Dongfeng Motor Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dongfeng Motor Group Bundle

Dongfeng Motor Group strategically leverages its diverse product portfolio, from passenger cars to commercial vehicles, to meet a wide range of consumer needs. Their pricing strategies aim for competitive positioning within various market segments, balancing value and affordability. Discover how their extensive distribution network and targeted promotional campaigns contribute to their market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Dongfeng Motor Group's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a global automotive giant.

Product

Dongfeng Motor Group boasts a diverse vehicle portfolio, encompassing passenger cars, commercial vehicles, new energy vehicles (NEVs), and specialized military vehicles. This wide array allows them to serve a broad spectrum of market needs, from personal transportation to industrial logistics and defense applications.

In 2023, Dongfeng's passenger vehicle sales saw significant growth, with figures indicating a strong performance in the SUV and sedan segments. The company's strategic push into NEVs is also yielding results, with sales of electric and hybrid models increasing by over 40% year-over-year, reflecting a commitment to sustainability and future market trends.

Dongfeng Motor Group is heavily prioritizing New Energy Vehicles (NEVs) as a core part of its strategy. This focus is evident in their ambitious plans to introduce a substantial number of new NEV models by 2026. These upcoming vehicles will span both battery-electric and plug-in hybrid technologies, catering to a diverse market under brands such as VOYAH, MHERO, eπ, and NAMMI.

This aggressive NEV expansion aligns with the global automotive industry's move towards sustainability and China's strong governmental support for vehicle electrification. For instance, in 2023, China's NEV sales surpassed 9 million units, demonstrating a robust market demand that Dongfeng is actively targeting.

Dongfeng Motor Group commands a robust presence in the commercial vehicle market, supplying a wide array of trucks and buses tailored for sectors including logistics, construction, and mining. This segment is a cornerstone of their global strategy, underpinning both domestic dominance and international expansion.

Recent product launches, such as the Dongfeng GX, KC PRO, and KC PLUS, underscore their dedication to advancing commercial vehicle technology. These new models showcase a focus on reliability, intelligent features, and enhanced user trust, reflecting a forward-looking approach that embraces both conventional powertrains and new energy solutions.

In 2023, Dongfeng Motor's commercial vehicle sales saw significant activity, with the company consistently ranking among the top domestic manufacturers. For instance, their heavy-duty truck sales in the first half of 2024 showed resilience, with specific models reporting year-on-year growth, indicating strong market reception for their updated offerings.

Advanced Technology Integration

Dongfeng Motor Group is significantly boosting its investment in R&D to weave advanced technologies into its vehicle lineup. This commitment is evident in their development of sophisticated intelligent driving systems and the establishment of their 'TIANYUAN Intelligence' technology brand. They are also creating new platforms specifically for electric and off-road vehicles, showcasing a forward-looking approach to market demands.

The company's strategic focus on 'Embodied Intelligence' is designed to imbue future vehicles with superior physical resilience, enhanced performance capabilities, intelligent control mechanisms, and a responsive digital framework. This holistic integration aims to create vehicles that are not just smart, but also robust and adaptable.

- R&D Investment: Dongfeng Motor Group's commitment to technological advancement is underscored by substantial R&D expenditures, aiming to lead in intelligent and new energy vehicle technologies.

- 'TIANYUAN Intelligence': This dedicated technology brand signifies a concentrated effort to develop and market advanced intelligent driving and connectivity features.

- Platform Development: Pioneering dedicated platforms for electric and off-road vehicles demonstrates a strategic move to capture growth in these key market segments.

- 'Embodied Intelligence': This concept highlights the integration of physical robustness, performance, intelligent control, and digital infrastructure for next-generation vehicles.

Automotive Components and Services

Dongfeng Motor Group's product strategy extends significantly beyond finished vehicles. They are a major producer of engines and a wide array of auto parts, demonstrating substantial vertical integration. This allows for greater control over quality and supply chain efficiency. For instance, in 2023, Dongfeng's powertrain division supplied millions of engines, supporting both their own vehicle production and external sales.

