Delta Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Electronics Bundle

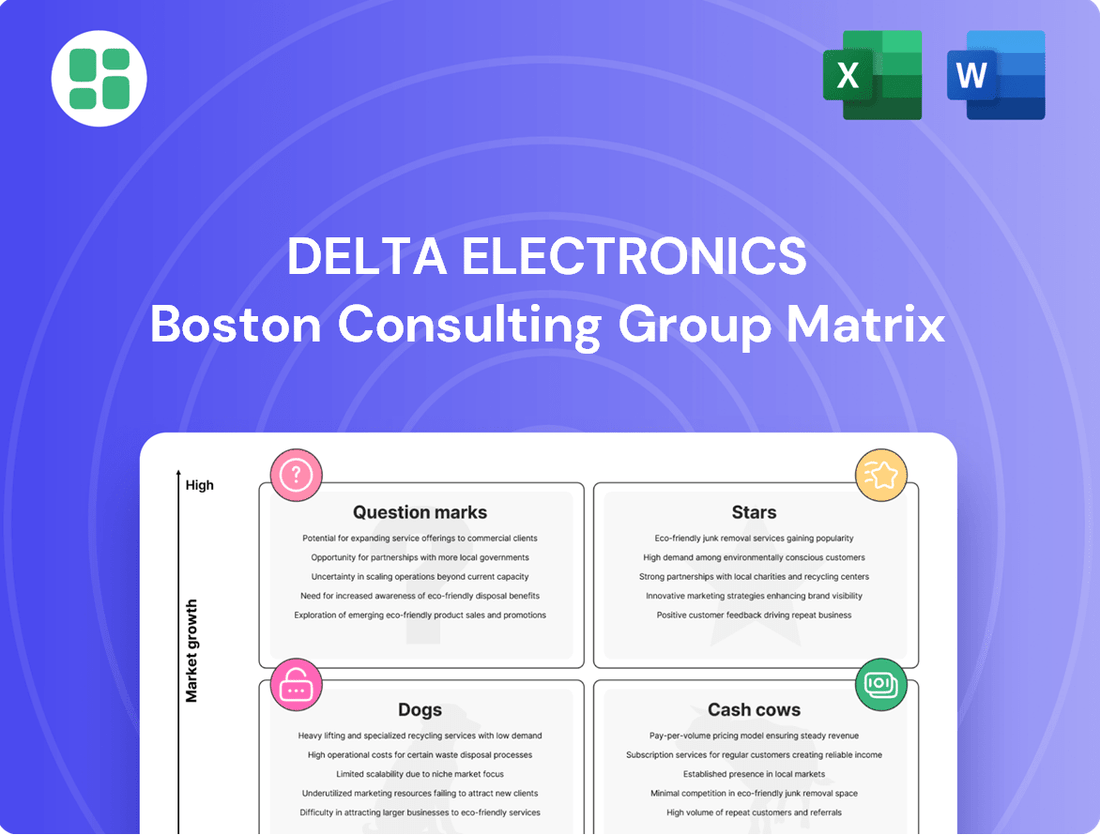

Unlock the strategic potential of Delta Electronics with a glance at their BCG Matrix. See how their products stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the dynamics driving their market performance.

Don't settle for a partial view; purchase the full BCG Matrix report to gain comprehensive quadrant-by-quadrant analysis, actionable strategic recommendations, and a clear roadmap for optimizing Delta Electronics' product portfolio and investment decisions.

Stars

Delta Electronics is a powerhouse in the burgeoning AI server market, providing essential high-output power supplies and advanced liquid cooling systems. These components are vital for the performance and reliability of cutting-edge AI infrastructure, positioning Delta as a key enabler of this technological revolution.

The company's AI-focused product revenue is on a steep upward trajectory, with projections indicating it could become Delta's main driver of growth by 2025. This surge is fueled by the insatiable demand for more powerful and efficient AI computing, where Delta's solutions are indispensable.

