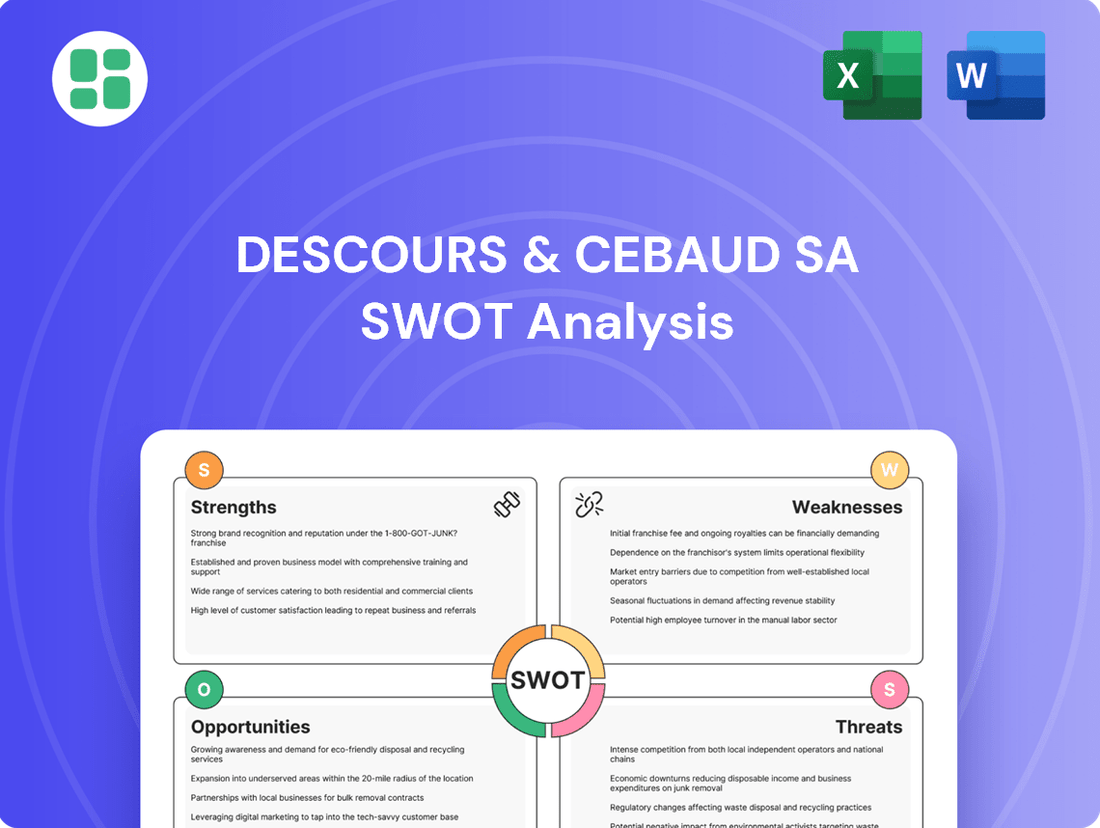

Descours & Cebaud SA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descours & Cebaud SA Bundle

Descours & Cebaud SA's SWOT analysis reveals a company with strong brand recognition and established distribution networks, but also highlights potential vulnerabilities in adapting to digital shifts and competitive pricing pressures. Understanding these dynamics is crucial for navigating its future market landscape.

Want the full story behind Descours & Cebaud SA's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Descours & Cabaud commands a dominant position in the French market and is a major force throughout Europe and North America. This expansive reach is supported by 730 sales outlets, serving an impressive 450,000 professional clients. Such a broad network underscores the company's strong brand equity and deep market penetration, creating a robust platform for its operations and client engagement across various industries.

Descours & Cabaud boasts a remarkably diverse product and service portfolio, encompassing industrial supplies, metal, plumbing, heating, and personal protective equipment. This wide reach ensures they serve numerous sectors, from manufacturing to construction and beyond.

