DFIN PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFIN Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping DFIN's trajectory. Our meticulously researched PESTLE analysis provides the deep insights you need to anticipate market shifts and capitalize on emerging opportunities. Don't just react to change—lead it. Download the full PESTLE analysis now and equip yourself with actionable intelligence.

Political factors

Shifts in government administration, such as the potential for a new administration in the United States following the 2024 election, could significantly alter regulatory priorities impacting financial services. For instance, a more interventionist approach could bolster demand for DFIN's compliance and reporting solutions, as seen when regulatory scrutiny intensified following the 2008 financial crisis, driving growth for similar service providers.

The political stability of key markets is also a critical factor. Geopolitical tensions or unexpected policy changes in major economies where DFIN's clients operate can create uncertainty, potentially affecting client investment and thus demand for DFIN's services. For example, ongoing trade disputes or political instability in regions like Eastern Europe could indirectly impact the financial sector's need for regulatory support.

Shifting international trade policies, including tariffs and trade agreements, significantly shape the global economic landscape and the ease of cross-border financial dealings. These changes directly impact the volume and intricacy of regulatory filings DFIN's multinational clients must manage. For instance, the World Trade Organization reported that global trade growth slowed to 0.6% in 2023, a notable decrease from previous years, highlighting the sensitivity of financial transactions to trade policy shifts.

For DFIN, evolving trade dynamics present both challenges and opportunities. Increased trade friction can dampen international IPOs and M&A activities, a core business area for the company. Conversely, new compliance mandates arising from altered trade agreements necessitate robust solutions, increasing demand for DFIN's expertise in navigating complex international regulatory requirements.

Geopolitical stability is a crucial element for financial markets, and by extension, for companies like DFIN that facilitate capital market transactions. Political instability, conflicts, or significant geopolitical events can indeed create a ripple effect, dampening investor confidence and leading to a slowdown in activities such as Initial Public Offerings (IPOs), Mergers & Acquisitions (M&A), and debt offerings. For instance, the ongoing geopolitical tensions in Eastern Europe, which intensified in early 2022, contributed to increased market volatility and a cautious approach from investors globally, potentially impacting the volume of deals that require DFIN's services.

Conversely, periods of geopolitical stability tend to foster an environment conducive to investment and economic growth. When global political landscapes are more predictable, businesses are more likely to pursue expansion, mergers, and public offerings, directly benefiting service providers like DFIN. The expectation for 2024 and 2025 is a continued focus on managing geopolitical risks, with market participants closely watching developments that could either spur or hinder cross-border investment and capital raising activities.

Government Spending and Fiscal Policy

Government fiscal policies, such as spending on infrastructure projects and tax reforms, directly impact the financial services sector. For instance, a significant infrastructure spending bill, like the Infrastructure Investment and Jobs Act passed in late 2021 with over $1 trillion allocated, can stimulate economic activity, leading to increased demand for financial reporting and compliance services that DFIN provides.

Tax reforms, such as changes in corporate tax rates or capital gains taxes, also shape financial markets. A lower corporate tax rate, for example, could encourage business investment and expansion, thereby boosting transaction volumes and the need for DFIN's solutions. Conversely, austerity measures or significant tax increases might dampen economic growth and reduce financial activity.

Economic stimulus packages, particularly those implemented during periods of economic downturn, can also influence the demand for DFIN's services. For example, stimulus measures aimed at supporting businesses may lead to increased M&A activity or capital raising efforts, both of which require robust financial documentation and compliance.

- Infrastructure Spending: The US Infrastructure Investment and Jobs Act allocated over $1 trillion, potentially driving financial transactions and compliance needs.

- Tax Policy Impact: Changes in corporate tax rates can influence business investment and M&A activity, affecting demand for financial reporting tools.

- Stimulus Measures: Government stimulus can boost economic activity, leading to greater use of financial reporting and compliance services.

Political Pressure for Transparency

Political pressure for increased transparency in financial reporting is a significant tailwind for DFIN. Governments worldwide are enacting stricter regulations to combat financial crime and enhance corporate governance, directly boosting demand for DFIN's compliance and reporting solutions. For instance, the ongoing global efforts to implement enhanced Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are creating a more complex compliance landscape for businesses.

This heightened regulatory environment translates into greater opportunities for DFIN. As governments strengthen oversight, companies face increased reporting burdens and a greater need for specialized tools to ensure accuracy and compliance. The U.S. Securities and Exchange Commission (SEC), for example, continues to refine its disclosure requirements, pushing companies towards more robust and timely reporting mechanisms.

- Increased Regulatory Scrutiny: Global regulators are intensifying their focus on corporate transparency and financial crime prevention, leading to more stringent disclosure requirements.

- Demand for Compliance Solutions: This regulatory push directly fuels demand for DFIN's services, which help companies navigate complex compliance landscapes and improve reporting accuracy.

