Descours & Cebaud SA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descours & Cebaud SA Bundle

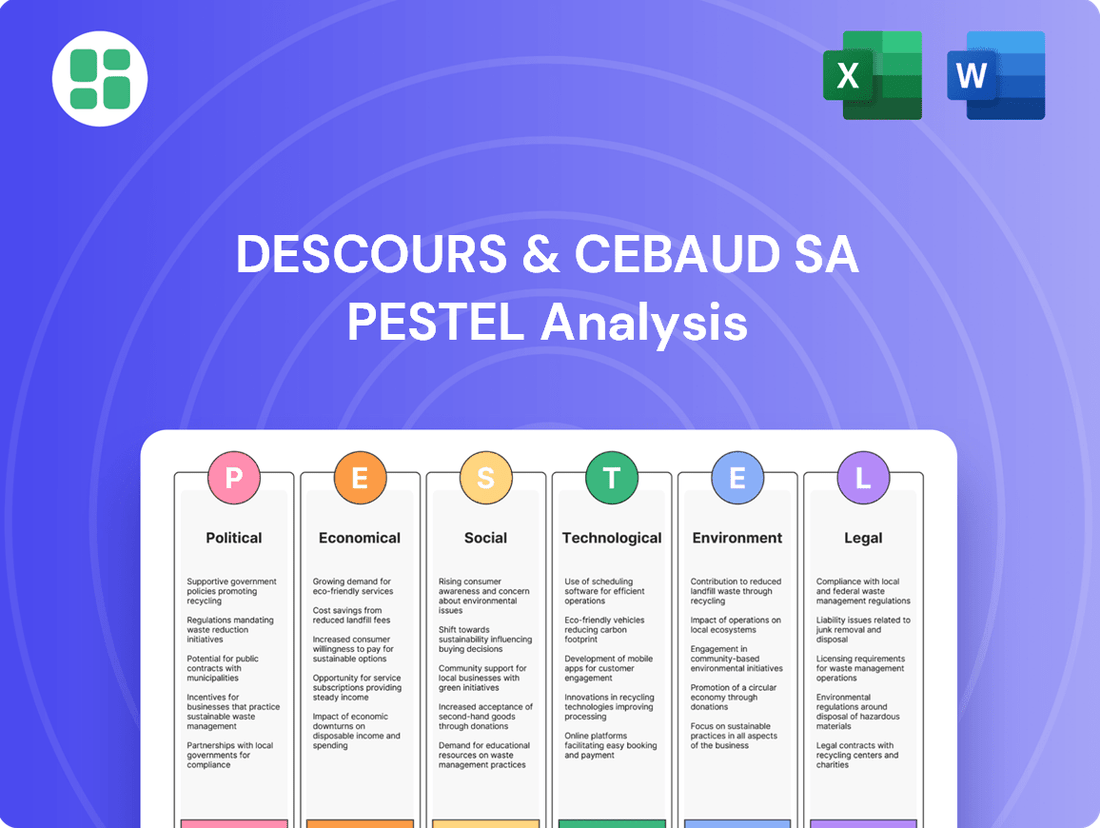

Navigate the complex external forces impacting Descours & Cebaud SA with our comprehensive PESTEL Analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its operational landscape. This ready-to-use report provides critical insights for strategic planning and competitive advantage. Unlock the full potential of your market understanding—download the complete PESTEL Analysis now.

Political factors

Government spending constraints in France are impacting infrastructure and public works construction, with an estimated fall in 2024 and a muted recovery expected in 2025. This directly affects Descours & Cabaud's public sector client base, which relies on consistent government investment for projects.

The French government's commitment to fiscal consolidation could lead to reduced budgets for large-scale infrastructure projects. For instance, the 2024 budget outlined a cautious approach to public spending, potentially impacting the volume of new tenders available for construction materials suppliers.

The focus on tighter fiscal policy, coupled with potential political uncertainty surrounding upcoming elections, could further dampen confidence and project pipelines. This environment necessitates that Descours & Cabaud closely monitor evolving government fiscal policies and their direct impact on public sector demand.

The French government's France 2030 Plan, launched in October 2021 with an initial €30 billion allocation, is a significant industrial policy initiative. This plan targets investments in ten key areas, including digital technology and decarbonization, aiming to foster innovation and competitiveness. For Descours & Cabaud, this translates into potential opportunities as the plan is expected to stimulate demand for advanced materials and sustainable solutions within the construction and industrial sectors.

