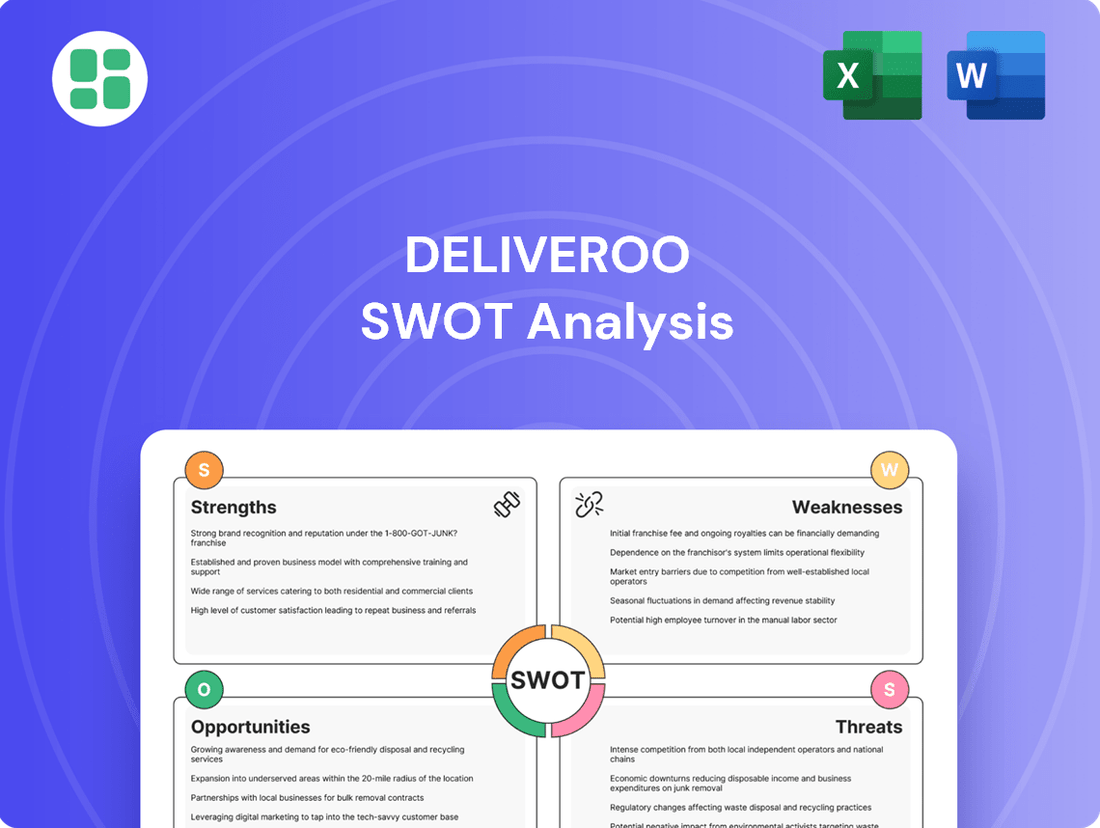

Deliveroo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deliveroo Bundle

Deliveroo's strong brand recognition and extensive restaurant network are key strengths, but the competitive landscape and evolving regulatory environment pose significant challenges. Understanding these internal capabilities and external pressures is crucial for strategic planning.

Want the full story behind Deliveroo's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Deliveroo boasts robust brand recognition, a key strength in the competitive food delivery sector. Its strong market position, especially in the UK and Ireland, is a testament to this, with the company consistently ranking among the leading platforms.

The company holds substantial market shares in major urban centers, notably London, where its dominance is estimated at around 70%. This high penetration in key markets directly translates into frequent customer orders and fosters significant loyalty, providing a solid foundation against rivals.

Deliveroo's in-house technology, powered by AI and machine learning, is a significant strength, optimizing delivery routes and reducing customer wait times. This advanced platform ensures efficient operations, a key factor in customer satisfaction and rider productivity.

In 2023, Deliveroo reported that its technology helped reduce average delivery times, contributing to a positive customer experience. The company continues to invest heavily in these capabilities, aiming to further enhance operational efficiency and maintain a competitive edge in the fast-paced food delivery market.

