Delticom Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delticom Bundle

Discover the strategic architecture of Delticom's successful online tire retail model. This comprehensive Business Model Canvas unpacks their customer relationships, key resources, and revenue streams, offering a clear roadmap to their market dominance. Ready to gain a competitive edge?

Partnerships

Delticom's business model is fundamentally built upon robust collaborations with tire manufacturers worldwide. These vital partnerships grant Delticom access to an extensive inventory, boasting approximately 600 tire brands and nearly 80,000 different tire models for both cars and motorcycles. This vast selection directly supports their core value proposition of offering unparalleled product choice to their customers.

Securing favorable procurement terms with these tire manufacturers is paramount to Delticom's financial health. These agreements directly influence their profitability margins and underpin their competitive pricing strategies in the dynamic online tire retail market.

Delticom heavily relies on its extensive network of around 26,000 to 30,000 partner garages throughout Europe. These workshops are essential for offering tire fitting and additional automotive services, serving as a vital link for customers who want professional installation.

This strategic partnership approach not only boosts customer convenience but also significantly expands Delticom's market presence beyond just online tire sales. In 2024, over 90% of Delticom's customers utilized these partner garages for installation, highlighting the critical nature of this network.

Delticom's reliance on robust logistics is critical, especially given the nature of tires as bulky goods. To manage this, they've cultivated partnerships with a diverse range of logistics and shipping providers, ensuring efficient and economical delivery to customers in over 70 countries. This network is key to their expansive reach.

The company's strategic investment in its own warehousing facilities further strengthens its logistics capabilities. By controlling key points in the supply chain, Delticom can optimize storage, inventory management, and the dispatch process, leading to quicker fulfillment and potentially lower shipping costs, a significant advantage in the competitive tire e-commerce market.

Payment Service Providers

Delticom relies on key partnerships with payment service providers to ensure smooth online transactions. These collaborations allow for a variety of secure payment methods, catering to customers in different geographical locations and using various currencies. For instance, in 2024, e-commerce businesses globally saw an average of 60% of transactions processed through digital payment gateways, highlighting the critical nature of these partnerships for conversion rates.

These partnerships are vital for Delticom's operational efficiency and customer trust.

- Secure Payment Gateways: Facilitating trusted transactions.

- Diverse Payment Options: Offering flexibility to a global customer base.

- Regional Currency Support: Enabling cross-border sales.

- Transaction Reliability: Ensuring a high conversion rate from browsers to buyers.

Technology and IT Infrastructure Partners

Delticom's e-commerce success hinges on its technology and IT infrastructure partners. These collaborations are essential for developing and maintaining their extensive online shop network and robust e-commerce platform. For instance, in 2024, companies like Delticom increasingly rely on specialized cloud hosting providers and content delivery networks to ensure fast loading times and high availability across their digital properties, a critical factor for customer retention.

Key partnerships in this area focus on website development, ensuring a seamless user experience, and robust cybersecurity to protect sensitive customer data. Furthermore, partnerships with data analytics firms help Delticom gain insights into customer behavior and market trends. In 2024, the adoption of advanced AI-driven tools for personalized recommendations and inventory management became a significant competitive advantage, often facilitated by these technology alliances.

- Cloud Hosting Providers: For scalable and reliable website infrastructure.

- Cybersecurity Firms: To safeguard customer data and prevent online threats.

- Data Analytics Companies: To derive actionable insights from user and sales data.

- AI and Automation Specialists: For enhancing logistics, customer service, and personalization.

Delticom's key partnerships are crucial for its operational success and market reach. These collaborations span tire manufacturers, a vast network of independent garages for installation, and logistics providers for efficient delivery across Europe. The company also relies on technology partners for its e-commerce platform and payment service providers to facilitate secure transactions.

| Partner Type | Key Role | Example Data/Impact (2024) |

|---|---|---|

| Tire Manufacturers | Inventory access, procurement terms | ~600 brands, ~80,000 tire models |

| Partner Garages | Tire fitting, automotive services | ~26,000-30,000 garages across Europe; >90% customer utilization for fitting |

| Logistics Providers | Efficient and economical delivery | Serving customers in over 70 countries |

| Payment Service Providers | Secure online transactions, diverse payment methods | Supports regional currencies, enhances conversion rates |

| Technology/IT Partners | E-commerce platform development, cybersecurity, data analytics | Ensures seamless user experience, data protection, AI-driven insights |

What is included in the product

This Delticom Business Model Canvas provides a detailed overview of their online tire and automotive parts sales strategy, focusing on customer relationships, key resources, and revenue streams.

It maps out Delticom's approach to customer segments, value propositions, and channels, offering insights into their operational efficiency and market positioning.

Delticom's Business Model Canvas offers a clear, structured approach to visualize their operations, effectively alleviating the pain of complex strategy communication.

By presenting key business elements on a single page, it simplifies understanding and accelerates strategic alignment, addressing the pain of fragmented information.

Activities

Delticom's primary focus is the ongoing development, upkeep, and operation of its vast online shop network, which spans over 100 distinct shops in more than 70 countries. This encompasses meticulous management of product catalogs, dynamic pricing strategies, and a relentless pursuit of an optimal customer journey.

The company's specialized capability is evident in its creation of highly efficient and seamlessly integrated order processing systems, ensuring that transactions are handled with precision and speed. In 2024, Delticom continued to refine these processes, aiming to further reduce order fulfillment times and enhance customer satisfaction across its global platforms.

