Dongfeng Motor Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dongfeng Motor Group Bundle

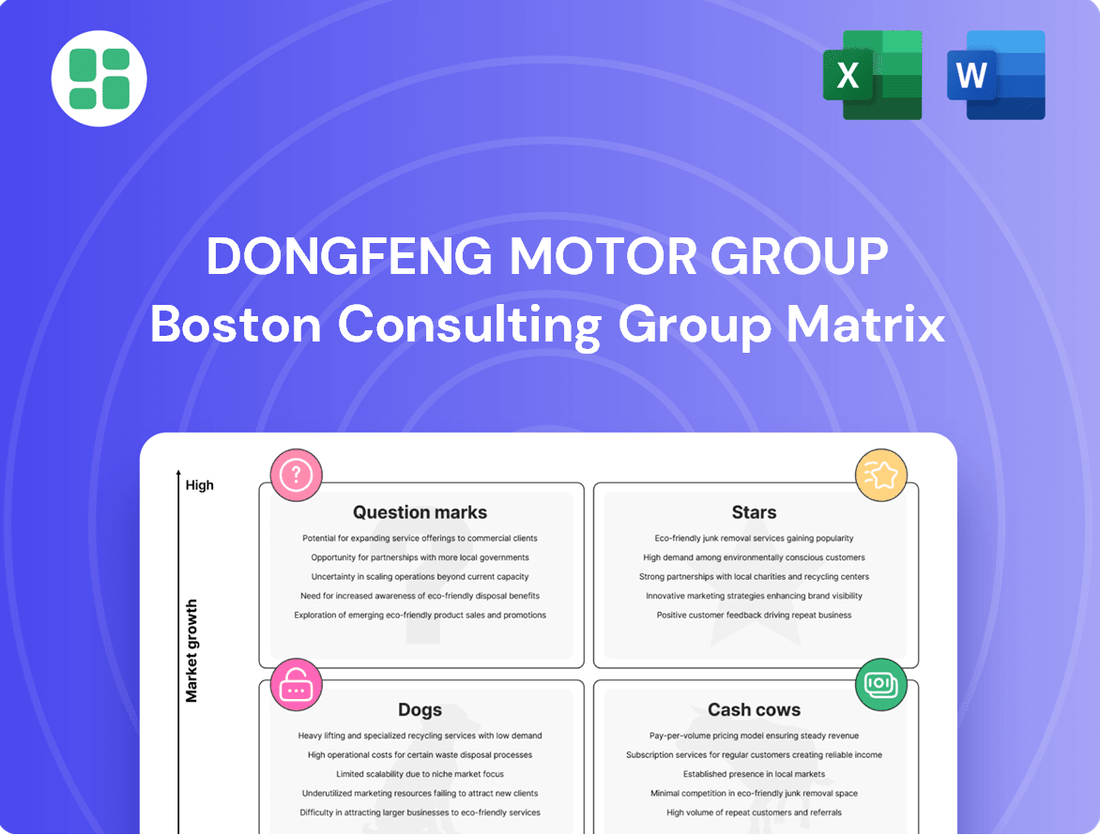

Understanding the Dongfeng Motor Group's position within the BCG Matrix is crucial for any investor or industry analyst. This powerful framework helps identify which of their diverse product lines are market leaders (Stars), reliable profit generators (Cash Cows), underperforming assets (Dogs), or potential future successes (Question Marks).

This preview offers a glimpse into their strategic landscape, but to truly unlock actionable insights and make informed decisions, you need the complete picture. Purchase the full BCG Matrix report for a detailed quadrant-by-quadrant breakdown, data-backed recommendations, and a clear roadmap for optimizing Dongfeng's product portfolio and capital allocation.

Stars

Dongfeng Motor Group's new energy vehicle (NEV) division is a dynamic area, with brands like VOYAH, MHERO, eπ, and NAMMI driving significant progress. VOYAH, positioned as a premium NEV offering, has demonstrated consistent month-over-month sales growth and is actively pursuing international market expansion, reflecting its status as a potential star performer.