Deliveroo has successfully broadened its appeal by venturing into grocery and general retail delivery. This strategic move taps into a rapidly expanding market beyond just restaurant meals.

By the second half of 2024, grocery delivery represented a substantial 16% of Deliveroo's Gross Transaction Value (GTV), underscoring the effectiveness of this diversification strategy.

Further strengthening its retail presence, Deliveroo forged new partnerships in 2024 with prominent retailers such as B&Q and The Perfume Shop, significantly expanding its product range and creating new avenues for revenue growth.

Growing and Enhanced Loyalty Program

Deliveroo is heavily investing in its Plus subscription service, aiming for a 'Plus-first' approach by 2026. This strategy is supported by significant enhancements rolled out in 2024, such as credit-back rewards and the introduction of a Plus Diamond tier. These initiatives are specifically designed to boost customer loyalty and encourage more frequent orders, creating a more predictable revenue flow.

The loyalty program is proving to be a powerful engine for customer engagement. For instance, Deliveroo reported that Plus subscribers placed 2.6 times more orders than non-Plus members in the first half of 2024. This demonstrates the direct impact of the program on driving repeat business and solidifying customer relationships.

- Strategic Shift: Deliveroo's ambition to become a 'Plus-first' business by 2026 underscores the growing importance of its loyalty program.

- Enhanced Features: Improvements in 2024, including credit-back incentives and new tiers like Plus Diamond, aim to increase customer retention and order frequency.

- Customer Engagement: The Plus program fosters deeper consumer engagement, with Plus subscribers ordering significantly more often than non-subscribers.

- Revenue Stability: This loyalty initiative contributes to a more stable and predictable revenue stream for the company.

Achieved Profitability and Positive Free Cash Flow

Deliveroo achieved a significant financial milestone by reporting its first annual profit of £3 million in 2024. This marks a crucial turnaround from prior periods of losses, showcasing improved financial health.

Furthermore, the company generated positive free cash flow amounting to £86 million in 2024. This positive cash flow indicates effective operational management and a stronger ability to fund future growth and investments.

- First Annual Profit: £3 million in 2024.

- Positive Free Cash Flow: £86 million generated in 2024.

- Financial Turnaround: Demonstrates effective cost control and operational efficiencies.

Deliveroo's technological prowess, leveraging AI and machine learning, optimizes delivery routes, a key factor in their 2023 success in reducing average delivery times. This efficiency not only enhances customer satisfaction but also boosts rider productivity, a crucial element in the competitive delivery landscape.

The expansion into grocery and general retail delivery is a significant strategic advantage, with grocery sales making up 16% of Gross Transaction Value (GTV) by the second half of 2024. New partnerships in 2024 with retailers like B&Q and The Perfume Shop further solidify this diversification.

Deliveroo's 'Plus-first' strategy, heavily invested in with enhancements like credit-back rewards and the Plus Diamond tier in 2024, is driving customer loyalty. In the first half of 2024, Plus subscribers ordered 2.6 times more than non-Plus members, highlighting the program's effectiveness.

Financially, Deliveroo achieved a landmark £3 million profit in 2024, its first annual profit, and generated £86 million in positive free cash flow, signaling a strong operational turnaround and improved financial health.

| Metric | 2024 Data | Significance |

|---|---|---|

| Annual Profit | £3 million | First annual profit, indicating financial turnaround. |

| Free Cash Flow | £86 million | Positive cash flow demonstrates operational efficiency. |

| Grocery GTV Share | 16% (H2 2024) | Shows success of retail diversification. |

| Plus Subscriber Order Frequency | 2.6x (H1 2024) | Highlights customer loyalty and engagement. |

What is included in the product

Offers a full breakdown of Deliveroo’s strategic business environment, examining its strengths in brand recognition and technology, weaknesses in profitability, opportunities in market expansion and new services, and threats from competition and regulation.

Identifies key competitive advantages and potential threats, enabling proactive strategy development to mitigate risks and capitalize on opportunities.

Weaknesses

Deliveroo operates in a crowded online food delivery arena, facing formidable rivals such as Uber Eats and Just Eat Takeaway.com. This intense rivalry often forces price adjustments and escalates the cost of attracting new customers, directly affecting Deliveroo's profit margins and its standing in the market. Staying ahead demands constant innovation and a commitment to enhancing customer benefits.