Delta's deep-rooted expertise in thermal management and power electronics has cemented its market leadership in this critical, high-demand sector. For instance, in 2024, the global AI hardware market experienced substantial growth, with power supply and cooling solutions representing a significant and rapidly expanding segment, directly benefiting Delta's strategic focus.

Delta Electronics is strategically positioned in the booming electric vehicle (EV) market with its robust EV charging solutions, encompassing ultra-fast DC chargers and sophisticated management systems. The company's commitment to innovation and capacity expansion, including significant investments in new products, underscores its confidence in the enduring growth trajectory of e-mobility, despite potential short-term market volatility.

The global EV market is experiencing substantial growth, with projections indicating continued expansion. For instance, by the end of 2024, the International Energy Agency (IEA) reported that electric car sales were expected to reach 17 million units globally, a significant jump from previous years. Delta's investment in increasing its global production capacity, particularly in regions like Europe and Asia, directly addresses this surging demand for charging infrastructure.

Delta Electronics' industrial automation solutions, a key player in smart manufacturing, are positioned for robust expansion. This segment includes collaborative robots (cobots) and sophisticated motion control systems, tapping into a market expected to see substantial growth in the coming years.

The company is actively innovating, recently launching its D-Bot series and digital twin solutions. These advancements are designed to boost factory efficiency and productivity globally, underscoring Delta's commitment to cutting-edge technology in this sector.

With a market projected to reach over $100 billion by 2028, Delta's focus on industrial automation, including its smart manufacturing offerings, makes it a strategic priority for the company's long-term growth trajectory and market leadership.

Advanced Data Center Infrastructure Solutions

Delta Electronics' advanced data center infrastructure solutions, particularly those designed for AI and high-performance computing, are positioned as a significant growth driver. The company's comprehensive offerings in power, air cooling, and liquid cooling are crucial for the expanding cloud and edge AI data center market. Delta's established strength in power management infrastructure provides a solid foundation for this high-growth segment.

The demand for robust cooling solutions is escalating, with liquid cooling emerging as a key area for expansion. This is driven by the increasing power densities of AI servers, which require more sophisticated thermal management than traditional air cooling can provide. Delta's investment and innovation in these areas are expected to capitalize on this trend.

Delta's strategic focus on data center infrastructure aligns with the global surge in AI adoption. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow substantially, necessitating advanced infrastructure. Delta's comprehensive power and cooling solutions are vital for supporting this expansion.

- Comprehensive Power Solutions: Delta offers integrated power systems essential for the stability and efficiency of AI-intensive data centers.

- Advanced Cooling Technologies: The company provides both air and liquid cooling solutions, catering to the diverse thermal management needs of modern data centers.

- Market Position in Power Management: Delta leverages its strong existing market share in power management to penetrate the growing data center infrastructure market.

- AI and HPC Focus: Solutions are specifically engineered to support the high power and cooling demands of Artificial Intelligence and High-Performance Computing workloads.

Integrated Renewable Energy Systems

Delta Electronics is making significant strides in integrated renewable energy systems, a key area for future growth. Their portfolio includes advanced photovoltaic (PV) inverters and sophisticated energy storage systems (ESS). These offerings are vital for improving energy efficiency and enabling greater energy independence as the world shifts towards cleaner power sources.

This strategic focus places Delta in a prime position within a rapidly expanding market. For instance, the global renewable energy market was valued at approximately $1,165.2 billion in 2023 and is projected to reach $2,176.5 billion by 2030, growing at a compound annual growth rate (CAGR) of 9.2% during this period. Delta's integrated solutions are designed to capture a significant share of this growth by providing comprehensive energy management for residential, commercial, and utility-scale applications.

- Market Expansion: Delta's investment in integrated renewable energy systems aligns with the projected 9.2% CAGR for the global renewable energy market through 2030.

- Product Development: The company is enhancing its offerings with advanced PV inverters and state-of-the-art energy storage systems (ESS).

- Strategic Importance: These integrated solutions are crucial for energy efficiency and autonomy in the global clean energy transition.

- Competitive Positioning: Delta is positioning itself as a leader in a market with strong, sustained growth prospects.