- Legislative Trends: Anticipated legislative actions in 2024 and 2025 are likely to further mandate digital reporting and enhanced data security, benefiting DFIN's technological offerings.

- Investor Protection Focus: A sustained emphasis on investor protection by governments worldwide necessitates clearer and more accessible financial information, a core DFIN competency.

Political stability and government policies are paramount for financial markets. Shifts in administration, like potential changes in the US following the 2024 election, can alter regulatory priorities, potentially boosting demand for DFIN's compliance solutions. Geopolitical tensions and trade policy changes, such as the World Trade Organization's report of a 0.6% global trade growth in 2023, directly impact cross-border financial dealings and the complexity of regulatory filings.

Government fiscal policies, including infrastructure spending and tax reforms, also play a crucial role. The US Infrastructure Investment and Jobs Act, with over $1 trillion allocated, can stimulate economic activity and increase demand for financial reporting services. Furthermore, increasing political pressure for transparency in financial reporting, driven by global efforts to combat financial crime and enhance corporate governance, directly fuels demand for DFIN's specialized tools.

| Factor | Impact on DFIN | Supporting Data/Trend |

|---|---|---|

| US Election 2024 | Potential shift in regulatory focus, impacting demand for compliance solutions. | Historically, increased regulatory scrutiny following financial crises boosted demand for similar services. |

| Global Trade Growth | Slower growth impacts cross-border financial transactions and regulatory filing complexity. | World Trade Organization reported 0.6% global trade growth in 2023. |

| Infrastructure Spending | Stimulates economic activity, increasing demand for financial reporting and compliance. | US Infrastructure Investment and Jobs Act allocated over $1 trillion. |

| Transparency Regulations | Heightened focus on AML/KYC and corporate governance drives demand for reporting tools. | Ongoing global implementation of enhanced AML and KYC regulations. |

What is included in the product

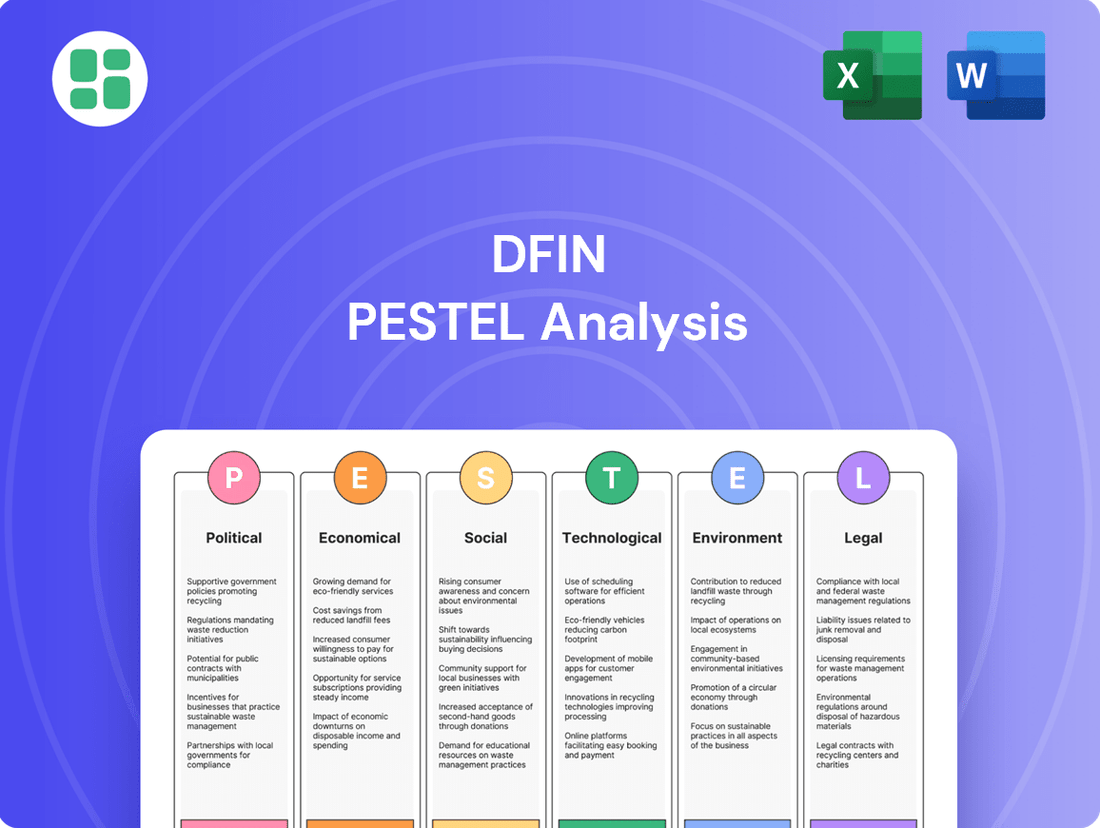

DFIN's PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This detailed breakdown equips stakeholders with actionable insights to navigate challenges and capitalize on emerging opportunities within DFIN's operating landscape.

