Delta Electronics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Electronics Bundle

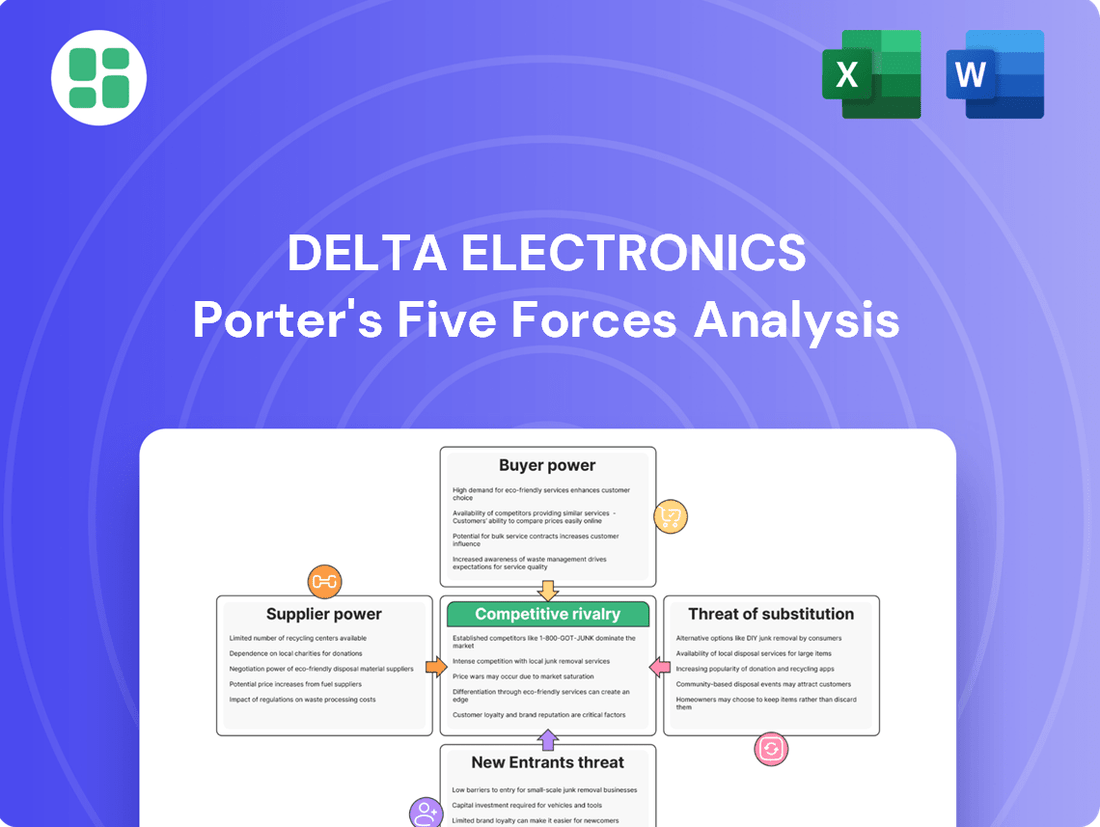

Delta Electronics faces intense competition, with significant pressure from rivals and the constant threat of new entrants disrupting the market. Understanding these dynamics is crucial for any stakeholder. The full Porter's Five Forces Analysis delves into the intricacies of buyer and supplier power, as well as the ever-present threat of substitutes.

Unlock the full Porter's Five Forces Analysis to explore Delta Electronics’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts Delta Electronics' bargaining power. For critical, specialized components like advanced semiconductors used in high-efficiency power supplies and AI applications, a small pool of high-quality manufacturers can dictate terms and pricing.

The global electronic component supply chain experienced notable disruptions in recent years due to geopolitical factors and material scarcity. However, available data indicates an improvement in lead times for many components throughout 2024, potentially easing some supplier leverage.

