DiaSorin Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DiaSorin Bundle

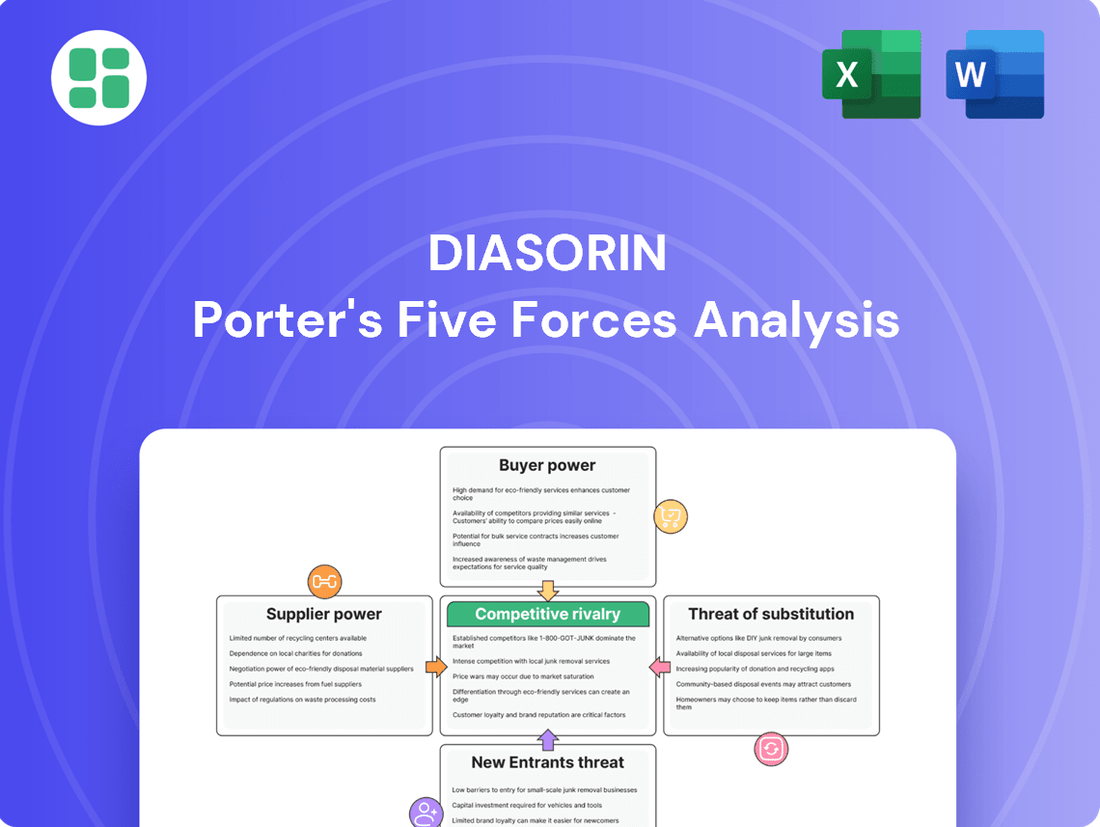

DiaSorin's competitive landscape is shaped by significant bargaining power from buyers and a moderate threat of substitutes in the diagnostics market. Understanding these forces is crucial for navigating the industry effectively.

The complete report reveals the real forces shaping DiaSorin’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DiaSorin's reliance on proprietary reagents and specialized components for its in-vitro diagnostics (IVD) significantly influences supplier bargaining power. Companies that manufacture unique, high-quality inputs for DiaSorin's diagnostic kits and automated analyzers hold considerable sway.

Suppliers possessing patents or exclusive manufacturing processes for critical raw materials can command higher prices and dictate terms. This dependence is evident in the specialized nature of many IVD components, where few alternatives exist, thereby concentrating power in the hands of these select suppliers.

The in vitro diagnostics sector demands rigorous adherence to quality and regulatory standards for all its raw materials. This necessity naturally narrows the field of potential suppliers who can meet these stringent requirements, creating a limited pool of qualified and approved vendors for companies like DiaSorin.

With fewer suppliers able to meet the industry's high bar, competition among them is reduced. This scarcity of qualified providers grants them greater bargaining power, allowing them to influence pricing and dictate terms of supply more effectively to DiaSorin.