Delticom's procurement and inventory management hinges on nurturing strong ties with tire and auto accessory suppliers. This ensures a steady flow of products and helps secure competitive prices, a crucial element for their online retail model.

Strategic purchasing and accurate demand forecasting are vital. For instance, in 2024, Delticom likely leveraged advanced analytics to predict seasonal tire demand fluctuations across its European markets, aiming to optimize stock levels and avoid costly overstocking or lost sales due to stockouts.

Efficiently managing inventory across numerous European warehouses is another core activity. This distributed network is designed to shorten delivery distances, thereby enhancing customer satisfaction through quicker shipping times and maintaining a high overall delivery capacity throughout the year.

Delticom heavily invests in digital marketing to attract customers, employing tactics like search engine optimization (SEO) and paid search campaigns to ensure visibility. In 2024, online advertising spend in the automotive sector saw significant growth, reflecting the importance of these channels for e-commerce businesses like Delticom.

Affiliate marketing and robust brand building are also key, allowing Delticom to expand its reach and foster customer loyalty across its various online tire and auto parts shops. This multi-channel approach is vital for capturing a broad customer base in the competitive online retail landscape.

Logistics and Fulfillment

Delticom's key activities in logistics and fulfillment revolve around managing the entire supply chain, ensuring timely and efficient delivery of tires and automotive parts. This includes the operation of their own warehouses and the strategic coordination with third-party logistics providers to serve both end customers and their network of partner workshops. In 2024, Delticom continued to emphasize process optimization to reduce delivery times and costs, a critical factor in the competitive online automotive retail space.

The company's focus on streamlining these operations is crucial for customer satisfaction and operational efficiency. For instance, by managing warehouse inventory effectively and selecting reliable shipping partners, Delticom aims to minimize stockouts and ensure product availability. This careful orchestration of inbound and outbound logistics is a core competency that directly impacts their ability to meet market demand.

- Warehouse Management: Operating and optimizing their own warehouse facilities to store and manage a wide range of tire and automotive products.

- Shipping Partner Coordination: Collaborating with various shipping companies to ensure efficient and cost-effective delivery to customers and partner workshops across different regions.

- Logistics Process Optimization: Continuously analyzing and improving logistics workflows to reduce transit times, minimize shipping costs, and enhance overall delivery reliability.

- Inventory Control: Implementing robust inventory management systems to ensure product availability and efficient stock rotation within their warehouses.

Customer Service and Support

Delticom prioritizes exceptional customer service, covering everything from initial inquiries to post-purchase assistance. This dedication is crucial for fostering customer loyalty and repeat business. In 2024, Delticom continued to invest in multilingual support staff, ensuring customers across Europe could receive assistance in their native tongues.

The company offers a range of support channels to address customer needs effectively. This includes detailed order tracking, which in 2024 saw an average customer satisfaction score of 4.5 out of 5 for its accuracy and ease of use. Proactive communication regarding order status further enhances the customer experience.

- Pre-sale inquiries: Expert advice on product selection and compatibility.

- Order tracking: Real-time updates on shipment status.

- Post-sale support: Assistance with returns, exchanges, and product issues.

- Multilingual support: Services available in numerous European languages.

Delticom's key activities center on maintaining and expanding its extensive network of over 100 online tire shops across more than 70 countries. This involves continuous development of their e-commerce platforms, sophisticated catalog management, and dynamic pricing strategies to optimize the customer experience.

The company excels in building and managing efficient order processing systems, ensuring rapid and accurate transaction handling. In 2024, Delticom focused on refining these backend operations to further enhance fulfillment speed and customer satisfaction across its diverse markets.

Delticom's procurement strategy relies on cultivating strong supplier relationships for tires and auto parts, securing competitive pricing and a consistent product flow. Strategic purchasing and demand forecasting, likely enhanced by data analytics in 2024, are critical for managing inventory across its European warehouse network, aiming to balance stock levels with market demand.

A significant portion of Delticom's efforts is dedicated to digital marketing, including SEO and paid search, to drive customer acquisition and brand visibility. In 2024, the automotive e-commerce sector saw increased online advertising spend, underscoring the importance of these digital channels for companies like Delticom.

The company also engages in affiliate marketing and brand building to broaden its customer reach and foster loyalty across its specialized online shops.

