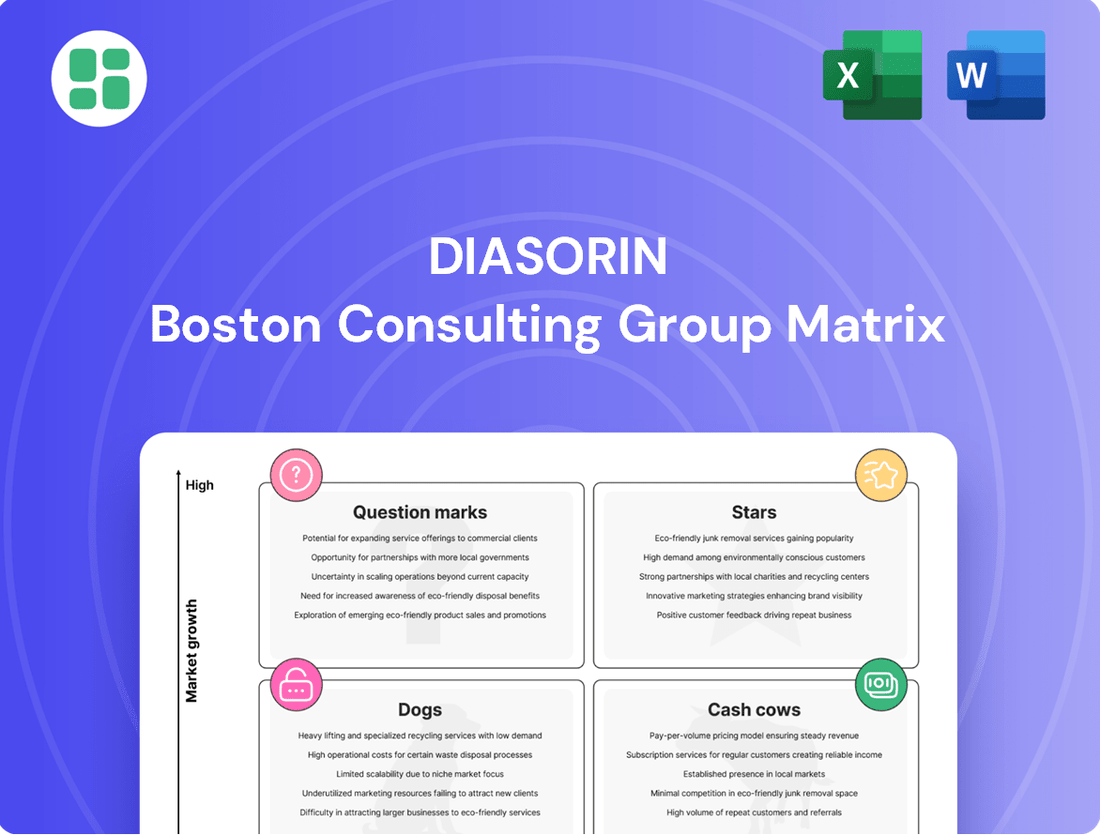

DiaSorin Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DiaSorin Bundle

Curious about DiaSorin's product portfolio performance? Our BCG Matrix preview highlights key areas, but to truly unlock strategic growth, you need the full picture. Discover which segments are poised for expansion and which require careful management.

Gain a comprehensive understanding of DiaSorin's market standing with our complete BCG Matrix. This detailed analysis will equip you with the insights needed to make informed decisions about resource allocation and future investments, moving beyond guesswork to strategic certainty.

Don't miss out on the actionable intelligence within the full DiaSorin BCG Matrix. Purchase now to receive a detailed breakdown of each product's position, enabling you to confidently navigate the competitive landscape and optimize your business strategy.

Stars

The LIAISON PLEX® platform is a significant contributor to DiaSorin's growth, particularly with its recently cleared blood culture assays and respiratory panels. This automated system taps into the expanding molecular diagnostics market, showcasing strong commercial momentum and substantial investment.