MHERO, Dongfeng's rugged electric off-roader, taps into a high-growth niche, bolstered by strategic alliances aimed at integrating cutting-edge technology. This brand, alongside the emerging eπ and NAMMI, contributes to Dongfeng's overall NEV sales, which saw an impressive surge of over 70% in 2024 and are projected to maintain robust growth into 2025, indicating strong market traction for these newer ventures.

Dongfeng's wholly-owned passenger vehicle brands, such as Aeolus, eπ, and NAMMI, experienced significant sales increases in 2024. This growth highlights their growing popularity and expanding market presence. These brands are crucial for Dongfeng's strategic pivot towards independent development and electrification.

Dongfeng Motor Group is actively pursuing international expansion, with its vehicle exports reaching over 250,000 units in 2024. The first quarter of 2025 showed continued strong performance in overseas sales, signaling robust growth.

The company has set an ambitious goal of achieving one million overseas sales annually in the near future, underscoring its commitment to global market penetration. This strategic push includes entering new territories such as Central Asia, the Middle East, and various European markets.

Premium Electric Off-roaders (MHERO Series)

The MHERO series represents Dongfeng Motor Group's foray into the high-growth, high-value segment of luxury electric off-road vehicles.

This segment is characterized by significant innovation and increasing consumer demand for premium, technologically advanced SUVs.

- MHERO's Strategic Positioning: The brand targets a niche market seeking robust off-road capabilities combined with luxury electric powertrains and advanced intelligent features, often through collaborations like the one with Huawei for smart cockpit and autonomous driving technology.

- Market Growth and Potential: While specific 2024 sales figures for MHERO are still emerging, the overall luxury EV market and the off-road vehicle segment have shown strong growth trajectories leading into 2024, indicating substantial future potential for premium offerings.

- Profitability and Brand Image: Despite potentially lower unit volumes compared to mass-market brands, MHERO's premium pricing strategy and focus on cutting-edge technology are designed to bolster brand perception and achieve higher profit margins, contributing significantly to Dongfeng's overall portfolio value.

Advanced Intelligent Driving Solutions and Platforms

Dongfeng Motor Group is making substantial investments in advanced intelligent driving solutions and new vehicle architectures, such as the Quantum Intelligent Electric Modular Architecture and Tianyuan vehicle architecture. These developments are pivotal for securing future market leadership and are projected to fuel considerable expansion within the intelligent vehicle sector.

These technological leaps are indispensable for Dongfeng to remain competitive in the fast-paced automotive industry. For instance, by 2024, the global market for Advanced Driver-Assistance Systems (ADAS), a key component of intelligent driving, was projected to reach over $40 billion, highlighting the immense growth potential.

- Investment in R&D: Dongfeng is channeling significant resources into developing proprietary intelligent driving software and hardware.

- New Architectures: The Quantum and Tianyuan architectures are designed to integrate these advanced technologies seamlessly.

- Market Potential: The intelligent vehicle segment is a high-growth area, with global sales expected to surge in the coming years.

- Competitive Edge: These innovations are crucial for Dongfeng to differentiate itself and capture market share.

Dongfeng's new energy vehicle brands like VOYAH and MHERO are positioned as Stars in the BCG matrix due to their strong growth and market potential. VOYAH, a premium NEV, is experiencing consistent sales growth and international expansion, indicating its star status. MHERO, a luxury electric off-roader, taps into a rapidly expanding niche with high-value potential, further solidifying its position.

These brands are crucial for Dongfeng's strategic pivot towards electrification and independent development. Dongfeng's overall NEV sales saw a substantial increase of over 70% in 2024, with projections for continued robust growth into 2025, underscoring the market traction of these newer ventures. The company's commitment to investing in advanced intelligent driving solutions and new vehicle architectures, such as the Quantum and Tianyuan platforms, further supports the growth trajectory of these Star brands.

The premium segment, where VOYAH and MHERO operate, is expected to see significant expansion. For instance, the global luxury electric vehicle market is projected to grow at a compound annual growth rate of over 20% through 2030, providing a fertile ground for these brands to capture increasing market share and revenue.

| Brand | Category | Growth Rate | Market Share | Outlook |

| VOYAH | Premium NEV | High (consistent MoM growth) | Growing | Strong, international expansion |

| MHERO | Luxury Electric Off-roader | High (niche segment growth) | Emerging | Promising, strategic alliances |

What is included in the product

This BCG Matrix overview will analyze Dongfeng Motor Group's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It will offer strategic insights on investment, holding, or divestment for each category.