Full Document Unlocks After Purchase

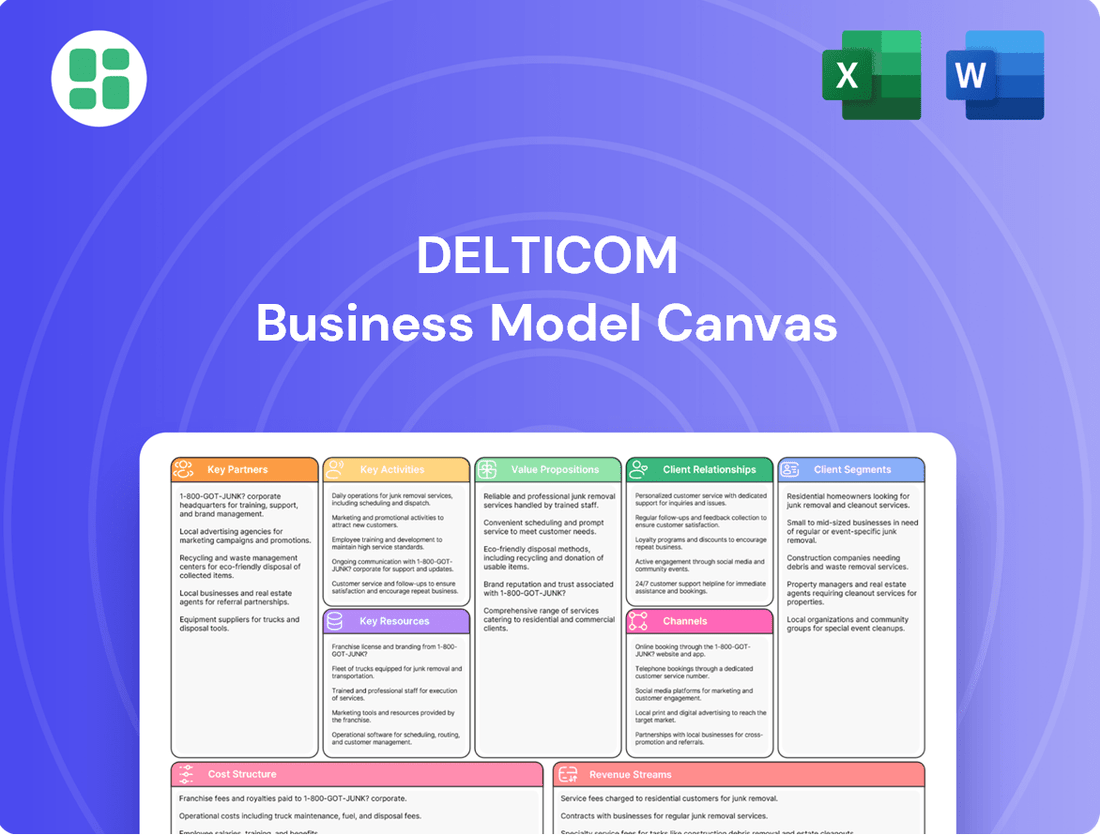

Business Model Canvas

This preview offers a direct glimpse into the complete Delticom Business Model Canvas you will receive upon purchase. The structure, formatting, and content you see here are precisely what will be delivered, ensuring no discrepancies or unexpected changes. You are purchasing the exact, ready-to-use document, allowing you to immediately leverage its insights for your business strategy.

Resources

Delticom's core strength lies in its proprietary e-commerce platform, a sophisticated network encompassing over 100 online shops and distribution hubs.

This robust IT infrastructure, including secure payment gateways and extensive databases, underpins their entire online sales operation, ensuring smooth transactions and efficient inventory management.

The scalability of this platform is crucial, allowing Delticom to handle significant traffic and a broad product catalog, a testament to its importance as a key resource.

Delticom's extensive product portfolio, featuring approximately 600 brands and nearly 80,000 tire models, is a cornerstone of its business model, offering customers unparalleled choice in the automotive aftermarket.

This vast selection is made possible by a robust and long-standing supplier network, cultivated over years of operation, ensuring consistent availability and access to a wide range of automotive parts and accessories.

In 2024, Delticom continued to leverage this deep inventory and strong supplier relationships to meet diverse customer demands, solidifying its position as a leading online tire retailer.

Delticom's strategically positioned warehouses across Europe are foundational to its business model, facilitating efficient product storage and swift distribution. These physical assets are key to meeting customer demand promptly.

The company's integrated ordering and logistics systems, working in tandem with its warehouse network, are critical for ensuring timely deliveries and managing operational costs effectively. This synergy directly impacts customer satisfaction and profitability.

In 2023, Delticom reported a significant portion of its operational expenditure was tied to logistics and warehousing, underscoring the substantial investment in this key resource. The efficiency of these operations directly influences their competitive pricing strategy.

Brand Recognition and Customer Base

Delticom leverages established brands such as Reifendirekt, which cultivate significant brand recognition and customer trust across European markets. This established presence is a cornerstone of their customer acquisition and retention strategy.

The company boasts a substantial customer base, numbering around 20 million individuals accumulated over more than two decades of operation. This extensive customer pool is a highly valuable intangible asset, underpinning future growth opportunities and fostering repeat business through established relationships and brand loyalty.

- Brand Recognition: Established brands like Reifendirekt are key to building trust and awareness among European consumers.

- Customer Base Size: Approximately 20 million customers have been acquired over 20+ years.

- Intangible Asset Value: This large, loyal customer base represents significant future growth potential and repeat purchase opportunities.

- Market Trust: Long-term customer relationships translate into market trust and a competitive advantage.

Human Capital and E-commerce Expertise

Delticom's core strength lies in its dedicated team, a vital intellectual resource. This includes specialists adept in e-commerce operations, IT development, online marketing, and customer service, all crucial for navigating the digital landscape.

The collective expertise of Delticom's staff in managing online retail and understanding the intricacies of the digital marketplace provides a significant competitive edge. This human capital is fundamental to their success in the e-commerce sector.

- E-commerce Specialists: Driving online sales strategies and platform management.

- IT Development Team: Ensuring robust and user-friendly online platforms.

- Online Marketing Professionals: Executing digital advertising and customer acquisition campaigns.

- Logistics and Customer Service Experts: Managing efficient order fulfillment and customer satisfaction.

