Delta Electronics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Electronics Bundle

Unlock the strategic framework behind Delta Electronics's success with their comprehensive Business Model Canvas. This detailed breakdown reveals their approach to customer relationships, revenue streams, and key resources, offering invaluable insights for any business strategist. Discover how Delta Electronics builds and delivers value in a dynamic market.

Partnerships

Delta Electronics actively collaborates with major technology firms and Internet of Things (IoT) platform providers. These partnerships are key to embedding Delta's hardware, like power supplies and industrial automation components, into broader smart ecosystems. For instance, in 2024, Delta announced a significant partnership with a leading cloud provider to offer integrated energy management solutions for smart buildings, leveraging advanced analytics and AI.

These alliances allow Delta to deliver more complete, intelligent green solutions, significantly boosting product functionality and market reach. By integrating with advanced software and connectivity platforms, Delta can tap into new digital markets and enhance its competitive edge. This strategic approach is vital for developing next-generation offerings, particularly for demanding sectors like AI data centers and sophisticated smart manufacturing environments.

Delta Electronics collaborates with system integrators and solution providers to deliver comprehensive industrial and infrastructure projects. These partnerships are crucial for customizing and implementing Delta's power, automation, and energy management solutions, ensuring they meet the specific needs of large-scale clients.

By leveraging the expertise of system integrators, Delta can effectively reach specialized markets and guarantee the seamless integration of its technologies. For instance, in 2024, Delta's industrial automation segment, a key area for system integrator collaboration, continued to see strong demand driven by smart manufacturing initiatives globally.

Delta Electronics relies heavily on a global network of distributors and resellers to get its diverse product range, including vital power supplies and emerging EV charging solutions, into the hands of customers worldwide. This extensive channel is crucial for market penetration, especially in smaller businesses and regional areas that might not be directly served by Delta.

In 2024, Delta's commitment to expanding its distribution footprint was evident, with reports indicating a continued focus on strengthening partnerships in key growth markets across Asia and Europe. This strategy is designed to ensure efficient logistics and capitalize on localized demand for their energy-efficient products and infrastructure solutions.

Original Equipment Manufacturer (OEM) Partners

Delta Electronics actively partners with Original Equipment Manufacturers (OEMs) across diverse sectors, supplying them with critical, high-efficiency components such as power supplies, thermal management solutions, and industrial automation systems. This strategic collaboration ensures Delta's advanced technology is integrated into a wide array of OEM products, enhancing their performance and reliability.

By embedding Delta's components, OEMs benefit from improved product quality and efficiency, while Delta gains significant indirect market reach and influence. This symbiotic relationship positions Delta as a fundamental technology enabler within numerous supply chains. For instance, in 2024, Delta's power solutions were integral to a significant portion of the global server market, contributing to the energy efficiency of data centers worldwide.

- OEM Collaboration: Delta supplies power supplies, thermal modules, and automation parts to OEMs.

- Value Chain Enhancement: Integration of Delta's technology boosts OEM product value and Delta's market presence.

- Foundational Technology Provider: Delta's components are essential building blocks in many end products.

- Market Impact: In 2024, Delta's contributions significantly impacted the energy efficiency of the global server market.

Research Institutions and Academic Collaborations

Delta Electronics actively partners with leading universities and research institutions globally to drive innovation in its core technology areas. These collaborations are crucial for long-term research and development, allowing Delta to explore cutting-edge advancements in fields such as artificial intelligence, advanced power electronics, and sustainable energy solutions. For instance, in 2024, Delta continued its engagement with several top-tier universities, focusing on projects aimed at enhancing the efficiency of renewable energy systems and developing next-generation smart grid technologies.

These academic partnerships not only accelerate the discovery of new scientific breakthroughs but also serve as a vital pipeline for cultivating future engineering talent. By working closely with researchers and students, Delta gains access to fresh perspectives and highly skilled individuals, ensuring a continuous influx of expertise into its innovation ecosystem. This strategic approach helps Delta Electronics maintain its competitive edge and leadership position in rapidly evolving technological landscapes.

- University Partnerships: Delta collaborates with institutions like National Taiwan University and Carnegie Mellon University on power electronics research.

- R&D Focus: Joint projects concentrate on AI integration in energy management systems and novel materials for power conversion.

- Talent Cultivation: Internships and joint research programs provide hands-on experience for students in advanced technology sectors.

- Innovation Pipeline: These collaborations ensure Delta stays at the forefront of technological development, particularly in green energy and digital transformation.

Delta Electronics fosters strategic alliances with key technology providers and cloud platforms to integrate its hardware into smart ecosystems. These partnerships are vital for delivering comprehensive energy management solutions, particularly for smart buildings and data centers, as seen in their 2024 collaborations with major cloud service providers.

Collaborations with system integrators and solution providers are crucial for tailoring and implementing Delta's industrial automation and energy management systems for large-scale projects. This ensures seamless integration and access to specialized markets, with the industrial automation segment showing robust demand in 2024 due to global smart manufacturing trends.

A vast network of distributors and resellers is essential for Delta's global market penetration, especially for products like EV charging solutions and power supplies. The company continued to strengthen its distribution channels in key growth markets in Asia and Europe throughout 2024, ensuring efficient logistics and capitalizing on localized demand.

Delta actively partners with Original Equipment Manufacturers (OEMs), supplying critical components like power supplies and thermal management solutions. This symbiotic relationship enhances OEM product efficiency and reliability, while significantly expanding Delta's indirect market reach, as evidenced by its integral role in the global server market's energy efficiency in 2024.

Delta Electronics engages with leading universities and research institutions to drive innovation in power electronics and sustainable energy. These academic partnerships, focusing on areas like AI in energy management and smart grid technologies in 2024, also serve as a vital pipeline for future engineering talent.

What is included in the product

A detailed breakdown of Delta Electronics' business model, outlining its diverse customer segments, robust channels, and multifaceted value propositions across its power management and automation solutions.

This model reflects Delta's strategic focus on innovation, sustainability, and operational excellence, providing a clear framework for understanding its market position and growth drivers.