Complementing their component manufacturing, Dongfeng offers a suite of related services, notably automotive finance. These services are often established through strategic joint ventures, such as their partnerships with international automakers. This comprehensive approach provides a more complete value proposition to customers and business partners alike. In 2024, their financial services segment reported a notable increase in loan origination volume, reflecting growing demand.

- Vertical Integration: Dongfeng manufactures engines and auto parts, controlling more of the value chain.

- Diversified Offerings: Beyond components, they provide automotive finance and other related services.

- Strategic Partnerships: Joint ventures enhance their service capabilities and market reach.

- Market Strength: This diversified model bolsters Dongfeng's overall competitive position in the automotive sector.

Dongfeng's product strategy centers on a broad portfolio, with a significant push into New Energy Vehicles (NEVs) like those under the VOYAH and MHERO brands. They also maintain a strong commercial vehicle presence, launching updated models like the KC PRO. Furthermore, Dongfeng leverages vertical integration by producing engines and auto parts, complemented by automotive finance services.

| Product Category | Key Brands/Models | 2023/2024 Highlights | Strategic Focus |

|---|---|---|---|

| Passenger NEVs | VOYAH, MHERO, eπ, NAMMI | NEV sales up over 40% YoY in 2023; ambitious new model introductions planned by 2026. | Electrification, intelligent driving, premium segment expansion. |

| Commercial Vehicles | Various Trucks & Buses | Strong domestic ranking; updated models like GX, KC PRO, KC PLUS launched; resilience in heavy-duty truck sales in H1 2024. | Reliability, intelligent features, diverse sector applications. |

| Powertrains & Parts | Engines, Auto Components | Supplied millions of engines in 2023; supports internal production and external sales. | Vertical integration, supply chain control, quality assurance. |

| Automotive Services | Automotive Finance | Notable increase in loan origination volume in 2024; strategic joint ventures. | Customer value proposition enhancement, market reach expansion. |

What is included in the product

This analysis delves into Dongfeng Motor Group's marketing mix, examining its diverse product portfolio, strategic pricing across segments, extensive distribution network, and multifaceted promotional activities.

It offers a comprehensive understanding of Dongfeng's market positioning and competitive strategies, ideal for stakeholders seeking insights into their marketing approach.

This 4P's analysis for Dongfeng Motor Group simplifies complex marketing strategies, offering a clear roadmap to address market challenges and boost brand performance.

It provides a concise, actionable framework for understanding Dongfeng's marketing levers, directly alleviating concerns about strategic clarity and market competitiveness.

Place

Dongfeng Motor Group boasts an impressive domestic distribution network, a cornerstone of its market strategy. This network spans across China's vast landscape, reaching numerous provinces, autonomous regions, and municipalities, making its vehicles readily available to a broad customer base.

As of December 2024, the group's extensive reach was quantified by its 6,440 sales outlets. This figure, encompassing its joint ventures and associated enterprises, underscores the significant investment in accessibility and market penetration within China.

This wide-ranging presence is instrumental in reinforcing Dongfeng's strong market position. It allows the company to effectively serve diverse customer needs and maintain a competitive edge in the highly dynamic Chinese automotive sector.

Dongfeng Motor Group is significantly stepping up its global presence, aiming for a substantial boost in international sales. The company's strategy involves entering diverse markets such as Southeast Asia, with Indonesia and Thailand as key targets, alongside European nations like Poland and Portugal, and Middle Eastern hubs including the UAE and Saudi Arabia. This push is supported by building lasting local partnerships and establishing robust distribution networks in major international urban centers.

Dongfeng Motor Group heavily leverages strategic joint ventures and partnerships, a cornerstone of its product development and market expansion, especially in the passenger vehicle segment. These collaborations are vital for integrating advanced global technologies with Dongfeng's deep understanding of the Chinese market, bolstering its competitive position.

By teaming up with international automotive giants, Dongfeng gains access to cutting-edge manufacturing processes and design innovations. For instance, its long-standing joint venture with Nissan, Dongfeng Nissan Passenger Vehicle Company, has been a significant contributor to its sales volume, with the brand consistently ranking among the top sellers in China. In 2023, Dongfeng Nissan's sales reached approximately 790,000 units, showcasing the immense impact of these strategic alliances on market penetration and distribution reach.