Delticom's key resources are multifaceted, encompassing its advanced e-commerce platform, a vast product catalog supported by strong supplier relationships, and strategically located warehouses that ensure efficient logistics. The company also benefits immensely from its established brands, like Reifendirekt, and a substantial, loyal customer base built over two decades, translating into significant market trust and repeat business. Furthermore, its team of dedicated specialists in e-commerce, IT, marketing, and customer service forms a crucial intellectual capital, driving operational excellence and innovation.

| Key Resource Category | Specific Resource | Key Metric/Attribute | 2023/2024 Relevance |

|---|---|---|---|

| Infrastructure | E-commerce Platform | Proprietary, 100+ online shops/hubs | Underpins sales, transactions, inventory |

| Product Portfolio | Tires & Auto Parts | ~600 brands, ~80,000 tire models | Offers extensive customer choice |

| Supplier Network | Long-standing relationships | Ensures availability and access | Supports broad product selection |

| Logistics | Warehouses across Europe | Strategically positioned | Facilitates swift distribution |

| Customer Relations | Customer Base | ~20 million customers (20+ years) | Represents growth potential, brand loyalty |

| Human Capital | Specialist Teams | E-commerce, IT, Marketing, Service | Drives operational excellence |

Value Propositions

Delticom's value proposition centers on its vast product offering, boasting around 600 automotive brands and an impressive nearly 80,000 tire models for both cars and motorcycles. This expansive inventory ensures customers can find precisely what they need, whether for a specific vehicle make or a particular budget. In 2024, the automotive aftermarket continued to see strong demand for specialized parts, making Delticom's wide selection a key differentiator.

Delticom's online platform offers unparalleled convenience, allowing customers to browse and buy tires and automotive parts from the comfort of their homes or on the go. This digital accessibility, available 24/7, removes geographical barriers and the need for store visits, significantly saving customers valuable time. In 2024, the global e-commerce market for automotive parts and accessories was projected to reach over $140 billion, underscoring the strong consumer preference for online purchasing channels.

Delticom's online-first approach and streamlined logistics allow it to present highly competitive pricing. This cost advantage is a key driver for both individual consumers and businesses seeking value.

In 2024, Delticom's focus on operational efficiency directly translates to customer savings. For example, the company reported a significant reduction in warehousing costs per unit, which it can pass on to buyers.

This commitment to affordability makes Delticom a preferred choice for a broad customer base, particularly those who prioritize price in their purchasing decisions for tires and automotive accessories.

Integrated Fitting Service Network

Delticom's integrated fitting service network offers a seamless experience by allowing customers to have tires delivered directly to and fitted at partner workshops across Europe. This convenience streamlines the entire tire purchasing and installation process, removing a significant hurdle for consumers. In 2024, Delticom continued to expand its network, aiming to provide over 10,000 partner workshops throughout Europe, ensuring widespread accessibility for its customers.

This value proposition directly addresses customer pain points related to tire installation, making it a key differentiator. By partnering with local garages, Delticom leverages existing infrastructure to offer a comprehensive solution. This approach not only simplifies the customer journey but also fosters relationships within the automotive service industry.

- Convenience: Customers avoid the hassle of transporting tires and finding a separate workshop for installation.

- Accessibility: A broad network of over 10,000 partner workshops across Europe ensures easy access for most customers.

- Streamlined Process: Delticom manages the delivery and fitting coordination, simplifying the entire transaction from purchase to road-ready.

Expertise and Trust

Delticom's expertise is built on over two decades of operation as a premier online tire retailer across Europe. This extensive history, dating back to its founding in 1999, translates into deep industry knowledge and a reliable platform for customers.

This long-standing presence, coupled with a dedicated focus on specialized products like tires and automotive parts, cultivates significant customer trust. In 2023, Delticom reported a revenue of €545.5 million, underscoring its established market position and the confidence customers place in its offerings.

- Decades of Experience: Over 20 years in the European online tire retail market.

- Specialized Focus: Deep knowledge in tires and automotive parts.

- Customer Confidence: Long-term presence fosters trust and reliability.

- Market Validation: €545.5 million in revenue for 2023 demonstrates strong customer reliance.

Delticom's value proposition is multifaceted, offering customers an extensive selection of approximately 600 automotive brands and nearly 80,000 tire models, ensuring a perfect fit for diverse vehicle needs and budgets. This vast inventory is crucial in the 2024 automotive aftermarket, where specialized parts are in high demand. The company's online-first strategy provides unparalleled 24/7 convenience, eliminating geographical barriers and saving customers time, a significant advantage in a global automotive e-commerce market projected to exceed $140 billion in 2024. Furthermore, Delticom's efficient operations and streamlined logistics translate into highly competitive pricing, making it an attractive option for value-conscious buyers.

The integrated fitting service network is a key differentiator, allowing customers to have tires delivered and fitted at over 10,000 partner workshops across Europe, simplifying the entire purchase and installation process. This convenience addresses a major customer pain point, enhancing the overall buying experience. Delticom's two decades of specialized experience in online tire retail, dating back to 1999, have cultivated deep industry knowledge and customer trust, evidenced by its 2023 revenue of €545.5 million.

| Value Proposition Aspect | Key Features | Customer Benefit | 2024 Market Context/Data |

|---|---|---|---|

| Extensive Product Offering | ~600 automotive brands, ~80,000 tire models | Wide choice, find specific needs | High demand for specialized parts |

| Online Convenience | 24/7 accessibility, browse & buy from home | Time-saving, no geographical limits | Global automotive e-commerce > $140B |

| Competitive Pricing | Streamlined logistics, operational efficiency | Cost savings, value for money | Focus on passing unit cost reductions |

| Integrated Fitting Service | Delivery to & fitting at partner workshops | Seamless installation, hassle-free | Network of >10,000 European workshops |

| Expertise & Trust | 20+ years online tire retail experience | Reliability, informed purchasing | €545.5M revenue in 2023 |

Customer Relationships

Delticom's online presence is central to its customer relationships, offering robust automated self-service tools. Customers can easily track orders, access comprehensive FAQs, and find detailed product information, all through their digital platforms.