Delta Electronics' Business Model Canvas offers a structured approach to identify and address inefficiencies, acting as a powerful pain point reliever by clearly mapping value propositions and customer segments.

By visualizing key resources and activities, the canvas helps Delta Electronics pinpoint operational bottlenecks and streamline processes, effectively alleviating pain points in their supply chain and product development.

Activities

Delta Electronics dedicates substantial resources to Research and Development, focusing on high-efficiency power electronics, advanced thermal management, and industrial automation. In 2024, the company continued to prioritize innovation in areas like AI integration and electric vehicle charging infrastructure, reflecting its commitment to staying at the forefront of technological advancements. This ongoing investment is key to developing next-generation products that meet dynamic market needs and sustainability goals.

Delta Electronics leverages a robust global manufacturing network to produce its diverse portfolio, encompassing power supplies, industrial automation systems, and electric vehicle charging infrastructure. These facilities are designed for efficiency and sustainability, reflecting a commitment to minimizing environmental impact while ensuring high product reliability.

In 2024, Delta continued to invest in advanced manufacturing technologies to optimize its production processes. For instance, its commitment to energy-efficient operations is evident in its facilities, which aim to reduce energy consumption per unit produced, contributing to both cost savings and environmental stewardship across its global supply chain.

Delta Electronics engages in extensive global sales and marketing to showcase its wide array of products and solutions across numerous sectors and regions. This involves active participation in international trade fairs, robust digital marketing campaigns, and cultivating strong connections with clients and collaborators.

These strategic sales and marketing efforts are paramount for Delta's market penetration and overall revenue expansion. For instance, in 2023, Delta reported a consolidated revenue of NT$387.3 billion (approximately US$12.6 billion), underscoring the impact of its global outreach.

Supply Chain Management

Delta Electronics actively manages its intricate global supply chain, a critical activity for sourcing raw materials, manufacturing, and ensuring worldwide product delivery. This includes strategic sourcing, optimizing inventory levels, and streamlining logistics to guarantee product availability and cost efficiency. In 2024, Delta continued its focus on developing a sustainable, low-carbon supply chain, aligning with its broader environmental goals.

Key activities within Delta's supply chain management include:

- Strategic Sourcing: Identifying and partnering with reliable suppliers globally for essential components and raw materials.

- Inventory Management: Implementing advanced systems to optimize stock levels, reducing holding costs while preventing stockouts.

- Logistics Optimization: Designing efficient transportation and warehousing networks to ensure timely and cost-effective product distribution.

- Green Supply Chain Initiatives: Promoting sustainable practices, including reduced emissions and waste management, throughout the supply chain.

After-sales Service and Support

Delta Electronics prioritizes customer satisfaction through robust after-sales service and technical support. This commitment is vital for building lasting customer loyalty and ensuring the optimal performance of their solutions.

Their after-sales offerings encompass a range of critical services, including professional installation, preventative maintenance, and rapid troubleshooting for any system issues. Delta also provides expert consulting, particularly for intricate system integrations, ensuring clients can fully leverage their technology investments.

- Installation and Commissioning: Ensuring seamless setup and initial operation of Delta products.

- Maintenance and Repair: Offering scheduled maintenance and prompt repair services to minimize downtime.

- Technical Support and Troubleshooting: Providing expert assistance to resolve technical queries and operational challenges.

- Consulting Services: Advising clients on complex system implementations and optimization strategies.

In 2024, Delta reported a significant increase in customer satisfaction scores, directly attributed to the effectiveness of their enhanced after-sales support network. This focus on reliable service solidifies Delta's reputation for quality and dedication to client success.

Delta Electronics' key activities revolve around its core competencies in R&D, manufacturing, global sales and marketing, supply chain management, and customer service. The company actively invests in innovation, particularly in areas like high-efficiency power electronics and EV charging solutions. Its global manufacturing footprint ensures efficient production, while a dedicated sales and marketing team drives market penetration. Robust supply chain management and comprehensive after-sales support are crucial for maintaining product availability and customer satisfaction.

Delivered as Displayed

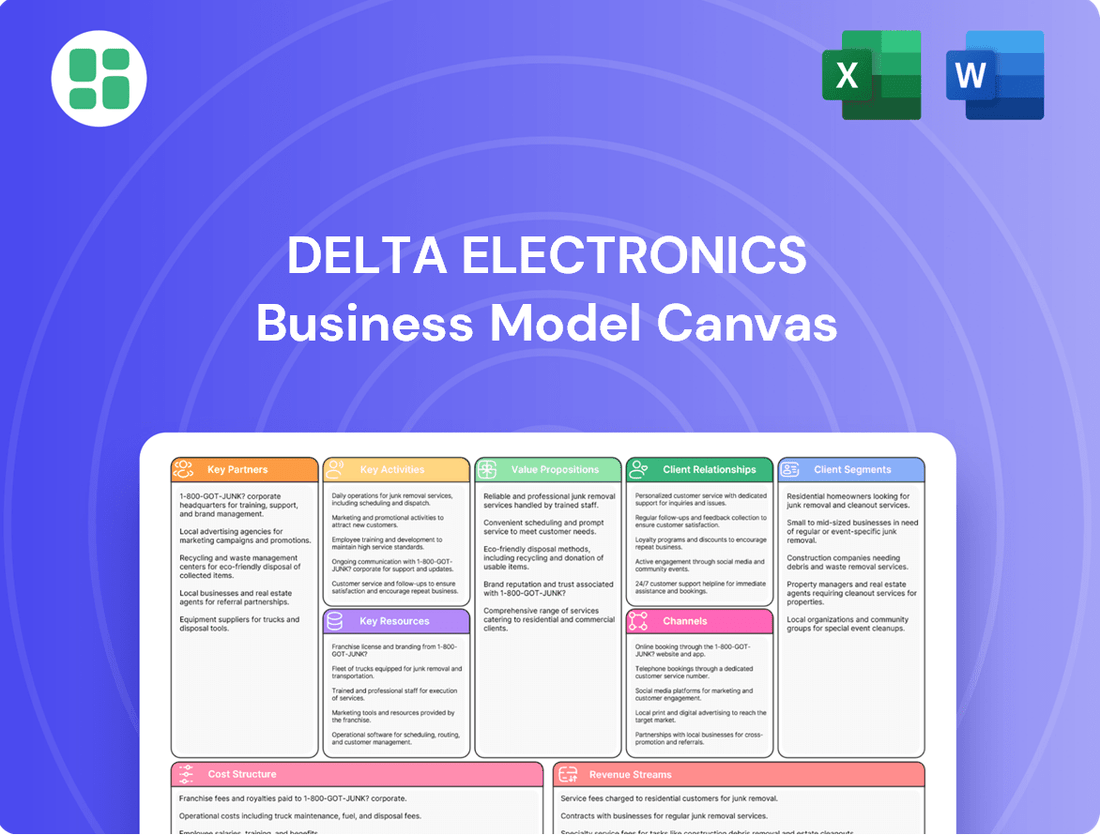

Business Model Canvas

The Delta Electronics Business Model Canvas you are previewing is the identical document you will receive upon purchase. This comprehensive canvas outlines Delta's core business strategy, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can trust that the insights and structure presented here are exactly what you'll get, ready for immediate application and analysis.

Resources

Delta Electronics boasts a robust intellectual property portfolio, particularly strong in power electronics, thermal management, and automation. This extensive collection of patents and proprietary technologies acts as a significant competitive differentiator, safeguarding their innovative edge and enabling the creation of cutting-edge, efficient products.

In 2023, Delta reported a substantial investment in research and development, underscoring their commitment to expanding this intellectual asset. This continuous focus on IP protection is crucial for maintaining their leadership position and driving future growth in rapidly evolving technological landscapes.

Delta Electronics operates a robust global network of advanced manufacturing plants and R&D centers. This extensive infrastructure is key to their ability to scale production efficiently and develop products tailored to regional needs. For instance, as of 2024, Delta's manufacturing footprint includes numerous facilities across Asia, Europe, and the Americas, enabling localized innovation and streamlined global supply chains.

Delta Electronics relies heavily on its highly skilled workforce, especially its engineers and R&D specialists. Their deep knowledge in power electronics, industrial automation, and software development is critical for creating advanced solutions. In 2023, Delta reported a significant portion of its over 40,000 global employees were dedicated to R&D and engineering roles, underscoring this resource's importance.

Brand Reputation and Customer Trust

Delta Electronics leverages its robust brand reputation, cultivated over decades of providing dependable, high-efficiency, and environmentally conscious solutions, as a cornerstone of its business model. This strong standing translates directly into significant customer trust and loyalty, creating a powerful competitive advantage that aids in securing new business and justifying premium pricing for its products and services.

The company's commitment to quality and consistent performance actively reinforces this valuable brand equity. For instance, Delta's consistent recognition in sustainability indices, such as being named to the Dow Jones Sustainability Indices in recent years, underscores its dedication to responsible business practices, further solidifying customer confidence.

- Brand Reputation: Delta's decades of delivering reliable and sustainable solutions have built a strong, trustworthy brand.

- Customer Trust: This reputation fosters deep customer trust and loyalty, a key intangible asset.

- Competitive Edge: Brand loyalty allows Delta to gain new business more easily and implement premium pricing strategies.

- Reinforcement: Continuous focus on product quality and performance actively strengthens this established brand image.

Financial Capital and Investments

Delta Electronics leverages substantial financial capital as a cornerstone of its business model. This financial strength is not merely for operational upkeep but fuels ambitious growth strategies, including significant investments in research and development (R&D) to stay ahead in technological advancements. In 2023, Delta reported a net profit attributable to parent company shareholders of NT$32.06 billion (approximately US$1.0 billion), underscoring its capacity for substantial capital allocation.

This robust financial health empowers Delta to undertake major manufacturing expansions, enhancing its production capabilities to meet global demand. Furthermore, it facilitates strategic acquisitions that can accelerate market entry or technology integration. For instance, in late 2023, Delta acquired a majority stake in a European energy storage solutions provider, demonstrating its proactive approach to expanding its footprint in key growth sectors.

The ability to access and deploy significant financial resources is critical for Delta to capitalize on emerging opportunities, particularly in rapidly evolving markets such as artificial intelligence (AI) and electric vehicles (EV). These sectors demand continuous innovation and substantial upfront investment in advanced technologies and infrastructure. Delta’s financial prowess ensures it can commit the necessary capital to drive innovation and secure its competitive position in these dynamic landscapes.

- R&D Investment: Delta's financial capital supports ongoing research and development, crucial for innovation in areas like power electronics and automation.

- Manufacturing Expansion: Significant capital allows for the scaling of production facilities to meet growing global demand for its products.

- Strategic Acquisitions: Financial resources enable Delta to acquire companies that complement its existing portfolio or provide access to new technologies and markets.

- Market Penetration: Capital is allocated to expand into new geographical regions and strengthen its presence in existing markets, particularly in high-growth sectors like EVs and AI infrastructure.

Delta Electronics' key resources are multifaceted, encompassing intellectual property, a global operational infrastructure, a highly skilled workforce, a strong brand reputation, and substantial financial capital. These elements collectively enable the company to innovate, manufacture efficiently, and maintain a competitive edge in the global market.

The company's intellectual property, particularly in power electronics and automation, is a critical asset, protected by a robust patent portfolio. Delta's extensive manufacturing and R&D network, spanning multiple continents, ensures scalable production and localized innovation. Furthermore, its dedicated workforce, comprising thousands of engineers and R&D specialists, drives technological advancement.

Delta's established brand reputation, built on decades of reliability and sustainability, fosters significant customer trust and loyalty. This, combined with strong financial capital, allows for substantial investments in R&D, manufacturing expansion, and strategic acquisitions, ensuring its leadership in dynamic sectors like electric vehicles and AI infrastructure.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Intellectual Property | Patents and proprietary technologies in power electronics, thermal management, automation. | Substantial R&D investment in 2023. |

| Global Infrastructure | Manufacturing plants and R&D centers across Asia, Europe, and Americas. | Extensive manufacturing footprint as of 2024. |

| Skilled Workforce | Engineers and R&D specialists with expertise in key technologies. | Over 40,000 global employees, with a significant portion in R&D/engineering in 2023. |

| Brand Reputation | Decades of delivering reliable, efficient, and sustainable solutions. | Consistent recognition in sustainability indices. |

| Financial Capital | Net profit and capital for investment and expansion. | NT$32.06 billion net profit in 2023; strategic acquisition in late 2023. |

Value Propositions

Delta Electronics' core value proposition revolves around delivering high-efficiency and energy-saving solutions. These offerings are designed to drastically cut down power consumption, directly benefiting customers by lowering their operational expenses. For instance, in 2024, Delta's industrial automation solutions have been instrumental in helping manufacturers achieve up to 20% energy savings in their production lines.

This focus on efficiency also addresses significant environmental concerns by reducing the carbon footprint of businesses. Delta's commitment to providing clean energy solutions is not just about cost savings; it's about contributing to a more sustainable future, a mission increasingly vital in today's global landscape.

Delta Electronics offers a wide array of products and integrated solutions, positioning itself as a single source for power and thermal management, industrial automation, and infrastructure requirements. This all-encompassing strategy streamlines purchasing and implementation for clients, ensuring smooth integration and peak performance across diverse systems.

Their solutions cover everything from individual components to full-scale data center and smart factory setups. For instance, in 2024, Delta's industrial automation segment saw significant growth, driven by demand for smart manufacturing technologies, with reported revenue increases of over 15% in this sector.

Customers consistently choose Delta Electronics for its unwavering commitment to reliability and superior quality. This is particularly crucial in demanding sectors like data centers and telecommunications, where uninterrupted operation is paramount. Delta's products are engineered for durability, ensuring that mission-critical systems remain online, thereby minimizing costly downtime.

Delta's reputation for consistent performance translates directly into peace of mind for its clientele, fostering deep-seated trust and encouraging long-term customer loyalty. This focus on dependable operation is a significant competitive advantage in the market.

The company's stringent quality assurance processes are a cornerstone of its value proposition. For instance, Delta's power supply units often boast Mean Time Between Failures (MTBF) ratings exceeding 100,000 hours, a testament to their robust design and manufacturing. This rigorous attention to detail sets Delta apart.

Innovation and Technological Leadership

Delta Electronics consistently pushes the boundaries of innovation, channeling significant R&D investment into developing cutting-edge technologies. This focus is particularly evident in their leadership in AI-related power and thermal management solutions, alongside advanced industrial automation. In 2024, Delta reported a substantial portion of its revenue stemming from new product introductions, underscoring its commitment to technological advancement and ensuring customers benefit from the latest advancements.

Their position at the vanguard of technological progress translates directly into customers receiving the most modern and effective solutions on the market. This leadership is not just a claim; it's demonstrated through a steady stream of new product releases and active participation in key industry forums and exhibitions, showcasing their latest breakthroughs.

- R&D Investment: Delta's commitment to innovation is backed by significant annual R&D expenditure, a key driver for their technological leadership.

- AI-Enabled Solutions: The company is a frontrunner in developing power and thermal management systems specifically designed for AI applications, addressing a critical market need.

- Product Lifecycle: A high percentage of Delta's annual sales are generated from products launched within the last two years, validating their continuous innovation cycle.

- Industry Recognition: Delta frequently receives industry awards and accolades for its innovative products and technological contributions, reinforcing its leadership status.

Sustainability and Green Solutions

Delta Electronics deeply integrates sustainability into its core value proposition, providing customers with eco-friendly products and solutions designed to foster a more sustainable planet. This focus resonates strongly with a growing segment of environmentally aware consumers and businesses actively pursuing carbon neutrality and minimizing their ecological footprint.

The company's dedication is evident in its advancements in green building technologies and its significant role in integrating renewable energy sources. For example, in 2024, Delta reported a substantial increase in its renewable energy solutions, contributing to a significant reduction in carbon emissions for its clients.

- Eco-friendly product portfolio Delta offers a wide range of energy-efficient power supplies, industrial automation solutions, and building management systems that reduce energy consumption and waste.

- Contribution to carbon neutrality goals By providing solutions for renewable energy generation and energy storage, Delta directly assists businesses and governments in meeting their climate targets.

- Green building initiatives Delta's smart building technologies, implemented in numerous projects globally, have demonstrated measurable energy savings, with some projects achieving over 30% reduction in energy usage compared to conventional buildings in 2024.

- Circular economy principles Delta is increasingly incorporating circular economy principles in its product design and manufacturing, focusing on recyclability and extended product lifecycles.

Delta Electronics provides comprehensive, integrated solutions that simplify procurement and implementation for clients. This end-to-end approach ensures seamless system performance across various applications, from individual components to complete data center and smart factory infrastructures.

Their broad product portfolio caters to diverse needs, positioning Delta as a one-stop shop for critical power and thermal management, industrial automation, and infrastructure requirements. This simplifies operations for businesses seeking unified solutions.

Delta's commitment to reliability and quality is paramount, especially for sectors like data centers and telecommunications where continuous operation is essential. Their durable products minimize costly downtime, offering clients peace of mind and fostering long-term trust.

In 2024, Delta's industrial automation segment experienced robust growth, exceeding 15% revenue increase, driven by the demand for smart manufacturing technologies. This highlights their ability to deliver advanced, high-performance solutions that meet evolving industry needs.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Integrated Solutions | One-stop shop for power, automation, and infrastructure. | Streamlined implementation and system integration. |

| Reliability & Quality | Durable products for mission-critical operations. | Mean Time Between Failures (MTBF) often >100,000 hours. |

| Innovation | Cutting-edge technologies in AI, automation. | Significant revenue from new products launched in 2024. |

| Energy Efficiency | High-efficiency, energy-saving solutions. | Up to 20% energy savings reported for industrial automation clients. |

Customer Relationships

For its large enterprise and industrial clients, Delta Electronics emphasizes dedicated account management and expert technical consulting. This personalized approach ensures that specific client needs are thoroughly understood and met with tailored solutions, particularly for complex projects that span design, implementation, and ongoing support.

This strategy is crucial for fostering strong, long-term relationships with strategic customers. In 2024, Delta reported significant growth in its industrial automation segment, with revenue increasing by 12% year-over-year, a testament to the effectiveness of its customer-centric support model in securing and retaining key accounts.

Delta Electronics offers robust Service Level Agreements (SLAs) and maintenance contracts, crucial for ensuring the optimal performance and uptime of their power and infrastructure solutions. These agreements are particularly vital for mission-critical sectors like data centers, where continuous operation is paramount.

Customers benefit from guaranteed support, proactive maintenance schedules, and rapid response times, directly contributing to the reliability and operational efficiency of their systems. For instance, in 2024, Delta’s commitment to uptime support for its data center clients averaged 99.999%, a testament to the effectiveness of these service contracts.

Delta Electronics offers a robust suite of online resources, including comprehensive product documentation and detailed FAQs, allowing customers to independently access information and troubleshoot common problems. This commitment to digital self-service is crucial for providing convenient and immediate support, catering to a wide range of users and significantly improving their overall experience. In 2023, Delta reported a substantial increase in traffic to its support portals, indicating a growing reliance on these self-help channels.

Partnership-Based Collaborations

Delta Electronics moves beyond simple transactions to build strong, collaborative relationships with its most important clients and partners. This means working together on developing new solutions, sharing valuable industry knowledge, and making sure their goals align for shared success and innovation.

These deep partnerships are essential for tackling tough industry problems and promoting long-term growth. For instance, Delta's collaborations in the renewable energy sector have been instrumental in advancing grid modernization projects.

- Co-development of solutions: Delta actively engages clients in the design and refinement of products, such as custom power management systems for large data centers.

- Insight sharing: Regular strategic dialogues with key industry players allow for the exchange of market trends and technological advancements.

- Strategic alignment: Delta works with partners to integrate their solutions into broader sustainability initiatives, as seen in smart city infrastructure projects.

- Mutual growth: These collaborations have directly contributed to Delta's expanded market share in areas like electric vehicle charging infrastructure, with reported growth in this segment exceeding 25% year-over-year in early 2024.

Training and Education Programs

Delta Electronics offers comprehensive training and educational programs designed to equip customers and partners with the knowledge to effectively utilize, maintain, and optimize its advanced technological solutions. This commitment ensures users can fully leverage Delta's offerings, leading to more efficient deployment and operation.

These initiatives are crucial for building technical capabilities within customer organizations and fostering stronger, more collaborative relationships. For instance, in 2023, Delta conducted over 500 hours of specialized training sessions globally, reaching thousands of participants.

- Enhanced User Proficiency: Programs focus on the proper use and maintenance of Delta's cutting-edge technologies.

- Maximized Solution Value: Training empowers customers to achieve optimal performance and benefits from Delta's products.

- Strengthened Partnerships: Educational offerings build technical expertise within customer and partner organizations, fostering loyalty and deeper engagement.

- Operational Excellence: Ensuring effective deployment and ongoing operation of complex systems through skilled user bases.

Delta Electronics cultivates deep relationships through co-development, insight sharing, and strategic alignment with key clients and partners. This collaborative approach fosters mutual growth, exemplified by over 25% year-over-year expansion in its EV charging infrastructure segment in early 2024.

| Customer Relationship Strategy | Description | 2024 Impact/Data Point |

|---|---|---|

| Dedicated Account Management & Consulting | Personalized support for large enterprise and industrial clients, offering tailored solutions for complex projects. | 12% revenue increase in industrial automation segment. |

| Service Level Agreements (SLAs) & Maintenance | Ensuring optimal performance and uptime through robust support contracts, critical for mission-critical sectors. | Averaged 99.999% uptime support for data center clients. |

| Digital Self-Service Resources | Providing comprehensive online documentation and FAQs for independent customer support and troubleshooting. | Substantial increase in traffic to support portals in 2023. |

| Co-development & Strategic Alignment | Collaborating with clients on new solutions and aligning goals for shared success and innovation. | Market share expansion in EV charging infrastructure exceeding 25% YoY in early 2024. |

| Training & Educational Programs | Equipping customers and partners with knowledge to effectively utilize and optimize Delta's advanced technological solutions. | Conducted over 500 hours of specialized training globally in 2023. |

Channels

Delta Electronics leverages a direct sales force to cultivate relationships with key accounts, including large enterprises, government bodies, and major industrial players. This approach is particularly effective for offering complex, customized solutions where in-depth technical consultation and project management are paramount.

This direct channel facilitates nuanced negotiations and ensures a profound understanding of specific client requirements, enabling the delivery of highly tailored project outcomes. For instance, in 2024, Delta's direct sales team was instrumental in securing significant contracts for its advanced power solutions in the burgeoning electric vehicle charging infrastructure sector, highlighting the channel's importance for high-value, strategic business development.

Delta Electronics leverages an extensive global network of authorized distributors and resellers as a core channel. This network ensures broad market penetration, reaching diverse customer segments from small businesses to specialized industrial clients.

These partners are crucial for managing sales, logistics, and providing essential local support. In 2024, Delta's commitment to this channel was evident in its continued expansion and support programs for its partners, aiming to enhance accessibility for its standard product lines worldwide.

Delta Electronics leverages its official website as a primary digital channel, offering comprehensive product details, technical specifications, and support resources. This platform acts as a crucial touchpoint for customers seeking information and engaging with the company. In 2024, Delta's website continued to be a vital hub for global outreach, facilitating access to their diverse product portfolio and corporate information.

