Delta Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Bundle

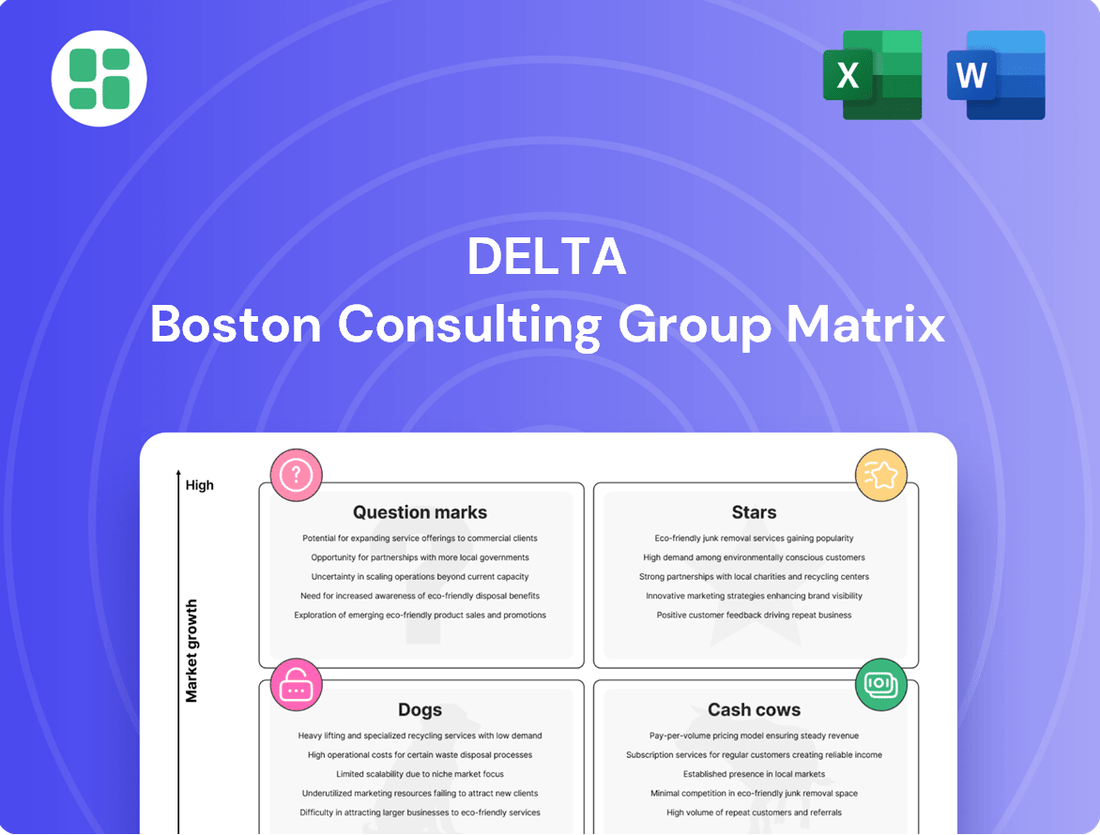

The Delta BCG Matrix offers a crucial snapshot of a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. Understanding these placements is vital for informed strategic decisions. Purchase the full BCG Matrix to unlock a comprehensive analysis, detailed quadrant breakdowns, and actionable insights that will guide your investment and product development strategies.

Stars

Delta Corp's premium offshore casino segments, exemplified by VIP tables and exclusive gaming zones on vessels like Deltin Royale, are a significant high-growth area. These offerings target India's expanding affluent demographic, which drives higher profit margins.

Delta Corp's strategic expansion into new Indian states, aiming for additional casino licenses, positions it as a potential market leader in a rapidly growing sector. This move is crucial as the Indian gaming market is expected to see substantial growth, with projections indicating a CAGR of over 20% in the coming years. Early entry into these nascent markets could secure a significant competitive advantage.

Developing integrated resort components beyond core gaming, such as luxury hotels, entertainment venues, and convention spaces, is crucial for capturing the burgeoning tourism and Meetings, Incentives, Conferences, and Exhibitions (MICE) markets. These additions are designed to attract a wider customer base and increase overall spend per visitor. For example, in 2024, the global MICE market was projected to reach over $1.1 trillion, highlighting the significant revenue potential.

These diversified offerings aim to secure a larger slice of the leisure and business travel expenditure, establishing new and robust revenue streams within the expanding hospitality sector. Projects like the Dhargalim resort are strategically positioned to achieve high growth and establish market dominance in their specific niches.

Innovation in Live Gaming Experiences

Delta Corp's strategic focus on innovation in live gaming experiences is crucial for maintaining its competitive edge. Investing in novel live gaming formats and cutting-edge technologies can draw in younger demographics and boost engagement from existing customers. For instance, in the fiscal year 2023, Delta Corp reported a consolidated revenue of INR 833.5 crore, with its gaming operations forming a significant portion of this. This suggests that enhancements to the live gaming floor directly impact topline growth.

By consistently upgrading the gaming environment with contemporary amenities and distinctive attractions, Delta Corp can stimulate increased visitor numbers and higher revenue per patron. This forward-thinking strategy is essential for securing market leadership in the dynamic entertainment sector. The company's commitment to evolving its offerings, such as introducing new electronic table games or interactive live dealer setups, directly contributes to its financial performance and market position.

Key areas for innovation include:

- Development of interactive live dealer games: Enhancing player interaction and real-time engagement.

- Integration of augmented reality (AR) elements: Creating immersive gaming environments.

- Personalized gaming experiences: Leveraging data analytics to tailor offerings to individual player preferences.

- Introduction of skill-based gaming options: Attracting a broader audience beyond traditional chance-based games.

Targeted Marketing for Emerging Customer Segments

Delta's strategy to target emerging customer segments, particularly younger, tech-savvy demographics and international tourists, aligns with a high-growth approach within the BCG matrix framework. By tailoring gaming and hospitality experiences, Delta aims to tap into new revenue streams and increase its market share.

This focused marketing effort leverages digital platforms and strategic partnerships to connect with these expanding audiences. For instance, in 2024, the global travel market saw a significant rebound, with international tourist arrivals projected to reach 1.1 billion by the end of the year, according to the UN World Tourism Organization. This presents a substantial opportunity for Delta to attract a broader customer base.

- Targeted Digital Campaigns: Utilizing social media marketing and influencer collaborations to reach younger, digitally native consumers.

- Personalized Promotions: Offering customized gaming packages and hospitality deals based on segment preferences.

- International Market Outreach: Developing marketing materials and partnerships specifically for key international tourist markets, such as Asia and Europe.

- Loyalty Program Enhancements: Introducing tiered loyalty benefits that appeal to the spending habits and preferences of emerging customer groups.

Stars in the Delta BCG Matrix represent business segments with high market share in a high-growth industry. These segments require significant investment to maintain their growth trajectory and competitive position. Delta Corp’s premium offshore casino operations, appealing to India’s growing affluent population, exemplify this category.

The company's expansion into new Indian states for casino licenses, coupled with investments in integrated resorts and innovative gaming experiences, are strategic moves to solidify its Star status. These initiatives are designed to capture a larger share of a rapidly expanding market, projected to grow at over 20% CAGR.

Delta Corp's focus on attracting younger, tech-savvy demographics and international tourists through targeted digital campaigns and personalized offers further reinforces its Star positioning. This proactive approach aims to capitalize on market growth and secure long-term dominance.

Delta Corp's revenue from gaming operations forms a substantial part of its overall financial performance, as seen in its consolidated revenue of INR 833.5 crore in FY23. The company's strategic investments in enhancing live gaming experiences and expanding its hospitality offerings are crucial for maintaining its Star status in a dynamic market.

| Segment | Market Growth | Market Share | Investment Need | Delta Corp's Position |

|---|---|---|---|---|

| Premium Offshore Casinos | High | High | High | Star |

| Integrated Resorts (Hospitality) | High | Growing | High | Potential Star |

| New State Casino Licenses | High | Emerging | High | Question Mark/Star |

What is included in the product

The Delta BCG Matrix categorizes products by market share and growth, guiding investment decisions.

