Delticom SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delticom Bundle

Delticom's strong online presence and extensive product range are key strengths, but the competitive landscape and evolving customer preferences present significant challenges. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Delticom’s market position, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Delticom AG commands extensive European market leadership, operating over 300 online shops in more than 70 countries. This vast network signifies a deep penetration into diverse European markets, solidifying its position as a dominant player in the online tire and wheel sector.

Their established presence across the continent translates to significant brand recognition and a substantial customer base, a direct result of years of consistent operation and market development. This leadership is a testament to their ability to navigate and succeed within the complex European e-commerce landscape.

Delticom boasts a truly comprehensive product portfolio, featuring around 600 brands and over 80,000 tire models for cars and motorcycles. This vast selection also extends to complete wheels and rims, providing customers with an unparalleled variety of choices.

This extensive product diversity is a significant strength, allowing Delticom to cater to a broad spectrum of customer needs and preferences. Whether private individuals or business clients, the sheer breadth of their offering ensures they can meet diverse demands effectively.

By offering such a wide array of products, Delticom is well-positioned to capture a larger share of the market. This strategy also inherently reduces the company's reliance on any single brand or product category, fostering greater stability.

Delticom's strength lies in its deeply ingrained e-commerce and logistics infrastructure, honed since its 1999 inception. This robust system is a significant competitive advantage, ensuring smooth operations from order placement to final delivery.

The company's own warehouses are key assets, underpinning its ability to manage inventory effectively. This internal capability is complemented by an extensive network of approximately 30,000 partner garages across Europe, facilitating convenient tire fitting services for customers.

This integrated model allows Delticom to offer efficient delivery and service, directly contributing to enhanced customer satisfaction and fostering loyalty. In 2023, Delticom reported significant growth in its e-commerce segment, demonstrating the continued effectiveness of its logistical prowess.

Strategic Focus on Profitable Growth and Cost Optimization

Delticom's strategic focus on profitable growth and cost optimization is a significant strength. In fiscal year 2024, the company demonstrated this by boosting its operating EBITDA to €22.7 million, surpassing its initial expectations. This commitment to improving both revenue generation and operational efficiency is key to its financial health.

Looking ahead to 2025, Delticom is maintaining this dual approach, aiming for continued profitable growth while actively working to reduce costs. This proactive stance is crucial for navigating inflationary pressures and ensuring sustained financial performance.

Key aspects of this strength include:

- Enhanced Profitability: Achieved an operating EBITDA of €22.7 million in FY 2024.

- Cost Management: Ongoing initiatives to offset inflation-related cost increases in 2025.

- Sustainable Performance: A clear commitment to long-term financial stability through efficiency.

Investment in Automation and AI

Delticom's strategic investment in automation and AI is a significant strength, bolstering its long-term market position. The company is actively integrating intelligent automation and artificial intelligence into its logistics and operational processes. This technological push is designed to enhance customer communication and streamline operations, ensuring efficiency in the competitive digital commerce landscape.

These advancements are crucial for maintaining market leadership. For instance, in 2024, companies that effectively leverage AI in logistics saw an average reduction in operational costs by up to 15%. Delticom's commitment to this area positions it to capitalize on such efficiencies.

- Enhanced Customer Experience: AI-powered tools can personalize customer interactions and provide faster support.

- Optimized Logistics: Automation in warehouses and delivery networks leads to quicker order fulfillment and reduced errors.

- Data-Driven Decision Making: AI analyzes vast datasets to identify trends and improve strategic planning.

- Cost Efficiencies: Streamlined processes through automation directly translate to lower operating expenses.

Delticom's extensive European market leadership, with over 300 online shops in more than 70 countries, provides a significant competitive edge. This vast reach translates into strong brand recognition and a loyal customer base, built over years of consistent operation and market development. Their ability to effectively navigate the complex European e-commerce landscape solidifies their dominant position.

The company offers an exceptionally comprehensive product portfolio, featuring around 600 brands and over 80,000 tire models, alongside complete wheels and rims. This unparalleled variety caters to a broad spectrum of customer needs, reducing reliance on any single product category and fostering market stability.

Delticom's deeply ingrained e-commerce and logistics infrastructure, established since 1999, is a core strength. This robust system, supported by its own warehouses and a network of approximately 30,000 partner garages, ensures efficient order fulfillment and convenient fitting services, directly enhancing customer satisfaction. In 2023, their e-commerce segment showed significant growth, reflecting this operational prowess.

