball participation in the U.S. reached 13.6 million adults, a significant jump from previous years. Dick's Sporting Goods could capitalize on this by expanding its selection of pickleball paddles, balls, and apparel, and by sponsoring local leagues or events to capture a larger share of this burgeoning market.

Advanced Wearable Technology and Smart Fitness Devices

The advanced wearable technology and smart fitness device market is experiencing robust expansion, with global sales projected to reach over $130 billion by 2024. While Dick's Sporting Goods has a strong presence in general sporting goods, its market share in these highly specialized, tech-driven segments may be less dominant compared to pure technology retailers. This segment requires significant, ongoing investment in both inventory and targeted marketing efforts to effectively compete and capture a larger share of the growing consumer demand.

- Market Growth: The global wearables market is expected to see continued strong growth through 2025, driven by innovation in health tracking and smart features.

- Competitive Landscape: Dick's faces competition from established tech giants and specialized fitness brands in the wearable space.

- Investment Needs: Capturing market share necessitates substantial investment in up-to-date inventory and aggressive marketing campaigns to highlight product benefits and differentiation.

- Potential for Expansion: Despite competition, there's a significant opportunity for Dick's to increase its footprint by strategically curating its wearable offerings and enhancing its in-store and online customer experience for these products.

International Expansion Initiatives

Dick's Sporting Goods' international expansion initiatives would likely be classified as Question Marks in the BCG Matrix. Entering new geographic markets offers high growth potential, as seen with the global sporting goods market projected to reach over $700 billion by 2025, but necessitates significant upfront investment.

These ventures would begin with a low initial market share in unfamiliar territories. For instance, while Dick's has a strong presence in the US, establishing brand recognition and distribution networks in Europe or Asia would require substantial capital and time.

Significant uncertainties surround consumer adoption and the competitive landscape in these new markets. Dick's would face established local retailers and global competitors, requiring careful market research and tailored strategies to gain traction.

- High Growth Potential: Global sporting goods market expected to exceed $700 billion by 2025.

- Low Initial Market Share: Entering new territories means starting from scratch in terms of brand recognition and customer base.

- Substantial Investment Required: Establishing operations, marketing, and supply chains in foreign countries demands significant capital outlay.

- Significant Uncertainties: Consumer preferences, regulatory environments, and competitive intensity vary greatly by region.

Question Marks represent business areas with low market share in high-growth industries. Dick's Sporting Goods' Public Lands stores fit this description, aiming to capture a slice of the expanding outdoor recreation market. Similarly, investments in emerging sports like pickleball or advanced wearable technology also fall into this category. These ventures require significant capital for marketing and inventory, as Dick's builds its presence against established players.

BCG Matrix Data Sources

Our Dick's Sporting Goods BCG Matrix is built on a foundation of robust data, integrating company financial statements, market research reports, and industry growth trends.