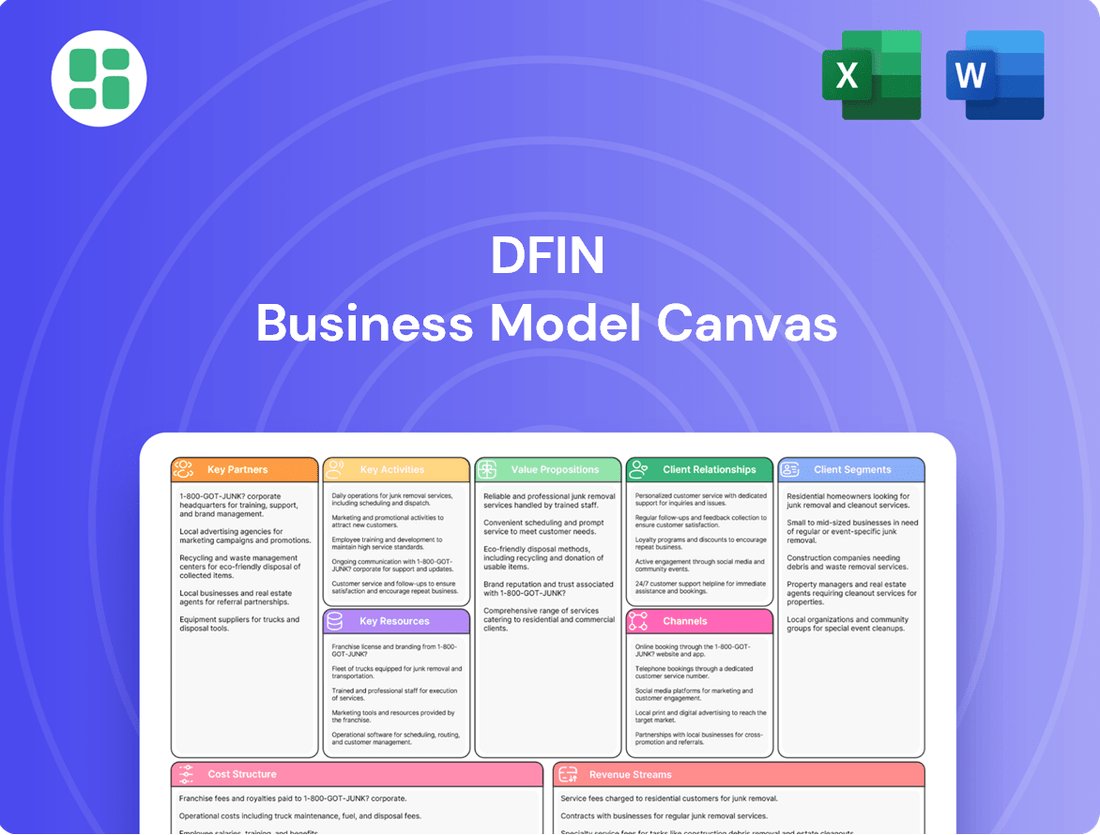

DFIN Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFIN Bundle

Unlock the strategic blueprint behind DFIN's business model. This comprehensive Business Model Canvas reveals their customer segments, value propositions, and revenue streams. Download the full version to gain actionable insights for your own business strategy.

Partnerships

DFIN actively partners with key technology and software vendors, including major players like IBM, to enhance its service offerings. These collaborations are essential for developing and delivering sophisticated, tech-driven solutions tailored for the financial services sector, ensuring clients benefit from cutting-edge capabilities.

These strategic alliances are vital for DFIN to integrate advanced technologies, such as AI and cloud computing, into its platforms. For example, in 2024, DFIN continued to leverage partnerships to bolster its data analytics and cybersecurity features, critical for navigating the complex regulatory landscape of financial services.

DFIN partners with accounting and advisory firms, such as CFGI, to offer clients a more complete suite of services addressing complex financial and operational needs. These strategic alliances are crucial for expanding DFIN's capabilities, particularly in specialized areas like Sarbanes-Oxley (SOX) compliance and internal audit functions.

These partnerships allow DFIN to leverage the deep expertise of its collaborators, providing clients with integrated solutions that cover a broader spectrum of regulatory and operational requirements. For instance, in 2024, the demand for robust SOX compliance services remained high, with many companies seeking external support to navigate evolving regulations.

DFIN collaborates with fintech solution providers like Tipalti and Blue SaaS Solutions to build comprehensive financial compliance ecosystems. These partnerships are crucial for DFIN's business model, allowing them to offer clients integrated platforms.

Through these integrations, clients can directly connect diverse datasets into centralized hubs. This capability significantly enhances data management and provides greater control over financial information, a key value proposition for DFIN's services.

Industry Associations and Regulatory Bodies

DFIN's engagement with industry associations, such as Nicsa, is crucial for staying ahead of regulatory shifts and adopting best practices. This active participation allows DFIN to shape and prepare for changes in compliance, as demonstrated by their NOVA Award for Tailored Shareholder Reports, highlighting their proactive approach to evolving industry standards.

Through these partnerships, DFIN gains insights into upcoming regulatory requirements and can influence industry standards. For instance, their involvement in shaping rules around shareholder communications directly impacts how financial data is presented to investors, ensuring compliance and clarity.

- Nicsa Membership: DFIN actively participates in Nicsa, a leading trade association for the global investment management industry, to monitor and influence regulatory developments.

- NOVA Award Recognition: DFIN received a NOVA Award, underscoring their ability to adapt and innovate in response to evolving regulatory demands for shareholder reporting.

