DiaSorin PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DiaSorin Bundle

Navigate the complex external environment impacting DiaSorin with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping the diagnostics industry. Equip yourself with actionable intelligence to refine your strategy and anticipate market shifts. Download the full report now for a decisive competitive advantage.

Political factors

Government healthcare spending and reimbursement policies are critical for DiaSorin, directly influencing its revenue streams and ability to access markets. For instance, in 2024, many developed nations are grappling with rising healthcare costs, potentially leading to tighter reimbursement policies for diagnostic tests. This could mean lower payment rates for DiaSorin's innovative solutions, impacting profitability.

Conversely, shifts in government priorities can create significant opportunities. In 2025, we anticipate continued government investment in public health initiatives, particularly in areas like infectious disease surveillance and early cancer detection. Such programs, if they expand access to diagnostic testing, could directly benefit DiaSorin by increasing demand for its reagents and instrumentation.

Geopolitical instability and shifting trade policies, like tariffs or new trade barriers, pose a significant risk to DiaSorin's global operations. These disruptions can directly impact its supply chains, potentially increasing the cost of essential raw materials or the finished diagnostic instruments it imports and exports. For instance, the imposition of tariffs between major trading partners, such as those seen in recent years between the US and China, could directly affect the cost structure for companies like DiaSorin, which rely on international sourcing and distribution networks.

Global regulatory bodies are increasingly focused on harmonization, with initiatives like the IMDRF aiming to create common frameworks for medical devices. This could simplify market entry for DiaSorin's diagnostic solutions. For instance, the IMDRF's work on unique device identification (UDI) aims to improve traceability worldwide.

However, significant regulatory divergences persist, particularly between major markets. The European Union's In Vitro Diagnostic Regulation (IVDR) presents a more stringent compliance pathway compared to the U.S. Food and Drug Administration (FDA) guidelines. Navigating these differences, such as the IVDR's extensive data requirements for clinical evidence, demands substantial investment in product adaptation and documentation, impacting DiaSorin's R&D and market launch timelines.

Public Health Priorities and Pandemic Preparedness

Government priorities in public health directly shape the market for diagnostic solutions like those offered by DiaSorin. For instance, a heightened focus on infectious disease surveillance, particularly in light of recent global health events, can significantly boost demand for DiaSorin's molecular diagnostic tests. In 2024, many nations continued to allocate substantial resources towards strengthening their public health infrastructure, with diagnostic capabilities being a key component.

National pandemic preparedness strategies are a significant driver for DiaSorin's business. These strategies often include substantial investments in diagnostic testing capacity and the development of rapid response mechanisms. For example, the US government's continued investment in the Biomedical Advanced Research and Development Authority (BARDA) aims to bolster domestic manufacturing of critical medical supplies, including diagnostic tests, which could benefit companies like DiaSorin. This focus creates direct opportunities for DiaSorin to supply its advanced diagnostic platforms and reagents.

- Increased funding for infectious disease research and surveillance programs globally.

- Government mandates for enhanced pandemic preparedness, including stockpiling of diagnostic supplies.

- Policy shifts favoring domestic production of medical diagnostics.

Political Stability and Healthcare System Structure

DiaSorin's business is significantly influenced by the political stability of its key markets. For instance, a stable political climate in countries like Italy, where DiaSorin is headquartered, and major markets such as the United States and Germany, fosters a predictable operational and investment environment. Conversely, political instability can disrupt supply chains, impact regulatory frameworks, and dampen consumer confidence, thereby affecting demand for diagnostic products.

The structure of healthcare systems plays a crucial role in DiaSorin's market penetration and revenue generation. Countries with well-funded, publicly accessible healthcare systems, like many in Europe, often present consistent demand for diagnostic solutions. In contrast, healthcare systems heavily reliant on private insurance or out-of-pocket payments, as seen in parts of the US, can lead to more variable demand patterns influenced by economic conditions and policy changes. DiaSorin's 2024 revenue, for example, will be shaped by how these systems navigate evolving healthcare needs and funding models.

- Political Stability: DiaSorin operates in over 100 countries, with significant exposure to markets like the US, Italy, and Germany, whose political stability directly impacts regulatory certainty and market access.

- Healthcare System Structure: The reimbursement policies and accessibility of diagnostic testing within national healthcare systems, such as Italy's Servizio Sanitario Nazionale (SSN) and the US Medicare/Medicaid programs, are critical determinants of DiaSorin's product adoption and sales performance.

- Impact of Reforms: Potential healthcare reforms or shifts in government spending priorities in major markets could alter the demand for in-vitro diagnostics, affecting DiaSorin's strategic planning and financial projections for 2024-2025.

Government healthcare spending and reimbursement policies are critical for DiaSorin, directly influencing its revenue streams and ability to access markets. For instance, in 2024, many developed nations are grappling with rising healthcare costs, potentially leading to tighter reimbursement policies for diagnostic tests. This could mean lower payment rates for DiaSorin's innovative solutions, impacting profitability.

Conversely, shifts in government priorities can create significant opportunities. In 2025, we anticipate continued government investment in public health initiatives, particularly in areas like infectious disease surveillance and early cancer detection. Such programs, if they expand access to diagnostic testing, could directly benefit DiaSorin by increasing demand for its reagents and instrumentation.

