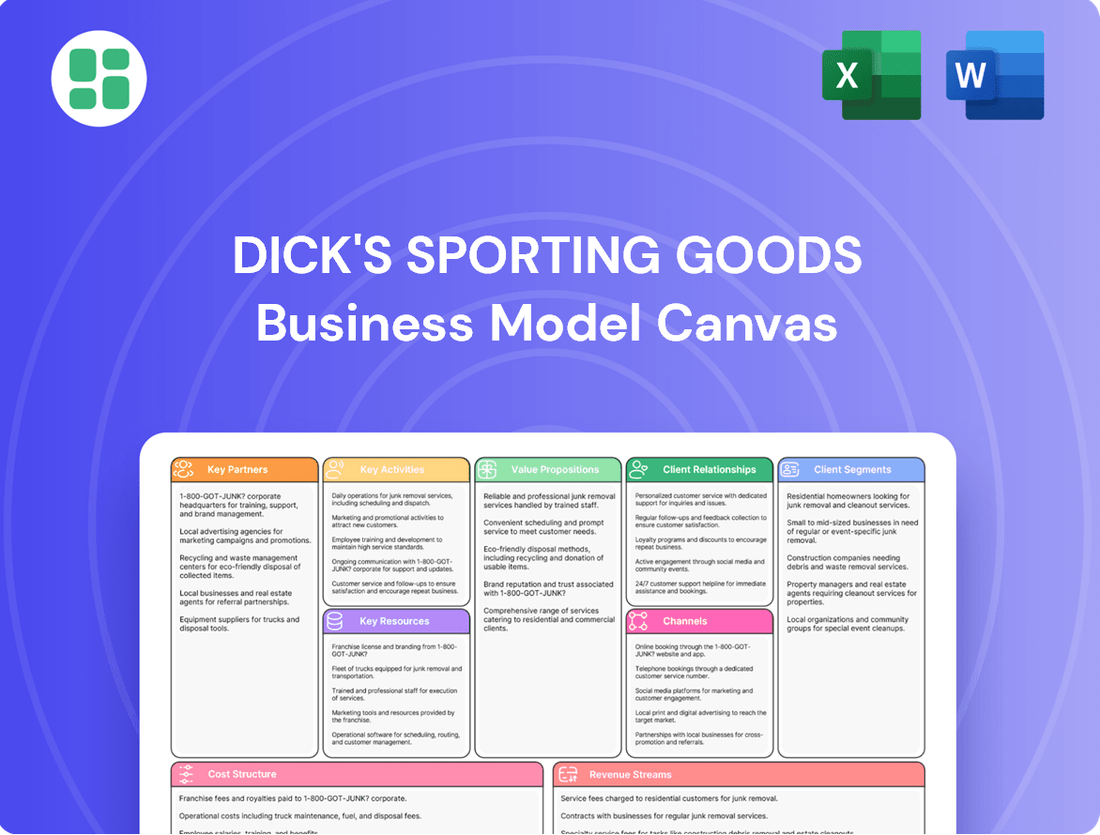

Dick's Sporting Goods Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dick's Sporting Goods Bundle

Unlock the strategic blueprint of Dick's Sporting Goods's success with their comprehensive Business Model Canvas. Discover how they leverage key partnerships, define their value propositions, and manage customer relationships to dominate the sporting goods market. This detailed analysis is your key to understanding their operational excellence.

Dive into the core of Dick's Sporting Goods's winning strategy with their complete Business Model Canvas. See how they structure their revenue streams, manage costs, and identify their key activities for sustained growth. Ready to gain actionable insights?

Want to dissect the success of a retail giant? Dick's Sporting Goods's full Business Model Canvas breaks down their customer segments, channels, and competitive advantages. Download it now to learn from their proven model.

Partnerships

Dick's Sporting Goods cultivates strategic brand alliances with industry titans like Nike, Adidas, and Under Armour. These collaborations ensure a robust inventory of authentic, premium merchandise, a cornerstone of their retail strategy.

These partnerships are vital for securing exclusive product offerings and reinforcing Dick's market standing, particularly as major brands increasingly prioritize direct-to-consumer sales channels. For instance, Nike's direct sales strategy means that strong wholesale relationships, like those with Dick's, become even more critical for broad market access.

Dick's Sporting Goods actively cultivates relationships with youth sports organizations and leagues. A prime example is their strategic investment in Unrivaled Sports, a move designed to deepen engagement within this crucial demographic. These partnerships are vital for building brand loyalty from an early age.

Initiatives like the Jr. WNBA program and 'It's Her Shot' further demonstrate Dick's commitment to youth sports. These collaborations not only boost brand visibility but also foster strong community ties. They also act as a direct channel to cultivate future generations of customers.

Dick's Sporting Goods partners with technology and e-commerce solution providers to bolster its omnichannel strategy. These collaborations are crucial for refining its online platform and optimizing the supply chain, ensuring a smooth customer journey across all touchpoints.

By integrating advanced technologies like artificial intelligence, Dick's aims to boost production efficiencies. For instance, the company has been investing in technology to improve its inventory management and fulfillment processes. In 2023, Dick's reported a significant increase in its e-commerce sales, highlighting the importance of these technological partnerships in driving digital growth.

Furthermore, the adoption of digital twin technology is being explored to create virtual replicas of its supply chain. This allows for better simulation, analysis, and ultimately, improvements in logistics and operational flow. These advancements are key to Dick's commitment to providing a seamless and responsive customer experience, especially as online shopping continues to dominate retail.

Private Label Manufacturers

Dick's Sporting Goods leverages private label manufacturers to produce exclusive brands like DSG, CALIA, and VRST. These collaborations are crucial for offering unique merchandise and maintaining control over product quality and pricing. In 2023, private label brands represented a significant portion of Dick's sales, contributing to their overall gross profit margin which stood at approximately 30.3% for the fiscal year.

These partnerships enable Dick's to swiftly adapt to evolving consumer preferences and market demands. By working closely with manufacturers, the company can ensure a consistent supply chain and faster product development cycles, which is vital in the fast-paced sporting goods industry. For instance, the success of CALIA, a women's activewear line, demonstrates the power of these strategic manufacturing relationships in creating popular, differentiated offerings.

- Brand Development: Enables creation of exclusive lines like DSG, CALIA, and VRST.

