Dongfeng Motor Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dongfeng Motor Group Bundle

Dongfeng Motor Group faces significant competitive pressures, with intense rivalry among established players and the looming threat of new entrants impacting market share. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this dynamic automotive landscape.

The complete report reveals the real forces shaping Dongfeng Motor Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The automotive sector, including giants like Dongfeng Motor Group, is increasingly dependent on highly specialized components. Think about things like the semiconductors that power modern vehicle electronics, the advanced battery cells crucial for New Energy Vehicles (NEVs), and intricate electronic control units. These aren't items you can just pick up anywhere.

Many of these critical parts come from a select group of global manufacturers. This limited supply base means these suppliers hold considerable bargaining power. For instance, the global semiconductor shortage experienced in recent years significantly impacted automotive production worldwide, forcing many automakers to reduce output and pay premium prices for available chips.

This dependence on a few specialized suppliers can translate directly into higher costs for Dongfeng. If a key component becomes scarce, suppliers can dictate higher prices, and there's a real risk of supply chain disruptions that could halt production lines. In 2023, the average cost of raw materials for electric vehicle batteries, a key component for NEVs, saw significant fluctuations, directly affecting vehicle manufacturers' margins.

Suppliers of key raw materials, especially for electric vehicle (EV) batteries like lithium, cobalt, and nickel, hold significant bargaining power. For instance, lithium prices saw substantial volatility in 2023, with carbonate prices in China fluctuating by over 50% throughout the year, directly impacting production costs.

These volatile commodity prices directly translate into unpredictable production expenses for Dongfeng Motor Group. This reliance on global market swings makes precise cost forecasting and maintaining cost control a persistent challenge for the company.

Suppliers leading in automotive technology, like those for advanced driver-assistance systems (ADAS) or new battery tech, wield significant power. For instance, in 2024, companies specializing in high-density EV batteries saw their order books swell, giving them leverage in pricing negotiations with major automakers like Dongfeng.

Dongfeng Motor Group's dependence on these innovators for competitive edge means switching suppliers can be costly and disruptive, potentially impacting product development timelines and market competitiveness. This reliance can translate into higher component costs or the need for long-term, restrictive supply agreements.

Global Supply Chain Dynamics

Dongfeng Motor Group's numerous joint ventures, including those with Nissan and Honda, embed it deeply within intricate global supply chains. This global integration grants access to a wide array of components but simultaneously exposes the company to vulnerabilities such as supply chain disruptions and geopolitical instability, impacting its operational efficiency and cost structure.

Suppliers with a global footprint often wield significant bargaining power. Their ability to serve multiple markets and their established international networks mean they can dictate terms more effectively, potentially increasing costs for automakers like Dongfeng. For instance, a shortage of critical semiconductor components in 2024, driven by global demand and production issues, demonstrated the leverage such suppliers can exert.

- Global Sourcing Risks: Dongfeng's reliance on international suppliers for advanced technologies and specialized parts means it's susceptible to price hikes and availability issues driven by global market conditions.

- Supplier Concentration: In certain component categories, a limited number of global suppliers may dominate the market, granting them enhanced bargaining power over Dongfeng.

- Logistical Costs: The complexity of managing a global supply chain introduces significant logistical costs and potential delays, which can be influenced by supplier efficiency and global shipping dynamics.

Supplier Concentration and Scale

Supplier concentration significantly impacts Dongfeng Motor Group's bargaining power. In certain automotive component sectors, a few major manufacturers hold substantial market share, giving them considerable leverage. For instance, specialized electronic components or advanced powertrain systems might be sourced from a limited number of global suppliers who benefit from significant economies of scale.

These large-scale suppliers often dictate terms, making it challenging for individual automakers like Dongfeng to negotiate aggressively on price or delivery schedules. If Dongfeng represents a small fraction of a dominant supplier's total sales, the supplier has less incentive to accommodate Dongfeng's specific demands, potentially limiting Dongfeng's flexibility in sourcing and cost management.

- Supplier Concentration: Key automotive component markets, such as advanced driver-assistance systems (ADAS) or high-performance battery cells, often feature a limited number of dominant global suppliers.

- Economies of Scale: Major suppliers leverage their large production volumes to achieve lower per-unit costs, strengthening their negotiating position against individual buyers.

- Negotiating Leverage: Dongfeng's bargaining power diminishes if it is not a primary customer for a concentrated supplier, potentially leading to less favorable pricing and supply terms.