The DFIN PESTLE Analysis provides a clear, summarized version of complex external factors, making it easy to reference during meetings and ensuring all stakeholders are aligned on market dynamics.

Economic factors

Global economic growth is a critical driver for DFIN, as its services are deeply intertwined with capital markets activity. Robust economic expansion generally fuels higher volumes of mergers, acquisitions, and initial public offerings, all of which necessitate DFIN's expertise in regulatory compliance and financial reporting. For instance, the IMF projected global growth to reach 3.2% in 2024, a slight slowdown from 2023 but still indicative of continued economic expansion that supports DFIN's client base.

Conversely, economic slowdowns or recessions can significantly dampen demand for DFIN's services. A contraction in economic activity typically leads to fewer corporate transactions and reduced capital raising efforts, directly impacting the need for DFIN's specialized reporting and compliance solutions. The World Bank, in its January 2024 Global Economic Prospects report, warned of persistent inflation and high interest rates contributing to slower growth in advanced economies, a factor that could present headwinds for DFIN.

Interest rate fluctuations significantly influence DFIN's operating environment. For instance, the U.S. Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, a period where many companies were actively managing their financial disclosures. Higher rates increase the cost of capital for businesses, potentially leading to adjustments in investment strategies and, consequently, the volume and complexity of financial filings that DFIN supports.

Conversely, periods of lower interest rates, such as those seen in prior years, can incentivize borrowing and investment, stimulating economic activity and increasing the demand for DFIN's services related to capital markets transactions and regulatory compliance. The anticipation of future rate changes also impacts market sentiment and corporate decision-making, directly affecting the types of financial communications DFIN's clients require.

Rising inflation in 2024 and early 2025 directly impacts DFIN's operational expenses, from the cost of skilled labor and essential technology infrastructure to the significant investment in software development. For instance, the US Consumer Price Index (CPI) saw a notable increase, with annual inflation rates fluctuating around 3.0% to 3.5% in late 2024, impacting these input costs.

Furthermore, these inflationary pressures can erode the profitability of DFIN's clients, potentially altering their demand for regulatory reporting services or prompting a shift in their investment strategies. This could necessitate DFIN adapting its service offerings to meet evolving client needs in a more cost-conscious environment.

To navigate this, DFIN must strategically manage its pricing models and rigorously control its cost structures. Maintaining profitability requires a keen focus on efficiency and value delivery, ensuring that DFIN can absorb rising costs while continuing to provide essential services to its client base.

Financial Market Volatility

High financial market volatility, a persistent theme in late 2024 and projected into 2025, injects significant uncertainty into business planning and investment decisions. For instance, the S&P 500 experienced a notable surge in its VIX index, a key measure of market volatility, throughout 2024, reflecting investor apprehension regarding inflation and geopolitical events. This heightened uncertainty can prompt companies to delay or scale back capital expenditures and M&A activities, directly impacting the demand for DFIN's core services in financial disclosure and compliance.

While periods of volatility can amplify the need for robust risk management and regulatory adherence, potentially boosting demand for certain DFIN offerings, sustained high levels of unpredictability tend to dampen overall financial transaction volumes. For example, a slowdown in IPO markets, often linked to volatile conditions, directly reduces the need for DFIN's IPO readiness services. Conversely, market stability, as seen in periods of consistent economic growth and predictable interest rate environments, typically fuels greater transaction activity, thereby increasing the volume of DFIN’s work in areas like SPACs and debt offerings.

- 2024 VIX Index Performance: The Cboe Volatility Index (VIX) averaged above 15 for much of 2024, a level indicating elevated market anxiety compared to historical norms.

- IPO Market Trends: The number of IPOs in 2024 remained subdued compared to pre-pandemic peaks, with many companies opting to wait for more stable market conditions, impacting DFIN's related service revenue.

- Investor Sentiment: Surveys in late 2024 indicated a cautious investor sentiment, with a significant percentage of respondents planning to reduce their risk exposure, signaling a potential decrease in demand for high-growth, transaction-heavy DFIN services.

- Interest Rate Sensitivity: Fluctuations in central bank interest rate policies throughout 2024 and into 2025 have directly influenced borrowing costs and investment appetite, creating a dynamic environment for DFIN's debt and equity issuance clients.

Investment Trends and Capital Flow

Global investment activity, encompassing foreign direct investment (FDI), private equity (PE), and venture capital (VC), significantly shapes financial market dynamics. For instance, global FDI inflows reached an estimated $1.8 trillion in 2024, a notable increase from previous years, signaling robust investor confidence.