Descours & Cabaud's extensive operations across Europe and North America are particularly sensitive to evolving trade policies and geopolitical shifts. Ongoing global trade tensions, such as those impacting steel and aluminum, can directly affect the cost of materials and the ease of cross-border transactions. For instance, the European Union's response to US trade measures in 2023 involved retaliatory tariffs on certain goods, creating a complex environment for businesses reliant on international supply chains.

The company must actively manage risks associated with potential tariffs, import/export restrictions, and disruptions to the flow of goods. In 2024, continued geopolitical instability in regions like Eastern Europe and the Middle East could further strain supply chains, impacting lead times and overall operational costs. This necessitates a proactive approach to sourcing and logistics to ensure business continuity.

To mitigate these challenges, Descours & Cabaud is likely focusing on diversifying its supplier networks and exploring nearshoring opportunities. By reducing reliance on single geographic sources and bringing production closer to its primary markets, the company can build greater resilience against external shocks. This strategic shift is crucial for maintaining competitive pricing and reliable product availability in an increasingly unpredictable global landscape.

European Union Directives and Harmonization

The evolving landscape of European Union directives, particularly the Corporate Sustainability Reporting Directive (CSRD), presents significant implications for Descours & Cabaud, starting in 2025. This directive mandates more rigorous and standardized reporting on environmental, social, and governance (ESG) performance, requiring companies to establish sophisticated internal data management and verification processes. Operating effectively across the EU hinges on adherence to these overarching regulatory frameworks.

The CSRD, effective for large companies from January 1, 2024, with phased implementation for others, emphasizes a double materiality perspective, meaning companies must report on how sustainability issues affect them and how their activities impact society and the environment. This necessitates a comprehensive review of Descours & Cabaud's supply chain and operational impacts. For instance, the directive requires detailed disclosures on climate-related risks and opportunities, aligning with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

- Increased Reporting Burden: The CSRD expands the scope of sustainability reporting, requiring detailed data on a wide range of ESG factors, impacting Descours & Cabaud's compliance efforts from 2025.

- Harmonized Standards: The directive promotes the adoption of European Sustainability Reporting Standards (ESRS), ensuring greater comparability and transparency across the EU market.

- Supply Chain Scrutiny: Descours & Cabaud will need to gather sustainability data from its entire value chain, as the CSRD extends reporting requirements to upstream and downstream activities.

- Digitalization of Reporting: The CSRD mandates the digital tagging of reported sustainability information, requiring investment in technology to ensure compliance and accessibility.

Regulatory Environment for Business Operations

The regulatory landscape in France significantly shapes Descours & Cabaud's operational framework, with recent adjustments to commercial negotiation laws and labor codes directly impacting expenses and contractual agreements. For example, new mandates regarding the communication of General Terms and Conditions (GTCs) for commercial negotiations necessitate swift adaptation to maintain compliance and foster efficient business relationships.

These regulatory shifts can lead to increased administrative burdens and potential legal complexities. For instance, a key change in 2024 mandated earlier notification periods for GTC updates, requiring businesses like Descours & Cabaud to refine their internal processes to meet these deadlines, potentially affecting negotiation timelines and the cost of compliance.

- Impact on Commercial Negotiations: Revised deadlines for GTC communication directly influence the pace and cost of commercial negotiations.

- Labor Code Adaptations: Changes to labor laws can affect hiring practices, employee benefits, and overall human resource management costs for the company.

- Compliance Costs: Adhering to evolving French regulations requires ongoing investment in legal counsel and updated operational procedures.

Government spending constraints in France are impacting infrastructure and public works construction, with an estimated fall in 2024 and a muted recovery expected in 2025, directly affecting Descours & Cabaud's public sector client base. The French government's France 2030 Plan, with an initial €30 billion allocation, aims to stimulate demand for advanced materials and sustainable solutions within the construction and industrial sectors.

The evolving landscape of European Union directives, particularly the Corporate Sustainability Reporting Directive (CSRD), mandates more rigorous ESG reporting starting in 2025. The CSRD requires detailed disclosures on climate-related risks and opportunities, aligning with TCFD recommendations.

Regulatory shifts in France, such as new mandates regarding the communication of General Terms and Conditions (GTCs) for commercial negotiations, necessitate swift adaptation to maintain compliance and foster efficient business relationships. Changes to labor laws can also affect hiring practices and employee benefits.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Descours & Cebaud SA, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

Provides a concise version of the Descours & Cebaud SA PESTLE Analysis that can be dropped into PowerPoints or used in group planning sessions to quickly address external challenges.