Geopolitical instability and shifting trade policies, like tariffs or new trade barriers, pose a significant risk to DiaSorin's global operations. These disruptions can directly impact its supply chains, potentially increasing the cost of essential raw materials or the finished diagnostic instruments it imports and exports. For instance, the imposition of tariffs between major trading partners, such as those seen in recent years between the US and China, could directly affect the cost structure for companies like DiaSorin, which rely on international sourcing and distribution networks.

Global regulatory bodies are increasingly focused on harmonization, with initiatives like the IMDRF aiming to create common frameworks for medical devices. This could simplify market entry for DiaSorin's diagnostic solutions. For instance, the IMDRF's work on unique device identification (UDI) aims to improve traceability worldwide.

However, significant regulatory divergences persist, particularly between major markets. The European Union's In Vitro Diagnostic Regulation (IVDR) presents a more stringent compliance pathway compared to the U.S. Food and Drug Administration (FDA) guidelines. Navigating these differences, such as the IVDR's extensive data requirements for clinical evidence, demands substantial investment in product adaptation and documentation, impacting DiaSorin's R&D and market launch timelines.

Government priorities in public health directly shape the market for diagnostic solutions like those offered by DiaSorin. For instance, a heightened focus on infectious disease surveillance, particularly in light of recent global health events, can significantly boost demand for DiaSorin's molecular diagnostic tests. In 2024, many nations continued to allocate substantial resources towards strengthening their public health infrastructure, with diagnostic capabilities being a key component.

National pandemic preparedness strategies are a significant driver for DiaSorin's business. These strategies often include substantial investments in diagnostic testing capacity and the development of rapid response mechanisms. For example, the US government's continued investment in the Biomedical Advanced Research and Development Authority (BARDA) aims to bolster domestic manufacturing of critical medical supplies, including diagnostic tests, which could benefit companies like DiaSorin. This focus creates direct opportunities for DiaSorin to supply its advanced diagnostic platforms and reagents.

- Increased funding for infectious disease research and surveillance programs globally.

- Government mandates for enhanced pandemic preparedness, including stockpiling of diagnostic supplies.

- Policy shifts favoring domestic production of medical diagnostics.

DiaSorin's business is significantly influenced by the political stability of its key markets. For instance, a stable political climate in countries like Italy, where DiaSorin is headquartered, and major markets such as the United States and Germany, fosters a predictable operational and investment environment. Conversely, political instability can disrupt supply chains, impact regulatory frameworks, and dampen consumer confidence, thereby affecting demand for diagnostic products.

The structure of healthcare systems plays a crucial role in DiaSorin's market penetration and revenue generation. Countries with well-funded, publicly accessible healthcare systems, like many in Europe, often present consistent demand for diagnostic solutions. In contrast, healthcare systems heavily reliant on private insurance or out-of-pocket payments, as seen in parts of the US, can lead to more variable demand patterns influenced by economic conditions and policy changes. DiaSorin's 2024 revenue, for example, will be shaped by how these systems navigate evolving healthcare needs and funding models.

- Political Stability: DiaSorin operates in over 100 countries, with significant exposure to markets like the US, Italy, and Germany, whose political stability directly impacts regulatory certainty and market access.

- Healthcare System Structure: The reimbursement policies and accessibility of diagnostic testing within national healthcare systems, such as Italy's Servizio Sanitario Nazionale (SSN) and the US Medicare/Medicaid programs, are critical determinants of DiaSorin's product adoption and sales performance.

- Impact of Reforms: Potential healthcare reforms or shifts in government spending priorities in major markets could alter the demand for in-vitro diagnostics, affecting DiaSorin's strategic planning and financial projections for 2024-2025.

Government policies on healthcare spending and reimbursement directly impact DiaSorin's revenue, with nations facing rising costs potentially tightening reimbursement for diagnostic tests in 2024. However, increased government investment in public health initiatives, such as infectious disease surveillance and cancer detection, is anticipated for 2025, creating demand for DiaSorin's solutions. Geopolitical shifts and trade policies can disrupt supply chains and increase costs, while regulatory harmonization efforts, like IMDRF's UDI system, can simplify market entry, though divergences like the EU's IVDR require significant investment.

