Delta Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Bundle

Understanding the competitive landscape for Delta Air Lines through Porter's Five Forces reveals the intense rivalry among existing airlines and the significant threat posed by substitutes like high-speed rail. Buyer power is also a critical factor, as customers have numerous choices and are often price-sensitive.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Delta’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Delta Corp's reliance on specialized manufacturers for high-tech casino gaming equipment, like slot machines and table game components, highlights the significant bargaining power of these suppliers. The unique nature of these products and the limited pool of globally recognized, reputable providers means these suppliers can dictate terms, particularly when offering cutting-edge technology.

The substantial switching costs associated with integrating new proprietary systems and the inherent complexities of these specialized setups further amplify supplier leverage. For instance, in 2024, the global gaming equipment market saw continued consolidation, with a few key players dominating the supply of advanced electronic gaming machines, reinforcing their pricing power.

Delta Corp's reliance on IT infrastructure, software, and cybersecurity providers for its online skill gaming platforms means these vendors hold significant bargaining power. Suppliers offering specialized, scalable, and secure real-money gaming platforms can often dictate higher prices, especially when their solutions are complex or hard to substitute.

In 2024, the global IT infrastructure market was valued at approximately $472.4 billion, with cloud services, a key component for gaming platforms, experiencing robust growth. This demand for advanced, reliable infrastructure strengthens the position of major IT vendors.

Landlords of prime real estate, especially for integrated resorts in Goa where Delta Corp has a substantial footprint, wield significant bargaining power. The limited availability of suitable, licensed locations for casinos, particularly offshore, restricts Delta Corp's options, potentially driving up lease costs and dictating less favorable contract terms.

Human Capital for Niche Roles

Delta Corp's reliance on highly skilled personnel for its niche operations, such as experienced casino dealers and specialized IT professionals for online gaming, significantly influences supplier bargaining power. A scarcity of talent in these areas, especially for roles in gaming floor management and the development of sophisticated online gaming platforms, can elevate the leverage of these human capital suppliers. This dynamic is particularly relevant as the gaming industry continues its digital transformation, increasing demand for specialized tech expertise.

The limited availability of such specialized talent means that these professionals can command higher salaries and more attractive benefit packages. For instance, in 2024, the demand for cybersecurity experts in the online gaming sector saw salary increases of up to 15% in some regions due to the critical need for data protection. This directly impacts Delta Corp's operational costs, potentially squeezing profit margins and affecting the overall quality of service delivery if not managed effectively.

- High Demand for Specialized Gaming Talent: The need for experienced casino dealers and skilled gaming floor managers remains consistent, while the rapid growth of online gaming creates a surge in demand for IT professionals with expertise in areas like blockchain, AI, and cybersecurity.

- Limited Supply of Niche Skills: The pool of individuals possessing the specific combination of gaming industry experience and advanced technical skills required for modern online platforms is relatively small, intensifying competition among employers.

- Impact on Operational Costs: Increased bargaining power for these skilled employees translates to higher labor costs, affecting Delta Corp's profitability and its ability to allocate resources to other strategic areas.

- Potential for Service Quality Fluctuations: A shortage of qualified personnel can lead to challenges in maintaining consistent service quality, particularly in fast-paced casino environments or during peak online gaming periods.

Luxury Goods and Hospitality Service Providers

For an integrated resort and hospitality operator like Delta Corp, the bargaining power of suppliers in the luxury goods and hospitality service sector can be a significant factor. Delta Corp sources a variety of high-end products, premium food and beverage items, and specialized services to meet the expectations of its affluent customer base.

While some of these supplies might be readily available, suppliers offering exclusive or exceptionally high-quality luxury goods, unique culinary ingredients, or bespoke hospitality services can command moderate bargaining power. This is particularly true for suppliers whose products are critical for maintaining the premium brand image and guest experience that Delta Corp aims to deliver. For instance, in 2024, the global luxury goods market continued its robust growth, with reports indicating a 7% increase in sales, highlighting the value placed on unique and high-quality offerings.

The ability of Delta Corp to maintain its stringent quality standards is directly linked to the reliability and quality of its suppliers. This dependence can shift some leverage towards suppliers who consistently meet these demanding requirements. For example, a specialized wine distributor or a designer furniture provider catering to luxury hotels might have more sway than a bulk supplier of standard amenities.

- Supplier Specialization: Suppliers of unique luxury goods or specialized hospitality services often have higher bargaining power due to their niche offerings.

- Quality Dependence: Delta Corp's reliance on premium suppliers to uphold its brand image and guest experience can empower these suppliers.

- Market Trends: The continued growth in the luxury market, with global sales increasing by 7% in 2024, underscores the value of exclusive products and services, potentially strengthening supplier positions.

Suppliers of specialized gaming technology and IT infrastructure hold considerable sway due to the unique nature of their products and high switching costs. This is amplified by market consolidation, as seen in the 2024 gaming equipment sector, where a few key players dominate advanced electronic machine supply.

Prime real estate locations for integrated resorts also grant landlords significant bargaining power, particularly in areas with limited availability. Furthermore, the scarcity of highly skilled talent, such as experienced casino dealers and specialized IT professionals for online gaming, allows these human capital suppliers to command higher compensation, with cybersecurity experts in online gaming seeing up to a 15% salary increase in 2024.

| Supplier Category | Factors Influencing Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Specialized Gaming Equipment Manufacturers | Unique technology, limited providers, high switching costs | Market consolidation, pricing power of dominant players |

| IT Infrastructure & Software Providers | Specialized, scalable, secure platforms | Global IT infrastructure market valued at ~$472.4 billion; robust cloud services growth |

| Prime Real Estate Locations | Limited availability, licensing restrictions | High demand for suitable, licensed casino locations |

| Highly Skilled Personnel (e.g., IT, Dealers) | Scarcity of niche skills, digital transformation demand | Up to 15% salary increase for cybersecurity experts in online gaming |

| Luxury Goods & Hospitality Services | Exclusive/high-quality offerings, brand image dependence | Global luxury goods market sales increased by 7% |

What is included in the product

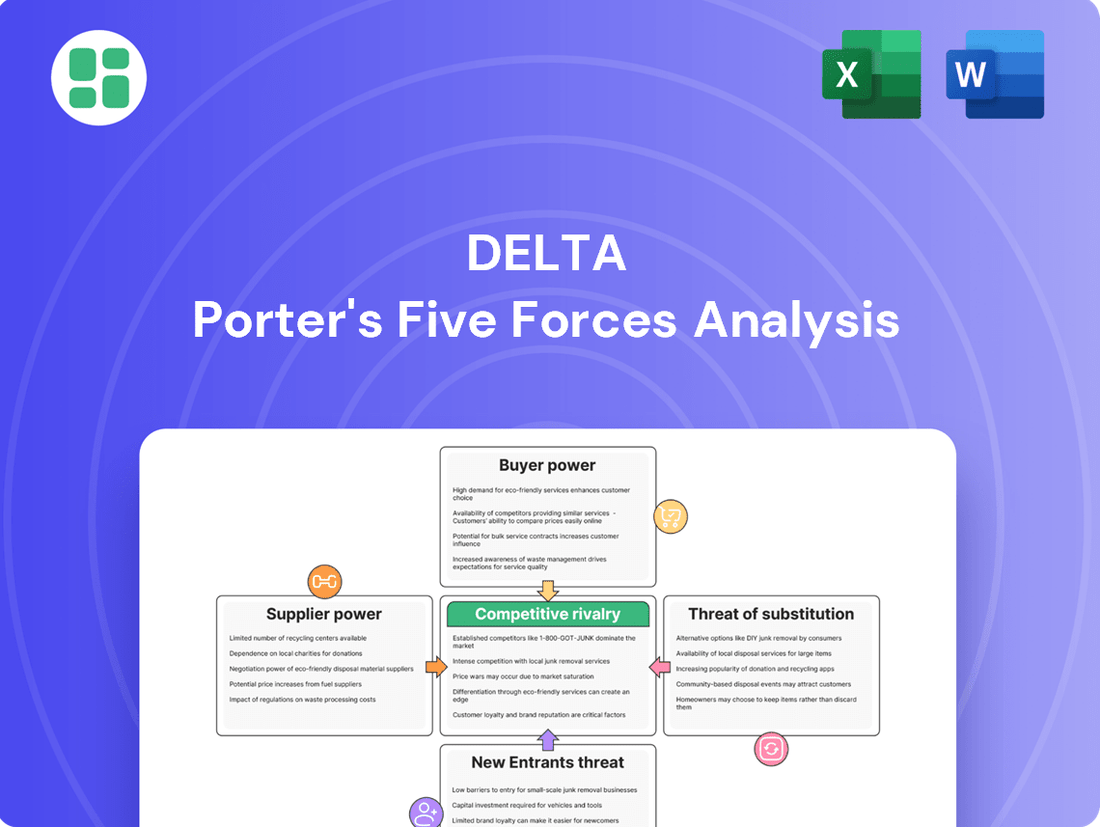

Analyzes the five competitive forces—rivalry, new entrants, substitutes, buyer power, and supplier power—to assess Delta's industry attractiveness and strategic position.

Effortlessly identify and address competitive pressures by visualizing the intensity of each of Porter's Five Forces with a dynamic, interactive dashboard.

Customers Bargaining Power

Customers in the online skill gaming sector, particularly those playing poker and rummy, exhibit significant price sensitivity. This is largely driven by the abundance of alternative platforms readily accessible to them. The imposition of a 28% Goods and Services Tax (GST) on deposits has further intensified this, as it directly increases the cost for players, pushing some towards unregulated or offshore options.

The 28% GST on deposits has demonstrably impacted player economics, making them more attuned to platform fees and how winnings are distributed. This tax burden acts as a direct cost increase, amplifying the bargaining power of these gamers.

Furthermore, the low friction involved in migrating between different online gaming applications significantly bolsters the bargaining power of customers. If one platform becomes less attractive due to pricing or fees, players can easily switch to a competitor, forcing platforms to remain competitive.

Customers today have an incredibly diverse range of entertainment choices, extending far beyond casinos and online gaming. Think about everything from streaming services and video games to live events, dining out, and even simple outdoor activities. This vast landscape of substitutes means that if Delta Corp's offerings aren't hitting the mark on value or appeal, customers can readily shift their spending elsewhere without much hassle.

The ease with which customers can switch between these various entertainment options significantly amplifies their bargaining power. For instance, the global digital entertainment market was valued at over $3.5 trillion in 2024, showcasing the sheer volume of competing options available. This accessibility to alternatives empowers consumers to demand better pricing, superior experiences, or more compelling features from any single provider like Delta Corp.

For online gaming platforms, the bargaining power of customers is significantly amplified by low switching costs. Users can typically transition between different gaming sites or download new applications with minimal effort or expense. This ease of movement allows players to readily compare offerings, such as game variety, user experience, and promotional deals.

This dynamic forces companies like Delta Corp to constantly adapt. For instance, in 2024, the online gaming market saw increased competition with new entrants offering attractive sign-up bonuses and loyalty programs. Delta Corp, to maintain its market share, would need to invest in customer retention strategies, potentially through enhanced loyalty rewards or exclusive in-game content, to counteract the ease with which customers can explore alternatives.

Loyalty Programs and Customer Retention in Casinos

While casino patrons, particularly high-rollers, demonstrate some brand loyalty through personalized services and loyalty programs, their bargaining power remains substantial due to the significant capital they invest. Delta Corp works to counter this by providing unique experiences and rewards, but customers can easily shift to competing gaming venues if the offerings aren't sufficiently attractive or competitive.

This dynamic underscores the critical need for ongoing investment in enhancing the customer experience to maintain a competitive edge. For instance, in 2023, the Indian gaming industry, which includes casinos, saw significant growth, with reports indicating a substantial increase in revenue, suggesting that customer spending power is a key driver.

- Customer Loyalty: Delta Corp's loyalty programs are designed to foster repeat business by offering tiered benefits and exclusive access.

- Price Sensitivity: Despite loyalty efforts, high-value customers can switch if competitors offer demonstrably better value or more appealing incentives.

- Competitive Landscape: The presence of multiple gaming operators means customers have choices, directly impacting the bargaining power they wield.

- Investment in Experience: Continuous enhancement of gaming floors, dining, and entertainment is crucial to retain customers and mitigate their bargaining power.

Impact of Regulatory Changes on Customer Behavior

Recent regulatory shifts, like the 28% Goods and Services Tax (GST) on deposits in the online gaming sector, significantly alter customer decision-making. This tax directly impacts the cost of engaging with regulated platforms, making them less appealing when compared to unregulated offshore alternatives.

This governmental intervention effectively amplifies customer bargaining power. Consumers become more sensitive to pricing and terms, actively seeking out platforms that offer a lower effective cost or more favorable conditions. For instance, in India, the implementation of this GST has led to discussions about potential shifts in user base towards platforms not subject to such direct taxation.

- Increased Price Sensitivity: Customers are more likely to compare prices and seek value, especially when new taxes are introduced.

- Shift to Unregulated Markets: Regulatory costs can push consumers towards offshore or less regulated options if they offer a better deal.

- Demand for Transparency: Customers expect clarity on how taxes and fees affect their overall spending.

Customers possess considerable bargaining power in the gaming sector due to numerous alternatives and low switching costs. The 28% GST on online gaming deposits, implemented in 2023, directly increased player costs, amplifying their sensitivity to pricing and driving some towards unregulated platforms. This regulatory impact, coupled with the vast array of entertainment choices available globally, compels companies like Delta Corp to focus on superior customer experiences and value propositions to retain their clientele.

| Factor | Impact on Bargaining Power | Example/Data (2024) |

|---|---|---|

| Availability of Substitutes | High | Global digital entertainment market valued over $3.5 trillion in 2024, offering numerous alternatives to gaming. |

| Switching Costs | Low | Online gamers can easily switch between platforms with minimal effort or expense. |

| Price Sensitivity (Post-GST) | Increased | The 28% GST on deposits directly raises costs for players, making them more price-conscious. |

| Customer Loyalty (Casino) | Moderate | High-rollers may show loyalty due to personalized services, but can switch for better value. |

Full Version Awaits

Delta Porter's Five Forces Analysis

This preview shows the exact Delta Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive document meticulously breaks down the competitive landscape of Delta Air Lines, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products or services. You'll gain actionable insights into the strategic positioning and potential challenges facing Delta.

Rivalry Among Competitors

The Indian online gaming arena, encompassing skill-based games such as poker and rummy, is teeming with a substantial number of both local and global competitors. Delta Corp's expansion into this sector means it contends with a multitude of platforms vying for the growing number of online gamers.

This market fragmentation, coupled with the projected 488 million online gamers in India by 2024, underscores the intense competitive landscape Delta Corp operates within.

Delta Corp holds a commanding position as India's foremost operator in both land-based and offshore casinos, with a notable presence in Goa. This leadership, however, exists within a landscape where competition, while constrained by licensing regulations, is still quite intense among the handful of authorized players.

The rivalry in this organized casino segment often centers on attracting premium clientele. Strategies include enhancing the overall hospitality experience, offering exclusive amenities, and securing strategically advantageous locations to draw in high-spending patrons.

The casino and integrated resort sector is characterized by immense fixed costs, encompassing everything from sprawling infrastructure and essential gaming licenses to ongoing operational expenses. For instance, the development of a new Las Vegas Strip resort can easily cost billions of dollars, with Caesars Entertainment alone investing over $3.5 billion in its Horseshoe Las Vegas redevelopment project, as of early 2024. These substantial upfront investments create a significant financial commitment.

These high fixed costs, combined with stringent regulatory requirements and the highly specialized nature of casino assets, erect formidable exit barriers. It’s not as simple as selling off inventory; these are large, complex, and often regulated businesses. This lack of easy exit means that companies are compelled to stay in the market, even during downturns, in an effort to recoup their investments and cover their substantial overheads.

Consequently, this environment fosters intense competitive rivalry. With players locked into the market, the drive to maintain profitability and market share becomes paramount. Competitors continuously vie for customer attention and spending, leading to aggressive marketing, loyalty programs, and investment in new attractions to ensure they remain relevant and financially viable against their entrenched rivals.

Regulatory Landscape and its Impact on Competition

India's regulatory environment for online gaming is a significant factor influencing competition. The country's fragmented gambling laws, which differ from state to state, create a complex operational landscape. This patchwork of regulations makes it challenging for businesses to operate consistently across the nation.

The introduction of a 28% Goods and Services Tax (GST) on online gaming deposits in October 2023 has further reshaped the competitive arena. While intended to standardize taxation, this levy has presented hurdles for legally operating entities. For instance, some platforms have had to adjust their business models or pricing strategies in response to this new tax burden.

- Fragmented State Laws: Varying gambling regulations across Indian states create operational complexities for online gaming companies.

- 28% GST on Deposits: The recent GST imposition impacts revenue models and pricing for regulated online gaming platforms.

- Impact on Regulated Players: The GST has led to challenges for compliant businesses, potentially affecting their market share.

- Unregulated Competition: The tax and regulatory changes may inadvertently benefit offshore, unregulated operators who do not adhere to Indian laws.

Growth Potential of the Indian Gaming Market

The Indian gaming market is a hotbed of activity, with projections indicating it will reach a substantial USD 15.2 billion by 2033, growing at a compound annual growth rate of 15.2% from 2025. This rapid expansion fuels intense competition as numerous companies enter the fray, all aiming to capture a piece of this lucrative and expanding sector.

Specifically, the online gambling segment is also set for considerable growth, expected to hit USD 5.7 billion by 2033, with a CAGR of 7.78%. This robust growth trajectory not only attracts new entrants but also intensifies the rivalry among existing players, leading to a more competitive landscape.

- Projected Market Size: Indian gaming market to reach USD 15.2 billion by 2033.

- Growth Rate: Anticipated CAGR of 15.2% from 2025.

- Online Gambling Segment: Expected to reach USD 5.7 billion by 2033, with a 7.78% CAGR.

- Competitive Impact: High growth potential attracts more players, intensifying rivalry.

Competitive rivalry in the Indian gaming sector is fierce, driven by a fragmented market and aggressive growth projections. The online gaming segment, expected to reach USD 5.7 billion by 2033 with a 7.78% CAGR, sees numerous players vying for market share. Similarly, the overall Indian gaming market is projected to hit USD 15.2 billion by 2033, fueling intense competition.

The imposition of a 28% GST on online gaming deposits in October 2023 has added another layer of complexity, impacting revenue models and potentially benefiting unregulated operators. This regulatory environment, coupled with varying state laws, creates a challenging landscape for legally operating entities.

In the casino segment, where Delta Corp is a leader, rivalry focuses on premium clientele through enhanced hospitality and strategic locations. Despite licensing constraints, the handful of authorized players engage in intense competition, particularly given the high fixed costs and exit barriers inherent in the casino industry.

| Market Segment | Projected Value (2033) | CAGR (approx.) | Key Competitive Factor |

|---|---|---|---|

| Indian Gaming Market | USD 15.2 billion | 15.2% (from 2025) | Market share acquisition, innovation |

| Online Gambling Segment | USD 5.7 billion | 7.78% | Customer acquisition, pricing, regulatory compliance |

| Land-based/Offshore Casinos | N/A (specific data not provided) | N/A | Premium customer experience, location, loyalty programs |

SSubstitutes Threaten

Consumers have a vast array of choices for their leisure time and spending money. Beyond casinos, people can enjoy movies, attend concerts, dine out, travel, or engage with various digital entertainment options. For instance, the global online gaming market was projected to reach over $100 billion in 2024, showcasing the significant competition for entertainment dollars.

These numerous substitutes directly impact Delta Corp's potential customer base. If other activities offer a better perceived value or a more favorable cost-benefit ratio, consumers might opt for them instead of Delta's casino or online gaming services. This constant availability of alternatives puts pressure on Delta to continually enhance its offerings and value proposition.

A significant threat to Delta Corp stems from illegal gambling operations and offshore online betting platforms. These entities often bypass the regulatory oversight and taxation faced by legitimate Indian companies, creating an uneven playing field.

The recent imposition of a 28% Goods and Services Tax (GST) on deposits for regulated online gaming platforms in India has reportedly pushed some consumers towards these unregulated alternatives. This shift directly impacts Delta Corp's online gaming segment, as users seek to avoid the increased tax burden.

While precise figures for the scale of illegal and offshore platform usage are difficult to quantify, industry reports from 2024 suggest a growing trend of users migrating to such services due to tax implications. This presents a substantial substitute threat, eroding the customer base and revenue potential for compliant operators like Delta Corp.

The burgeoning popularity of non-real money online games and esports presents a significant threat of substitutes for Delta Corp. These platforms, often free-to-play or subscription-based, are capturing substantial user engagement, particularly within the Indian market. For instance, the Indian mobile gaming sector saw a significant surge, with reports indicating millions of daily active users across various casual and competitive titles in 2024.

While Delta Corp's core business revolves around real-money gaming, the increasing time and disposable income allocated to these alternative entertainment options represent a diversion of consumer attention. This shift can indirectly impact the demand for Delta Corp's offerings, as consumers may opt for the accessibility and lower perceived risk of non-wagering games, thereby reducing the pool of potential customers for real-money platforms.

Traditional Forms of Legal Gambling

Traditional forms of legal gambling, such as state-run lotteries and horse race betting, can act as substitutes for casino gaming and online skill games. These established options provide alternative entertainment and betting avenues, potentially drawing away customers who might otherwise patronize Delta Corp's businesses.

For instance, in 2023, U.S. state lotteries generated over $100 billion in sales, indicating a significant market for alternative gambling. Horse racing, while a smaller market, also represents a traditional substitute, with pari-mutuel handle in the U.S. reaching billions annually.

- Lottery Sales: U.S. state lotteries reported over $100 billion in sales in 2023, representing a substantial alternative to other forms of gambling.

- Horse Race Betting: The U.S. horse racing industry sees billions in annual handle, providing a long-standing substitute for casino and online gaming.

- Customer Diversion: These traditional forms can attract different demographics or those seeking more accessible or varied gambling experiences, potentially impacting Delta Corp's customer base.

Changing Consumer Preferences and Digital Adoption

The growing preference for digital entertainment, amplified by India's increasing smartphone usage and affordable internet, presents a significant threat of substitutes for Delta Corp. By the end of 2023, smartphone penetration in India had reached approximately 70%, with over 700 million internet users, a number projected to grow substantially in 2024. This digital shift means consumers have readily accessible alternatives for entertainment.

Consumers can easily pivot to a wide array of online gaming and entertainment platforms, both domestic and international. For instance, the online gaming sector in India was valued at around $2.2 billion in 2023 and is expected to reach $5 billion by 2025, indicating a highly competitive and dynamic market. If Delta Corp's digital offerings fail to captivate or compete effectively on user experience and value, customers can swiftly migrate to substitutes.