- Margin Control: Allows for better management of product costs and profitability.

- Market Responsiveness: Facilitates quicker introduction of new products aligned with trends.

- Supply Chain Efficiency: Supports consistent availability of differentiated merchandise.

Logistics and Fulfillment Partners

Dick's Sporting Goods relies heavily on its logistics and fulfillment partners to maintain an efficient supply chain. These partnerships are crucial for managing inventory across its vast product range and supporting its omnichannel strategy, which includes the increasingly important ship-from-store capability. This allows them to leverage their physical store footprint for online order fulfillment, enhancing speed and customer convenience.

To bolster these operations, Dick's has been actively investing in its distribution network. In 2023, the company continued to expand and modernize its distribution centers, aiming to improve product flow and overall efficiency. These investments are designed to ensure that products reach customers quickly and reliably, whether ordered online for home delivery or for in-store pickup.

- Key Logistics Partners: While specific partner names are often proprietary, Dick's collaborates with national and regional carriers for last-mile delivery.

- Distribution Center Investments: The company has been strategically investing in new and upgraded distribution centers to support its growing e-commerce business and omnichannel fulfillment needs.

- Omnichannel Support: Fulfillment partners enable Dick's to offer services like buy online, pick up in-store (BOPIS) and ship-from-store, which were significant drivers of their recent sales growth.

- Inventory Management: Strong logistics partnerships are fundamental to accurate inventory tracking and efficient stock movement, minimizing stockouts and optimizing product availability.

Dick's Sporting Goods' key partnerships extend to financial institutions and payment processors, crucial for facilitating transactions and managing customer credit. These relationships underpin their ability to offer flexible payment options, thereby enhancing customer convenience and potentially increasing sales volume.

Collaborations with technology providers are also vital, supporting Dick's e-commerce platform and in-store digital experiences. For instance, in 2023, the company continued to invest in its digital capabilities, aiming for seamless integration across all customer touchpoints. This focus on technology partnerships is essential for adapting to evolving consumer shopping habits and maintaining a competitive edge in the retail landscape.

Dick's also partners with various media and advertising agencies to execute marketing campaigns. These alliances are instrumental in reaching target audiences and building brand awareness. In 2024, Dick's has continued to leverage digital marketing channels, including social media and programmatic advertising, to drive customer engagement and sales.

| Partnership Type | Strategic Importance | 2023/2024 Focus/Impact |

| Financial Institutions/Payment Processors | Facilitate transactions, offer payment flexibility | Enhanced customer convenience, supported sales volume |

| Technology Providers | Support e-commerce, in-store digital experiences | Continued investment in digital capabilities, seamless integration |

| Media & Advertising Agencies | Brand awareness, customer reach | Leveraged digital marketing channels for engagement and sales |

What is included in the product

Dick's Sporting Goods' business model focuses on providing a wide selection of sporting goods and apparel through a blend of physical retail stores and a robust e-commerce platform, targeting a broad range of athletes and outdoor enthusiasts.

Dick's Sporting Goods' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their strategy, making complex operations easily digestible for quick review and team collaboration.

This visual tool efficiently addresses the pain of information overload by condensing Dick's Sporting Goods' core components, enabling rapid understanding and adaptation for new insights.

Activities

Dick's Sporting Goods' key activity revolves around the strategic procurement and meticulous curation of its merchandise. This involves sourcing a diverse array of authentic, high-quality sporting goods, apparel, and footwear from a mix of premium, national, and their own private label brands. This approach ensures a unique product offering designed to resonate with a broad customer base and stay ahead of evolving market demands.

For fiscal year 2023, Dick's Sporting Goods reported net sales of $12.32 billion, underscoring the scale of their procurement operations. The company's ability to manage such a vast assortment, balancing national brands with exclusive private labels like DSG and Calia, is crucial for driving customer traffic and maintaining competitive pricing.

Dick's Sporting Goods focuses on delivering a smooth omnichannel experience, blending its physical stores like Dick's, Golf Galaxy, Public Lands, House of Sport, and Field House with strong online and mobile platforms. This integration is crucial for meeting modern consumer expectations.

Key activities include enabling services like buy online, pick up in store (BOPIS) and ship-from-store. These options significantly boost customer convenience and leverage the company's extensive store network. In 2023, Dick's reported that approximately 40% of its online sales involved in-store pickup, highlighting the importance of this omnichannel capability.

Dick's Sporting Goods actively engages customers through robust marketing and brand promotion. This includes significant investment in digital advertising, strategic partnerships with influencers, and the effective utilization of their ScoreCard loyalty program to foster repeat business.

In 2024, the company continued to emphasize data-driven strategies to personalize marketing efforts, aiming to enhance customer acquisition and retention. This focus on tailored outreach is crucial in a competitive retail landscape.

Supply Chain and Inventory Management

Dick's Sporting Goods prioritizes an efficient supply chain to ensure products are available and costs are managed effectively. This involves everything from getting products from suppliers to getting them to customers, whether that's in stores or directly to their homes.

The company is actively investing in its logistics infrastructure. For instance, in 2023, Dick's continued to expand its network of distribution centers, aiming to speed up delivery times and improve inventory accuracy. They are also leveraging technology, like artificial intelligence, to better predict demand and optimize how products move through their system, which helps cut down on operational expenses.

- Distribution Network Expansion: Investments in new and upgraded distribution centers support faster fulfillment and broader reach.

- AI-Powered Optimization: Utilizing artificial intelligence to enhance inventory flow, demand forecasting, and reduce logistical costs.

- In-Store Fulfillment Capabilities: Strengthening the ability to fulfill online orders from store inventory, enhancing customer convenience and inventory turnover.

- Supplier Relationships: Maintaining strong partnerships with suppliers to ensure timely and cost-effective sourcing of a wide range of sporting goods.

Experiential Store Development and Management

Dick's Sporting Goods actively develops and manages unique store formats, such as their 'House of Sport' and 'Field House' concepts. These experiential locations are designed to go beyond traditional retail, incorporating interactive elements and premium services to create a more engaging customer journey. This focus on innovative store development is a cornerstone of their strategy to stand out in the competitive sporting goods market.

These specialized stores are crucial for Dick's growth and differentiation. For instance, the House of Sport stores aim to provide a highly curated and immersive experience, often featuring specialized zones for different sports and offering services like batting cages or putting greens. This approach directly addresses the desire for more than just product purchasing, fostering a deeper connection with the brand and its offerings.