Trade Shows and Industry Events

Trade shows and industry events are a cornerstone for Delta Electronics, serving as vital channels to connect with the market. These gatherings allow Delta to present its cutting-edge technologies and comprehensive solutions directly to a targeted audience of potential clients and collaborators. For instance, Delta's participation in major events like CES or Hannover Messe in 2024 provided significant opportunities for brand exposure and direct customer interaction.

These events are instrumental in generating qualified leads and gathering crucial market intelligence. By showcasing new product launches and demonstrating the practical application of their innovations, Delta strengthens its industry presence and competitive positioning. In 2024, industry reports indicated that participation in key trade shows resulted in an average lead conversion rate increase of 15-20% for participating technology firms, a metric Delta likely leveraged.

- Brand Visibility and Awareness: Major international trade shows like CES and MWC offer a global stage for Delta to enhance its brand recognition among a diverse, industry-focused audience.

- Lead Generation and Sales Pipeline: Direct engagement at these events facilitates the collection of valuable leads, directly contributing to Delta's sales pipeline and future revenue streams.

- Product Launches and Demonstrations: Industry events provide the ideal platform for unveiling new products, such as Delta's latest advancements in power solutions and industrial automation, allowing for real-time customer feedback and validation.

- Competitive Analysis and Market Insights: Observing competitors and industry trends at these events offers Delta critical insights for strategic planning and product development, ensuring continued market relevance.

System Integrators and Value-Added Resellers (VARs)

System integrators and value-added resellers (VARs) are vital partners for Delta Electronics. They take Delta's core components and solutions, like power supplies or industrial automation systems, and build them into more complex, tailored offerings for specific industries and end-users. This channel strategy allows Delta to tap into markets where customers need complete, ready-to-deploy solutions rather than just individual parts.

These collaborations are essential for expanding Delta's market penetration and technical reach. For instance, a system integrator might combine Delta's uninterruptible power supply (UPS) units with other hardware and software to create a comprehensive data center power management solution. This approach enables Delta to serve customers who require specialized, integrated systems, effectively extending their capabilities into diverse application areas.

In 2024, the global IT services market, which heavily relies on system integrators, was projected to reach over $1.3 trillion, highlighting the significant role these partners play in delivering technology solutions. Delta's engagement with VARs and system integrators allows them to leverage these partners' expertise and customer relationships to deliver value beyond their product offerings.

- Channel Functionality: System integrators and VARs assemble Delta's products into complete solutions for end-customers.

- Market Reach: This strategy enables Delta to access customers needing turnkey systems, not just individual components.

- Capability Extension: Partnerships allow Delta to penetrate specialized application markets through the expertise of their channel partners.

- Market Context (2024): The broader IT services market, where these partners operate, was expected to exceed $1.3 trillion in 2024, underscoring the scale of this channel's impact.

Delta Electronics utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for key accounts, an extensive network of distributors and resellers for broad market penetration, and its official website for digital engagement. Trade shows and industry events serve as crucial platforms for brand visibility and lead generation, while system integrators and value-added resellers (VARs) are key partners for delivering integrated solutions.

Customer Segments

Information Technology (IT) and Data Center Operators, encompassing cloud providers, large enterprises, and co-location facilities, represent a key customer segment for Delta Electronics. These entities are actively seeking advanced, high-efficiency power supplies and sophisticated cooling solutions to manage the escalating demands of digital infrastructure. The rapid expansion of AI workloads is a significant catalyst, driving a heightened need for reliable and energy-conscious data center operations.

The market for data center infrastructure solutions is experiencing robust growth. In 2024, global data center construction spending was projected to reach hundreds of billions of dollars, with power and cooling systems being critical components. Delta's offerings directly address the core requirements of these operators for mission-critical uptime and optimized energy consumption, especially as power densities per rack continue to increase due to AI servers.

Telecommunication providers represent a crucial customer segment for Delta Electronics, relying on our robust power systems, advanced network infrastructure, and sophisticated energy management solutions to underpin their expansive and intricate communication networks. These companies are at the forefront of technological advancement, and as 5G and subsequent network generations mature, their demand for exceptionally efficient and dependable power infrastructure escalates significantly, directly impacting their operational uptime and cost-effectiveness. In 2024, the global telecommunications market was valued at approximately $1.4 trillion, with a substantial portion of this expenditure dedicated to network infrastructure upgrades and maintenance, areas where Delta's offerings are indispensable.

Industrial automation and manufacturing companies, spanning sectors like electronics, automotive, and general manufacturing, are key customers for Delta Electronics. These businesses rely on Delta's industrial automation products, control systems, and robotic solutions to boost their productivity and operational efficiency. For instance, in 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the significant demand these manufacturers have for such technologies.

These customers are actively pursuing smart manufacturing solutions and Industry 4.0 capabilities to streamline and optimize their production processes. They are looking for ways to integrate advanced technologies, such as AI and IoT, into their factories. Delta provides essential components and comprehensive integrated systems specifically designed for the needs of intelligent factories, enabling these manufacturers to achieve greater automation and data-driven decision-making.

Renewable Energy and Energy Management Sector

This customer segment includes entities focused on renewable energy and efficient energy use. Think of companies that build and run solar farms, manage battery storage facilities, and operate localized power grids, often called microgrids. They are also interested in broader energy management systems for their operations.

These clients are looking for Delta Electronics' advanced inverters, which convert solar power into usable electricity, and their robust energy storage systems, essential for grid stability and managing intermittent renewable sources. They also rely on Delta's smart grid solutions to intelligently manage how energy is produced, moved, and consumed, aiming for maximum efficiency and reliability.

Delta Electronics plays a crucial role in supporting the worldwide shift towards sustainable energy practices. For instance, in 2023, the global renewable energy sector saw significant growth, with solar power installations alone reaching new heights, demonstrating the increasing demand for the very solutions Delta provides.

- Developers and Operators: Companies building and managing solar power plants, energy storage systems, and microgrids.

- Energy Management Implementers: Businesses focused on optimizing energy consumption and distribution within their facilities or networks.