- Digital Shift: Over 700 million internet users in India by end-2023, with smartphone penetration around 70%.

- Market Growth: India's online gaming market valued at $2.2 billion in 2023, projected to hit $5 billion by 2025.

- Consumer Agility: Easy access to international and domestic online entertainment platforms allows for quick switching.

The threat of substitutes for Delta Corp is significant, as consumers have numerous alternative ways to spend their leisure time and money. Beyond traditional gambling, options like movies, concerts, travel, and digital entertainment compete for consumer attention. For example, the global online gaming market was projected to exceed $100 billion in 2024, highlighting the intense competition for entertainment spending.

These substitutes directly affect Delta's customer base. If other activities offer better perceived value or a more favorable cost-benefit ratio, consumers may choose them over Delta's offerings. This necessitates Delta's continuous improvement of its services and value proposition to remain competitive.

The rise of unregulated online betting platforms and illegal gambling operations poses a substantial substitute threat. These entities often avoid the regulatory and tax burdens faced by compliant businesses like Delta Corp, creating an uneven playing field. The 28% Goods and Services Tax (GST) on online gaming deposits in India has reportedly encouraged some users to shift to these unregulated alternatives, impacting Delta's online gaming segment.

Furthermore, the growing popularity of non-real money online games and esports is diverting consumer engagement. While Delta focuses on real-money gaming, the time and money spent on these alternative platforms, which saw millions of daily active users in India in 2024, can indirectly reduce demand for Delta's services. Traditional legal gambling, such as state lotteries and horse racing, also acts as a substitute, with U.S. state lotteries alone generating over $100 billion in sales in 2023.

| Substitute Category | Example | Market Data (2023-2024) | Impact on Delta Corp |

| Digital Entertainment | Online Gaming (Global) | Projected >$100 billion in 2024 | Diversion of consumer attention and spending from real-money gaming. |

| Unregulated Betting | Offshore Online Platforms | Growing trend due to tax implications (2024 reports) | Erosion of customer base and revenue for compliant operators. |

| Casual Gaming/Esports | Mobile Gaming (India) | Millions of daily active users (2024) | Captures user engagement, potentially reducing interest in real-money alternatives. |

| Traditional Gambling | State Lotteries (U.S.) | >$100 billion in sales (2023) | Offers alternative betting avenues, potentially drawing customers. |

Entrants Threaten

The threat of new entrants into India's casino market is significantly dampened by formidable regulatory and licensing hurdles. Gambling is primarily governed by state-level laws, with most Indian states imposing strict prohibitions. For instance, only a select few states, such as Goa and Sikkim, permit casino operations, and even there, the licensing process is notoriously complex, lengthy, and demands substantial capital investment. This intricate web of regulations effectively acts as a powerful deterrent, severely restricting the influx of new players into Delta Corp's established casino segment.

Developing and operating integrated resorts and large-scale casino facilities requires immense upfront capital. For instance, the cost of constructing a new integrated resort can easily run into billions of dollars, encompassing land acquisition, building, gaming equipment, and initial operational setup. This substantial financial hurdle significantly deters potential new competitors from entering the market.

Delta Corp, operating under its Deltin brand, has cultivated a significant and loyal customer base within India's casino and hospitality sector. This established market presence acts as a formidable barrier to new entrants.

Aspiring competitors would face considerable hurdles in replicating Delta Corp's brand recognition and the trust it has earned. Significant capital outlay for marketing and a prolonged period would be necessary to even approach the loyalty enjoyed by the incumbent.

For instance, in the fiscal year 2023-24, Delta Corp reported revenue from its casinos and hospitality operations, underscoring its substantial market footprint. This financial strength allows for continued investment in brand building and customer retention, further solidifying its position against potential newcomers.