- Experiential Store Development: Dick's invests in creating innovative store concepts like 'House of Sport' and 'Field House'.

- Enhanced Customer Experience: These stores feature interactive elements and elevated services to improve in-store engagement.

- Strategic Growth Driver: These formats are central to Dick's strategy for market differentiation and future growth.

Dick's Sporting Goods' key activities center on strategic merchandise procurement, omnichannel experience management, and customer engagement through marketing and loyalty programs. They also focus on efficient supply chain operations and the development of innovative store formats. These activities collectively aim to drive sales, enhance customer satisfaction, and maintain a competitive edge in the retail landscape.

| Key Activity | Description | Supporting Data/Facts |

|---|---|---|

| Merchandise Procurement | Sourcing a diverse range of sporting goods, apparel, and footwear from national and private label brands. | Net sales of $12.32 billion in fiscal year 2023. |

| Omnichannel Experience | Integrating physical stores with online and mobile platforms, offering services like BOPIS. | Approximately 40% of online sales involved in-store pickup in 2023. |

| Customer Engagement | Utilizing marketing, influencer partnerships, and the ScoreCard loyalty program. | Continued emphasis on data-driven personalization in 2024 marketing efforts. |

| Supply Chain Efficiency | Managing product flow from suppliers to customers, including investments in logistics. | Expansion of distribution centers and AI for demand forecasting in 2023. |

| Store Format Development | Creating unique, experiential store concepts like 'House of Sport' and 'Field House'. | These formats are key to market differentiation and future growth. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for Dick's Sporting Goods that you are previewing is the actual document you will receive upon purchase. This is not a mockup or sample; it is a direct representation of the comprehensive analysis you will gain full access to. Once your order is complete, you will be able to download this exact file, providing you with a professional and ready-to-use strategic blueprint for Dick's Sporting Goods.

Resources

Dick's Sporting Goods leverages a vast physical retail network, encompassing its namesake stores alongside specialized formats like Golf Galaxy and Public Lands. This extensive footprint, including the newer House of Sport and Field House concepts, is crucial for driving sales and fostering customer interaction.

As of early 2024, Dick's operates over 700 stores across the United States. These locations are not just points of sale but also vital hubs for the company's omnichannel strategy, facilitating services like buy online, pick up in-store and ship-from-store, thereby enhancing customer convenience and operational efficiency.

Dick's Sporting Goods leverages robust e-commerce websites and mobile applications, including its highly-rated GameChanger app, as a cornerstone of its digital strategy. These platforms are not just sales channels; they are dynamic hubs for customer interaction, data collection, and personalized marketing efforts.

In fiscal year 2023, Dick's reported that its e-commerce sales represented approximately 18% of total net sales, demonstrating the significant role these digital assets play. The GameChanger app, in particular, has been instrumental in driving customer loyalty and engagement, offering features like scorekeeping and team management that foster a deeper connection beyond simple transactions.

This digital infrastructure is crucial for operational efficiencies, enabling data-driven insights into customer behavior, inventory management, and targeted promotional campaigns. The ability to personalize the shopping experience through these platforms is a key differentiator in the competitive retail landscape, driving both online and in-store traffic.

Dick's Sporting Goods' strong brand reputation, built over years, acts as a powerful intangible asset. This recognition fosters trust and encourages customers to choose their products over competitors.

The ScoreCard loyalty program is a cornerstone, boasting over 25 million active members as of early 2024. This extensive membership base directly translates into consistent repeat purchases, forming a stable revenue stream and significantly reducing customer acquisition costs.

Beyond driving sales, the loyalty program provides Dick's with invaluable customer data. This information allows for personalized marketing, targeted promotions, and a deeper understanding of consumer preferences, further strengthening brand equity and customer loyalty.

Diverse Product Inventory and Private Label Brands

Dick's Sporting Goods leverages a vast and curated inventory, featuring top national brands alongside its own profitable private label lines like DSG, CALIA, and VRST. This dual approach allows them to cater to a broad customer base while also improving their profit margins.

The company's commitment to its private label brands is a significant driver of its business model. For instance, in the first quarter of 2024, Dick's reported that its private brands achieved a 15% increase in sales, contributing significantly to overall revenue growth.

- Diverse Product Range: Offers a wide selection of sporting goods, apparel, and footwear from national and international brands.

- Private Label Strength: Features and actively promotes its own brands, such as DSG, CALIA, and VRST, which often carry higher profit margins.

- Inventory Management: A key resource is the ability to manage this diverse inventory efficiently to meet customer demand across various sports and activities.

- Brand Partnerships: Strong relationships with leading national brands are crucial for securing popular products and maintaining a competitive edge.

Skilled Workforce and Sports Experts

Dick's Sporting Goods relies heavily on its skilled workforce, particularly in-store associates with deep sports knowledge. These experts are crucial for providing personalized recommendations and specialized services like golf club fitting, directly impacting customer satisfaction and fostering loyalty.

The company's investment in training and retaining these knowledgeable employees is a key differentiator. For instance, during the fiscal year 2023, Dick's Sporting Goods continued to emphasize associate development, aiming to enhance the in-store experience.

- In-Store Expertise: Employees act as trusted advisors, guiding customers through product selection based on their specific needs and skill levels.

- Customer Experience Enhancement: The presence of sports experts elevates the shopping journey, turning a simple purchase into a valuable interaction.

- Service Specialization: Services like custom equipment fitting, offered by trained staff, add significant value and encourage repeat business.

- Employee Engagement: A focus on creating a knowledgeable and engaged workforce contributes to higher customer retention rates.

Dick's Sporting Goods' key resources include its extensive physical retail footprint, a robust e-commerce platform, a strong brand reputation, a loyal customer base driven by its ScoreCard program, a diverse and curated inventory with profitable private label brands, and a skilled, knowledgeable workforce. These elements collectively enable the company to deliver a comprehensive and engaging customer experience across multiple touchpoints.

| Resource Category | Specific Assets | Impact/Value |

|---|---|---|

| Physical Retail | Over 700 stores (as of early 2024), including specialized formats (Golf Galaxy, Public Lands, House of Sport, Field House) | Drives sales, facilitates omnichannel services, fosters customer interaction. |

| Digital Platform | E-commerce websites, mobile apps (e.g., GameChanger app) | Significant sales channel (approx. 18% of total net sales in FY2023), enables data collection, personalized marketing, customer engagement. |

| Brand & Loyalty | Strong brand reputation, ScoreCard loyalty program (over 25 million active members as of early 2024) | Fosters trust, drives repeat purchases, provides valuable customer data for targeted marketing. |

| Inventory | National brands, private label brands (DSG, CALIA, VRST) with strong sales growth (15% increase in Q1 2024) | Caters to diverse customer needs, enhances profit margins, maintains competitive edge. |

| Human Capital | Skilled in-store associates with sports expertise | Enhances customer experience through personalized recommendations and specialized services, driving satisfaction and loyalty. |

Value Propositions

Dick's Sporting Goods boasts a comprehensive product assortment, featuring a wide and deep selection of authentic, high-quality sporting goods, apparel, and footwear. This extensive range covers numerous categories and brands, encompassing premium, national, and exclusive private labels, ensuring customers find all their athletic and outdoor needs met in one location.

For fiscal year 2023, Dick's reported net sales of $12.33 billion, demonstrating the broad appeal and demand for their diverse product offerings. This vast selection caters to a wide array of customer interests, from professional athletes to casual enthusiasts.

Dick's Sporting Goods offers a seamless omnichannel experience, letting customers shop online, in-store, or via mobile with ease. This integration means you can browse a vast selection, make a purchase, and choose how you receive your items, all within a connected ecosystem. For instance, in the first quarter of 2024, Dick's reported that its same-store sales increased by 5.3%, indicating strong customer engagement with their offerings, which are heavily influenced by these convenient shopping options.

Services like curbside pickup and in-store pickup are key to this seamlessness, providing ultimate flexibility. You can order online and have your gear ready for you without even leaving your car, or quickly grab it inside the store. This convenience is a major draw, contributing to the company's ability to adapt to evolving consumer preferences and maintain its competitive edge in the retail landscape.

Dick's Sporting Goods is transforming its physical stores into experiential hubs. Concepts like House of Sport and Field House offer engaging activities, including batting cages, climbing walls, and golf simulators. These immersive environments allow customers to test products in dynamic settings, fostering a deeper connection with the brand and its offerings.

Expert Advice and Specialized Services

Dick's Sporting Goods offers expert advice and specialized services, like personalized equipment fitting and assembly, directly from their knowledgeable associates. This hands-on assistance is crucial for customers, especially those investing in technical gear, ensuring they select the right products for their needs and skill level.

This personalized approach significantly boosts customer satisfaction and fosters loyalty. For instance, in fiscal year 2023, Dick's reported net sales of $12.31 billion, indicating a strong customer base that values these expert interactions. The company's commitment to in-store expertise, such as golf club fittings or bike assembly, directly contributes to this revenue stream by building confidence and reducing return rates.

- Expert Staff: Provides specialized knowledge for product selection.

- Personalized Fitting: Ensures optimal performance and comfort for equipment.

- Assembly Services: Offers convenience and proper setup for purchased items.

- Enhanced Satisfaction: Drives repeat business and positive customer experiences.

Value Through Private Labels and Loyalty Programs

Dick's Sporting Goods enhances customer value by offering a compelling mix of quality private label brands and a robust loyalty program. These in-house brands provide customers with access to high-performance gear at more accessible price points, fostering a perception of good value. For instance, their private label sales have consistently contributed a significant portion to their overall revenue, demonstrating customer trust in these offerings.

The ScoreCard loyalty program is central to this value proposition, rewarding repeat business with tangible benefits. Members receive exclusive discounts, earn points on purchases that can be redeemed for future savings, and gain early access to new product launches and sales events. This tiered approach incentivizes continued engagement and builds a loyal customer base. In fiscal year 2023, Dick's reported that its loyalty members represented a substantial percentage of its total sales, highlighting the program's impact.

- Private Label Quality and Affordability: Dick's private label brands, such as DSG and CALIA, offer customers high-quality athletic apparel and equipment at competitive prices, differentiating them from national brands.

- ScoreCard Loyalty Program Benefits: The program provides members with rewards, exclusive discounts, and early access to products, encouraging repeat purchases and fostering customer loyalty.

- Customer Retention and Engagement: This dual strategy of quality private labels and a rewarding loyalty program drives customer retention and increases overall customer lifetime value.

- Sales Contribution: Private label sales and loyalty program engagement are key drivers of Dick's overall sales performance and market differentiation.

Dick's Sporting Goods offers a vast and deep selection of authentic, high-quality sporting goods, apparel, and footwear across numerous categories and brands, including premium, national, and exclusive private labels. This extensive assortment ensures customers can find everything they need for their athletic pursuits in one place.

The company provides a seamless omnichannel experience, allowing customers to shop online, in-store, or via mobile with integrated options like curbside and in-store pickup. This convenience, coupled with a 5.3% increase in same-store sales in Q1 2024, highlights strong customer engagement with their accessible shopping channels.

Dick's transforms stores into experiential hubs with concepts like House of Sport and Field House, featuring batting cages and climbing walls, allowing product testing in dynamic settings. This experiential retail approach fosters deeper customer connections and brand loyalty.

Expert staff offer personalized assistance, including equipment fitting and assembly, enhancing customer satisfaction and confidence. In fiscal year 2023, net sales reached $12.31 billion, underscoring the value customers place on this knowledgeable, hands-on support.

Dick's enhances value through quality private label brands and its ScoreCard loyalty program. Private labels offer high-performance gear at competitive prices, while the loyalty program rewards repeat business with exclusive benefits, driving customer retention and lifetime value.

| Value Proposition | Description | Fiscal Year 2023 Data |

|---|---|---|

| Comprehensive Product Assortment | Wide and deep selection of authentic, high-quality sporting goods, apparel, and footwear across multiple categories and brands. | Net Sales: $12.33 billion |

| Seamless Omnichannel Experience | Integrated online, in-store, and mobile shopping with convenient pickup options like curbside and in-store. | Q1 2024 Same-Store Sales Increase: 5.3% |

| Experiential Retail Environments | Stores transformed into hubs with interactive elements like batting cages and climbing walls for product testing. | N/A (Qualitative Value) |

| Expert Advice and Services | Knowledgeable associates provide personalized equipment fitting and assembly services. | Net Sales: $12.31 billion (Indicative of customer trust in expertise) |

| Private Label Brands & Loyalty Program | Quality, affordable private label brands and a rewarding loyalty program (ScoreCard) to drive repeat business and engagement. | Loyalty members represent a substantial percentage of total sales. |

Customer Relationships

Dick's Sporting Goods cultivates robust customer connections via its ScoreCard loyalty program. This initiative rewards members with points, special deals, and early product access, directly encouraging repeat purchases and gathering crucial data for tailored engagement.

