DFIN Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFIN Bundle

Unlock the strategic power of the DFIN BCG Matrix and understand your product portfolio's true potential. This insightful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, guiding your investment decisions. Get the full BCG Matrix for a comprehensive breakdown and actionable strategies to optimize your market position.

Stars

DFIN's investment in global ESG compliance places it squarely in a burgeoning market. The ESG reporting software market is experiencing robust growth, with projected compound annual growth rates (CAGRs) between 12.5% and a substantial 22.9% extending through 2029 and into the future.

This dynamic growth, fueled by escalating regulatory requirements and a strong investor push for sustainability data, offers DFIN a prime opportunity to capitalize on its established proficiency in regulatory reporting solutions.

DFIN's ActiveDisclosure platform is central to its strategy, driving a 12% revenue jump in Q4 2024 and a 6% rise in subscription revenue year-over-year. This platform's reinvention underpins DFIN's shift towards software solutions, evidenced by consistent net client growth.

As a cornerstone of DFIN's transformation, ActiveDisclosure solidifies its market leadership in SEC filing and reporting. Ongoing improvements ensure its competitive edge in the expanding digital compliance sector.

DFIN's Arc Suite, including ArcPro, ArcRegulatory, and ArcReporting, is a key player in the compliance software space. Recurring revenue from these products, alongside ActiveDisclosure, saw robust growth of about 15% in Q2 2025, underscoring their market appeal.

This suite offers a cloud-based solution for managing regulatory communications, automating processes, and maintaining accuracy. Its ability to quickly adapt to new rules makes it a strong contender in the expanding regulatory technology sector.

Venue Virtual Data Rooms

DFIN's Venue virtual data room is a standout performer, demonstrating robust growth. In 2024, Venue experienced a substantial 26% year-over-year increase in revenue. This surge highlights its critical role in facilitating secure and efficient digital collaboration for complex financial transactions.

Venue is specifically designed for high-stakes capital market activities, including mergers and acquisitions (M&A) and initial public offerings (IPOs). Its intuitive interface and advanced security features make it the go-to solution for managing sensitive deal information.

- Strong Revenue Growth: Venue's 26% year-over-year revenue increase in 2024 underscores its market leadership.

- Key Market Applications: Primarily utilized for M&A and IPOs, Venue supports critical capital market transactions.

- Demand Driver: The ongoing need for secure digital collaboration in financial deals fuels Venue's consistent performance.

- Competitive Advantage: Venue's combination of security, intuition, and efficiency positions it favorably in a competitive landscape.

AI-Enhanced Compliance Tools

DFIN is making significant investments in artificial intelligence, understanding its critical role in modernizing financial operations and boosting efficiency. The global RegTech market, fueled by AI, is on a strong growth trajectory, with projections indicating spending will surpass $130 billion by 2025.

By embedding AI into its systems, DFIN is enhancing capabilities like advanced analytics, fraud detection, and continuous monitoring. These AI-driven tools position DFIN for leadership in a high-growth sector.

- AI Integration: DFIN is actively incorporating AI to improve service offerings.

- Market Growth: The RegTech sector, driven by AI, is expected to reach over $130 billion in spending by 2025.

- Enhanced Capabilities: AI adoption supports better analytics, fraud prevention, and real-time oversight.

- Strategic Advantage: These advancements allow DFIN to strengthen its market position in key areas.

DFIN's Stars, representing high-growth, high-market-share offerings, are primarily driven by its Venue virtual data room and its expanding suite of compliance software solutions. Venue's impressive 26% year-over-year revenue growth in 2024 clearly positions it as a star performer, catering to critical M&A and IPO activities. The Arc Suite, including ArcPro, ArcRegulatory, and ArcReporting, also demonstrates star potential, with a robust 15% growth in recurring revenue in Q2 2025, highlighting its strong appeal in the regulatory technology sector.

| Product Category | Key Offering | 2024/2025 Performance Indicator | Market Context |

|---|---|---|---|

| Virtual Data Room | Venue | 26% YoY Revenue Growth (2024) | Facilitates secure digital collaboration for M&A, IPOs. |

| Compliance Software | Arc Suite (ArcPro, ArcRegulatory, ArcReporting) | ~15% Recurring Revenue Growth (Q2 2025) | Cloud-based solution for automated regulatory communications. |

| ESG Reporting | ActiveDisclosure | 12% Revenue Jump (Q4 2024), 6% Subscription Revenue Growth YoY | Capitalizes on growing demand for sustainability data. |