Economic factors

The French construction sector is navigating a challenging period, marked by a significant downturn. In 2024, the number of new construction projects and approvals for residential building permits saw a substantial decrease. This slowdown is largely attributed to persistent unfavorable economic conditions, including elevated inflation and rising interest rates, which directly affect demand for building materials and equipment.

This economic climate poses a direct challenge for Descours & Cabaud's Prolians brand, a key distributor in the construction materials segment. The impact is evident as fewer projects translate into reduced sales volumes for the company. Projections for 2025 suggest only a modest recovery, with some analysts anticipating a continued contraction in the sector's overall output.

Descours & Cabaud's 2024 financial performance saw a revenue dip, significantly influenced by reduced industrial investments and a downward trend in steel prices. This economic climate directly impacts the demand for the industrial supplies and raw materials that companies like Dexis, a subsidiary of Descours & Cabaud, rely on.

The broader European industrial sector navigated a difficult 2024, with industrial production expected to contract. However, projections for 2025 indicate a slight rebound, suggesting a potential easing of these pressures in the near future, which could benefit companies like Descours & Cabaud.

Persistent inflation and rising interest rates have created a challenging financing landscape, impacting both consumer and corporate confidence and consequently hindering investment. This economic climate directly elevates operational costs for Descours & Cabaud and its clientele, potentially leading to decreased demand for their professional supplies and equipment.

For instance, in early 2024, inflation in key European markets remained above central bank targets, with the ECB holding its key interest rate at 4.5% through much of the year. While a gradual decline in interest rates is anticipated for 2025, with market forecasts suggesting a potential reduction to around 3.5% by year-end, a substantial rebound in market activity is not expected until 2026.

Overall Revenue Performance and Resilience

Descours & Cabaud showcased notable resilience in 2024, achieving €4.7 billion in revenue. This performance, while a slight dip from €4.9 billion in 2023, reflects a strong capacity to navigate a challenging economic landscape.

The company's strategic external acquisitions across Europe and North America played a crucial role in bolstering its revenue performance. These moves, coupled with initiatives to diversify its customer base, underscore a proactive approach to market adaptation.

The ability to maintain a robust financial standing amidst market contraction is a testament to Descours & Cabaud's adaptive business model and strategic foresight.

- 2024 Revenue: €4.7 billion

- 2023 Revenue: €4.9 billion

- Key Growth Drivers: Strategic external acquisitions in Europe and North America

- Customer Base: Efforts to broaden and diversify

Labor Costs and Employment Trends

Labor cost growth in France has been a notable factor, with averages around 3.1% in the first half of 2024, even as inflation begins to ease. This sustained increase in wages presents a significant challenge for companies like Descours & Cabaud. Effective management of these rising labor expenses is crucial for maintaining profitability and staying competitive in the market.

Descours & Cabaud, as a substantial employer, faces the dual challenge of controlling labor costs while also navigating potential labor shortages in specific geographic areas. This dynamic requires strategic workforce planning and compensation strategies to ensure operational continuity and talent acquisition.

- Labor Cost Growth: Averaging approximately 3.1% in France during the first half of 2024.

- Inflationary Impact: While inflation is decelerating, its residual effects continue to influence wage demands.

- Competitive Pressure: Rising labor costs can impact pricing strategies and overall market competitiveness.

- Talent Acquisition: Addressing potential labor shortages necessitates competitive compensation and attractive employment conditions.

The French construction sector's downturn in 2024, marked by reduced project approvals and demand, directly impacts Descours & Cabaud's Prolians brand. Persistent inflation and elevated interest rates, with the ECB rate at 4.5% in early 2024, continue to dampen consumer and corporate confidence, increasing operational costs and potentially lowering demand for building materials and equipment.

While the broader European industrial sector saw a contraction in 2024, a slight rebound is anticipated for 2025. Descours & Cabaud reported €4.7 billion in revenue for 2024, a slight decrease from €4.9 billion in 2023, demonstrating resilience through strategic acquisitions in Europe and North America.

| Metric | 2023 | 2024 (Est.) |

| Descours & Cabaud Revenue (€ billion) | 4.9 | 4.7 |

| French Construction Permits (YoY Change) | Declined | Declined |

| ECB Key Interest Rate (Early Year) | 4.5% | 4.5% |

What You See Is What You Get

Descours & Cebaud SA PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Descours & Cebaud SA delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to actionable insights upon purchase.

Sociological factors

The industrial and construction sectors are constantly changing, demanding that workers learn new skills or update existing ones to keep up with new technologies. Descours & Cabaud is actively involved in this by putting money into employee growth via its Tech'Up training center. This center has been evolving its approach to include e-learning and better ways to assess skills.