The bargaining power of suppliers for Dongfeng Motor Group is significant, particularly for specialized components like semiconductors and advanced battery cells. In 2024, the automotive industry continued to grapple with supply chain constraints for critical electronic components, leading to increased negotiation leverage for chip manufacturers.

Suppliers of raw materials for electric vehicle batteries, such as lithium and cobalt, also hold substantial power due to market volatility. For instance, the price of battery-grade lithium carbonate in China experienced considerable fluctuations throughout 2023, impacting production costs for automakers.

Furthermore, suppliers leading in automotive technology, like those providing advanced driver-assistance systems (ADAS), benefit from high demand and limited competition. This concentration of expertise allows them to command premium pricing and favorable terms from manufacturers like Dongfeng.

| Supplier Type | Key Components | Impact on Dongfeng | 2023/2024 Data Point |

| Semiconductor Manufacturers | ECUs, infotainment systems | Price increases, potential production delays | Global semiconductor shortages persisted in 2024, affecting automotive output. |

| Battery Material Suppliers | Lithium, cobalt, nickel | Volatile raw material costs, impacting EV pricing | Lithium carbonate prices in China fluctuated by over 50% in 2023. |

| Advanced Technology Providers | ADAS, AI software | Higher component costs, reliance on innovation | Companies specializing in high-density EV batteries saw increased order books in 2024. |

What is included in the product

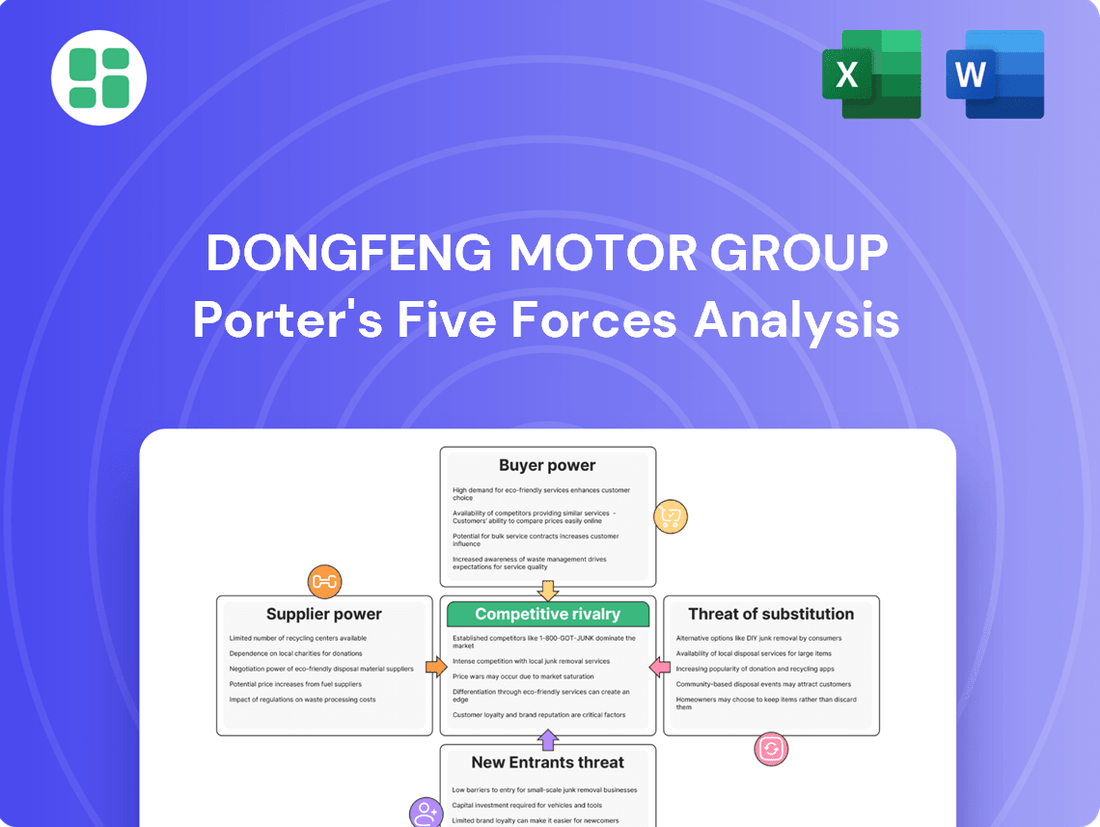

This analysis of Dongfeng Motor Group's Porter's Five Forces examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products on its automotive market position.