Deliveroo's heavy reliance on its gig economy model presents a significant weakness, as it faces continuous regulatory scrutiny and potential legal battles concerning worker classification and entitlements. This business structure, while offering flexibility, leaves the company vulnerable to shifts in labor laws across its operating regions.

Despite a UK Supreme Court ruling in late 2023 that classified riders as independent contractors, the evolving legal landscape in other markets could still impose substantial costs and operational complexities. For instance, in France, the "Climber" law, implemented in 2023, has increased scrutiny on platform work, potentially impacting similar business models.

While Deliveroo reported achieving overall profitability in 2024, the food delivery industry inherently operates on thin margins, and certain international markets continue to present significant hurdles. This dynamic means that maintaining consistent profitability across every region where Deliveroo operates remains a persistent challenge.

For instance, the company's strategic exit from Hong Kong in early 2025 underscores these difficulties, highlighting the ongoing struggle to attain profitable scale in specific geographies. These market-specific complexities directly impact the company's ability to achieve uniform financial success across its global footprint.

Vulnerability to Consumer Discretionary Spending Fluctuations

Deliveroo's reliance on discretionary spending makes it susceptible to economic downturns. During 2024, an uncertain consumer environment directly impacted order volumes and the average order value, as consumers tightened their belts.

This sensitivity means that periods of high inflation or recession can significantly dent Deliveroo's gross transaction value. For instance, if consumers cut back on non-essential food delivery services, the company's top-line performance will suffer.

- Economic Sensitivity: Deliveroo's revenue is directly tied to how much disposable income consumers have available for non-essential services like food delivery.

- Impact of Inflation: Rising inflation in 2024 put pressure on household budgets, leading some consumers to reduce or forgo food delivery orders.

- Shift in Consumer Behavior: During economic uncertainty, consumers may opt for cheaper alternatives or reduce the frequency of ordering from platforms like Deliveroo.

- Reduced Order Value: Even if consumers still order, they might choose lower-priced items, impacting the overall gross transaction value per order.

Operational Complexities and Cost Management

Managing Deliveroo's extensive network of restaurants, riders, and customers across diverse geographical markets is inherently complex. This intricate web requires sophisticated logistics and coordination, which can lead to inefficiencies if not meticulously managed.

Despite efforts to streamline operations, Deliveroo faces ongoing cost pressures. For instance, rising fuel prices and the need for competitive rider incentives, alongside essential technology upkeep, directly impact operating expenses. In 2023, the company reported that rider costs, including payments and insurance, represented a significant portion of their expenditure.

- Operational Complexity: Coordinating a multi-sided platform with varying demands and supply across numerous cities.

- Cost Management Challenges: Balancing rider pay, fuel surcharges, and technology investment against revenue.

- Profitability Pressure: The need for continuous efficiency gains is paramount in a sector characterized by thin profit margins, especially as consumer spending patterns fluctuate.

Deliveroo's business model faces significant challenges due to its reliance on the gig economy, leading to ongoing regulatory scrutiny and potential legal disputes over worker classification. For example, while a UK Supreme Court ruling in late 2023 affirmed riders as independent contractors, evolving labor laws in other markets, such as France's 2023 "Climber" law, could impose substantial costs and operational complexities.

The company's profitability is also hampered by thin margins inherent in the food delivery sector, with certain international markets proving particularly difficult to navigate profitably. Deliveroo's strategic exit from Hong Kong in early 2025 exemplifies these persistent struggles to achieve profitable scale in specific geographies, impacting overall financial consistency.

Deliveroo's susceptibility to economic downturns is another key weakness, as its revenue is tied to consumer discretionary spending. In 2024, an uncertain economic environment and inflationary pressures directly impacted order volumes and average order values, as consumers reduced non-essential spending.

The operational complexity of managing a vast network of restaurants, riders, and customers across diverse regions presents ongoing cost pressures. Factors like rising fuel prices, the need for competitive rider incentives, and technology investments in 2023 contributed significantly to operating expenses, with rider costs representing a substantial portion of expenditure.

What You See Is What You Get

Deliveroo SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global online food delivery market is expected to reach $173.57 billion by 2025, growing at a compound annual growth rate of 10.7% from 2024. This significant market expansion, fueled by technology and a consumer demand for convenience, presents a substantial opportunity for Deliveroo. The company is well-positioned to leverage this trend, especially with increasing adoption among younger demographics.

