Deliveroo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deliveroo Bundle

Unlock the full strategic blueprint behind Deliveroo's business model. This in-depth Business Model Canvas reveals how the company connects restaurants, riders, and customers, driving value and capturing market share. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leading food delivery platform.

Partnerships

Deliveroo's success hinges on its extensive network of restaurant partners, encompassing everything from beloved local spots to globally recognized brands. This diversity is key to attracting and retaining customers, as it ensures a wide array of culinary choices are readily available. In 2023, Deliveroo reported working with over 100,000 restaurants across its operating markets.

These crucial relationships allow restaurants to tap into a significantly larger customer pool and outsource the often-challenging task of delivery. By managing the logistics, Deliveroo enables restaurant owners to focus on their core operations: preparing high-quality food.

Deliveroo's business model hinges on its extensive network of independent couriers, who are the backbone of its delivery operations. These riders are crucial for the timely pick-up and drop-off of food from partner restaurants directly to customers' doors.

These independent contractors benefit from the flexibility Deliveroo offers, enabling them to choose their working hours and earn income on their own terms. This flexible model is a key attraction for a large courier base, ensuring consistent service availability.

In 2024, Deliveroo reported a significant number of active riders across its markets, highlighting the scale of this crucial partnership. For instance, the company consistently emphasizes the flexibility and earning potential it provides to its courier fleet, a core element of its value proposition to these partners.

Deliveroo has significantly broadened its appeal by forging partnerships with grocery chains and various retail businesses, moving beyond its initial restaurant focus. This strategic move enables them to provide rapid delivery of a wider array of goods, including everyday groceries, health and beauty items, and even home improvement supplies.

This diversification is proving to be a smart play. For instance, in the UK, Deliveroo reported a substantial increase in grocery orders, with some partners seeing their online sales grow by over 100% in the first year of collaboration. By the end of 2024, it's projected that grocery and retail partnerships will account for a significant portion of Deliveroo's total revenue, reflecting a clear shift in consumer demand for convenient, on-demand access to a broader range of products.

Payment Gateway Providers

Deliveroo relies heavily on partnerships with secure payment gateway providers to facilitate its online transactions. These collaborations are fundamental for processing customer payments efficiently and safely, which directly impacts user trust and operational continuity. For instance, in 2023, the global digital payments market was valued at over $9 trillion, underscoring the scale and importance of these services.

These partnerships ensure that Deliveroo can accept a wide range of payment methods, from credit and debit cards to digital wallets, offering customers flexibility and convenience. A reliable payment infrastructure is non-negotiable; any disruption can lead to lost orders and revenue. In 2024, the trend towards contactless and mobile payments continues to grow, making robust gateway integration even more critical.

- Secure Transaction Processing: Ensures customer data is protected during online payments.

- Payment Method Diversity: Enables acceptance of various payment types, increasing customer reach.

- Operational Efficiency: Facilitates quick and reliable payment settlements, crucial for a fast-paced delivery service.

- Building Customer Trust: A seamless and secure payment experience is vital for customer confidence and repeat business.

Advertising and Media Partners

Deliveroo is actively building its advertising business through strategic alliances with media companies. A prime example is their partnership with SMG, aiming to bolster their retail media offerings. This collaboration is designed to directly link advertisers with Deliveroo's substantial and engaged customer base.

These partnerships are crucial for creating a significant advertising revenue stream for Deliveroo. By connecting brands with consumers actively seeking products, they unlock new monetization opportunities. For instance, in 2024, Deliveroo reported a notable increase in its advertising revenue, driven by these strategic media collaborations.

- SMG Partnership: Accelerates retail media development.

- Advertiser Access: Connects brands with high-intent consumers.

- Revenue Growth: Creates a new, significant income stream.

- Merchant Value: Offers targeted marketing opportunities for partners.