A dynamic dashboard visualizing Dongfeng Motor Group's Porter's Five Forces, allowing for rapid identification and mitigation of competitive threats.

Customers Bargaining Power

The bargaining power of customers for Dongfeng Motor Group is significantly amplified by the highly competitive landscape of the Chinese automotive market. With a multitude of domestic and international brands, consumers have an abundance of choices across all vehicle segments and price ranges.

This market saturation means customers can easily switch to competitors if Dongfeng fails to meet their expectations regarding price, quality, or features. In 2024, China's passenger vehicle sales reached approximately 26 million units, highlighting the sheer volume of options available to consumers and the pressure on manufacturers like Dongfeng to remain attractive.

To counter this, Dongfeng must consistently deliver compelling value propositions, including competitive pricing strategies and innovative product development. For instance, offering advanced driver-assistance systems or improved fuel efficiency can be key differentiators in attracting and retaining buyers in this dynamic environment.

Price sensitivity is a major factor for Dongfeng, especially in the mass-market segments of the Chinese auto industry. Many consumers are actively comparing not just sticker prices but also the overall value proposition, including features, build quality, and post-purchase support. This dynamic directly impacts Dongfeng's ability to maintain healthy profit margins, as they must constantly strive for cost-efficiency while delivering perceived value.

Customers today have unprecedented access to information, significantly boosting their bargaining power. Online platforms, vehicle comparison sites, and social media buzz allow buyers to thoroughly research specifications, performance, reliability, and ownership costs. For instance, in 2024, a significant majority of car buyers reported using online resources extensively during their research phase, with many citing reviews and expert comparisons as key decision-influencers.

This widespread transparency compels manufacturers like Dongfeng Motor Group to uphold stringent quality and service standards. Negative reviews or poor customer experiences can rapidly damage brand reputation and deter potential buyers, forcing Dongfeng to be more responsive to customer demands and concerns to maintain market share.

Rapid Innovation and Consumer Expectations

The automotive industry, especially in 2024, is characterized by relentless technological progress, particularly in New Energy Vehicles (NEVs) and advanced driver-assistance systems. This rapid innovation directly fuels escalating consumer expectations. Customers now anticipate cutting-edge connectivity, sophisticated infotainment, enhanced safety features, and efficient, sustainable powertrains as standard offerings.

Dongfeng Motor Group, like its competitors, faces pressure to constantly update its product portfolio to align with these evolving demands. Consumers are increasingly brand-agnostic when it comes to technological superiority, readily switching to manufacturers that offer a more compelling user experience or demonstrably better features. For instance, in 2023, the global NEV market saw significant growth, with China leading the charge, indicating a strong consumer preference for these advanced technologies.

- Elevated Expectations: Consumers in 2024 expect seamless integration of smart technology and advanced safety features in their vehicles.

- NEV Dominance: The rapid growth of the New Energy Vehicle market means customers prioritize sustainable and technologically advanced powertrains.

- Brand Loyalty Shift: A willingness to switch brands for superior technology means Dongfeng must innovate to retain and attract customers.

- Competitive Landscape: Competitors are also heavily investing in R&D for NEVs and smart features, intensifying the pressure on Dongfeng.

Influence of Government Policies and Incentives

Government policies and incentives, especially those encouraging new energy vehicles (NEVs) or specific vehicle types, profoundly shape customer choices in China. For instance, in 2023, China continued its commitment to NEV adoption, with policies like purchase tax exemptions playing a crucial role. These incentives, alongside preferential licensing, can steer consumer demand towards particular vehicle segments or brands, directly impacting sales volumes.

Dongfeng Motor Group's performance is susceptible to these policy shifts. When customers can access greater financial advantages through government support, their bargaining power grows as they can more readily opt for vehicles that offer these benefits. This dynamic means Dongfeng must remain agile, aligning its product offerings and marketing strategies with evolving government directives to maintain its market position.

- NEV Sales Growth: China's NEV sales in 2023 surpassed 9 million units, a significant increase from previous years, driven by supportive government policies.

- Policy Impact on Demand: Purchase tax exemptions alone saved Chinese consumers billions of yuan in 2023, directly influencing their willingness to buy NEVs.

- Competitive Landscape: Government incentives can level the playing field or create advantages for manufacturers who can best leverage these policies, thereby influencing customer preferences.