These heightened investment flows translate into more intricate financial operations and a greater need for specialized financial data and reporting services. As PE deal value in 2024 approached $2.5 trillion globally, the complexity of due diligence and post-transaction reporting escalates, directly benefiting firms like DFIN that offer advanced compliance and analytics.

Conversely, shifts in these capital flows present both opportunities and challenges.

- Global FDI Inflows: Projected to remain strong in 2024, supporting market activity.

- Private Equity Activity: Deal values in 2024 are robust, driving demand for complex financial structuring.

- Venture Capital Investment: While showing some sector-specific moderation in early 2025, overall VC funding remains crucial for innovation-driven markets.

- Impact on DFIN: Increased investment complexity directly correlates with higher demand for DFIN's reporting and compliance solutions.

Economic factors significantly influence DFIN's business, with global growth directly correlating to capital markets activity. A healthy economy, projected by the IMF at 3.2% for 2024, typically boosts mergers, acquisitions, and IPOs, increasing demand for DFIN's compliance and reporting services. Conversely, economic slowdowns or recessions, as warned by the World Bank due to persistent inflation and high interest rates, can dampen this demand.

Inflation, with US CPI fluctuating around 3.0%-3.5% in late 2024, impacts DFIN's operational costs and can affect client profitability, necessitating strategic pricing and cost control. High market volatility, evidenced by the VIX index averaging above 15 in 2024, creates uncertainty that can delay corporate transactions, though it can also increase the need for risk management services.

Global investment activity, with FDI inflows reaching an estimated $1.8 trillion in 2024 and PE deal values approaching $2.5 trillion, fuels complex financial operations. This increased complexity directly drives demand for DFIN's advanced compliance and analytics solutions, as seen in the robust activity within the private equity sector.

| Economic Factor | 2024/2025 Projection/Data | Impact on DFIN |

|---|---|---|

| Global Economic Growth | IMF projected 3.2% in 2024 | Higher activity in M&A, IPOs increases demand for services. |

| Inflation (US CPI) | Fluctuating around 3.0%-3.5% (late 2024) | Increases operational costs; may affect client spending on services. |

| Market Volatility (VIX) | Averaged above 15 (2024) | Can delay transactions, but increases need for risk management. |

| Global FDI Inflows | Estimated $1.8 trillion (2024) | Supports market activity and complex financial operations. |

| Private Equity Deal Value | Approaching $2.5 trillion (2024) | Drives demand for complex reporting and compliance solutions. |

What You See Is What You Get

DFIN PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive DFIN PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting DFIN. You'll gain valuable insights into the external forces shaping the company's strategic landscape.

Sociological factors

Societal shifts are significantly reshaping the workforce. For instance, in the US, the median age of the workforce is gradually increasing, with a notable portion of the population nearing retirement age. This demographic trend, coupled with the rise of a digitally native younger generation, directly impacts the talent pool available to DFIN and its clients.

DFIN must proactively adapt its talent acquisition and development strategies. This means focusing on attracting and retaining professionals who possess a blend of financial acumen and technological proficiency, a demand that is projected to grow. For example, by 2025, demand for roles requiring both finance and tech skills is expected to outpace supply in many sectors.

These demographic changes also influence how clients engage with DFIN's digital offerings. As a younger, more tech-savvy demographic becomes a larger part of the client base, expectations for seamless, intuitive digital interactions will rise, necessitating continuous investment in user experience and platform innovation.

Societal expectations for transparency are significantly shaping corporate behavior, particularly in finance. A 2024 survey indicated that 78% of consumers believe companies should be more open about their operations and data handling, a sentiment that directly fuels demand for DFIN's disclosure solutions.

This growing public demand for ethical conduct and clear communication is a powerful driver for regulatory change. For instance, recent updates to financial reporting standards in the EU, effective from 2025, mandate more granular data disclosure, creating a direct market opportunity for DFIN.

DFIN is well-positioned to capitalize on this trend by offering tools that help companies meet these heightened transparency requirements. By providing the technology and expertise for accurate and timely reporting, DFIN can become an indispensable partner for businesses navigating this evolving landscape.

Growing public awareness of data privacy, amplified by high-profile breaches in 2024, means DFIN must prioritize secure data handling. Consumers increasingly expect financial institutions to safeguard their sensitive information, making DFIN's commitment to robust data management a key differentiator.

Societal demand for transparency and control over personal data is reshaping how financial services operate. For DFIN, this translates to a need for advanced, compliant platforms that assure clients their data is protected, a critical factor given that 65% of consumers in a late 2024 survey indicated they would switch providers due to privacy concerns.

Remote Work and Digital Collaboration

The shift towards remote and hybrid work models has fundamentally altered collaboration within the financial sector. This necessitates robust digital infrastructure, making DFIN's cloud-based solutions vital for maintaining operational efficiency and regulatory compliance across dispersed teams. The demand for seamless digital interaction and secure data access is a direct consequence of this sociological trend.