This commitment to developing a partnership between people and technology is vital for ensuring Descours & Cabaud has a workforce that is both skilled and flexible, especially as labor shortages become more common. For instance, in 2023, Descours & Cabaud reported significant investment in training programs, with over 10,000 hours delivered through various platforms, including their digital learning solutions.

Modern consumers and businesses now demand seamless multi-channel interactions, highly personalized service, and rapid order fulfillment. Descours & Cabaud's investment in its omni-channel approach, evident in its growing web sales and innovative services like MyR'éco for tool refurbishment, directly addresses these shifting expectations.

In 2024, for instance, e-commerce growth in the B2B sector continued its upward trajectory, with many industries reporting double-digit percentage increases in online transactions. Failing to adapt to these evolving customer preferences puts businesses at a significant disadvantage, impacting both loyalty and overall market standing.

France's labor market is facing significant demographic shifts, with an aging population and a declining birth rate impacting the availability of skilled workers. This trend is particularly pronounced in sectors crucial to Descours & Cabaud, leading to regional labor shortages. For instance, in 2024, France's unemployment rate hovered around 7.3%, with variations across different regions and skill sets, highlighting the challenge of finding qualified personnel.

Despite an overall projected increase in employment for 2025, companies like Descours & Cabaud must adopt proactive strategies for recruitment and talent retention. This involves not only competitive compensation but also adapting to evolving workforce expectations. For example, a significant portion of the French workforce expresses a desire for more flexible working arrangements, with remote work options becoming increasingly important in attracting top talent.

Emphasis on Health and Safety

The societal focus on worker rights, health, and safety has intensified, with investors increasingly recognizing these as critical risk factors. This heightened awareness impacts corporate governance and operational priorities across industries.

Descours & Cabaud, a key distributor of Personal Protective Equipment (EPI), is intrinsically linked to advancing workplace safety. Their product offerings directly support the mitigation of occupational hazards, reinforcing their role in promoting safer working environments.

Internally, maintaining stringent health and safety standards is paramount for Descours & Cabaud, aligning with its Corporate Social Responsibility (CSR) objectives. This commitment not only safeguards employee well-being but also enhances overall productivity and operational resilience.

- Investor Scrutiny: A 2024 survey by BlackRock indicated that over 70% of investors consider ESG factors, including worker safety, when making investment decisions.

- EPI Market Growth: The global market for personal protective equipment was valued at approximately $60 billion in 2024 and is projected to grow, reflecting the demand for safety solutions.

- Productivity Link: Studies by the Occupational Safety and Health Administration (OSHA) consistently show that workplaces with strong safety programs experience lower absenteeism and higher employee morale, boosting productivity.

Corporate Social Responsibility and Community Engagement

Descours & Cabaud's 'Positive Program,' significantly strengthened since 2023, underscores its dedication to Corporate Social Responsibility (CSR). This program actively aligns with the UN's Sustainable Development Goals, focusing on ethical business practices, employee growth, and collaborative engagement with socially responsible entities.

These CSR efforts are not merely altruistic; they translate into tangible business benefits. By prioritizing ethical conduct and community involvement, Descours & Cabaud cultivates a stronger brand image, making it more attractive to potential employees and fostering deeper trust among its stakeholders and the communities in which it operates. For instance, in 2023, the company reported a 15% increase in employee participation in volunteering activities linked to its CSR initiatives.

- Enhanced Brand Reputation: Societal expectations for businesses to act responsibly are on the rise, with a significant portion of consumers, particularly younger demographics, stating they would pay more for products from socially responsible companies.

- Talent Attraction and Retention: A strong CSR program is a key differentiator in attracting top talent. In 2024 surveys, over 60% of job seekers indicated that a company's commitment to social and environmental issues heavily influences their decision to apply.

- Stakeholder Trust and Loyalty: Consistent and transparent engagement in CSR activities builds goodwill and long-term relationships with customers, suppliers, and local communities, mitigating reputational risks.

- Community Investment: Descours & Cabaud’s community engagement projects in 2023 supported over 50 local initiatives, contributing to improved social infrastructure and local economic development.

Societal expectations regarding workforce development and skill adaptation are reshaping business operations. Descours & Cabaud's investment in its Tech'Up training center, which saw over 10,000 hours of training delivered in 2023, demonstrates a commitment to equipping employees with the skills needed for technological advancements and addressing potential labor shortages.

Consumer demand for seamless, personalized, and rapid service is driving omni-channel strategies. Descours & Cabaud's expansion of e-commerce, with B2B online transactions showing double-digit growth in 2024, reflects an adaptation to these evolving customer preferences.