The bargaining power of customers for Dongfeng Motor Group is substantial due to the intense competition and abundant choices in the Chinese automotive market. In 2024, with passenger vehicle sales around 26 million units, consumers have significant leverage to switch brands if Dongfeng doesn't meet expectations on price, quality, or features.

Customers are highly informed, utilizing online resources extensively in 2024 to compare vehicles, influencing their purchasing decisions and pressuring Dongfeng to maintain high standards. This transparency means negative reviews can quickly impact brand reputation, forcing Dongfeng to be more responsive to customer demands.

Rapid technological advancements, particularly in New Energy Vehicles (NEVs), have elevated consumer expectations for smart features and advanced powertrains. Dongfeng must continuously innovate to keep pace, as customers are increasingly willing to switch brands for superior technology, a trend highlighted by China's leading role in the global NEV market in 2023.

Government policies, such as NEV purchase tax exemptions, significantly influence customer choices and enhance their bargaining power by reducing costs. Dongfeng must align its product strategy with these directives, as seen with China's continued commitment to NEV adoption, which saw NEV sales surpass 9 million units in 2023.

Preview the Actual Deliverable

Dongfeng Motor Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Dongfeng Motor Group, offering a detailed examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing you with a thorough strategic overview.

Rivalry Among Competitors

Dongfeng Motor Group navigates a highly competitive automotive market, facing intense rivalry from both domestic giants like BYD, Geely, and SAIC, as well as significant international players such as Volkswagen and Toyota, many of whom operate through joint ventures within China. This crowded field necessitates constant innovation and aggressive strategies to capture market share.

In 2024, the Chinese auto market continued to see fierce competition, with brands vying for dominance through new model launches and price adjustments. For instance, sales figures for leading domestic brands often show year-over-year growth in the double digits, indicating the pressure on all manufacturers to perform.

Companies are heavily investing in research and development, particularly in areas like electric vehicles and advanced driver-assistance systems, to differentiate themselves. This arms race in technology and product development is a direct result of the pressure from numerous competitors, both local and global, vying for the same customer base.

The Chinese New Energy Vehicle (NEV) market is experiencing explosive growth, fueling intense competition. Dongfeng faces rivals not only from established automakers but also from agile EV startups like Nio and Xpeng, and even tech giants venturing into auto manufacturing. This dynamic landscape demands constant innovation in battery technology, autonomous driving, and connected car features.

The automotive industry, including Dongfeng Motor Group, is characterized by intense competitive rivalry fueled by a relentless pursuit of product differentiation. Automakers are constantly vying for consumer attention through advancements in vehicle design, cutting-edge technology, enhanced performance, and innovative features. This dynamic environment necessitates significant and ongoing investment in research and development to stay ahead.

In 2024, the race for differentiation is particularly evident in areas like electric vehicle (EV) technology, autonomous driving capabilities, and advanced in-car connectivity. Companies are pouring billions into these sectors; for instance, global automotive R&D spending was projected to exceed $200 billion in 2024, with a substantial portion dedicated to electrification and software-defined vehicles. Dongfeng must actively participate in this innovation pipeline to maintain its market position and appeal to evolving consumer preferences.

Aggressive Pricing Strategies and Promotions

The Chinese automotive market, particularly for passenger vehicles, is intensely competitive, often triggering price wars. Manufacturers frequently employ aggressive pricing, discounts, and promotional campaigns to boost sales and manage inventory levels, especially when facing oversupply or economic downturns. For instance, in 2023, the average transaction price in China saw a slight decline due to these competitive pressures.

These widespread aggressive pricing strategies directly impact Dongfeng Motor Group's profitability. Maintaining competitive pricing while ensuring healthy profit margins necessitates stringent cost control and operational efficiency. Dongfeng's ability to navigate these price pressures is crucial for its market share and financial performance.

- Intensified Competition: The automotive sector in China is characterized by a high number of domestic and international players, leading to frequent price adjustments.

- Promotional Activities: Discounts, limited-time offers, and bundled services are common tactics used by competitors to attract customers.

- Margin Pressure: Aggressive pricing directly squeezes profit margins for all manufacturers, including Dongfeng, requiring a strong focus on cost optimization.

Extensive Distribution and Service Networks

Dongfeng Motor Group’s competitive rivalry is significantly shaped by its extensive distribution and service networks. Beyond the vehicles themselves, competition hinges on the sheer breadth and quality of sales, distribution, and after-sales support. This means having a strong presence of dealerships, ensuring top-notch service experiences, and fostering positive customer interactions are key differentiators.