Focus on Service Network Expansion

Dongfeng Truck is actively expanding its service network overseas as a core part of its 'Overseas Service Priority' strategy. This focus on after-sales support is crucial for building customer trust and ensuring long-term success in international markets.

In Indonesia, a key growth market, Dongfeng plans a significant expansion of its service outlets. The goal is to reach 64 service points across Sumatra and Java, aiming for comprehensive nationwide coverage. This expansion is designed to ensure that customers are never more than 50 kilometers away from a service center.

- Target: 64 service outlets in Indonesia (Sumatra & Java).

- Coverage: Nationwide presence with a service radius under 50 km.

- Strategy: 'Overseas Service Priority' to enhance customer satisfaction.

Multi-channel Approach for Commercial Vehicles

Dongfeng Motor Group employs a multi-channel strategy for its commercial vehicles, extending beyond physical service outlets to encompass a rapid and efficient support system. This approach is reinforced by the development of a smart logistics ecosystem and a robust sales channel network designed to deliver comprehensive, full life cycle value to a global customer base.

The company's commitment to customer support is evident in its strategic investments. For instance, in 2024, Dongfeng continued to expand its service network, aiming for increased accessibility and faster response times. This expansion is crucial for maintaining customer loyalty in the competitive commercial vehicle market.

- Expanding Service Network: Dongfeng is actively increasing the number of physical service locations to ensure widespread coverage and prompt assistance for commercial vehicle operators.

- Smart Logistics Ecosystem: The company is investing in smart logistics to optimize delivery and after-sales support, enhancing operational efficiency for its clients.

- Mature Sales Channels: Dongfeng is building a well-established sales channel network, facilitating easier access to vehicles and related services for customers worldwide.

- Specialized Application Showcases: Dedicated exhibition areas highlight Dongfeng's expertise in specific sectors such as port logistics, expressway operations, and mining, demonstrating tailored solutions.

Dongfeng's place strategy emphasizes a robust domestic distribution network, boasting 6,440 sales outlets as of December 2024, ensuring broad accessibility across China. This physical presence is augmented by a strategic global expansion, targeting key markets in Southeast Asia, Europe, and the Middle East through local partnerships and distribution networks.

The company is also enhancing its international service network, particularly in Indonesia, with a goal of 64 service points in Sumatra and Java to maintain a service radius under 50 kilometers. This focus on after-sales support is a critical component of its 'Overseas Service Priority' strategy, aiming to build customer trust and long-term success.

Dongfeng's commercial vehicle division employs a multi-channel approach, integrating a smart logistics ecosystem and mature sales channels for full life cycle value. Specialized application showcases further demonstrate tailored solutions for various industry sectors, reinforcing its market position.