What is included in the product

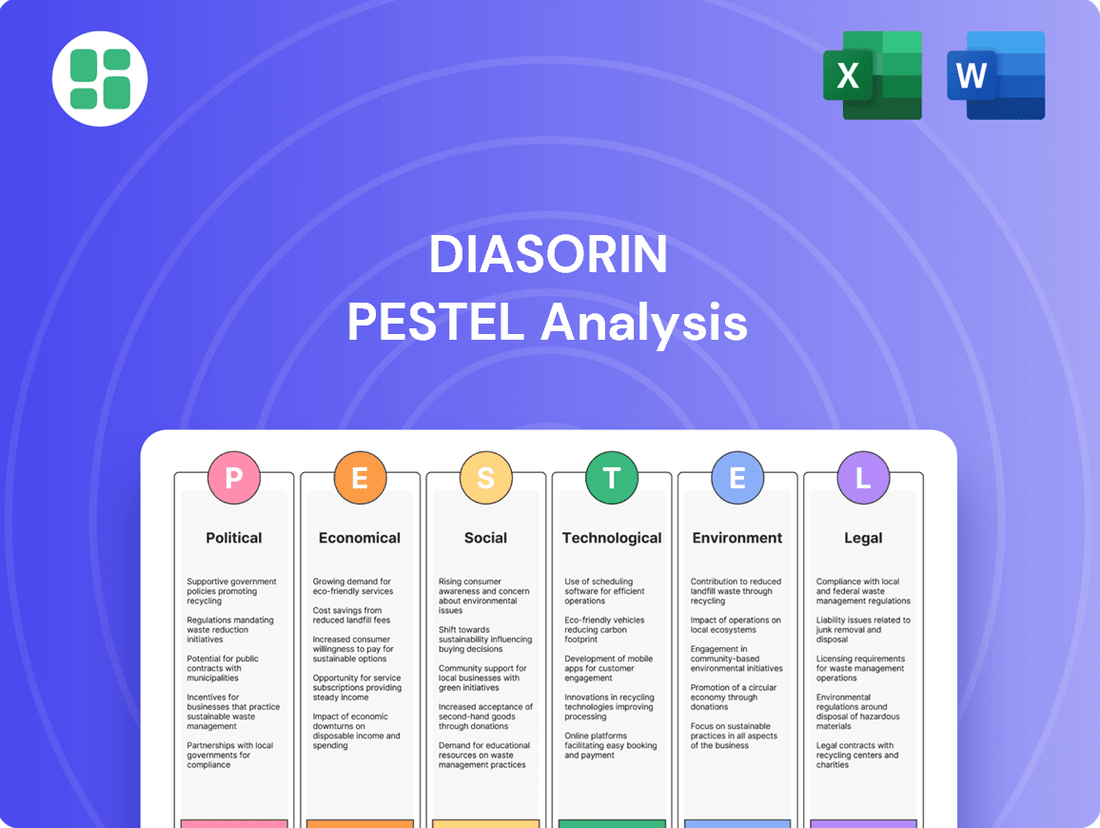

This PESTLE analysis provides a comprehensive evaluation of the external macro-environmental factors impacting DiaSorin, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within DiaSorin's operating landscape.

A DiaSorin PESTLE analysis provides a clean, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

The DiaSorin PESTLE analysis offers a visually segmented breakdown by PESTEL categories, allowing for quick interpretation at a glance and relieving the burden of complex data synthesis.

Economic factors

Global economic growth directly impacts national healthcare budgets, influencing how much hospitals and diagnostic labs can spend. A strong economy usually means more investment in advanced diagnostic tools, which benefits companies like DiaSorin.

Conversely, economic slowdowns can lead to budget constraints in healthcare, potentially reducing demand for DiaSorin's offerings. For instance, the IMF projected global growth to be 3.2% in 2024, a slight slowdown from 2023, indicating a cautious environment for healthcare spending.

Persistent inflationary pressures, especially concerning raw materials, energy, and labor, are directly impacting DiaSorin's production expenses and profit margins. For instance, in 2024, global inflation rates remained a significant concern, with energy prices fluctuating and labor costs continuing their upward trend across many developed economies, directly affecting the cost of goods sold for diagnostic companies like DiaSorin.

Supply chain disruptions, coupled with elevated freight expenses, are further intensifying these cost pressures for DiaSorin. As of early 2025, while some supply chain bottlenecks have eased compared to peak pandemic levels, the cost of international shipping and logistics remains notably higher than pre-2020 benchmarks, compelling DiaSorin to focus on robust cost management and potential pricing adjustments to maintain profitability.

DiaSorin's global operations expose it to currency exchange rate fluctuations, impacting its reported revenues and profitability as foreign earnings are converted to its reporting currency. For instance, a significant weakening of currencies like the US Dollar against the Euro could reduce the Euro-denominated value of its US sales.

In 2024, the Euro experienced periods of volatility against major currencies. If the Euro strengthens considerably against currencies where DiaSorin has substantial sales, such as the US Dollar or the Japanese Yen, its reported revenue and profit margins could be negatively affected.

To mitigate these risks, DiaSorin likely employs hedging strategies, such as forward contracts, to lock in exchange rates for anticipated transactions. However, these strategies have costs, and imperfect hedging can still lead to financial impacts.

Healthcare Spending Trends and Private vs. Public Funding

Healthcare spending is a critical economic factor influencing diagnostic companies like DiaSorin. Globally, healthcare expenditure continues to rise, driven by aging populations and advancements in medical technology. For instance, the World Health Organization projected global health spending to reach $10 trillion by 2024, a significant increase from previous years.

The balance between public and private funding plays a crucial role in shaping market dynamics for diagnostic tests. In many developed nations, public healthcare systems, funded through taxes or national insurance, often represent a substantial and stable customer base for diagnostic providers. Conversely, markets with a higher proportion of private insurance or out-of-pocket spending can exhibit more volatile demand patterns, influenced by economic conditions and individual consumer choices.