This ongoing evolution means financial professionals increasingly rely on platforms that facilitate real-time data sharing and communication. For instance, a 2024 survey indicated that over 70% of financial services firms reported increased reliance on digital collaboration tools since 2020. DFIN's focus on secure, accessible digital platforms directly addresses this amplified need.

- Increased reliance on cloud-based financial software for remote teams.

- Growing demand for secure digital communication and data sharing platforms.

- Financial professionals report higher productivity with effective remote collaboration tools.

ESG Awareness and Investor Pressure

Societal awareness of Environmental, Social, and Governance (ESG) issues continues to surge, directly impacting investor behavior and corporate strategy. This heightened consciousness translates into significant investor pressure on companies to demonstrate strong ESG performance and transparent reporting. For instance, in early 2024, global sustainable investment assets reached an estimated $37.5 trillion, according to Morningstar data, underscoring the financial clout behind ESG principles.

DFIN, as a compliance and reporting specialist, is strategically positioned to capitalize on this trend. By offering robust solutions for collecting, managing, and disclosing ESG data, DFIN directly addresses the growing demand from investors for sustainable and responsible investment opportunities. This alignment with market sentiment is crucial for future growth.

- Growing Investor Demand: Sustainable investment assets globally surpassed $37.5 trillion by early 2024, indicating a powerful shift in capital allocation.

- Regulatory Tailwinds: Increasing regulatory focus on ESG disclosures globally, with many jurisdictions implementing mandatory reporting frameworks, further bolsters the need for DFIN's services.

- Corporate Responsibility: Companies are increasingly recognizing that strong ESG performance is not just a compliance issue but a driver of brand reputation and long-term value creation.

- Data Management Needs: The complexity of ESG data collection and reporting requires specialized tools and expertise, areas where DFIN excels.

Societal expectations for transparency and ethical conduct are increasingly influencing financial markets, driving demand for clear and accurate corporate disclosures. For example, a late 2024 survey revealed that 78% of consumers expect companies to be more open about their operations, directly benefiting DFIN's disclosure solutions.

The growing awareness of data privacy, highlighted by significant breaches in 2024, necessitates robust security measures. With 65% of consumers indicating they would switch providers over privacy concerns, DFIN's commitment to secure data handling becomes a critical competitive advantage.

Societal shifts towards remote and hybrid work models have amplified the need for accessible digital collaboration tools. Over 70% of financial services firms reported increased reliance on these tools in 2024, underscoring the demand for DFIN's secure, cloud-based platforms.

The surge in Environmental, Social, and Governance (ESG) awareness continues to shape investor behavior, with global sustainable investment assets reaching an estimated $37.5 trillion by early 2024. DFIN's ability to facilitate ESG data management and reporting directly aligns with this powerful market trend.

Technological factors

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly reshaping financial data analysis and reporting. DFIN can harness these advancements to automate compliance, boost data precision, and anticipate regulatory shifts, ultimately making its services more efficient and insightful for clients.

By implementing AI, DFIN can offer more sophisticated risk management capabilities, a crucial advantage in today's complex financial landscape. For instance, AI-powered fraud detection systems are becoming increasingly vital; in 2024, financial institutions are investing heavily in these technologies to combat escalating cyber threats.

The financial industry's increasing adoption of cloud computing, projected to reach $1 trillion globally by 2025, offers DFIN significant advantages in scalability and data processing. This shift necessitates a heightened focus on cybersecurity. For instance, a 2024 report indicated that financial institutions experienced a 15% rise in cyberattacks targeting cloud infrastructure, underscoring the critical need for DFIN to invest in advanced encryption and threat detection systems to safeguard client data and maintain regulatory compliance.

Blockchain and distributed ledger technology (DLT) are poised to reshape financial operations. These advancements offer enhanced security and transparency for record-keeping and transaction verification. For instance, the global blockchain market was valued at approximately $12.17 billion in 2023 and is projected to reach $175.82 billion by 2030, indicating significant growth and adoption potential.

DFIN must actively monitor these evolving technologies to understand their implications for traditional reporting. Integrating DLT could streamline compliance, as seen in pilot programs exploring its use for regulatory reporting, potentially reducing manual effort and improving data accuracy.

Automation and Digital Transformation

The pervasive digital transformation and automation across industries, including financial services, directly fuels the demand for DFIN's software-as-a-service (SaaS) and digital solutions. Clients are actively looking to streamline their operations by automating manual reporting processes, minimizing human error, and boosting overall efficiency. For instance, in 2024, the global automation market was projected to reach over $60 billion, highlighting the significant investment in these technologies.