Switching costs for Delta Electronics can be significant, especially when dealing with highly integrated or custom-designed components. These costs aren't just about finding a new supplier; they involve substantial investments in redesigning products, rigorous re-qualification processes for new parts, and the potential for costly disruptions to ongoing production lines.

For instance, if Delta relies on a supplier for a unique power management IC that is deeply embedded in their product architecture, the effort to switch could involve months of engineering work and extensive testing. This integration makes it difficult and expensive to simply swap out one supplier for another.

To counter this, Delta actively pursues strategies like diversifying its supplier base and continuously strengthening its procurement processes. This proactive approach helps to mitigate the risks associated with high switching costs and ensures greater supply chain resilience.

Suppliers offering unique or highly specialized inputs, like advanced silicon carbide (SiC) solutions crucial for next-generation power management and electric vehicle (EV) applications, wield significant bargaining power. Delta Electronics' reliance on such specialized components, exemplified by its collaboration with Microchip Technology for SiC, underscores this dynamic. The unique nature of these advanced materials and the limited number of suppliers capable of producing them at scale means Delta must carefully manage these relationships to mitigate potential cost increases or supply disruptions.

Threat of Forward Integration

The threat of suppliers integrating forward into Delta Electronics' core business areas, such as power and thermal management or industrial automation, is generally low. This is primarily due to the substantial capital investment, advanced research and development capabilities, and deep market expertise necessary to compete effectively in these sectors. For instance, developing sophisticated EV charging solutions requires significant R&D expenditure, which many component suppliers may not possess.

While a direct threat of forward integration is minimal, large and well-capitalized component manufacturers could potentially develop more integrated product offerings. This might present a minor, long-term challenge by offering solutions that bundle components, potentially bypassing some of Delta's value-added services. However, Delta's established brand reputation and extensive customer relationships in 2024 provide a significant barrier to entry for such attempts.

- Low Capital Barrier for Suppliers: The significant capital, R&D, and market expertise required in Delta's core sectors limit the threat of supplier forward integration.

- Potential for Integrated Solutions: Large component manufacturers might offer more bundled solutions, posing a minor long-term threat by potentially bypassing some of Delta's value-added services.

- Delta's Competitive Advantages: Delta's established brand and customer relationships in 2024 act as a strong defense against potential forward integration by suppliers.

Importance to Supplier

Delta Electronics' substantial purchasing volume, driven by its global operations, often gives it considerable bargaining power over its suppliers. This scale allows Delta to negotiate favorable terms, potentially securing lower prices or preferential treatment.

However, this leverage can be tempered if Delta's key components are sourced from suppliers whose products are in high demand across various sectors, such as general-purpose semiconductors. In such cases, the supplier's importance to the broader market can diminish Delta's individual influence.

For instance, the global semiconductor shortage experienced in 2021 and 2022 significantly shifted bargaining power towards chip manufacturers, impacting companies like Delta that rely heavily on these components.

The bargaining power of suppliers is a crucial factor in Delta Electronics' operational costs and profitability.

The bargaining power of suppliers for Delta Electronics is influenced by several factors, including supplier concentration, switching costs, and the availability of substitute inputs. While Delta's significant purchasing volume grants it leverage, this can be diminished when key components are in high demand across multiple industries.

For example, the semiconductor industry, a critical supplier for Delta, saw its bargaining power surge during the global shortages of 2021-2022, impacting Delta's ability to negotiate favorable terms. However, available market analysis for 2024 suggests a stabilization in lead times for many electronic components, potentially rebalancing some of this power.

Suppliers of highly specialized components, such as advanced silicon carbide (SiC) solutions vital for electric vehicles, hold considerable sway due to the limited number of manufacturers capable of producing these at scale. Delta's reliance on such niche suppliers, like Microchip Technology for SiC, highlights the need for careful relationship management to avoid price hikes or supply interruptions.

