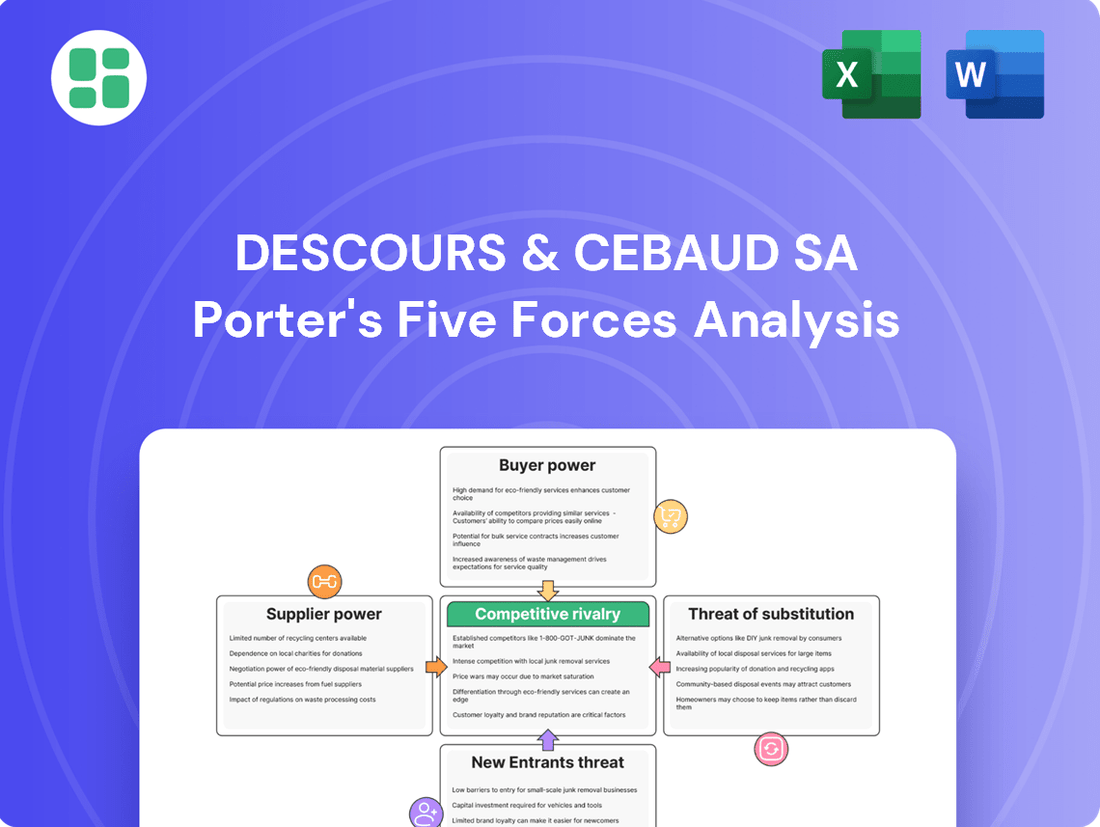

Descours & Cebaud SA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descours & Cebaud SA Bundle

Descours & Cebaud SA operates in a landscape shaped by significant buyer power and the constant threat of substitutes, demanding strategic agility. Understanding the intensity of these forces is crucial for navigating its competitive arena effectively.

The complete report reveals the real forces shaping Descours & Cebaud SA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Descours & Cabaud hinges significantly on supplier concentration and product differentiation. Dealing with a broad spectrum of professional supplies, the company interacts with diverse suppliers, from bulk commodity providers to niche manufacturers of specialized equipment. For instance, in 2024, the market for certain high-performance industrial lubricants saw consolidation, potentially increasing the leverage of the remaining key suppliers.

Switching costs for Descours & Cabaud to change suppliers can vary significantly. For many standard industrial supplies, the ease of finding alternatives means these costs are relatively low. However, when dealing with specialized components, proprietary systems, or products that require specific integration or supplier-specific training, the financial and operational impact of switching can become quite substantial.