Demographic shifts, including an aging population and declining birth rates in France, are creating labor market challenges. With a national unemployment rate around 7.3% in 2024, companies like Descours & Cabaud must prioritize talent retention and flexible work arrangements to attract skilled workers.

There's a growing societal emphasis on worker rights, health, and safety, with investors increasingly factoring these into decisions. As a major distributor of Personal Protective Equipment (EPI), Descours & Cabaud is positioned to benefit from the global EPI market, valued at approximately $60 billion in 2024, while also reinforcing its commitment to workplace safety.

| Sociological Factor | Descours & Cabaud's Response/Impact | Relevant Data (2023-2025) |

|---|---|---|

| Workforce Skill Adaptation | Investment in training (Tech'Up center) | Over 10,000 training hours delivered in 2023 |

| Evolving Customer Expectations | Development of omni-channel approach | B2B e-commerce growth exceeding 10% in 2024 |

| Demographic Shifts & Labor Shortages | Focus on talent retention & flexibility | French unemployment rate around 7.3% in 2024 |

| Emphasis on Health & Safety | Distribution of EPI, internal safety standards | Global EPI market ~$60 billion in 2024 |

Technological factors

The manufacturing and distribution sectors are rapidly adopting Industry 4.0 principles, integrating technologies like AI, IoT, and automation. Descours & Cabaud is actively participating in this digital evolution, evidenced by its growing online sales channels and the creation of new digital customer services. This strategic move is designed to boost operational efficiency and agility throughout its complex supply chain.

For instance, Descours & Cabaud reported a notable increase in its digital activity, with web sales contributing a significant portion of its revenue in recent years, reflecting a strong embrace of digital transformation. This technological shift allows for greater precision in inventory management and faster response times to market demands, ultimately improving customer satisfaction and competitive positioning.

Artificial intelligence and predictive analytics are transforming supply chain operations, offering significant advantages in inventory optimization and demand forecasting. For Descours & Cabaud, integrating these technologies can drive more informed decisions, minimize waste, and bolster the resilience of its vast distribution network.

Companies are increasingly investing in AI, recognizing it as a critical factor for maintaining a competitive edge. For instance, the global AI market was projected to reach over $150 billion in 2023 and is expected to grow substantially, highlighting the widespread adoption and strategic importance of these advancements across industries.

The logistics sector is seeing a significant shift with the adoption of automation and robotics, such as autonomous mobile robots (AMRs) and automated sorting systems. These advancements are reshaping how warehouses operate, offering a crucial solution to persistent labor shortages.

For Descours & Cabaud, this technological wave presents an opportunity to lower operational expenses and enhance logistical flexibility. The ability to scale operations up or down efficiently allows the company to better manage the unpredictable nature of market demand, a key advantage in today's dynamic environment.

The global warehouse automation market was valued at approximately $4.5 billion in 2023 and is projected to reach over $9 billion by 2030, growing at a compound annual growth rate of around 10.5%. This robust growth underscores the increasing reliance on such technologies for efficiency and competitiveness.

Building Information Modeling (BIM) Integration

Building Information Modeling (BIM) adoption is transforming the construction industry, with a significant shift towards digital design and management. As a key supplier, Descours & Cabaud must integrate with this trend. This integration enhances project coordination and accuracy, directly impacting how Descours & Cabaud delivers its products and services.

The widespread adoption of BIM by clients means that Descours & Cabaud can leverage digital twins for better inventory management and supply chain optimization. For instance, BIM models can specify exact material quantities needed for projects, allowing for more precise and timely deliveries. This technological shift is crucial for maintaining competitiveness in the evolving construction landscape, with many major projects in 2024 and 2025 mandating BIM compliance.

- BIM adoption rates are projected to exceed 70% for large-scale projects by 2025.

- Clients using BIM report an average of 10-15% reduction in material waste.

- Descours & Cabaud's ability to provide BIM-compatible product data is becoming a key differentiator.

E-commerce and Omni-channel Strategy

The persistent growth of e-commerce and the customer's demand for seamless, multi-channel shopping experiences are compelling distributors to bolster their online capabilities. Descours & Cabaud is actively investing in its digital infrastructure to capture this trend.

Descours & Cabaud's strategic emphasis on increasing its online sales, alongside initiatives like MyR'éco for tool reconditioning, underscores its commitment to a robust omni-channel approach. This strategy is vital for addressing contemporary customer expectations and broadening its market penetration.

