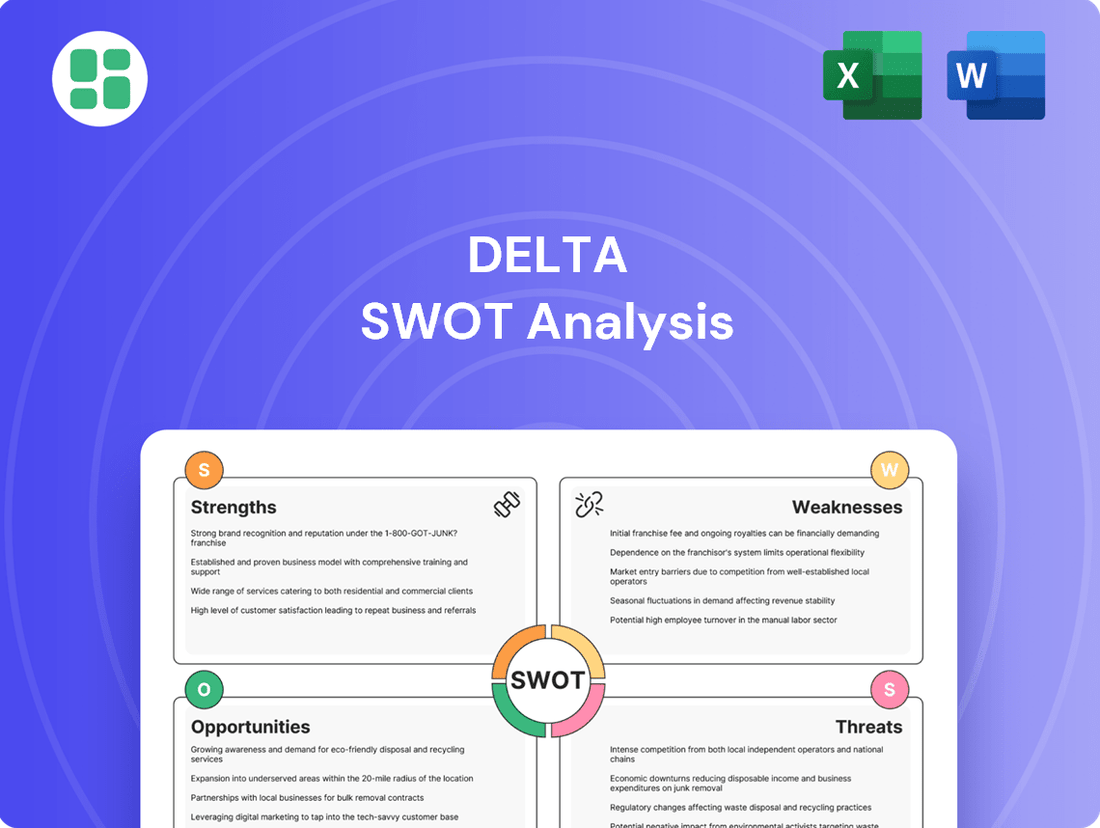

Delta SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Bundle

Delta's strategic positioning is clear, but what truly sets them apart? Our comprehensive SWOT analysis dives deep into their unique strengths, potential threats, and untapped opportunities.

Want to understand the full picture of Delta's competitive edge and where they're headed? Unlock actionable insights and strategic takeaways by purchasing the complete SWOT analysis, designed to empower your own business decisions.

Strengths

Delta Corp commands a commanding presence as the undisputed market leader in India's casino gaming and hospitality industry, especially in the lucrative Goa market. This entrenched position translates into a powerful brand reputation and a loyal customer base, offering a significant competitive advantage in player acquisition and retention.

Their impressive portfolio boasts flagship properties such as the renowned offshore casino Deltin Royale and the popular land-based establishment Deltin Jaqk, solidifying their market dominance. For the fiscal year ending March 31, 2024, Delta Corp reported consolidated revenue of ₹1,155.6 crore, with their gaming and hospitality segment being the primary revenue driver.

Delta Corp's diversified business portfolio is a significant strength, extending beyond its traditional casino operations into the burgeoning online skill gaming sector. This strategic move includes popular platforms like Adda52.com for poker and Adda52rummy.com, tapping into India's rapidly expanding digital entertainment market.

This diversification not only reduces reliance on a single revenue stream, thereby mitigating risk, but also positions Delta Corp to capitalize on the substantial growth anticipated in online gaming. For instance, the Indian online gaming market was projected to reach approximately $2.8 billion by 2024, with further substantial growth expected through 2025.

Delta Corp's strategic expansion into offline assets is a significant strength, with a planned investment of ₹1,100 Crore over the next two years. This capital infusion is earmarked for enhancing its physical infrastructure, including a new offshore vessel and a 450-room hotel.

The company is also set to introduce a larger floating casino by 2025, replacing the current Deltin Royale. These moves underscore a commitment to bolstering its brick-and-mortar presence and diversifying its revenue streams beyond the online segment.

Integrated Resort Model

Delta's integrated resort model is a significant strength, blending gaming with a full spectrum of hospitality services. This creates a unique, all-encompassing entertainment destination that drives customer loyalty and diversifies revenue beyond just gaming floors.

This multifaceted approach is crucial for business stability. By offering hotels, dining, entertainment, and potentially future attractions like theme parks, Delta captures a larger share of consumer spending and builds resilience against fluctuations in any single segment. For example, in 2024, the hospitality segment of integrated resorts has shown robust performance, with average daily rates (ADRs) for hotel rooms in major tourist destinations increasing by approximately 8-10% year-over-year, bolstering the overall revenue mix.

The benefits of this model are evident in Delta's financial performance and market position:

- Enhanced Customer Lifetime Value: By providing a complete experience, customers tend to spend more time and money within the resort, increasing their overall value to the company.

- Multiple Revenue Streams: Diversification across gaming, lodging, food and beverage, and entertainment creates a more stable and predictable income flow.

- Competitive Advantage: The ability to offer a seamless, high-quality experience differentiates Delta from competitors focused solely on gaming.

- Resilience to Market Volatility: A diversified revenue base makes the company less susceptible to downturns in any single market segment.

Strong Operational Performance in Core Gaming

Delta Corp's core gaming operations demonstrate resilience, with a notable year-on-year increase in gaming revenue, even amidst broader profit fluctuations. This sustained performance highlights strong customer demand for their casino properties and adept management of their most profitable business segments.

Key indicators of this strength include:

- Consistent Revenue Growth: Gaming revenue has shown an upward trend, underscoring the continued popularity of their casino offerings.

- Effective Segment Management: The company's ability to maintain and grow revenue in its primary gaming division points to efficient operational strategies.

- Market Demand: The increasing revenue signifies a robust and persistent demand for Delta Corp's casino experiences in the current market.

Delta Corp's market leadership in India's casino and hospitality sector, particularly in Goa, is a significant strength. This dominance is supported by a strong brand and a loyal customer base, which aids in attracting and keeping players. Their impressive portfolio includes well-known establishments like the Deltin Royale offshore casino and the land-based Deltin Jaqk, reinforcing their market leading position.

The company's strategic diversification into online skill gaming, with platforms such as Adda52.com and Adda52rummy.com, is a key strength. This move taps into India's rapidly growing digital entertainment market, projected to reach approximately $2.8 billion by 2024, with further growth anticipated through 2025. This diversification not only spreads risk but also positions Delta Corp to benefit from the online gaming boom.

Delta Corp's commitment to expanding its offline presence, with a planned investment of ₹1,100 crore over the next two years, is a considerable strength. This investment will enhance physical infrastructure, including a new offshore vessel and a 450-room hotel, and a larger floating casino by 2025. These developments highlight a focus on strengthening their physical assets and diversifying revenue beyond online operations.

The integrated resort model, which combines gaming with a comprehensive range of hospitality services, is a core strength. This creates a unique entertainment destination that fosters customer loyalty and generates revenue from multiple sources beyond just gaming. This approach enhances customer lifetime value and provides resilience against market volatility, as seen in the robust performance of hospitality segments in 2024, with ADRs increasing by 8-10% year-over-year in key tourist areas.