DFIN's strength lies in its capacity to deliver user-friendly, automated platforms. This capability is paramount for addressing the evolving needs of its clientele and maintaining a competitive edge in a rapidly digitizing landscape. The company's focus on intuitive design ensures that clients can easily adopt and leverage these automated solutions to enhance their financial reporting and compliance workflows.

- Increased Demand for Efficiency: Businesses are prioritizing automation to cut costs and speed up processes.

- Reduced Errors: Automation in reporting significantly lowers the risk of manual data entry mistakes.

- Competitive Advantage: DFIN's automated platforms help clients stay ahead by improving operational agility.

- Market Growth: The global market for financial process automation is expanding, with significant growth expected through 2025.

Cybersecurity Threats and Data Integrity

The escalating sophistication and frequency of cyberattacks present a substantial risk to financial data and the ability to meet regulatory requirements. In 2024, the global average cost of a data breach reached $4.45 million, a figure that continues to climb, underscoring the financial implications of security failures.

DFIN, operating critical financial reporting infrastructure, must invest heavily in advanced cybersecurity defenses to safeguard its internal operations and the sensitive client data it handles. The company's commitment to robust protection is essential given that cybercrime is projected to cost the world $10.5 trillion annually by 2025.

Ensuring data integrity and building resilience against these evolving threats is absolutely crucial for DFIN's reputation and the consistent reliability of its services. A single significant breach could severely damage client trust and lead to substantial financial and operational disruptions.

Key considerations include:

- Investing in AI-powered threat detection and response systems.

- Implementing multi-factor authentication across all platforms.

- Conducting regular penetration testing and vulnerability assessments.

- Prioritizing employee training on cybersecurity best practices.

Technological advancements like AI and blockchain are transforming financial reporting, driving demand for automated, secure, and transparent solutions. DFIN's ability to integrate these technologies will be key to its future success and competitive advantage.

The increasing reliance on cloud infrastructure necessitates robust cybersecurity measures, as cyber threats continue to escalate. DFIN must prioritize data protection to maintain client trust and regulatory compliance amidst growing cybercrime costs.

| Technology | Impact on Financial Reporting | DFIN Opportunity/Challenge | 2024/2025 Data Point |

|---|---|---|---|

| Artificial Intelligence (AI) | Automates compliance, enhances data precision, anticipates regulatory shifts. | Improves efficiency and insight generation for clients. | Financial institutions investing heavily in AI for fraud detection in 2024. |

| Cloud Computing | Offers scalability and improved data processing capabilities. | Requires focus on cybersecurity due to increased cloud-based cyberattacks. | Global cloud computing market projected to reach $1 trillion by 2025. |

| Blockchain/DLT | Enhances security and transparency in record-keeping and transactions. | Streamlines compliance and reduces manual effort in regulatory reporting. | Global blockchain market valued at $12.17 billion in 2023, projected growth to $175.82 billion by 2030. |

| Automation (SaaS) | Meets demand for streamlined operations, reduced errors, and increased efficiency. | DFIN's user-friendly platforms provide a competitive edge. | Global automation market projected to exceed $60 billion in 2024. |

Legal factors

DFIN's business is intrinsically tied to financial regulations, making any shifts in laws from entities like the SEC, FINRA, or global regulatory bodies a direct influence on its services. For instance, the SEC's ongoing review of Regulation S-K for enhanced ESG disclosures, expected to be finalized in late 2024, will necessitate DFIN to adapt its platform to accommodate new data points and reporting structures for its clients.

Staying ahead of these regulatory changes is paramount for DFIN to maintain the compliance and utility of its software and solutions. This includes adapting to evolving requirements for financial reporting formats, the specifics of disclosure mandates, and the timing of compliance deadlines, which can significantly impact client needs and DFIN's service offerings.

The global landscape of data privacy is rapidly evolving, with regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) setting high standards for data handling. DFIN must navigate these complex legal frameworks, ensuring its processes for managing sensitive client information are robust and compliant. Failure to do so, for instance, could result in significant penalties; GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Laws governing corporate governance, executive pay, and board diversity significantly influence how public companies present information in their filings. DFIN's services are designed to help companies meet these evolving disclosure obligations, making them crucial for compliance.

Recent regulatory shifts, such as the SEC's proposed rules for climate-related disclosures and enhanced executive compensation reporting, directly impact DFIN's market. For instance, the push for greater ESG transparency in 2024 and 2025 presents a clear opportunity for DFIN to expand its offerings in sustainable finance reporting solutions.

Antitrust and Competition Law

Antitrust and competition laws are crucial for DFIN, especially given its specialized market niche. These regulations directly influence DFIN's strategic growth avenues, particularly concerning mergers and acquisitions. For instance, the U.S. Department of Justice and the Federal Trade Commission actively review transactions to prevent undue market concentration. In 2023, the FTC alone reviewed over 2,500 premerger notifications, indicating a robust enforcement environment that DFIN must navigate.