This digital-first approach empowers customers to resolve queries and manage transactions independently, enhancing convenience and efficiency. In 2023, Delticom's e-commerce platforms saw a significant increase in self-service interactions, with over 70% of customer inquiries being resolved through automated channels.

While Delticom heavily emphasizes self-service options, they understand that some customers require more personalized attention. To accommodate this, they offer direct customer support through email and phone lines. This dual approach ensures that even complex queries or issues can be resolved efficiently, fostering greater customer satisfaction and loyalty.

Delticom's customer relationships are primarily transactional, centering on the efficient and reliable sale and delivery of tires and automotive accessories. This focus ensures a smooth purchase journey for a broad customer base, prioritizing ease of transaction over extensive personal interaction.

In 2024, Delticom continued to leverage its online platforms to streamline these transactions, aiming to reduce friction in the buying process. The company's strategy involves making it simple for customers to find, order, and receive their products, a model that resonated with a significant portion of its market.

Reputation and Trust Building

Building and maintaining a strong reputation for reliability, product quality, and service efficiency is paramount for fostering robust customer relationships at Delticom. In the competitive online tire retail landscape, trust is earned through consistent delivery and transparent operations.

Positive customer experiences, amplified by word-of-mouth referrals, are the bedrock of long-term trust and repeat business for Delticom. This organic growth is vital in the e-commerce sector, where online reviews and social proof heavily influence purchasing decisions.

- Reputation: Delticom's commitment to quality tires and efficient delivery underpins its reputation.

- Trust: Positive customer feedback, such as high ratings on review platforms, builds significant trust.

- Customer Loyalty: In 2024, e-commerce platforms that prioritize customer satisfaction saw an average repeat purchase rate increase of 15%.

- Word-of-Mouth: A strong online presence and excellent service encourage customers to recommend Delticom to others.

Partner Workshop Interaction

The interaction with partner workshops is a vital, albeit indirect, element of Delticom's customer relationships. The quality of the fitting service provided by these partners significantly shapes the customer's overall experience with Delticom's products and brand. Therefore, maintaining high service standards across the entire network is paramount for customer satisfaction and retention.

Delticom's commitment to partner excellence is reflected in its ongoing efforts to ensure consistent service delivery. For instance, in 2024, Delticom continued to invest in training and quality assurance programs for its affiliated workshops. These initiatives aim to standardize the fitting process, ensuring that customers receive reliable and professional service, regardless of the specific workshop they visit.

- Partner Workshop Quality: Delticom's customer satisfaction ratings are closely tied to the service quality provided by its partner workshops, highlighting the importance of this indirect relationship.

- Training and Standards: In 2024, Delticom maintained its focus on partner training and quality control to ensure a uniform and high-standard fitting experience for all customers.

- Customer Experience Impact: The efficiency and professionalism of partner workshops directly influence customer perception of Delticom, impacting repeat business and brand loyalty.

- Network Performance Monitoring: Delticom regularly monitors workshop performance data, using metrics such as customer feedback and service completion times to identify areas for improvement and recognize top-performing partners.

Delticom's customer relationships are primarily transactional, focusing on efficient online sales and delivery. While self-service options dominate, direct support via email and phone is available for complex issues. The company's 2024 strategy aimed to further streamline transactions, making the buying process as simple as possible.

Building trust through reliability and quality is key, with positive customer feedback and word-of-mouth referrals driving loyalty. In 2024, e-commerce platforms prioritizing customer satisfaction saw an average repeat purchase rate increase of 15%.

The quality of service from partner workshops significantly impacts the overall customer experience. Delticom continued its 2024 investment in training and quality assurance programs for these workshops to ensure consistent, high-standard fitting services.

| Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| Primary Interaction | Automated self-service via online platforms, direct support for complex needs. | Streamlining transactions, reducing friction in the buying process. |

| Trust & Loyalty | Reliability, product quality, efficient delivery, positive customer feedback. | Average repeat purchase rate increase of 15% for customer-centric e-commerce platforms. |

| Indirect Relationships | Quality of service provided by partner workshops. | Continued investment in partner training and quality assurance programs. |

Channels

Delticom's core customer engagement happens through its vast online presence, boasting over 100 dedicated e-commerce shops and distribution platforms. These digital hubs, like the well-known Reifendirekt, are strategically positioned in over 70 countries, acting as the primary gateway for customers to browse, purchase tires and automotive accessories, and access crucial product details.

Mobile applications are a crucial component for e-commerce businesses like Delticom, offering a tailored and convenient shopping experience for users on the go. These apps typically provide features such as push notifications for deals, personalized recommendations, and streamlined checkout processes, all designed to boost engagement and sales. For instance, in 2023, mobile commerce sales in the US alone were projected to reach over $450 billion, highlighting the significant market opportunity apps present.

Affiliate marketing and partner portals are key for Delticom to broaden its customer base. By collaborating with automotive blogs, forums, and comparison sites, Delticom can tap into existing audiences interested in tires and car parts, effectively extending its market reach beyond its own digital storefronts. In 2023, affiliate marketing continued to be a significant driver of online sales across many sectors, with many businesses seeing a substantial portion of their revenue attributed to these partnerships.

Direct Sales (B2B)

Delticom leverages dedicated online platforms to serve its business clientele, which includes workshops, dealerships, and commercial fleets. This approach streamlines the process for bulk orders and specialized business requirements.

The direct sales channel is crucial for handling larger transactions and offering tailored solutions. For instance, in 2024, the commercial vehicle tire market saw significant activity, with fleet operators prioritizing cost-efficiency and reliability, areas where Delticom’s direct sales efforts would be focused.