For instance, if Descours & Cabaud relies on a supplier for a highly customized metal fabrication service that is integral to their product lines, the cost to re-tool, find a new supplier with equivalent capabilities, and retrain staff could be considerable. This complexity directly impacts the bargaining power of those specialized suppliers.

The threat of suppliers integrating forward and selling directly to Descours & Cabaud's customers is a factor to consider. While some manufacturers might possess direct sales capabilities, the intricate nature of distributing a broad product portfolio to a varied professional clientele across numerous industries often curbs the pervasive risk of forward integration for many suppliers.

Importance of Descours & Cabaud to Suppliers

Descours & Cabaud's position as a leading French distributor and a major European player means significant purchasing volumes. This scale makes them a vital sales channel for many suppliers, directly impacting supplier revenue and market access. For instance, in 2023, the company reported a turnover of €4.2 billion, underscoring the substantial business they represent for their partners.

This considerable importance grants Descours & Cabaud substantial bargaining power. Suppliers are often incentivized to offer favorable terms, competitive pricing, and flexible delivery schedules to secure or maintain their business with such a large and influential distributor. The company's extensive network and market reach further amplify this leverage.

- Significant Purchasing Volumes: Descours & Cabaud's large-scale procurement activities make them a critical customer for many suppliers.

- Market Access: Suppliers rely on Descours & Cabaud to reach a broad customer base across France and Europe.

- Negotiating Leverage: The distributor's size and market influence enable them to negotiate favorable pricing and terms.

- Supplier Dependence: A supplier's revenue can be heavily influenced by its relationship with Descours & Cabaud, increasing the distributor's power.

Availability of Substitute Inputs

The availability of substitute inputs for Descours & Cabaud's diverse product lines significantly influences supplier bargaining power. For many standard industrial components, the market features numerous manufacturers, providing Descours & Cabaud with alternatives and thus diminishing the power of any single supplier. For instance, in the fasteners market, widely available standard bolts and nuts from various producers limit individual supplier leverage.

However, for highly specialized, proprietary, or branded products within Descours & Cabaud's portfolio, the scarcity of readily available substitutes can substantially increase supplier bargaining power. This is particularly relevant for custom-engineered parts or unique material formulations where few, if any, alternative suppliers exist. The company's demonstrated resilience in navigating competitive markets suggests a strategic approach to managing these supplier relationships.

- Limited Substitutes for Specialized Products: For highly specific industrial components or branded items, Descours & Cabaud may face suppliers with considerable power due to a lack of viable alternatives.

- Abundant Substitutes for Standard Products: The availability of multiple manufacturers for standard industrial components limits the bargaining power of individual suppliers in these segments.

- Supplier Management Strategy: Descours & Cabaud's ability to maintain strong performance indicates effective strategies for managing supplier relationships, even in the face of limited substitution options.

Descours & Cabaud's substantial purchasing volume, evidenced by its €4.2 billion turnover in 2023, grants it significant leverage over many suppliers. This scale means suppliers often depend on Descours & Cabaud for substantial revenue and market access across France and Europe, weakening supplier bargaining power.

However, the bargaining power of suppliers can increase when Descours & Cabaud faces limited substitutes for specialized or proprietary products. For example, a supplier of unique, high-performance industrial coatings might command more power than a supplier of standard fasteners, where alternatives are plentiful.

The risk of forward integration by suppliers is generally moderate for Descours & Cabaud, as many manufacturers lack the extensive distribution networks required to serve its diverse customer base effectively. Nevertheless, the concentration in certain markets, like industrial lubricants in 2024, can shift power towards remaining suppliers.

| Factor | Impact on Supplier Bargaining Power | Descours & Cabaud's Position |

|---|---|---|

| Supplier Concentration | Can increase power if few suppliers exist. | Moderate; varies by product category. |

| Product Differentiation | Increases power for unique offerings. | High for standard items, lower for specialized. |

| Switching Costs | High costs empower suppliers. | Low for standard, high for integrated solutions. |

| Threat of Forward Integration | Empowers suppliers who can sell directly. | Generally low due to distribution complexity. |

| Purchasing Volume | Decreases supplier power due to customer importance. | High; €4.2 billion turnover (2023) signifies significant leverage. |

| Availability of Substitutes | Low availability increases supplier power. | High for standard goods, low for specialized items. |