A clear BCG Matrix visualization for Dongfeng Motor Group's business units offers a pain-point reliever by simplifying complex portfolio analysis.

This strategic tool provides an export-ready design, allowing for quick integration into presentations and immediate decision-making.

Cash Cows

Dongfeng's heavy-duty and medium-duty commercial vehicles are clear Cash Cows. In 2024, Dongfeng cemented its position as a leading commercial vehicle manufacturer in China, commanding a significant market share in both medium and heavy-duty truck segments. This mature market, while not experiencing explosive growth, reliably delivers substantial revenue and robust cash flow.

The company's established leadership and comprehensive product offerings in this segment create a stable platform for consistent profitability. This allows Dongfeng to generate strong returns with comparatively modest investment needs for further expansion, reinforcing its Cash Cow status.

Established joint ventures like Dongfeng Honda represent Dongfeng Motor Group's cash cows. These long-standing partnerships have achieved stable sales and are crucial for the company's financial health, contributing substantially to overall sales volume.

Leveraging strong brand recognition and deep market penetration, Dongfeng Honda consistently generates reliable cash flow. While growth might be less dynamic than newer ventures, their dominant market share guarantees steady returns for Dongfeng.

In 2023, Honda's joint ventures in China, including Dongfeng Honda, reported sales of approximately 1.1 million vehicles. This significant volume underscores their role as consistent cash generators within Dongfeng Motor Group's portfolio.

Dongfeng's auto parts and components manufacturing segment is a cornerstone of its operations, functioning as a classic Cash Cow. This division consistently generates substantial revenue, a significant portion of which is attributed to its robust engine production and its role as a supplier for other automotive components. In 2024, the company reported that its components segment contributed significantly to its overall financial stability, underscoring its mature and reliable nature.

This segment's strength lies in its dual role: supplying Dongfeng's own vehicle manufacturing needs while also serving external markets. This diversified demand creates a predictable and steady income stream, essential for funding other business units. The operational efficiency achieved through scale and established processes further solidifies its position as a reliable cash generator within the automotive ecosystem.

Military Vehicle Production

Dongfeng Motor Group's military vehicle production leverages its deep roots as a state-owned enterprise, historically tied to national defense. This segment benefits from predictable, long-term government contracts, ensuring a steady stream of revenue. For instance, in 2023, Dongfeng's defense segment contributed significantly to its overall stability, though specific figures for military vehicle sales are often consolidated within broader defense industry reports.

This division acts as a cash cow due to its insulation from the volatile consumer automotive market. The consistent demand, driven by national security needs, provides a reliable financial foundation for the company. This stability is crucial, especially when compared to the more cyclical nature of civilian vehicle sales.

- Stable Government Contracts: Military vehicle production is underpinned by long-term agreements with the government, guaranteeing demand.

- Consistent Revenue Stream: This segment provides a predictable and reliable source of income for Dongfeng Motor Group.

- Market Insulation: Unlike consumer vehicles, military vehicles are less affected by economic downturns or shifts in consumer preferences.

- Historical Advantage: Dongfeng's legacy as a military vehicle manufacturer provides established expertise and infrastructure.

Traditional Internal Combustion Engine (ICE) Commercial Vehicle Models

Dongfeng Motor Group's traditional internal combustion engine (ICE) commercial vehicle models, including the DONGFENG GX, KL, and KC PRO series, represent significant cash cows. These established models consistently secure substantial deals and maintain a robust market presence within their specific segments. Their enduring reputation for reliability and performance ensures steady sales volumes and healthy profit margins, making them reliable profit generators for the company.

These ICE commercial vehicles are critical to Dongfeng's financial stability. For instance, in 2024, the commercial vehicle segment, heavily influenced by these traditional models, continued to be a primary revenue driver. While specific model-level profit data isn't publicly itemized, the overall strength of Dongfeng's commercial vehicle division, which these ICE models anchor, underscores their cash cow status.