A strategic focus on profitable growth and cost optimization is evident in Delticom's financial performance. The company achieved an operating EBITDA of €22.7 million in FY 2024, exceeding expectations, and maintains this dual approach for 2025 to counter inflation and ensure sustained financial health.

Delticom's investment in automation and AI is a forward-looking strength, aiming to enhance customer communication and streamline operations. Companies leveraging AI in logistics saw up to a 15% reduction in operational costs in 2024, a benefit Delticom is poised to realize.

| Key Strength Area | Description | Supporting Data/Fact |

|---|---|---|

| Market Leadership | Extensive European presence | Over 300 online shops in 70+ countries |

| Product Portfolio | Vast selection of tires and wheels | ~600 brands, 80,000+ tire models |

| Logistics & E-commerce | Integrated operational infrastructure | ~30,000 partner garages; FY2023 e-commerce growth |

| Financial Strategy | Focus on profitability and cost control | FY2024 operating EBITDA of €22.7 million |

| Technological Investment | Automation and AI integration | Potential for up to 15% operational cost reduction (industry benchmark) |

What is included in the product

Delivers a strategic overview of Delticom’s internal and external business factors, highlighting its strengths in e-commerce and brand recognition, weaknesses in logistical complexity, opportunities in market expansion and new product lines, and threats from intense competition and changing consumer preferences.

Identifies key Strengths and Weaknesses to proactively address potential Threats and capitalize on Opportunities.

Weaknesses

Delticom has experienced negative free cash flow for the trailing twelve months, despite an increase in revenues and operating EBITDA. Management points to increased depreciation from IFRS 16 and interest costs from warehouse investments as key contributors to this cash flow deficit.

This persistent negative free cash flow raises questions about Delticom's capacity to maintain its dividend payments without relying on additional debt or equity financing. For instance, in the first quarter of 2024, the company reported a free cash flow of -€3.5 million, a significant shift from the positive figures seen in prior periods.

Delticom's dividend per share has seen a consistent annual decline over the last ten years, a trend that stands in contrast to its growing earnings per share. This divergence signals a strategic choice by management to prioritize reinvesting profits into growth opportunities rather than distributing them to shareholders. For investors primarily seeking regular income, this shift could be a point of concern, potentially leading to dissatisfaction if consistent dividend payouts were a key investment criterion.

Delticom's revenue is highly susceptible to seasonal demand, as evidenced by the surge in winter tire purchases in late 2024. This reliance on specific weather patterns and seasonal peaks introduces inherent unpredictability into the company's annual financial performance.

While Delticom can leverage these seasonal shifts, a strong dependence on them necessitates flexible inventory strategies and dynamic marketing campaigns to mitigate potential revenue volatility.

Audit and Reporting Delays

In 2024, Delticom faced significant hurdles with audit and reporting, notably delaying its 2023 Annual Report and Annual General Meeting (AGM). This postponement stemmed from extended audit procedures, which can raise concerns about the robustness of internal controls or the complexity of the company's financial reporting. Such delays can erode investor confidence and diminish transparency.

The inability to meet reporting deadlines suggests potential underlying issues in financial data compilation or validation. For instance, if the audit process required extensive adjustments or clarifications, it might indicate weaknesses in the company's accounting practices or systems. This lack of timely disclosure is a critical weakness for any publicly traded entity.

Maintaining consistent and punctual financial reporting is paramount for building and sustaining stakeholder trust. Investors rely on timely information to make informed decisions, and delays can create uncertainty and negatively impact share price. Delticom's 2024 experience highlights the importance of efficient audit processes and transparent communication regarding any reporting challenges.

- Audit Process Complexity: Extended audit timelines in 2024 suggest potential complexities in Delticom's financial reporting.

- Investor Confidence Impact: Delays in publishing the 2023 Annual Report and postponing the AGM can negatively affect investor sentiment.

- Transparency Concerns: Such postponements may signal internal control weaknesses or challenges in financial data accuracy.

- Timeliness is Crucial: Consistent and timely financial disclosures are vital for maintaining stakeholder trust and market credibility.

Vulnerability to Economic Downturns

Delticom's strategic planning for 2025 may not fully account for severe economic downturns or sector-specific challenges. This leaves the company exposed if economic conditions worsen significantly, impacting its ability to maintain sales and profitability.

Broader economic uncertainties, including geopolitical tensions and trade disputes, especially within Europe, pose a considerable threat. Such factors could lead to reduced consumer spending on non-essential automotive products, directly affecting Delticom's sales volumes and overall financial performance.