These laws can impact DFIN's ability to expand through strategic acquisitions, as any deal that could significantly lessen competition or create a monopoly would face intense scrutiny. Similarly, if DFIN achieves a dominant market position, it could be subject to investigations regarding its practices. For example, in 2024, several technology companies faced antitrust investigations in the EU for alleged anti-competitive behavior, highlighting the global reach of these regulations.

- Merger Scrutiny: Antitrust regulators, like the FTC and DOJ in the U.S., examine transactions that could impact market competition.

- Market Dominance: Companies with significant market share may face investigations into their business practices to ensure fair competition.

- Global Enforcement: Regulatory bodies worldwide, such as the European Commission, actively enforce competition laws, affecting international operations.

Intellectual Property Rights

DFIN's business is built upon its proprietary software, algorithms, and data management technologies, making intellectual property (IP) protection crucial. Robust IP laws are vital for DFIN to prevent infringement and maintain its competitive edge in the financial services technology sector. The company actively manages its portfolio of patents, copyrights, and trade secrets to secure its unique technological solutions.

The strength and enforcement of IP laws directly impact DFIN's ability to monetize its innovations. For instance, in 2023, the global IP market saw significant activity, with companies filing millions of patents, underscoring the importance of such protections. DFIN's ongoing investment in R&D, which fuels its technological advancements, is directly safeguarded by these legal frameworks.

- Protection of Proprietary Software: DFIN's core software platforms are protected by copyright and patent law, preventing unauthorized copying or use.

- Safeguarding Algorithms: Proprietary algorithms, key to DFIN's data analysis and financial reporting solutions, are often protected as trade secrets.

- Enforcement of Patents: DFIN relies on patent law to prevent competitors from developing and marketing similar technologies, ensuring market exclusivity for its innovations.

- Data Management Technologies: The legal framework surrounding data management and privacy also plays a role in protecting DFIN's secure handling of sensitive financial information.

Legal factors significantly shape DFIN's operational landscape, demanding constant adaptation to evolving compliance requirements. New regulations, such as those concerning ESG reporting and climate disclosures, directly influence the services DFIN must offer clients to ensure their filings are accurate and meet standards set by bodies like the SEC. For example, the SEC's proposed climate disclosure rules, expected to impact reporting in late 2024 and 2025, will require DFIN to enhance its solutions for sustainability data management.

Data privacy laws, like GDPR and CCPA, are critical. DFIN must ensure its handling of sensitive client data adheres to these stringent global standards, as non-compliance can lead to substantial penalties. Intellectual property laws are also paramount, protecting DFIN's proprietary software and algorithms, which are central to its competitive advantage and revenue generation. The company's reliance on these unique technologies means robust IP protection is essential for maintaining market exclusivity and fostering continued innovation.

Antitrust and competition laws impact DFIN's strategic growth, particularly regarding mergers and acquisitions. Regulators actively scrutinize deals that could reduce market competition, a factor DFIN must consider in its expansion plans. The U.S. Federal Trade Commission, for instance, reviewed over 2,500 premerger notifications in 2023, highlighting the rigorous oversight governing corporate consolidation.

Environmental factors

Governments worldwide are increasingly mandating ESG reporting. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) significantly expands disclosure requirements for a vast number of companies, with initial reports due in 2025 for fiscal year 2024. This regulatory shift compels businesses to meticulously track and report their environmental footprint, social impact, and governance practices.

These evolving ESG reporting mandates present a substantial growth avenue for DFIN. By offering robust solutions for data collection, management, and transparent disclosure, DFIN can transform a complex compliance challenge for its clients into a strategic advantage. This allows companies to not only meet regulatory obligations but also leverage ESG data for enhanced decision-making and stakeholder communication.

Climate change regulations are increasingly shaping the financial landscape. Jurisdictions worldwide are implementing stricter rules, including mandatory carbon emission reporting and detailed climate risk disclosures. For instance, the SEC's proposed climate disclosure rules, expected to be finalized in 2024, will require public companies to report greenhouse gas emissions and climate-related financial risks, impacting DFIN's client base.

These evolving environmental reporting requirements necessitate robust compliance systems for financial institutions and public companies. DFIN, as a provider of financial data and analytics, is well-positioned to develop and enhance its platforms. This includes offering tools that facilitate specialized climate-related disclosures, helping clients adhere to burgeoning green legislation and avoid potential penalties.

Beyond regulatory requirements, a growing number of companies are proactively implementing corporate sustainability initiatives. This shift is largely driven by increasing investor demand for Environmental, Social, and Governance (ESG) performance, a desire to enhance brand reputation, and the pursuit of operational efficiencies. For instance, in 2024, a significant portion of global institutional investors indicated that ESG factors influence their investment decisions, with many divesting from companies with poor sustainability records.