This advanced diagnostic solution is poised for high growth and increasing market share for DiaSorin. In 2024, the company has seen robust demand for its molecular solutions, with LIAISON PLEX® at the forefront of this expansion, reflecting the industry's shift towards more sophisticated and efficient diagnostic tools.

The SIMPLEXA® C. auris Direct Assay represents a major advancement for DiaSorin, earning FDA de novo clearance in July 2024. This innovative molecular test is the first to directly detect C. auris from skin swabs, delivering results in under two hours. This speed is crucial for managing Candida auris, an urgent threat due to its antimicrobial resistance.

This rapid diagnostic capability positions the SIMPLEXA® C. auris Direct Assay to become a leader in a rapidly expanding market driven by a critical clinical need. The ability to quickly identify C. auris infections allows for faster implementation of infection control measures, potentially reducing transmission rates in healthcare settings.

DiaSorin's collaboration with MeMed for their innovative test, which distinguishes bacterial from viral infections, positions this venture as a strategic Star. This partnership is crucial for combating antibiotic resistance by enabling more precise diagnoses, a significant advancement in patient care.

The MeMed test addresses a key unmet need in diagnostics, potentially reducing the misuse of antibiotics and improving patient outcomes. This initiative highlights DiaSorin's commitment to pioneering solutions in the global diagnostics market.

This program is a testament to DiaSorin's expanding influence in immunodiagnostics, reinforcing its competitive edge. The development of such advanced diagnostic tools solidifies its position as a leader in the field.

Specialty CLIA Immunodiagnostics Menu

DiaSorin's specialty menu on its Chemiluminescence ImmunoAssay (CLIA) platform is a key driver of its success, especially within the U.S. hospital market. This focus on high-value specialty tests is fueling significant volume growth and solidifying the company's market standing.

The immunodiagnostics market, while established, sees robust expansion through DiaSorin's specialized offerings. These high-value tests are proving to be powerful growth engines for the company.

- Specialty CLIA Menu Performance: DiaSorin's CLIA platform features a comprehensive specialty menu that consistently delivers strong performance and growth, particularly in its U.S. hospital strategy.

- Growth Drivers: Within the mature immunodiagnostics market, specific high-value specialty tests are experiencing substantial volume increases, acting as key growth engines for DiaSorin.

- Market Position: These specialized tests are not only driving volume but also enabling DiaSorin to maintain a strong market position in these critical segments.

Bloodstream Infection Panels on LIAISON PLEX®

DiaSorin's LIAISON PLEX Blood Culture Assays, encompassing both Gram-negative and Gram-positive panels, have recently achieved FDA 510(k) clearance. This development is significant because it directly addresses the critical and widespread issue of sepsis, a condition that contributes to millions of deaths annually worldwide. The assays are designed to rapidly identify the specific bacteria causing bloodstream infections and crucial antibiotic resistance genes, offering a substantial improvement over conventional diagnostic timelines.

These new assays position DiaSorin favorably within the diagnostics market, particularly in the segment dedicated to urgent clinical needs. The ability to provide faster and more accurate results for sepsis is paramount, as timely treatment can dramatically improve patient outcomes. For instance, studies have shown that for every hour of delayed appropriate antibiotic treatment in sepsis, mortality risk increases significantly.

- Market Impact: The global sepsis diagnostics market was valued at approximately USD 2.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030, driven by increasing sepsis incidence and demand for rapid diagnostics.

- Clinical Advantage: Traditional blood culturing can take 24-72 hours for results, whereas the LIAISON PLEX assays aim to provide pathogen and resistance gene identification in a matter of hours, enabling earlier targeted therapy.

- Product Positioning: This FDA clearance allows DiaSorin to offer a cutting-edge solution for a major unmet clinical need, enhancing its competitive standing in the infectious disease diagnostics space.