Stars in the BCG Matrix represent high-growth, high-market-share business units. For Delta Electronics, their AI server power supplies and cooling systems clearly fit this description. The AI hardware market is experiencing explosive growth, and Delta's established expertise positions them as a leader.

By 2025, AI-focused product revenue is projected to be Delta's primary growth engine, reflecting a strong market position in a rapidly expanding sector. This segment demands advanced solutions, which Delta is actively providing and innovating upon.

The company's strategic investments in AI infrastructure, coupled with the global surge in AI adoption, solidify its Star status. For instance, the global AI market was valued at approximately $200 billion in 2023, with significant continued growth expected, underscoring the potential of Delta's AI-related offerings.

What is included in the product

The Delta Electronics BCG Matrix provides a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, recommending which units to grow, maintain, or divest based on market share and growth.

Provides a clear, visual representation of Delta Electronics' business units, simplifying complex strategic decisions.

Offers a concise, actionable framework for resource allocation, reducing the pain of uncertainty.

Cash Cows

Delta Electronics' standard high-efficiency power supplies are a prime example of a cash cow within their business portfolio. These products serve established markets like general IT, industrial, and telecommunications, where Delta has a strong, recognized presence.

The mature nature of these markets means growth is steady rather than explosive, but Delta's significant market share ensures consistent, robust cash flow. This reliability allows Delta to invest less aggressively in these segments, freeing up capital for other ventures.

For instance, in 2024, the global power supply market, encompassing these segments, was valued at approximately $25 billion, with Delta holding a notable share. The company's long-standing reputation for quality and performance in these traditional areas directly translates into predictable revenue streams.

Delta Electronics holds a significant position in traditional telecom power systems, consistently delivering dependable power solutions to telecom companies worldwide. This area represents a stable income source for Delta, characterized by established infrastructure and lengthy product lifecycles.

While growth in this segment is moderate, fueled by ongoing 5G network expansions, it remains a key revenue generator. For instance, the global telecom power market was valued at approximately $15 billion in 2023 and is projected to grow at a CAGR of around 4% through 2028, showcasing its consistent demand.

Delta Electronics' basic industrial automation components, including standard drives, controllers, and sensors, are its established cash cows. These foundational products cater to a wide array of industries, leveraging Delta's deep market penetration and decades of experience.

These reliable offerings consistently generate substantial revenue and cash flow for Delta. For instance, in 2024, Delta reported a significant portion of its revenue stemming from its industrial automation segment, with basic components forming the bedrock of this performance, allowing the company to fund innovation in areas like smart manufacturing.

Established Building Automation Systems

Delta Electronics' established building automation systems, encompassing energy management, HVAC, and lighting control, represent a significant Cash Cow. These mature offerings address the persistent demand for operational efficiency in buildings, a market segment that, while not experiencing explosive growth like newer smart technologies, provides a steady and predictable revenue stream.

The reliable income generated by these systems is a testament to their widespread adoption and the consistent replacement cycles within existing infrastructure. For instance, the global building automation systems market was valued at approximately $86.2 billion in 2023 and is projected to reach $195.5 billion by 2030, growing at a CAGR of 12.5% during the forecast period. Within this, the established segments continue to hold a substantial share due to their proven track record and integration into a vast number of commercial and residential properties.

- Core Competency: Delta's strength lies in providing robust and reliable solutions for energy management, HVAC, and lighting control, essential for modern building operations.

- Market Stability: Despite the rise of advanced smart building solutions, the demand for these foundational automation systems remains strong, driven by ongoing construction and retrofitting projects.

- Revenue Generation: These established products consistently generate significant cash flow for Delta due to their broad market penetration and the necessity of maintaining and upgrading existing building systems.

- Strategic Importance: As Cash Cows, these systems fund Delta's investments in its Stars and Question Marks, supporting the company's overall growth strategy and innovation pipeline.

General Purpose Passive Electronic Components

Delta Electronics operates within the general purpose passive electronic components market, encompassing items like inductors and resistors. These components are fundamental building blocks found in virtually all electronic devices, from smartphones to vehicles.