Deliveroo's key partnerships extend beyond restaurants to include a growing number of grocery and retail businesses, broadening its service offering. These collaborations allow Deliveroo to provide on-demand delivery of a wider range of products, from everyday essentials to specialty items. By the close of 2024, it's anticipated that these retail partnerships will represent a substantial portion of Deliveroo's revenue, reflecting a significant shift in consumer demand for convenient, broad-spectrum delivery services.

| Partner Type | Key Contribution | 2023/2024 Data Point |

|---|---|---|

| Restaurants | Core food delivery service | Over 100,000 restaurant partners globally in 2023 |

| Grocery & Retail | Expanded product selection, increased revenue | Significant growth in grocery orders; some partners saw >100% online sales increase |

| Media Companies (e.g., SMG) | Development of advertising business, retail media | Notable increase in advertising revenue driven by media collaborations in 2024 |

What is included in the product

A dynamic platform connecting restaurants, riders, and consumers, Deliveroo's Business Model Canvas highlights its three-sided marketplace and efficient logistics network.

It details key partners like restaurants and riders, customer segments including busy professionals and families, and a value proposition of convenient food delivery.

The Deliveroo Business Model Canvas acts as a pain point reliever by visually mapping out how the company addresses customer desires for convenient food delivery and restaurant needs for wider reach, streamlining complex operations into a clear, actionable framework.

Activities

Deliveroo's core activity revolves around the continuous development, updating, and maintenance of its sophisticated technology platform. This encompasses the mobile applications used by customers, restaurants, and couriers, ensuring a smooth and efficient experience for all parties. The company invests heavily in improving user interfaces and search functionalities to make discovery easier.

Maintaining the stability and scalability of its backend systems is paramount. In 2023, Deliveroo reported significant investment in technology, with a focus on enhancing its app performance and expanding its service capabilities. This ongoing technical upkeep is vital for staying ahead in the competitive food delivery market and providing a reliable service.

Deliveroo's core operation hinges on sophisticated logistics and dispatch optimization. This involves fine-tuning delivery routes, ensuring couriers are dispatched with maximum efficiency, and employing strategies like multi-pickup stacking to serve multiple customers from a single trip. These efforts are geared towards slashing delivery times and cutting operational expenses, thereby boosting the overall performance of their delivery network.

Innovations play a crucial role in streamlining these processes. Features such as rider check-in and order-ready buttons are implemented to expedite the handover of food from restaurants to couriers. For instance, in 2023, Deliveroo reported that its technology helped reduce average delivery times, a testament to the effectiveness of their logistics optimization.

Deliveroo's core activities revolve around meticulously managing and growing its extensive network. This involves actively onboarding new restaurants and grocery stores, ensuring a diverse and appealing selection for customers. Simultaneously, the company focuses on attracting, training, and retaining a reliable pool of independent couriers, crucial for timely deliveries.

A key operational focus is balancing supply and demand within the marketplace. Deliveroo invests in systems and processes to ensure enough riders are available during peak hours and that merchant partners can fulfill orders efficiently. This proactive management is vital for maintaining service quality and customer satisfaction.

In 2024, Deliveroo continued to strengthen its merchant relationships, expanding its grocery offering with partners like Marks & Spencer and Waitrose. The company also emphasized courier support, with initiatives aimed at improving earnings and working conditions, recognizing their pivotal role in the business model.

Marketing and Customer Acquisition/Retention

Deliveroo actively pursues marketing and advertising to attract new users and keep existing ones ordering. This includes everything from digital ads to local partnerships, aiming to build brand recognition and encourage repeat business. For instance, in 2023, Deliveroo invested significantly in marketing, contributing to its user growth and order frequency.

Key to this strategy are initiatives like Deliveroo Plus, a subscription service offering benefits such as free delivery to foster loyalty. These programs are vital for maintaining a competitive edge and ensuring consistent order volumes in the fast-paced food delivery market.

- Targeted Promotions: Running specific deals and discounts to attract new customers and re-engage lapsed users.

- Brand Building: Investing in advertising campaigns across various channels to enhance Deliveroo's image and reach.

- Loyalty Programs: Implementing and promoting services like Deliveroo Plus to incentivize repeat orders and customer retention.

- Data-Driven Marketing: Utilizing customer data to personalize offers and improve the effectiveness of marketing spend.

Data Analytics and Business Intelligence

Deliveroo heavily relies on data analytics and business intelligence to understand customer preferences and optimize operations. By analyzing vast datasets on order patterns, delivery times, and customer feedback, they can refine their services. For instance, insights into peak ordering times and popular cuisines allow for better restaurant partner allocation and rider deployment.