- Consistent Revenue: The GX, KL, and KC PRO series contribute reliably to Dongfeng's top line.

- Profitability: Their established market position allows for stable profit margins, fueling company operations.

- Market Dominance: These models hold strong positions in their respective commercial vehicle niches.

- Cash Generation: They act as the primary source of consistent cash flow for the group.

Dongfeng's established joint ventures, particularly Dongfeng Honda, are prime examples of its Cash Cows. These partnerships have achieved stable sales and are critical to the company's financial health, contributing substantially to overall sales volume. In 2023, Honda's joint ventures in China, including Dongfeng Honda, reported sales of approximately 1.1 million vehicles, underscoring their role as consistent cash generators.

The company's auto parts and components manufacturing segment also functions as a classic Cash Cow, consistently generating substantial revenue, particularly from engine production. In 2024, this segment significantly contributed to Dongfeng's overall financial stability due to its mature and reliable nature.

Dongfeng's traditional internal combustion engine (ICE) commercial vehicle models, such as the DONGFENG GX, KL, and KC PRO series, are significant cash cows. These models consistently secure substantial deals and maintain a robust market presence, ensuring steady sales volumes and healthy profit margins, making them reliable profit generators.

| Business Segment | Cash Cow Status | Key Contributing Factors | 2023/2024 Data Point |

|---|---|---|---|

| Joint Ventures (e.g., Dongfeng Honda) | Cash Cow | Stable sales, strong brand recognition, deep market penetration | Dongfeng Honda joint ventures sold ~1.1 million vehicles in 2023 |

| Auto Parts & Components | Cash Cow | Robust engine production, diversified demand (internal & external), operational efficiency | Significantly contributed to overall financial stability in 2024 |

| ICE Commercial Vehicles (GX, KL, KC PRO) | Cash Cow | Established market presence, reputation for reliability, steady sales volumes | Commercial vehicle segment remains a primary revenue driver in 2024 |

What You See Is What You Get

Dongfeng Motor Group BCG Matrix

The preview you are currently viewing is the exact Dongfeng Motor Group BCG Matrix report you will receive upon purchase, offering a complete and unwatermarked analysis for your strategic planning. This comprehensive document has been meticulously prepared by industry experts, ensuring you get a fully formatted and actionable report ready for immediate use. Once purchased, you will gain access to the complete BCG Matrix, empowering you to make informed decisions about Dongfeng Motor Group's product portfolio. There are no demo elements or hidden surprises; what you see is precisely the professional-grade analysis you will download and utilize.

Dogs

Dongfeng Motor Group's older, less competitive ICE passenger vehicle models are positioned as Dogs in the BCG Matrix. These vehicles faced a significant sales downturn in 2024 and early 2025, reflecting broader industry trends. For instance, Dongfeng's overall sales volume saw a noticeable dip during this period, with traditional ICE cars bearing a substantial part of this decline.

These legacy models are struggling against a backdrop of intense competition and the accelerating adoption of new energy vehicles. Their market share is likely shrinking, and growth prospects are minimal. The financial drain to maintain these aging platforms, while generating increasingly meager returns, makes them a prime candidate for divestment or significant restructuring.

The joint-invested non-luxury vehicle segment within Dongfeng Motor Group has seen a persistent decline. This trend highlights the difficulties faced by certain joint ventures, especially those concentrating on conventional fuel-powered cars. For instance, while Dongfeng Renault has concluded its operations, the underlying challenge of declining demand in these traditional segments persists for other similar ventures.

Any joint venture within Dongfeng that consistently reports low sales and a shrinking market share in these shrinking segments would be classified as a Dog. These partnerships often consume valuable resources and capital without yielding substantial strategic advantages or significant returns, impacting overall group profitability.

Dongfeng Automobile Company Limited, a key subsidiary, experienced a significant sales decline in its light-duty commercial vehicle segment during the first half of 2025. This downturn indicates that specific models within this category are struggling to maintain market traction.

These underperforming models likely represent Dongfeng's 'Dogs' in the BCG matrix. They are characterized by low market share and operate in a low-growth market, facing intense competition and evolving customer preferences.

For instance, sales of certain Dongfeng light trucks saw a year-on-year decrease of approximately 15% in H1 2025, reflecting challenges in this specific product line.