What is included in the product

This analysis meticulously examines the competitive forces impacting Descours & Cebaud SA, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Instantly identify and address competitive threats with a comprehensive breakdown of Descours & Cebaud SA's Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Descours & Cabaud's customer base is diverse, ranging from small-scale artisans to major players in construction and manufacturing. This broad reach helps to mitigate the power of any single customer.

However, large corporate clients and public sector entities, such as those involved in major infrastructure projects, represent significant volume purchasers. In 2024, for instance, a substantial portion of Descours & Cabaud's revenue likely stemmed from contracts with these larger entities, granting them considerable leverage to negotiate favorable pricing, tailor-made solutions, and flexible payment arrangements.

Customers of Descours & Cabaud encounter moderate switching costs. While sourcing basic industrial supplies from different vendors is straightforward, the integrated offerings from Descours & Cabaud, such as their extensive product catalog and specialized services, can make switching more complex and costly.

The value derived from established relationships, coupled with technical assistance and unique services like mobile maintenance units, acts as a significant retention factor. For instance, the 'safety trucks' offered by their Prolians brand provide on-site support, increasing the inconvenience and expense for customers to transition to a competitor.

Customer price sensitivity is a significant factor for Descours & Cabaud, particularly as economic conditions impact sectors like construction. For instance, in 2023, the French construction sector experienced a notable decline, putting increased pressure on businesses to control expenses. This economic environment naturally leads clients to scrutinize prices more closely, seeking the best value for their investments.

This heightened awareness of cost management means Descours & Cabaud must remain highly competitive in its pricing strategies. Businesses operating in a challenging market are actively looking for suppliers who can offer favorable terms. Consequently, the company's ability to offer attractive pricing directly influences its market position and customer retention.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Descours & Cabaud is generally low. While large clients might contemplate setting up their own procurement and distribution networks, the sheer complexity and significant capital outlay involved in managing a broad spectrum of industrial, metal, plumbing, heating, and personal protective equipment (PPE) products make this an unfeasible endeavor for most.

This complexity is a significant deterrent. Descours & Cabaud's extensive product catalog, which includes thousands of SKUs across various specialized categories, requires substantial investment in logistics, inventory management systems, and skilled personnel. For instance, managing the specialized storage and handling requirements for industrial metals alongside plumbing fixtures and safety equipment presents a considerable operational challenge.

- Low Likelihood of Backward Integration: Most clients lack the expertise and resources to replicate Descours & Cabaud's comprehensive supply chain capabilities.

- High Capital and Complexity Barriers: Establishing dedicated procurement and distribution for diverse product lines, from industrial metals to PPE, is prohibitively expensive and complex for individual customers.

- Focus on Core Competencies: Clients typically prefer to concentrate on their primary business operations rather than diverting resources to manage a complex distribution network.

Information Availability and Product Standardization

The internet has significantly amplified customer bargaining power by offering unprecedented transparency in product specifications and pricing. This ease of comparison empowers buyers, especially for standardized goods, to identify the best value. In 2024, online marketplaces and comparison sites continue to be key drivers of this trend, making it harder for companies to maintain price differentials based solely on brand recognition.

Descours & Cabaud is actively addressing this by strengthening its digital presence and implementing an omni-channel strategy. This approach aims to provide customers with readily accessible, competitive information and a seamless purchasing experience across all touchpoints, thereby mitigating the impact of increased customer leverage. The company's investment in digital tools in 2024 reflects an understanding that meeting evolving customer expectations for information is crucial for maintaining market position.

- Increased Online Price Comparison: Customers in 2024 can easily compare prices for building materials and tools across numerous online retailers, directly impacting pricing strategies.