In 2023, ScoreCard members represented a significant portion of Dick's sales, with loyalty program members spending more than non-members. The program's tiered structure, offering increasing benefits with higher spending, is a key driver of sustained customer engagement.

Dick's Sporting Goods leverages customer data from its Scorecard loyalty program and digital interactions to craft personalized marketing campaigns. This includes targeted emails and text alerts featuring relevant products and promotions, aiming to boost customer engagement and sales.

Dick's Sporting Goods cultivates strong customer relationships through its in-store service, where "teammates" offer expert advice and product demonstrations. This personal interaction is crucial for a positive shopping experience.

In 2024, the company continued to emphasize this, with a focus on specialized services like equipment fittings and repairs, aiming to build loyalty and repeat business.

Community and Youth Sports Engagement

Dick's Sporting Goods fosters strong customer relationships through deep engagement with community and youth sports. They actively support local teams, leagues, and impactful initiatives such as the Jr. WNBA and their own 'It's Her Shot' program, which aims to increase girls' participation in basketball.

This commitment goes beyond mere sponsorship; it builds genuine brand affinity and a shared sense of purpose. By investing in the grassroots of sports, Dick's connects with customers on an emotional level, creating loyalty that transcends simple transactions.

- Community Support: Dick's provided over $100 million in donations and sponsorships to youth sports organizations and community initiatives by the end of 2023.

- Youth Programs: The Jr. WNBA and 'It's Her Shot' programs are key examples of their dedication to fostering participation and development in young athletes.

- Brand Affinity: This community-focused approach cultivates a strong positive brand image and encourages repeat business from families involved in youth sports.

Digital Interaction and Support

Dick's Sporting Goods actively engages customers through its robust digital ecosystem. Its e-commerce website and mobile applications serve as primary hubs for interaction, offering personalized recommendations and seamless purchasing experiences. In 2024, the company continued to invest in enhancing these platforms, aiming for greater user convenience and engagement.

Customer support is integrated across these digital channels, providing readily accessible assistance. This includes features like live chat, FAQs, and order tracking, ensuring a smooth customer journey. The company's commitment to digital interaction is evident in its efforts to maintain a strong online presence and responsive communication strategies.

- Digital Engagement: Dick's utilizes its e-commerce site, mobile apps, and social media to foster continuous customer interaction and provide easy access to information and support.

- Mobile App Integration: The GameChanger app, for instance, offers specialized features for youth sports, deepening engagement beyond traditional retail.

- Responsive Support: Customers can expect timely assistance through various digital touchpoints, reflecting the company's focus on a positive online experience.

Dick's Sporting Goods fosters strong customer relationships through its comprehensive ScoreCard loyalty program, which saw continued growth and engagement in 2023 and 2024. The company also emphasizes personalized digital experiences and in-store expert service to build lasting connections.

| Customer Relationship Strategy | Key Initiatives | 2023/2024 Impact/Focus |

|---|---|---|

| Loyalty Program | ScoreCard Rewards | Drove repeat purchases and data collection; members spent more than non-members. |

| Personalized Engagement | Targeted marketing (email, SMS) | Leveraged loyalty data for relevant promotions, enhancing customer connection. |

| In-Store Experience | Expert advice, product fitting/repair | Focused on specialized services to build loyalty and encourage repeat visits. |

| Community Involvement | Youth sports support (Jr. WNBA, 'It's Her Shot') | Invested over $100 million in donations/sponsorships, building brand affinity. |

| Digital Ecosystem | E-commerce, mobile apps, social media | Enhanced platforms for seamless purchasing and continuous customer interaction. |

Channels

Dick's Sporting Goods' primary sales channel is its extensive network of large-format retail stores, numbering over 700 locations across the United States. These physical stores are the backbone of the company's strategy, providing customers with a wide array of sporting goods, apparel, and footwear. In 2023, the company reported net sales of $12.33 billion, with a significant portion driven by these brick-and-mortar locations.

These retail stores are not just points of sale but also crucial hubs for customer engagement, offering in-store experiences that complement their product selection. They facilitate immediate purchases, returns, and provide a platform for personalized customer service, reinforcing brand loyalty and driving repeat business.

Golf Galaxy and Public Lands, as specialty retail chains under Dick's Sporting Goods, are designed to capture niche markets by offering deep product selections and expert advice. Golf Galaxy, for instance, provides a comprehensive range of golf equipment, apparel, and technology, alongside services like club fitting and repair, directly appealing to dedicated golfers.

Public Lands focuses on outdoor enthusiasts, stocking gear for activities like hiking, camping, and fishing, emphasizing sustainability and community engagement. This specialization allows them to build stronger relationships with specific customer groups who seek specialized knowledge and tailored product assortments that a general sporting goods store might not fully provide.

For the fiscal year 2023, Dick's Sporting Goods reported net sales of $12.32 billion, with their specialty concepts contributing to this overall growth by attracting and retaining customers with specialized needs.

DICKS.com is a vital sales channel for Dick's Sporting Goods, providing access to their complete product range alongside online-exclusive offerings. This digital storefront is central to their omnichannel strategy, enabling customers to seamlessly utilize services like buy online, pick up in store (BOPIS) and ship-to-home options.

In fiscal year 2023, Dick's Sporting Goods reported that its e-commerce segment continued to be a significant driver of growth, with online sales contributing substantially to the company's overall revenue. While specific percentage breakdowns for 2024 are not yet fully reported, the trend from previous years, where e-commerce represented a considerable portion of total sales, is expected to persist and potentially grow.

Mobile Applications (Dick's App, GameChanger)

Dick's Sporting Goods leverages mobile applications like its primary shopping app and the specialized GameChanger app to create a seamless and engaging customer journey. These platforms offer convenient browsing and purchasing, direct access to loyalty program rewards, and unique community features, particularly for youth sports enthusiasts through GameChanger. This dual approach not only boosts digital sales but also deepens customer relationships by providing added value beyond simple transactions.