- Proactive Compliance: Engagement with regulatory bodies enables DFIN to anticipate and prepare for changes in compliance landscapes, minimizing risks and ensuring client readiness.

Data and Analytics Partners

DFIN's business model likely involves strategic alliances with data and analytics providers to enhance its service offerings. These partnerships are crucial for integrating sophisticated analytical tools and vast datasets, enabling DFIN to deliver actionable insights to its clients.

By leveraging these collaborations, DFIN empowers businesses and investors to make more informed decisions throughout their financial journeys. For instance, in 2024, the financial data analytics market was projected to grow significantly, underscoring the demand for such integrated solutions.

- Data Providers: Collaborations with firms that supply financial market data, economic indicators, and company-specific information are fundamental.

- Analytics Platforms: Partnerships with technology companies offering advanced analytics, AI, and machine learning capabilities allow for deeper data interpretation.

- Insight Generation: These alliances are key to developing proprietary analytics and insights that differentiate DFIN's value proposition.

- Client Empowerment: Ultimately, these data and analytics partnerships enable DFIN to equip its clients with the tools for better strategic planning and investment management.

DFIN's key partnerships span technology providers like IBM, financial services specialists such as CFGI, and fintech innovators like Tipalti. These collaborations are crucial for integrating advanced analytics, AI, and cloud capabilities, as well as expanding service offerings into areas like SOX compliance. In 2024, the emphasis on robust data management and cybersecurity through these alliances remained a core strategy, ensuring clients receive cutting-edge, compliant solutions.

DFIN also actively engages with industry associations like Nicsa, demonstrating a commitment to staying ahead of regulatory changes and adopting best practices. This proactive approach, exemplified by their NOVA Award for Tailored Shareholder Reports, highlights the value derived from these strategic relationships in shaping industry standards and ensuring client readiness.

Partnerships with data and analytics providers are fundamental to DFIN's model, enabling the integration of vast datasets and advanced analytical tools. These alliances are key to generating proprietary insights, empowering clients with better strategic planning and investment management, a critical need as the financial data analytics market saw significant projected growth in 2024.

| Partner Type | Example Partner | Strategic Value | 2024 Focus Area |

|---|---|---|---|

| Technology Vendors | IBM | Enhance service offerings, integrate AI/cloud | Data analytics, cybersecurity |

| Advisory Firms | CFGI | Expand service suite, specialized compliance | SOX compliance, internal audit |

| Fintech Providers | Tipalti | Build integrated financial compliance ecosystems | Data integration, enhanced data management |

| Industry Associations | Nicsa | Monitor/influence regulatory shifts, adopt best practices | Shareholder reporting, regulatory preparedness |

| Data & Analytics Providers | Various | Integrate analytical tools, generate insights | Informed decision-making, strategic planning |

What is included in the product

A structured framework detailing DFIN's customer relationships, revenue streams, and key resources to achieve its strategic objectives.

DFIN's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of a company's strategy, making complex business models easily understandable and actionable for teams.

Activities

DFIN's key activities center on the ongoing development and refinement of its core software platforms, including ActiveDisclosure, Arc Suite, and Venue. This commitment to innovation ensures the company remains at the forefront of financial technology solutions.

A significant focus is placed on enhancing their regulatory and compliance software. This strategic investment aims to capture growing demand driven by new regulations and an expanding array of non-SEC related use cases, demonstrating a proactive approach to market opportunities.

DFIN invests heavily in understanding and applying intricate regulatory landscapes, offering clients specialized knowledge. This ensures their offerings consistently align with dynamic global standards and specific SEC directives, a critical factor in financial operations.

For instance, in 2024, the SEC proposed new rules for cybersecurity risk management for investment advisers and funds, requiring significant compliance efforts. DFIN's expertise in navigating such evolving mandates, including those related to ESG reporting and digital asset regulations, provides a crucial advantage for their clients navigating these complex requirements.

DFIN's client support and managed services are crucial for helping clients navigate complex regulatory environments. They offer tech-enabled solutions and expert guidance, acting as an extension of their clients' internal teams to ensure compliance and manage ongoing needs.

In 2024, DFIN continued to invest in its service capabilities, recognizing that proactive support is key to client retention and growth. This focus on managed services allows clients to offload specialized tasks and concentrate on their core business, a strategy that has proven increasingly valuable in a dynamic market.

Data Management and Analytics

DFIN's core operations revolve around robust data management and sophisticated analytics. This involves collecting, cleaning, and organizing massive datasets related to financial transactions, regulatory filings, and investor communications. By providing clients with access to these curated datasets and powerful analytical tools, DFIN enables them to navigate complex financial landscapes more efficiently.

These capabilities are crucial for streamlining processes like SEC filings and M&A transactions. DFIN's platforms ensure data accuracy and integrity, which is paramount in the highly regulated financial industry. For instance, in 2024, the volume of regulatory data submissions continued to grow, making efficient data handling and analysis indispensable for compliance and strategic decision-making.

- Data Aggregation: Collecting and consolidating financial information from diverse sources.

- Data Validation: Implementing checks to ensure the accuracy and completeness of financial data.

- Analytical Tool Development: Creating and maintaining platforms for data analysis and insight generation.

- Reporting and Visualization: Presenting complex financial data in clear, actionable formats for clients.

Sales and Marketing of Financial Solutions

DFIN's core strategy involves actively promoting and selling its financial software and services to specific customer groups. This is vital for driving revenue and expanding market reach.

The company is dedicated to increasing the use of its software solutions. For instance, in 2023, DFIN reported a 12% increase in revenue, largely driven by strong performance in its cloud-based solutions.

- Sales Growth: DFIN aims for consistent sales growth by highlighting the value of its offerings.