- Targeted Online Platforms: Delticom operates specialized e-commerce sites designed to meet the specific needs of business customers, facilitating efficient procurement of tires and related products.

- Focus on Business Needs: This channel prioritizes bulk purchasing, fleet management solutions, and customized service offerings for commercial entities.

- Market Relevance (2024): The commercial sector, particularly logistics and transportation, continued to be a major driver of tire demand in 2024, emphasizing the importance of direct sales channels for securing large contracts.

Partner Workshop Network (for Service Delivery)

Delticom's partner workshop network is essential for customer satisfaction, acting as the final touchpoint for tire fitting after online purchase. This network, comprising approximately 10,000 independent workshops across Europe as of early 2024, ensures convenient and professional installation for Delticom's customers.

This physical infrastructure is not a direct sales channel but a vital component of the service delivery. It bridges the gap between the online purchase and the actual use of the product, thereby reinforcing Delticom's value proposition of offering a complete tire solution.

- Network Size: Over 10,000 partner workshops across Europe.

- Function: Tire fitting and installation service for customers.

- Role in Business Model: Crucial for service delivery and customer journey completion.

- Impact: Enhances customer experience and brand reliability.

Delticom's channels are predominantly digital, with over 100 e-commerce shops serving customers in more than 70 countries. These platforms, such as Reifendirekt, are the primary interface for product browsing and purchase. Mobile applications further enhance this by offering a streamlined, personalized shopping experience, reflecting the growing trend of mobile commerce, which saw significant growth in 2023.

Affiliate marketing and partner portals extend Delticom's reach by leveraging external automotive content creators and comparison sites. This strategy taps into established audiences, driving traffic and sales, a method that proved highly effective across many industries in 2023. For business customers, Delticom utilizes dedicated online platforms to manage bulk orders and specialized needs, a critical channel given the strong demand from commercial sectors in 2024.

The direct sales channel is vital for larger transactions and tailored solutions, particularly for the commercial vehicle tire market where cost-efficiency and reliability are paramount. This channel allows for direct engagement with fleet operators and other businesses. Finally, a network of approximately 10,000 partner workshops across Europe provides essential tire fitting services, completing the customer journey from online purchase to physical installation.

| Channel Type | Description | Key Features | 2023/2024 Relevance |

|---|---|---|---|

| E-commerce Shops | Over 100 dedicated online platforms | Product browsing, purchase, details | Primary sales gateway in 70+ countries |

| Mobile Applications | Dedicated apps for on-the-go users | Push notifications, personalized recommendations | Significant driver of sales, reflecting mobile commerce growth |

| Affiliate Marketing/Partner Portals | Collaboration with automotive content sites | Extended market reach, access to niche audiences | Effective for customer acquisition and brand visibility |

| Dedicated Business Platforms | Specialized sites for commercial clients | Bulk orders, fleet management, tailored solutions | Crucial for serving logistics and transportation sectors |

| Direct Sales | Personalized service for large transactions | Customized solutions, focus on fleet needs | Key for commercial vehicle tire market engagement |

| Partner Workshop Network | ~10,000 independent workshops in Europe | Tire fitting and installation services | Essential for customer satisfaction and service completion |

Customer Segments

Private car owners represent Delticom's most significant customer base, accounting for the majority of its sales. These individuals are primarily looking for tires, wheels, and automotive parts for their personal cars. In 2024, the automotive aftermarket, which includes tire sales, continued to be a robust sector, with consumers prioritizing value and ease of purchase.

This segment values a broad product range, allowing them to compare options and find the best fit for their specific vehicle and budget. Convenience is also a major driver, with many seeking streamlined online ordering and the availability of professional fitting services to complete their purchase efficiently.

Motorcycle owners represent a distinct niche within Delticom's customer base, focusing on enthusiasts who require specialized tires and accessories for their bikes. This segment values performance, durability, and brand reputation when making purchasing decisions.

In 2024, the global motorcycle tire market was projected to reach over $15 billion, indicating a substantial and active market for specialized products like those offered by Delticom. Motorcycle owners often engage in frequent online research and are influenced by peer reviews and expert opinions.

Delticom's B2B segment caters to a wide range of commercial clients, from small businesses with a few vehicles to large corporations managing extensive fleets. This includes taxi services, delivery companies, and logistics providers who rely on a consistent supply of tires and automotive accessories to keep their operations running smoothly.

For these business customers, Delticom emphasizes competitive bulk pricing, ensuring cost-effectiveness for high-volume purchases. Reliability in supply chain management and efficient, timely delivery are paramount, as downtime directly impacts their revenue and operational efficiency. In 2024, the B2B sector continued to be a significant revenue driver, with fleet managers increasingly seeking streamlined procurement solutions.

Automotive Workshops and Dealerships

Delticom's business model extends beyond individual car owners to include automotive workshops and dealerships. These professional clients rely on Delticom for a consistent and cost-effective supply of tires and automotive parts to support their service operations and inventory for resale. In 2024, the automotive aftermarket in Europe continued to show robust demand, with independent workshops playing a crucial role in vehicle maintenance and repair.

This B2B segment prioritizes a streamlined procurement process and advantageous trade pricing to maintain their own profitability. Their loyalty is often secured by a dependable supply chain that minimizes downtime and ensures product availability. Delticom's ability to offer bulk purchasing options and efficient logistics directly addresses these critical needs.