Dongfeng’s capacity to offer comprehensive support and maintain customer satisfaction through its widespread network is absolutely vital for its long-term competitive standing and for building lasting brand loyalty. For instance, as of late 2023, Dongfeng Motor Corporation maintained over 3,000 sales and service outlets across China, a testament to its commitment to reach and customer care.

- Extensive Dealership Footprint: Dongfeng’s vast network of dealerships ensures product availability and accessibility across diverse geographical regions in China.

- Service Quality and Customer Experience: The group’s focus on high-quality after-sales service and a positive customer journey fosters brand loyalty and repeat business.

- Competitive Advantage: A robust distribution and service infrastructure provides a significant competitive edge against rivals, particularly in a market as large and varied as China.

The competitive rivalry within the Chinese automotive market is exceptionally fierce, impacting Dongfeng Motor Group significantly. This intense competition is driven by a large number of domestic and international manufacturers, leading to frequent price adjustments and aggressive promotional activities. For example, in 2023, the average transaction price for passenger vehicles in China saw a slight decrease due to these market dynamics.

This aggressive pricing strategy puts considerable pressure on profit margins for all players, including Dongfeng. To counter this, companies must focus on stringent cost control and operational efficiency. Dongfeng’s extensive network of over 3,000 sales and service outlets across China, as of late 2023, provides a crucial advantage in ensuring product accessibility and fostering customer loyalty through quality after-sales support.

| Key Competitor Actions | Impact on Dongfeng | 2024 Market Trend |

| Aggressive pricing and discounts | Margin pressure, need for cost control | Continued price adjustments, potential for price wars |

| New model launches and technological innovation (EVs, ADAS) | Necessity for R&D investment, product differentiation | Accelerated pace of innovation, focus on NEVs and smart features |

| Expansion of distribution and service networks | Need to maintain and enhance customer experience | Emphasis on customer service and brand loyalty |

SSubstitutes Threaten

The ongoing expansion of public transportation in China presents a significant threat of substitutes for Dongfeng Motor Group. As of 2024, major cities like Shanghai and Beijing have continued to invest heavily in subway and bus networks, making them increasingly viable alternatives for daily commutes. For instance, Beijing's subway system alone transported over 3.7 billion passengers in 2023, highlighting its extensive reach and utility.

This enhanced public transit infrastructure directly competes with private car ownership, particularly for urban dwellers. The convenience, affordability, and reduced environmental impact of public transport can dissuade consumers from purchasing vehicles, especially in the entry-level and compact car segments where Dongfeng is a strong player. This shift in consumer preference can lead to a noticeable dampening of demand for Dongfeng's smaller models.

The rise of ride-sharing services like Didi Chuxing and Meituan Mobility presents a significant threat of substitutes for traditional car ownership, directly impacting Dongfeng Motor Group. These platforms offer convenient, on-demand transportation, negating the need for personal vehicle ownership, maintenance, insurance, and parking costs for many consumers.

For individuals who only require occasional vehicle use, ride-sharing becomes a compelling alternative. This growing preference for mobility-as-a-service (MaaS) can lead to a decrease in new vehicle sales, as consumers opt for flexible, pay-as-you-go transportation solutions.

In 2024, ride-sharing services continued to capture market share, particularly in urban areas. For instance, Didi Chuxing reported a substantial increase in active users in major Chinese cities, indicating a sustained shift away from private car ownership for daily commutes and leisure travel.

The growing popularity of micromobility solutions like electric bikes and scooters presents a significant threat of substitutes for Dongfeng Motor Group. These options provide an affordable and eco-friendly alternative for short urban trips, potentially reducing demand for smaller Dongfeng vehicles. For instance, by 2024, the global micromobility market is projected to reach hundreds of billions of dollars, indicating a substantial shift in consumer preferences for short-distance transportation.

Changing Urban Lifestyles and Preferences

A significant shift in urban lifestyles presents a growing threat of substitutes for traditional car ownership, impacting companies like Dongfeng Motor Group. Younger urban dwellers, in particular, are increasingly valuing convenience, sustainability, and access to mobility solutions over the outright ownership of a personal vehicle. This trend suggests a potential decline in demand for new cars as primary transportation.