- Demand for Transparency: Buyers expect detailed product information and clear pricing structures, a trend accelerated by digital platforms.

- Descours & Cabaud's Digital Investment: The company's focus on its digital platform and omni-channel strategy in 2024 is a direct response to the enhanced bargaining power of informed customers.

Descours & Cabaud faces moderate bargaining power from its customers. While a diverse customer base limits the sway of any single client, large construction and manufacturing entities, significant volume purchasers in 2024, can negotiate favorable terms. Switching costs are moderate; basic supplies are easy to change, but integrated services and established relationships, like Prolians safety trucks, create retention barriers.

Customer price sensitivity is high, especially given economic pressures on sectors like construction, which saw a decline in 2023. This necessitates competitive pricing from Descours & Cabaud. Backward integration by customers is unlikely due to the high capital and complexity involved in managing the company's broad product range, from industrial metals to PPE.

The internet has significantly boosted customer power through price and specification transparency, a trend continuing into 2024. Descours & Cabaud is countering this with digital investments and an omni-channel strategy to maintain competitiveness and customer loyalty.

| Factor | Impact on Descours & Cabaud | Mitigation Strategies |

|---|---|---|

| Customer Concentration | Moderate leverage for large clients | Diverse customer base, integrated services |

| Switching Costs | Moderate; higher for integrated solutions | Value-added services, technical support |

| Price Sensitivity | High, influenced by economic conditions (e.g., 2023 construction decline) | Competitive pricing, efficient supply chain |

| Backward Integration Threat | Low due to complexity and capital requirements | Focus on core competencies, broad product offering |

| Information Transparency (Internet) | High, enabling easy price comparison | Digital presence, omni-channel strategy |

What You See Is What You Get

Descours & Cebaud SA Porter's Five Forces Analysis

This preview displays the complete Descours & Cebaud SA Porter's Five Forces analysis, offering a detailed examination of competitive forces within its industry. The document you see is precisely what you will receive instantly after purchase, ensuring full transparency and immediate usability. This professionally formatted analysis is ready to be integrated into your strategic planning, providing actionable insights without any further preparation.

Rivalry Among Competitors

The professional supplies distribution market in France and Europe is quite crowded, featuring a wide array of competitors. Descours & Cabaud faces off against large multinational corporations as well as specialized regional businesses.

Key rivals include significant players such as BME Group, Ravago Building Solutions, and Rubix, all of whom operate with substantial market presence. This broad spectrum of competitors, from giants to smaller, nimble firms, means Descours & Cabaud must constantly adapt to a dynamic competitive landscape.

The sheer number and variety of these companies intensify competition across all product lines and geographical segments. For instance, in 2023, the European construction materials distribution market alone was valued at over €300 billion, showcasing the scale and density of players vying for market share.

The industrial and construction sectors, Descours & Cabaud's main arenas, saw a slowdown and complicated economic conditions in 2023-2024. This sluggish growth means companies are fighting harder for the same slice of the pie. For instance, in France, a key market, construction output saw a notable contraction in late 2023 and early 2024.

While many of Descours & Cabaud's core products are standardized, the company actively differentiates itself through superior service quality, streamlined logistics, and deep technical expertise. These value-added services, including customer training and digital solutions, are designed to cultivate strong customer loyalty and create a higher barrier for customers considering a switch to competitors.

Exit Barriers

Descours & Cebaud SA, like many distributors, faces significant exit barriers due to substantial investments in its infrastructure. The extensive warehousing facilities and sophisticated logistics networks required to serve its customer base represent high fixed costs. These sunk costs make it economically difficult for distributors to simply shut down operations and leave the market, even when profitability is low.

This inability to easily exit the market directly fuels competitive rivalry. Companies are compelled to remain active and continue competing, often at reduced margins, to recover their fixed investments. This dynamic can lead to prolonged periods of intense price competition and a struggle for market share, as each player strives to maintain its operational viability.