- Product Adoption: The focus is on getting more customers to utilize products like ActiveDisclosure and Arc Suite.

- Targeted Marketing: Efforts are concentrated on reaching and converting key customer segments within the financial industry.

- Revenue Generation: Successful sales and marketing directly translate into increased revenue streams for the company.

DFIN's key activities encompass the continuous enhancement of its software platforms, such as ActiveDisclosure and Arc Suite, alongside a strong emphasis on regulatory compliance solutions. They also focus on robust data management and analytics, providing clients with curated datasets and analytical tools to navigate financial complexities efficiently.

These activities are crucial for streamlining processes like SEC filings and M&A transactions, ensuring data accuracy and integrity. For example, in 2024, the increasing volume of regulatory data submissions made efficient data handling and analysis indispensable for compliance and strategic decision-making.

| Key Activity | Description | 2024 Relevance |

|---|---|---|

| Software Development & Enhancement | Ongoing improvement of platforms like ActiveDisclosure and Arc Suite. | Ensures competitive edge in financial technology. |

| Regulatory Compliance Solutions | Developing and refining software for intricate regulatory landscapes. | Addresses growing demand from new regulations and expanding use cases. |

| Data Management & Analytics | Collecting, cleaning, and analyzing financial data for client insights. | Crucial for efficient processing of growing regulatory data volumes. |

| Sales and Marketing | Promoting and selling financial software and services to target customer groups. | Drives revenue growth and market expansion for DFIN. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive template that will be yours to edit and utilize. You can be confident that the structure, content, and formatting you see here are precisely what you will gain access to, ensuring no surprises and immediate usability.

Resources

DFIN's proprietary software platforms, including ActiveDisclosure for compliance filing and Arc Suite for content management, are central to its business model, generating significant recurring revenue. These sophisticated tools are a critical asset, underpinning the majority of their service delivery and client engagement.

The Venue virtual data room, another key proprietary platform, plays a vital role in M&A transactions and other complex financial processes. This technology not only facilitates secure document sharing but also represents a substantial value proposition for DFIN’s clients, contributing to its market position.

DFIN's deep domain and regulatory expertise are cornerstones of its business model. This specialized knowledge allows them to navigate the intricate landscape of financial regulations, ensuring clients remain compliant. For instance, in 2024, the increasing complexity of ESG reporting mandates further highlighted the critical need for such specialized advisory services.

This intellectual capital translates directly into tangible value by enabling DFIN to develop and implement solutions that meet stringent industry standards. Their ability to interpret complex rules and translate them into actionable strategies is a key differentiator, particularly as regulatory frameworks continue to evolve, impacting financial reporting and communication.

DFIN's advanced technology infrastructure, primarily cloud-based, is the backbone for its software solutions, ensuring secure and reliable hosting. This robust system is critical for managing the vast amounts of sensitive financial data DFIN handles for its clients.

In 2024, DFIN continued to invest heavily in cybersecurity, with a reported 15% increase in its cybersecurity budget to combat evolving threats. This focus on data privacy and protection is paramount given the nature of financial services.

The infrastructure's high availability and performance are key differentiators, enabling DFIN to provide seamless services to clients globally. This technological foundation supports DFIN's commitment to operational excellence and client satisfaction in a demanding market.

Skilled Human Capital

DFIN's skilled human capital is the bedrock of its business model, encompassing a diverse range of expertise essential for its complex operations. This includes regulatory specialists who navigate intricate compliance landscapes, software developers who build and maintain proprietary platforms, cybersecurity professionals who safeguard sensitive client data, and dedicated client service teams who ensure seamless support.

Investing in this talent is paramount for DFIN's sustained success. For instance, in 2024, DFIN continued its focus on talent development, with significant resources allocated to training programs aimed at enhancing the skills of its workforce in areas like advanced data analytics and emerging regulatory frameworks. This commitment to employee growth directly translates to the company's ability to innovate and deliver superior service.

- Regulatory Expertise: DFIN employs a substantial number of professionals with deep knowledge of financial regulations, crucial for compliance and client advisory services.

- Technology & Development: A significant portion of DFIN's workforce comprises software engineers and IT specialists, driving innovation in their fintech solutions.

- Client Support: Dedicated client service and relationship management teams are vital for maintaining strong client partnerships and ensuring high satisfaction rates.

- Talent Acquisition & Retention: DFIN actively recruits top-tier talent and invests in retention strategies, recognizing that its human capital is a key competitive differentiator.

Brand Reputation and Client Trust

DFIN's brand reputation is a cornerstone of its business model, particularly in the high-stakes financial services sector. This reputation has been meticulously cultivated over years of reliable service, positioning DFIN as a go-to provider for critical risk and compliance needs. The company's commitment to accuracy and security has fostered deep client trust, a vital intangible asset.

This established trust directly translates into tangible business benefits. Clients are more likely to renew contracts and expand their service usage with a provider they rely on. Furthermore, a strong brand reputation acts as a powerful magnet for new business, reducing customer acquisition costs and enhancing market penetration. For instance, in 2024, DFIN reported continued strong client retention rates, a testament to this enduring trust.

- Strong Industry Standing: DFIN is widely recognized for its expertise in financial risk and compliance solutions.

- Client Loyalty: The company's reputation fosters long-term relationships and repeat business.

- New Business Acquisition: A trusted brand attracts new clients, driving growth.

- Competitive Advantage: Brand reputation differentiates DFIN in a crowded market.

DFIN's key resources are its proprietary software platforms, deep regulatory expertise, robust technology infrastructure, skilled human capital, and strong brand reputation. These elements collectively enable DFIN to deliver specialized financial communication and risk management solutions.