DiaSorin faces a significant challenge with high switching costs for its essential components. The process of changing suppliers isn't a simple swap; it demands extensive requalification of new materials and potentially new regulatory submissions. This complexity inherently strengthens the hand of current suppliers, as the effort and risk involved in finding and integrating alternatives are considerable.

For instance, in the highly regulated diagnostics industry, even minor component changes can trigger lengthy validation periods. In 2023, the average time for medical device component requalification could extend from six months to over a year, depending on the criticality of the part. This lengthy process, coupled with the risk of production downtime and potential product performance issues, makes DiaSorin hesitant to switch, thereby increasing supplier bargaining power.

Supplier Concentration in Niche Markets

In specific, specialized segments of the diagnostics market, DiaSorin might encounter suppliers who hold a dominant position. For instance, if a particular diagnostic assay relies on a unique reagent or a highly specialized piece of technology, and only a handful of companies produce it, these suppliers gain significant leverage. This concentration means DiaSorin's reliance on these few sources for critical components can empower those suppliers to dictate terms, influence pricing, and affect delivery timelines, potentially impacting DiaSorin's operational efficiency and cost structure.

The bargaining power of these concentrated suppliers is amplified when DiaSorin has limited alternative sources for these niche inputs. For example, if a critical antibody for a rare disease diagnostic is sourced from a single supplier due to its proprietary manufacturing process, that supplier's ability to demand higher prices or impose stricter delivery schedules is substantial. This situation can directly affect DiaSorin's profitability and its ability to respond to market demand promptly.

- Supplier Dominance in Niche Reagents: In certain specialized diagnostic areas, a small number of companies may control the supply of essential reagents or technologies.

- Impact on DiaSorin's Sourcing: If DiaSorin relies heavily on these few suppliers for critical components, their bargaining power increases significantly.

- Potential for Price Increases and Delivery Constraints: Concentrated suppliers can leverage their position to influence pricing and delivery schedules, potentially impacting DiaSorin's costs and responsiveness.

Potential for Supplier Forward Integration

The potential for supplier forward integration presents a significant threat to DiaSorin. If a critical supplier were to enter the in-vitro diagnostics (IVD) manufacturing or distribution market, they could leverage their existing capabilities to compete directly with DiaSorin.

This strategic move by a supplier could dramatically increase their bargaining power. By becoming a direct competitor, a supplier could dictate terms more aggressively, potentially impacting DiaSorin's pricing, product availability, and market share.

For instance, a supplier of specialized reagents or diagnostic components might acquire or develop its own IVD testing platforms. This would allow them to capture more of the value chain, directly challenging DiaSorin's existing business model.

- Supplier Forward Integration Threat: Suppliers might enter DiaSorin's IVD market, becoming direct competitors.

- Increased Bargaining Power: This integration allows suppliers to exert greater pressure on DiaSorin regarding pricing and terms.

- Value Chain Capture: Suppliers could capture more profit by moving into manufacturing and distribution, impacting DiaSorin's margins.

DiaSorin's suppliers of specialized reagents and components hold considerable bargaining power due to the proprietary nature and high quality demands of the in-vitro diagnostics (IVD) sector. The stringent regulatory environment limits the pool of qualified suppliers, concentrating power among those who can meet these exacting standards.

High switching costs, often involving lengthy requalification processes that can extend over a year as seen in 2023 for medical devices, further bolster supplier leverage. This makes it difficult and costly for DiaSorin to change providers, reinforcing the position of existing suppliers who can dictate terms and pricing.

In niche segments, suppliers with unique, patented inputs or dominant market positions for critical components can command premium prices and impose stricter delivery schedules, directly impacting DiaSorin's operational efficiency and profitability.

The threat of supplier forward integration, where a key supplier might enter the IVD market as a competitor, poses a significant risk, allowing them to exert greater control over pricing and terms.

| Factor | Impact on DiaSorin | Supporting Data/Example |

|---|---|---|

| Proprietary Reagents | High Bargaining Power | Suppliers of unique, patented IVD components. |

| Regulatory Standards | Limited Supplier Pool | Stringent IVD quality requirements narrow vendor options. |

| Switching Costs | Increased Supplier Leverage | Requalification can take 6-12+ months (2023 data). |

| Niche Market Dominance | Price & Delivery Control | Single-source suppliers for critical, rare disease reagents. |

| Forward Integration Risk | Competitive Threat | Suppliers potentially entering DiaSorin's market. |

What is included in the product

This analysis unpacks the competitive forces shaping DiaSorin's market, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Quickly identify and mitigate competitive threats with a visually intuitive Porter's Five Forces analysis, streamlining strategic planning.