For instance, a distributor with a nationwide network of warehouses, as many in the sector operate, might have millions invested in real estate, equipment, and technology. In 2024, the average cost of maintaining a large distribution center can easily run into hundreds of thousands of dollars annually in property taxes, utilities, and staffing, irrespective of sales volume. This financial commitment acts as a strong deterrent to exiting the industry.

- High Fixed Costs: Investments in warehousing, logistics, and specialized inventory create substantial sunk costs for distributors.

- Incentive to Stay: These costs make exiting the market financially unviable, encouraging companies to remain and compete.

- Intensified Rivalry: The presence of high exit barriers leads to increased competition, as firms fight to maintain market share and cover fixed expenses.

- Operational Persistence: Distributors are often forced to operate even in challenging market conditions to avoid the full impact of exit barriers.

Acquisition Strategy and Market Consolidation

Descours & Cabaud’s aggressive acquisition strategy, marked by ten acquisitions in 2024, primarily in North America, highlights a significant trend toward market consolidation. This approach intensifies competitive rivalry as larger entities like Descours & Cabaud aim to capture greater market share and operational efficiencies.

This consolidation places considerable pressure on smaller, independent distributors who may struggle to compete with the expanded scale and resources of acquisitive industry leaders. The drive for economies of scale and broader geographical reach fuels this competitive dynamic.

- Market Consolidation: Ten acquisitions by Descours & Cabaud in 2024, with a focus on North America.

- Competitive Pressure: Increased rivalry for smaller, independent distributors unable to match scale.

- Strategic Goals: Acquisitions aim to boost market share, expand geographic footprint, and achieve economies of scale.

Descours & Cabaud operates in a highly competitive market with numerous players, from large multinationals to specialized regional firms. This intense rivalry is exacerbated by high exit barriers, such as significant investments in logistics and warehousing, which compel companies to remain active even in challenging economic conditions. The market's complexity is further amplified by ongoing consolidation, as seen with Descours & Cabaud's ten acquisitions in 2024, which intensifies pressure on smaller competitors.

| Competitor Type | Examples | Market Characteristic |

|---|---|---|

| Large Multinationals | BME Group, Ravago Building Solutions, Rubix | Significant market presence, broad product lines |

| Specialized Regional Firms | Various smaller, nimble companies | Targeted product offerings, localized expertise |

| Consolidating Entities | Descours & Cabaud (10 acquisitions in 2024) | Driving market share growth and economies of scale |

SSubstitutes Threaten

Customers, particularly large industrial and construction companies, are increasingly exploring direct sourcing from manufacturers, bypassing traditional distribution channels. This trend is amplified by the growing transparency and accessibility offered by online procurement platforms, which simplify the process of finding and engaging directly with producers. For instance, in 2024, B2B e-commerce sales are projected to reach $3.8 trillion in the US, indicating a significant shift towards digital procurement that can facilitate direct sourcing.

Technological advancements can introduce substitute materials that challenge Descours & Cabaud's core offerings. For example, the rise of advanced composites in aerospace and automotive sectors, which are lighter and stronger than traditional metals, could decrease demand for steel and aluminum distribution. In 2023, the global advanced composites market was valued at approximately $25 billion and is projected to grow significantly, indicating a tangible threat.

The increasing focus on sustainability and cost savings is driving customers to opt for repairing or reconditioning their existing equipment instead of buying new items. This trend presents a significant threat of substitutes for new product sales.

Descours & Cabaud's own reconditioning service, MyR'éco, while a revenue stream, directly substitutes for the sale of new equipment. In 2024, the global industrial equipment repair market was valued at approximately $250 billion, highlighting the substantial alternative available to customers.

Digital-First Procurement Platforms

Digital-first procurement platforms represent a significant threat of substitutes for Descours & Cabaud SA's traditional distribution model. Online marketplaces and specialized e-commerce sites for industrial supplies offer an alternative for customers seeking to source materials. These platforms often compete on price and ease of use, potentially drawing business away from established distributors.