For instance, a significant contraction in European GDP, which some forecasts suggest could be as high as 1-2% in a severe recessionary scenario for 2025, would likely translate into lower demand for tires and automotive accessories. This directly impacts Delticom's core business.

The company's reliance on consumer discretionary spending for automotive parts means it's particularly vulnerable to shifts in consumer confidence and disposable income during economic slowdowns.

Delticom's financial health is strained by negative free cash flow, a situation exacerbated by increased depreciation and interest costs related to warehouse investments. This trend, evident in the first quarter of 2024 with a -€3.5 million free cash flow, raises concerns about its ability to sustain dividend payments without additional financing.

The company's dividend per share has been on a decade-long decline, diverging from earnings growth, suggesting a strategic shift towards reinvestment over shareholder payouts. This could deter income-focused investors. Furthermore, Delticom's revenue is highly susceptible to seasonal demand, particularly for winter tires, introducing significant annual financial unpredictability.

Significant delays in publishing its 2023 Annual Report and postponing its Annual General Meeting in 2024 point to potential weaknesses in internal controls or financial reporting complexity, which can erode investor confidence and transparency.

Delticom's strategic planning may not adequately address severe economic downturns, leaving it vulnerable to reduced consumer spending on automotive products during economic slowdowns, a risk amplified by broader European geopolitical tensions and trade disputes.

Preview Before You Purchase

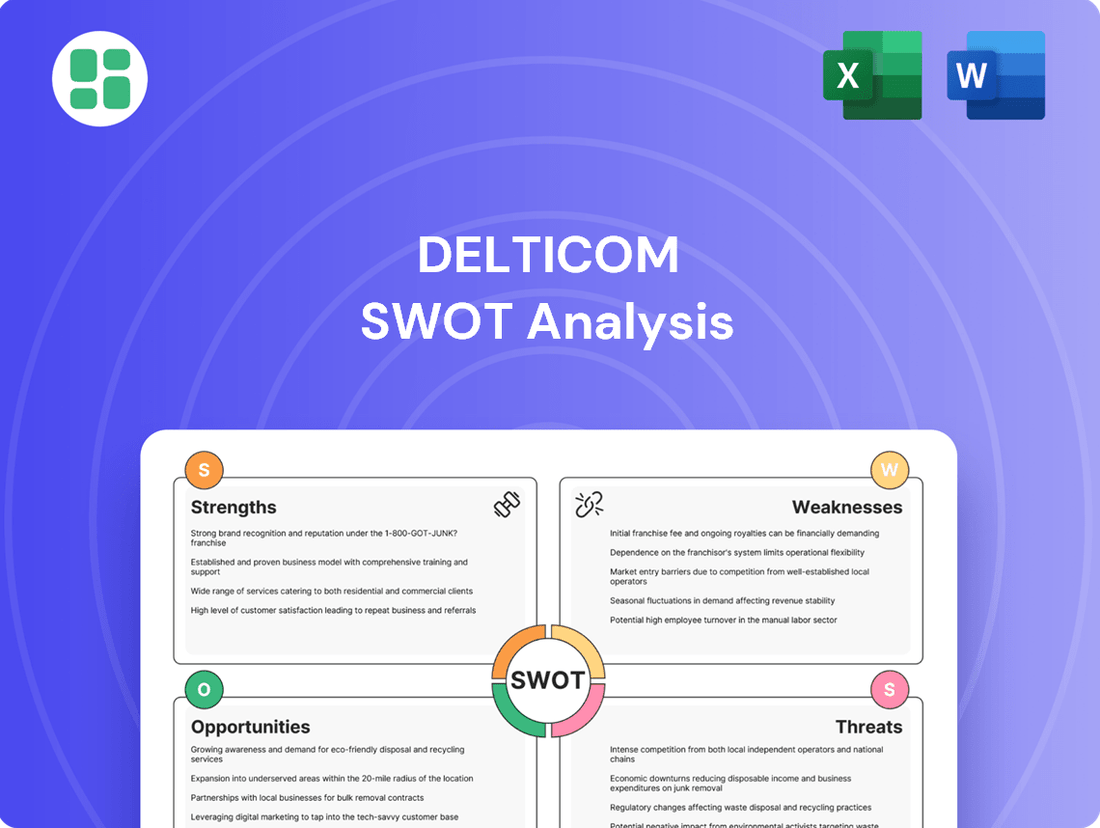

Delticom SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're viewing a live preview of the actual SWOT analysis file, showcasing the Strengths, Weaknesses, Opportunities, and Threats for Delticom. The complete version, offering a comprehensive understanding of their market position, becomes available after checkout.