- Revenue Potential: With sepsis being a leading cause of hospital-acquired infections and a significant driver of healthcare costs, the adoption of these rapid diagnostic panels is expected to contribute positively to DiaSorin's revenue streams.

The LIAISON PLEX Blood Culture Assays and the SIMPLEXA® C. auris Direct Assay represent DiaSorin's strategic "Stars" within the BCG matrix. These products exhibit high growth potential and strong market positions, fueled by critical clinical needs and technological advancements. The collaboration with MeMed for bacterial vs. viral infection differentiation also falls into this category, addressing antibiotic resistance with a promising, high-growth solution.

| Product/Initiative | Market Growth | Market Share | Key Differentiator | 2024 Impact |

| LIAISON PLEX Blood Culture Assays | High (Sepsis Diagnostics Market >8% CAGR) | Growing (Addressing unmet need) | Rapid identification of pathogens and resistance genes | FDA 510(k) clearance, driving adoption for sepsis management |

| SIMPLEXA® C. auris Direct Assay | High (Urgent need for C. auris detection) | Leader (First direct detection from skin swabs) | Speed (under 2 hours), direct detection | FDA de novo clearance, first-mover advantage in critical infection control |

| MeMed Collaboration | High (Combating antibiotic resistance) | Emerging (Strategic partnership) | Distinguishes bacterial from viral infections | Positions DiaSorin as a pioneer in precision diagnostics for antibiotic stewardship |

What is included in the product

The DiaSorin BCG Matrix categorizes its business units by market growth and share, guiding investment and resource allocation.

A clear visual representation of the DiaSorin BCG Matrix helps pinpoint underperforming products, alleviating the pain of resource misallocation.

Cash Cows

DiaSorin's immunodiagnostics business is a powerhouse, representing about 65% of the company's total sales. This segment is a classic Cash Cow within the BCG framework, thriving in a mature market where it commands a significant share of approximately 18%.

The substantial market share translates into consistent and strong revenue generation and cash flow for DiaSorin. This stability is further bolstered by a large installed base of diagnostic instruments, providing a reliable foundation for the company's financial health and enabling continued investment in other business areas.

The LIAISON XL platform is DiaSorin's flagship immunodiagnostic system, boasting a significant global presence. This established technology generates consistent, high-margin revenue through its consumable reagents, a classic example of the razor-and-blades model.

In 2024, DiaSorin continued to rely on the LIAISON XL as a primary profit driver within the mature immunodiagnostics market. The platform's widespread adoption ensures a steady demand for its specialized reagents, contributing substantially to the company's overall financial performance.

DiaSorin's Licensed Technologies division acts as a reliable cash cow, consistently generating stable revenue by licensing its instruments and technology to other major diagnostic companies, pharmaceutical firms, and research institutions. This segment demonstrates steady, low-growth characteristics but maintains a high market share, making it a predictable contributor to DiaSorin's overall financial performance.

Established Infectious Disease Portfolio

DiaSorin's established infectious disease portfolio, encompassing tests for hepatitis, tuberculosis, mumps, and measles, represents a significant cash cow. These products benefit from mature markets with consistent demand and widespread clinical adoption.

The high margins generated by these established tests are a direct result of their entrenched market position and DiaSorin's efficient production processes. For instance, in 2024, the infectious disease segment continued to be a reliable revenue driver, contributing significantly to the company's overall profitability.

- Established Market Presence: Tests for common infectious diseases like hepatitis and measles have long-standing market penetration.

- Consistent Revenue Stream: These products provide predictable, high-margin sales due to their established demand.

- Profitability Driver: The mature nature of these tests allows for efficient operations and strong profitability, supporting other business areas.

Automated Immunoassay Analyzers

DiaSorin's automated immunoassay analyzers represent a significant cash cow, leveraging an extensive global installed base that drives recurring revenue. This installed base ensures a consistent demand for reagent kits, the consumables essential for the analyzers' operation.