The threat of suppliers integrating forward into Delta's core business areas is generally low due to the substantial capital, R&D, and market expertise required. However, large component manufacturers could potentially offer more bundled solutions, posing a minor long-term challenge by bypassing some of Delta's value-added services, though Delta's strong brand and customer relationships in 2024 offer a significant defense.

| Factor | Impact on Delta Electronics | 2024 Trend/Observation |

|---|---|---|

| Supplier Concentration | High for specialized components, allowing suppliers to dictate terms. | Stable for critical, advanced materials; improving for general components. |

| Switching Costs | Significant for integrated or custom-designed components, involving redesign and re-qualification. | Remains high for deeply embedded custom parts, necessitating strong supplier partnerships. |

| Purchasing Volume | Delta's scale provides negotiation leverage. | Continues to be a key strength, though tempered by broad market demand for certain components. |

| Forward Integration Threat | Low due to high barriers to entry in Delta's core sectors. | Minimal direct threat, but potential for bundled solutions from large component makers exists. |

What is included in the product

This analysis examines the competitive forces impacting Delta Electronics, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the power electronics and automation industry.

Instantly identify competitive threats and opportunities with a visual breakdown of Delta Electronics' market landscape.

Streamline strategic planning by quickly assessing the impact of supplier power and buyer bargaining on profitability.

Customers Bargaining Power

Delta Electronics' diverse customer base across IT, telecommunications, industrial automation, and renewable energy generally limits individual customer bargaining power. However, key large enterprise or original equipment manufacturer (OEM) clients can exert significant influence due to their substantial purchase volumes, impacting pricing and contract terms.

Delta Electronics' emphasis on highly efficient power supplies, industrial automation, and smart energy solutions creates a tangible product differentiation. This focus helps to mitigate the bargaining power of customers by offering unique value propositions.

By consistently investing in innovation and developing advanced energy-saving technologies, Delta provides added value that is not readily available from competitors. This is particularly evident in specialized markets such as AI data center power management and liquid cooling solutions, where Delta's offerings are critical for performance and efficiency.

Customers integrating Delta Electronics' solutions into their intricate systems, such as data centers, industrial production lines, or EV charging networks, often encounter significant switching costs. These costs can encompass the financial outlay and operational disruption associated with replacing existing infrastructure, the necessity of retraining personnel on new equipment and protocols, and the complex challenge of ensuring seamless compatibility with newly adopted systems. For instance, a data center operator deeply embedded with Delta's power management solutions would face substantial expenses and downtime to transition to a competitor's offerings, effectively limiting their bargaining power.

Customer Information

Customers in technologically advanced sectors, particularly those in the electronics industry, often have a deep understanding of product specifications, available alternatives, and prevailing market prices. This heightened awareness, especially for more standardized or commoditized components, significantly amplifies their bargaining power. For instance, major electronics manufacturers who purchase components in bulk can leverage their knowledge to negotiate better terms, pushing companies like Delta Electronics to constantly innovate and deliver superior value to remain competitive.

The bargaining power of customers for Delta Electronics is influenced by several factors:

- Information Asymmetry Reduction: In 2024, the widespread availability of online product reviews, technical datasheets, and comparative analyses means customers are better informed than ever, reducing the information advantage suppliers once held.

- Switching Costs: For customers integrating Delta's components into their own complex products, the cost and effort associated with re-qualifying new suppliers can be substantial, providing Delta with some leverage. However, if Delta's components are highly commoditized, switching costs can be lower.

- Volume Purchasing: Large original equipment manufacturers (OEMs) represent a significant portion of Delta's customer base. Their substantial order volumes grant them considerable leverage in price negotiations, as demonstrated by the fact that the top 10 customers accounted for approximately 60% of Delta's revenue in recent fiscal years.

- Price Sensitivity: In segments where Delta's products are critical but represent a smaller portion of the end product's cost, customers may be less price-sensitive. Conversely, for more standard components, price becomes a primary negotiation point.