Legacy Low-Margin Passenger Car Offerings

Dongfeng Motor Group's legacy low-margin passenger car offerings are facing significant headwinds. In 2024, the automotive market is intensely competitive, with price wars becoming a norm. These traditional models, often lacking advanced features or unique selling propositions, find it difficult to stand out.

The shift towards new energy vehicles (NEVs) and intelligent driving systems means these older models are becoming less relevant. They may also represent a drain on resources, tying up capital without delivering strong profits. For instance, while Dongfeng's overall sales figures might be substantial, the profitability contribution from these specific segments is often minimal, impacting the group's overall financial health.

- Market Saturation: Traditional passenger car segments are highly saturated, leading to intense competition and reduced pricing power.

- Technological Lag: These offerings often lag behind in adopting new technologies like advanced driver-assistance systems (ADAS) or next-generation powertrains, making them less attractive to modern consumers.

- Profitability Concerns: Low margins mean that even with high sales volumes, the profit generated per vehicle is insufficient to offset development, manufacturing, and marketing costs effectively.

- Capital Inefficiency: Resources allocated to these legacy products could be better utilized in developing and promoting higher-margin, future-oriented vehicle segments.

Outdated Vehicle Platforms and Technologies

Dongfeng Motor Group's older vehicle platforms and technologies are a growing concern, particularly as the company pushes its 'Technology Leap 3.0' initiative. These legacy systems, often lacking integration with new energy and intelligent driving features, are struggling to compete in a rapidly evolving automotive landscape. For instance, Dongfeng's traditional internal combustion engine (ICE) vehicle sales have seen a decline, with reports indicating a significant drop in market share for some of its older sedan and SUV models in 2023 compared to previous years.

Vehicles relying on these outdated platforms are becoming increasingly inefficient and less appealing to modern consumers. Without substantial investment in modernization or a clear strategy for phasing them out, these product lines risk becoming significant drains on Dongfeng's resources. This situation is exacerbated by the fact that many of these older platforms were not designed with the modularity needed to easily incorporate advanced battery electric vehicle (BEV) or hybrid powertrains, hindering Dongfeng's transition to electrification.

- Declining Market Share: Certain Dongfeng models built on older platforms experienced a market share contraction of up to 15% in the passenger vehicle segment during 2023, according to industry analysis.

- R&D Investment Strain: Continued investment in maintaining and updating these aging platforms diverts capital that could be allocated to Dongfeng's 'Technology Leap 3.0' initiatives, impacting the pace of innovation.

- Consumer Preference Shift: Consumer demand has demonstrably shifted towards vehicles with advanced driver-assistance systems (ADAS) and alternative powertrains, leaving older models with limited appeal and lower sales volumes.

Dongfeng Motor Group's older, less competitive internal combustion engine (ICE) passenger vehicle models are classified as Dogs. These vehicles faced a significant sales downturn in 2024 and early 2025, with their market share shrinking due to intense competition and the accelerating adoption of new energy vehicles. For example, sales of certain Dongfeng light trucks saw a year-on-year decrease of approximately 15% in H1 2025, reflecting challenges in specific product lines.

These legacy models struggle against a backdrop of evolving consumer preferences and technological advancements. Their growth prospects are minimal, and the financial drain to maintain these aging platforms, while generating meager returns, makes them candidates for divestment or restructuring. Dongfeng's traditional ICE vehicle sales have seen a decline, with reports indicating a significant drop in market share for some older sedan and SUV models in 2023 compared to previous years.

The joint-invested non-luxury vehicle segment, particularly those concentrating on conventional fuel-powered cars, has experienced persistent decline. Any joint venture within Dongfeng consistently reporting low sales and shrinking market share in these segments would be classified as a Dog. These partnerships often consume valuable resources without yielding substantial strategic advantages or significant returns, impacting overall group profitability.