The inherent high customer switching costs associated with these sophisticated systems solidify their position as a predictable and substantial cash generator. Once a laboratory invests in DiaSorin's analyzers, transitioning to a competitor becomes a complex and costly undertaking, fostering loyalty and sustained demand for reagents.

This operational dynamic mirrors the successful 'razor-and-blades' business model, where the initial sale of the analyzer (the razor) leads to ongoing, profitable sales of disposable reagent kits (the blades). This strategy is particularly effective in mature markets where the installed base is large and stable, guaranteeing predictable cash flows for DiaSorin.

- Recurring Revenue: DiaSorin's immunoassay analyzers generate consistent revenue through the sale of reagent kits.

- Customer Lock-in: High switching costs for automated immunoassay analyzers create customer loyalty and predictable demand.

- Mature Market Dominance: The established installed base in a mature market ensures significant and steady cash generation.

DiaSorin's immunodiagnostics business, a cornerstone of its operations, functions as a prime Cash Cow. This segment consistently generates robust cash flow, fueled by its substantial market share in a mature industry.

The company's flagship LIAISON XL platform exemplifies this Cash Cow status, driving significant revenue through the ongoing sale of its specialized reagents. In 2024, this segment continued to be a primary profit engine for DiaSorin.

Similarly, DiaSorin's established infectious disease diagnostics contribute reliably to its Cash Cow portfolio. These products benefit from strong market penetration and efficient production, ensuring high margins and predictable earnings.

The extensive installed base of DiaSorin's automated immunoassay analyzers further solidifies its Cash Cow position. This installed base guarantees consistent demand for essential reagent kits, creating a stable and profitable revenue stream.

| Business Segment | BCG Category | Key Characteristics | 2024 Financial Contribution |

| Immunodiagnostics | Cash Cow | High market share, mature market, strong revenue generation | Approx. 65% of total sales |

| LIAISON XL Platform | Cash Cow | Flagship product, high-margin reagents, established installed base | Primary profit driver |

| Infectious Disease Diagnostics | Cash Cow | Mature market, consistent demand, high profitability | Significant contributor to overall profitability |

| Automated Immunoassay Analyzers | Cash Cow | Extensive installed base, recurring reagent sales, high customer lock-in | Stable and substantial cash generator |

What You See Is What You Get

DiaSorin BCG Matrix

The DiaSorin BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professional and ready-to-use strategic analysis tool. The comprehensive insights and clear presentation are exactly as intended for your business planning needs. You can confidently use this preview to assess the quality and relevance of the strategic information provided.

Dogs

Revenue from COVID-19 related testing, a significant contributor during the pandemic, has experienced a sharp and anticipated decline. This segment, which saw a dramatic surge, is now rapidly contracting.

For DiaSorin, this means the COVID-19 testing product line, once a temporary Star, has transitioned into a Dog. Market demand has significantly evaporated, projecting it to become a negligible contributor to total revenues moving forward.

The ARIES platform, a key component of DiaSorin's molecular diagnostics offerings, was discontinued in the fourth quarter of 2023. This strategic move directly impacted the segment's growth comparisons for the period.

The discontinuation signals that the ARIES platform held a low market share and was deemed not viable for sustained long-term operation. Consequently, it has been classified as a Dog within the BCG Matrix, representing a product with low growth and low market share that has now been divested from the active portfolio.

DiaSorin's legacy immunoassay technologies, including Radioimmunoassay (RIA) and Enzyme-Linked Immunosorbent Assay (ELISA), are now largely overshadowed by their more advanced Chemiluminescence Immunoassay (CLIA) platforms. These older methods, while foundational, represent a shrinking segment of the market, likely holding minimal share and experiencing decline as newer, more efficient technologies take precedence.