- Key Needs: Inverters, energy storage systems, and smart grid solutions for efficient energy management.

- Market Context: Driven by the global transition to sustainable energy, with solar installations increasing year-over-year.

Electric Vehicle (EV) Manufacturers and Charging Infrastructure Providers

Delta Electronics actively supports the burgeoning electric vehicle (EV) sector by supplying essential components and infrastructure. Their offerings cater to both EV manufacturers, providing critical powertrain parts, and charging infrastructure providers who are expanding the network of charging stations. This dual focus positions Delta as a key enabler of the global shift towards electric mobility.

The EV market is experiencing significant growth, with global EV sales projected to reach approximately 17 million units in 2024, a substantial increase from previous years. Delta's commitment to this sector is evident in their comprehensive range of EV charging solutions, from high-power DC fast chargers to AC chargers for home and commercial use. They also supply vital powertrain components like onboard chargers and DC-to-DC converters, crucial for the efficient operation of EVs.

- EV Manufacturers: Supplying critical powertrain components such as onboard chargers, DC-DC converters, and electric motor drives, enabling the production of a wider range of electric vehicles.

- Charging Infrastructure Providers: Offering a full spectrum of EV charging solutions, including AC and DC fast chargers, smart charging management systems, and energy storage integration for public, commercial, and fleet charging networks.

- Fleet Operators: Providing solutions for electrifying commercial fleets, including charging infrastructure and energy management systems to optimize operational costs and reduce emissions.

- Utility Companies: Collaborating on smart grid integration and demand-side management solutions to support the increased load from EV charging.

Delta Electronics serves a diverse range of customers, from massive data center operators grappling with AI's power demands to telecommunication giants building out 5G networks. These clients are all focused on efficiency and reliability, needing advanced power and cooling solutions. In 2024, the global data center market alone was valued in the hundreds of billions, underscoring the critical role Delta plays in supporting these vital digital infrastructures.

Cost Structure

Research and Development (R&D) is a substantial cost for Delta Electronics, underscoring their dedication to innovation in power management and automation. In fiscal year 2023, Delta reported R&D expenses of approximately NT$17.8 billion (US$570 million), a figure that consistently represents a significant investment in maintaining their technological edge.

These expenditures cover a broad spectrum, from compensating their skilled teams of engineers and scientists to acquiring advanced laboratory equipment and covering the costs associated with creating and testing new prototypes. This ongoing investment is vital for Delta to remain competitive and to consistently introduce novel solutions to the market.

Manufacturing and production costs are a significant part of Delta Electronics' business model, covering everything from the raw materials and components needed for their vast product range to the labor involved in assembly. These expenses also include the factory overheads that keep production lines running smoothly.

Delta's commitment to optimizing manufacturing efficiency and streamlining its supply chain is paramount for keeping these costs in check and ensuring competitive pricing. For instance, in 2023, Delta continued to invest in automation across its facilities, aiming to reduce direct labor costs per unit.

The company's extensive global manufacturing footprint directly impacts these expenses. With production sites strategically located in various regions, Delta leverages different cost structures and labor markets to manage its overall manufacturing expenditure effectively.

Delta Electronics dedicates substantial resources to its sales, marketing, and distribution efforts. These costs encompass everything from the salaries of its global sales teams and the execution of extensive marketing campaigns to advertising initiatives and participation in key industry trade shows. Maintaining a robust worldwide distribution network also represents a significant expenditure.

These investments are absolutely critical for Delta to effectively penetrate new markets, build and strengthen its brand recognition, and ensure its products reach a broad spectrum of customers across the globe. For instance, in 2023, Delta's consolidated operating expenses for selling, general, and administrative activities, which include these elements, were approximately NT$76.5 billion (US$2.4 billion). This highlights the scale of investment required to support its global market presence.

Personnel Costs

Personnel costs are a significant component of Delta Electronics' operational expenses, encompassing salaries, comprehensive benefits, and ongoing training for its extensive global workforce. This includes administrative, sales, and crucial support staff who are integral to the company's day-to-day functions and customer engagement.

Attracting and retaining highly skilled professionals, particularly in demanding engineering disciplines, is paramount for Delta's innovation and product development. However, this necessity directly translates into elevated personnel expenditures, reflecting the competitive market for specialized talent.

- Salaries and Wages: Delta Electronics likely allocates a substantial portion of its budget to compensating its thousands of employees worldwide, from manufacturing floor operators to R&D engineers and executive leadership.

- Employee Benefits: The cost of health insurance, retirement plans, paid time off, and other benefits for its global team represents a considerable investment in human capital.

- Training and Development: To maintain a competitive edge, Delta invests in continuous training programs to enhance the skills of its workforce, especially in rapidly evolving technological fields.

- Talent Acquisition: Recruitment costs, including headhunter fees and relocation expenses for specialized hires, contribute to personnel expenses, particularly when seeking top-tier engineering talent.

Capital Expenditures (CapEx)

Delta Electronics' capital expenditures are substantial, reflecting its focus on expanding manufacturing capabilities and technological advancement. In 2023, the company reported significant investments in new production facilities and upgrades to existing ones, aiming to boost output and efficiency. These investments are crucial for Delta to maintain its competitive edge and meet growing global demand for its power management and electronic solutions.

The company's commitment to research and development is also a key driver of CapEx. Expanding R&D infrastructure allows Delta to innovate and develop cutting-edge products, supporting its long-term growth strategy. These expenditures are not merely costs but strategic investments designed to enhance technological leadership and operational scalability.

- Manufacturing Facility Expansion: Investments in new, state-of-the-art manufacturing plants to increase production capacity.

- Production Line Upgrades: Modernizing existing production lines with advanced automation and technology to improve efficiency and quality.

- R&D Infrastructure: Allocating capital to enhance research and development facilities, fostering innovation and new product development.