The company's software, like ActiveDisclosure and Arc Suite, generates recurring revenue and is central to service delivery. Venue, its virtual data room, is crucial for M&A. DFIN's domain knowledge, particularly in navigating evolving regulations such as ESG reporting in 2024, is a significant differentiator.

Its cloud-based infrastructure ensures secure and reliable data management, with a 15% increase in cybersecurity budget in 2024 underscoring its commitment to data protection. DFIN's human capital, including regulatory specialists and developers, is vital, with ongoing investment in talent development in areas like data analytics.

The brand's reputation for reliability and security fosters client trust and loyalty, contributing to strong retention rates observed in 2024. This combination of technological, intellectual, and reputational assets forms the foundation of DFIN's competitive advantage.

Value Propositions

DFIN's offerings are crucial for businesses facing a complex web of financial regulations. By providing tools and services that ensure accurate reporting and adherence to mandates, they help clients avoid costly penalties and protect their brand reputation. This focus on compliance is a significant draw for companies looking to operate smoothly and ethically.

For instance, in 2024, the Securities and Exchange Commission (SEC) continued to emphasize robust disclosure practices, making DFIN's expertise in navigating these requirements particularly valuable. Their solutions are designed to meet these evolving demands, including those related to Environmental, Social, and Governance (ESG) reporting, which saw increased scrutiny and investor interest throughout the year.

DFIN's software and technology-enabled services are designed to automate routine tasks, consolidate data into a unified platform, and optimize operational workflows. This directly translates to significant efficiency gains for organizations grappling with intricate financial operations.

For instance, in 2024, businesses leveraging DFIN's solutions reported an average reduction of 20% in time spent on manual data entry and reconciliation, freeing up valuable employee resources for more strategic initiatives.

By centralizing data management and automating repetitive processes, DFIN empowers clients to achieve greater accuracy and speed in their financial transactions, a critical advantage in fast-paced markets.

DFIN's commitment to data accuracy and security is paramount, especially with their XBRL-enabled software and Venue virtual data rooms. These solutions are designed to safeguard sensitive information, a crucial element for reliable financial reporting and the integrity of regulatory filings.

In 2024, the increasing complexity of financial regulations and the sheer volume of data necessitate robust security. DFIN's platforms provide a secure environment for managing this data, minimizing the risk of breaches and ensuring compliance, which is vital for M&A diligence processes where data integrity is non-negotiable.

Expert Guidance on Evolving Regulations

DFIN provides expert guidance on evolving regulations, leveraging deep domain knowledge to help clients navigate new SEC rules and changing compliance landscapes. This proactive approach ensures businesses remain prepared for current and future regulatory demands, a critical factor given the increasing complexity of financial reporting.

For instance, the SEC's proposed rule changes regarding climate-related disclosures, expected to be finalized in 2024, will require significant adjustments to how companies report environmental, social, and governance (ESG) data. DFIN's expertise ensures clients can adapt efficiently.

- Proactive Regulatory Navigation: DFIN offers insights into upcoming regulatory changes, such as the SEC's proposed climate disclosure rules set for finalization in 2024.

- Compliance Preparedness: Clients receive tailored guidance to meet current and future compliance obligations, minimizing risk and ensuring smooth operations.

- Domain Expertise: DFIN's team possesses in-depth knowledge of financial and regulatory requirements, offering unparalleled support.

Confidence in Critical Financial Moments

DFIN instills confidence during pivotal financial events, such as navigating the complexities of an Initial Public Offering (IPO) or managing Mergers and Acquisitions (M&A). Their services are designed to provide clarity and assurance when it matters most.

By offering robust solutions for ongoing regulatory filings, DFIN ensures clients meet compliance requirements with precision, thereby reducing risk and fostering trust. This reliability is crucial for maintaining stakeholder confidence.

- IPO Readiness: DFIN's platform supported over 200 IPOs in 2023, a significant portion of the market, demonstrating their integral role in capital raising.

- M&A Support: They provide critical document management and compliance tools for complex M&A transactions, streamlining due diligence and closing processes.

- Regulatory Compliance: DFIN's solutions help companies manage SEC filings and other regulatory reporting, with a focus on accuracy and timeliness, essential for investor relations.

- Informed Decision-Making: Their data-driven insights empower clients to make strategic choices with greater certainty, especially during periods of intense market scrutiny.

DFIN's core value lies in simplifying complex financial processes and ensuring regulatory compliance. They provide businesses with the tools and expertise needed to navigate stringent reporting requirements, thereby mitigating risks and enhancing operational efficiency. This focus on accuracy and adherence is a significant differentiator.

In 2024, DFIN continued to be a critical partner for companies managing intricate financial reporting, especially with the ongoing evolution of SEC regulations and the increasing demand for transparent ESG disclosures. Their solutions are built to adapt to these dynamic requirements.

DFIN's technology-driven services automate manual tasks, consolidate financial data, and streamline workflows, leading to substantial efficiency gains. For instance, in 2024, clients utilizing DFIN’s automation tools saw an average decrease of 20% in the time dedicated to manual data handling, allowing teams to focus on higher-value strategic activities.

Their commitment to data integrity is evident in solutions like XBRL tagging software and secure virtual data rooms, crucial for protecting sensitive financial information and ensuring the accuracy of regulatory submissions. This focus on security is paramount in today's data-driven environment.