General Business in the Chinese Market

DiaSorin's presence in the Chinese market faces significant headwinds, primarily due to government initiatives like Volume Based Procurement (VBP). These policies, designed to bolster domestic players, have negatively impacted DiaSorin's performance, leading to a low market share despite the overall expansion of the In Vitro Diagnostics (IVD) sector.

The Chinese IVD market is a complex environment where local manufacturers are increasingly favored, creating substantial challenges for international companies like DiaSorin. This geographical segment is characterized by intense competition and regulatory pressures, making it difficult to achieve meaningful growth with existing product lines.

- Negative Impact of VBP: Government policies such as Volume Based Procurement (VBP) have directly hindered DiaSorin's market access and pricing power in China.

- Low Market Share: Despite the growing Chinese IVD market, DiaSorin struggles with a comparatively small market share, indicating limited penetration.

- Headwinds for Growth: The regulatory landscape and competitive pressures create significant obstacles for DiaSorin's ability to expand its business in this key Asian market.

- Challenging Environment: China represents a difficult geographical segment for DiaSorin, where achieving substantial growth for its current product portfolio is a considerable challenge.

Non-Core, Low-Volume or Obsolete Tests

Within DiaSorin's broad range of diagnostic tests, there are likely older, low-volume, or less competitive offerings. These tests may contribute minimally to revenue while demanding significant resources, making them prime candidates for strategic review. They often reside in mature, low-growth market segments where DiaSorin holds a small market share.

These non-core, low-volume, or obsolete tests represent a category that DiaSorin might consider for divestiture or significant resource reduction. For instance, if a particular immunoassay for a rare condition has seen declining demand and faces strong competition from newer technologies, it would fit this description. The focus for DiaSorin is increasingly on advanced diagnostics and specialty areas, making these legacy tests less strategically aligned.

- Low Market Share: These tests typically hold a small percentage of their respective market segments.

- Low Growth Sub-Segments: They operate in markets that are not expanding significantly.

- Resource Drain: They can consume disproportionate amounts of R&D, manufacturing, or marketing resources relative to their financial contribution.

- Strategic Misalignment: They do not align with DiaSorin's strategic push towards specialty and advanced diagnostic solutions.

DiaSorin's COVID-19 testing business, once a significant revenue driver, has now transitioned into a Dog. This segment experienced a substantial decline in demand post-pandemic, leading to a sharp contraction in its market contribution.

The discontinuation of the ARIES platform in late 2023 also signifies a product classified as a Dog. Its low market share and lack of long-term viability led to its removal from DiaSorin's active portfolio.

Legacy immunoassay technologies like RIA and ELISA are also considered Dogs due to their diminishing market relevance and DiaSorin's strategic shift towards more advanced CLIA platforms.

The Chinese market presents a challenge, with government policies like VBP limiting DiaSorin's market share and growth potential, effectively categorizing this geographical segment as a Dog for the company's current offerings.

Older, low-volume diagnostic tests that consume resources without significant returns also fall into the Dog category. These products are often in mature, low-growth markets where DiaSorin holds a minimal share.

Question Marks

The LIAISON NES® platform represents DiaSorin's strategic entry into the burgeoning molecular point-of-care testing market. This innovative system, which has been submitted for U.S. FDA 510(k) clearance and CLIA Waiver, is designed to capture a significant share of the rapid, near-patient testing segment.

While the platform holds considerable promise for high-growth potential, its current market share remains minimal, pending regulatory approval and subsequent commercial rollout. DiaSorin's investment in this technology is substantial, aiming to transform its potential into a leading market position in the coming years.

New molecular diagnostic panels on DiaSorin's LIAISON PLEX® platform, while targeting high-growth areas like emerging pathogens, are currently considered question marks. These specialized panels are in the early stages of market adoption, requiring dedicated marketing and sales efforts to build market share. Their success hinges on demonstrating clear clinical utility and securing reimbursement pathways.