Threat of Backward Integration

The threat of customers backward integrating to produce their own power and thermal management solutions is generally low for Delta Electronics. This is primarily because the significant capital outlay, coupled with the need for highly specialized engineering talent and established economies of scale, makes in-house production a formidable undertaking for most of Delta's varied clientele.

For instance, a typical automotive manufacturer, while a key customer, would face substantial barriers to entry if they considered producing their own advanced power supplies or thermal cooling systems. The R&D investment alone for cutting-edge solutions can run into tens of millions of dollars, a cost that is often prohibitive compared to sourcing from specialists like Delta.

Furthermore, Delta's established manufacturing processes and global supply chain provide cost efficiencies that are difficult for individual customers to replicate. In 2024, the global power electronics market is valued in the hundreds of billions, a testament to the scale and complexity involved, which further deters customer backward integration.

- High Capital Investment: Establishing manufacturing facilities for advanced power and thermal solutions requires significant upfront capital, often in the hundreds of millions of dollars.

- Specialized Expertise: Developing and producing these complex components demands highly skilled engineers and technicians with deep knowledge in areas like semiconductor design and thermal dynamics.

- Economies of Scale: Delta leverages large-scale production to achieve lower per-unit costs, a competitive advantage that individual customers would struggle to match.

- Focus on Core Competencies: Most customers prefer to concentrate on their primary business, such as vehicle design or data center operations, rather than diverting resources to a non-core manufacturing activity.

Delta Electronics faces moderate customer bargaining power, largely dictated by customer size and product standardization. While large volume purchasers can negotiate pricing, Delta's product differentiation and high switching costs for integrated solutions offer a degree of counter-leverage.

In 2024, customers' access to information has increased, potentially empowering them in negotiations. However, Delta's investment in specialized solutions like AI data center power management, where switching costs are substantial, helps to maintain its pricing power. For example, the significant investment required for re-qualifying power management systems in a large data center can deter customers from switching, even with price incentives.

The bargaining power of customers for Delta Electronics can be summarized by these key points:

| Factor | Impact on Delta Electronics | Supporting Data/Context (2024) |

|---|---|---|

| Volume Purchasing | High leverage for large customers | Top 10 customers accounted for ~60% of revenue in recent fiscal years, giving them significant negotiation power. |

| Product Differentiation | Lowers customer bargaining power | Delta's advanced energy-saving technologies and specialized solutions (e.g., AI data center power) offer unique value. |

| Switching Costs | Lowers customer bargaining power | Integration into complex systems like EV charging networks or industrial automation creates significant costs and operational disruption for customers to switch. |

| Information Availability | Increases customer bargaining power | Widespread online data and comparative analyses in 2024 empower customers with market knowledge. |

Preview the Actual Deliverable

Delta Electronics Porter's Five Forces Analysis

This preview shows the exact Delta Electronics Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It comprehensively details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products or services. This in-depth analysis provides actionable insights into Delta Electronics' strategic positioning.

Rivalry Among Competitors

Delta Electronics operates within several dynamic and expanding sectors, notably industrial automation, electric vehicle (EV) charging infrastructure, and thermal management solutions for data centers. The industrial automation market, for instance, is anticipated to see robust expansion. This growth, coupled with the burgeoning EV charging station market, can help to temper intense competitive rivalry by creating a more abundant landscape of opportunities for various industry participants.

Delta Electronics operates in highly competitive arenas, including power and thermal management, industrial automation, and electric vehicle (EV) charging. The sheer number of global and regional players, from massive diversified corporations to focused niche companies, means Delta faces constant pressure. For instance, in the industrial automation space, giants like Siemens and Schneider Electric, along with ABB, command significant market share, directly challenging Delta's offerings.

The EV charging sector, while newer, is rapidly attracting a multitude of specialized providers, further fragmenting the market and intensifying rivalry. This diverse competitive makeup, where established industrial players and agile startups vie for dominance, forces Delta to continuously innovate and differentiate its products and services to maintain its market position.