Recent trends indicate a growing emphasis on value-based healthcare, where reimbursement is increasingly tied to patient outcomes rather than the volume of services provided. This shift encourages investment in diagnostic technologies that can improve patient care and reduce overall healthcare costs. For example, the adoption of advanced molecular diagnostics, which can lead to more targeted and effective treatments, is expected to accelerate.

- Global healthcare spending is projected to hit $10 trillion by 2024.

- Public healthcare systems offer more stable purchasing environments for diagnostics.

- Private funding models can lead to more variable demand for diagnostic tests.

- Value-based healthcare models are driving demand for outcome-improving diagnostic technologies.

Research and Development Investment Levels

Economic conditions significantly shape R&D investment in the diagnostics sector. A strong economy typically spurs higher R&D spending, enabling companies like DiaSorin to innovate or acquire new testing technologies, crucial for staying ahead.

For instance, global R&D spending in the life sciences sector, which includes diagnostics, saw substantial growth leading up to 2024. In 2023, pharmaceutical and biotech companies, key players in diagnostic innovation, allocated an estimated 18-20% of their revenue to R&D, a trend expected to continue into 2025, driven by the demand for advanced diagnostics.

- Increased R&D Funding: Favorable economic climates allow for greater allocation of capital towards developing novel diagnostic solutions.

- Acquisition Opportunities: Economic downturns can present opportunities to acquire promising R&D assets or smaller innovative firms at more attractive valuations.

- Market Demand: Robust economies often translate to higher healthcare spending, increasing demand for diagnostic tests and justifying R&D investments.

- Innovation Pipeline: Sustained R&D investment is critical for DiaSorin to maintain a pipeline of advanced diagnostic products and services.

Economic growth directly influences healthcare budgets, impacting spending on advanced diagnostics. A robust economy supports increased investment in tools like those offered by DiaSorin. For example, the IMF forecasted global growth at 3.2% for 2024, indicating a cautious environment for healthcare expenditure.

Inflationary pressures, particularly on raw materials and labor, directly affect DiaSorin's production costs and profit margins. Global inflation remained a concern in 2024, with rising energy and labor costs impacting the cost of goods sold for diagnostic companies.

Currency fluctuations pose a risk to DiaSorin's reported revenues and profitability. For instance, a strengthening Euro against currencies where DiaSorin has significant sales, like the US Dollar, could negatively impact its financial results.

| Economic Factor | Impact on DiaSorin | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Influences healthcare budgets and diagnostic spending. | IMF projected 3.2% global growth in 2024, a slight slowdown. |

| Inflation | Increases production costs and impacts profit margins. | Persistent inflation in 2024 affected raw material, energy, and labor costs. |

| Currency Exchange Rates | Affects reported revenue and profitability from international sales. | Euro volatility in 2024; strengthening Euro can reduce USD/JPY sales value. |

| Healthcare Spending | Drives demand for diagnostic tests and technologies. | WHO projected global health spending to reach $10 trillion by 2024. |

Preview the Actual Deliverable

DiaSorin PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive DiaSorin PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed understanding of the external forces shaping DiaSorin's strategic landscape.

Sociological factors

The world's population is getting older, and this trend is a major boost for companies like DiaSorin, which specialize in diagnostic tests. As people age, they are more likely to develop chronic conditions. For instance, by 2050, the World Health Organization projects that over 2.1 billion people will be aged 60 and above.

This demographic shift directly translates to a higher demand for diagnostic solutions for diseases that commonly affect older adults. DiaSorin's focus on areas like cardiovascular health, diabetes monitoring, and cancer screening aligns perfectly with these growing needs. In 2024, the global diagnostics market is expected to reach over $100 billion, with a significant portion driven by age-related disease testing.

A heightened global consciousness regarding health and a strong push towards preventive measures are significantly influencing the diagnostic market. This societal shift encourages earlier identification of illnesses and promotes routine health check-ups.

This trend directly benefits companies like DiaSorin, as it fuels demand for their diagnostic solutions. As people and healthcare providers prioritize proactive health management over reactive treatment, the need for sophisticated diagnostic tests, including those DiaSorin specializes in, is on the rise.

For instance, the global in-vitro diagnostics market was valued at approximately $90 billion in 2023 and is projected to grow, reflecting this increased focus on early detection and prevention.

Global lifestyle shifts, marked by increasing urbanization and a surge in international travel, are directly impacting how infectious diseases spread and persist. This dynamic creates a fluctuating demand for diagnostic solutions, a trend DiaSorin is poised to address. For instance, the World Health Organization reported over 1.5 billion international tourist arrivals in 2023, a significant increase from pre-pandemic levels, highlighting the heightened risk of pathogen transmission across borders.

DiaSorin's strategic focus on infectious disease diagnostics positions it advantageously to meet these evolving public health challenges. As new pathogens emerge or existing ones resurge due to lifestyle changes, the company's diagnostic platforms can be rapidly deployed. In 2024, the company's revenue from its infectious disease segment, which includes tests for viral and bacterial infections, has shown consistent growth, reflecting market demand for reliable diagnostic tools in an interconnected world.