Customers Bargaining Power

Hospitals and large diagnostic laboratory networks are consolidating, creating powerful purchasing blocs. This trend, evident in the growing number of integrated delivery networks, significantly enhances their ability to negotiate favorable pricing and terms for DiaSorin's diagnostic solutions. For instance, in 2024, major hospital systems continued to merge, increasing their market share and thus their leverage in supplier negotiations.

The availability of alternative In Vitro Diagnostics (IVD) providers significantly impacts DiaSorin's customer bargaining power. While DiaSorin holds a strong position, the IVD landscape is competitive, featuring global leaders such as Roche, Abbott, and Siemens Healthineers. These established players offer comparable diagnostic solutions, giving customers the leverage to compare and select providers based on price, performance, or service.

Healthcare budgets worldwide are experiencing significant strain, making customers extremely sensitive to the prices of diagnostic solutions. This pressure means DiaSorin must often compete on cost, which can negatively impact its profit margins and increase the bargaining power of buyers operating under tight financial constraints.

Standardization and Interoperability Demands

Customers in the diagnostics sector increasingly demand standardization and interoperability. This means they want to connect different diagnostic machines and software seamlessly. For DiaSorin, if its products don't easily integrate with other systems, or if competitors offer more connected solutions, customers gain leverage. This can lead to price negotiations or a shift in loyalty to providers offering greater operational efficiency.

The drive for interoperability is a significant factor influencing customer bargaining power. For example, a hospital laboratory manager might prefer a diagnostic platform that can easily share data with their existing Laboratory Information System (LIS). If DiaSorin's offerings are perceived as less compatible than rivals, such as Roche Diagnostics or Siemens Healthineers, customers can push for discounts or better service agreements. In 2024, the global LIS market size was estimated to be around $1.5 billion, highlighting the importance of integration within healthcare IT infrastructure.

- Standardization Pressure: Healthcare providers favor diagnostic tools that adhere to industry standards, simplifying data management and workflow.

- Interoperability Advantage: Companies offering solutions that seamlessly integrate with existing hospital IT systems, like LIS and EHRs, gain a competitive edge.

- Customer Leverage: Lack of standardization or interoperability can empower customers to demand better pricing or switch to more compatible alternatives.

- Market Trend: The increasing complexity of laboratory operations fuels the demand for integrated diagnostic platforms, enhancing customer bargaining power.

Customer's Ability to Influence Product Development

Large customers, such as major hospital networks or influential diagnostic laboratories, hold considerable sway over DiaSorin's product development. Their specific requirements for new assays, enhanced performance characteristics, or more competitive pricing can steer DiaSorin's research and development priorities.

For instance, if a significant portion of DiaSorin's revenue comes from a few key accounts, their collective demand for a particular type of diagnostic test could compel DiaSorin to allocate resources towards its creation. This concentration of purchasing power effectively shifts some of the influence in product innovation towards these major clients.

- Key Opinion Leaders (KOLs) can dictate the direction of new diagnostic test development.

- Major lab networks’ purchasing volume gives them leverage to demand specific product features.

- Customer needs for cost-efficiency can pressure DiaSorin to optimize production and pricing.

The bargaining power of customers in the diagnostics sector is substantial, driven by consolidation among healthcare providers and the availability of numerous competing In Vitro Diagnostics (IVD) solutions. Customers are highly price-sensitive due to global healthcare budget constraints, pushing DiaSorin to compete on cost. Furthermore, the increasing demand for standardization and interoperability means that DiaSorin faces pressure to ensure its products seamlessly integrate with existing hospital IT systems, otherwise, customers can leverage this to negotiate better terms or switch to more compatible providers.

| Factor | Impact on DiaSorin | Example/Data (2024) |

|---|---|---|

| Customer Consolidation | Increased leverage for bulk purchasing and price negotiation. | Major hospital systems continued to merge, enhancing their purchasing blocs. |

| Availability of Alternatives | Customers can compare and switch based on price, performance, or service. | Key competitors include Roche, Abbott, and Siemens Healthineers. |

| Price Sensitivity | Pressure on profit margins and need for cost-competitive solutions. | Global healthcare budgets faced significant strain, increasing customer focus on cost. |

| Demand for Interoperability | Requirement for seamless integration with existing IT systems (LIS, EHRs). | The global LIS market was valued around $1.5 billion in 2024, underscoring integration importance. |

Full Version Awaits

DiaSorin Porter's Five Forces Analysis

This preview showcases the complete DiaSorin Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the diagnostics industry. You are viewing the exact, professionally formatted document that you will receive immediately upon purchase, ensuring full transparency and no hidden content. This detailed analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, providing valuable strategic insights.