Delta Corp's core gaming operations exhibit resilience, with consistent year-on-year growth in gaming revenue. This sustained performance indicates strong customer demand for their casino properties and effective management of their most profitable business segments. For instance, in Q4 FY24, the company reported a consolidated revenue of ₹1,155.6 crore, with gaming and hospitality remaining the primary revenue drivers.

| Key Strength | Description | Supporting Data/Fact |

|---|---|---|

| Market Leadership | Dominant position in India's casino and hospitality sector, especially in Goa. | Strong brand reputation and loyal customer base. |

| Diversification | Expansion into online skill gaming (Adda52.com, Adda52rummy.com). | Indian online gaming market projected to reach ~$2.8 billion by 2024. |

| Offline Expansion | Planned investment of ₹1,100 crore for new vessels and hotel. | New offshore vessel and 450-room hotel planned; larger floating casino by 2025. |

| Integrated Resort Model | Synergy of gaming, hospitality, dining, and entertainment. | Enhances customer lifetime value and provides multiple revenue streams. Hospitality ADRs up 8-10% in 2024. |

| Gaming Operations Resilience | Consistent revenue growth in core gaming segment. | Indicates strong customer demand and effective segment management. |

What is included in the product

Delivers a strategic overview of Delta’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Delta Corp faces a substantial challenge due to the 28% Goods and Services Tax (GST) applied to online gaming and casinos. This tax is calculated on the total value of bets or chips, not just the gross gaming revenue.

This hefty tax burden has directly impacted Delta Corp's financial performance, leading to a noticeable decrease in its net profits. For instance, reports in early 2024 indicated that the company's net profit for the quarter ending December 31, 2023, saw a significant year-on-year decline, largely attributed to this tax structure.

Delta Corp's significant reliance on its casino operations in Goa presents a notable weakness. This geographical concentration, with a substantial portion of its physical casino business rooted in this single state, exposes the company to heightened risks from localized regulatory shifts or political instability. While operations in Sikkim, Daman, and Nepal offer some diversification, the overwhelming dependence on Goa remains a key vulnerability.

The new Goods and Services Tax (GST) regime has significantly impacted Delta Corp's online gaming segment, causing a noticeable slowdown in revenue growth. This regulatory shift has directly influenced the company's strategic decisions, leading to the postponement of planned expansions within this lucrative sector.

Adding to the challenges, Delta Corp is currently grappling with substantial retrospective GST demands. These liabilities create considerable financial uncertainty and strain the company's resources, impacting its ability to invest and grow.

Fluctuations in Profitability

Delta's profitability has shown considerable volatility. For instance, recent financial reports reveal a significant quarter-on-quarter dip in net profit. This decline is partly attributable to the Goods and Services Tax (GST) implementation and the non-recurrence of one-off gains from prior periods.

While the gaming segment demonstrates revenue expansion, the overall profitability picture has been dampened. This inconsistency in earnings can negatively affect investor confidence and valuation multiples.

- Q4 2023 Net Profit Decline: Delta reported a notable decrease in net profit for the fourth quarter of 2023 compared to the previous quarter.

- GST Impact: The introduction and adjustments related to GST have created headwinds for consistent profit margins.

- Absence of One-Time Gains: The comparison base for profitability was elevated by significant one-time gains in earlier periods, making current results appear weaker.

- Investor Sentiment: Fluctuating profitability can lead to increased investor caution, potentially impacting share price performance.

Hospitality Segment Underperformance

Delta Corp's hospitality segment has shown a concerning trend of declining revenues. For the fiscal year ending March 31, 2024, the company reported a consolidated revenue of ₹2,457.47 crore, with the hospitality segment contributing ₹57.76 crore, a notable decrease from previous periods. This underperformance in a crucial diversified business area directly impacts Delta Corp's overall financial health and necessitates a strategic review.

The quarter-on-quarter performance further underscores this weakness. In the fourth quarter of FY24, the hospitality segment's revenue stood at ₹13.16 crore, a significant drop compared to ₹16.36 crore in the preceding quarter. This consistent decline suggests underlying issues within the hospitality operations that require immediate attention to reverse the negative trajectory.

- Revenue Decline: Hospitality segment revenue fell to ₹57.76 crore in FY24, down from previous years.

- Quarterly Drop: Q4 FY24 revenue was ₹13.16 crore, a decrease from Q3 FY24's ₹16.36 crore.

- Impact on Overall Results: This underperformance in a diversified segment weighs down consolidated financial performance.

- Strategic Imperative: There is a clear need for improved operational efficiency or a strategic re-evaluation of the hospitality division.

The 28% GST on online gaming, calculated on bet value, significantly strains Delta Corp's profitability, leading to a sharp decline in net profits as seen in Q4 2023. This tax structure has also hampered revenue growth in the online segment, forcing a postponement of expansion plans. Furthermore, substantial retrospective GST demands create financial uncertainty and divert resources.

Delta Corp's heavy reliance on its Goa casino operations is a key weakness, making it vulnerable to localized regulatory changes. The hospitality segment also exhibits a concerning trend of declining revenues, with FY24 revenue at ₹57.76 crore and a quarter-on-quarter drop in Q4 FY24 to ₹13.16 crore, impacting overall financial health.

| Segment | FY24 Revenue (₹ Crore) | Q4 FY24 Revenue (₹ Crore) | Q3 FY24 Revenue (₹ Crore) | Key Weakness |

|---|---|---|---|---|

| Online Gaming | N/A | N/A | N/A | Impacted by 28% GST on bet value, revenue growth slowdown. |

| Casinos (Goa Dominant) | N/A | N/A | N/A | Geographical concentration risk. |

| Hospitality | 57.76 | 13.16 | 16.36 | Declining revenues, underperformance in diversified segment. |

Full Version Awaits

Delta SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

The Indian gaming market is booming, expected to hit $8.36 billion by 2030, growing at a 15.68% annual rate. This expansion, fueled by better digital infrastructure and cheaper internet, offers Delta Corp a significant opportunity to expand its reach.

Delta Corp can capitalize on evolving gaming regulations by expanding its physical casino presence into new Indian states or union territories. This strategic move could unlock untapped customer bases and revenue streams. For instance, as of early 2024, several states are reviewing their gaming policies, presenting potential new markets for Delta.

Beyond traditional casinos, Delta's development of a water theme park and integrated resorts signifies a significant opportunity to diversify entertainment formats. These ventures can attract a broader demographic and create new revenue streams, moving beyond the core gaming business and potentially boosting overall company performance as seen in similar integrated resort models globally.

India's burgeoning digital landscape presents a substantial opportunity, particularly within the mobile gaming sector, which is projected to reach over 600 million gamers by 2025. This segment already accounts for roughly 80% of the overall gaming market, highlighting a clear consumer preference for accessible, mobile-first entertainment.

This widespread adoption of smartphones and a growing willingness among users to invest in digital experiences directly benefits Delta Corp. The company can capitalize on this trend by further developing and promoting its online skill-based gaming platforms, tapping into a massive and engaged user base.

Leveraging Tourism and Disposable Income Growth

India's economic trajectory, marked by steady growth and increasing urbanization, directly fuels a surge in disposable incomes. This financial uplift translates into a greater appetite for premium leisure and entertainment, particularly high-end gaming and hospitality. Delta Corp is strategically positioned to benefit from this evolving consumer landscape.

The company can leverage this opportunity by enhancing its integrated resorts and casinos to attract both domestic tourists and affluent international visitors. By focusing on luxury amenities and exclusive gaming experiences, Delta Corp can tap into this growing segment of the market.

- Rising Disposable Incomes: India's per capita disposable income is projected to grow, creating a larger consumer base for luxury services.

- Tourism Influx: Increased international and domestic travel, driven by economic progress, offers a significant customer pool for integrated resorts.

- Demand for Premium Experiences: A growing segment of the population seeks sophisticated entertainment and gaming, aligning with Delta Corp's offerings.

Strategic Demerger to Unlock Value

Delta Corp's strategic demerger, separating its gaming operations from hospitality and real estate, is designed to sharpen management focus and unlock shareholder value. This move could streamline operations, allowing each segment to pursue its distinct growth strategies more effectively.