The company's mobile strategy is a key driver of its digital growth. For instance, in the first quarter of 2024, Dick's reported a 5% increase in same-store sales, with e-commerce continuing to be a significant contributor. The mobile app experience is central to this, offering personalized recommendations and easy access to promotions, which in turn encourages repeat purchases and strengthens brand loyalty.

- Convenience and Access: Dick's mobile app provides a user-friendly interface for product discovery, purchasing, and managing loyalty accounts, making shopping effortless.

- Engagement through GameChanger: The GameChanger app fosters community by facilitating team communication, scheduling, and scorekeeping for youth sports, creating a sticky ecosystem for families.

- Digital Sales Driver: Mobile transactions represent a substantial portion of Dick's online revenue, directly contributing to the company's overall sales performance and market share.

- Enhanced Customer Connectivity: Push notifications for sales, personalized offers, and team updates via GameChanger keep customers actively connected to the brand and its offerings.

Direct-to-Consumer Marketing (Email, Direct Mail, Social Media)

Dick's Sporting Goods leverages direct-to-consumer channels like email, direct mail, and social media to directly engage its customer base. These efforts are crucial for communicating promotions, highlighting new product arrivals, and sharing brand-relevant content, fostering a personalized connection.

This direct communication strategy is designed to drive both online sales and foot traffic to their physical stores. For instance, in fiscal year 2023, Dick's reported net sales of $10.3 billion, underscoring the importance of effective customer outreach. Their social media presence, actively promoting new gear and events, plays a significant role in this engagement.

- Email Marketing: Used for personalized offers and new product announcements, driving repeat purchases.

- Direct Mail: Continues to be a channel for reaching specific customer segments with tailored promotions.

- Social Media: Platforms like Instagram and Facebook are utilized for brand building, customer interaction, and driving traffic to e-commerce and physical locations.

Dick's Sporting Goods utilizes a robust omnichannel approach, integrating its physical stores, e-commerce website, and mobile applications to provide a seamless customer experience. This strategy ensures customers can shop anytime, anywhere, and receive their purchases through various convenient methods.

The company's physical retail presence remains a cornerstone, complemented by a strong online platform and engaging mobile apps like GameChanger. This multi-channel strategy is designed to meet diverse customer preferences, driving sales and fostering brand loyalty through consistent engagement and accessible services.

For fiscal year 2023, Dick's Sporting Goods reported net sales of $12.32 billion, with its integrated channel strategy contributing significantly to this performance. The ongoing investment in digital capabilities and the expansion of specialty concepts like Golf Galaxy and Public Lands further solidify its market position.

The company's digital channels, including its website and mobile apps, are critical for reaching a wider audience and facilitating convenient transactions. In Q1 2024, Dick's reported a 5% increase in same-store sales, highlighting the effectiveness of its integrated approach.

| Channel | Description | Key Features | 2023 Net Sales Contribution (Approximate) |

|---|---|---|---|

| Retail Stores | Over 700 large-format locations | In-store experience, BOPIS, returns, personalized service | Majority of $12.32 billion |

| E-commerce (DICKS.com) | Online storefront | Full product range, online exclusives, ship-to-home | Significant portion of total sales |

| Mobile Apps | Dick's app, GameChanger app | Convenient browsing/purchasing, loyalty programs, community features | Drives digital growth and engagement |

| Specialty Concepts | Golf Galaxy, Public Lands | Niche market focus, expert advice, specialized product assortments | Contributes to overall sales growth |

Customer Segments

Casual athletes and fitness enthusiasts represent a significant customer base for Dick's Sporting Goods. This segment includes individuals and families who participate in recreational sports, enjoy general fitness activities, and are looking for apparel and equipment to support an active lifestyle. They often prioritize convenience when shopping, appreciate a wide variety of products to choose from, and are sensitive to accessible price points. For instance, in 2023, Dick's reported a net sales increase to $10.03 billion, reflecting the sustained demand from such broad consumer groups.

Serious athletes and competitive sports teams represent a crucial customer segment for Dick's Sporting Goods. This group includes dedicated individuals, coaches, and entire sports organizations that demand specialized equipment, high-performance apparel, and professional-grade gear to excel in their respective sports. They are not casual participants; they are invested in their performance and seek products that can withstand rigorous use and contribute to their competitive edge.

This segment's purchasing behavior is characterized by a focus on quality, durability, and brand reputation. They are often willing to invest more in products that offer superior performance, advanced technology, and a proven track record. For instance, a competitive runner might prioritize a specific brand of shoes known for its cushioning and energy return, while a professional basketball team would look for durable, high-quality uniforms and training equipment. Dick's Sporting Goods caters to this by offering a wide selection of premium brands and specialized product lines designed for serious athletic pursuits.

In 2024, the sports equipment and apparel market continued to show robust growth, driven by increased participation in various sports and a growing emphasis on health and fitness. For example, the global sports apparel market was projected to reach over $200 billion by 2025, with a significant portion attributed to performance-oriented wear sought by serious athletes. Dick's Sporting Goods, by stocking brands like Nike, Adidas, and Under Armour, directly addresses the needs of this discerning customer base, ensuring they have access to the latest innovations and trusted products essential for their competitive endeavors.

Parents and guardians are a significant customer segment for Dick's Sporting Goods, actively purchasing equipment, apparel, and accessories for their children involved in organized youth sports and school teams. They often seek products that offer a good balance of value and durability, understanding that children's gear can experience wear and tear. Convenience in shopping and product availability is also a key consideration for these busy families.

In 2024, the youth sports market continued to be robust, with families investing heavily in their children's athletic pursuits. Dick's Sporting Goods likely saw continued strong sales from this demographic, driven by back-to-school shopping and seasonal sports sign-ups. The company's focus on offering a wide selection of brands and price points caters directly to the varied needs and budgets of parents making these purchases.

Outdoor Enthusiasts (Hikers, Campers, Anglers)

Outdoor Enthusiasts, including dedicated hikers, campers, and anglers, represent a core customer base for Dick's Sporting Goods, particularly through its Public Lands banner. These individuals actively seek specialized, high-performance gear to enhance their experiences in nature. For instance, in 2024, the outdoor recreation industry in the U.S. continued to see strong engagement, with camping alone experiencing a significant resurgence.