Deliveroo can significantly broaden its appeal by moving beyond food delivery into diverse non-food and retail sectors. This includes categories like DIY supplies, home furnishings, and gift items, which represent untapped revenue potential. For instance, partnerships with retailers such as B&Q and Not On The High Street in 2023 demonstrate a concrete strategy to access these new markets.

Deliveroo can significantly boost its operations by further integrating advanced AI and machine learning. This technology offers a powerful avenue to refine logistics, tailor customer interactions, and streamline overall efficiency. For instance, AI can optimize delivery routes, improve how orders are grouped, and provide actionable data insights, all contributing to quicker deliveries and lower expenses.

By leveraging AI for predictive analytics, Deliveroo can anticipate demand fluctuations and manage rider availability more effectively. This data-driven approach not only enhances customer satisfaction through faster, more reliable service but also strengthens Deliveroo's competitive edge. In 2023, the company reported that its AI-driven initiatives in route optimization had already contributed to a notable reduction in delivery times, a trend expected to continue with deeper investment.

Strategic Partnerships and Exclusive Restaurant Deals

Deliveroo can significantly boost its market position by forging more exclusive partnerships with sought-after restaurant chains and popular local establishments. This strategy directly addresses the desire for unique offerings, setting Deliveroo apart in a crowded delivery landscape and attracting a broader customer base. For instance, campaigns in 2024, like those featuring exclusive partners in Dublin, have already underscored the tangible benefits of these collaborations. Such deals not only expand the available selection for consumers but also cultivate stronger customer loyalty by providing access to restaurants unavailable elsewhere.

These strategic alliances offer several key advantages:

- Enhanced Differentiation: Exclusive deals provide a unique selling proposition against rivals.

- Customer Acquisition and Retention: Access to popular, exclusive restaurants drives new sign-ups and encourages repeat business.

- Increased Order Volume: A wider, more appealing selection directly translates to more orders.

- Brand Value: Associating with premium or popular brands elevates Deliveroo's own brand perception.

Growth in Subscription Services and Loyalty Programs

Deliveroo's focus on its subscription service, Deliveroo Plus, presents a significant growth opportunity. By enhancing and expanding the program's benefits, Deliveroo aims to foster greater customer loyalty and increase order frequency. This strategy is supported by observed improvements in engagement metrics throughout 2025, indicating positive customer reception.

The company's stated ambition to transition into a 'Plus-first' business by 2026 underscores the strategic importance of this initiative. A growing subscriber base, coupled with increasingly attractive benefits, is expected to cultivate a more predictable and valuable customer segment, thereby bolstering revenue stability.

- Enhanced Deliveroo Plus: Continued investment in loyalty program features can boost customer retention and order frequency.

- 'Plus-first' Strategy: The 2026 goal signals a commitment to subscription as a core growth driver.

- Predictable Revenue: Expanding the subscriber base secures a higher-value, more consistent customer segment.

The global online food delivery market is projected to reach $173.57 billion by 2025, with a CAGR of 10.7% from 2024, presenting a vast opportunity for Deliveroo to capitalize on increasing consumer demand for convenience.

Expanding into non-food retail sectors, such as DIY and home furnishings, offers untapped revenue streams, as demonstrated by Deliveroo's 2023 partnerships with retailers like B&Q.

Further integration of AI and machine learning can optimize logistics, personalize customer experiences, and improve route efficiency, as evidenced by Deliveroo's 2023 report on AI-driven delivery time reductions.

Exclusive partnerships with popular restaurants, like those highlighted in Dublin in 2024, enhance differentiation and drive customer acquisition and retention.

Strengthening the Deliveroo Plus subscription service is a key growth driver, with the company aiming for a 'Plus-first' model by 2026, supported by positive engagement metrics observed in 2025.

Threats

The online food delivery sector is intensely competitive, with ongoing consolidation presenting a significant risk. Deliveroo's agreed acquisition by DoorDash, anticipated for completion in Q4 2025, introduces inherent integration challenges, potential brand dilution, and the possibility of redundancies.