A clear, visual representation of your portfolio's strengths and weaknesses, simplifying complex strategic decisions.

Cash Cows

Delta Corp's established offshore casinos in Goa, such as Deltin Royale and Deltin JAQK, exemplify strong cash cows within the BCG matrix. These ventures command a significant portion of the Indian gaming market, a segment that is mature but highly lucrative.

These operations consistently produce robust cash flows, requiring minimal additional investment for marketing or expansion to sustain their market leadership. For instance, in the fiscal year ending March 31, 2023, Delta Corp reported revenue of ₹1,012 crore, with its gaming and hospitality segment, which includes these casinos, being a primary contributor.

Established land-based casinos in Sikkim, like Casino Deltin Denzong, are solid cash cows for Delta Corp. These operations, while in a market with less explosive growth potential than newer ventures, consistently generate profits due to their established presence and loyal customer base.

Delta's existing hotel properties, such as Deltin Suites in Goa, are prime examples of cash cows within the BCG matrix. These assets are strategically integrated with or complement the company's casino operations, ensuring a consistent and dependable flow of revenue from accommodation, dining, and various other services. They benefit from Delta's established brand and loyal customer base, minimizing the need for significant new capital outlays to maintain their profitability.

Ancillary Services within Flagship Properties

Ancillary services within Delta Corp's flagship properties, like its casinos, are classic cash cows. These offerings, including diverse dining options, vibrant bars, and captivating entertainment shows, consistently deliver robust profit margins. For instance, in fiscal year 2024, Delta Corp reported that its non-gaming revenue, largely driven by these ancillary services, accounted for a significant portion of its overall profitability, demonstrating their crucial role in generating stable income.

These services are designed to complement the core gaming experience, effectively capturing additional spending from the substantial footfall generated by the casinos. They require minimal new investment for growth, yet they provide a substantial and highly predictable stream of cash flow, reinforcing their position as mature, high-yield assets within the company's portfolio.

- High Profit Margins: Ancillary services like restaurants and bars within Delta Corp's casinos yield consistently high profit margins.

- Customer Experience Enhancement: These services improve the overall customer journey, encouraging longer stays and increased spending.

- Low Investment, High Returns: They demand low growth investment but generate significant and predictable cash flow, characteristic of cash cows.

- 2024 Performance Indicator: In FY2024, Delta Corp's non-gaming revenue, driven by these ancillary offerings, proved to be a stable and profitable contributor to their financial results.

Deltin Daman (Hospitality Component)

The hospitality component of Deltin Daman, even with its casino operations still developing, operates as a cash cow. This five-star integrated resort consistently brings in revenue through hotel accommodations, banquets, and other hospitality services. Its established brand and infrastructure ensure a steady stream of income.

The resort benefits from its prime location and reputation, drawing in guests seeking a premium experience. This stability in revenue generation allows the company to invest in future growth areas while maintaining a solid financial base. For instance, in 2023, the Indian hospitality sector saw a significant rebound, with occupancy rates in luxury hotels reaching an average of 70-75% in key tourist destinations.

- Stable Revenue Streams: Consistent income from hotel stays, food and beverage, and event bookings.

- Established Brand Recognition: Leverages the Deltin brand to attract a loyal customer base.

- Infrastructure Utilization: Maximizes returns from existing five-star facilities.

- Cash Flow Generation: Provides reliable cash flow to support other business segments or investments.

Cash cows in the Delta BCG Matrix represent established, high-market-share products or services in low-growth industries. These are the reliable profit generators that require minimal investment to maintain their position. Delta Corp's established offshore casinos in Goa, like Deltin Royale, and land-based casinos in Sikkim, such as Casino Deltin Denzong, are prime examples. These ventures consistently generate substantial profits, contributing significantly to the company's overall financial health without needing aggressive expansion strategies.

The ancillary services offered within Delta Corp's flagship properties, such as diverse dining options and entertainment shows within their casinos, also function as cash cows. These services enhance the customer experience and capture additional spending, demanding low growth investment while yielding significant and predictable cash flow. For instance, in FY2024, Delta Corp's non-gaming revenue, largely driven by these ancillary offerings, proved to be a stable and profitable contributor to their financial results.

Delta's existing hotel properties, like Deltin Suites in Goa, and the hospitality component of Deltin Daman, are also considered cash cows. These assets benefit from Delta's established brand and loyal customer base, ensuring a consistent and dependable flow of revenue from accommodation and other services. Their established infrastructure and prime locations maximize returns from existing facilities, providing reliable cash flow to support other business segments or investments.

| Delta Corp Segment | BCG Category | Key Characteristics | FY2023 Revenue Contribution (Approx.) |

|---|---|---|---|

| Goa Offshore Casinos (Deltin Royale, JAQK) | Cash Cow | High market share, mature market, stable cash flow | Significant portion of ₹1,012 crore total revenue |

| Sikkim Land-based Casinos (Deltin Denzong) | Cash Cow | Established presence, loyal customer base, consistent profitability | Stable contributor to gaming and hospitality segment |

| Ancillary Services (Casinos) | Cash Cow | High profit margins, low investment, predictable cash flow | Significant portion of FY2024 profitability (non-gaming revenue) |

| Hospitality (Deltin Suites, Deltin Daman) | Cash Cow | Steady income, brand recognition, infrastructure utilization | Consistent revenue from accommodation and services |

Preview = Final Product

Delta BCG Matrix

The preview you're viewing is the identical, fully formatted Delta BCG Matrix document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive, ready-to-use strategic tool for your business analysis.

Dogs

Older hotel properties within Delta Corp's portfolio that struggle with low occupancy and stagnant revenue are prime examples of dogs in the BCG matrix. These underperforming assets likely incur significant maintenance and operational expenses, acting as a drain on the company's overall financial health.

For instance, if a hotel property in a declining tourist area saw occupancy rates dip to 40% in 2024, a stark contrast to the company's average of 75%, it would clearly fall into the dog category. Such properties offer minimal returns and often require substantial, potentially unrecoverable, investment for revitalization or may need to be divested.

Within Delta Corp's diverse online gaming landscape, certain niche or outdated offerings might be categorized as dogs in the BCG matrix. These could be specific sub-platforms or legacy games that haven't kept pace with evolving player preferences or have been significantly impacted by the 28% Goods and Services Tax (GST). For instance, if a particular fantasy sports platform or an older card game portal within Delta Corp's ecosystem is experiencing a steady decline in user activity and holds a minimal share of the overall online gaming market, it would fit this description.

These underperforming assets are characterized by low user engagement and a shrinking market share, consistently draining resources without showing signs of a turnaround. In 2024, the online gaming sector has seen increased regulatory scrutiny and tax burdens, which can exacerbate the challenges for these less competitive offerings. Delta Corp's financial reports for the period ending March 31, 2024, indicated a substantial impact on its online gaming revenue, underscoring the need to evaluate such legacy segments.

Delta Corp's divestment of its Nepal operations to Ability Games in February 2024 aligns with the 'Dog' quadrant of the BCG Matrix. This move signals that these businesses likely possessed low market share and limited growth potential, making them candidates for divestment.

By shedding these non-core assets, Delta Corp can strategically reallocate its capital and management focus towards areas with higher growth prospects and market dominance. This streamlining is crucial for enhancing overall business efficiency and profitability.

Less Popular Gaming Machine Floors

Older gaming machine sections or specific electronic table game areas within casinos that consistently see low player numbers and generate substantially less income than other attractions can be categorized as dogs in the BCG matrix. These underperforming assets occupy valuable floor space and represent tied-up capital that doesn't contribute significantly to the casino's bottom line.

Casinos must actively monitor these areas, as they can become significant cash drains. For instance, a 2024 industry report indicated that certain older slot machine denominations, particularly those with less popular themes or outdated technology, can underperform by as much as 30-40% compared to newer, high-demand machines. This necessitates a strategy of continuous evaluation and timely replacement to avoid these profitability traps.

- Underperforming Assets: Specific gaming machine sections or electronic tables with consistently low patronage.

- Capital Tie-up: These areas occupy valuable floor space and capital without generating substantial returns.

- Revenue Drain: They contribute significantly less revenue compared to other, more popular casino offerings.

- Strategic Replacement: Continuous monitoring and timely replacement are crucial to mitigate losses and optimize floor space utilization.

Stagnant Real Estate Holdings

Stagnant real estate holdings, often referred to as "Dogs" in the BCG Matrix context, represent assets that are not contributing significantly to a company's growth or profitability. These are typically non-strategic properties that are not actively developed or used for core business operations, tying up valuable capital and incurring ongoing expenses without generating meaningful returns. For instance, a gaming company might hold undeveloped land parcels or underutilized office buildings that are not aligned with its primary gaming business strategy.

The strategic decision to separate such assets, as seen in a potential demerger, aims to unlock capital and streamline operations. This move allows the core business, in this example the gaming operations, to focus resources on areas with higher growth potential. By divesting these stagnant holdings, the company can reduce its overhead and reallocate funds towards more productive investments, thereby improving overall financial health.

Consider a scenario where a company has real estate assets valued at $50 million that are generating only a 1% annual return, while its core business operations are yielding 15%. This represents a significant opportunity cost. In 2024, the real estate sector experienced varied performance, with some markets showing modest appreciation while others faced challenges, underscoring the importance of actively managing property portfolios.

- Stagnant Real Estate Holdings: Assets with low growth and low market share.

- Impact: Tie up capital, incur holding costs, and offer minimal returns.

- Strategic Action: Divestment or restructuring to free up resources.

- Example: Undeveloped land or underutilized buildings not core to business strategy.

Dogs represent business units or products with low market share and low growth potential. These are often cash traps, consuming resources without generating significant returns, and may require divestment or liquidation.

For example, a legacy online game that has seen a sharp decline in active users due to competition and changing player preferences, holding less than 2% of the market share and experiencing negative growth in 2024, would be a dog. Such an offering drains marketing and development funds without a clear path to profitability.

Delta Corp's older hotel properties, especially those in less popular tourist destinations, can be categorized as dogs. If a property's occupancy rate in 2024 fell below 50% and its revenue contribution was minimal, it would fit this profile, requiring significant capital for upgrades or consideration for sale.

Similarly, certain underperforming casino gaming machines or electronic table game sections that consistently attract low player volume and generate negligible revenue are dogs. These occupy prime real estate within casinos, representing an inefficient use of capital and space.

Question Marks

Delta Corp's decision to retain a 49% stake in Deltatech Gaming (Adda52) after selling the majority to Head Digital Works places it squarely in the question mark category of the BCG matrix. While the online skill gaming sector is a high-growth area, with projections indicating substantial expansion, the recent implementation of a 28% Goods and Services Tax (GST) has led to revenue de-growth for the segment.

This remaining investment in Deltatech Gaming presents a dual-edged sword. If the market successfully navigates the new tax regime or if regulatory conditions improve, the potential for significant returns is considerable. However, currently, the venture is consuming cash without generating commensurate returns, necessitating a strategic evaluation of whether to inject further capital or consider a complete divestment.

Delta Corp's ventures into new online gaming verticals like fantasy sports or esports betting are currently question marks on the BCG matrix. These are rapidly expanding sectors in India, with the fantasy sports market alone projected to reach $3.7 billion by 2024, according to reports. Delta's initial market share in these areas would likely be low, reflecting the nascent stage of their engagement.