This data-driven approach directly impacts strategic decision-making, including dynamic pricing adjustments and the creation of personalized marketing campaigns. In 2023, Deliveroo reported a significant increase in its average order value, partly attributed to these data-informed strategies that enhance customer engagement and spending.

Machine learning models play a crucial role in improving the relevance of advertising for their partners. By understanding user behavior and preferences, Deliveroo can offer targeted promotions and recommendations, boosting conversion rates for restaurants and increasing advertising revenue. This focus on data ensures a more efficient and personalized experience for all stakeholders.

- Customer Behavior Analysis: Understanding ordering habits, dietary preferences, and peak times to tailor offerings.

- Operational Efficiency: Optimizing delivery routes, rider allocation, and restaurant partnerships based on performance data.

- Market Trend Identification: Analyzing cuisine popularity and regional demand to inform expansion and menu strategies.

- Personalized Marketing: Leveraging data to deliver targeted promotions and recommendations to customers, enhancing engagement.

Deliveroo's key activities center on platform development, logistics optimization, and network management. This includes enhancing their technology for customers, restaurants, and couriers, ensuring smooth operations and efficient delivery routes. They also focus on onboarding new partners and retaining a strong courier base.

In 2023, Deliveroo reported substantial investments in technology to improve app performance and expand services. The company actively refines its logistics, aiming to reduce delivery times and operational costs, with innovations like rider check-in features contributing to this efficiency.

Furthermore, Deliveroo engages in targeted marketing and loyalty programs, such as Deliveroo Plus, to drive customer acquisition and retention. Data analytics are crucial for understanding customer behavior and optimizing operations, leading to initiatives like personalized marketing campaigns and dynamic pricing. In 2023, this data-driven approach contributed to an increase in their average order value.