This segment represents a mature and expansive market. In 2024, the global passive electronic components market was valued at approximately $30 billion, exhibiting steady demand. Delta's presence here ensures consistent revenue streams, as these components are critical for the vast consumer electronics and automotive industries, which continue to grow at a predictable pace.

- Market Size: The global passive electronic components market is a substantial sector, projected to reach over $35 billion by 2028.

- Key Applications: Essential for consumer electronics, automotive systems, industrial equipment, and telecommunications.

- Demand Stability: Consistent demand from established industries provides reliable revenue for Delta.

- Growth Rate: While not as high-growth as specialized components, this segment offers predictable and stable cash flow.

Delta Electronics' standard high-efficiency power supplies are a prime example of a cash cow within their business portfolio, serving established markets like general IT, industrial, and telecommunications where Delta has a strong presence.

The mature nature of these markets means growth is steady rather than explosive, but Delta's significant market share ensures consistent, robust cash flow, allowing for less aggressive investment in these segments and freeing up capital for other ventures.

For instance, in 2024, the global power supply market was valued at approximately $25 billion, with Delta holding a notable share, and the company's long-standing reputation for quality and performance translates into predictable revenue streams.

Delta's established building automation systems, encompassing energy management, HVAC, and lighting control, represent a significant Cash Cow, addressing persistent demand for operational efficiency in buildings and providing a steady, predictable revenue stream.

| Product Segment | Market Status | Delta's Role | Financial Contribution |

| Standard Power Supplies | Mature, Stable | High Market Share | Consistent Cash Flow |

| Telecom Power Systems | Mature, Steady Growth | Strong Presence | Reliable Revenue |

| Basic Industrial Automation | Mature, Broad Application | Deep Market Penetration | Substantial Revenue Generation |

| Building Automation Systems | Mature, Persistent Demand | Widespread Adoption | Significant Cash Flow |

| General Purpose Passive Components | Mature, Expansive | Critical Supplier | Predictable Revenue Streams |

What You’re Viewing Is Included

Delta Electronics BCG Matrix

The preview you see is the complete and final Delta Electronics BCG Matrix report you will receive after purchase. This comprehensive document is meticulously crafted to provide actionable insights into Delta Electronics' product portfolio, categorizing each business unit as a Star, Cash Cow, Question Mark, or Dog. You'll gain a clear, visual representation of their market position and growth potential, enabling informed strategic decision-making.

Dogs

Delta Electronics' Legacy Display Products, encompassing solutions for control rooms and projection venues, appear to be positioned in the Dogs quadrant of the BCG Matrix. These products are not frequently cited as key growth areas in recent Delta Electronics reports, indicating they likely operate in mature or declining markets with limited expansion potential.

The financial performance of this segment is suggestive of low returns, potentially struggling to generate significant profits or market share against newer technologies. For instance, while Delta Electronics saw overall revenue growth in 2023, specific segment data for legacy displays often shows stable but unexceptional performance, hinting at a mature product lifecycle.

Commoditized consumer electronics power products, a segment Delta Electronics operates within, have experienced a downturn in recent shipment volumes. This market is characterized by significant price competition and a tendency towards commoditization, meaning products become largely undifferentiated and are primarily chosen based on price.

Consequently, these power products often yield low profit margins and present limited opportunities for substantial growth. For Delta Electronics, this category could potentially become a cash trap, consuming resources without generating significant returns, especially as newer, more specialized power solutions gain traction.

In Delta Electronics' BCG Matrix analysis, basic networking components fall into a category that warrants careful consideration. While Delta has a strong presence in ICT infrastructure, certain networking-related sales have shown slower performance, which can temper overall growth in this segment.

This suggests that less sophisticated or highly commoditized networking components may be experiencing low market share and limited growth. As of 2024, the global market for basic networking hardware, while substantial, is also highly competitive with many established players, potentially impacting Delta's ability to gain significant traction in these specific sub-sectors.

Consequently, these types of networking components might be candidates for divestiture or require minimal further investment, as they may not align with Delta's strategic goals for high-growth, high-market-share areas.

Standard Air Cooling Fans for Less Demanding Applications

Standard air cooling fans, while a foundational product for Delta Electronics, likely occupy a position in the Dogs quadrant of the BCG matrix. This segment caters to less demanding applications, placing it in a market characterized by intense competition and slower growth rates.

These products, though still generating some revenue, may offer minimal cash flow and possess limited prospects for significant future expansion, especially when contrasted with Delta's more innovative and high-growth thermal management solutions. For instance, the global industrial fan market, which includes standard air cooling, was projected to grow at a CAGR of around 4.5% between 2023 and 2028, a modest figure compared to the burgeoning demand for advanced cooling in sectors like AI.

- Market Saturation: The standard air cooling fan market is mature and highly competitive, with numerous established players.

- Low Differentiation: Products in this segment often have limited technological differentiation, leading to price-based competition.

- Limited Growth Potential: Demand is primarily driven by replacement cycles and less sophisticated applications, capping growth opportunities.

- Cash Generation: While they may contribute to revenue, the profit margins are typically lower, resulting in minimal cash generation relative to other business units.

Older, Less Integrated Industrial Control Systems

Older, less integrated industrial control systems are likely positioned in the Dogs quadrant of Delta Electronics' BCG Matrix. As the company champions its advanced IoT-enabled smart manufacturing and collaborative robot solutions, these legacy systems face diminishing relevance.

These older systems possess low market share and low growth potential. For instance, while Delta’s newer smart manufacturing solutions saw significant adoption in 2024, particularly in sectors like automotive and electronics seeking Industry 4.0 integration, the market for standalone, less connected control systems continued to shrink.

- Low Market Share: These systems represent a smaller portion of Delta's overall sales compared to their newer, integrated offerings.

- Low Growth Prospects: The demand for these older technologies is declining as industries prioritize digital transformation and automation.

- Competitive Disadvantage: They struggle to offer the efficiency, connectivity, and data analytics capabilities of modern industrial control solutions.

- Strategic Consideration: Delta may need to consider phasing out or divesting from these products to focus resources on high-growth areas.

Delta Electronics' legacy display products, such as those for control rooms, and commoditized consumer electronics power products are likely in the Dogs quadrant. These segments operate in mature or declining markets with low growth and profit margins, facing intense price competition and limited differentiation. For example, the global industrial fan market, which includes standard air cooling fans, is projected for modest growth, contrasting with the demand for advanced cooling solutions.

Basic networking components and older industrial control systems also fall into this category. These areas exhibit low market share and limited growth prospects due to market saturation and the industry's shift towards digital transformation and automation. Delta's strategic focus is on higher-growth areas, suggesting these Dog products may require minimal further investment or potential divestiture.

| Product Category | BCG Quadrant | Market Characteristics | Growth Potential | Profitability |

|---|---|---|---|---|

| Legacy Display Products | Dogs | Mature, declining market, low differentiation | Limited | Low |

| Commoditized Consumer Power Products | Dogs | Highly competitive, price-sensitive, commoditized | Low | Low margins |

| Basic Networking Components | Dogs | Saturated, competitive, slower performance in some sub-sectors | Limited | Moderate to low |

| Standard Air Cooling Fans | Dogs | Mature, high competition, low differentiation | Modest (e.g., ~4.5% CAGR for industrial fans 2023-2028) | Low |

| Older Industrial Control Systems | Dogs | Shrinking market, low adoption, declining relevance | Declining | Low |

Question Marks

Hydrogen Power Solutions for Delta Electronics likely falls into the question mark category of the BCG matrix. Delta's investment in a megawatt-level hydrogen lab signifies a strong commitment to this high-growth, emerging energy sector.

While the hydrogen market is poised for expansion, Delta's current market share in this nascent technology is probably minimal. This necessitates significant investment in research, development, and commercialization to capture future market opportunities.

Delta Electronics' acquisition of ACT Genomics in June 2025 positions the latter as a potential question mark in Delta's BCG matrix. This move signals Delta's entry into the advanced healthcare solutions sector, a market anticipated to experience significant growth. However, ACT Genomics' current market share and revenue within this nascent segment are likely small, reflecting the early stages of its development and integration into Delta's broader strategy.