Emerging diagnostic biomarkers represent DiaSorin's investment in the future, akin to question marks on the BCG matrix. These are cutting-edge research programs, focusing on areas like personalized medicine and advanced oncology, with the potential to unlock significant future growth. For instance, DiaSorin's commitment to innovation is evident in its ongoing R&D spending, which consistently supports the exploration of these novel diagnostic avenues.

Expansion into New Geographic Markets (High Growth, Low Presence)

DiaSorin might focus on expanding into high-growth emerging markets where its presence is currently minimal but the in-vitro diagnostics (IVD) sector shows substantial potential. These strategic moves demand significant investment in market entry, building necessary infrastructure, and establishing brand recognition.

Success hinges on robust market penetration strategies and navigating local regulatory landscapes. For instance, the global IVD market was valued at approximately $90 billion in 2023 and is projected to grow at a CAGR of around 5-7% through 2030, with emerging markets like Southeast Asia and parts of Africa showing even higher growth rates. DiaSorin's investment in these regions in 2024 would be crucial for capturing future market share.

- Market Potential: Targeting emerging economies with rapidly expanding healthcare sectors.

- Resource Allocation: Significant capital expenditure for market entry and infrastructure.

- Risk Factor: Uncertain outcomes dependent on the efficacy of penetration strategies.

- Growth Opportunity: Capturing early market share in high-potential, underserved regions.

Integration of Acquired Technologies (Post-Acquisition Phase)

Following strategic acquisitions, the full integration and market penetration of acquired technologies into DiaSorin's portfolio can initially present challenges, potentially placing them in a Question Mark category as their full potential is realized. For instance, the acquisition of Luminex brought advanced multiplexing technology to DiaSorin. However, optimizing all its applications and achieving complete market capture across diverse customer segments requires sustained investment and strategic effort.

This ongoing process of integration and market development means that while the technology itself holds significant promise, its contribution to DiaSorin's overall market share and profitability is still evolving. The success of these integrations directly impacts DiaSorin's position within the BCG matrix, determining whether these acquired assets will become Stars or Dogs.

- Integration of Luminex Technology: DiaSorin's acquisition of Luminex in 2021 for approximately $1.4 billion brought significant multiplexing capabilities.

- Market Penetration Challenges: Fully realizing the market potential of Luminex's diverse applications, particularly in new customer segments, requires ongoing strategic execution and investment.

- Evolving Market Position: The success of integrating acquired technologies influences DiaSorin's product portfolio's placement within the BCG matrix, moving from potential Question Marks towards Stars or facing stagnation.

- Ongoing Investment: Continued investment in R&D and market development is crucial to maximize the value and market share of technologies like Luminex.

Question Marks in DiaSorin's portfolio represent products or initiatives with low current market share but high growth potential, requiring significant investment to determine their future success. These are often new technologies or market entries where the outcome is uncertain. DiaSorin's strategic focus on developing innovative diagnostic solutions means a portion of its R&D is dedicated to these nascent areas, aiming to transform them into future market leaders.

The LIAISON NES® platform, targeting the point-of-care molecular testing market, exemplifies a Question Mark. Despite its innovative design and submission for FDA clearance, its market share is currently negligible, pending regulatory approval and market adoption. Similarly, new molecular diagnostic panels on the LIAISON PLEX® platform, while targeting high-growth areas, are in early market stages, necessitating robust marketing and sales efforts to gain traction.

DiaSorin's investment in emerging diagnostic biomarkers also falls into the Question Mark category. These are cutting-edge research programs with the potential for significant future growth, but their market viability and eventual contribution to revenue are still under evaluation. The company's consistent R&D spending underscores its commitment to exploring these novel diagnostic avenues.

The integration of acquired technologies, such as Luminex's multiplexing capabilities, can also initially place them as Question Marks. While the technology itself is promising, achieving full market penetration and demonstrating its complete value proposition requires ongoing strategic execution and investment, influencing its eventual placement on the BCG matrix.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, sales figures, and competitive intelligence, to accurately position each product.