Full Document Unlocks After Purchase

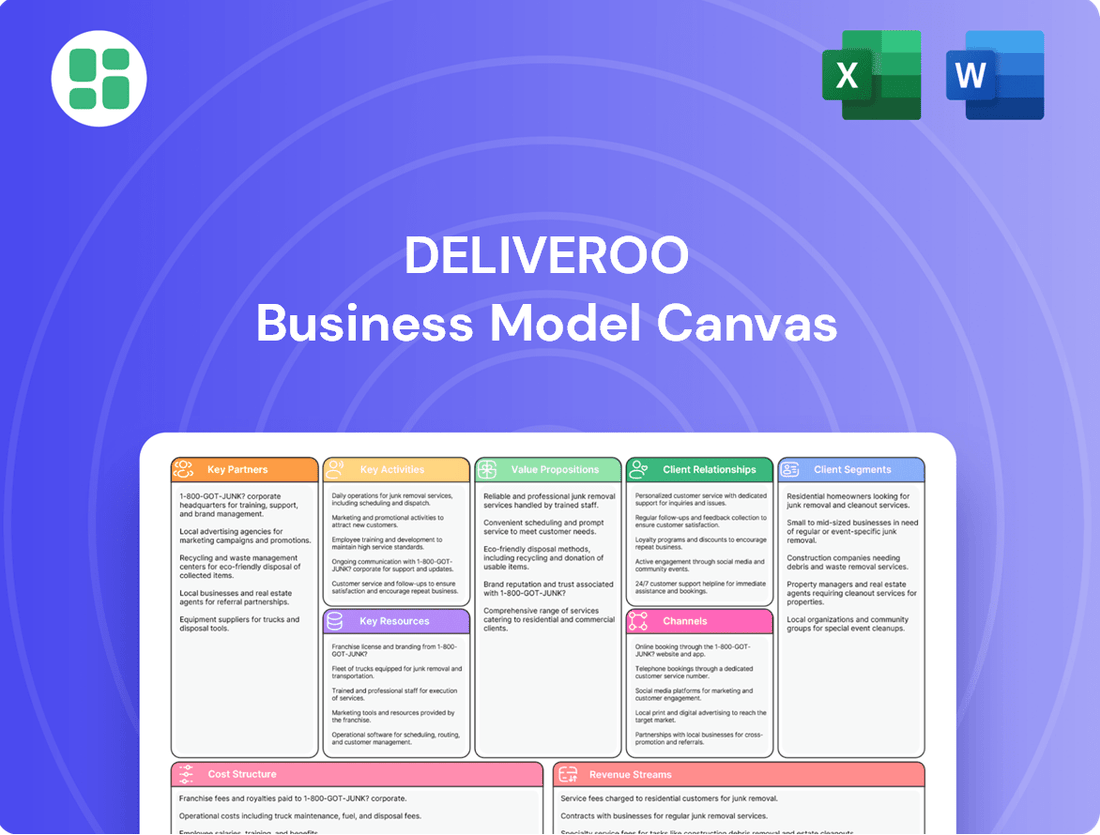

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a transparent look at Deliveroo's operational framework. This comprehensive view details key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. Upon completing your order, you will gain full access to this identical, ready-to-use document, allowing you to immediately leverage its insights.

Resources

Deliveroo's proprietary technology platform, encompassing its customer, restaurant, and rider mobile applications, along with sophisticated backend systems and algorithms, is a fundamental resource. This technology is the engine that drives seamless ordering, efficient rider dispatch, and real-time order tracking, creating a smooth experience for all users. In 2023, Deliveroo reported that its technology enabled the processing of millions of orders weekly, highlighting its scalability and operational efficiency.

Deliveroo's brand and reputation are cornerstones of its business model, built on a promise of convenience, speed, and reliable quality. This strong public image is crucial for attracting and keeping customers, restaurants, and riders alike, which in turn fuels repeat business and word-of-mouth growth. For instance, Deliveroo reported a 6% increase in orders in the first quarter of 2024 compared to the previous year, underscoring the continued appeal of its service.

Deliveroo's extensive network of approximately 186,000 restaurants, grocers, and retail partners globally is a cornerstone of its business model. This vast selection directly fuels customer choice and engagement, offering a significant competitive advantage.

Maintaining and continually growing this diverse partner ecosystem is paramount for Deliveroo's sustained success. The breadth of offerings is a key differentiator, attracting and retaining a broad customer base.

Network of Independent Couriers

Deliveroo’s extensive network of over 135,000 independent couriers is a cornerstone of its business model, providing the essential workforce for order fulfillment. This vast and adaptable fleet allows Deliveroo to cover a wide geographical area and respond dynamically to customer demand, ensuring efficient and timely deliveries. The company’s ability to scale its delivery capacity up or down based on order volume is directly tied to the availability and dedication of these riders.

The quality of service and customer satisfaction heavily depend on the responsiveness and reliability of this courier network. Deliveroo actively works to maintain this critical resource through various initiatives focused on rider welfare and engagement. For instance, in 2024, Deliveroo continued to emphasize fair pay structures and provide access to benefits and support services, aiming to foster a positive working environment for its riders.

- Vast Courier Fleet: Over 135,000 independent couriers globally.

- Operational Flexibility: Enables efficient and widespread order fulfillment.

- Service Quality Driver: Rider responsiveness directly impacts customer satisfaction.

- Rider Engagement: Ongoing investment in welfare and support to retain couriers.

Customer Data and Insights

Deliveroo leverages a massive trove of customer data, including preferences, order history, and delivery feedback, as a core asset. This information is crucial for tailoring the platform to individual users, driving targeted marketing campaigns, and streamlining logistics.

The insights gleaned from this data allow Deliveroo to continuously improve its service offerings. For instance, by analyzing popular cuisines and peak ordering times, they can better onboard restaurants and optimize delivery routes. In 2023, Deliveroo reported that personalized recommendations contributed to a significant portion of order value, underscoring the impact of their data utilization.

- Customer Preferences: Data on past orders, viewed restaurants, and cuisine choices inform personalized recommendations and promotions.

- Order Patterns: Understanding peak ordering times, popular dishes, and order frequency helps optimize restaurant partnerships and delivery logistics.

- Delivery Performance: Feedback on delivery speed, driver interactions, and order accuracy provides insights for operational improvements and customer satisfaction.

Deliveroo's proprietary technology platform, including its customer, restaurant, and rider apps, is a critical resource. This technology facilitates seamless ordering, efficient dispatch, and real-time tracking, enhancing user experience. In 2023, Deliveroo processed millions of orders weekly via its platform, demonstrating its scalability.