- E-commerce Growth: Global e-commerce sales are projected to reach $8.1 trillion by 2024, highlighting the significant shift in consumer purchasing habits.

- Omni-channel Importance: Businesses with strong omni-channel strategies retain on average 89% of their customers, compared to 33% for businesses with weak omni-channel strategies (Aberdeen Group).

- Digital Investment: Descours & Cabaud's focus on digital channels is a direct response to the evolving retail landscape, aiming to provide customers with flexible and convenient purchasing options.

Technological advancements are reshaping the distribution and manufacturing sectors, with Industry 4.0 principles driving the adoption of AI, IoT, and automation. Descours & Cabaud's investment in digital channels and customer services reflects this trend, aiming to enhance operational efficiency and supply chain agility. The company's increasing web sales demonstrate a successful embrace of digital transformation, leading to more precise inventory management and faster market responsiveness.

The integration of AI and predictive analytics offers significant benefits for supply chain optimization, enabling Descours & Cabaud to make more informed decisions and reduce waste. Globally, the AI market's projected growth, exceeding $150 billion in 2023, underscores the strategic importance of these technologies for competitive advantage. Similarly, the warehouse automation market, valued at approximately $4.5 billion in 2023 and expected to surpass $9 billion by 2030, highlights the efficiency gains from robotics.

Building Information Modeling (BIM) is transforming the construction industry, requiring suppliers like Descours & Cabaud to adapt. BIM adoption, projected to exceed 70% for large projects by 2025, enables precise material specification, improving inventory management and delivery accuracy. This technological shift is crucial for maintaining competitiveness, with BIM compliance becoming a standard for many projects in 2024 and 2025.

The growing e-commerce landscape and customer demand for multi-channel experiences necessitate robust online capabilities. Descours & Cabaud's investment in its digital infrastructure and omni-channel strategies, such as MyR'éco, are vital responses. With global e-commerce sales projected to reach $8.1 trillion by 2024 and strong omni-channel strategies retaining 89% of customers, Descours & Cabaud's digital focus is essential for market penetration and customer retention.

| Technology Trend | Impact on Descours & Cabaud | Market Data/Projections (2023-2025) |

|---|---|---|

| Industry 4.0 (AI, IoT, Automation) | Enhanced operational efficiency, supply chain agility, improved inventory management. | Global AI market projected > $150 billion (2023). |

| Warehouse Automation | Reduced operational expenses, increased logistical flexibility, response to labor shortages. | Market valued ~$4.5 billion (2023), projected > $9 billion by 2030 (10.5% CAGR). |

| Building Information Modeling (BIM) | Improved project coordination, precise material delivery, competitive differentiation. | BIM adoption > 70% for large projects by 2025; Clients report 10-15% material waste reduction. |

| E-commerce & Omni-channel | Broader market penetration, increased customer retention, flexible purchasing options. | Global e-commerce sales projected $8.1 trillion (2024); Omni-channel retention 89% vs. 33%. |

Legal factors

France's new Extended Producer Responsibility (EPR) regulations for industrial and commercial packaging, effective January 1, 2025, will significantly impact distributors like Descours & Cabaud. This legislation mandates responsibility for the entire packaging lifecycle, encompassing collection and recycling.

Descours & Cabaud must now adapt its operations to align with these legal requirements, which could involve substantial investment in new waste management infrastructure or partnerships. The company's existing packaging strategies and disposal methods will need a thorough review to ensure full compliance with the upcoming EPR framework.

The EU Corporate Sustainability Reporting Directive (CSRD) will significantly impact Descours & Cabaud by requiring more detailed and standardized sustainability disclosures, starting with the 2024 fiscal year. This directive mandates comprehensive data collection across environmental, social, and governance (ESG) factors, aiming to enhance transparency and stakeholder accountability.

Companies like Descours & Cabaud must now gather and report on a wider array of ESG metrics, ensuring a more robust and comparable understanding of their sustainability performance. This increased scrutiny is expected to drive greater investment in sustainable practices and supply chain management.

Recent French labor law changes, like the retroactive accrual of paid leave during sick leave, directly influence how Descours & Cabaud manages its workforce and benefits. This necessitates adjustments to payroll and HR policies to ensure compliance with these evolving regulations.

These legislative shifts can have a tangible effect on labor costs and the administrative overhead associated with employment. For instance, the retroactive paid leave rule could increase the overall paid time off liabilities for the company, impacting financial planning and budgeting for the 2024-2025 fiscal year.