This trend creates a substantial market for tools and services that can effectively track, analyze, and report on diverse environmental metrics. Companies are actively seeking ways to measure and manage their energy consumption, waste reduction efforts, and greenhouse gas emissions across their entire supply chains. The need for transparent and reliable data in these areas is paramount for building stakeholder trust and demonstrating genuine commitment to environmental stewardship.

DFIN can strategically position its offerings as essential components of these comprehensive sustainability programs. By providing clients with robust solutions for data management and reporting, DFIN can help them effectively showcase their dedication to environmental responsibility. This includes enabling clients to communicate their progress on key performance indicators, such as reducing carbon footprints or improving resource efficiency, thereby aligning with the evolving expectations of investors and the broader market.

Resource Scarcity and Operational Impact

While DFIN's core software isn't directly tied to physical resources, the increasing global concern over resource scarcity, especially energy and water, can indirectly influence its operations. This scarcity can lead to higher operational costs for DFIN's data centers and the cloud infrastructure providers it relies on. For instance, in 2024, the global average price of electricity for data centers saw an upward trend due to increased demand and supply chain pressures.

DFIN must proactively consider the environmental footprint of its IT infrastructure. This involves evaluating the sustainability commitments of its cloud partners. Seeking providers who are demonstrably committed to renewable energy sources, such as solar and wind power, is crucial for aligning with broader environmental responsibility and mitigating future cost volatility associated with fossil fuels. Many leading cloud providers are setting ambitious renewable energy targets, with some aiming for 100% renewable energy by 2030.

- Rising Energy Costs: Increased demand for power, particularly in data-intensive sectors, is driving up electricity prices globally, impacting operational expenditures for IT infrastructure.

- Water Usage in Cooling: Data centers often require significant water for cooling systems, making water scarcity a potential operational risk in certain regions.

- Renewable Energy Adoption: A growing number of cloud service providers are investing heavily in renewable energy sources to power their operations, a trend DFIN can leverage.

- ESG Reporting: Investors and regulators are increasingly focused on Environmental, Social, and Governance (ESG) factors, making sustainable IT practices a strategic imperative.

Investor and Stakeholder Pressure for Green Practices

Investors and consumers are increasingly focused on environmental, social, and governance (ESG) factors. For instance, in 2024, sustainable investment funds saw continued inflows, with global ESG assets projected to reach $50 trillion by 2025, according to various market analyses. This external pressure directly influences DFIN's clientele, pushing them towards more sustainable operations and robust environmental reporting to meet these growing demands.

DFIN plays a crucial role in helping its clients navigate this landscape by facilitating accurate and comprehensive environmental disclosures. This capability allows businesses to demonstrably meet stakeholder expectations, thereby bolstering their public image and making them more attractive to investors who prioritize sustainability. For example, companies with strong ESG ratings often experience lower costs of capital and higher valuations.

- Growing ESG Investment: Global ESG assets are anticipated to surpass $50 trillion by 2025, indicating a significant shift in investor priorities.

- Stakeholder Scrutiny: Both investors and consumers are actively evaluating companies based on their environmental performance and sustainability initiatives.

- DFIN's Value Proposition: DFIN enables clients to provide transparent and accurate environmental data, enhancing their reputation and investor appeal.

Governments globally are implementing stricter climate change regulations, including mandatory carbon emission reporting and detailed climate risk disclosures. For instance, the SEC's finalized climate disclosure rules in 2024 require public companies to report greenhouse gas emissions and climate-related financial risks, directly impacting DFIN's client base.

These evolving environmental reporting requirements necessitate robust compliance systems for financial institutions and public companies. DFIN is well-positioned to offer tools that facilitate specialized climate-related disclosures, helping clients adhere to burgeoning green legislation and avoid potential penalties.

The increasing global concern over resource scarcity, particularly energy and water, can indirectly influence DFIN's operations by increasing the operational costs for its data centers and cloud infrastructure. For example, in 2024, data center electricity prices saw an upward trend due to increased demand and supply chain pressures.

DFIN must consider the environmental footprint of its IT infrastructure by evaluating the sustainability commitments of its cloud partners, prioritizing providers committed to renewable energy sources to mitigate future cost volatility and align with environmental responsibility.

| Environmental Factor | Impact on DFIN Clients | DFIN's Opportunity |

|---|---|---|

| Climate Regulations | Mandatory emissions and climate risk reporting | Provide compliance and reporting solutions |

| Resource Scarcity | Increased operational costs for IT infrastructure | Offer energy-efficient solutions and cloud partner guidance |

| ESG Investor Demand | Pressure for transparent environmental performance | Facilitate ESG data collection and reporting |

PESTLE Analysis Data Sources

Our PESTLE analysis is grounded in comprehensive data from reputable sources including government publications, international organizations, and leading market research firms. This ensures each insight into political, economic, social, technological, legal, and environmental factors is factually sound and current.