Rivalry Among Competitors

The in vitro diagnostics (IVD) market is a battlefield dominated by formidable global players. Companies like Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, and Danaher, through its Beckman Coulter division, are constantly vying for market share. These giants aren't just large; they are deeply entrenched with massive research and development budgets, comprehensive product lines covering a vast array of diagnostic needs, and established, far-reaching distribution networks. This concentration of resources and capabilities among a few key competitors significantly escalates the intensity of rivalry within the IVD sector.

The diagnostic industry, including players like DiaSorin, is characterized by a fierce competition fueled by a relentless pursuit of innovation. Companies are locked in an ongoing race to develop cutting-edge test methodologies, advanced automation solutions, and sophisticated diagnostic platforms. This necessitates substantial and continuous investment in Research and Development (R&D) to stay ahead.

For DiaSorin, this translates into a significant R&D expenditure. In 2023, DiaSorin reported R&D expenses of €210.5 million, representing approximately 11.4% of its total revenue. This commitment underscores the critical importance of developing new and improved diagnostic tests and technologies to maintain a competitive edge in this rapidly evolving market.

DiaSorin, like many in the diagnostics sector, faces a competitive landscape where product differentiation plays a crucial role. While there's a general level of competition, companies carve out advantages by specializing in specific test menus. For instance, DiaSorin has built significant expertise in areas like bone metabolism and infectious diseases. This strategic focus can lessen direct head-to-head rivalry within those particular niches, allowing for stronger market positioning. However, it simultaneously contributes to a broader, more intense competition as firms vie for overall market share with more comprehensive diagnostic solutions.

Market Growth and Saturation Points

While the in-vitro diagnostics (IVD) market is expected to keep expanding, fueled by chronic diseases and an aging global population, some specific areas within the market could be nearing saturation or experiencing slower growth. For instance, the global IVD market was valued at approximately USD 92.1 billion in 2023 and is projected to reach USD 130.8 billion by 2028, exhibiting a compound annual growth rate (CAGR) of 7.3% during that period. However, segments like basic immunoassay tests might see more mature growth compared to advanced molecular diagnostics or companion diagnostics.

This potential for saturation in certain segments can significantly ramp up competition among players vying for market share. Companies might resort to more aggressive pricing tactics or intensified marketing campaigns to capture or retain their customer base. For example, in highly competitive diagnostic reagent markets, price erosion can become a common strategy as companies seek to maintain sales volumes.

- Market Growth Drivers: Increasing prevalence of chronic diseases (e.g., diabetes, cardiovascular diseases) and an aging global population are key growth catalysts for the IVD market.

- Saturation Concerns: Certain IVD segments, particularly those with established technologies and widespread adoption, may experience slower growth rates or market saturation.

- Competitive Response: Saturated markets often lead to intensified competition, potentially involving price wars, increased R&D investment in differentiated products, or strategic partnerships.

- Impact on Pricing: When market saturation looms, companies may lower prices to maintain sales volume, impacting overall profitability for less differentiated offerings.

Acquisitions and Strategic Alliances

The diagnostics industry is characterized by a dynamic competitive landscape driven by frequent mergers, acquisitions, and strategic alliances. These moves are strategic plays for companies aiming to broaden their product offerings, secure new market footholds, or integrate cutting-edge technologies. For instance, DiaSorin's acquisition of Luminex in 2021 for $1.8 billion was a significant consolidation, enhancing its capabilities in molecular diagnostics and expanding its global reach. Such M&A activity constantly reshapes who the key players are and how they compete, demanding agility from all participants.

These consolidations are not just about size; they are about acquiring specialized expertise and intellectual property. Companies are actively seeking to fill gaps in their diagnostic portfolios, particularly in areas like molecular testing and advanced immunoassay platforms. The rationale often centers on achieving economies of scale, improving R&D efficiency, and accelerating time-to-market for new diagnostic solutions.

- Increased Consolidation: The diagnostics sector has seen a notable uptick in M&A activity, with companies like Thermo Fisher Scientific and Abbott Laboratories frequently engaging in strategic acquisitions to bolster their market positions.

- Portfolio Expansion: Acquisitions are a primary method for companies to diversify their product lines, offering a wider range of diagnostic tests and platforms to healthcare providers.

- Technology Integration: Strategic alliances and acquisitions often focus on integrating novel technologies, such as advanced genetic sequencing or AI-driven diagnostic tools, to maintain a competitive edge.

- Market Access: Companies leverage M&A to gain access to new geographic markets or specific customer segments that were previously difficult to penetrate.

The competitive rivalry within the in-vitro diagnostics (IVD) market is intense, driven by a few dominant global players. Companies like Roche, Abbott, and Siemens Healthineers possess substantial R&D budgets and extensive distribution networks, creating high barriers to entry and intensifying competition for market share. This rivalry is further fueled by a continuous drive for innovation, with companies investing heavily in developing new diagnostic tests and platforms.

DiaSorin's commitment to R&D is evident, with €210.5 million spent in 2023, representing about 11.4% of its revenue. This investment is crucial for staying competitive in a market where product differentiation, often through specialization in areas like bone metabolism or infectious diseases, is key. However, even specialized niches face broader competition from companies offering more comprehensive diagnostic solutions.

The IVD market, valued at USD 92.1 billion in 2023 and projected to reach USD 130.8 billion by 2028, faces potential saturation in certain segments. This can lead to aggressive pricing and marketing strategies as companies fight for market share, particularly in mature areas like basic immunoassay tests.

Mergers and acquisitions are a constant feature, reshaping the competitive landscape. DiaSorin's $1.8 billion acquisition of Luminex in 2021 exemplifies this trend, bolstering its molecular diagnostics capabilities and global reach. Such consolidation aims to expand product portfolios, integrate new technologies, and gain market access, demanding continuous adaptation from all industry participants.

SSubstitutes Threaten

The rise of Point-of-Care Testing (POCT) presents a significant threat of substitution for DiaSorin's traditional laboratory-based in-vitro diagnostics (IVD) business. POCT devices deliver quick results directly to patients or clinicians, bypassing the need for centralized labs. This shift can erode the demand for DiaSorin's core lab instruments if competitors offer more efficient and widely adopted POCT solutions.

While DiaSorin does have some POCT offerings, the broader market's embrace of advanced POCT could directly substitute for their established diagnostic platforms. For instance, the global POCT market was valued at approximately USD 35.5 billion in 2023 and is projected to grow substantially, indicating a strong trend towards decentralized testing that could impact traditional IVD players.

Alternative diagnostic approaches, like advanced imaging such as MRI and CT scans, can sometimes replace the need for specific in vitro diagnostic (IVD) tests, especially for certain conditions. For example, in 2024, the global medical imaging market was valued at over $40 billion, indicating a significant reliance on these non-IVD methods.

Clinical observation and symptom-based diagnoses also present a substitute threat, as they can lead to treatment decisions without requiring laboratory-based IVD panels. This can directly reduce the demand for particular IVD tests, impacting companies like DiaSorin.

The burgeoning field of digital health, including wearable sensors and AI-powered diagnostic tools, presents a significant threat of substitution for traditional in-vitro diagnostic (IVD) tests. These innovations can offer continuous health monitoring and preliminary diagnoses, potentially bypassing the need for some lab-based IVD procedures. For instance, advancements in AI algorithms analyzing biometric data from smartwatches could provide early indicators of certain conditions, reducing reliance on specific blood or urine tests.

Direct-to-Consumer (DTC) Genetic Testing

The threat of substitutes for DiaSorin's in-vitro diagnostics (IVD) market, particularly concerning genetic testing, is emerging from the direct-to-consumer (DTC) genetic testing sector. While these services differ in their regulatory oversight and clinical validation compared to traditional IVD tests, they offer individuals insights into inherited conditions and predispositions outside of conventional healthcare channels. This can, for some consumers, lessen their perceived need for specific clinical genetic tests offered by companies like DiaSorin.

Consider these points regarding DTC genetic testing as a substitute:

- Indirect Substitution: DTC genetic tests provide health-related information, acting as an indirect substitute by offering insights into inherited traits and potential health risks without requiring a clinical diagnostic pathway.

- Market Reach: Companies like 23andMe and AncestryDNA have amassed significant customer bases, with 23andMe reporting over 12 million registered users as of early 2023, indicating a substantial reach that could influence demand for clinical genetic testing.

- Perceived Value: For individuals seeking general information about ancestry or a broad overview of certain health predispositions, DTC tests may offer a sufficient level of insight, potentially reducing their inclination to opt for more specialized and clinically validated IVD genetic tests.

- Cost and Accessibility: DTC tests are often more accessible and less expensive than clinical genetic testing, making them an attractive alternative for consumers prioritizing cost-effectiveness and ease of access over clinical rigor.

Preventive Healthcare and Lifestyle Changes

The growing emphasis on preventive healthcare and lifestyle changes presents a significant threat of substitutes for diagnostic test providers like DiaSorin. As individuals become more proactive about their health through wellness programs and lifestyle interventions, the incidence of certain preventable diseases may decline. This shift from reactive diagnosis to proactive wellness could lead to a reduced demand for diagnostic tests associated with these conditions over the long term.

For instance, the global wellness market, valued at approximately $5.6 trillion in 2023, is projected to continue its expansion. This growth fuels investments in areas like personalized nutrition, fitness tracking, and mental well-being, all of which aim to mitigate the need for medical interventions, including diagnostic testing. This trend directly impacts the market for diagnostic solutions by offering an alternative pathway to health management.

Consider the impact on specific diagnostic areas. A rise in preventative cardiovascular health initiatives, for example, could decrease the demand for routine cholesterol and cardiac enzyme tests. Similarly, increased focus on early cancer screening through lifestyle modifications and genetic predispositions rather than solely relying on diagnostic markers could alter market dynamics. These preventive measures act as substitutes by addressing health concerns before they necessitate traditional diagnostic pathways.

Key aspects of this threat include:

- Shifting Consumer Focus: Consumers are increasingly investing in preventative health, impacting demand for reactive diagnostic services.

- Growth in Wellness Industry: The expanding global wellness market offers alternative health management solutions.

- Reduced Incidence of Disease: Successful lifestyle interventions can lower the occurrence of conditions requiring diagnostic tests.

- Long-Term Market Impact: This trend represents a fundamental shift, potentially reducing the overall reliance on diagnostic testing in the future.

The threat of substitutes for DiaSorin's IVD business is multifaceted, ranging from technological advancements to evolving healthcare philosophies. Point-of-care testing (POCT) offers rapid results, potentially bypassing traditional labs, with the global POCT market valued at approximately USD 35.5 billion in 2023. Advanced imaging and even clinical observation can sometimes replace specific IVD tests, with the medical imaging market exceeding $40 billion in 2024. Furthermore, the burgeoning digital health sector and direct-to-consumer genetic testing, with companies like 23andMe having over 12 million users, present alternative avenues for health insights, often at lower costs.

| Substitute Category | Example | Market Size/User Base (Approximate) | Year |

|---|---|---|---|

| Point-of-Care Testing (POCT) | Rapid diagnostic devices | USD 35.5 billion | 2023 |

| Medical Imaging | MRI, CT Scans | Over USD 40 billion | 2024 |

| Direct-to-Consumer Genetic Testing | 23andMe, AncestryDNA | Over 12 million users (23andMe) | Early 2023 |

Entrants Threaten

Establishing an in-vitro diagnostics (IVD) company demands significant upfront capital. For instance, research and development alone can run into millions of dollars, not to mention the costs associated with building specialized manufacturing facilities, such as clean rooms, and establishing robust global distribution networks. These high capital investment requirements act as a substantial barrier, effectively deterring many potential new competitors from entering the market.

The in-vitro diagnostics (IVD) sector is a prime example of how stringent regulatory approval processes act as a formidable barrier to entry. Agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), alongside numerous national bodies, impose rigorous standards for safety and efficacy. For instance, the FDA's premarket approval (PMA) pathway, often required for high-risk IVD devices, can take years and cost millions of dollars in clinical trials and documentation, significantly deterring nascent companies.

The in vitro diagnostics (IVD) industry, where DiaSorin operates, requires highly specialized scientific knowledge. Developing and manufacturing these products demands deep expertise across fields like molecular biology, immunology, biochemistry, engineering, and software development.

New companies entering this arena face a significant hurdle in attracting and retaining talent with these niche skills. This difficulty in acquiring specialized human capital acts as a protective barrier for established players like DiaSorin, who have already cultivated these capabilities.

Established Brand Reputation and Customer Loyalty

Established brand reputation and customer loyalty present a significant barrier for new entrants in the diagnostics market. Companies like DiaSorin have cultivated deep relationships with healthcare providers over decades, fostering trust in their product reliability and service. This loyalty means new companies must invest heavily in marketing and sales to even begin to chip away at existing market share.

Consider the impact of this loyalty: new entrants struggle to gain traction against established players who are already embedded in hospital procurement systems and laboratory workflows. For instance, in 2024, the diagnostics industry continued to see high switching costs for customers, making it difficult for newcomers to displace incumbents even with potentially innovative solutions.

The threat is further amplified by the critical nature of diagnostic testing. Healthcare providers are hesitant to switch suppliers for essential tests due to concerns about accuracy, regulatory compliance, and the potential disruption to patient care. This inherent conservatism in the sector plays directly into the hands of established firms.

- Brand Recognition: DiaSorin's long-standing presence has built significant brand recognition, making it a trusted name in clinical diagnostics.

- Customer Relationships: Decades of service have cemented strong relationships with hospitals and laboratories, creating high switching costs for clients.

- Trust in Critical Sectors: In healthcare, trust is paramount; new entrants must overcome skepticism regarding the performance and reliability of their offerings.

- Market Inertia: Existing customer loyalty creates inertia, making it challenging for new companies to penetrate a market dominated by trusted, established brands.

Complex Distribution Channels and Sales Networks

DiaSorin faces a significant threat from new entrants due to the intricate nature of distribution channels and sales networks within the global healthcare sector. Effectively navigating the procurement processes of hospitals and diagnostic laboratories worldwide demands specialized knowledge and established relationships, which are difficult for newcomers to replicate quickly.

Building these sophisticated sales, marketing, and distribution infrastructures from the ground up represents a substantial hurdle. It requires considerable capital investment and a lengthy period to cultivate the necessary reach and trust, effectively acting as a barrier to entry that shields existing players like DiaSorin.

- High Capital Investment: Establishing a global healthcare distribution network can cost hundreds of millions of dollars, encompassing warehousing, logistics, regulatory compliance, and sales force training.

- Long Lead Times: It typically takes years, often five to ten, for a new entrant to build a comparable sales and distribution infrastructure and gain market access.

- Established Relationships: Incumbents benefit from long-standing relationships with key healthcare providers, making it challenging for new companies to secure initial sales and build credibility.

The threat of new entrants for DiaSorin is moderate, primarily due to substantial barriers like high capital requirements and complex regulatory hurdles. Developing and manufacturing in-vitro diagnostics (IVD) requires millions for R&D and specialized facilities. Regulatory bodies such as the FDA and EMA impose rigorous approval processes, with pathways like the FDA's PMA taking years and costing millions, significantly deterring startups.

The specialized knowledge needed in fields like molecular biology and immunology also presents a challenge for newcomers. Attracting and retaining talent with these niche skills is difficult, giving established companies like DiaSorin an advantage.

Furthermore, established brand recognition and customer loyalty create inertia in the market. In 2024, switching costs for healthcare providers remained high, making it hard for new entrants to dislodge incumbents even with innovative solutions, as providers prioritize accuracy and reliability for critical diagnostic tests.

The intricate global healthcare distribution channels and sales networks are another significant barrier. Building these infrastructures requires considerable capital and time to cultivate trust and reach, effectively protecting established players.

| Barrier Type | Description | Estimated Cost/Time |

|---|---|---|

| Capital Requirements | R&D, specialized manufacturing, global distribution | Millions to hundreds of millions of dollars |

| Regulatory Approval | FDA PMA, EMA, national bodies | Years and millions of dollars |

| Specialized Knowledge | Molecular biology, immunology, biochemistry | Difficulty in talent acquisition |

| Brand Loyalty & Switching Costs | Trust, established relationships, workflow integration | High, difficult to overcome |

| Distribution & Sales Networks | Global reach, procurement access | Years to build, significant investment |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for DiaSorin leverages a comprehensive dataset including DiaSorin's annual reports, SEC filings, and investor presentations. We also incorporate industry-specific market research reports from firms like EvaluatePharma and Frost & Sullivan, alongside data from financial databases such as S&P Capital IQ.