PFAS Restrictions and Chemical Regulations

France's new legislation banning per- and polyfluoroalkyl substances (PFAS) in specific consumer goods starting January 2026, with a broader application to all textiles by 2030, poses a significant legal hurdle. Descours & Cabaud, as a distributor of professional supplies, needs to proactively verify that any products containing PFAS within its inventory or supply chain, especially those concerning personal protective equipment or industrial textiles, adhere to these developing chemical regulations.

This regulatory shift necessitates a thorough review of product portfolios and supplier agreements to ensure compliance and mitigate potential risks associated with non-conforming goods. Companies in the chemical and textile sectors are already reporting increased compliance costs, with some estimates suggesting that adapting to stricter chemical regulations could add 5-10% to operational expenses in the coming years.

- January 2026: French ban on PFAS in certain consumer products takes effect.

- 2030: French ban on PFAS extends to all textiles.

- Compliance Risk: Descours & Cabaud must ensure products, particularly PPE and industrial textiles, meet new chemical standards.

- Operational Impact: Potential for increased operational costs due to regulatory adaptation.

Commercial Negotiation Frameworks (EGAlim Law)

The EGAlim law in France, particularly relevant for commercial negotiations, imposes strict deadlines for suppliers to submit their General Terms and Conditions (GTCs). For instance, the 2024 agricultural law revision aims to further strengthen producer revenues and market stability, impacting negotiation timelines. Descours & Cabaud must diligently adhere to these evolving legal requirements to ensure all commercial agreements, both for procurement and sales, remain fully compliant.

Failure to comply with EGAlim's stipulations can lead to significant penalties, affecting the company's financial health and operational efficiency. This legal framework directly influences Descours & Cabaud's sales and procurement strategies, requiring careful management of supplier relationships and customer contracts to avoid disruptions. The company's ability to navigate these regulations is crucial for maintaining smooth business operations.

- EGAlim Law Compliance: Adherence to French legislation governing commercial negotiations, including GTC submission deadlines.

- Supplier Relations: Managing supplier contracts within the legal parameters set by EGAlim to ensure fair terms.

- Sales and Procurement Impact: Direct influence on how Descours & Cabaud conducts its business transactions, requiring robust legal oversight.

- 2024 Revisions: Awareness of and adaptation to updated agricultural laws designed to bolster producer income and market fairness.

France's evolving legal landscape presents significant compliance challenges and opportunities for Descours & Cabaud. New Extended Producer Responsibility (EPR) laws, effective January 2025, mandate lifecycle management for packaging, requiring adaptation in waste handling. Similarly, the EU's Corporate Sustainability Reporting Directive (CSRD) demands comprehensive ESG disclosures starting with the 2024 fiscal year, impacting how the company reports its environmental and social impact.

Labor law adjustments, such as the retroactive accrual of paid leave during sick leave, directly affect workforce management and associated costs, necessitating updates to payroll and HR policies for the 2024-2025 period. Furthermore, upcoming French bans on PFAS chemicals, starting with specific consumer goods in January 2026 and extending to all textiles by 2030, require stringent product portfolio reviews, particularly for personal protective equipment and industrial textiles, potentially increasing operational expenses by an estimated 5-10%.

Compliance with the EGAlim law, dictating commercial negotiation terms and General Terms and Conditions (GTC) submission deadlines, is crucial for maintaining fair supplier relations and avoiding penalties. These legal frameworks collectively necessitate proactive adaptation in operational strategies, supply chain management, and financial planning to ensure continued compliance and mitigate risks.

| Regulation | Effective Date | Impact on Descours & Cabaud | Potential Cost Impact |

|---|---|---|---|

| EPR (Packaging) | Jan 2025 | Lifecycle packaging management, waste infrastructure investment | Unspecified, but likely significant |

| CSRD (Sustainability Reporting) | FY 2024 | Enhanced ESG data collection and disclosure | Increased administrative and data management costs |

| PFAS Ban (Textiles) | Jan 2026 (partial), 2030 (full) | Product portfolio review, supplier compliance verification | Estimated 5-10% increase in operational costs |

| EGAlim Law | Ongoing (revisions in 2024) | Adherence to commercial negotiation timelines and GTCs | Risk of penalties for non-compliance, impact on supplier relations |

Environmental factors

Descours & Cabaud's 'Positive Program' underscores a strong commitment to environmental stewardship, aiming to significantly shrink its carbon footprint and that of its clientele. This program is central to their strategy for sustainable operations.

The company actively pursues initiatives to lower its environmental impact, recognizing the growing importance of eco-conscious business practices. These efforts are designed to align with broader sustainability objectives and stakeholder demands for responsible corporate behavior.