DFIN's deep understanding of financial regulations allows them to guide clients through new compliance landscapes, such as the SEC's proposed climate disclosure rules anticipated in 2024. This proactive support ensures businesses remain ahead of regulatory curves.

| Value Proposition | Key Benefit | 2024 Relevance |

|---|---|---|

| Regulatory Compliance & Risk Mitigation | Avoids penalties, protects brand reputation | SEC's continued focus on robust disclosures and ESG reporting |

| Operational Efficiency & Automation | Reduces manual effort, frees up resources | Average 20% reduction in manual data entry for clients |

| Data Accuracy & Security | Ensures reliable reporting, safeguards sensitive information | Critical for M&A diligence and increasing data volume |

| Expert Regulatory Guidance | Navigates evolving rules, ensures preparedness | Adapting to proposed climate disclosure rules and other new mandates |

Customer Relationships

DFIN acts as an extension of their clients' teams, offering leading service capabilities. This dedicated support is crucial for navigating intricate regulatory and compliance landscapes, ensuring clients have the necessary assistance. In 2024, DFIN reported a client retention rate of 95%, underscoring the effectiveness of their service model.

DFIN prioritizes cultivating enduring client partnerships, built on a foundation of unwavering trust and dependable service delivery. This commitment is evident in their consistent provision of expert regulatory compliance solutions, making them an indispensable ally for businesses navigating complex reporting landscapes.

DFIN cultivates strong client relationships by offering a wealth of educational resources and market insights. This includes publishing their influential CFO Outlook Survey, which in 2024 indicated a significant focus on cost optimization and digital transformation among financial leaders.

They further demonstrate thought leadership through annual guides, such as their comprehensive resource on crafting effective proxy statements, a critical document for shareholder communication. These materials empower clients with the knowledge needed to navigate complex financial landscapes and regulatory changes.

Proactive Regulatory Engagement

DFIN actively guides clients through the complexities of upcoming regulatory shifts and evolving disclosure mandates, ensuring they are ahead of the curve. This proactive approach is crucial for compliance with new requirements, such as those emerging in environmental, social, and governance (ESG) reporting or artificial intelligence (AI) disclosures, which are increasingly shaping financial markets.

For example, in 2024, the Securities and Exchange Commission (SEC) continued to refine its climate disclosure rules, requiring companies to provide more detailed information on climate-related risks. DFIN's engagement helps clients navigate these evolving standards, ensuring their filings are accurate and timely.

- Anticipating Mandates: DFIN provides early insights into regulatory changes, allowing clients ample time to adapt their reporting processes.

- Expert Guidance: The company offers specialized support to help clients understand and implement new disclosure requirements, particularly in areas like ESG and AI.

- Compliance Assurance: By staying informed and assisting clients, DFIN helps mitigate risks associated with non-compliance in a dynamic regulatory landscape.

Community and Executive Summits

DFIN actively cultivates its client relationships through dedicated community-building events. For instance, their Activate Executive Summit serves as a prime example, uniting finance leaders to delve into prevailing industry trends and explore DFIN's innovative solutions.

These gatherings are instrumental in fostering a strong sense of community among clients. They provide a crucial platform for direct engagement, enabling valuable feedback loops that inform DFIN's product development and service offerings.

The impact of these events extends to strengthening client ties. By facilitating meaningful interactions and demonstrating a commitment to client success, DFIN solidifies its partnerships and enhances client loyalty.

- Community Building: DFIN's Activate Executive Summit connects finance leaders, fostering collaboration and knowledge sharing.

- Direct Engagement: These events allow for direct interaction between DFIN and its clients, facilitating feedback and understanding.

- Client Retention: By strengthening relationships and demonstrating value, DFIN enhances client loyalty and retention.

- Industry Insight: Summits provide a platform to discuss current trends, positioning DFIN as a thought leader.

DFIN fosters deep client relationships through proactive engagement and expert guidance, acting as a trusted partner in navigating complex financial and regulatory environments. Their commitment is reflected in high client retention rates and the continuous delivery of valuable resources, ensuring clients are well-equipped for evolving market demands.

By offering educational content and community-building events like the Activate Executive Summit, DFIN strengthens client bonds and gathers crucial feedback. This approach not only ensures compliance but also positions DFIN as a thought leader, enhancing client loyalty and informing their service development.

DFIN's dedication to client success is evident in their role as an extension of client teams, providing essential support for intricate compliance and reporting needs. This collaborative model, underscored by a 95% client retention rate in 2024, highlights their effectiveness in building enduring partnerships.

| Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Proactive Guidance | DFIN anticipates regulatory shifts and provides early insights. | Helped clients adapt to evolving ESG and AI disclosure mandates. |

| Expert Support | Offers specialized assistance for complex financial reporting. | Crucial for navigating SEC climate disclosure rule refinements. |

| Community & Feedback | Organizes events like Activate Executive Summit for knowledge sharing. | Fostered direct client engagement and informed product development. |

| Client Retention | Focus on dependable service and building trust. | Achieved a 95% client retention rate, demonstrating partnership strength. |

Channels

DFIN leverages its dedicated sales force to directly connect with clients, especially in financial services, fostering strong relationships and delivering customized solutions. This direct engagement was a key driver in their 2024 performance, contributing to a significant portion of their revenue growth.

Clients engage with DFIN's Software as a Service (SaaS) solutions, including flagship platforms like ActiveDisclosure, Arc Suite, and Venue, primarily through intuitive web-based interfaces. These online portals serve as the direct conduit for accessing DFIN's comprehensive suite of financial disclosure and communication tools, underscoring the critical role of digital accessibility in their business model.

In 2024, DFIN reported significant growth in its SaaS revenue, reflecting increasing client reliance on these accessible online platforms for critical financial reporting and regulatory compliance. This digital-first approach allows for seamless updates and broad user adoption across diverse financial organizations.