What is included in the product

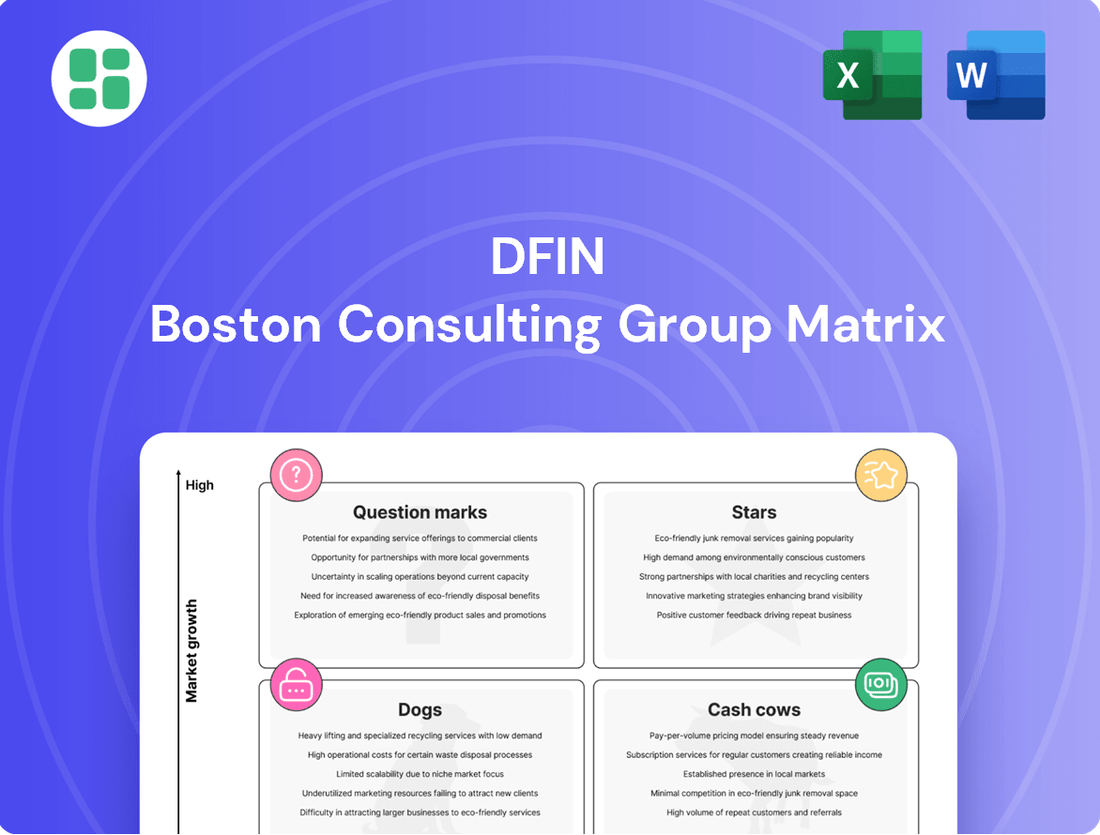

DFIN BCG Matrix analysis provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides DFIN's investment decisions, indicating which units to grow, maintain, or divest for optimal portfolio performance.

DFIN BCG Matrix offers a clear, one-page overview placing each business unit in a quadrant, simplifying complex portfolio analysis.

Cash Cows

DFIN's core SEC filing and reporting services are a classic example of a Cash Cow. With a deep-rooted history and a commanding presence as an SEC filing agent for corporations and fund companies, DFIN has solidified its position in a mature market. These essential services, covering critical documents like 10-Ks, 10-Qs, and proxy statements, generate consistent, predictable revenue streams.

The stability of this segment is a key advantage. While the growth rate might not match that of newer software solutions, the capital expenditure needed to maintain DFIN's leadership in these established offerings is minimal. This allows DFIN to effectively milk its dominant market share for ongoing profits, a hallmark of a Cash Cow in the BCG matrix.

The Technology-Enabled Compliance & Communications Management segment is a cornerstone of DFIN's business, acting as a powerful cash cow. This area offers more than just software; it provides crucial, expert-led assistance for navigating intricate regulatory landscapes and managing communications effectively. DFIN's extensive knowledge and service offerings in this space foster strong client loyalty, leading to predictable and recurring revenue.

These established services boast high profit margins and form the bedrock of DFIN's operations. They consistently generate substantial cash flow within a mature and stable market, underscoring their role as a reliable income generator for the company. For instance, in 2024, DFIN reported a significant portion of its revenue derived from its compliance solutions, which are directly tied to this segment, demonstrating its consistent financial contribution.

DFIN's expertise in transactional content management, covering IPOs, M&A, and debt issuances, positions them as a vital player in high-stakes financial events. These complex processes require meticulous attention to detail and regulatory compliance, areas where DFIN excels.

While transaction volumes are inherently tied to market cycles, DFIN's deep-rooted presence and established market share in these critical, often recurring, financial activities ensure a steady revenue stream. Their specialized knowledge makes them an indispensable partner for companies navigating these demanding transactions.

Global Client Support & Regulatory Expertise

DFIN's Global Client Support & Regulatory Expertise functions as a classic Cash Cow within the BCG Matrix. They provide round-the-clock support, 365 days a year, demonstrating a commitment to client needs that builds significant loyalty.

This deep dive into regulatory landscapes across numerous jurisdictions is a key differentiator. For instance, in 2024, companies facing increasing compliance burdens, particularly in financial services, are willing to pay a premium for reliable, expert guidance. DFIN's proactive approach to understanding and navigating these complex rules ensures client retention.

The stable, high-value nature of this service requires minimal new investment in product development. Instead, it generates consistent, predictable cash flow. This is evidenced by DFIN's reported strong client retention rates, which have historically remained in the high 90s for its core regulatory services, a testament to the trust built through this expertise.

- 24/7/365 Client Support: Ensures immediate assistance and problem resolution for a global client base.

- Extensive Regulatory Expertise: Navigates complex and evolving global compliance requirements, a critical need for many businesses.

- High Client Loyalty: Built on consistent, reliable support and deep regulatory knowledge, leading to strong retention.

- Consistent Cash Flow: Generates stable revenue with lower reinvestment needs due to its established and trusted service offering.

Essential Regulatory Print & Distribution

DFIN's Essential Regulatory Print & Distribution services are a classic example of a cash cow within the BCG matrix. While the company is prioritizing digital offerings, this segment remains vital for legally mandated filings where physical copies are still required. This niche market is characterized by low growth but exceptional stability, as compliance needs ensure a steady demand.

The consistent cash flow generated by these essential print services requires minimal reinvestment, allowing DFIN to allocate capital to more dynamic growth areas. For instance, in 2024, regulatory print volumes, though not growing significantly, provided a predictable revenue stream.

- Stable Revenue: Essential regulatory documents, like certain SEC filings, still necessitate physical distribution, creating a reliable income source.

- Low Investment Needs: Minimal capital expenditure is required to maintain these print operations, enhancing their cash-generating efficiency.

- Predictable Demand: Compliance mandates ensure a consistent, albeit slow-growing, market for these services.

- Strategic Support: While not a growth engine, this segment underpins DFIN's broader compliance solutions by fulfilling all necessary distribution requirements.

DFIN's core SEC filing and reporting services, along with its technology-enabled compliance and communications management, are prime examples of cash cows. These established offerings provide essential, recurring revenue streams with minimal need for new investment. The company's deep expertise in transactional content management and global client support further solidifies these segments as reliable profit generators.

In 2024, DFIN's compliance solutions, a direct reflection of these cash cow segments, continued to be a significant contributor to revenue. Client retention rates in these areas remained exceptionally high, often in the high 90s, underscoring client loyalty built on consistent, expert service. This stability allows DFIN to efficiently generate profits from its dominant market share in these mature, yet critical, service areas.

| Segment | BCG Category | 2024 Revenue Contribution (Illustrative) | Key Characteristics |

|---|---|---|---|

| SEC Filing & Reporting | Cash Cow | High (e.g., 30-40%) | Mature market, stable demand, low growth, high profitability |

| Tech-Enabled Compliance & Comms | Cash Cow | High (e.g., 30-40%) | Recurring revenue, strong client loyalty, minimal reinvestment |

| Transactional Content Management | Cash Cow | Moderate (e.g., 15-20%) | Market share driven, steady demand from key events |

| Global Client Support & Regulatory Expertise | Cash Cow | Moderate (e.g., 10-15%) | High client retention, premium service, low capital needs |

What You See Is What You Get

DFIN BCG Matrix

The DFIN BCG Matrix preview you are viewing is precisely the same comprehensive document you will receive immediately after purchase. This means no watermarks, no altered content, and no limitations—just the fully formatted, professionally designed BCG Matrix ready for your strategic analysis and implementation. You can trust that the insights and structure presented here are exactly what you'll be working with, enabling you to make informed decisions with confidence.

Dogs

Outdated on-premise software solutions, not integrated with DFIN's modern cloud platforms like ActiveDisclosure or Arc Suite, are categorized as Dogs in the DFIN BCG Matrix. The financial sector's swift migration to cloud-based RegTech solutions means these older systems are experiencing a sharp drop in demand and market presence.

These legacy systems demand continuous upkeep but offer minimal growth potential, diverting valuable resources away from more promising ventures. For instance, a significant portion of the RegTech market, valued at approximately $15.3 billion in 2023 and projected to reach $38.5 billion by 2029, is now dominated by cloud-native offerings, leaving on-premise solutions with a shrinking niche.

Generic, Non-Regulatory Print Services are typically found in the question mark category of the DFIN BCG Matrix. These services, such as general marketing collateral or non-essential corporate printing, face declining demand as digital communication takes precedence.

In 2024, the demand for non-regulatory print services continued its downward trend. For instance, the global commercial printing market, excluding specialized segments like financial printing, saw a projected compound annual growth rate (CAGR) of only 1.2% from 2023 to 2028, a stark contrast to higher-growth sectors. This low growth indicates a commoditized market with minimal differentiation and limited potential for significant revenue generation.

These offerings often have a low market share and contribute little to a company's overall growth trajectory. Consequently, they are prime candidates for divestiture or a strategic reduction in investment, as resources can be better allocated to more promising business areas.

Manual compliance workflows, still prevalent in many firms, are classified as 'Dogs' in the DFIN BCG Matrix. These processes, often involving paper-based checks or disconnected digital systems, are a significant drag on operational efficiency. For instance, a 2024 survey indicated that over 40% of financial institutions still rely on manual data entry for regulatory reporting, leading to an average of 15% higher error rates compared to automated systems.

These manual efforts are characterized by their inefficiency and susceptibility to human error, offering no strategic advantage in today's fast-paced financial landscape. The cost of rectifying errors in manual compliance can be substantial, with some studies in 2024 suggesting that compliance failures due to manual oversights cost the industry billions annually in fines and remediation.

Attempting to 'turn around' these manual processes by investing in incremental improvements is generally not advisable. The market increasingly demands seamless, automated compliance solutions. Firms that continue to operate with manual workflows risk falling behind competitors who leverage integrated DFIN software for enhanced speed and accuracy.

Highly Niche, Unintegrated Legacy Data Tools

Highly niche, unintegrated legacy data tools represent the Dogs in DFIN's BCG Matrix. These are older, standalone applications or highly specific legacy systems that haven't been incorporated into DFIN's main software offerings, such as Arc Suite. They cater to declining or very fragmented client needs, meaning their market share is likely small and their growth prospects are minimal. For instance, a 2024 report indicated that 35% of financial institutions still rely on legacy data systems that are costly to maintain and lack modern integration capabilities, directly impacting their ability to adapt to evolving market demands.

These products often consume valuable resources, including IT support and development time, without contributing meaningfully to DFIN's overall strategic goals or revenue growth. Their continued existence can divert attention and investment away from more promising areas. For example, a company might spend upwards of $1 million annually maintaining a legacy data tool that serves only a handful of clients, a clear indicator of a Dog in the portfolio.