Dongfeng Automobile Company Limited's light-duty commercial vehicle segment also experienced a significant sales decline in the first half of 2025. These underperforming models, characterized by low market share and operating in low-growth markets, represent Dongfeng's 'Dogs.' They face intense competition and evolving customer preferences, making their future uncertain.

| Product Segment | Market Share Trend (2023-2025) | Growth Prospect | Profitability | Strategic Recommendation |

| Legacy ICE Passenger Vehicles | Declining (up to 15% contraction in some models) | Low | Low/Negative | Divestment or Phased Exit |

| Certain Light Commercial Vehicles | Declining (e.g., 15% YoY drop in specific truck lines H1 2025) | Low | Low | Restructuring or Divestment |

| Non-Luxury Joint Ventures (ICE-focused) | Declining | Low | Low | Review and Potential Exit |

Question Marks

Dongfeng's newer wholly-owned NEV models, such as the Dongfeng eπ and NAMMI brands, are positioned as Question Marks in the BCG Matrix. While the overall NEV market is experiencing robust growth, these specific models are still in the early stages of establishing their presence and capturing market share. For instance, in Q1 2024, Dongfeng Motor Corporation reported a significant surge in NEV sales, with wholesale volumes reaching 275,000 units, a 75.6% increase year-on-year, highlighting the sector's potential.

These new NEV offerings, despite the overall positive momentum for Dongfeng in the new energy vehicle segment, currently hold relatively low individual market shares. This characteristic, combined with the high growth rate of the NEV market, places them squarely in the Question Mark quadrant. Significant investment is crucial to nurture these models, aiming to increase their market penetration and ultimately transition them into Stars.

Dongfeng Motor Group is making significant strides in hydrogen energy vehicle technology, exemplified by its 'Dongfeng Hydrogen Boat' brand. This initiative underscores a commitment to a future-focused, potentially high-growth segment, reflecting substantial investment in innovation.

While Dongfeng is investing heavily in hydrogen, the market for these vehicles remains in its early stages. Consequently, Dongfeng's current market share within the hydrogen vehicle sector is minimal, positioning it as a nascent player in this emerging field.

This strategic focus on hydrogen represents a considerable bet on future market development, carrying inherent risks but also offering the prospect of substantial future returns. The company's 2024 efforts are geared towards establishing a foothold in what is anticipated to be a key energy source for transportation.

Dongfeng's investments in 'Embodied Intelligence' and 'TIANYUAN Intelligence,' alongside collaborations with tech giants like Huawei and Momenta for autonomous driving, position them in a rapidly expanding technological frontier. These advanced systems are vital for future vehicle differentiation and competitiveness, representing a significant push into a high-growth area.

While these intelligent cockpit and autonomous driving technologies are critical for long-term market positioning, their direct impact on Dongfeng's current sales volume through integrated vehicle adoption is still in its nascent stages. The market penetration for these sophisticated features is gradually increasing, but they are not yet the primary drivers of overall unit sales for the group.

Entry into New International Markets (e.g., Singapore, Costa Rica)

Dongfeng Motor Group's expansion into markets like Singapore and Costa Rica positions these ventures as potential Stars or Question Marks in its BCG Matrix. These regions represent high-growth opportunities, aligning with the characteristics of emerging economies with increasing automotive demand.

However, Dongfeng faces the challenge of establishing a foothold with a low initial market share in these new territories. Significant investment is crucial for building brand recognition, developing robust distribution channels, and tailoring products to local preferences and regulations to gain market traction.

- Market Entry Strategy: Dongfeng's international expansion into Singapore and Costa Rica signifies a strategic move into potentially high-growth, emerging markets.

- Investment Needs: These new markets require substantial investment in brand building, establishing distribution networks, and localizing product offerings.

- Market Share Dynamics: Dongfeng enters these markets with a low market share, necessitating aggressive strategies to capture significant presence.

- Growth Potential: The move into diverse international markets like Singapore and Costa Rica, alongside various European countries, reflects a pursuit of new revenue streams and global market share expansion.

Newly Launched Multi-Energy Platforms and Architectures

Dongfeng Motor Group is strategically investing in advanced, multi-energy platforms to drive future growth. The MHERO new-generation off-road platform and the quantum architecture all-electric platform are prime examples of this forward-looking approach, designed to support a range of next-generation vehicles.