Workforce Demographics and Healthcare Professional Shortages

Demographic shifts are significantly reshaping the healthcare landscape, leading to critical shortages of skilled professionals. For instance, the Association of American Medical Colleges projected a shortage of between 37,800 and 124,000 physicians by 2034 in the US alone, a trend that extends to laboratory technicians and other vital healthcare roles. These workforce gaps directly influence the pace at which new diagnostic technologies, like those offered by DiaSorin, can be adopted and effectively utilized within clinical settings.

DiaSorin's strategic focus on developing automated analyzers and intuitive, user-friendly systems directly addresses these workforce challenges. By reducing the reliance on extensive manual labor and simplifying complex testing procedures, these innovations can help laboratories operate more efficiently even with fewer personnel. This not only mitigates the impact of shortages but also enhances overall diagnostic throughput and accuracy.

- Projected Physician Shortage: The US could face a deficit of up to 124,000 physicians by 2034, impacting the availability of skilled personnel across healthcare.

- Automation as a Solution: DiaSorin's automated systems aim to increase laboratory efficiency, compensating for a lack of specialized technicians.

- User-Friendly Technology: Simplifying complex diagnostic processes allows existing staff to manage higher workloads, easing the strain caused by shortages.

- Impact on Adoption: Workforce demographics are a key factor in how quickly and widely advanced diagnostic tools can be implemented.

Patient Expectations for Personalized Medicine

Societal shifts are increasingly highlighting the demand for personalized medicine, where treatments are specifically designed for an individual's genetic makeup and health profile. This growing expectation directly fuels the need for sophisticated diagnostic tools, such as molecular and companion diagnostics, which are essential for pinpointing biomarkers and directing targeted therapies. DiaSorin's focus on these advanced diagnostic areas positions it well to meet this evolving patient and healthcare provider demand.

The market for personalized medicine is experiencing significant growth. For instance, the global personalized medicine market was valued at approximately USD 520 billion in 2023 and is projected to reach over USD 900 billion by 2030, growing at a compound annual growth rate (CAGR) of around 8.2% during this period. This expansion underscores the increasing integration of diagnostics into treatment pathways.

- Growing Patient Demand: Patients are actively seeking treatments tailored to their unique biological characteristics rather than one-size-fits-all approaches.

- Diagnostic Technology Advancement: The rise of personalized medicine is intrinsically linked to breakthroughs in genetic sequencing and biomarker identification technologies.

- Impact on Healthcare Spending: While potentially increasing upfront costs, personalized medicine aims to improve efficacy and reduce overall healthcare expenditure by avoiding ineffective treatments.

- Regulatory Landscape: Regulatory bodies are adapting to approve and facilitate the use of personalized diagnostics and therapies, further enabling market growth.

Societal trends are increasingly emphasizing personalized medicine, driving demand for advanced diagnostics like molecular and companion tests. This shift aligns with DiaSorin's strategic focus, as the global personalized medicine market was valued around USD 520 billion in 2023 and is expected to exceed USD 900 billion by 2030.

The growing patient preference for tailored treatments over generalized approaches directly fuels the need for sophisticated diagnostic tools that identify specific biomarkers. This trend is further supported by advancements in genetic sequencing and biomarker identification technologies, which are crucial for the effective implementation of personalized therapies.

While personalized medicine may involve higher initial costs, it aims to improve treatment effectiveness and potentially lower overall healthcare expenses by minimizing the use of ineffective therapies. Regulatory bodies are also evolving to approve and facilitate the use of these personalized diagnostics and treatments, further enabling market expansion.

Technological factors

The diagnostics sector is undergoing a significant shift driven by rapid advancements in AI, Machine Learning, and automation. These technologies are not just buzzwords; they are actively reshaping how diagnostic tests are developed, performed, and interpreted. For companies like DiaSorin, this presents a substantial opportunity to innovate and gain a competitive edge.

DiaSorin can harness these powerful tools to boost diagnostic accuracy, making tests more reliable and reducing the chance of false positives or negatives. Furthermore, automation can streamline complex laboratory workflows, freeing up valuable time for skilled technicians and increasing overall lab efficiency. Imagine a lab where routine tasks are handled by machines, allowing scientists to focus on more critical analyses.

Predictive analytics, powered by ML, offers another avenue for DiaSorin. By analyzing vast datasets, these systems can identify patterns and predict disease outbreaks or patient responses to treatments, enabling proactive healthcare interventions. This move towards predictive diagnostics is a major trend, aiming to shift healthcare from reactive to proactive care. For instance, AI algorithms are already showing promise in early cancer detection from medical imaging, a field where precision is paramount.

The development of smarter, more integrated diagnostic platforms is also a key benefit. These platforms can connect different diagnostic tools, share data seamlessly, and provide a more comprehensive patient picture. This integration leads to faster turnaround times and more precise results, ultimately benefiting both healthcare providers and patients. The global AI in healthcare market size was valued at approximately $15.4 billion in 2023 and is projected to grow significantly, underscoring the immense potential of these technologies.

The increasing demand for rapid, decentralized diagnostic solutions is fueling significant growth in the Point-of-Care Testing (POCT) market. This trend is particularly evident in infectious disease screening and emergency diagnostics, where timely results are critical.