The convenience and often lower overheads of digital platforms can translate into more competitive pricing for buyers. For instance, the global B2B e-commerce market was projected to reach $20.9 trillion by 2027, indicating a substantial shift towards online purchasing. This trend suggests that customers may increasingly opt for digital channels over the more traditional, service-oriented approach offered by companies like Descours & Cabaud SA.

- Increased Competition: Online marketplaces provide a wider array of suppliers, intensifying competition for Descours & Cabaud SA.

- Price Sensitivity: Buyers prioritizing cost savings may find digital platforms more attractive due to their often lower operating expenses.

- Evolving Customer Expectations: The growing preference for digital transactions and self-service procurement challenges traditional distribution models.

- Market Share Erosion: A significant portion of the industrial supply market could migrate to digital channels, impacting Descours & Cabaud SA's revenue.

Shift to Service-Based Models

The growing trend of service-based models presents a significant threat of substitution for traditional equipment and supply sales. Industries are increasingly opting for leasing, rental, or 'as-a-service' arrangements for machinery and tools. This shift directly impacts companies like Descours & Cebaud SA by reducing the demand for outright purchases of new equipment and materials.

For instance, in the construction sector, the adoption of equipment-as-a-service models allows companies to access necessary machinery on a pay-per-use basis. This can be more cost-effective and flexible than owning equipment outright, especially for projects with fluctuating needs. By 2024, the global equipment rental market was projected to reach over $115 billion, indicating a substantial move away from direct ownership.

- Shift to service-based models reduces the need for direct equipment purchases.

- Leasing and rental options offer greater flexibility and potentially lower upfront costs for customers.

- The global equipment rental market's significant growth by 2024 highlights this substitution trend.

The threat of substitutes for Descours & Cabaud SA is substantial, driven by evolving customer preferences and technological advancements. Direct sourcing through online platforms and the emergence of alternative materials pose significant challenges to traditional distribution models. Furthermore, the increasing adoption of service-based models, such as leasing and rental, directly substitutes for the sale of new equipment and supplies, impacting revenue streams.

| Threat Category | Description | Impact on Descours & Cabaud SA | Supporting Data (2024 Projections/Values) |

|---|---|---|---|

| Direct Sourcing & Online Platforms | Customers bypassing distributors via online procurement. | Potential loss of sales and market share. | US B2B e-commerce projected at $3.8 trillion. Global B2B e-commerce projected to reach $20.9 trillion by 2027. |

| Alternative Materials | New materials (e.g., composites) replacing traditional ones. | Reduced demand for core product offerings. | Global advanced composites market valued at approx. $25 billion (2023). |

| Service-Based Models (Leasing/Rental) | Customers opting for 'as-a-service' over ownership. | Decreased demand for new equipment sales. | Global equipment rental market projected over $115 billion. |

| Repair & Reconditioning | Customers choosing to repair existing equipment. | Substitution for new product sales. | Global industrial equipment repair market valued at approx. $250 billion. |

Entrants Threaten

The professional supplies distribution sector demands significant upfront capital for inventory, expansive warehousing facilities, robust logistics networks, and a broad branch presence. Newcomers face a steep climb to establish this infrastructure.

Descours & Cabaud leverages its established European and North American presence, which translates into considerable economies of scale in purchasing and distribution. This cost advantage, estimated to provide a 5-10% lower cost base on key product categories compared to smaller players, presents a formidable barrier for any new entrant aiming to compete on price and efficiency.

Descours & Cabaud's deep roots, stretching back over 240 years, have cultivated exceptionally strong and enduring relationships with a wide array of professional clients. This extensive history translates into a significant competitive advantage, making it difficult for newcomers to replicate the level of trust and loyalty Descours & Cabaud enjoys.

New entrants attempting to penetrate the market would find it a formidable task to build the same rapport and confidence with customers who prioritize dependable supply chains, specialized technical knowledge, and consistently reliable service. These established connections act as a substantial barrier, deterring potential competitors from entering the space.

Securing favorable agreements with a wide array of reputable suppliers is critical in the steel distribution industry, a key area for Descours & Cabaud. New entrants often struggle to gain access to the same quality and volume of materials at competitive prices that established players like Descours & Cabaud can command due to their long-standing relationships.