Same Document Delivered

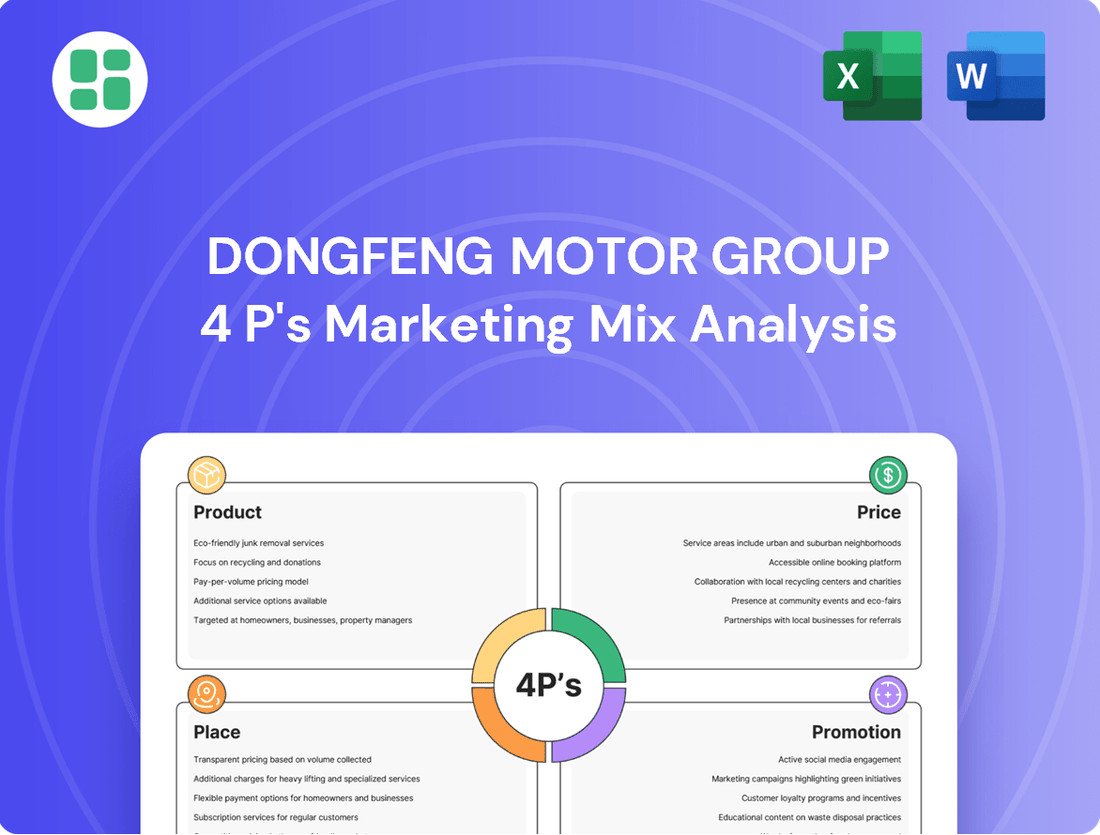

Dongfeng Motor Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Dongfeng Motor Group's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Dongfeng Motor Group is strategically boosting its global brand awareness by actively participating in international exhibitions and targeted brand events. For instance, their presence at the International Automotive & Supply Chain Expo in Hong Kong in 2025 and the dedicated Dongfeng Day events in Southeast Asia during 2025 are key to showcasing their technological advancements and flagship vehicle models. These efforts are designed to significantly enhance brand recognition and build credibility with a wide array of global consumers.

Dongfeng Motor Group leverages major automotive exhibitions like Auto China 2024 to showcase its latest innovations, including new energy vehicles (NEVs). These high-profile events generate substantial media buzz and provide a crucial platform for direct customer engagement.

Furthermore, dedicated launch events, such as the recent introduction of new commercial truck models in Jakarta, Indonesia, allow Dongfeng to highlight specific product strengths and technological advancements. This direct interaction with potential buyers and industry partners is key to building brand awareness and driving initial sales interest.

Dongfeng Motor Group strategically partners with local entities in new markets to facilitate vehicle introductions and build robust sales networks. This collaborative strategy, evident in their Polish market entry where they partnered with a local distributor in 2023, leverages existing infrastructure and market knowledge.

These partnerships are crucial for brand promotion and sales, enabling Dongfeng to tap into established distribution channels and local consumer insights. For instance, in Saudi Arabia, Dongfeng's 2024 expansion involved alliances with local automotive groups to accelerate market penetration.

Joint marketing initiatives and the development of tailored 'Dongfeng Solutions' are integral to these collaborations. These efforts aim to address specific regional consumer preferences and regulatory requirements, enhancing market acceptance and sales performance.

Digital and Intelligent Marketing Initiatives

Dongfeng Motor Group is increasingly leveraging digital and intelligent marketing to connect with consumers. Their focus on intelligent networking and smart logistics points to a strategy that includes robust online presence and data-driven campaigns. This approach aims to engage a digitally native audience, highlighting the advanced technologies in their vehicles.

Key initiatives likely involve:

- Enhanced Online Presence: Utilizing official websites, automotive portals, and e-commerce platforms for product information, sales, and customer service.

- Social Media Engagement: Active participation on platforms like WeChat and Weibo to build brand community, share news, and run targeted promotions.

- Data-Driven Campaigns: Employing analytics to understand consumer behavior, personalize marketing messages, and optimize advertising spend for better reach and conversion.

- Virtual Showrooms and Experiences: Offering immersive online experiences to showcase vehicle features and innovations, particularly relevant for their smart and electric vehicle lines.