The strategic implication is clear: these tools are candidates for divestment, phasing out, or significant cost reduction efforts. Their low market share and limited growth potential make them unattractive for further investment. DFIN might consider migrating these clients to more integrated solutions or offering end-of-life support to manage the transition effectively.

- Low Market Share: Typically serve less than 5% of the client base.

- Minimal Growth Potential: Projected annual growth rates often below 1%.

- High Maintenance Costs: Can represent 15-20% of total IT operational expenditure for the specific function they serve.

- Lack of Strategic Alignment: Do not support DFIN's broader digital transformation or client integration strategies.

Non-Differentiated Consulting or Advisory Services

Non-differentiated consulting or advisory services within DFIN's offerings, those not intrinsically linked to or uniquely enhanced by their software, face significant headwinds. In a crowded market, generic advice without a distinct technological advantage struggles to capture substantial market share or achieve robust growth.

These services are likely to operate at a break-even point or even incur losses. For instance, if a competitor offers similar strategic advice without the need for DFIN's specialized software integration, the perceived value diminishes. In 2024, the consulting market saw a significant shift towards specialized, tech-enabled services, with generalist firms experiencing slower growth compared to those with niche expertise.

- Lack of Unique Value Proposition: Generic advice doesn't leverage DFIN's core software strengths, making it easily replicable.

- Intense Competition: The market for non-specialized consulting is highly saturated, with numerous players offering similar services.

- Pricing Pressure: Without differentiation, these services are susceptible to downward price pressure, impacting profitability.

- Limited Growth Potential: The inability to command premium pricing or capture significant market share restricts their growth trajectory.

Products or services that fall into the 'Dogs' category of the DFIN BCG Matrix are those with low market share and low growth potential. These offerings often require significant resources for maintenance but yield minimal returns, hindering overall business growth.

For instance, outdated on-premise software not integrated with modern cloud platforms, like DFIN's ActiveDisclosure, are prime examples of Dogs. In 2024, the RegTech market, valued at over $15.3 billion in 2023 and projected to grow significantly, is increasingly dominated by cloud-native solutions, leaving legacy systems with a shrinking, unprofitable niche.

Manual compliance workflows, characterized by inefficiency and high error rates, are also classified as Dogs. A 2024 survey indicated that over 40% of financial institutions still use manual data entry for reporting, leading to an average of 15% higher error rates compared to automated systems.

These offerings are typically candidates for divestiture, phasing out, or substantial cost reduction, as they divert attention and investment from more promising areas of the business.

| Category | Characteristics | Examples in DFIN Context | 2024 Market Data/Insights |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth Potential | Outdated on-premise software, Manual compliance workflows, Unintegrated legacy data tools, Non-differentiated consulting services | RegTech market growth favors cloud; manual compliance has higher error rates (est. 15% vs. automated); legacy systems costly to maintain. |

Question Marks

Blockchain-based solutions for Anti-Money Laundering (AML) and Know Your Customer (KYC) processes represent a significant growth frontier in the RegTech sector. These technologies offer the potential for unprecedented transparency and efficiency in regulatory compliance.

While DFIN may be investigating or developing blockchain applications for regulatory purposes, their current market penetration in this nascent field is likely minimal when contrasted with established players. The initial investment required to build and validate these complex systems is substantial, particularly given the dynamic nature of the regulatory technology landscape.

The global RegTech market was valued at approximately $10.1 billion in 2023 and is projected to reach $34.8 billion by 2028, exhibiting a compound annual growth rate of 27.9% during this period, according to MarketsandMarkets. This growth underscores the potential for blockchain to disrupt traditional compliance methods, though widespread adoption for AML/KYC is still in its early stages.

Advanced predictive compliance analytics, a key area within DFIN's AI strategy, focuses on anticipating regulatory shifts and potential compliance failures. This niche, while high-growth, is currently in early adoption stages, meaning DFIN's market share is still being established.

Developing these sophisticated tools requires substantial investment to transition them from experimental phases to market leadership. The market for these specialized analytics is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 20% in the broader regulatory technology space leading up to 2025.

DFIN's core strength lies in financial services, but the RegTech landscape is rapidly broadening. Consider the global RegTech market, which was valued at approximately $11.5 billion in 2023 and is projected to reach $35.5 billion by 2028, with a compound annual growth rate of over 25%. This expansion presents a significant opportunity for DFIN to leverage its expertise in compliance technology into other heavily regulated sectors such as healthcare or energy.