Aggressive competition from major players like Uber Eats and Just Eat Takeaway.com continues to exert pressure, potentially impacting Deliveroo's market share and profitability. For instance, as of early 2024, the global online food delivery market was valued at over $200 billion, with significant growth projections, underscoring the intense battle for dominance.

While Deliveroo riders were affirmed as self-employed by a UK Supreme Court ruling, the regulatory environment for gig workers globally is still a significant concern. This uncertainty means future legal challenges or new legislation could impact Deliveroo's operational model.

New laws mandating employee benefits, minimum wages, or collective bargaining rights for gig workers, as seen with ongoing discussions in the UK and EU, could substantially raise Deliveroo's operating expenses. Such changes would directly challenge the flexibility that underpins their current delivery system.

Macroeconomic headwinds like persistent inflation and the looming threat of recession significantly impact Deliveroo. These factors directly curb consumer discretionary spending, meaning fewer people are likely to order takeaway meals or opt for delivery services when budgets tighten.

This economic uncertainty can translate into lower order volumes and a reduction in the average amount customers spend per order. Deliveroo itself acknowledged this risk, noting an 'uncertain consumer environment' in its 2024 financial reporting, underscoring the direct impact on its business operations and revenue streams.

Rising Operational Costs and Supply Chain Volatility

Deliveroo faces significant headwinds from rising operational costs, particularly fuel prices for its courier network, which saw a notable increase throughout 2024. Labor market pressures also contribute to higher wage expectations for riders, directly impacting profitability.

The company's extensive and complex supply chain, encompassing restaurants, couriers, and consumers, presents a constant challenge in efficiently absorbing or passing on these escalating expenses. This cost volatility can significantly compress the already tight profit margins typical in the food delivery industry.

- Increased Fuel Costs: Average global fuel prices experienced volatility in 2024, impacting courier expenses.

- Labor Market Pressures: Demand for gig economy workers has led to upward pressure on rider compensation.

- Margin Squeeze: The delivery sector's thin margins are particularly vulnerable to these operational cost increases.

Reputational Damage from Service Issues or Ethical Concerns

Deliveroo faces significant threats from potential reputational damage stemming from service disruptions or ethical missteps. Persistent issues like late deliveries, inaccurate orders, or subpar customer service can erode customer loyalty in the fiercely competitive food delivery sector. For instance, a widespread service failure could lead to a measurable increase in customer churn, directly impacting revenue. In 2024, online reviews and social media sentiment analysis are critical indicators of brand health, with negative feedback on service quality often translating into decreased order volume.

Furthermore, negative press concerning rider welfare, such as concerns over pay or working conditions, or data privacy breaches, can severely undermine consumer trust and brand perception. A data breach, for example, could result in significant fines and a long-lasting stain on the company's image, deterring new customers and alienating existing ones. By mid-2025, consumer awareness regarding ethical business practices is at an all-time high, making proactive management of these areas paramount for maintaining a positive brand image and market position.

- Service Quality: Late deliveries, incorrect orders, and poor customer support are key drivers of reputational damage.

- Rider Welfare: Negative publicity surrounding rider pay, benefits, or working conditions can impact brand image.

- Data Privacy: Breaches of customer or rider data can lead to significant trust erosion and financial penalties.

- Ethical Concerns: Transparency in business practices and adherence to ethical standards are increasingly scrutinized by consumers.

Deliveroo faces intense competition, with rivals like Uber Eats and Just Eat Takeaway.com constantly vying for market share. The global online food delivery market, valued at over $200 billion in early 2024, highlights this fierce battle for dominance.

Regulatory uncertainty surrounding gig worker status poses a significant threat, as new legislation could increase operational costs. Macroeconomic headwinds, including inflation and recession fears, are also impacting consumer discretionary spending, leading to potentially lower order volumes.

Rising operational costs, particularly fuel and labor pressures, are squeezing Deliveroo's already thin profit margins. Furthermore, potential reputational damage from service disruptions or ethical missteps, such as rider welfare concerns or data breaches, could erode customer trust and loyalty.

SWOT Analysis Data Sources

This Deliveroo SWOT analysis is built upon a robust foundation of real-time data, encompassing publicly available financial reports, comprehensive market research, and expert industry analysis to ensure a thorough and actionable assessment.