This segment prioritizes durability, functionality, and brand reputation when purchasing equipment for activities like backpacking, fishing expeditions, and wilderness camping. They are often willing to invest in premium products that offer reliability and advanced features. The market for outdoor gear is substantial; for example, the U.S. fishing equipment market was valued at billions of dollars in recent years, indicating the spending power within this niche.

- Core Activities: Hiking, camping, fishing, and general nature-based pursuits.

- Gear Needs: Specialized, high-performance equipment for durability and functionality.

- Purchasing Drivers: Brand reputation, product reliability, and advanced features.

- Market Significance: Strong consumer spending in segments like camping and fishing.

Golf Enthusiasts

Golf enthusiasts, encompassing players from beginners to seasoned professionals, represent a core customer segment for DICK'S Sporting Goods, particularly through its specialized Golf Galaxy stores. This group seeks a comprehensive range of golf equipment, including clubs, balls, and bags, alongside performance apparel and essential accessories. Their purchasing decisions are often driven by a desire for expert advice, access to premium brands, and products that can enhance their game. In 2024, the golf industry continued to see robust engagement, with participation rates remaining strong, indicating a sustained demand for these specialized offerings.

Golf Galaxy caters to this segment by providing not only a wide selection of merchandise but also crucial specialized services. Club fitting sessions, a key draw for serious golfers, are designed to optimize equipment for individual swing mechanics and playing styles. This focus on personalized service and high-quality, performance-oriented products resonates deeply with golfers who prioritize improvement and enjoy the technical aspects of the sport. The company's investment in these in-store experiences directly addresses the needs of this discerning customer base.

- Broad Appeal: Serves golfers across all skill levels, from casual players to competitive athletes.

- Specialized Retail: Primarily addressed through the dedicated Golf Galaxy store format, offering a focused selection.

- Product Focus: Demand centers on golf clubs, apparel, accessories, and advanced fitting services.

- Value Drivers: Customers prioritize brand reputation, expert guidance, and products that boost performance.

Dick's Sporting Goods serves a diverse customer base, from casual fitness enthusiasts to serious athletes and parents outfitting their children. The company also targets outdoor adventurers and dedicated golfers through specialized channels like Public Lands and Golf Galaxy. This broad reach allows Dick's to capture significant market share across various sporting and recreational activities.

In 2024, the company continued to leverage its omni-channel strategy to meet the needs of these varied segments, blending in-store experiences with robust e-commerce capabilities. For instance, Dick's reported net sales of $10.03 billion for the fiscal year ending February 3, 2024, demonstrating the sustained demand from its wide customer demographics.

| Customer Segment | Key Characteristics | Dick's Sporting Goods Approach |

|---|---|---|

| Casual Athletes & Fitness Enthusiasts | Active lifestyle, broad product needs, price-sensitive | Wide selection, accessible pricing, convenient shopping |

| Serious Athletes & Teams | Performance-driven, quality-focused, brand-loyal | Specialized gear, premium brands, advanced technology |

| Parents & Guardians | Outfitting children, value and durability conscious | Youth sports focus, balanced pricing, brand variety |

| Outdoor Enthusiasts | Nature-focused, gear reliability, specialized needs | Public Lands banner, durable equipment, performance features |

| Golf Enthusiasts | Skill improvement, expert advice, premium equipment | Golf Galaxy stores, club fitting, brand selection |

Cost Structure

The Cost of Goods Sold (COGS) is the most significant expense for Dick's Sporting Goods, encompassing the direct costs of acquiring merchandise from major brands and producing their own private label items. For fiscal year 2023, Dick's reported a COGS of $7.23 billion, representing approximately 73% of their total net sales.

Effectively managing inventory and optimizing sourcing strategies are paramount to controlling this substantial cost. This involves negotiating favorable terms with suppliers and minimizing waste or obsolescence in their product stock.

Dick's Sporting Goods faces substantial store operating expenses, a key component of its cost structure. These costs encompass rent for its vast network of physical locations, utilities to power them, ongoing maintenance, and depreciation of assets. In 2023, the company reported selling, general, and administrative expenses, which include these operating costs, of approximately $3.5 billion.

The company is also investing in new store formats like House of Sport and Field House, which likely add to these operational expenditures. These newer concepts may involve higher build-out costs and potentially different utility or staffing needs compared to traditional Dick's Sporting Goods stores.

Employee wages and benefits represent a significant cost for Dick's Sporting Goods, encompassing thousands of associates across its retail stores, distribution centers, and corporate offices. This includes hourly pay for sales associates and specialized staff, as well as salaries for management and corporate functions.

In 2023, Dick's Sporting Goods reported selling, general and administrative expenses of approximately $2.7 billion, a substantial portion of which is attributable to employee compensation and benefits. This investment is crucial for delivering their value proposition, which relies on knowledgeable staff to assist customers and manage operations effectively.

Marketing and Advertising Expenses

Dick's Sporting Goods invests heavily in marketing and advertising to fuel its omnichannel growth. These costs encompass a wide array of channels, from digital ads and traditional media to strategic brand partnerships and promotions for their loyalty program. The goal is clear: attract new customers and boost overall brand recognition.

In fiscal year 2023, Dick's Sporting Goods reported advertising and marketing expenses of $625 million. This significant outlay reflects a strategic push to enhance customer engagement and drive sales across both online and in-store platforms.

- Digital Advertising: Significant portion dedicated to online campaigns, including search engine marketing and social media advertising.

- Traditional Media: Continued investment in television, radio, and print to reach broader audiences.

- Brand Partnerships: Collaborations with athletes and sports leagues to enhance brand credibility and reach.

- Loyalty Program: Promotions and communications aimed at retaining existing customers and encouraging repeat purchases.

Technology and Supply Chain Investments

Dick's Sporting Goods dedicates significant resources to its technology and supply chain infrastructure. These ongoing capital expenditures and operational costs are essential for maintaining and upgrading its e-commerce platforms and digital capabilities. For instance, in fiscal year 2023, the company reported capital expenditures of $556 million, a portion of which was allocated to enhancing its omnichannel experience and supply chain efficiency.