Delta Electronics actively pursues product differentiation by focusing on high-efficiency, energy-saving, and innovative solutions, exemplified by its AI server power supplies and collaborative robots. This strategy aims to command premium pricing and foster customer loyalty, moving away from pure price competition.

Continuous innovation is paramount for Delta to sustain its competitive advantage, particularly in fast-paced sectors like AI-driven data center cooling. For instance, in 2024, the company continued to invest heavily in R&D to develop next-generation cooling technologies that can handle the increasing thermal demands of advanced computing infrastructure.

Exit Barriers

Delta Electronics operates in industries with substantial exit barriers. High fixed costs are a major factor. These include significant investments in manufacturing facilities, ongoing research and development (R&D), and the need for specialized labor. For instance, the semiconductor and power electronics sectors, where Delta is active, demand highly capital-intensive production lines and continuous innovation to remain competitive.

These high exit barriers mean that companies are often compelled to stay in the market and continue competing, even when facing challenging economic conditions or reduced profitability. This persistence intensifies the competitive rivalry, as firms are less likely to cease operations and reduce the overall supply or market pressure.

The implications for Delta are clear: the industry structure encourages aggressive competition. Companies are incentivized to fight for market share rather than exit, leading to price wars and a constant drive for efficiency and differentiation. This dynamic is evident across many of Delta's core markets, where established players are reluctant to cede ground.

- High Capital Investment: The electrical equipment manufacturing sector, a key area for Delta, often requires substantial upfront investment in specialized machinery and advanced production technologies.

- R&D Intensity: Continuous innovation in areas like power management and renewable energy solutions necessitates ongoing, significant R&D expenditure, making it costly to abandon these pursuits.

- Specialized Workforce: The need for skilled engineers and technicians in areas such as power electronics and automation creates a reliance on a specialized labor pool, adding to the cost of exiting.

- Brand Reputation and Customer Relationships: Years of building brand loyalty and established customer relationships represent intangible assets that are difficult to recover upon exit, encouraging continued participation.

Strategic Commitments of Rivals

Many competitors are pouring resources into R&D and market expansion, especially in booming sectors like smart manufacturing and green energy. For instance, Schneider Electric, a key rival, announced a significant investment in its French manufacturing facilities in 2024, aiming to boost smart production capabilities.

These commitments extend to strategic acquisitions, as seen with Siemens' acquisition of a specialized AI firm in late 2023 to enhance its industrial automation offerings. This aggressive pursuit of future growth mirrors Delta Electronics' own strategic moves, such as its 2024 collaboration with Texas Instruments to accelerate electric vehicle technology development.

These substantial investments signal a fierce competition where securing technological leadership and market share through strategic alliances and internal development is paramount for survival and growth.

- R&D Investment: Competitors are increasing R&D spending to innovate in smart manufacturing and sustainable energy.

- Acquisitions: Strategic buyouts are common as firms aim to acquire new technologies and market access.

- Market Expansion: Rivals are actively expanding their global reach, particularly in high-demand regions.

- Strategic Partnerships: Collaborations, like Delta's with Texas Instruments, are crucial for co-developing next-generation technologies.

Delta Electronics faces intense competition across its key markets, including industrial automation and EV charging. Major players like Siemens and Schneider Electric, alongside numerous specialized firms, create a crowded landscape. This rivalry is fueled by significant investments in R&D and market expansion by competitors, as evidenced by Schneider Electric's 2024 investment in French smart manufacturing. Delta's strategy of product differentiation, focusing on high-efficiency solutions, is crucial for navigating this competitive environment.

| Competitor | Key Market Focus | 2024 Strategic Move Example |

|---|---|---|

| Siemens | Industrial Automation, Digitalization | Acquisition of AI firm (late 2023) to enhance automation offerings |

| Schneider Electric | Energy Management, Industrial Automation | Significant investment in French smart manufacturing facilities (2024) |

| ABB | Robotics, Electrification, Automation | Continued investment in electrification and automation solutions |

| Delta Electronics | Power Management, Industrial Automation, EV Charging | Collaboration with Texas Instruments for EV technology (2024) |

SSubstitutes Threaten

The threat of substitutes for Delta Electronics hinges on alternatives offering a similar or superior price-performance ratio. For instance, in the power supply sector, advancements in energy conversion technologies or novel battery solutions could present viable substitutes, potentially impacting Delta's market share if they offer significant cost or efficiency advantages.