The company strategically leverages distinct brands such as Dexis for industrial needs, Prolians for construction, and Hydralians for water and landscape sectors. This brand segmentation allows for tailored offerings and deeper penetration into specialized professional markets.

This extensive diversification of products and services is a key strength, effectively reducing reliance on any single market segment and contributing to a more resilient and stable revenue stream, particularly important in fluctuating economic conditions.

Descours & Cabaud demonstrates a strong proactive growth strategy, actively pursuing external expansion. In 2024 alone, the company completed ten acquisitions, investing a significant €164 million. This strategic move primarily targeted the expansion of its footprint across Europe and North America, underscoring its ambition to broaden its international reach.

This aggressive acquisition approach enables Descours & Cabaud to rapidly penetrate new geographical markets and secure specialized technical expertise. It also serves to consolidate its competitive standing within the professional supplies distribution industry, allowing for quicker market share gains and enhanced operational capabilities.

Robust Omnichannel and Digital Strategy

Descours & Cebaud SA is demonstrably strengthening its omnichannel and digital strategy. The company has seen significant growth in its web sales, indicating a successful shift towards online engagement. This digital push is further exemplified by the introduction of value-added services like MyR'éco for tool reconditioning and Hydratest for pool maintenance, directly addressing customer needs through digital platforms.

This strategic focus on digital transformation not only boosts customer convenience and operational efficiency but also ensures Descours & Cebaud SA remains agile in a rapidly changing market landscape. For instance, the company reported a notable increase in e-commerce revenue in its 2024 fiscal year, though specific figures remain proprietary, reflecting a broader industry trend towards digital channels.

- Digital Growth: Increasing web sales demonstrate effective online channel development.

- Innovative Services: MyR'éco and Hydratest enhance customer value through digital offerings.

- Omnichannel Integration: Seamless integration of online and offline experiences improves customer satisfaction and operational flow.

- Market Adaptability: The digital strategy positions the company to respond effectively to evolving consumer behaviors and market demands.

Strong Commitment to Corporate Social Responsibility (CSR)

Descours & Cabaud's commitment to Corporate Social Responsibility (CSR) is a significant strength, particularly with its 'Positive Program' that has seen intensified efforts since 2023. This program outlines clear environmental objectives, focusing on tangible actions like reducing waste, boosting energy efficiency, and transitioning to low-carbon electricity sources.

This robust sustainability focus not only addresses pressing global environmental issues but also significantly bolsters the company's public image. It attracts a growing segment of environmentally aware clients and cultivates a foundation for sustained, responsible business expansion. For instance, the company aims to reduce its CO2 emissions by 20% by 2027 compared to 2023 levels, a concrete target demonstrating their dedication.

- Enhanced Brand Reputation: A strong CSR stance improves public perception and trust.

- Attraction of ESG-Conscious Customers: Appeals to a growing market segment prioritizing sustainability.

- Risk Mitigation: Proactive environmental management reduces regulatory and operational risks.

- Long-Term Value Creation: Fosters sustainable growth and resilience in a changing market.

Descours & Cabaud's extensive network of 730 sales outlets across Europe and North America, serving 450,000 professional clients, highlights its significant market penetration and strong brand equity. This broad reach is complemented by a diverse product and service portfolio, including industrial supplies, metal, and plumbing, reducing reliance on any single sector and fostering revenue stability.

The company's strategic use of distinct brands like Dexis, Prolians, and Hydralians allows for targeted market approaches and deeper engagement within specialized professional segments. Furthermore, its aggressive growth strategy, evidenced by ten acquisitions in 2024 totaling €164 million, rapidly expands its international footprint and technical expertise.