The demerger is anticipated to attract investors with a specific interest in the gaming sector, potentially leading to a higher valuation for the standalone gaming entity. For instance, in the fiscal year ending March 31, 2024, Delta Corp's gaming and hospitality segment reported revenues of approximately INR 820 crore, highlighting its significant contribution.

- Enhanced Operational Focus: Allows dedicated management attention to gaming and hospitality/real estate separately.

- Value Unlocking: Potential for higher market valuation by isolating high-growth gaming assets.

- Investor Appeal: Attracts specialized investors keen on the gaming industry's growth prospects.

- Financial Clarity: Improved transparency in financial reporting for each distinct business.

The Indian gaming market's rapid expansion, projected to reach $8.36 billion by 2030, presents a significant opportunity for Delta Corp to broaden its market presence. Furthermore, the evolving regulatory landscape in India, with several states reviewing gaming policies as of early 2024, opens avenues for Delta Corp to establish or expand its physical casino operations in new territories, tapping into previously unreached customer segments.

Delta Corp's diversification into integrated resorts and water theme parks offers a chance to attract a wider audience beyond traditional casino patrons. The burgeoning digital economy in India, with over 600 million projected mobile gamers by 2025, provides a substantial platform for Delta Corp to enhance its online skill-based gaming offerings, leveraging the strong preference for mobile-first entertainment.

India's economic growth and increasing urbanization are leading to higher disposable incomes, fueling demand for premium leisure and entertainment experiences, which Delta Corp is well-positioned to meet. The company's strategic demerger of its gaming operations is expected to unlock shareholder value and attract specialized investors focused on the high-growth gaming sector, potentially leading to a higher valuation for its gaming assets.

| Opportunity Area | Key Driver | Delta Corp's Advantage | 2024/2025 Data Point |

|---|---|---|---|

| Market Expansion | Booming Indian Gaming Market | Leverage growth in digital infrastructure and internet penetration | Market projected to reach $8.36 billion by 2030 (15.68% CAGR) |

| Regulatory Evolution | Favorable Policy Changes | Expand physical casino presence into new states | Several states reviewing gaming policies in early 2024 |

| Diversification | Integrated Resorts & Theme Parks | Attract broader demographics and new revenue streams | Global integrated resort models show strong revenue potential |

| Digital Engagement | Growth of Mobile Gaming | Enhance online skill-based gaming platforms | Over 600 million mobile gamers projected by 2025 |

| Economic Growth | Rising Disposable Incomes | Cater to demand for premium leisure and gaming | Growing per capita disposable income in India |

| Strategic Demerger | Operational Focus & Value Unlocking | Attract specialized gaming investors | Gaming & Hospitality segment revenue of INR 820 crore in FY24 |

Threats

The most significant threat stems from the volatile regulatory environment, especially the 28% Goods and Services Tax (GST) applied to the full face value of bets. This tax significantly inflates gaming costs for both players and operators.

Ongoing legal battles concerning retrospective GST demands introduce substantial uncertainty and financial risk for Delta Corp. For instance, in late 2023, tax authorities issued demands totaling over ₹6,000 crore (approximately $720 million USD) to the company, highlighting the magnitude of this threat.

Delta Corp faces a significant threat from intensified competition within the Indian online gaming sector. While it holds a strong position in online poker and rummy, the overall market is crowded with both established domestic companies and aggressive international entrants. For instance, the Indian online gaming market was projected to reach $3.76 billion by 2025, indicating substantial growth and attracting new players.

The aggressive marketing and product development strategies employed by these competitors pose a direct risk to Delta Corp's market share. New companies entering the space, often backed by substantial funding, can quickly gain traction, while existing rivals are continuously innovating to capture a larger audience. This dynamic environment necessitates constant adaptation and investment from Delta Corp to maintain its leadership.

While the Indian government has offered some support to the gaming sector, there's persistent public criticism and political pressure to tighten regulations or even relocate casinos, particularly those operating offshore in Goa. This sentiment is fueled by concerns over gambling addiction.

Negative public perception could translate into more stringent government policies, potentially impacting operations. For instance, in 2023, Goa saw discussions around increasing casino fees and relocating them offshore, reflecting this ongoing scrutiny.