In industrial automation, simpler, less integrated systems might emerge as substitutes for Delta's comprehensive solutions, particularly for less complex applications where cost is a primary driver. For example, if a competitor develops a modular automation component that significantly undercuts the price of Delta's integrated systems while performing adequately for a segment of the market, it would represent a direct threat.

Customer propensity to substitute is a significant factor, driven by how easily customers can switch to alternatives and the perceived advantages those alternatives offer. For Delta Electronics, particularly in sectors like energy management, this means considering the appeal of new technologies.

In the energy management space, the rise of AI-powered smart grids and distributed renewable energy sources presents a clear substitution threat. These innovations can reduce reliance on traditional grid infrastructure, a core area for Delta. For instance, the global smart grid market was valued at approximately $27.6 billion in 2023 and is projected to grow significantly, indicating increasing customer interest in these alternative solutions.

Technological advancements in fields like energy storage and generation present a significant threat of substitutes for Delta Electronics. Innovations in solid-state batteries, for instance, could diminish the demand for traditional charging infrastructure that Delta currently supplies. Similarly, advancements in hydrogen fuel cells might offer alternative energy solutions that bypass the need for certain power conversion components Delta manufactures.

Indirect Substitutes

Indirect substitutes can emerge from fundamental shifts in how industries operate. For example, a significant move towards decentralized power generation, such as widespread adoption of localized microgrids, could diminish the market for Delta Electronics' large-scale, centralized power management systems. This trend, driven by renewable energy integration, directly challenges traditional grid infrastructure that Delta serves.

Furthermore, advancements in energy efficiency at the component level present another threat. If individual electronic components become so efficient that they require minimal power or generate very little heat, the overall demand for specialized power and thermal management products, a core offering for Delta, could shrink. For instance, the increasing efficiency of processors and power supplies in consumer electronics directly impacts the volume and sophistication of thermal management solutions needed.

- Decentralized Power Generation: The growth of distributed energy resources (DERs) is a key indirect substitute. By 2024, the global microgrid market was projected to reach over $30 billion, indicating a substantial shift away from solely centralized models.

- Component-Level Efficiency: Continued improvements in semiconductor technology, leading to lower power consumption in devices, reduce the necessity for robust external power management. For example, advancements in ARM-based processors for laptops and servers demonstrate this trend.

- Energy Storage Solutions: The rise of advanced battery technologies and energy storage systems can also act as a substitute by enabling more localized energy management and reducing reliance on grid-scale solutions. The global energy storage market is expected to see significant expansion, with projections suggesting it could reach hundreds of billions of dollars by the mid-2020s.

Regulatory and Environmental Shifts

Evolving regulatory landscapes and increasing environmental pressures can drive the adoption of new technologies that act as substitutes for Delta Electronics' current product lines. For instance, governments pushing for specific renewable energy sources or energy storage mandates could favor solutions that are not Delta's core offerings, requiring significant adaptation. In 2024, many nations intensified their commitments to decarbonization, with the EU's Emissions Trading System (ETS) and the US Inflation Reduction Act (IRA) providing substantial incentives for green technologies that might compete with or displace existing energy infrastructure solutions.

Governments worldwide are increasingly implementing policies that encourage or mandate the use of specific energy technologies. These mandates can directly create substitute threats by favoring alternative solutions over those Delta currently specializes in. For example, a strong push for hydrogen fuel cells in transportation or grid balancing could reduce demand for traditional battery storage systems, a key area for Delta. By mid-2024, countries like Germany and Japan were actively investing in hydrogen infrastructure, signaling a potential shift in the energy storage market.