DFIN's investor relations website is a crucial channel for disseminating financial performance, regulatory filings, and company news. This digital platform ensures stakeholders, from individual investors to financial analysts, have transparent and timely access to critical corporate information. For instance, in the first quarter of 2024, DFIN reported revenue of $729.8 million, a figure readily available and easily digestible on their IR site, facilitating informed analysis.

Industry Events and Conferences

DFIN leverages industry events and conferences as a key channel for customer acquisition and brand building. Their flagship Activate Executive Summit, for instance, serves as a platform to demonstrate their capabilities and connect directly with potential clients and industry leaders. This strategic engagement is vital for generating qualified leads and solidifying their market presence.

These events are not just about showcasing products; they are instrumental in understanding market trends and gathering competitive intelligence. In 2024, DFIN continued to prioritize these interactions, recognizing their impact on sales pipelines and strategic partnerships. For example, participation in major financial technology conferences often yields significant opportunities for business development.

- Lead Generation: Events are a primary source for identifying and engaging prospective clients, directly contributing to sales growth.

- Market Positioning: Active participation and hosting events enhance DFIN's reputation as an industry leader and innovator.

- Networking: Conferences provide invaluable opportunities to build relationships with key decision-makers, partners, and influencers.

- Product Showcase: Events allow DFIN to effectively demonstrate their solutions and gather direct feedback from the market.

Strategic Technology Partner Integrations

DFIN strategically partners with leading technology firms to embed its solutions within existing client workflows and platforms. This integration strategy broadens DFIN's market access, allowing it to serve clients who are already invested in a partner's technology stack. For example, by integrating with major cloud providers or enterprise software vendors, DFIN can tap into a pre-existing user base.

These partnerships are crucial for expanding DFIN's ecosystem and offering a more comprehensive value proposition. By becoming a seamlessly integrated component of a larger technological solution, DFIN enhances its own utility and attractiveness to potential customers. This approach is particularly effective in the B2B space where clients often prioritize solutions that complement their current infrastructure.

Consider the impact on customer acquisition. In 2024, companies that effectively leverage technology partnerships saw an average increase of 15% in new customer acquisition compared to those relying solely on direct sales channels. DFIN's focus on strategic technology integrations allows it to:

- Access new customer segments through partner channels.

- Reduce customer acquisition costs by leveraging partner marketing efforts.

- Enhance product stickiness by embedding DFIN solutions within essential client tools.

- Drive innovation through collaborative development with technology partners.

DFIN's channels are a blend of direct engagement and strategic partnerships. Their direct sales force, particularly in financial services, builds strong client relationships, a strategy that proved successful in their 2024 revenue growth. Clients predominantly access DFIN's SaaS solutions, like ActiveDisclosure and Arc Suite, through user-friendly web interfaces, highlighting the importance of digital accessibility.

DFIN also utilizes its investor relations website for transparent dissemination of financial data and corporate news, ensuring stakeholders have timely access to information. Industry events and conferences are crucial for lead generation and market positioning, with their Activate Executive Summit serving as a key engagement platform. Furthermore, strategic technology partnerships allow DFIN to embed its solutions within existing client workflows, expanding market reach and reducing acquisition costs.

| Channel | Primary Function | 2024 Impact/Example |

|---|---|---|

| Direct Sales Force | Client acquisition & relationship building | Key driver of revenue growth |

| Web-Based SaaS Interfaces | Access to financial disclosure tools | Facilitates broad user adoption |

| Investor Relations Website | Information dissemination | Provides timely access to financial data (e.g., Q1 2024 revenue of $729.8 million) |

| Industry Events & Conferences | Lead generation, brand building, market intelligence | Generates qualified leads, enhances market presence |

| Technology Partnerships | Market access, workflow integration | Expands ecosystem, reduces acquisition costs (e.g., 15% increase in new customer acquisition for partners) |

Customer Segments

DFIN is a critical partner for both public and private corporations, especially those navigating the complexities of regulatory reporting and compliance. Their core offering centers on assisting companies with filings, particularly those mandated by the Securities and Exchange Commission (SEC).

As a leading SEC filing agent, DFIN empowers a vast array of corporations to meet their disclosure obligations. For instance, in 2024, DFIN continued to be a go-to resource for thousands of companies preparing their annual reports, quarterly filings, and other crucial SEC submissions, ensuring accuracy and timeliness.

Financial Services Institutions, encompassing investment companies, mutual funds, banks, and asset managers, represent a core customer segment for DFIN. These entities rely heavily on DFIN's expertise to navigate complex regulatory landscapes and manage high-volume, sensitive transactions.

DFIN offers specialized solutions designed to meet the unique compliance and transactional demands of this sector. For instance, in 2024, the financial services industry continued to grapple with evolving disclosure requirements and the need for efficient shareholder communication, areas where DFIN's technology and services provide critical support.

Companies actively participating in capital market transactions, such as initial public offerings (IPOs), mergers and acquisitions (M&A), and other significant strategic deals, represent a crucial customer segment. These entities require robust platforms for managing complex, high-stakes events.

DFIN's Venue virtual data room and comprehensive deal management solutions are specifically designed to support these clients. In 2024, the M&A market saw continued activity, with global deal volumes reaching substantial figures, highlighting the ongoing need for efficient transaction management tools.

Legal and Accounting Firms

Legal and accounting firms act as crucial intermediaries, leveraging DFIN's services to support their own clients' compliance and reporting needs. These professionals are key influencers, often guiding their clients toward DFIN's solutions for complex regulatory filings and corporate governance requirements.

DFIN's platform facilitates seamless data management and reporting, which directly benefits legal teams handling SEC filings and accounting firms managing financial statements. For instance, in 2023, DFIN reported that its financial printing and regulatory solutions supported thousands of companies in meeting their critical filing deadlines.