- Reliable Supply Chain: Workshops and dealerships need assurance that their tire and parts orders will be fulfilled promptly to avoid service disruptions.

- Competitive Trade Prices: Access to wholesale or trade pricing is essential for these businesses to manage their costs and maintain healthy profit margins.

- Product Variety and Availability: A comprehensive catalog catering to diverse vehicle makes and models is a key differentiator for B2B customers.

- Efficient Order Processing: Streamlined ordering systems and quick delivery are paramount for businesses operating on tight schedules.

Price-Sensitive Buyers

A substantial segment of Delticom's clientele comprises price-sensitive buyers. These individuals are drawn to the company's online platform primarily because of its ability to offer competitive pricing, a key differentiator in the tire market.

These customers are actively engaged in seeking out promotions and discounts, prioritizing cost savings in their purchasing decisions. For them, the value proposition lies in acquiring quality tires at the lowest possible price point.

- Price Sensitivity: A significant portion of Delticom's customer base is likely price-sensitive, attracted by the competitive pricing offered through the online model.

- Deal Seeking Behavior: These customers actively seek out deals and value cost savings, often comparing prices across various online retailers.

- Online Channel Preference: The online model's cost efficiencies directly translate into savings for these buyers, reinforcing their preference for digital purchasing.

Delticom serves a diverse customer base, with private car owners forming its largest group, seeking tires, wheels, and parts for personal use. In 2024, the automotive aftermarket continued to see consumers prioritize value and easy online purchasing, reflecting a strong demand for accessible automotive solutions.

Motorcycle enthusiasts represent a specialized segment, valuing performance and durability in their tire choices. The global motorcycle tire market, projected to exceed $15 billion in 2024, highlights the significant opportunity for specialized offerings.

Delticom also caters to B2B clients, including fleet operators and small businesses, who depend on reliable supply and competitive pricing for their operations. In 2024, the B2B sector remained a key revenue driver, with businesses seeking efficient procurement.

Additionally, automotive workshops and dealerships rely on Delticom for consistent, cost-effective supplies to support their service and resale needs. The European automotive aftermarket in 2024 showed robust demand, with independent workshops being vital for maintenance.

Price-sensitive buyers are a significant demographic, attracted by Delticom's competitive online pricing and frequent promotions, making cost savings a primary purchasing driver.

Cost Structure

The most significant expense for Delticom is the direct cost of acquiring tires, wheels, and automotive parts from suppliers. This outlay represents the purchase price of the inventory itself, a crucial element in their business model.

In 2024, like previous years, this procurement cost is expected to be the largest single driver of Delticom's cost structure. For instance, in 2023, the cost of sales, which primarily comprises COGS, stood at €687.8 million, highlighting its substantial impact on profitability.

These direct costs also encompass any immediate expenses incurred to get these items ready for sale, such as inbound shipping and handling charges. Effectively managing these procurement costs is vital for Delticom's competitive pricing and overall financial health.

Delticom's logistics and warehousing represent a significant portion of its cost structure. Managing a network of warehouses across Europe involves substantial expenses for rent, utilities, and staffing to handle picking, packing, and shipping operations efficiently.

Transportation and delivery services across the continent also contribute heavily to these costs. In 2024, the global logistics market was valued at approximately $9.7 trillion, highlighting the scale of these operational expenses for companies like Delticom that rely on extensive distribution networks.

Delticom dedicates significant resources to marketing and sales, a key component of its business model. These expenses are vital for driving traffic and conversions across its extensive network of online tire and auto parts shops. In 2024, the company continued to focus on digital channels, recognizing their importance in reaching a broad customer base.

The company's marketing strategy heavily relies on online advertising, search engine optimization (SEO), and targeted campaigns to acquire new customers. These investments are essential for staying competitive in the crowded e-commerce space and ensuring consistent sales growth.

IT and Technology Development Costs

Delticom's cost structure heavily relies on significant investments in IT and technology development to maintain its extensive e-commerce operations. This includes the continuous upkeep and enhancement of its online platforms, ensuring a seamless user experience for customers across various regions.

These expenditures encompass a broad range of activities, from core software development and website maintenance to robust cybersecurity measures designed to protect sensitive customer data and transaction integrity. For instance, in 2024, e-commerce companies globally saw IT spending increase, with many allocating over 15% of their operational budget to digital infrastructure and cybersecurity to combat rising threats.

Key components of these IT and technology development costs for Delticom include:

- Personnel Costs: Salaries and benefits for software developers, IT support staff, and cybersecurity experts.

- Software Licenses and Subscriptions: Fees for operating systems, development tools, CRM software, and other essential applications.

- Infrastructure and Hosting: Costs associated with servers, cloud computing services, and data center maintenance to ensure platform availability.

- Cybersecurity Investments: Spending on firewalls, intrusion detection systems, data encryption, and regular security audits to safeguard against breaches.

Personnel Costs

Personnel costs are a significant component of Delticom's expense structure. These costs encompass salaries, wages, and benefits for the company's workforce, which is crucial for its e-commerce and logistics operations.

In 2024, Delticom's employee count stood at 122 individuals. This team is distributed across key functions including e-commerce management, customer support, warehousing and delivery logistics, information technology, and general administration.

- Salaries and wages for all staff.

- Employee benefits such as health insurance and retirement contributions.

- Training and development expenses to maintain a skilled workforce.

- Payroll taxes and other employment-related statutory costs.

Delticom's cost structure is heavily influenced by its procurement of tires, wheels, and auto parts, which forms the largest expense. This is followed by significant outlays for logistics and warehousing to manage its European distribution network. Marketing and sales, particularly digital advertising and SEO, are also crucial investments for customer acquisition and growth.