This evolving consumer preference means that alternatives like enhanced public transportation networks, readily available ride-sharing services, and the proliferation of micromobility options such as e-scooters and shared bicycles are becoming more attractive. For instance, in many major global cities, the usage of ride-sharing services saw substantial growth in 2024, with some platforms reporting double-digit percentage increases in active users compared to the previous year. These alternatives directly compete with the need for a personal car, especially for shorter urban commutes.

- Urbanization and Mobility Choices: As more people move to cities, the demand for efficient, shared, and sustainable transport solutions rises.

- Rise of Sharing Economy: Ride-sharing and car-sharing platforms are becoming increasingly popular, offering flexibility without the commitment of ownership.

- Environmental Concerns: Growing awareness of environmental issues encourages a move away from fossil-fuel-dependent private vehicles towards greener alternatives.

- Technological Advancements: Improvements in public transport technology and the development of new mobility services make alternatives more viable and appealing.

Future Autonomous Driving and Fleet Models

The rise of autonomous driving technology poses a significant threat of substitution for traditional car ownership models, impacting companies like Dongfeng Motor Group. In the long term, widespread adoption of autonomous vehicles could foster new subscription-based mobility services, reducing the demand for individual car purchases.

If autonomous fleets become highly efficient and readily available, the perceived necessity of owning a personal vehicle could drastically decline. This shift represents a fundamental substitute that could reshape the entire automotive industry landscape, potentially impacting Dongfeng's sales volumes.

- Autonomous Vehicle Adoption: Projections suggest a substantial increase in autonomous vehicle sales, with some estimates forecasting millions of units on the road globally by the late 2020s and early 2030s.

- Mobility-as-a-Service (MaaS): The MaaS market is expected to grow significantly, offering consumers alternatives to personal car ownership through ride-sharing and subscription services.

- Fleet Efficiency: Optimized routing and utilization of autonomous fleets could offer cost savings and convenience that directly compete with the expenses and hassles of individual car ownership.

The threat of substitutes for Dongfeng Motor Group is multifaceted, encompassing advancements in public transportation, the burgeoning ride-sharing economy, and the rise of micromobility. These alternatives directly challenge the traditional model of private car ownership, particularly in urban environments where convenience and cost-effectiveness are paramount. As of 2024, significant investments in public transit infrastructure, coupled with the increasing adoption of ride-sharing and eco-friendly micromobility options, present a compelling case for consumers to forgo personal vehicle purchases.

| Substitute Category | Key Drivers | Impact on Dongfeng |

|---|---|---|

| Public Transportation | Urbanization, Government Investment, Environmental Concerns | Reduced demand for entry-level and compact vehicles |

| Ride-Sharing Services | Convenience, Cost Savings, Mobility-as-a-Service (MaaS) adoption | Decreased new vehicle sales, shift towards flexible mobility solutions |

| Micromobility (E-scooters, E-bikes) | Short-distance urban travel, Affordability, Eco-friendliness | Potential decline in demand for smaller Dongfeng models |

Entrants Threaten

The automotive sector demands immense capital for R&D, manufacturing plants, and global supply chains. Newcomers must secure substantial funding to even consider entering the market and challenging established giants like Dongfeng Motor Group. This substantial financial hurdle significantly discourages potential competitors from entering.

Strict government regulations, including rigorous safety standards and demanding environmental emissions requirements, significantly deter new entrants in China's automotive market. For instance, China's New Energy Vehicle (NEV) mandates, like the dual-credit policy, require manufacturers to meet specific production quotas for electric vehicles or purchase credits, adding a layer of complexity and cost.

The intricate licensing processes and the substantial investment needed for testing, certification, and ongoing compliance with these evolving standards create a high barrier to entry. These regulatory complexities directly translate into increased capital expenditure and extended timelines for new players aiming to establish a foothold in the competitive landscape.

Established brand recognition and loyalty represent a significant barrier for new entrants looking to challenge Dongfeng Motor Group. Decades of presence in the automotive market have allowed Dongfeng to cultivate strong customer trust and brand preference. For instance, in 2023, Dongfeng Motor Corporation reported a revenue of approximately RMB 135.7 billion, reflecting its substantial market share and the loyalty of its customer base.

Newcomers must invest heavily in marketing and product development to even begin to erode this established loyalty. Convincing consumers to switch from familiar and trusted brands like those offered by Dongfeng requires not just competitive pricing, but also superior product quality, innovative features, and exceptional after-sales service. The sheer scale of marketing expenditure needed can be prohibitive, with major automotive brands often spending billions annually on advertising and brand building.