DiaSorin's strategic investments in POCT systems directly address this demand, enabling quicker diagnoses right at the patient's bedside. This enhances accessibility and operational efficiency, a key advantage in managing outbreaks and critical care scenarios. For instance, the global POCT market was valued at approximately USD 35.1 billion in 2023 and is projected to reach USD 63.5 billion by 2030, growing at a CAGR of 8.9% during the forecast period, according to some market analyses.

Breakthroughs in molecular diagnostics, genomics, and liquid biopsies are revolutionizing disease detection, offering earlier and more accurate identification of conditions like cancer and genetic disorders. These advancements are crucial for proactive healthcare, moving towards personalized medicine.

DiaSorin is well-positioned to leverage these technological leaps through its dedicated focus on molecular diagnostic platforms and specialized tests. The company's offerings are designed for high sensitivity and specificity, directly addressing the growing demand for precise diagnostic solutions in areas like infectious diseases and autoimmune conditions.

For instance, the global molecular diagnostics market was valued at approximately $26.5 billion in 2023 and is projected to reach over $50 billion by 2030, demonstrating significant growth driven by these innovations. DiaSorin’s investment in R&D for these areas, including its Luminex acquisition in 2021 for $1.5 billion, underscores its commitment to capitalizing on this expanding market.

Data Integration and Digital Health Solutions

The increasing focus on data integration and digital health solutions offers DiaSorin significant avenues for growth. The widespread adoption of electronic health records (EHRs) and the rise of remote patient monitoring (RPM) create opportunities for DiaSorin to link its diagnostic platforms more effectively, fostering a seamless flow of patient data. This integration is crucial for enhancing clinical decision support and building comprehensive diagnostic ecosystems. For instance, by 2025, it's projected that over 90% of U.S. hospitals will have a certified EHR system in place, highlighting the pervasive nature of digital health infrastructure.

DiaSorin can leverage this trend to develop solutions that connect its diagnostic instruments directly with EHRs and RPM platforms. This facilitates real-time data access for clinicians, leading to quicker and more informed treatment decisions. The company's investment in digital innovation is key to capitalizing on this technological shift. In 2024, the global digital health market was valued at over $300 billion, with significant growth expected in areas like AI-powered diagnostics and telehealth.

The development of integrated diagnostic ecosystems, where data from various sources converges, allows for a more holistic view of patient health. This can lead to personalized medicine approaches and improved patient outcomes. DiaSorin’s strategic partnerships and platform development are geared towards this interconnected future of healthcare. By 2026, the RPM market alone is anticipated to reach approximately $175 billion globally, underscoring the demand for connected health technologies.

- Data Integration: Connecting diagnostic platforms with EHRs and RPM systems for seamless data flow.

- Clinical Decision Support: Enhancing diagnostic accuracy and treatment planning through integrated data.

- Digital Health Market Growth: Capitalizing on a rapidly expanding market, projected to exceed $300 billion in 2024.

- Ecosystem Development: Creating comprehensive diagnostic ecosystems for personalized medicine.

Research and Development for New Biomarkers

DiaSorin's commitment to continuous research and development in identifying new biomarkers is paramount for expanding its diagnostic test offerings and maintaining a competitive edge. This focus directly impacts its ability to address evolving healthcare needs.

Investment in R&D for biomarker discovery and validation is crucial for DiaSorin to deliver advanced diagnostic solutions for increasingly complex and emerging medical conditions. For example, in 2023, DiaSorin reported R&D expenses of €207.5 million, a significant portion of which is allocated to these critical areas.

- Biomarker Discovery: Ongoing efforts to uncover novel biological indicators for diseases.

- Validation Studies: Rigorous testing to confirm the accuracy and reliability of new biomarkers.

- Competitive Advantage: Early identification of biomarkers allows for first-mover advantage in diagnostic markets.

- Market Expansion: New biomarkers enable the development of tests for previously untestable conditions, broadening DiaSorin's market reach.

Technological advancements are rapidly transforming diagnostics, with AI and automation enhancing accuracy and efficiency. DiaSorin's integration of these tools streamlines workflows and improves test reliability.

Predictive analytics, powered by machine learning, allows for proactive healthcare by identifying disease patterns and predicting patient responses. This shift towards predictive diagnostics is a major industry trend, with AI in healthcare valued at approximately $15.4 billion in 2023.

The rise of Point-of-Care Testing (POCT) and molecular diagnostics, including genomics and liquid biopsies, offers earlier and more precise disease detection. DiaSorin's focus on these areas, supported by its $1.5 billion Luminex acquisition in 2021, positions it to capitalize on the growing molecular diagnostics market, which was valued at $26.5 billion in 2023.

Digital health solutions and data integration with EHRs and remote patient monitoring are creating interconnected diagnostic ecosystems. The global digital health market exceeded $300 billion in 2024, and DiaSorin's investments in these areas are crucial for its growth and for enabling personalized medicine approaches.

Legal factors

DiaSorin navigates a complex web of regulations, including the EU's In Vitro Diagnostic Regulation (IVDR) and the U.S. Food and Drug Administration (FDA) oversight. These frameworks dictate everything from product design and manufacturing to how devices are marketed and monitored after they reach the market.