Furthermore, the company dedicates substantial resources to IT and technology development, covering platform maintenance, cybersecurity, and software. Personnel costs, including salaries and benefits for its 122 employees in 2024 across various operational functions, represent another core expense category.

| Cost Category | Description | 2023 Data (Example) | 2024 Outlook (General) |

|---|---|---|---|

| Cost of Goods Sold | Direct cost of acquiring inventory (tires, parts) | €687.8 million (Cost of Sales) | Expected to remain the largest single expense driver. |

| Logistics & Warehousing | Rent, utilities, staffing, transportation | Significant portion of operational costs. | Continued investment in efficient distribution. |

| Marketing & Sales | Digital advertising, SEO, campaigns | Essential for customer acquisition. | Focus on online channels for broad reach. |

| IT & Technology | Platform development, maintenance, cybersecurity | Over 15% of budget for e-commerce companies globally in 2024. | Ongoing investment in digital infrastructure. |

| Personnel Costs | Salaries, benefits, training for 122 employees (2024) | Covering e-commerce, IT, logistics, admin staff. | Crucial for operational execution. |

Revenue Streams

Delticom's main way of making money comes from selling car and motorcycle tires directly to customers through its many online stores. They offer a huge selection of tires for all seasons and from many different manufacturers.

In 2024, the online tire market continued to grow, with Delticom leveraging its established e-commerce platform to capture a significant share. The company's focus on a broad product range and competitive pricing remains a key driver of its revenue from this primary stream.

Delticom significantly boosts its earnings through the online sale of complete wheel and rim packages, encompassing both stylish alloy and practical steel options. These are frequently bundled with tires, offering customers a convenient, all-in-one solution for vehicle upgrades or replacements.

Revenue is also generated from the sale of various automotive accessories, complementing the core tire and wheel business. This diversifies the product offering and increases the average order value.

Commissions from Partner Workshop Services

Delticom likely generates revenue through commissions earned from its extensive network of partner garages. These garages perform services like tire fitting for customers who are directed to them via Delticom's online platforms. This commission structure forms a significant, service-driven revenue stream.

This model means Delticom acts as a facilitator, connecting customers needing automotive services with qualified workshops. For each successful referral and service completion, Delticom receives a pre-agreed commission, effectively monetizing its customer reach and platform utility.

- Commission Fees: Delticom earns a percentage of the service cost from partner garages for referred customers.

- Referral Partnerships: Revenue is directly tied to the volume of services booked and completed through its network.

- Service Facilitation: This stream highlights Delticom's role in bridging customer demand with service provider supply.

Platform Business Commission Income

Delticom has strategically expanded its revenue model by introducing a platform business, allowing third-party sellers to access its customer base. This shift, initiated in fiscal year 2023, diversifies income beyond its traditional shop operations.

The core of this new revenue stream is commission income. Delticom earns a percentage on sales generated by these external partners through its platform, effectively monetizing its established online presence and customer reach.

This platform approach leverages Delticom's existing infrastructure and customer loyalty. It provides a valuable channel for third parties to reach Delticom's private and commercial clientele, while generating a new, scalable income source for Delticom itself.

For instance, in the first half of 2024, Delticom reported a significant increase in its platform business contribution. While specific commission percentages are proprietary, the overall revenue growth indicates a successful integration of this new model.

- Platform Business Commission Income: Delticom earns revenue by charging third-party sellers a commission on sales made through its platform.

- Expansion Since FY 2023: This platform model was introduced to supplement the existing shop business, broadening Delticom's revenue base.

- Access to Customer Base: Delticom provides external sellers with access to its established private and commercial end customers.

- Revenue Diversification: The platform business represents a key initiative to diversify income streams and enhance overall financial resilience.

Delticom's revenue streams are primarily driven by the direct online sale of tires and complete wheel sets, catering to a broad customer base. This core business is augmented by the sale of automotive accessories, further diversifying its product offering and increasing average transaction values.

A significant portion of earnings also stems from its role as a facilitator in the automotive service sector. Delticom earns commissions by connecting customers with its network of partner garages for services like tire fitting, monetizing its extensive customer reach and online platform.

Furthermore, Delticom has successfully implemented a platform business model since fiscal year 2023, generating commission income from third-party sellers. This initiative leverages its existing customer base to create a scalable, diversified revenue stream, showing promising growth in 2024.

| Revenue Stream | Description | Key Drivers | 2024 Relevance |

|---|---|---|---|

| Online Tire Sales | Direct sales of car and motorcycle tires. | Product breadth, competitive pricing, e-commerce platform. | Continued market growth, significant market share capture. |

| Complete Wheel Sales | Sale of tire and rim packages (alloy/steel). | Convenience, bundled offerings, vehicle customization. | High demand for integrated solutions. |

| Automotive Accessories | Sales of complementary car parts and accessories. | Product diversification, increased average order value. | Supports core business, broadens customer appeal. |

| Garage Referral Commissions | Commissions from partner garages for referred services. | Customer reach, platform utility, successful service referrals. | Monetizes customer demand for fitting services. |

| Platform Business Commissions | Commissions from third-party sellers on sales via Delticom's platform. | Access to customer base, established online presence. | Significant growth and revenue diversification since FY 2023. |

Business Model Canvas Data Sources

The Delticom Business Model Canvas is built upon a foundation of extensive market research, customer behavior analysis, and internal operational data. These sources provide a comprehensive view of the tire e-commerce landscape and Delticom's strategic positioning.