Evolving Regulatory Environment for Online Gaming

The evolving regulatory landscape in India presents a significant threat to new entrants in the online gaming sector. While capital requirements might be lower than traditional casinos, the complexities of navigating varying state-level laws and the recent introduction of a 28% Goods and Services Tax (GST) on online gaming deposits, effective from October 1, 2023, create substantial hurdles. This tax, applied on the full value of deposits rather than gross gaming revenue, significantly impacts profitability and operational models.

New players must contend with this dynamic environment, which includes ongoing discussions about a unified national framework and potential 'whitelist mechanisms' for gaming operators. Such uncertainties can deter investment and slow down market entry, as companies need to factor in compliance costs and potential shifts in policy. For instance, the implementation of the GST has already led some operators to reconsider their market presence or business strategies.

- GST Impact: The 28% GST on deposits, implemented in October 2023, directly increases the cost of playing for users and reduces the net revenue for operators, posing a challenge for new, less capitalized entrants.

- Regulatory Fragmentation: India's online gaming sector is governed by a patchwork of state-specific laws, requiring new entrants to invest heavily in legal expertise and compliance for each target market.

- Policy Uncertainty: Ongoing debates about a national regulatory framework and potential licensing requirements create an unpredictable environment, making long-term strategic planning difficult for new businesses.

Access to Specialized Expertise and Distribution Channels

Operating a successful casino and online gaming business demands highly specialized expertise across gaming operations, cutting-edge technology, targeted marketing, and stringent regulatory compliance. Newcomers must either acquire this deep knowledge or build it from scratch, a process that often proves to be a substantial barrier to entry.

Securing effective distribution channels for online gaming platforms, which involves navigating complex app store policies and evolving advertising regulations, adds another significant hurdle for potential entrants. For instance, in 2024, major app stores continued to update their guidelines for gaming and gambling applications, requiring ongoing adaptation and investment in compliance.

- Specialized Expertise: Gaming operations, technology, marketing, and regulatory compliance are critical and difficult to replicate.

- Distribution Channels: Accessing and maintaining effective channels, including app stores and advertising networks, is a significant challenge.

- Regulatory Landscape: Navigating diverse and evolving gaming regulations in different jurisdictions requires substantial legal and operational investment.

The threat of new entrants into India's casino and online gaming markets is considerably low due to a confluence of high capital requirements, stringent regulatory frameworks, and established brand loyalty. These factors create substantial barriers that make market entry exceptionally challenging for new players.

The Indian government's approach to gaming, particularly the imposition of a 28% GST on online gaming deposits effective October 2023, significantly increases operational costs, thereby deterring new, less capitalized entrants. Furthermore, the fragmented nature of state-level regulations necessitates considerable investment in legal and compliance expertise, adding another layer of difficulty.

Delta Corp's established market presence and brand recognition, built over years of operation, represent a significant competitive advantage. This incumbency, coupled with the substantial capital needed for new integrated resort development, effectively shields the market from widespread new competition.

| Factor | Impact on New Entrants | Example/Data Point |

|---|---|---|

| Regulatory Hurdles | High deterrent due to complex licensing and state-specific laws. | Only a few states like Goa and Sikkim permit casino operations. |

| Capital Investment | Extremely high for integrated resorts, running into billions of dollars. | Construction costs for new resorts are a major barrier. |

| Brand Loyalty & Market Presence | Difficult for new entrants to replicate Delta Corp's established customer base. | Delta Corp's strong brand recognition requires significant marketing investment to challenge. |

| Online Gaming GST | 28% GST on deposits increases costs and reduces operator profitability. | Effective October 1, 2023, this tax impacts business models. |

| Specialized Expertise | Requires deep knowledge in gaming operations, tech, marketing, and compliance. | New entrants must build or acquire this expertise, a time-consuming process. |

Porter's Five Forces Analysis Data Sources

Our Delta Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and expert commentary from financial analysts.

We leverage a combination of primary data from direct industry engagement and secondary data from reputable sources like government economic indicators and trade association publications to accurately assess competitive pressures.