Opportunities

The European tire market is on a growth trajectory, with projections indicating a compound annual growth rate (CAGR) of 2.45% between 2025 and 2033. This expansion is fueled by increasing vehicle sales and a growing demand for specialized tires, including those that are high-performance or environmentally friendly.

This favorable market environment presents a significant opportunity for Delticom to boost its sales volumes and capture a larger share of the European tire market. The expanding vehicle parc across the continent further underpins this potential for increased demand.

The online tire retail sector is booming, offering unparalleled convenience and choice to customers. Delticom's established digital infrastructure positions it to capitalize on this growing consumer preference for e-commerce in automotive purchases.

This shift is amplified by ongoing technological innovations that continuously improve the online shopping journey. In 2024, the global online automotive parts market, which includes tires, was projected to reach over $20 billion, demonstrating the significant potential for growth in online sales penetration.

Delticom is actively exploring diversification into new sectors, notably the 'efood' delivery space, by leveraging its established logistics capabilities. This strategic move aims to broaden revenue sources beyond its traditional tire e-commerce operations, potentially mitigating risks associated with market fluctuations in the automotive sector.

This venture into 'efood' represents a significant opportunity for Delticom to unlock new growth avenues and capitalize on operational synergies within its existing logistics infrastructure. By extending its reach into a rapidly growing market, Delticom can create a more resilient business model, reducing its dependence on the core tire business.

Demand for Specialized EV Tires

The accelerating global shift towards electric vehicles (EVs) creates a substantial market for specialized tires. These tires are engineered for characteristics like reduced rolling resistance to maximize battery range and enhanced durability to handle the instant torque and weight of EVs. Delticom can leverage this by broadening its EV tire selection, directly supporting the automotive sector's electrification goals.

The EV market is experiencing robust growth, with projections indicating continued expansion. For instance, global EV sales were expected to reach approximately 14 million units in 2024, a significant increase from previous years. This surge directly translates into a growing demand for tires specifically suited for EV performance requirements.

- Growing EV Adoption: Global EV sales are projected to surpass 14 million units in 2024, driving demand for specialized tires.

- Performance Requirements: EV tires focus on low rolling resistance for extended range and robust construction for higher torque and weight.

- Market Expansion: Delticom can enhance its product portfolio to cater to this rapidly expanding niche within the tire market.

Leveraging Data and AI for Customer Insights

Delticom can significantly enhance customer engagement by deploying AI-driven personalization in its communications. This approach, which saw a notable uptick in adoption across e-commerce in 2024, allows for tailored offers and support, directly improving the customer experience.

Analyzing purchasing data through AI can unlock deeper insights into customer preferences. For instance, in 2024, companies leveraging advanced analytics reported an average 15% increase in sales conversion rates by better understanding customer journeys.

- AI-powered personalization: Tailor marketing messages and product recommendations based on individual customer behavior and purchase history.

- Predictive analytics: Forecast customer needs and preferences to proactively offer relevant products and services, boosting sales.

- Enhanced customer service: Utilize AI chatbots for instant, 24/7 support, resolving queries efficiently and improving overall satisfaction.

- Data-driven product development: Refine product assortments and service offerings based on granular customer insights, increasing market relevance.

The expanding European tire market, projected for a 2.45% CAGR through 2033, offers Delticom substantial growth potential by increasing sales and market share. The burgeoning online tire retail sector, with the global online automotive parts market valued at over $20 billion in 2024, further supports Delticom's digital-first strategy.

Delticom's diversification into the 'efood' delivery sector leverages its existing logistics, aiming to create new revenue streams and enhance business resilience. The accelerating adoption of electric vehicles (EVs) presents a significant opportunity for specialized tire sales, as global EV sales approached 14 million units in 2024.

Furthermore, implementing AI-driven personalization can significantly boost customer engagement and sales conversion rates, with data-driven approaches reporting up to a 15% increase in sales in 2024.

Threats

The online tire retail landscape is fiercely competitive, with many companies battling for dominance. This often results in aggressive pricing strategies and can squeeze profit margins for all involved.

Delticom contends with a broad range of competitors, including other established online tire sellers, traditional auto shops that have embraced e-commerce, and even tire manufacturers selling directly to consumers. For instance, in 2023, the global online tire market was valued at approximately $30 billion, with significant growth projected, indicating a crowded marketplace.

This intense rivalry from diverse channels poses a substantial threat to Delticom's profitability, as maintaining competitive pricing while covering operational costs becomes increasingly challenging.

The tire industry, including companies like Delticom, faces significant risks from fluctuating prices of key raw materials such as natural rubber, synthetic rubber (derived from oil), and steel. These price swings can directly impact production expenses and, consequently, profit margins.

For instance, crude oil prices, a major component in synthetic rubber, saw considerable volatility in late 2023 and early 2024, influenced by geopolitical events and global demand. Should these upward trends persist, Delticom might struggle to pass on the increased costs to consumers, potentially squeezing its profitability if cost-saving efficiencies aren't realized.

Persistent economic uncertainties and moderate growth forecasts for the eurozone economy in 2024 and 2025 present a significant threat. Structural weaknesses and ongoing geopolitical risks, including trade conflicts, could further dampen consumer spending power and overall market stability.

A prolonged economic downturn, potentially characterized by slower GDP growth in key European markets, could directly reduce demand for new tires and automotive accessories. For example, if eurozone GDP growth forecasts are revised downwards from the projected 0.5% to 1.5% range for 2024 and 2025, this would likely impact Delticom's revenue streams by decreasing discretionary spending on vehicle maintenance and upgrades.

Supply Chain Disruptions

Global supply chain vulnerabilities, highlighted by events in recent years, pose a significant threat to Delticom. These disruptions can impact product availability and escalate logistics expenses. For instance, the ongoing geopolitical tensions and trade policy shifts in 2024 continue to create uncertainty in international shipping routes and component sourcing.

Delticom's extensive international network and dependence on streamlined distribution make it particularly susceptible. A major supply chain interruption could result in stockouts, leading to delayed customer deliveries and a decline in overall satisfaction. The cost of freight, which saw significant increases in 2023, remains a sensitive factor that could be further exacerbated by supply chain bottlenecks.

- Increased Logistics Costs: Continued global shipping challenges could push freight costs higher, impacting Delticom's profitability.

- Product Availability Issues: Disruptions in manufacturing or transportation could lead to shortages of key tire and auto parts.

- Reduced Customer Satisfaction: Delayed deliveries and out-of-stock items directly affect the customer experience, potentially leading to lost sales.

Regulatory Changes and Environmental Standards

Evolving environmental consciousness is driving stricter regulations across the tire industry. Delticom, like its competitors, faces the challenge of adapting to new standards concerning tire production, disposal, and performance metrics such as noise levels, rolling resistance, and wet grip. For instance, the EU's tire labeling regulation, updated in 2021, continues to influence consumer choices and manufacturer priorities, pushing for greater fuel efficiency and safety.

These shifts could demand substantial investments in research and development for greener materials and manufacturing processes, as well as potential upgrades to operational infrastructure. Failure to adapt swiftly to these evolving environmental mandates, such as those potentially introduced in late 2024 or early 2025, could result in significant penalties or place Delticom at a competitive disadvantage against more agile players in the market.

- Increased R&D Costs: Adapting to new environmental standards for tire production and performance may require significant investment in new materials and technologies.

- Compliance Risks: Non-adherence to evolving regulations, such as those on tire disposal or emissions, could lead to fines and reputational damage.

- Market Access Limitations: Stricter environmental requirements in key markets could restrict market access for products that do not meet the latest standards.

Delticom faces intense competition from established online retailers, traditional garages going digital, and even tire manufacturers selling directly. This crowded market, valued at approximately $30 billion globally in 2023, forces aggressive pricing, potentially shrinking profit margins.

Fluctuations in raw material costs, particularly for oil-derived synthetic rubber, pose a significant threat. With oil prices showing volatility through late 2023 and into 2024, Delticom may struggle to absorb rising production expenses without impacting consumer prices, thereby squeezing profitability.

Economic slowdowns in key European markets, with eurozone GDP growth forecasts for 2024-2025 hovering between 0.5% and 1.5%, could dampen consumer spending on tires and auto parts. Persistent geopolitical risks also contribute to market instability, further reducing discretionary spending.

Global supply chain disruptions continue to be a vulnerability. Uncertainties in international shipping and component sourcing, evident in 2024, can lead to product shortages, increased logistics costs (freight costs rose significantly in 2023), and negatively impact customer satisfaction due to delivery delays.

Evolving environmental regulations, such as the EU's tire labeling standards, necessitate investment in R&D for greener materials and processes. Failure to adapt to these evolving standards, potentially introduced in late 2024 or early 2025, could result in compliance risks, fines, and market access limitations.

SWOT Analysis Data Sources

This Delticom SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.