These shifts necessitate that Delta Electronics remain agile and responsive to emerging technological trends and regulatory directives. Failure to adapt to government-driven preferences for new energy solutions could lead to a loss of market share. The growing emphasis on circular economy principles and sustainable sourcing, highlighted by initiatives like the European Green Deal, also encourages the development of substitute materials and manufacturing processes that could impact Delta's supply chain and product design.

- Government Mandates: Policies favoring specific renewable energy sources or storage technologies can create substitutes.

- Environmental Pressures: Increasing focus on sustainability and circular economy principles may drive adoption of alternative solutions.

- Technological Advancements: Emerging technologies, such as hydrogen fuel cells, could displace existing Delta offerings.

- Regulatory Adaptation: Delta must adapt to evolving regulations like the EU ETS and US IRA to mitigate substitute threats.

The threat of substitutes for Delta Electronics is significant, driven by advancements in energy management and automation technologies that offer comparable or better price-performance ratios. For instance, the increasing efficiency of consumer electronics reduces the need for robust external power management, impacting Delta's core offerings.

Decentralized power generation, like microgrids, and advanced energy storage solutions such as improved battery technologies, act as key substitutes by enabling localized energy management. The global microgrid market was projected to exceed $30 billion in 2024, highlighting a substantial shift away from traditional, centralized power systems.

Evolving regulatory landscapes, such as the EU Emissions Trading System and the US Inflation Reduction Act in 2024, also foster the adoption of alternative green technologies. These policies can favor solutions that compete with or displace Delta's existing infrastructure, necessitating continuous adaptation to maintain market relevance.

| Substitute Area | 2024 Market Projection/Trend | Impact on Delta Electronics |

| Microgrids & DERs | Global market projected over $30 billion | Reduces reliance on centralized power management systems. |

| Energy Storage | Significant expansion expected, potentially hundreds of billions by mid-2020s | Advanced battery tech can bypass traditional charging infrastructure needs. |

| Component Efficiency | Increasing processor and power supply efficiency | Shrinks demand for specialized power and thermal management products. |

| Hydrogen Fuel Cells | Growing investment in infrastructure (e.g., Germany, Japan) | Potential displacement of battery storage and related power conversion components. |

Entrants Threaten

Delta Electronics operates in sectors like power electronics, industrial automation, and EV charging, all requiring substantial upfront capital. For instance, establishing advanced manufacturing facilities for power supplies alone can cost tens of millions of dollars.

These high capital requirements, encompassing research and development, sophisticated machinery, and establishing global supply chains, create a significant barrier. Potential new entrants often struggle to secure the necessary funding to compete effectively with established players like Delta.

Delta Electronics enjoys significant advantages from economies of scale and scope, particularly in its manufacturing and research and development efforts. Its expansive global operations and broad product range allow it to spread fixed costs across a larger output, driving down per-unit costs. For instance, in 2023, Delta reported a revenue of approximately $10.7 billion, underscoring its substantial operational volume.

New companies entering the market would face immense difficulty in matching Delta's cost efficiencies. To achieve comparable economies of scale, a new entrant would need to invest heavily in production capacity and R&D, a daunting task when facing an established player with existing infrastructure and market penetration. This barrier makes it challenging for newcomers to compete effectively on price against Delta.

Delta Electronics benefits from significant product differentiation and deeply entrenched brand loyalty, making it difficult for new players to gain a foothold. Over decades, Delta has cultivated a strong reputation for reliability, high efficiency, and continuous innovation in critical sectors like data center power and industrial automation. This established trust and perceived quality represent a substantial barrier to entry, as new entrants would need to invest heavily to replicate such brand equity and prove their mettle in demanding applications.