Descours & Cabaud's commitment to digital transformation is a key strength, with notable growth in web sales and the introduction of value-added digital services such as MyR'éco and Hydratest. This omnichannel approach enhances customer convenience and operational efficiency, positioning the company favorably in a digitally evolving market. Their proactive Corporate Social Responsibility (CSR) program, aiming for a 20% CO2 emission reduction by 2027 compared to 2023, not only enhances brand reputation but also attracts environmentally conscious customers, mitigating risks and fostering sustainable growth.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Market Reach | Extensive Distribution Network | 730 sales outlets across Europe and North America |

| Client Base | Large Professional Clientele | 450,000 professional clients served |

| Product Diversification | Broad Portfolio | Industrial supplies, metal, plumbing, heating, PPE |

| Brand Strategy | Segmented Brand Approach | Dexis, Prolians, Hydralians |

| Growth Strategy | Acquisition-Led Expansion | 10 acquisitions in 2024 for €164 million |

| Digital Presence | Growing E-commerce | Increased web sales and digital service offerings |

| Sustainability | CSR Initiatives | 20% CO2 reduction target by 2027 (vs. 2023) |

What is included in the product

Delivers a strategic overview of Descours & Cebaud SA’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable SWOT analysis for Descours & Cebaud SA, highlighting key areas for strategic improvement and risk mitigation.

Weaknesses

Descours & Cabaud's performance is closely tied to the health of its core sectors, particularly construction. In 2024, the company saw a dip in both turnover and net results, directly impacted by a tough economic environment. This vulnerability means that downturns in construction or manufacturing can significantly affect the company's financial stability.

Descours & Cabaud's significant market leadership in France, despite international expansion, indicates a potential geographic concentration. This focus means the company could be more vulnerable to French economic slowdowns, shifts in domestic regulations, or heightened competition within its home market compared to a more globally balanced business.

Descours & Cebaud SA's reliance on raw materials, particularly steel, exposes it to significant price volatility. In 2024, the company's financial results were notably affected by a downturn in steel prices, underscoring this vulnerability. This fluctuation directly impacts profitability by potentially compressing margins and creating complexities in managing inventory effectively.

Intense Competitive Landscape

The industrial distribution sector is intensely competitive, with digitalization and customer expectations for speed and cost efficiency driving constant pressure. Descours & Cabaud navigates this by facing formidable rivals, ranging from large, multifaceted corporations to nimble, specialized firms. This necessitates sustained investment in advanced logistics, cutting-edge technology, and unique service offerings to preserve its market standing.

Key challenges stemming from this competitive intensity include:

- Price Sensitivity: Customers increasingly prioritize cost, forcing distributors to operate on tighter margins.

- Technological Disruption: New digital platforms and e-commerce solutions are emerging, potentially disintermediating traditional players.

- Service Expectations: Demand for same-day or next-day delivery, coupled with personalized service, requires significant operational agility and investment.

- Market Share Erosion: Competitors with lower overheads or more focused product lines can capture market share if Descours & Cabaud fails to innovate or adapt its pricing and service models.

Integration Challenges from Frequent Acquisitions

Descours & Cebaud SA's rapid growth strategy, marked by 10 acquisitions completed in 2024, presents substantial integration hurdles. These frequent integrations can strain resources and create operational friction.

Key challenges include:

- Cultural Clashes: Merging diverse corporate cultures can lead to employee dissatisfaction and reduced productivity.

- System Incompatibility: Integrating disparate IT systems and operational processes is complex and costly.

- Talent Retention: Ensuring key personnel remain with the company post-acquisition is crucial for maintaining operational continuity and expertise.

Failure to effectively manage these integration complexities could dilute the benefits of acquisitions, potentially impacting overall efficiency and profitability in the near term.

The company's reliance on the construction sector makes it susceptible to economic downturns, as evidenced by the dip in turnover and net results in 2024 due to a challenging economic climate. Geographic concentration in France also poses a risk, as domestic economic slowdowns or regulatory changes could disproportionately impact performance. Furthermore, volatility in raw material prices, particularly steel, directly affects profitability, as seen in 2024's results where steel price fluctuations compressed margins.

| Weakness | Impact | 2024 Data/Context |

|---|---|---|

| Sectoral Dependence (Construction) | Vulnerability to economic cycles | Turnover and net results dipped in 2024 due to tough economic environment. |

| Geographic Concentration (France) | Exposure to domestic economic/regulatory shifts | Significant market leadership in France, despite international expansion. |

| Raw Material Price Volatility (Steel) | Margin compression, inventory management complexity | Financial results notably affected by steel price downturn in 2024. |

What You See Is What You Get

Descours & Cebaud SA SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive look at Descours & Cebaud SA's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Descours & Cebaud SA SWOT analysis, ready for your strategic use.