Targeted al Activities for Specific Segments

Dongfeng Motor Group strategically tailors its promotional efforts to resonate with distinct customer segments and vehicle categories. For its commercial vehicle lines, promotions consistently underscore attributes like unwavering reliability, intelligent features, and the inherent trust associated with the brand. These campaigns often spotlight specific models engineered for demanding applications, such as those in port logistics or heavy-duty freight transport, emphasizing durability and operational efficiency.

In the burgeoning New Energy Vehicle (NEV) sector, Dongfeng's promotional messaging pivots to highlight cutting-edge technology and significant environmental advantages. This approach is designed to attract consumers who are increasingly prioritizing sustainability and are influenced by evolving environmental policies and societal trends. By focusing on innovation and eco-friendliness, Dongfeng aims to capture market share in this rapidly expanding segment.

Dongfeng's promotional activities in 2024 reflect these targeted strategies. For example, their commercial vehicle division has seen success with campaigns emphasizing total cost of ownership for fleet operators, a key consideration in that segment. Simultaneously, NEV promotions have leveraged digital platforms to showcase advanced battery technology and charging infrastructure, aligning with consumer interest in smart, green mobility solutions. In the first half of 2024, Dongfeng reported a significant increase in NEV sales, driven partly by these focused promotional campaigns.

- Commercial Vehicle Promotions: Emphasis on reliability, intelligence, and trust for sectors like port logistics and heavy-duty transport.

- NEV Promotions: Focus on advanced technology and environmental benefits to attract eco-conscious consumers.

- 2024 Performance: Dongfeng's NEV sales saw notable growth in early 2024, supported by targeted marketing.

- Strategic Alignment: Promotional activities are directly linked to segment-specific needs and broader market trends.

Dongfeng Motor Group's promotional strategy in 2024-2025 centers on showcasing technological prowess and global reach through international events and targeted digital campaigns. Their presence at Auto China 2024 highlighted new energy vehicles (NEVs), while events in Southeast Asia in 2025 aim to boost brand recognition.

Partnerships with local distributors, such as in Poland (2023) and Saudi Arabia (2024), are crucial for market penetration and tailored promotions. These collaborations facilitate access to established sales networks and local consumer insights, bolstering brand visibility and sales efforts.

Digital marketing is a key pillar, with efforts focused on enhancing online presence, social media engagement, and data-driven campaigns to connect with a younger, digitally-savvy audience. Virtual showrooms further augment this by offering immersive product experiences.

Promotions are segmented, emphasizing reliability and intelligence for commercial vehicles and cutting-edge technology and sustainability for NEVs. This tailored approach, evident in their 2024 NEV sales growth, directly addresses specific market demands and consumer preferences.

| Promotional Focus | Key Activities | Target Segment | 2024/2025 Data/Examples |

|---|---|---|---|

| Global Brand Awareness | International Exhibitions, Brand Events | Global Consumers, Industry Partners | Presence at Auto China 2024, Dongfeng Day in Southeast Asia (2025) |

| Market Penetration & Sales | Local Partnerships, Joint Marketing | New Market Consumers | Polish Market Entry (2023), Saudi Arabia Expansion (2024) |

| Digital Engagement | Online Presence, Social Media, Data Analytics | Digitally Native Audience | Focus on WeChat, Weibo, Virtual Showrooms |

| Segment-Specific Messaging | Product Reliability, Tech Innovation, Sustainability | Commercial Vehicle Operators, NEV Buyers | Increased NEV Sales in early 2024 driven by targeted promotions |

Price

Dongfeng Motor Group navigates a fiercely competitive automotive landscape, particularly within China, where price competition intensified significantly in 2024. To secure market share and appeal to a broad consumer base, the company must implement agile pricing strategies. This includes employing aggressive pricing tactics for high-volume, mainstream models, while potentially utilizing value-based pricing for its more premium or niche offerings.

Dongfeng Motor Group employs value-based pricing for its premium new energy vehicle brands, such as VOYAH and MHERO. This strategy aligns pricing with the advanced technology, luxurious appointments, and superior performance these vehicles offer, positioning them as aspirational choices. For instance, the VOYAH Courage was launched in European markets with prices ranging from approximately 270,000 to 430,000 yuan, underscoring its premium market placement.