Staying compliant is paramount, especially with new demands for robust clinical evidence, ongoing post-market surveillance, and the implementation of Unique Device Identification (UDI) systems. For instance, the IVDR, fully implemented in May 2022, significantly increased the scrutiny and data requirements for IVD products, impacting market entry timelines and ongoing compliance costs for companies like DiaSorin.

DiaSorin operates under stringent data privacy regulations such as GDPR and HIPAA, which govern the handling of sensitive patient information. These laws necessitate significant investment in secure data management systems and protocols. For instance, in 2024, the global cybersecurity market for healthcare is projected to reach $125 billion, highlighting the critical need for companies like DiaSorin to prioritize robust protection against escalating cyber threats to their connected diagnostic systems.

DiaSorin's reliance on strong intellectual property rights and patent protection is paramount for its diagnostic innovations. The company's ability to secure and defend patents directly impacts its competitive edge and the recovery of substantial research and development expenditures. For instance, in 2023, the global pharmaceutical and biotechnology patent filings saw continued robust activity, underscoring the critical legal landscape for companies like DiaSorin.

Product Liability and Consumer Protection Laws

DiaSorin operates under stringent product liability and consumer protection laws, which mandate accountability for the safety and efficacy of its diagnostic devices. Failure to meet these standards can result in significant legal repercussions and damage to brand reputation. For instance, in 2023, the European Union's Medical Device Regulation (MDR) continued to impose rigorous requirements on manufacturers, including enhanced post-market surveillance and stricter clinical evidence for market access, impacting companies like DiaSorin.

Maintaining robust quality control systems and proactive post-market surveillance are therefore critical for DiaSorin to mitigate legal exposure and foster consumer confidence. This includes diligent tracking of device performance, prompt investigation of any reported issues, and transparent communication with regulatory bodies and end-users. The increasing focus on patient safety and product traceability underscores the importance of these legal frameworks for the biotechnology sector.

Key considerations for DiaSorin in this area include:

- Compliance with evolving global regulatory standards: Staying abreast of and adhering to diverse international regulations like the MDR in Europe and FDA requirements in the United States is paramount.

- Robust quality management systems: Implementing and maintaining ISO 13485 certified quality management systems ensures consistent product quality and safety.

- Proactive risk management: Establishing comprehensive risk management processes throughout the product lifecycle, from design to post-market, is essential.

- Effective complaint handling and vigilance: Swift and thorough investigation of customer complaints and adverse events, coupled with timely reporting to regulatory authorities, is crucial for ongoing compliance and consumer trust.

Anti-Corruption and Anti-Bribery Laws

DiaSorin's global operations necessitate strict adherence to anti-corruption and anti-bribery legislation, including the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. These laws are critical for maintaining ethical business practices, especially when engaging with healthcare professionals and government entities across different jurisdictions. Failure to comply can result in severe financial penalties and significant reputational harm.

To mitigate these risks, DiaSorin implements robust internal controls and promotes a strong culture of ethical conduct. This proactive approach helps ensure that all business dealings are transparent and lawful. For instance, in 2023, the U.S. Department of Justice reported significant enforcement actions under the FCPA, highlighting the ongoing scrutiny and potential liabilities for multinational corporations.

- Global Compliance: DiaSorin must navigate a complex web of international anti-corruption laws.

- FCPA & UK Bribery Act: Key legislation requiring diligent adherence.

- Risk Mitigation: Strong internal controls and ethical training are essential.

- Consequences of Non-Compliance: Financial penalties and reputational damage are significant threats.

DiaSorin's legal landscape is shaped by stringent regulations like the EU's IVDR and the FDA's oversight, demanding robust clinical evidence and post-market surveillance. The company must also comply with global data privacy laws such as GDPR and HIPAA, necessitating significant investment in secure data management, especially as the healthcare cybersecurity market is projected to reach $125 billion in 2024.

Intellectual property protection is crucial for DiaSorin's diagnostic innovations, with continued robust activity in global pharmaceutical and biotechnology patent filings in 2023 underscoring its importance. Furthermore, adherence to product liability laws and consumer protection standards, including the EU's MDR, is vital for device safety and market access.

DiaSorin also faces legal obligations under anti-corruption laws like the FCPA and UK Bribery Act, with the U.S. Department of Justice reporting significant enforcement actions in 2023. Maintaining strong internal controls and ethical training are key to mitigating these risks and avoiding severe financial and reputational damage.

| Regulatory Area | Key Legislation/Framework | Impact on DiaSorin | Data Point/Trend |

|---|---|---|---|

| Product Approval & Market Access | EU IVDR, US FDA | Increased scrutiny, data requirements, market entry timelines | IVDR fully implemented May 2022 |

| Data Privacy | GDPR, HIPAA | Investment in secure data management, cybersecurity | Global healthcare cybersecurity market projected $125 billion in 2024 |

| Intellectual Property | Patent Law | Protection of innovations, R&D cost recovery | Robust global patent filings in pharma/biotech in 2023 |

| Product Safety & Liability | EU MDR | Enhanced post-market surveillance, stricter clinical evidence | MDR continued to impose rigorous requirements in 2023 |

| Business Ethics | FCPA, UK Bribery Act | Need for strong internal controls, ethical training | Significant FCPA enforcement actions reported by US DOJ in 2023 |

Environmental factors

The in vitro diagnostics sector, including companies like DiaSorin, produces a range of waste, from biological and chemical byproducts to electronic waste from equipment. These materials are heavily regulated, requiring specialized handling and disposal to prevent environmental contamination. For instance, the European Union's Waste Framework Directive sets stringent guidelines for waste management across member states, impacting DiaSorin's operations.

DiaSorin's commitment to environmental stewardship necessitates significant investment in robust waste management infrastructure and the adoption of sustainable disposal technologies. This includes exploring options like waste-to-energy solutions or advanced recycling programs for electronic components, aligning with global sustainability trends and regulatory pressures. In 2023, companies in the healthcare sector globally saw increased scrutiny on their waste disposal practices, with a growing emphasis on circular economy principles.

DiaSorin's global operations, including its manufacturing sites, inherently lead to energy consumption and a carbon footprint. As environmental responsibility becomes a more significant expectation, the company faces pressure to adopt energy-efficient methods and investigate renewable energy options.

The push for sustainability means DiaSorin will likely need to set clear goals for reducing its greenhouse gas emissions. For instance, in 2023, many companies in the healthcare sector reported on their Scope 1 and Scope 2 emissions, with a growing trend towards setting science-based targets for emissions reduction by 2030.

The environmental footprint of sourcing raw materials for diagnostic reagents and device components is a growing concern for companies like DiaSorin. This includes the impact of extraction, processing, and transportation on ecosystems and resource depletion.

DiaSorin is increasingly pressured by stakeholders, including investors and regulators, to demonstrate robust sustainable and ethical sourcing practices throughout its supply chain. This involves ensuring suppliers minimize environmental degradation and actively support responsible resource management, a trend amplified by heightened global environmental awareness in 2024 and 2025.

Water Usage and Wastewater Treatment

DiaSorin's manufacturing processes for diagnostic solutions can be water-intensive. Effective wastewater treatment is crucial to meet stringent environmental regulations and minimize ecological impact. For instance, the company's commitment to sustainability in 2023 included initiatives aimed at reducing water consumption across its facilities, though specific figures for water usage per unit of production are not publicly detailed.

To address this, DiaSorin must prioritize water conservation strategies and invest in sophisticated wastewater treatment technologies. This ensures compliance with local discharge limits and supports a reduced environmental footprint. The company's 2024 sustainability roadmap emphasizes continuous improvement in resource management, which implicitly covers water usage and treatment.

- Water Consumption: Manufacturing diagnostic kits and instruments can require substantial water for cleaning, cooling, and processing.

- Wastewater Management: Effluents from these processes may contain chemicals or biological agents requiring specialized treatment before discharge.

- Regulatory Compliance: Adherence to local and international environmental standards for water discharge is a significant operational consideration.

- Sustainability Initiatives: Ongoing efforts to reduce water usage and improve treatment efficiency are key to DiaSorin's environmental stewardship.

Climate Change and Supply Chain Resilience

Climate change poses significant threats to global supply chains, directly impacting companies like DiaSorin. Extreme weather events, such as floods and droughts, can disrupt manufacturing, transportation, and the availability of raw materials essential for diagnostic product components. For instance, a severe drought in a key agricultural region could affect the supply of specific biological reagents, driving up costs and potentially delaying production timelines for DiaSorin's diagnostic kits.

Building robust supply chain resilience is therefore paramount for operational continuity and mitigating financial risks. Companies are increasingly focusing on diversifying suppliers, establishing buffer stock, and investing in advanced logistics to navigate these environmental challenges. DiaSorin's proactive assessment of climate-related risks will be crucial in ensuring uninterrupted product delivery and maintaining its competitive edge in the evolving market landscape.

- Supply Chain Disruptions: Extreme weather events in 2024 and projected for 2025 continue to pose a risk to global logistics, potentially impacting the timely delivery of raw materials and finished goods for DiaSorin.

- Cost Volatility: Climate-induced scarcity of certain components or increased transportation costs due to weather disruptions can lead to unpredictable price fluctuations for DiaSorin's product inputs.

- Operational Continuity: Proactive risk management, including supplier diversification and inventory management, is essential for DiaSorin to maintain consistent production and meet market demand amidst climate uncertainties.

DiaSorin's environmental impact is multifaceted, encompassing waste generation, energy consumption, and resource sourcing. The company must navigate stringent regulations regarding hazardous waste disposal, a challenge amplified by global trends emphasizing circular economy principles, observed in increased scrutiny of healthcare sector waste practices in 2023. Proactive investment in sustainable disposal technologies and energy-efficient operations is crucial for mitigating its carbon footprint, with many healthcare companies in 2023 reporting on emissions and setting targets for reduction.

PESTLE Analysis Data Sources

Our DiaSorin PESTLE analysis is built on a robust foundation of data from leading global economic institutions, reputable market research firms, and official government publications. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to provide a comprehensive overview.