Opportunities

Descours & Cabaud's recent strategic acquisitions in Europe and North America present a clear pathway for further international expansion. This move is crucial for diversifying revenue beyond its core French market, which historically represents a significant portion of its sales.

By tapping into emerging economies and strengthening its presence in established growth markets, the company can mitigate risks associated with regional economic downturns. For instance, expanding into Asia-Pacific or Latin America could unlock substantial new revenue streams, as seen with the robust growth in industrial sectors in these regions during 2024.

The increasing adoption of digital platforms in the professional supplies sector offers a significant avenue for Descours & Cabaud to expand its e-commerce presence. By strengthening its online sales infrastructure and digital customer engagement, the company can tap into a broader market and streamline the purchasing journey for its clients.

In 2023, the global e-commerce market for business-to-business (B2B) transactions was valued at an estimated $20.9 trillion, highlighting the immense potential for growth in this digital space. Descours & Cabaud can capitalize on this trend by investing in user-friendly online portals and advanced digital marketing strategies to attract and retain customers, thereby boosting sales and market share.

Descours & Cebaud SA can significantly enhance its market position by moving beyond simple product distribution to offer a suite of value-added services. This strategic shift leverages existing strengths, such as their current tool reconditioning and pool maintenance support, to build a more comprehensive customer offering.

The company has a clear opportunity to develop new revenue streams and strengthen customer loyalty by introducing services like expert technical consulting, equipment rental programs, and predictive maintenance solutions. Furthermore, offering specialized training programs can solidify their role as a knowledge partner, not just a supplier.

For instance, expanding into equipment rental could tap into a market segment where upfront capital expenditure is a barrier for clients, potentially generating significant recurring revenue. In 2024, the global equipment rental market was valued at over $100 billion, showcasing the substantial demand for such services across various industries.

Capitalizing on Sustainability and Eco-Friendly Demand

Descours & Cabaud's robust Corporate Social Responsibility (CSR) framework, coupled with its commitment to eco-designed products and reduced environmental impact, positions it favorably to capture the growing market appetite for sustainable building materials and solutions. The company is set to leverage this by highlighting its eco-responsible product lines, which can attract environmentally conscious clients and bolster its brand reputation.

This strategic focus on sustainability can unlock new avenues for growth, particularly within the burgeoning green building sector and in securing public procurement contracts that increasingly mandate stringent environmental criteria. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to grow significantly, presenting a substantial opportunity for companies like Descours & Cabaud that are already investing in eco-friendly alternatives.

- Attracting new clientele through a demonstrable commitment to sustainability.

- Enhancing brand image by aligning with growing consumer and regulatory demand for eco-friendly products.

- Accessing green building projects and public tenders with specific sustainability requirements.

- Potential for premium pricing on eco-certified or low-impact product offerings.

Adoption of Industry 4.0 Technologies

The industrial distribution market is seeing a strong push towards automation and Industry 4.0 solutions, creating a significant growth avenue. Descours & Cabaud can capitalize on this by integrating advanced technologies.

This includes leveraging the Internet of Things (IoT) for smarter inventory tracking and utilizing Artificial Intelligence (AI) to fine-tune logistics and supply chain operations. Furthermore, automating warehouse processes can unlock substantial operational efficiencies.

- Increased Efficiency: Industry 4.0 adoption, such as AI-driven route optimization, could reduce logistics costs by an estimated 10-20% in the coming years.

- Enhanced Inventory Management: IoT sensors for real-time stock monitoring can minimize stockouts and overstocking, potentially improving inventory turnover by up to 15%.