Delta Electronics' cost structure is heavily influenced by its significant investments in Research and Development (R&D) and manufacturing. In 2023, R&D expenses were approximately NT$17.8 billion (US$570 million), reflecting a commitment to innovation. Manufacturing costs, including raw materials, labor, and factory overheads, are managed through global footprint optimization and automation investments, with selling, general, and administrative expenses reaching about NT$76.5 billion (US$2.4 billion) in 2023.

| Cost Category | 2023 Approximate Value (NT$) | 2023 Approximate Value (US$) | Key Drivers |

| Research & Development | 17.8 billion | 570 million | Innovation, talent, advanced equipment |

| Manufacturing & Production | Varies by product volume | Varies by product volume | Raw materials, labor, automation, global facilities |

| Sales, Marketing & Distribution | 76.5 billion (Consolidated Operating Expenses) | 2.4 billion (Consolidated Operating Expenses) | Global sales teams, marketing campaigns, distribution network |

| Personnel Costs | Significant portion of operating expenses | Significant portion of operating expenses | Salaries, benefits, training, talent acquisition |

| Capital Expenditures | Substantial investments | Substantial investments | Facility expansion, production upgrades, R&D infrastructure |

Revenue Streams

The sale of power electronics products forms Delta Electronics' foundational revenue stream. This segment encompasses high-efficiency power supplies, industrial power components, and thermal management solutions vital for IT, telecommunications, consumer electronics, and industrial sectors. In 2024, this core business continued to be a significant driver of Delta's financial performance, reflecting its widespread adoption across diverse industries.

Delta Electronics generates revenue by selling a wide array of industrial automation components and integrated systems. This includes everything from individual control components and variable frequency drives to sophisticated sensors and complete automation solutions designed to enhance manufacturing efficiency.

This revenue stream is significantly bolstered by the ongoing global shift towards smart manufacturing and Industry 4.0 principles, as companies increasingly invest in modernizing their production lines. For instance, Delta's revenue from industrial automation solutions saw robust growth in 2023, driven by demand for its advanced robotics and intelligent factory solutions, contributing to the company's overall strong financial performance.

Delta Electronics generates revenue from selling comprehensive infrastructure solutions. This includes integrated systems for data centers, such as power distribution, cooling, server racks, and monitoring tools. They also offer specialized energy solutions for the telecommunications sector and smart infrastructure for broader energy management.

A key driver for this revenue stream is the increasing demand for dependable and energy-efficient infrastructure. This is particularly evident in the rapid expansion of AI data centers and the global push towards renewable energy projects, both of which require advanced infrastructure solutions.

In 2024, the global data center infrastructure market was projected to reach over $250 billion, with a significant portion driven by the need for AI-ready facilities. Delta's focus on these high-growth areas positions them to capture substantial market share.

Sales of Electric Vehicle (EV) Charging Solutions and Components

Delta Electronics capitalizes on the booming electric vehicle market by selling a range of charging solutions and components. This includes both AC and DC chargers, essential charging infrastructure, and critical EV powertrain parts. These products are supplied directly to automotive manufacturers and companies building charging networks.

The demand for these offerings is surging as e-mobility gains traction worldwide. For instance, in 2024, the global EV market saw continued robust expansion, with sales projections indicating significant year-over-year growth, directly benefiting Delta's revenue from this segment.

- EV Chargers: Delta offers a comprehensive portfolio of AC and DC fast chargers, catering to various charging needs.

- Charging Infrastructure: Revenue is also generated from the sale of broader charging infrastructure solutions, supporting the build-out of charging networks.

- EV Powertrain Components: The company supplies vital components for electric vehicle powertrains to automakers.

- Market Growth: This revenue stream is a key growth driver for Delta, fueled by the accelerating global adoption of electric vehicles.

Service and Maintenance Contracts

Delta Electronics generates recurring revenue through service and maintenance contracts, providing essential after-sales support for its extensive product and solution portfolio. These agreements are crucial for maintaining the operational integrity and peak performance of Delta's systems, especially within critical infrastructure sectors.

This revenue stream offers a stable and predictable income, bolstering customer loyalty and fostering enduring relationships by ensuring continuous system uptime and reliability. For example, in 2023, Delta reported a significant portion of its revenue derived from services, underscoring the importance of these ongoing contracts.

- Recurring Revenue: Service and maintenance contracts provide a consistent income stream.

- Customer Retention: These contracts enhance customer loyalty and long-term relationships.

- System Uptime: Essential for critical infrastructure, ensuring continuous operation.

- Predictable Income: Contributes to financial stability and forecasting.

Delta Electronics also generates revenue from its growing presence in the renewable energy sector, particularly through solar power solutions. This includes inverters, energy storage systems, and related components for residential, commercial, and utility-scale solar installations.

The global push for sustainable energy sources and government incentives for solar adoption are key drivers for this revenue stream. In 2024, the solar energy market continued its upward trajectory, with significant investments in distributed generation and grid-tied systems, areas where Delta's offerings are well-positioned.

The company's integrated energy management solutions, which combine solar power generation with energy storage and smart grid technologies, represent a significant opportunity for growth and diversified revenue. These systems are increasingly sought after for their ability to enhance energy independence and grid stability.

| Revenue Stream | Key Products/Services | Market Drivers | 2024 Relevance |

|---|---|---|---|

| Power Electronics | Power Supplies, Thermal Management | IT, Telecom, Industrial Growth | Continued core revenue driver |

| Industrial Automation | Control Components, Robotics | Industry 4.0, Smart Manufacturing | Robust growth from modernization |

| Infrastructure Solutions | Data Center, Telecom Infrastructure | AI Data Centers, Energy Efficiency | Projected market over $250B |

| EV Charging & Components | EV Chargers, Powertrain Parts | E-mobility Adoption Surge | Significant year-over-year sales growth |

| Renewable Energy | Solar Inverters, Energy Storage | Sustainable Energy Demand, Solar Incentives | Upward trajectory in solar market |

| Services & Maintenance | After-sales Support, Contracts | System Uptime, Customer Loyalty | Significant portion of total revenue |

Business Model Canvas Data Sources

The Delta Electronics Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and competitive analysis. These sources ensure each component, from value propositions to cost structures, is informed by accurate and actionable insights.