Access to Distribution Channels

New companies entering the power electronics market, like Delta Electronics', face significant hurdles in establishing robust distribution networks. Building these channels globally, across sectors such as IT, telecommunications, industrial, and automotive, is a costly and lengthy undertaking. Delta Electronics has cultivated deep, long-standing relationships with original equipment manufacturers (OEMs) and system integrators, which are difficult for newcomers to replicate.

These established relationships translate into preferential access and trust, giving Delta a competitive edge. For instance, in 2024, securing shelf space and partnerships with major electronics distributors often requires substantial upfront investment and proven track records, which new entrants typically lack. Delta’s extensive sales and service infrastructure, built over decades, provides a significant barrier to entry, making it challenging for new players to reach customers effectively and efficiently.

- Established Relationships: Delta Electronics benefits from long-term partnerships with key OEMs and system integrators.

- Global Reach: Building comparable distribution networks across IT, telecom, industrial, and automotive sectors is a major challenge for new entrants.

- Time and Cost: The process of establishing reliable global distribution channels is both time-consuming and capital-intensive.

- Market Access: New entrants struggle to gain the same level of market access and customer engagement that Delta already possesses.

Proprietary Technology and Patents

Delta Electronics' significant investment in proprietary technology and its extensive patent portfolio act as a substantial barrier to entry for potential competitors. The company holds over 16,700 patents globally, with a strong focus on core areas like power electronics, mobility solutions, industrial automation, and smart infrastructure. This robust intellectual property makes it challenging for new entrants to develop competing products without either licensing Delta's technology or incurring the substantial costs and time associated with creating novel, non-infringing solutions.

The sheer volume and breadth of Delta's patents, particularly in critical and evolving sectors, create a high hurdle. For instance, in the rapidly advancing field of electric vehicle charging infrastructure, Delta's patented power conversion technologies and smart grid integration solutions are key differentiators. New companies entering this space would need to either navigate these existing patents or develop entirely new technological approaches, a process that is both capital-intensive and time-consuming, thereby limiting the threat of new entrants.

- Proprietary Technology: Delta Electronics possesses a vast portfolio of over 16,700 patents.

- Key Focus Areas: Patents are concentrated in power electronics, mobility, automation, and infrastructure.

- Barrier Creation: This intellectual property makes it difficult for new companies to enter the market without significant R&D investment or licensing agreements.

- Competitive Advantage: Delta's technological leadership deters new entrants by requiring them to match or surpass its advanced, patented solutions.

The threat of new entrants for Delta Electronics is generally low due to substantial barriers. High capital requirements for advanced manufacturing and R&D, estimated in the tens of millions for facilities alone, deter many potential competitors. Delta's established economies of scale, evidenced by its approximately $10.7 billion revenue in 2023, further increase the cost disadvantage for newcomers.

Delta's strong brand loyalty and product differentiation, built over decades, create a significant hurdle. New entrants also face challenges in replicating Delta's extensive global distribution networks and long-standing relationships with OEMs, which are crucial for market access. Furthermore, Delta's robust intellectual property portfolio, boasting over 16,700 patents globally, presents a formidable technological barrier.

| Barrier Type | Description | Impact on New Entrants | Delta's Position |

| Capital Requirements | High upfront investment for manufacturing and R&D. | Significant financial hurdle. | Well-established infrastructure. |

| Economies of Scale | Lower per-unit costs due to high production volume. | Difficulty competing on price. | Approx. $10.7 billion revenue (2023). |

| Brand Loyalty & Differentiation | Established reputation for quality and innovation. | Challenges in gaining customer trust. | Decades of market presence. |

| Distribution Networks | Extensive global reach and OEM relationships. | Limited market access for new players. | Deeply entrenched channels. |

| Intellectual Property | Vast patent portfolio (over 16,700). | Requires licensing or costly R&D to avoid infringement. | Strong technological leadership. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Delta Electronics is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from financial news outlets and trade publications to capture current market dynamics and competitive pressures.