Economic Downturn Affecting Discretionary Spending

An economic downturn in India presents a significant threat to Delta Corp. A slowdown typically curbs consumer discretionary spending, directly impacting leisure and entertainment, including casino visits and online gaming. This could lead to reduced footfalls and lower revenue streams for the company.

For instance, during periods of economic uncertainty, consumers often cut back on non-essential expenses. This trend was evident in the broader Indian consumer market in late 2023 and early 2024, where inflation and global economic headwinds influenced spending patterns. Such conditions directly translate to a threat for Delta Corp's revenue stability.

- Reduced Disposable Income: Economic slowdowns often lead to job losses or stagnant wage growth, decreasing the amount of money consumers have available for leisure activities.

- Lower Consumer Confidence: A weak economy erodes consumer confidence, making individuals more cautious about spending on non-essential services like gambling and entertainment.

- Impact on Gaming Revenue: Delta Corp's primary revenue drivers, casino operations and online gaming, are highly sensitive to discretionary spending. A contraction in this area directly threatens their top line.

- Increased Price Sensitivity: During economic downturns, consumers become more price-sensitive, potentially opting for cheaper entertainment alternatives or reducing overall spending.

Challenges in Relocating Offshore Casinos

The Goan government's repeated extensions for offshore casinos to vacate the Mandovi River, with the most recent deadline pushed to March 2027, presents a persistent threat. This ongoing uncertainty complicates long-term planning and investment in new infrastructure.

The logistical hurdles and substantial costs associated with relocating and establishing new operational bases are significant financial threats. Finding suitable, accessible, and regulatory-compliant alternative locations remains a major challenge for these businesses.

The protracted nature of this relocation process can deter potential investors and partners, impacting the financial stability and future growth prospects of offshore casino operators. This also affects the broader tourism and hospitality sector reliant on these establishments.

- March 2027: Latest deadline for offshore casinos to move out of the Mandovi River.

- Extended Deadlines: Indicate ongoing regulatory uncertainty and operational disruption.

- Logistical Costs: Significant financial burden associated with finding and establishing new sites.

- Investor Confidence: Prolonged uncertainty can negatively impact investment and financial partnerships.

The primary threat to Delta Corp is the evolving regulatory landscape, particularly the 28% Goods and Services Tax (GST) on the full face value of bets, significantly increasing operational costs. This is compounded by substantial legal risks from retrospective GST demands, with over ₹6,000 crore (approximately $720 million USD) in demands issued in late 2023, creating considerable financial uncertainty.

Intensified competition in the Indian online gaming market, projected to reach $3.76 billion by 2025, poses a threat to market share. Aggressive marketing and innovation by domestic and international players demand continuous investment from Delta Corp to maintain its leadership position.

Negative public perception and political pressure to tighten regulations, fueled by concerns over gambling addiction, could lead to more stringent government policies, impacting operations. For example, in 2023, Goa considered increasing casino fees and relocating offshore casinos.

An economic downturn poses a risk due to reduced consumer discretionary spending, directly affecting revenue from casinos and online gaming. This heightened price sensitivity during economic uncertainty can impact Delta Corp's revenue stability.

| Threat Area | Specific Concern | Financial Implication | Example/Data Point |

|---|---|---|---|

| Regulatory Uncertainty | 28% GST on full face value of bets | Increased operational costs, reduced profit margins | GST demands of over ₹6,000 crore (approx. $720 million USD) issued in late 2023 |

| Competition | Growing online gaming market | Loss of market share, pressure on pricing | Indian online gaming market projected to reach $3.76 billion by 2025 |

| Public Perception | Concerns over gambling addiction | Potential for stricter regulations, operational limitations | Goa's discussions in 2023 on relocating offshore casinos |

| Economic Downturn | Reduced discretionary spending | Lower footfalls, decreased gaming revenue | General trend of reduced non-essential spending during economic headwinds in late 2023/early 2024 |

SWOT Analysis Data Sources

This analysis draws upon a robust blend of internal financial reports, comprehensive market intelligence, and validated customer feedback to provide a well-rounded perspective.