The brand and reputation of Deliveroo are vital, built on convenience and speed. This strong image attracts customers, restaurants, and riders, driving repeat business. Deliveroo saw a 6% increase in orders in Q1 2024 year-on-year, showing its continued appeal.

Deliveroo's extensive network of around 186,000 restaurants and grocers globally is a key asset, offering vast customer choice and a competitive edge. Maintaining and growing this partner ecosystem is crucial for sustained success and customer retention.

The company's network of over 135,000 independent couriers is essential for order fulfillment, enabling widespread coverage and dynamic response to demand. Rider availability and dedication directly impact service quality and customer satisfaction. Deliveroo continued to focus on fair pay and rider support in 2024.

Deliveroo utilizes significant customer data, including preferences and order history, to personalize the platform and optimize marketing and logistics. Insights from this data, such as personalized recommendations contributing to order value in 2023, drive service improvements.

| Resource | Description | Key Metric/Fact |

|---|---|---|

| Technology Platform | Customer, restaurant, and rider applications; backend systems and algorithms | Millions of orders processed weekly (2023) |

| Brand & Reputation | Promise of convenience, speed, and quality | 6% increase in orders (Q1 2024 vs Q1 2023) |

| Partner Network | ~186,000 restaurants, grocers, and retail partners | Vast selection fuels customer choice |

| Courier Network | Over 135,000 independent couriers | Enables efficient and dynamic delivery |

| Customer Data | Preferences, order history, feedback | Personalized recommendations boosted order value (2023) |

Value Propositions

Deliveroo brings restaurant-quality meals, groceries, and retail items right to your doorstep, offering unmatched convenience. In 2024, Deliveroo continued to expand its grocery offerings, partnering with major supermarkets to provide even more choice. This convenience is a key draw for busy consumers seeking quick and easy meal solutions.

Deliveroo significantly broadens a restaurant's customer base, enabling them to capture sales from individuals outside their immediate vicinity. This expansion is crucial for growth, as evidenced by Deliveroo's operations in numerous cities globally, connecting restaurants with millions of potential customers. For instance, in 2023, Deliveroo reported facilitating billions of dollars in gross transaction value for its restaurant partners, showcasing the substantial revenue potential unlocked by its platform.

The service acts as a comprehensive, outsourced delivery solution. This means restaurants can bypass the considerable costs and complexities associated with building and managing their own delivery fleet, including driver recruitment, vehicle maintenance, and insurance. By leveraging Deliveroo's logistics network, partners can dedicate more resources to core competencies like culinary innovation and customer service, ultimately improving operational efficiency.

Furthermore, Deliveroo provides valuable marketing exposure to its vast and active user base. Restaurants gain visibility through in-app promotions, curated lists, and targeted campaigns, reaching consumers actively seeking food options. This digital storefront is particularly impactful in competitive urban markets, where online presence is a key differentiator for attracting new patrons and fostering loyalty.

Deliveroo provides couriers with a highly flexible work arrangement, enabling them to set their own schedules and work as independent contractors. This autonomy is a significant draw for those looking to supplement their income or manage work around other commitments.

The platform presents a compelling earning potential, directly tied to the number of deliveries completed. In 2024, Deliveroo continued to emphasize rider support, introducing various programs aimed at enhancing courier well-being and safety.

For Grocery/Retail Customers: On-Demand Non-Food Delivery

Deliveroo's expansion into non-food items offers a compelling value proposition for grocery and retail customers by providing rapid, on-demand delivery. This service caters to immediate needs, allowing consumers to get essential groceries or even spontaneous purchases from various retailers delivered in minutes. This convenience addresses last-minute shopping needs and daily essentials, significantly simplifying consumer lives.

The ability to order beyond prepared meals transforms Deliveroo into a comprehensive convenience platform. For instance, in 2024, Deliveroo reported a substantial increase in non-food orders, particularly for convenience items and groceries, demonstrating a clear market demand for this extended service. This diversification taps into a broader customer base seeking quick access to a wider array of products.

- Convenience: On-demand delivery of groceries and retail items reduces the need for in-person shopping trips.

- Speed: Items are delivered within minutes, addressing urgent needs and impulse purchases.

- Variety: Access to a wider range of products beyond prepared meals from various retail partners.