Dongfeng Motor Group is enhancing product accessibility through flexible financing. For instance, in 2024, the company is focusing on expanding credit offerings in Southeast Asia, a key growth region. This strategy aims to boost sales of their commercial vehicle lines, which saw a 7% increase in market share in that region during the first half of 2024, directly attributed to these new financing plans.

Response to Market Demand and Economic Conditions

Dongfeng Motor Group's pricing is sensitive to market demand and economic shifts. For instance, the passenger vehicle terminal price saw a notable decline in 2024, directly impacting pricing strategies.

In response to these market dynamics, Dongfeng is actively refining its business structure and adapting its approaches. This includes strategic adjustments aimed at fostering operational growth and ensuring high-quality development, which can involve flexible pricing mechanisms.

- 2024 Passenger Vehicle Terminal Price Decline: Market data indicates a downward trend in passenger vehicle prices during 2024, a key factor influencing Dongfeng's pricing decisions.

- Strategic Business Optimization: The company is undertaking efforts to reconfigure its operations to better align with prevailing economic conditions and market demand.

- Focus on High-Quality Development: Dongfeng's strategy emphasizes not just recovery but also sustained, high-quality growth, necessitating agile pricing and product strategies.

- Dynamic Pricing Adjustments: To maintain competitiveness and profitability, Dongfeng is likely implementing dynamic pricing models that react to real-time market signals and economic indicators.

Government Policies and Subsidies for NEVs

Government incentives play a significant role in shaping the pricing of New Energy Vehicles (NEVs). For a company like Dongfeng Motor Group, a major player in China's automotive sector with a substantial NEV portfolio, these policies are crucial for market positioning. By factoring in national and local subsidies, Dongfeng can offer more attractive price points to consumers, thereby boosting sales and contributing to China's ambitious electrification targets.

These subsidies can directly reduce the upfront cost of NEVs, making them more competitive against traditional internal combustion engine vehicles. For instance, China's NEV purchase tax exemption, extended through 2027, represents a substantial financial benefit for buyers. This policy, coupled with potential local government rebates and charging infrastructure support, allows manufacturers like Dongfeng to calibrate their pricing strategies effectively.

- Purchase Tax Exemption: China's extension of NEV purchase tax exemption until the end of 2027 directly lowers the acquisition cost for consumers.

- Subsidies and Rebates: While direct central government purchase subsidies have been phased out, local governments may still offer incentives, impacting Dongfeng's pricing flexibility.

- Alignment with National Goals: Dongfeng's pricing of NEVs is strategically aligned with China's 2035 target for new energy vehicles to account for 50% of total auto sales.

- Market Competitiveness: Government support allows Dongfeng to price its NEVs competitively, encouraging wider adoption and market share growth.

Dongfeng Motor Group's pricing strategy is a delicate balance of market realities and strategic positioning, particularly evident in the competitive 2024 landscape. The company utilizes aggressive pricing for mainstream models to capture volume, while premium offerings like VOYAH and MHERO employ value-based pricing, reflecting their advanced technology and luxury. This dual approach is further influenced by government incentives, such as the NEV purchase tax exemption extended to 2027, which significantly impacts the affordability and market competitiveness of their electric vehicles.

| Vehicle Segment | Pricing Strategy | Example/Rationale |

|---|---|---|

| Mainstream Passenger Vehicles | Aggressive/Competitive | To secure market share amidst 2024 price declines. |

| Premium NEVs (VOYAH, MHERO) | Value-Based | Reflects advanced technology, luxury, and performance; e.g., VOYAH Courage priced ~270,000-430,000 yuan in Europe. |

| New Energy Vehicles (Overall) | Incentive-Influenced | Leverages purchase tax exemptions (until 2027) and potential local rebates to enhance affordability and meet electrification targets. |

4P's Marketing Mix Analysis Data Sources

Our Dongfeng Motor Group 4P's Marketing Mix Analysis is built on a foundation of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry analyses and market research reports. This ensures our insights into their product offerings, pricing strategies, distribution networks, and promotional activities are grounded in verifiable data.