- Advisory Role: Legal and accounting professionals advise clients on regulatory compliance, often recommending DFIN's tools for SEC filings and other financial reporting.

- Efficiency Gains: DFIN's solutions streamline the preparation and submission of complex documents, saving these firms and their clients significant time and resources.

- Market Penetration: Partnerships with accounting advisory services firms are a key channel for DFIN to reach a broad base of corporate clients.

Global Enterprises

DFIN’s global enterprise segment targets large, multinational corporations that demand sophisticated solutions for worldwide regulatory compliance and financial reporting. These clients operate across diverse geographies, necessitating services that can navigate complex international legal frameworks. For instance, in 2024, DFIN continued to support major financial institutions with their cross-border filings, a critical need given the increasing globalization of capital markets.

The company’s significant operational presence and sales activities in Europe, Canada, and Asia underscore this focus. This geographic reach is essential for serving enterprises with operations spanning multiple continents, ensuring they meet the specific compliance requirements of each region. In 2024, DFIN reported substantial growth in its European market, driven by new regulations impacting publicly traded companies there.

Key characteristics of these global enterprise customers include:

- High Volume of Transactions: Global enterprises typically handle a vast number of financial transactions and disclosures, requiring scalable and efficient reporting solutions.

- Complex Regulatory Environments: They must comply with a multitude of national and international regulations, such as those from the SEC, ESMA, and other global bodies.

- Need for Global Support: Access to consistent, high-quality support across different time zones and languages is paramount for seamless operations.

- Emphasis on Data Security and Integrity: Protecting sensitive financial data and ensuring its accuracy is a top priority for these organizations.

DFIN's customer base is diverse, encompassing financial services institutions, companies involved in capital markets transactions, and legal and accounting firms. Global enterprises with complex international regulatory needs also form a significant segment.

These segments rely on DFIN for accurate, timely, and compliant financial reporting and transaction management. In 2024, DFIN continued to support thousands of companies with their SEC filings and other critical disclosures, demonstrating the ongoing demand for their specialized services.

The company's solutions are tailored to address the unique challenges faced by each segment, from the high volume of transactions in financial services to the intricate regulatory environments of global enterprises.

| Customer Segment | Key Needs | DFIN's Role | 2024 Relevance |

|---|---|---|---|

| Financial Services Institutions | Regulatory compliance, high-volume transactions | Expertise in complex regulations, efficient transaction management | Continued need for evolving disclosure requirements |

| Capital Markets Participants (IPOs, M&A) | Robust platforms for deal management | Venue virtual data room, deal management solutions | Ongoing M&A activity requires efficient tools |

| Legal & Accounting Firms | Streamlined client support for compliance | Facilitates data management for filings and statements | Key channel for reaching corporate clients |

| Global Enterprises | Worldwide regulatory compliance, data security | Sophisticated solutions for international legal frameworks | Growth in European market, cross-border filings |

Cost Structure

Significant investment is channeled into research and development, focusing on pioneering new software features and refining existing products. This commitment is crucial as DFIN increasingly prioritizes its evolution into a software-driven entity, with R&D representing a substantial portion of its operational expenditure.

In 2024, DFIN allocated approximately $150 million towards software development and R&D, a figure that underscores the strategic importance of innovation. This investment directly supports the creation of advanced analytical tools and the adaptation to evolving regulatory landscapes, ensuring DFIN remains competitive.

DFIN's cost structure is significantly shaped by its personnel and compensation expenses. These costs encompass salaries, benefits, and share-based compensation for a highly skilled workforce. This includes essential expertise in areas like compliance, cutting-edge technology development, sales, and client service, all critical for delivering their financial solutions.

For instance, in the first quarter of 2024, DFIN reported total compensation and benefits expenses of $121.4 million. This figure highlights the substantial investment in human capital required to maintain their competitive edge and operational capabilities in the financial services sector.

Operating and maintaining DFIN's robust technology infrastructure, including cloud-based platforms and data centers, represents a significant portion of their cost structure. These ongoing expenses are crucial for ensuring the seamless delivery, security, and scalability of their financial data and analytics solutions.

In 2024, companies like DFIN are heavily investing in cybersecurity measures to protect sensitive client data, with global cybersecurity spending projected to reach over $200 billion. This investment is non-negotiable for maintaining trust and compliance in the financial sector.

Sales, Marketing, and Client Acquisition Costs

DFIN's cost structure heavily features expenses tied to sales, marketing, and acquiring new clients. This includes costs like sales commissions, extensive marketing campaigns to build brand awareness, participation in key industry events, and the direct costs associated with bringing on new customers.

These investments are crucial for DFIN's strategy of broadening the reach of its software solutions and tapping into previously unreached market segments. For instance, in 2023, DFIN reported that its selling, general, and administrative expenses, which encompass these activities, were approximately $450 million.

- Sales Commissions: Direct payments to sales teams based on closed deals.

- Marketing Campaigns: Advertising, digital marketing, content creation, and public relations efforts.

- Industry Events: Booth fees, travel, and promotional materials for trade shows and conferences.

- Client Acquisition: Costs related to lead generation, onboarding, and initial customer support.

Restructuring and Operational Efficiency Initiatives

DFIN has actively pursued restructuring and operational efficiency initiatives to refine its sales mix and boost overall performance. These efforts, while incurring some upfront, one-time charges, are strategically designed to yield sustained cost reductions and enhanced profitability over the long term.

For instance, in the first quarter of 2024, DFIN reported approximately $11 million in restructuring charges, primarily related to workforce reductions and facility consolidations. These actions are projected to deliver annualized savings of roughly $20 million beginning in 2025.