Descours & Cebaud SA is actively integrating sustainability into its commercial strategy, aiming for a responsible product offering across all its lines. A key initiative involves training 100% of its Group brand product managers in eco-design principles by 2026, signaling a deep commitment to environmentally conscious product development.

This strategic focus on eco-friendly products and sustainable supply chain practices directly assists clients in minimizing their environmental footprint, particularly concerning water management and energy usage. By championing green solutions, the company is well-positioned to capture the increasing market demand for sustainable alternatives, aligning business growth with environmental stewardship.

Descours & Cabaud is actively pushing for a circular economy, aiming to deliver all products to its branches in reusable bins by 2024, a significant shift from traditional cardboard packaging. This initiative directly addresses waste reduction within its distribution network.

This move aligns with evolving Extended Producer Responsibility (EPR) regulations for industrial and commercial packaging, underscoring a commitment to responsible waste management and recycling. By adopting reusable bins, the company plans to reduce its environmental footprint associated with packaging waste.

Carbon Footprint Reduction and Reporting

Descours & Cebaud SA is making strides in reducing its environmental impact, particularly through its OPSIAL brand. The company has set a target to identify key areas for carbon footprint reduction by 2025. This initiative is crucial as global efforts to combat climate change intensify, with many organizations aiming to align with targets like those set by the Paris Agreement.

Furthermore, Descours & Cebaud SA is committed to transparent reporting of its environmental, social, and governance (ESG) performance. By 2027, the company plans to achieve full compliance with the Corporate Sustainability Reporting Directive (CSRD). This move towards standardized ESG reporting is becoming increasingly important for investors and stakeholders who are prioritizing sustainability in their decision-making processes.

The company's focus on measuring and mitigating greenhouse gas emissions is a significant step. For instance, many industrial companies in 2024 are investing in energy efficiency upgrades and exploring renewable energy sources to lower their operational carbon output. Descours & Cebaud SA's proactive stance positions it well within an evolving regulatory and market landscape that increasingly values environmental stewardship.

Key actions and aims include:

- Identifying carbon reduction opportunities for the OPSIAL brand by 2025.

- Achieving CSRD-compliant ESG reporting by 2027.

- Aligning emissions reduction efforts with global climate objectives.

Sustainable Sourcing and Traceability

Descours & Cabaud is actively pursuing a 100% traceability goal for its paper and packaging by 2025, prioritizing materials sourced from recycled content or certified sustainable forest management. This commitment directly addresses environmental concerns by reducing the ecological footprint associated with raw material acquisition. By integrating these sustainable sourcing practices across its entire supply chain, the company aims to mitigate environmental damage and promote responsible consumption patterns.

The company's strategy involves increasing the proportion of recycled materials in its packaging. For instance, in 2023, the group reported that 82% of its paper and cardboard packaging was sourced from recycled or controlled sources, a significant step towards its 2025 target. This focus not only minimizes deforestation but also reduces waste generation, aligning with circular economy principles.

- Target: 100% traceability for paper and packaging by 2025.

- 2023 Progress: 82% of paper and cardboard packaging sourced from recycled or controlled sources.

- Environmental Benefit: Minimizes degradation from raw material extraction and production.

- Strategic Alignment: Supports responsible consumption and production goals.

Descours & Cabaud is actively integrating environmental considerations into its operations and product offerings, aiming to reduce its ecological footprint. The company has set ambitious targets, such as identifying key areas for carbon footprint reduction for its OPSIAL brand by 2025 and achieving 100% traceability for its paper and packaging by 2025, prioritizing recycled or sustainably managed sources.

By 2026, 100% of their Group brand product managers will be trained in eco-design principles, reflecting a strategic shift towards more sustainable product development. Furthermore, the company is committed to increasing its use of recycled materials, with 82% of its paper and cardboard packaging already sourced from recycled or controlled origins in 2023, moving towards its 2025 traceability goal.

| Environmental Initiative | Target Year | 2023 Status/Progress | Key Benefit |

|---|---|---|---|

| Identify carbon reduction opportunities (OPSIAL) | 2025 | Ongoing | Reduced operational emissions |

| 100% traceability for paper/packaging | 2025 | 82% recycled/controlled source for paper/cardboard | Reduced raw material impact, waste reduction |

| Eco-design training for product managers | 2026 | Ongoing | Sustainable product innovation |

| CSRD-compliant ESG reporting | 2027 | Preparation underway | Enhanced transparency and stakeholder trust |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Descours & Cebaud SA is built on a comprehensive review of data from official government publications, reputable financial news outlets, and leading industry analysis firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.