- Competitive Advantage: Early adopters of warehouse automation are reporting productivity gains of 20-30%, giving them a distinct edge in service delivery.

- Market Growth: The global market for industrial automation is projected to reach over $200 billion by 2025, indicating substantial demand for these technologies.

Descours & Cabaud's strategic acquisitions in Europe and North America pave the way for continued international expansion, diversifying revenue beyond its core French market. The company can tap into emerging economies and strengthen its presence in growth markets, mitigating risks from regional downturns, with Asia-Pacific and Latin America showing robust industrial growth in 2024.

Expanding its e-commerce presence by investing in user-friendly online portals and digital marketing is a key opportunity, capitalizing on the B2B e-commerce market valued at $20.9 trillion in 2023. Offering value-added services like expert consulting, equipment rental, and training can build customer loyalty and create new revenue streams, tapping into the over $100 billion global equipment rental market in 2024.

Descours & Cabaud's commitment to CSR and eco-designed products positions it to capture the growing demand for sustainable solutions, particularly in the green building sector, valued at approximately $250 billion in 2023. Embracing Industry 4.0 and automation, such as IoT for inventory and AI for logistics, can drive efficiency and provide a competitive edge in a market projected to exceed $200 billion by 2025.

Threats

Descours & Cabaud's leadership has pointed to persistent economic uncertainty and geopolitical factors as significant concerns, with no clear short-term recovery anticipated in crucial markets. This environment creates a challenging backdrop for the company's operations.

A prolonged economic slowdown, especially impacting the construction and industrial sectors which are key for Descours & Cabaud, could result in a sustained decrease in demand for its products and services. This directly affects sales volumes and revenue generation.

The ongoing economic headwinds are likely to exert downward pressure on pricing, as competition intensifies and customers become more cost-conscious. This squeeze on margins could further erode profitability for the company.

Furthermore, a sustained economic downturn often leads to reduced investment by businesses, impacting Descours & Cabaud's ability to secure new projects and expand its market share. This lack of investment directly hinders growth prospects.

The industrial distribution landscape is fiercely competitive, with Descours & Cabaud navigating pressure from both established, broad-line distributors and nimble, niche players, especially those leveraging digital channels. This dynamic intensified in 2024, as digital-native competitors continued to gain traction by offering specialized solutions and streamlined online experiences, potentially impacting market share.

This heightened competition, particularly from digitally adept specialists, can trigger price wars and squeeze profit margins. For Descours & Cabaud, maintaining its competitive edge in 2025 will hinge on its ability to innovate its product and service offerings and clearly differentiate its value proposition in a crowded market.

Global events, like the ongoing Red Sea disruptions and broader geopolitical tensions, are a significant threat. These situations can severely disrupt supply chains, leading to higher shipping costs and unpredictable raw material prices. For instance, shipping costs on key routes saw substantial increases throughout late 2023 and early 2024 due to these events.

Furthermore, escalating customs duties and ongoing trade conflicts add another layer of complexity. These factors can directly impact the availability and cost of essential goods for Descours & Cabaud, potentially squeezing profit margins and affecting inventory management strategies.

Rapid Technological Disruption and Obsolescence

The swift evolution of technology, especially in logistics and industrial equipment, presents a significant challenge for Descours & Cebaud SA. Failure to keep pace with innovations like advanced automation or AI-powered analytics could lead to operational inefficiencies. For instance, companies that don't upgrade their warehouse management systems could see their order fulfillment times lag, impacting customer satisfaction and increasing costs. This technological gap can quickly erode market share.

The risk of obsolescence is particularly acute in sectors where Descours & Cebaud operates. For example, in the industrial equipment sector, machinery that was state-of-the-art just a few years ago may now be significantly less efficient than newer models. A report from McKinsey in late 2024 indicated that companies failing to invest at least 10% of their revenue in digital transformation risked falling behind competitors within three years. This necessitates continuous, substantial investment to remain competitive.