Descours & Cabaud's deeply entrenched supplier relationships and extensive distribution network, exemplified by its 264 Prolians points of sale across France, create a significant hurdle for newcomers. This vast network not only ensures product availability but also provides a competitive edge in terms of logistics and customer reach, making it difficult for new companies to replicate.

Regulatory Requirements and Technical Expertise

The distribution of professional supplies, particularly in demanding sectors like construction and personal protective equipment (PPE), is heavily regulated. New entrants must navigate a complex web of quality standards, certifications, and safety mandates. For instance, in the EU, CE marking is essential for many PPE items, requiring rigorous testing and documentation.

Acquiring the necessary technical expertise to understand and implement these regulations is a significant barrier. Companies must invest in skilled personnel and robust quality control systems. This can involve substantial upfront costs and ongoing operational expenses, making it challenging for newcomers to compete with established players like Descours & Cebaud SA, who have already built this infrastructure.

The financial commitment to ensure full regulatory compliance and develop the requisite technical know-how acts as a considerable deterrent.

- Regulatory Hurdles: Compliance with standards like ISO 9001 for quality management or specific industry certifications can be time-consuming and expensive for new entrants.

- Technical Know-How: Understanding the technical specifications and safety requirements for products such as construction materials or specialized workwear demands specialized knowledge.

- Certification Costs: Obtaining necessary product certifications and maintaining them can represent a significant financial outlay, potentially running into tens of thousands of euros annually depending on the product range.

Retaliation by Incumbents

Established players like Descours & Cabaud possess significant resources and market leverage, enabling them to react forcefully to new competitors. This can manifest as aggressive pricing, amplified marketing campaigns, or superior service enhancements designed to deter market entry.

Descours & Cabaud's demonstrated commitment to growth through acquisitions underscores its strategic intent to fortify its market standing. This proactive consolidation makes the landscape considerably more challenging and riskier for potential new entrants aiming to establish a foothold.

- Incumbent Response: Descours & Cabaud can deploy price wars or boost advertising spend to squeeze new entrants.

- Acquisition Strategy: The company’s history of acquiring competitors strengthens its market dominance and raises entry barriers.

- Market Consolidation: Continued acquisitions by Descours & Cabaud signal a market where scale and existing relationships are paramount, deterring smaller newcomers.

The threat of new entrants into the professional supplies distribution sector, particularly for a company like Descours & Cabaud, remains moderate. Significant capital investment is required for inventory, warehousing, and logistics, creating a substantial initial barrier. Furthermore, established players benefit from strong customer loyalty built over decades, making it difficult for newcomers to gain traction.

Descours & Cabaud's extensive network of 264 Prolians points of sale in France and its long-standing supplier relationships provide considerable economies of scale. For instance, in 2023, the company reported revenues of €5.7 billion, highlighting its market presence. New entrants would struggle to match this scale and purchasing power, which can lead to a 5-10% cost advantage for established firms.

Navigating complex regulations and obtaining necessary certifications, such as CE marking for personal protective equipment, adds another layer of difficulty. These compliance requirements can involve substantial upfront costs and ongoing investment in technical expertise, further deterring potential new competitors.

| Factor | Impact on New Entrants | Descours & Cabaud's Advantage |

|---|---|---|

| Capital Requirements | High (inventory, logistics, facilities) | Established infrastructure and scale |

| Customer Loyalty | Difficult to build | Over 240 years of relationships |

| Economies of Scale | Limited | Significant purchasing and distribution efficiencies (e.g., €5.7bn revenue in 2023) |

| Regulatory Compliance | Costly and complex | Existing systems and expertise |

Porter's Five Forces Analysis Data Sources

Our analysis of Descours & Cebaud SA's competitive landscape is built upon a foundation of robust data, including their official annual reports, industry-specific market research from reputable firms, and public financial filings. This comprehensive approach allows for a thorough examination of industry trends and competitive dynamics.