Technological Expertise and R&D Capabilities

Developing cutting-edge automotive technology, especially in New Energy Vehicles (NEVs), smart cockpits, and autonomous driving, requires significant investment in research and development. Dongfeng Motor Group, for instance, has been actively investing in these areas, with a stated goal to achieve breakthroughs in core technologies. For new entrants, acquiring the necessary technological expertise and building robust R&D departments is a considerable hurdle, often demanding substantial capital and a lengthy development cycle.

The barrier to entry is amplified by the need for specialized engineering talent and access to advanced intellectual property. Companies like Dongfeng often possess established patent portfolios and relationships with technology providers, which are difficult for newcomers to replicate quickly. In 2024, the global automotive R&D spending is projected to reach new heights, with a significant portion allocated to electrification and intelligent driving systems, underscoring the high cost of staying competitive.

- High R&D Investment: The automotive sector's push towards NEVs and autonomous driving necessitates substantial R&D expenditure, creating a financial barrier for new players.

- Talent Acquisition: Securing specialized engineering talent in areas like AI and battery technology is competitive and costly, favoring established firms with strong employer branding.

- Intellectual Property: Existing patents and proprietary technologies held by established automakers present a significant challenge for new entrants seeking to innovate without infringement.

- Time to Market: Developing and validating new automotive technologies is a time-consuming process, giving incumbent firms an advantage in market entry.

Emergence of EV Startups and Tech Company Entrants

The automotive industry, including established players like Dongfeng Motor Group, faces a heightened threat from new entrants, particularly in the electric vehicle (EV) segment. While traditional manufacturing and supply chain complexities still present significant hurdles, the landscape is shifting. The emergence of agile EV startups, such as Nio and Xpeng, and the strategic entry of tech giants like Xiaomi and Huawei into automotive manufacturing, are effectively lowering the barrier to entry for a new breed of competitor. These newcomers often possess substantial financial resources, innovative approaches to vehicle development and sales, and a keen focus on software integration, directly challenging incumbent strategies.

These new entrants are not just replicating existing models; they are often redefining the automotive experience. For instance, Xiaomi's entry into the EV market in 2024 with its SU7 sedan, which garnered significant pre-orders, highlights the disruptive potential of tech companies. Their ability to leverage existing customer bases and technological expertise, particularly in areas like artificial intelligence and connectivity, allows them to carve out distinct market positions. This is particularly evident in the New Energy Vehicle (NEV) market, where innovation cycles are faster and brand loyalty can be more fluid.

- EV Startups: Companies like Nio, Xpeng, and Li Auto have rapidly gained traction by focusing on premium EVs and innovative ownership models.

- Tech Company Entry: Major technology firms, such as Xiaomi and Huawei, are leveraging their expertise in software, AI, and consumer electronics to develop and market vehicles. Xiaomi's SU7, launched in early 2024, received over 100,000 orders within its first month.

- Lowered Barriers: While capital-intensive, the focus on software-defined vehicles and direct-to-consumer sales models initiated by some new entrants can reduce traditional dealership network dependencies.

- Competitive Pressure: These new players often target specific market segments or technological advantages, forcing established automakers to accelerate their own EV development and digital transformation strategies.

The threat of new entrants for Dongfeng Motor Group is moderate but increasing, particularly from tech-focused companies and agile EV startups. While traditional barriers like capital investment and regulatory compliance remain high, the evolving automotive landscape, driven by electrification and software innovation, is creating new pathways for competition. These new players often bring fresh perspectives and leverage digital ecosystems, challenging established norms.

| New Entrant Type | Key Characteristics | Impact on Dongfeng |

|---|---|---|

| EV Startups (e.g., Nio, Xpeng) | Focus on premium EVs, innovative ownership models, strong digital presence | Pressure to accelerate EV development and enhance digital customer experience |

| Tech Giants (e.g., Xiaomi, Huawei) | Leverage software, AI, connectivity expertise; direct-to-consumer sales | Disruptive potential through integrated technology and rapid market entry; Xiaomi's SU7 received over 100,000 orders in its first month of 2024. |

| Traditional Automakers Entering New Markets | Capitalizing on established brand recognition and manufacturing scale | Increased competition in specific geographic or product segments |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dongfeng Motor Group leverages data from their annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.