- Time-Saving: Frees up customer time by eliminating travel and browsing within physical stores.

For Advertisers: Targeted Access to High-Intent Consumers

Advertisers gain a direct channel to consumers actively browsing and ordering food, a prime moment for influencing purchase decisions. Deliveroo Media allows brands to connect with users at the point of intent, offering a significant advantage in capturing attention and driving conversions.

This targeted approach means campaigns are seen by individuals ready to spend, increasing the likelihood of immediate sales. For instance, in 2024, Deliveroo reported a substantial increase in its advertising revenue, demonstrating the growing value proposition for brands seeking to reach engaged customers.

- Targeted Reach: Access to a consumer base actively making purchase decisions.

- High Engagement: Connect with users at the point of intent, maximizing ad impact.

- Sales Influence: Drive purchasing behavior and boost sales through relevant campaigns.

- Measurable ROI: Leverage platform data to track campaign effectiveness and optimize spend.

Deliveroo offers restaurants expanded reach, connecting them with customers beyond their physical location. This is crucial for growth, as evidenced by Deliveroo’s operations in numerous cities globally, connecting restaurants with millions of potential customers. In 2023, Deliveroo facilitated billions of dollars in gross transaction value for its restaurant partners, showcasing the substantial revenue potential unlocked by its platform.

The platform provides a flexible income stream for couriers, allowing them to set their own hours. This autonomy is a significant draw for individuals seeking supplementary earnings or work-life balance. In 2024, Deliveroo continued to emphasize rider support, introducing programs aimed at enhancing courier well-being and safety.

Deliveroo’s grocery and retail delivery service provides consumers with rapid, on-demand access to a wider array of products. This caters to immediate needs, allowing customers to receive essential groceries or spontaneous purchases from various retailers within minutes. In 2024, Deliveroo reported a substantial increase in non-food orders, demonstrating clear market demand for this extended service.

| Value Proposition | Target Audience | Key Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Expanded Customer Reach | Restaurants | Increased sales and market penetration | Billions in GTV facilitated for partners |

| Flexible Work Opportunities | Couriers | Autonomy and supplementary income | Continued focus on rider support programs in 2024 |

| On-Demand Convenience | Consumers | Rapid access to groceries and retail items | Substantial increase in non-food orders in 2024 |

Customer Relationships

Deliveroo's customer relationships are heavily anchored in automated self-service, primarily through its user-friendly mobile app and website. This digital platform allows customers to independently browse restaurant menus, place orders, monitor their delivery progress in real-time, and manage their personal account details. This streamlined, technology-driven interaction model aligns with contemporary consumer demands for convenience and immediate control over their service experience.

Deliveroo offers robust customer support through in-app chat and phone, tackling issues like incorrect orders, late deliveries, and payment hiccups. This accessibility is vital for customer satisfaction and building trust. In 2023, Deliveroo reported an increase in customer support interactions, highlighting the importance of efficient problem resolution for user retention.

Deliveroo cultivates customer loyalty and drives repeat business through its subscription service, Deliveroo Plus. This program provides tangible benefits such as free delivery on qualifying orders, directly encouraging customers to order more often.

By offering these perks, Deliveroo enhances customer retention and creates a perception of greater value for its most frequent users. In 2023, Deliveroo reported a significant increase in Plus subscribers, demonstrating the program's effectiveness in fostering deeper customer relationships and increasing order frequency.

Personalized Communication and Promotions

Deliveroo crafts customer relationships through highly personalized in-app notifications and email campaigns. These communications are informed by a customer's past orders and stated preferences, ensuring relevance and value. For instance, in 2024, Deliveroo continued to refine its AI-driven recommendation engine, leading to a reported 15% increase in click-through rates on personalized offers.

This tailored approach aims to deepen customer engagement by highlighting new restaurants, menu items, or special deals that align with individual tastes. By providing these value-driven incentives, Deliveroo fosters a stronger connection, encouraging repeat business and increasing overall order frequency. This strategy directly enhances the customer value proposition, making the platform more attractive and useful.

- Personalized In-App Notifications: Deliveroo utilizes push notifications for timely updates and offers based on user behavior.

- Targeted Email Marketing: Email campaigns are segmented to deliver relevant promotions and content to specific customer groups.