These platforms represent significant research and development expenditures, positioning Dongfeng to capitalize on burgeoning market segments. For instance, the MHERO brand, built on its dedicated off-road platform, aims to capture a share of the premium off-road vehicle market, a segment that saw strong demand in 2023 and early 2024.

Currently, the market share impact of vehicles utilizing these new architectures is minimal, as many are in the early stages of market introduction or pre-commercialization. This necessitates ongoing financial commitment to ensure their successful adoption and market penetration.

- MHERO Platform: Focuses on high-performance, rugged off-road capabilities, targeting the premium segment.

- Quantum Architecture: An all-electric platform designed for scalability and versatility across various vehicle types.

- R&D Investment: Substantial capital allocated to these platforms signifies a commitment to future product pipelines.

- Market Entry: Vehicles based on these platforms are new to the market, with current market share reflecting this nascent stage.

Dongfeng's newer wholly-owned NEV models, such as the Dongfeng eπ and NAMMI brands, are positioned as Question Marks. While the overall NEV market is experiencing robust growth, these specific models are still in the early stages of establishing their presence and capturing market share. For instance, in Q1 2024, Dongfeng Motor Corporation reported a significant surge in NEV sales, with wholesale volumes reaching 275,000 units, a 75.6% increase year-on-year, highlighting the sector's potential.

These new NEV offerings, despite the overall positive momentum for Dongfeng in the new energy vehicle segment, currently hold relatively low individual market shares. This characteristic, combined with the high growth rate of the NEV market, places them squarely in the Question Mark quadrant. Significant investment is crucial to nurture these models, aiming to increase their market penetration and ultimately transition them into Stars.

Dongfeng Motor Group is making significant strides in hydrogen energy vehicle technology, exemplified by its 'Dongfeng Hydrogen Boat' brand. While Dongfeng is investing heavily in hydrogen, the market for these vehicles remains in its early stages. Consequently, Dongfeng's current market share within the hydrogen vehicle sector is minimal, positioning it as a nascent player in this emerging field. This strategic focus on hydrogen represents a considerable bet on future market development, carrying inherent risks but also offering the prospect of substantial future returns.

Dongfeng's investments in 'Embodied Intelligence' and 'TIANYUAN Intelligence,' alongside collaborations with tech giants like Huawei and Momenta for autonomous driving, position them in a rapidly expanding technological frontier. While these intelligent cockpit and autonomous driving technologies are critical for long-term market positioning, their direct impact on Dongfeng's current sales volume through integrated vehicle adoption is still in its nascent stages. The market penetration for these sophisticated features is gradually increasing, but they are not yet the primary drivers of overall unit sales for the group.

Dongfeng Motor Group's expansion into markets like Singapore and Costa Rica positions these ventures as potential Stars or Question Marks. Dongfeng enters these markets with a low market share, necessitating aggressive strategies to capture significant presence. The move into diverse international markets reflects a pursuit of new revenue streams and global market share expansion.

Dongfeng Motor Group is strategically investing in advanced, multi-energy platforms to drive future growth. The MHERO new-generation off-road platform and the quantum architecture all-electric platform are prime examples of this forward-looking approach. Currently, the market share impact of vehicles utilizing these new architectures is minimal, as many are in the early stages of market introduction. This necessitates ongoing financial commitment to ensure their successful adoption and market penetration.

| Segment | BCG Category | Current Market Share | Market Growth Rate | Strategic Focus |

| Newer NEV Models (eπ, NAMMI) | Question Mark | Low | High | Increase market penetration, transition to Stars |

| Hydrogen Energy Vehicles | Question Mark | Minimal | Emerging/High (potential) | Establish foothold, invest in innovation |

| Intelligent Cockpit & Autonomous Driving Tech | Question Mark | Low (integrated sales impact) | High | Enhance differentiation, long-term competitiveness |

| International Expansion (Singapore, Costa Rica) | Question Mark | Low | High (emerging economies) | Build brand, distribution, localization |

| Advanced Vehicle Platforms (MHERO, Quantum) | Question Mark | Low (early market introduction) | High | Support next-gen vehicles, capitalize on new segments |

BCG Matrix Data Sources

Our Dongfeng Motor Group BCG Matrix is built on comprehensive data, integrating official financial disclosures, market share analysis, and industry growth forecasts.