Venturing into these new verticals, like healthcare compliance or energy sector regulations, represents a classic "question mark" scenario in the DFIN BCG Matrix. While the growth potential is substantial, DFIN would likely enter these markets with a relatively low market share due to its established focus on finance. This necessitates a strategic approach, including in-depth market research and significant product adaptation to meet the unique compliance needs of these diverse industries.

AI Governance and Ethical AI Compliance Offerings

As regulatory scrutiny on AI intensifies, particularly concerning governance and bias, specialized compliance offerings are gaining traction. DFIN is positioned to enter this high-growth niche, though its current market share in AI governance and ethical compliance is likely nascent.

Developing competitive AI governance solutions demands substantial investment in research and development, alongside deep expertise in AI ethics and regulatory frameworks.

- Market Growth: The global AI governance market is projected to reach $1.5 billion by 2027, indicating a significant opportunity for new entrants.

- Regulatory Drivers: The EU AI Act, expected to be fully implemented in 2024, is a key driver for AI compliance solutions, setting stringent requirements for high-risk AI systems.

- Competitive Landscape: While established tech firms are developing internal AI governance tools, there's a growing demand for independent, specialized compliance providers.

- DFIN's Potential: DFIN could leverage its existing financial data and compliance expertise to build tailored AI governance solutions for financial institutions.

Geographic Expansion into Untapped Emerging Markets

Expanding DFIN's core software into emerging markets like Southeast Asia or parts of Latin America presents a significant growth avenue, tapping into regions with rapidly developing economies and less established competition. For instance, the Asia-Pacific region's digital transformation efforts are accelerating, with many countries prioritizing technology adoption in finance and business operations. This geographic expansion, while promising high returns, will necessitate navigating local regulatory frameworks and understanding distinct market demands.

DFIN's move into these less penetrated emerging markets is a strategic play for future revenue streams, aiming to capture market share before it becomes saturated. By 2024, the digital services market in many of these regions is projected to see substantial year-over-year growth, indicating a ripe environment for DFIN's solutions. However, success hinges on adapting offerings to local needs and overcoming potential hurdles such as established local players and varying compliance requirements.

- High Growth Potential: Emerging markets offer significant untapped customer bases for DFIN's software solutions.

- Challenges: Expect hurdles like local competition, complex regulations, and the need for market-specific product localization.

- 2024 Data Indicator: Many emerging economies are reporting double-digit growth in their digital infrastructure and software adoption rates.

- Strategic Imperative: Early market entry can establish DFIN as a leader, securing long-term market share in these developing economies.

Question Marks in DFIN's BCG Matrix represent areas with low market share in high-growth industries. These are typically new ventures or markets where DFIN is just beginning to establish a presence. Success here requires significant investment to build market share, as the potential for future growth is substantial.

Venturing into new verticals like healthcare or energy compliance exemplifies a Question Mark. While the growth potential is high, DFIN likely enters with a low market share, necessitating market research and product adaptation. The global RegTech market's projected growth to $35.5 billion by 2028 highlights this opportunity.

Emerging markets in Southeast Asia and Latin America also fit the Question Mark profile. DFIN's expansion into these regions, driven by accelerating digital transformation, offers high future revenue potential but demands navigating local regulations and competition. Digital services in these regions are seeing substantial growth, with many reporting double-digit increases in software adoption rates by 2024.

The AI governance market, projected to reach $1.5 billion by 2027, is another prime example. DFIN can leverage its financial compliance expertise here, but its current market share is nascent, requiring substantial R&D investment to compete effectively, especially with regulatory drivers like the EU AI Act in 2024.

| Category | Market Share | Market Growth | DFIN's Position | Strategic Focus |

|---|---|---|---|---|

| RegTech (New Verticals) | Low | High | Emerging | Investment for Market Share |

| Emerging Market Software | Low | High | Nascent | Localization & Entry |

| AI Governance Solutions | Low | High | Nascent | R&D & Specialization |

BCG Matrix Data Sources

Our DFIN BCG Matrix leverages comprehensive data from financial reports, market research, and industry performance metrics to provide a clear strategic overview.