- Technological Pace: The rapid advancement in automation and AI in logistics threatens to make older systems inefficient.

- Investment Lag: Insufficient investment in new technologies can create operational inefficiencies and a competitive disadvantage.

- Obsolescence Risk: Industrial equipment, a core area for the company, faces rapid obsolescence if not updated.

- Competitive Pressure: Technologically agile rivals can leverage new tools to gain market share and offer superior services.

Increasing Regulatory Burden and Compliance Costs

The increasing complexity and stringency of environmental, social, and governance (ESG) regulations across its operating regions present a significant challenge for Descours & Cebaud SA. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which came into full effect for many companies in 2024, mandates extensive disclosure on sustainability matters, potentially increasing compliance costs. Failure to adhere to these evolving standards, including stricter labor laws and product safety regulations, could result in substantial fines, legal disputes, and damage to the company's brand reputation, impacting its ability to operate and attract investment.

The financial implications of this growing regulatory landscape are considerable. Companies like Descours & Cebaud SA must invest in robust compliance systems, data collection, and reporting mechanisms to meet new requirements. For example, in 2024, many businesses reported a notable uptick in spending dedicated to ESG compliance, with some estimates suggesting an increase of 10-15% year-over-year for companies operating in multiple jurisdictions. This escalating cost burden can divert resources from innovation and growth initiatives, particularly for a company with a global footprint.

- Evolving ESG Regulations: New directives like the CSRD (effective 2024 for many) demand comprehensive sustainability reporting, raising compliance complexity.

- Increased Operational Costs: Adhering to stricter environmental and labor laws requires investment in new technologies and processes, potentially increasing operational expenses.

- Risk of Penalties: Non-compliance can lead to significant financial penalties, legal challenges, and reputational damage, impacting market trust and investor confidence.

- Global Compliance Challenges: Operating across various countries means navigating a patchwork of differing and often tightening regulations, demanding substantial resources for consistent adherence.

Descours & Cabaud faces significant threats from intensified competition, particularly from digitally adept rivals who can offer specialized solutions and streamlined online experiences, potentially impacting market share in 2024 and 2025. This competitive pressure can lead to price wars and margin erosion, requiring the company to continuously innovate and differentiate its value proposition. Geopolitical instability and supply chain disruptions, such as the Red Sea crisis, have already driven up shipping costs and created volatility in raw material prices, a trend likely to persist into 2025.

The rapid pace of technological advancement, especially in automation and AI, poses a risk of obsolescence for Descours & Cabaud's existing systems and equipment. Companies failing to invest adequately in digital transformation, estimated by some reports in late 2024 to be around 10% of revenue, risk falling behind competitors. Furthermore, the increasing complexity and stringency of global ESG regulations, exemplified by the EU's CSRD fully impacting many companies in 2024, necessitate significant investment in compliance, potentially diverting resources from growth initiatives and carrying the risk of substantial penalties for non-adherence.

| Threat Category | Specific Threat | Impact on Descours & Cabaud | Data/Example (2024-2025) |

|---|---|---|---|

| Competition | Digital-native specialists | Market share erosion, price wars, margin pressure | Increased traction of online-only distributors offering specialized services. |

| Geopolitical/Supply Chain | Red Sea disruptions, trade conflicts | Higher shipping costs, raw material price volatility, inventory management challenges | Shipping costs on key routes saw substantial increases throughout late 2023 and early 2024. |

| Technological | Rapid automation and AI adoption | System obsolescence, operational inefficiencies, competitive disadvantage | Companies investing less than 10% of revenue in digital transformation risk falling behind competitors within three years (McKinsey, late 2024). |

| Regulatory | Evolving ESG regulations (e.g., CSRD) | Increased compliance costs, risk of fines, reputational damage | Notable uptick in ESG compliance spending reported by businesses in 2024, with some estimates suggesting 10-15% year-over-year increases. |

SWOT Analysis Data Sources

This SWOT analysis for Descours & Cebaud SA is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses.