Delticom Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delticom Bundle

Delticom's competitive landscape is shaped by intense rivalry among tire retailers, significant buyer power from large fleet operators, and the constant threat of online substitutes. Understanding these forces is crucial for navigating the automotive aftermarket.

The complete report reveals the real forces shaping Delticom’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The tire industry exhibits a degree of supplier concentration, with a handful of global giants dominating production. While Delticom boasts relationships with over 600 brands, the availability of high-demand or specialized tires often hinges on a smaller group of leading manufacturers, potentially increasing their bargaining power.

Suppliers' bargaining power significantly impacts Delticom through the volatility of key raw material prices. For instance, the cost of natural and synthetic rubber, carbon black, and steel, all critical components in tire manufacturing, can fluctuate dramatically. In 2024, global commodity markets experienced continued price pressures, with rubber prices seeing significant ups and downs due to weather patterns and geopolitical events affecting key producing regions. This volatility directly translates into potential cost increases for Delticom's suppliers.

Furthermore, global supply chain disruptions and escalating freight costs in 2024 have amplified the cost structure for tire manufacturers like Delticom. Shipping rates, particularly for ocean freight, remained elevated for much of the year, influenced by port congestion and a shortage of available containers. These logistical challenges mean suppliers face higher operational expenses, which they may then pass on to Delticom in the form of increased prices for finished tires or raw materials.

Switching primary suppliers for high-volume tire segments could lead Delticom to incur significant operational and logistical costs. These costs stem from establishing new relationships, integrating different supply chains, and ensuring consistent stock availability across its many online shops, which can bolster supplier leverage.

For instance, a disruption in supply for a key tire model could impact Delticom's ability to fulfill orders promptly, potentially leading to lost sales and customer dissatisfaction. In 2023, Delticom reported that its cost of goods sold was €796.8 million, highlighting the scale of its procurement operations where supplier reliability is paramount.

While these switching costs exist, Delticom's established extensive distribution network and robust logistics management capabilities do offer some mitigation. This infrastructure allows for greater flexibility in managing supplier relationships and potentially absorbing some of the initial impacts of supplier transitions.

Threat of Forward Integration by Suppliers

Large tire manufacturers might explore or bolster their direct-to-consumer (DTC) sales, effectively sidestepping online retailers like Delticom. This strategic move, known as forward integration, would intensify competition for Delticom and diminish tire makers' dependence on external distributors.

For instance, in 2024, several major tire brands continued to invest in their own e-commerce platforms, aiming for greater control over pricing and customer relationships. This trend poses a direct challenge to online tire retailers by potentially capturing a larger share of the direct sales market.

- Forward Integration Threat: Tire manufacturers may establish or expand their own DTC sales channels, bypassing intermediaries.

- Increased Competition: Such integration would directly compete with Delticom's online retail model.

- Reduced Manufacturer Reliance: Manufacturers would lessen their dependence on third-party distributors for sales.

- Delticom's Countermeasures: Delticom's existing online infrastructure and workshop partnerships offer a competitive buffer against these integration efforts.

Supplier Importance to Delticom vs. Delticom Importance to Suppliers

Delticom's standing as a major European online tire retailer, boasting a substantial customer base, makes it a crucial sales avenue for numerous tire manufacturers. This significant market access grants Delticom considerable bargaining power, as suppliers are keen to preserve their reach through its efficient distribution network.

The interdependence between Delticom and its suppliers fosters a more balanced power dynamic. For instance, in 2023, Delticom reported a revenue of €639.8 million, underscoring its substantial purchasing volume which suppliers value.

- Supplier Dependence: Many tire manufacturers rely on Delticom for a significant portion of their online sales volume in Europe.

- Delticom's Leverage: Delticom's large customer base and efficient logistics provide it with leverage to negotiate favorable terms.

- Mutual Benefit: Suppliers gain access to a broad market, while Delticom secures a consistent supply of tires at competitive prices.

Delticom faces moderate bargaining power from its suppliers due to the concentration within the tire manufacturing industry and the critical nature of raw materials. While Delticom's scale, evidenced by its €639.8 million revenue in 2023, provides leverage, suppliers can exert influence through price volatility and potential forward integration into direct-to-consumer sales, as seen with major brands bolstering their e-commerce platforms in 2024.

| Factor | Impact on Delticom | 2023/2024 Data Point |

|---|---|---|

| Supplier Concentration | Potential for increased leverage by major manufacturers. | Delticom works with over 600 brands, but high-demand tires rely on fewer key producers. |

| Raw Material Costs | Volatility in rubber, carbon black, and steel prices impacts supplier costs. | Rubber prices saw significant fluctuations in 2024 due to weather and geopolitical factors. |

| Logistics Costs | Elevated freight costs increase supplier operational expenses. | Ocean freight rates remained high in 2024 due to port congestion and container shortages. |

| Forward Integration | Direct competition from manufacturers' own e-commerce channels. | Several major tire brands expanded their DTC platforms in 2024. |

| Delticom's Leverage | Significant purchasing volume and market access. | Delticom's 2023 revenue of €639.8 million represents substantial buying power. |

What is included in the product

This analysis of Delticom's competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all crucial for understanding Delticom's strategic positioning.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force, enabling targeted strategic adjustments.

Customers Bargaining Power

Customers in the automotive aftermarket, especially when buying tires, are very focused on price. The internet makes it super easy for them to compare prices from different sellers, which really boosts their ability to negotiate. Delticom's customers can easily find tons of product details, read reviews, and see what competitors are charging online. This openness gives them a lot more power.

For online tire purchases, customers face minimal hurdles when switching between retailers. This ease of transition allows them to readily compare prices and brands, significantly increasing their bargaining power. In 2024, the online retail landscape for automotive parts, including tires, continued to be characterized by this low-friction environment.

Delticom combats this by offering a vast inventory, boasting over 600 tire brands and 80,000 distinct models. This extensive selection is designed to be a strong retention tool, aiming to satisfy diverse customer needs in one place. Despite this breadth of choice, the readily available alternatives in the digital marketplace ensure customers remain in a powerful position.

Delticom caters to a dual customer base, including businesses that often buy in bulk. These substantial orders can grant these business clients increased sway in negotiating price reductions or more advantageous contract conditions. For instance, in 2023, the B2B segment represented a significant portion of Delticom's sales, driving demand for fleet and corporate accounts.

The company faces the challenge of offering competitive prices to individual buyers while simultaneously providing appealing incentives to its business clientele to secure and retain market share. This balancing act is crucial for sustained growth, especially as B2B purchasing power can directly impact overall revenue streams and profitability margins.

Growth of E-commerce and Digital-First Behavior

The automotive aftermarket is seeing a significant shift towards e-commerce, with projections indicating it will reach $113.3 billion by 2025. This trend fuels a digital-first consumer behavior, where customers readily research and purchase products online.

This heightened online engagement grants consumers greater bargaining power. They can easily compare prices, read reviews, and access a vast selection of products from various retailers, diminishing their dependence on any single provider.

Delticom's strategy is well-positioned to capitalize on this digital shift, yet it also means the company must continually meet elevated customer expectations for convenience, choice, and competitive pricing.

- E-commerce Growth: Automotive aftermarket e-commerce is expected to hit $113.3 billion by 2025.

- Digital-First Behavior: Consumers increasingly prefer online research and purchasing for automotive parts.

- Increased Bargaining Power: Easy online comparison empowers customers with more choices and price sensitivity.

- Customer Expectations: Delticom faces pressure to deliver superior online experiences and value.

Hybrid Shopping Models and Service Expectations

The rise of hybrid shopping models, blending online convenience with physical services, significantly shapes customer expectations for tire retailers like Delticom. Customers increasingly anticipate a smooth transition from browsing and purchasing online to receiving reliable, local services, such as tire fitting.

Delticom addresses this by leveraging a network of partner workshops for its fitting services. However, the growing customer demand for an integrated experience, where online ease directly translates to dependable in-store execution, grants buyers more leverage. This expectation for seamlessness empowers customers, as they can more readily choose providers who best meet their combined digital and physical service needs.

- Hybrid models: Online purchase with in-store services like tire fitting.

- Customer expectation: Seamless integration of online convenience and local service.

- Delticom's approach: Network of partner workshops for fitting.

- Customer leverage: Enhanced control over purchasing journey due to integrated service demand.

Customers in the automotive aftermarket, particularly for tires, are highly price-sensitive. The internet facilitates easy price comparison across numerous retailers, significantly amplifying their bargaining power. This transparency, coupled with readily available product details and reviews, empowers buyers. In 2024, this low-friction online environment continued to give customers considerable leverage.

Delticom's extensive product range, featuring over 600 tire brands and 80,000 models, aims to retain customers by meeting diverse needs. However, the ease with which customers can switch between online providers means their bargaining power remains substantial. For instance, the automotive aftermarket e-commerce sector is projected to reach $113.3 billion by 2025, underscoring the digital shift and increased consumer choice.

Business clients, who often purchase in bulk, also wield considerable bargaining power. These large orders can lead to negotiated price reductions and more favorable contract terms. In 2023, the B2B segment was a key driver of Delticom's sales, highlighting the importance of catering to these high-volume buyers. The company must balance competitive pricing for individual consumers with attractive terms for its business clientele.

| Factor | Impact on Delticom | Customer Behavior |

|---|---|---|

| Price Sensitivity | High pressure to offer competitive pricing. | Customers actively compare prices online. |

| Ease of Switching | Low customer loyalty without strong value proposition. | Customers can easily move to alternative retailers. |

| Information Availability | Need for transparent and detailed product information. | Customers make informed decisions based on reviews and specs. |

| Bulk Purchasing (B2B) | Negotiating power for larger clients. | Business clients seek discounts and favorable terms. |

What You See Is What You Get

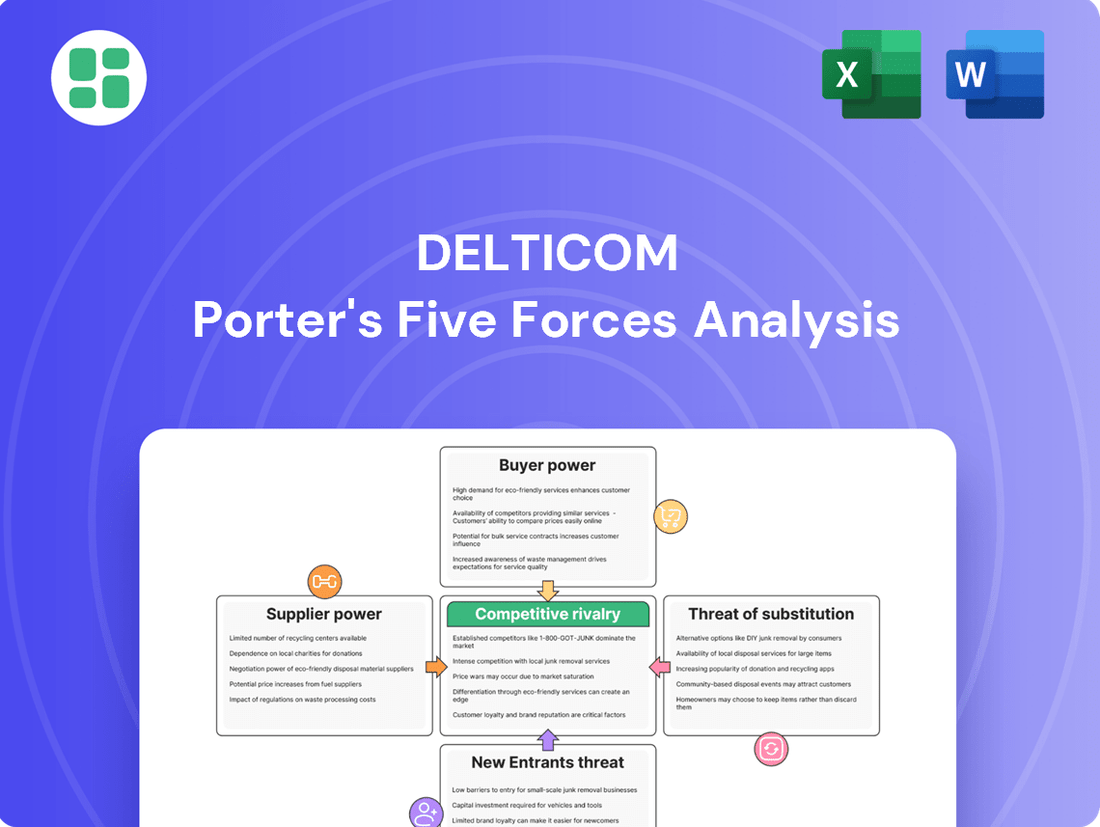

Delticom Porter's Five Forces Analysis

This preview showcases the comprehensive Delticom Porter's Five Forces Analysis, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products within the online tire retail market. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering an in-depth understanding of Delticom's strategic landscape. You can trust that the insights and formatting you see in this preview are precisely what you will receive, ensuring no discrepancies upon purchase.

Rivalry Among Competitors

The European tire and automotive aftermarket is a crowded space, with many companies vying for customer attention both online and in physical stores. This includes specialized online tire shops, traditional garages that are now selling online, and even tire manufacturers selling directly to consumers.

Delticom, a major online tire seller, finds itself competing not only with other dedicated online retailers but also with large online marketplaces like Amazon and eBay, which are increasingly stocking automotive parts and accessories. In 2023, the online automotive aftermarket in Europe was estimated to be worth billions of euros, highlighting the significant market share up for grabs.

The e-commerce automotive aftermarket is booming, with projections indicating it will reach $113.3 billion by 2025. This impressive growth, however, acts like a magnet, drawing in new competitors and substantial investment.

This influx of capital fuels a trend of rapid consolidation within the industry. Private equity firms and other strategic buyers are actively acquiring smaller players, creating larger, more powerful entities that can exert significant market influence.

As the market consolidates, the competitive landscape shifts. The remaining businesses face intensified rivalry as these consolidated giants leverage their increased scale and resources to capture a greater share of the growing market.

While tires can often be seen as commodities driven by price due to their technical specifications, Delticom actively combats this by offering an exceptionally broad selection of tire brands and models. This extensive product range allows customers to find tires that better match their specific needs and preferences, moving beyond a purely price-sensitive decision.

Delticom's competitive edge is further sharpened by its integrated service offering, particularly its extensive network of partner workshops. This ensures customers have convenient access to professional fitting services, a crucial element that adds significant value and differentiates Delticom from competitors who may only focus on the tire sale itself.

In 2023, the European tire market saw continued price competition, yet companies like Delticom demonstrated resilience by focusing on value-added services. For instance, the online tire retail sector experienced a growth of approximately 8% year-over-year, with service integration being a key driver for customer loyalty and retention in this competitive landscape.

Geographic Reach and Market Penetration

Delticom boasts an impressive geographic reach, operating over 100 online shops in more than 70 countries. This extensive network positions them as Europe's leading online tire retailer, creating a substantial barrier for new entrants attempting to match their market penetration.

Maintaining this broad market leadership necessitates ongoing investment in tailored strategies for each region. This includes localized marketing campaigns, efficient logistics networks, and customer service that resonates with diverse consumer bases.

- Geographic Footprint: Operates in over 70 countries.

- Online Shops: Manages more than 100 distinct online retail platforms.

- Market Position: Recognized as Europe's foremost online tire retailer.

- Competitive Advantage: Extensive reach acts as a barrier to smaller competitors.

Marketing Intensity and Brand Loyalty

Competition in the online tire market demands substantial marketing investment to capture and maintain customer attention. Delticom, like its competitors, must allocate significant resources to advertising and promotional activities to stand out. For instance, in 2024, the global online advertising market was projected to reach over $600 billion, highlighting the intensity of this spending battle.

Building strong brand loyalty is paramount, especially given the low costs associated with switching providers and the high sensitivity consumers have to pricing. Customers can easily compare prices across different platforms, making retention a key challenge. This environment means that even established brands need to work harder to keep customers coming back.

Delticom's brands, such as Reifendirekt, benefit from years of market presence and established recognition. However, this legacy requires continuous reinforcement through ongoing advertising campaigns and active customer engagement. Without this sustained effort, these brands risk losing ground to newer, more aggressive competitors who are also vying for market share.

- Marketing Spend: Online advertising expenditure is a critical factor, with the global digital ad market showing robust growth.

- Brand Loyalty: Low switching costs and price sensitivity make customer retention a continuous challenge.

- Competitive Pressure: Established brands must invest in marketing and engagement to counter aggressive rivals.

- Customer Acquisition: Continuous efforts are needed to attract new customers in a crowded online marketplace.

The competitive rivalry within the online tire and automotive aftermarket is intense, characterized by a large number of players and significant marketing expenditures. Delticom faces pressure from both specialized online retailers and broader e-commerce platforms. In 2024, the global online advertising market's projected over $600 billion spend underscores the high cost of customer acquisition and retention.

The market's growth, with projections of the e-commerce automotive aftermarket reaching $113.3 billion by 2025, attracts new entrants and fuels consolidation. This consolidation creates larger, more dominant competitors who can exert greater market influence, intensifying the rivalry for remaining businesses.

Delticom differentiates itself through a vast product selection and integrated service offerings like its partner workshop network, aiming to move beyond pure price competition. Despite this, the low cost of switching providers and high price sensitivity among consumers mean continuous marketing and customer engagement are vital to maintain brand loyalty and market share.

| Key Competitive Factors | Delticom's Approach | Market Trend Impact |

| Number of Competitors | High, including specialized online retailers, garages, manufacturers, and large marketplaces. | Intensifies customer acquisition costs and pricing pressure. |

| Marketing Investment | Significant allocation to advertising and promotions. | Global online ad market projected over $600 billion in 2024, indicating high spending battles. |

| Product Differentiation | Extensive tire brand and model selection. | Helps move beyond price-only decisions, fostering customer preference. |

| Service Integration | Extensive network of partner workshops for fitting. | Adds value and enhances customer loyalty in a competitive landscape. |

| Customer Loyalty Drivers | Brand recognition, ongoing engagement, and value-added services. | Crucial due to low switching costs and high price sensitivity. |

SSubstitutes Threaten

The rise of alternative mobility solutions poses a significant threat to traditional tire markets. For instance, in 2024, global urban public transport ridership continued its upward trajectory, with many cities investing heavily in expanding services. Ride-sharing platforms also saw sustained growth, offering convenient alternatives to private car use, thereby reducing the need for personal vehicle maintenance, including tire replacement.

Furthermore, the burgeoning popularity of electric bicycles and scooters, particularly in urban environments, directly competes with car usage for shorter trips. This trend, amplified by environmental consciousness and urban congestion concerns, can lead to a material decline in the demand for tires, especially for smaller, city-oriented vehicles. This shift represents a fundamental challenge to the core business model of tire manufacturers and retailers.

Technological leaps in tire production are creating products that last significantly longer. For instance, advancements in rubber compounds and tread designs have pushed average tire lifespans upwards, with many premium tires now rated for 50,000 to 70,000 miles or more, impacting how often consumers need replacements.

The push for sustainability and fuel efficiency is also a major driver. Innovations like green compounds and low-rolling resistance technologies not only benefit the environment but also extend the usable life of tires. This trend directly reduces the demand for frequent replacements, posing a threat to tire retailers like Delticom by shrinking their potential sales volume.

The threat of substitutes for new tires, particularly from used or remanufactured auto parts, is generally low for the tires themselves. However, the broader automotive aftermarket is seeing a significant rise in remanufactured components. For example, the global automotive remanufacturing market was valued at approximately $70 billion in 2023 and is projected to grow, driven by consumer demand for cost savings and increasing environmental consciousness.

While tires are a critical safety component and consumers typically opt for new ones to ensure performance and reliability, this growing trend in other automotive parts could subtly influence consumer perception. As more drivers embrace remanufactured alternators, starters, or engines, the general acceptance of re-used automotive products might expand, potentially creating a minor, indirect pressure on the perceived necessity of always purchasing brand-new tires.

Tire Repair and Retreading Services

For commercial vehicles, tire retreading presents a significant cost-saving alternative to buying new tires. In 2024, the global tire retreading market was valued at approximately $12 billion, demonstrating its economic appeal.

While less common for passenger cars, improved tire repair methods for minor damage can prolong the usability of existing tires. This reduces the urgency for new tire acquisitions, creating a moderate substitute threat for tire manufacturers and retailers.

- Retreading Cost Savings: Retreading can cost 30-50% less than new tires.

- Market Value: The tire retreading market reached around $12 billion in 2024.

- Passenger Car Repairs: Advanced repair techniques extend tire life, reducing new purchases.

Shift to Tire-as-a-Service Models

Emerging business models like tire subscription services, often termed Tire-as-a-Service, present a significant threat of substitutes for traditional online tire retailers. These models shift the customer focus from outright product ownership to paying for tire usage, fundamentally altering the purchasing dynamic.

This transition from a one-time product sale to an ongoing service relationship can directly reduce the volume of traditional tire sales for companies like Delticom. While still in its early stages, this 'pay-per-mile' or subscription approach has the potential to gain significant traction among consumers seeking convenience and predictable costs.

For instance, in 2024, the automotive service sector saw increased interest in flexible ownership models. While specific tire-as-a-service adoption rates are still developing, the broader trend towards subscription services across various industries indicates a growing consumer willingness to embrace such alternatives.

The threat lies in these new models potentially capturing a segment of the market that would otherwise purchase tires through established online channels, thereby impacting Delticom's core business.

The threat of substitutes for new tires is multifaceted, impacting Delticom's traditional sales model. Alternative mobility solutions like public transport and ride-sharing, which saw continued growth in 2024, reduce overall car usage and thus tire demand. Furthermore, advancements in tire technology are extending product lifespans, with premium tires now often lasting 50,000 to 70,000 miles, directly decreasing replacement frequency.

While used tires are generally not a direct substitute for safety-conscious consumers, the broader acceptance of remanufactured automotive parts, a market valued at about $70 billion in 2023, could indirectly influence perceptions. For commercial vehicles, retreading remains a significant cost-saving substitute, with the retreading market valued at approximately $12 billion in 2024, offering savings of 30-50% over new tires.

| Substitute Type | Impact on Delticom | Key Data Point (2024/2023) |

| Alternative Mobility | Reduced car usage, lower tire demand | Continued growth in public transport ridership globally |

| Extended Tire Lifespan | Decreased replacement frequency | Premium tires rated for 50,000-70,000+ miles |

| Retreading (Commercial) | Cost-saving alternative to new tires | Global retreading market ~$12 billion (2024) |

| Tire Subscription Services | Shift from product ownership to usage | Growing interest in flexible automotive service models |

Entrants Threaten

Entering the online tire retail space, especially at a scale comparable to Delticom, demands substantial upfront capital. This includes significant investment in stocking a wide variety of tires, building and maintaining sophisticated e-commerce websites, and setting up efficient warehousing and delivery networks. For instance, a new entrant aiming to match Delticom's inventory breadth would likely need to allocate tens of millions of euros just for initial stock and infrastructure.

Delticom has already made considerable investments in its own warehouses and has honed its ordering and logistics systems over years of operation. These established assets and processes create a high barrier to entry. New competitors would need to secure considerable funding to replicate this level of operational capacity and efficiency, making it challenging to compete on price and delivery speed from the outset.

Incumbents like Delticom, operating since 1999, leverage significant economies of scale in purchasing, marketing, and logistics. This allows them to negotiate better prices with suppliers and spread fixed costs over a larger volume, creating a substantial cost advantage.

New entrants would find it challenging to replicate Delticom's operational efficiency and cost structure from the outset. They would likely face higher per-unit costs, making it difficult to compete on price without sacrificing profitability, thus posing a barrier to entry.

Delticom's established relationships allow it to offer products from hundreds of brands, a significant hurdle for newcomers. New entrants would struggle to replicate this extensive product sourcing and the associated economies of scale.

Building a comparable service network, like Delticom's approximately 30,000 partner garages, presents another formidable barrier. The time and capital investment required to establish such a widespread and trusted network would be substantial for any new competitor entering the market.

Brand Recognition and Customer Trust

Brand recognition is a significant barrier for new entrants in the online tire retail market, as exemplified by Delticom. The company has cultivated substantial brand awareness, notably through its Reifendirekt brand, and has garnered the trust of a vast customer base exceeding 20 million individuals across Europe. This established reputation means newcomers must invest heavily in marketing and dedicate considerable time to achieve comparable levels of brand awareness and customer loyalty in a highly competitive online environment.

Delticom's success in building strong brand recognition and customer trust presents a formidable challenge for potential new entrants. For instance, in 2023, Reifendirekt continued to be a leading online tire retailer, demonstrating the sustained power of their brand. New competitors would face the daunting task of replicating this level of market penetration and consumer confidence, which typically requires substantial upfront investment in advertising and a proven track record of reliable service.

- Brand Strength: Delticom, particularly through Reifendirekt, has secured a dominant position in the European online tire market, built over years of operation.

- Customer Base: Over 20 million European customers represent a significant loyal base that new entrants would struggle to attract quickly.

- Marketing Investment: Newcomers need to allocate considerable resources to marketing campaigns to even begin to rival Delticom's established brand visibility.

- Trust Factor: Customer trust, earned through consistent service and product quality, is a non-monetary barrier that takes time and effort to build.

Regulatory Hurdles and Market Complexity

The threat of new entrants for Delticom is significantly impacted by regulatory hurdles and the inherent complexity of operating in a global market. Navigating over 70 countries means dealing with a patchwork of differing regulations, consumer protection laws, and import/export duties. For instance, in 2024, the European Union continued to harmonize certain consumer rights directives, adding another layer for potential entrants to understand and comply with. This intricate legal and operational framework across multiple national markets presents a substantial barrier, making it difficult and costly for new players to establish a foothold and scale effectively.

New entrants would need to invest heavily in legal expertise and compliance infrastructure to manage these diverse regulatory environments. The sheer operational complexity of managing logistics, pricing, and marketing across numerous countries, each with its own unique set of rules, acts as a strong deterrent. This complexity is not easily overcome, requiring significant capital and time commitment, thereby limiting the ease with which new competitors can emerge and challenge established players like Delticom.

- Regulatory Complexity: Delticom operates in over 70 countries, each with unique regulations impacting e-commerce, consumer rights, and trade.

- Legal and Operational Barriers: New entrants face substantial costs and challenges in establishing legal compliance and operational efficiency across multiple jurisdictions.

- Deterrent to Entry: The intricate web of laws and operational demands discourages potential new competitors from entering the market at scale.

The threat of new entrants in the online tire retail market, while present, is tempered by significant barriers for companies like Delticom. High capital requirements for inventory and infrastructure, coupled with established economies of scale and brand loyalty, make it challenging for newcomers to compete effectively. Delticom's extensive network of service partners and its multi-country operational expertise further solidify its market position, demanding substantial investment and time from any aspiring competitor.

| Barrier Type | Description | Impact on New Entrants | Delticom's Advantage |

|---|---|---|---|

| Capital Requirements | Significant investment needed for inventory, warehousing, and e-commerce platforms. | High barrier, requiring substantial funding. | Established infrastructure and scale. |

| Economies of Scale | Lower per-unit costs due to high volume purchasing and logistics. | New entrants face higher initial costs. | Negotiating power with suppliers, efficient logistics. |

| Brand Recognition & Trust | Customer loyalty built over years of operation. | Difficult and costly to build comparable brand awareness. | Over 20 million European customers, strong brand presence (e.g., Reifendirekt). |

| Network Effects | Extensive service partner network (approx. 30,000 garages). | Time-consuming and costly to replicate. | Widespread service availability for customers. |

| Regulatory Complexity | Navigating diverse regulations across 70+ countries. | Requires significant legal and compliance investment. | Established expertise in international operations. |

Porter's Five Forces Analysis Data Sources

Our Delticom Porter's Five Forces analysis is built upon a foundation of extensive data, including company annual reports, investor presentations, and industry-specific market research from leading firms. We also leverage publicly available financial statements and regulatory filings to ensure a comprehensive understanding of the competitive landscape.