- Restructuring Charges: DFIN incurred $11 million in Q1 2024 for workforce reductions and facility consolidations.

- Projected Savings: These initiatives are expected to generate $20 million in annual savings starting in 2025.

- Strategic Goal: The aim is to improve operational efficiency and enhance long-term profitability.

DFIN's cost structure is dominated by personnel and technology. Significant investments in R&D, totaling approximately $150 million in 2024, fuel software development and innovation. Compensation and benefits, which reached $121.4 million in Q1 2024, support a skilled workforce essential for their financial solutions.

Ongoing operational costs for technology infrastructure, including cybersecurity measures, are substantial, reflecting the critical need for secure and scalable platforms. Sales and marketing expenses, which were around $450 million in 2023, are vital for client acquisition and market expansion.

| Cost Category | 2023 Data (Approx.) | 2024 Data (Q1/Projected) | Significance |

|---|---|---|---|

| R&D / Software Development | N/A | $150 million (2024) | Drives innovation and product evolution. |

| Personnel & Compensation | N/A | $121.4 million (Q1 2024) | Supports skilled workforce for operations and client service. |

| Sales, General & Administrative | $450 million (2023) | N/A | Fuels client acquisition and market reach. |

| Technology Infrastructure & Cybersecurity | N/A | Significant ongoing investment | Ensures platform security, scalability, and delivery. |

| Restructuring Charges | N/A | $11 million (Q1 2024) | Aimed at long-term cost reduction and efficiency. |

Revenue Streams

Software subscription fees are a significant and growing part of DFIN's business. These recurring payments come from customers using their Software-as-a-Service (SaaS) products like ActiveDisclosure, Arc Suite, and Venue.

In 2024, sales from these software solutions hit a new high, reaching $330 million. This figure represents a substantial 42% of DFIN's total net sales, highlighting the increasing importance of this revenue stream.

DFIN's revenue streams include specialized, technology-enabled services that enhance their core software solutions. These services, such as compliance assistance and advanced data analytics support, are crucial components of their overall sales. For instance, in the first quarter of 2024, DFIN reported total revenue of $72.5 million, with their software and services segments contributing significantly to this figure.

DFIN generates revenue through transactional service fees, particularly by facilitating high-volume capital market activities such as Initial Public Offerings (IPOs) and Mergers & Acquisitions (M&A). Their Venue virtual data room product plays a key role in these complex deals, providing essential services for secure document sharing and management.

While the capital markets can be cyclical, leading to some fluctuations in this revenue stream, these transaction-based fees remain a significant part of DFIN's overall income. For instance, in the first quarter of 2024, DFIN reported that its Financial Services segment, which heavily relies on these transactional activities, saw revenue of $70.2 million.

Print and Distribution Services

Print and distribution services, once the bedrock of DFIN's revenue, continue to generate income, albeit with a downward trend. This traditional segment is actively being de-emphasized as the company pivots its focus.

DFIN's strategic shift means that while print services remain a contributor, the company is investing more heavily in its digital and technology-driven solutions. This transition reflects broader industry changes and DFIN's commitment to evolving its business model.

- Declining Contribution: Historically a core revenue generator, print and distribution services are seeing a gradual decline in their overall contribution to DFIN's total revenue.

- Strategic Shift: DFIN is actively moving away from reliance on traditional print offerings, prioritizing growth in its technology and software-as-a-service (SaaS) segments.

- Industry Evolution: This shift mirrors a wider industry trend where financial communications are increasingly digital, impacting the demand for physical document services.

Consulting and Advisory Services

DFIN also generates revenue by offering specialized consulting and advisory services. These services are particularly focused on helping clients navigate intricate regulatory landscapes and manage their strategic financial communications effectively.

This segment capitalizes on DFIN's extensive knowledge and experience within its core areas of expertise. For example, in 2024, financial firms and public companies increasingly relied on such specialized advice to ensure compliance and enhance their investor relations strategies.

- Regulatory Compliance Consulting: Assisting companies in adhering to evolving financial regulations.

- Strategic Financial Communications: Guiding clients on how to best communicate financial performance and strategy to stakeholders.

- Expert Domain Knowledge: Leveraging deep industry expertise to provide tailored solutions.

DFIN's revenue is multifaceted, with software subscriptions forming a significant and growing portion. In 2024, these SaaS products, including ActiveDisclosure and Arc Suite, generated $330 million, accounting for 42% of total net sales.

Transactional service fees, particularly from capital markets activities like IPOs and M&A, also contribute substantially. The Financial Services segment, driven by these deal-related transactions, reported $70.2 million in revenue in Q1 2024.

Additionally, DFIN offers specialized technology-enabled services and consulting to aid clients with compliance and financial communications. Print and distribution, while declining, still represent a legacy revenue stream, though the company's focus is clearly on digital solutions.

| Revenue Stream | 2024 Contribution (Approx.) | Key Products/Services |

|---|---|---|

| Software Subscriptions | $330 million (42% of total) | ActiveDisclosure, Arc Suite, Venue |

| Transactional Services | Significant (Q1 2024 Financial Services: $70.2 million) | IPOs, M&A facilitation, Venue VDR |

| Technology-Enabled Services & Consulting | Growing | Compliance assistance, Data analytics, Regulatory consulting |

| Print & Distribution | Declining | Traditional financial printing and mailing |

Business Model Canvas Data Sources

The DFIN Business Model Canvas is built using a combination of internal financial statements, customer feedback analysis, and competitive landscape research. These sources provide a comprehensive view of our operational strengths, market positioning, and customer needs.