Delta Electronics is venturing into niche AI/IoT applications within emerging smart city sectors, extending beyond its core infrastructure offerings. This includes developing solutions like intelligent street lighting and advanced surveillance systems, demonstrating a commitment to broader smart city integration.

While the smart city market presents significant growth opportunities, Delta's position in these specialized, fragmented, and rapidly evolving niche applications is still developing. Consequently, achieving substantial market share will necessitate strategic marketing efforts and dedicated investment to compete effectively.

Specialized Components for Next-Generation IT/Communication Products

Delta Electronics is actively investing in and expanding its capabilities in specialized passive components, crucial for emerging technologies such as 5G infrastructure, AI-driven high-performance computing, and edge computing. This strategic focus positions Delta to capitalize on significant future market growth. For instance, the global market for passive components used in 5G infrastructure alone was projected to reach approximately $2.5 billion in 2024, with substantial growth expected in the coming years.

While these are undoubtedly high-growth sectors, Delta's market share within these highly specialized, cutting-edge component segments may still be in its nascent stages. This necessitates ongoing, substantial investment in research and development (R&D) and concerted efforts for market penetration. The development cycle for such advanced components can be lengthy, requiring significant capital outlay before substantial returns are realized.

- Focus on 5G, AI, and Edge Computing: Delta's strategic emphasis on passive components for these next-generation technologies highlights its forward-looking approach.

- Developing Market Share: The company is likely building its presence in these niche, high-value markets, which often have established competitors.

- R&D and Market Penetration Investment: Significant resources are being allocated to innovation and establishing a foothold, indicating a potential Stars or Question Marks phase in the BCG matrix for these specific product lines.

- Growth Potential: The underlying markets for these components are experiencing rapid expansion, offering substantial long-term revenue opportunities.

New Geographic Market Expansions for Emerging Products

Delta Electronics is strategically expanding into new geographic markets for emerging products, aligning with its 'Design in India, Design for the World' initiative. This includes establishing new R&D centers and launching innovative products such as collaborative robots and electric vehicle (EV) chargers within India.

While India presents a significant growth opportunity, Delta's market share for these nascent product lines in these specific regions is still developing. This positions these emerging products in a growth phase, requiring substantial investment to capture market share and establish a strong foothold.

- Market Entry: Delta's expansion into India for collaborative robots and EV chargers signifies a strategic push into a high-potential emerging market.

- Growth Phase: These new product lines are in their early stages within India, indicating they are likely Stars or Question Marks in the BCG matrix, requiring significant investment.

- Investment Focus: The company's commitment to R&D and new product launches in India underscores a focus on capturing future market share.

- Global Strategy: The 'Design for the World' aspect suggests these Indian-developed products are intended for broader international market penetration.

Delta Electronics' ventures into areas like hydrogen power solutions, niche AI/IoT applications for smart cities, specialized passive components for 5G and AI, and new geographic market entries for products like collaborative robots and EV chargers all exhibit characteristics of Question Marks. These initiatives are in high-growth potential markets but likely have a low current market share for Delta.

Significant investment in research, development, and market penetration is required for these segments to mature and capture substantial future revenue. The success of these ventures hinges on Delta's ability to innovate and effectively compete in these evolving landscapes.

The company's strategic acquisitions and R&D focus in these emerging areas underscore a commitment to building future market positions. For example, the global market for passive components in 5G infrastructure was estimated at $2.5 billion in 2024, highlighting the scale of opportunity and the investment needed to gain traction.

Delta's expansion into India, with a focus on local R&D and product launches like EV chargers, exemplifies this Question Mark strategy. India's rapidly growing EV market, projected to see significant expansion in the coming years, presents a prime example of a high-growth, low-market-share scenario for Delta's new product lines.

BCG Matrix Data Sources

Our Delta Electronics BCG Matrix is built on comprehensive market data, integrating financial reports, industry growth rates, and competitor analysis to provide strategic insights.