Entering these high-growth segments demands substantial investment in marketing and robust platform development. This is crucial for Delta Corp to build brand awareness and acquire a significant user base, aiming to transition these new verticals from question marks to potential stars in their gaming portfolio.

The Dhargalim Integrated Resort Project in Goa is a classic question mark for Delta Corp. It's positioned in a market with strong tourism potential, a key growth driver, but it's still in the development stage, meaning it's not contributing to revenue yet. In 2024, the company continued to focus on advancing this project, which is crucial for its long-term expansion plans.

Expansion into Untapped Indian States

Expanding into emerging Indian states where casino gaming or integrated resorts are newly permitted or possess significant untapped potential aligns with the question mark quadrant of the Delta BCG Matrix. These ventures are characterized by high growth prospects but initially low market share for Delta Corp. For instance, states like Odisha and Tamil Nadu have shown increasing openness to regulated gaming, presenting future opportunities.

Strategic initiatives would involve extensive market research to understand local preferences and regulatory landscapes, coupled with substantial investment in building brand awareness and establishing a competitive edge. This approach is crucial for navigating these nascent markets effectively.

- High Growth Potential: Emerging states offer a fertile ground for new gaming and resort developments.

- Low Initial Market Share: Delta Corp would begin with a minimal presence in these new territories.

- Investment Requirements: Significant capital is necessary for market entry, brand building, and operational setup.

- Market Research: In-depth analysis is vital to tailor offerings to local demographics and regulations.

Adoption of Emerging Gaming Technologies

Investments in nascent gaming technologies like VR or AR casinos are prime examples of question marks in the Delta BCG Matrix. These areas represent high growth potential but currently hold minimal market share for Delta. For instance, the global VR in gaming market was projected to reach approximately $25 billion by 2024, indicating substantial opportunity.

These ventures demand significant research and development, alongside concerted efforts to drive market adoption. The success of these technologies hinges on overcoming hurdles such as hardware costs and user experience improvements. By 2025, the AR and VR market is expected to see continued expansion, with AR projected to outpace VR in revenue generation.

- High Growth Potential: The global VR in gaming market is experiencing rapid expansion, with significant projected growth.

- Low Market Share: Delta's current presence in these emerging technology segments is minimal, reflecting their nascent stage.

- Substantial Investment Required: Developing and promoting VR/AR gaming requires considerable R&D and marketing expenditure.

- Uncertain Future Viability: The long-term success of these technologies is still being determined by market acceptance and technological advancements.

Question marks represent business ventures with high growth potential but low current market share, requiring significant investment and strategic decision-making. Delta Corp's investment in Deltatech Gaming, despite the recent 28% GST impact, and its exploration of new online gaming verticals like fantasy sports and esports betting, exemplify this category. These areas demand substantial capital for development and marketing to transition them into future stars.

The Dhargalim Integrated Resort Project in Goa, still in development, and expansion into emerging Indian states with new gaming regulations are also question marks. These ventures, while promising due to tourism or untapped potential, require extensive market research and investment to establish a competitive foothold. Similarly, investments in nascent technologies like VR/AR casinos present high growth but low market share, with success dependent on overcoming technological and adoption hurdles.

| Venture | Market Growth | Market Share | Investment Need | Strategic Outlook |

| Deltatech Gaming (Adda52) | High (Online Skill Gaming) | Moderate (Post-GST) | Strategic Evaluation | Potential Star/Divestment |

| Fantasy Sports/Esports Betting | Very High (Projected $3.7B by 2024) | Low (Nascent) | High (Marketing/Platform) | Potential Star |

| Dhargalim Resort Project | High (Goa Tourism) | None (Development Stage) | High (Capital Expenditure) | Future Growth Driver |

| Emerging State Gaming | High (Untapped Potential) | Low (New Entrant) | High (Market Research/Brand) | Potential Star |

| VR/AR Casinos | Very High (Global VR Market ~$25B by 2024) | Low (Nascent Technology) | High (R&D/Adoption) | Uncertain Viability/Potential Star |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer feedback, and competitor analysis, to accurately position each business unit.