These investments fuel the company's ability to operate efficiently across both online and in-store channels, a critical component for future growth. The development and maintenance of advanced supply chain technology, including investments in new distribution centers, directly support faster fulfillment and improved inventory management.

Key areas of investment include:

- E-commerce Platform Enhancements: Continuous upgrades to the website and mobile app for a seamless customer experience.

- Digital Infrastructure: Investments in cloud computing, data analytics, and cybersecurity to support digital operations.

- Supply Chain Technology: Modernization of distribution centers and implementation of automation for increased efficiency.

- Omnichannel Capabilities: Development of systems that integrate online and in-store inventory and customer data.

Dick's Sporting Goods' cost structure is heavily influenced by its substantial Cost of Goods Sold (COGS), which represents the direct costs of merchandise. Beyond COGS, significant expenses include store operating costs like rent and utilities, as well as employee wages and benefits. The company also allocates considerable funds to marketing and advertising, alongside ongoing investments in technology and supply chain infrastructure to support its omnichannel strategy.

| Cost Category | Fiscal Year 2023 (Approximate) | Significance |

|---|---|---|

| Cost of Goods Sold (COGS) | $7.23 billion | Largest expense, ~73% of net sales |

| Selling, General & Administrative (SG&A) | $3.5 billion (includes store ops) | Covers rent, utilities, maintenance, depreciation, and employee costs |

| Advertising & Marketing | $625 million | Drives customer engagement and brand recognition |

| Capital Expenditures | $556 million (partial allocation) | Investments in technology, e-commerce, and supply chain |

Revenue Streams

Dick's Sporting Goods primarily generates revenue through the sale of a vast selection of sporting goods equipment. This encompasses everything from team sports gear like baseball bats and basketballs to individual pursuits such as running shoes and golf clubs, as well as fitness equipment. In fiscal year 2023, sales of athletic apparel and footwear were significant contributors, alongside equipment.

Dick's Sporting Goods generates substantial revenue from selling athletic apparel and footwear. This includes items from top brands as well as their own private labels, catering to a wide range of athletic needs and fashion trends.

The company has been actively investing in its footwear offerings, enhancing in-store displays and expanding its selection. This focus is a key driver of growth, reflecting the strong consumer demand for athletic shoes.

Private brands within the apparel and footwear segments are also significant contributors to revenue. Dick's has strategically developed these lines to offer value and unique styles, further boosting sales performance.

For the fiscal year 2023, Dick's Sporting Goods reported net sales of $10.01 billion, with athletic apparel and footwear being core components of this figure, demonstrating their continued importance to the company's financial success.

Dick's Sporting Goods generates significant revenue through its private label brands, such as DSG, CALIA, and VRST. These exclusive offerings are crucial for differentiating the company in a competitive market. In fiscal year 2023, private label penetration was a key driver of sales growth.

Sales from Specialty Retail Concepts

Dick's Sporting Goods generates revenue through its specialty retail concepts, Golf Galaxy and Public Lands. These brands target specific customer segments with tailored merchandise and experiences, broadening the company's overall market presence. For instance, Golf Galaxy offers a specialized selection of golf equipment and apparel, while Public Lands focuses on outdoor adventure gear.

These distinct channels contribute significantly to Dick's revenue mix. During the fiscal year 2023, Dick's reported consolidated net sales of $12.24 billion. While specific breakdowns for Golf Galaxy and Public Lands are not always separately itemized in top-line reports, their strategic role in attracting and retaining diverse customer bases is crucial for sustained sales growth.

The expansion into these niche markets allows Dick's to capture a wider audience and diversify its revenue streams beyond its core sporting goods offerings.

- Golf Galaxy: Specializes in golf equipment, apparel, and accessories, serving dedicated golfers.

- Public Lands: Focuses on outdoor and adventure gear, appealing to enthusiasts of hiking, camping, and other activities.

- Market Reach: These concepts extend Dick's brand visibility and attract customers interested in specialized sporting and outdoor pursuits.

- Revenue Contribution: While not always individually reported, these specialty stores are integral to the company's overall sales performance and market diversification strategy.

Digital and Omnichannel Sales

Dick's Sporting Goods generates substantial revenue through its digital and omnichannel sales channels. This includes direct online sales via DICKS.com and its mobile applications, as well as services like buy online, pick up in store (BOPIS). These integrated offerings provide customer convenience and drive sales growth.

E-commerce has proven to be a highly profitable and expanding segment for the company. In the fiscal year 2023, digital sales represented a significant portion of Dick's overall revenue, demonstrating its importance to the business model. The company continues to invest in its online infrastructure and user experience to further capitalize on this trend.

- Digital Sales Growth: E-commerce continues to be a key growth driver, with online sales consistently contributing a significant percentage to total revenue.

- Omnichannel Integration: Services like buy online, pick up in store enhance customer convenience and further boost sales by bridging online and physical retail experiences.

- Profitability: The e-commerce segment is not only growing but also proving to be a profitable avenue for Dick's Sporting Goods.

Dick's Sporting Goods diversifies its revenue through specialty retail concepts like Golf Galaxy and Public Lands, each targeting niche markets with tailored offerings. These ventures expand the company's market reach and attract specific customer segments, contributing to a broader revenue base beyond core sporting goods. For fiscal year 2023, Dick's reported net sales of $12.24 billion, with these specialized channels playing a vital role in overall financial performance and market diversification.

| Revenue Stream | Description | Fiscal Year 2023 Significance |

|---|---|---|

| Core Sporting Goods Sales | Broad range of athletic equipment, apparel, and footwear. | Primary revenue driver, encompassing a vast product selection. |

| Private Label Brands (DSG, CALIA, VRST) | Exclusive brands offering value and unique styles. | Key differentiator and significant contributor to sales growth. |

| Specialty Retail Concepts (Golf Galaxy, Public Lands) | Targeted merchandise and experiences for specific customer segments. | Broaden market presence and capture niche audiences within a $12.24 billion net sales figure. |

| Digital & Omnichannel Sales | Online sales via DICKS.com, mobile apps, and BOPIS. | Highly profitable and expanding segment, a significant portion of total revenue. |

Business Model Canvas Data Sources

The Dick's Sporting Goods Business Model Canvas is informed by a blend of internal financial reports, extensive market research, and competitive analysis. These sources provide a comprehensive view of customer behavior, industry trends, and operational efficiencies.