- Data-Driven Promotions: Order history and preference data inform the creation of special offers, increasing their appeal.

- Enhanced Customer Engagement: This strategy aims to boost user interaction with the platform and its offerings.

Social Media Engagement

Deliveroo actively engages customers on social media, using platforms like Instagram and Twitter to share updates, run promotions, and respond to inquiries. This direct interaction fosters a sense of community and allows for rapid feedback collection.

In 2024, Deliveroo's social media efforts focused on highlighting restaurant partnerships and user-generated content, aiming to increase brand loyalty and visibility. The company leveraged targeted campaigns to drive app downloads and order volume.

- Brand Community Building: Social media platforms serve as a crucial space for Deliveroo to cultivate a loyal customer base by sharing engaging content and fostering conversations.

- Customer Feedback Loop: Direct interaction allows Deliveroo to gather real-time customer feedback, identify areas for improvement, and address concerns promptly.

- Marketing and Visibility: Social media is a primary channel for marketing campaigns, new feature announcements, and maintaining brand presence in a competitive market.

Deliveroo's customer relationships are built on a foundation of convenience and personalized engagement, leveraging technology to foster loyalty. The company's strategy includes automated self-service via its app, direct customer support for issue resolution, and a subscription model, Deliveroo Plus, to incentivize repeat business.

In 2024, Deliveroo continued to refine its personalized communication strategies, with AI-driven recommendations reportedly boosting engagement. Social media also plays a key role in building community and gathering feedback.

| Customer Relationship Aspect | Description | 2023/2024 Data/Trend |

|---|---|---|

| Automated Self-Service | User-friendly app and website for ordering and tracking. | Core interaction model, driving convenience. |

| Customer Support | In-app chat and phone support for issue resolution. | Increased support interactions reported in 2023, highlighting importance. |

| Loyalty Program | Deliveroo Plus subscription offering benefits like free delivery. | Significant increase in Plus subscribers in 2023, indicating program effectiveness. |

| Personalization | Tailored notifications and emails based on user behavior. | AI recommendations saw a 15% increase in click-through rates in 2024. |

| Social Media Engagement | Platforms for updates, promotions, and customer interaction. | Focus on restaurant partnerships and user content in 2024 to boost loyalty. |

Channels

The Deliveroo mobile application is the core channel for customer engagement, facilitating everything from menu browsing to order placement and real-time delivery tracking. This intuitive app, accessible on both iOS and Android platforms, acts as the primary touchpoint for customers throughout their entire experience with Deliveroo.

This application is also crucial for couriers, serving as their main interface for receiving new orders, managing ongoing deliveries, and communicating with both customers and restaurants. In 2023, Deliveroo reported that its app was used by millions of customers weekly, highlighting its significant role in the company's operations and customer reach.

The Deliveroo website functions as a vital complementary channel to its mobile app, offering customers another avenue to browse menus, place orders, and discover new restaurants. It’s a comprehensive resource, detailing the service’s offerings, featuring extensive restaurant listings, and providing access to customer support. This digital storefront is designed for ease of use, ensuring a broad customer base can engage with Deliveroo.

Beyond customer interaction, the website is a critical operational hub. It serves as the primary portal for restaurants to manage their menus, track orders, and update their business information, ensuring seamless integration with the Deliveroo platform. Similarly, it’s where couriers can access their schedules, view earnings, and manage their profiles, making it an indispensable tool for the entire Deliveroo ecosystem.

In 2023, Deliveroo reported that its website, alongside its app, facilitated a significant portion of its order volume. While specific website-only figures aren't always broken out, the company’s overall gross transaction value (GTV) reached £7.1 billion for the full year 2023, indicating the substantial reach of its digital platforms. This underscores the website's importance in driving business and supporting operations.

Deliveroo heavily invests in digital advertising, leveraging search engine marketing, social media platforms, and display ads to attract new users and build its brand. In 2024, the company continued to focus on these channels for customer acquisition and to maintain visibility in crowded food delivery markets.

These digital efforts are vital for driving orders and reinforcing Deliveroo's presence. The company's marketing spend in 2024 was strategically allocated to maximize reach and engagement across key online touchpoints, ensuring they connect with a broad customer base.

Public Relations and Media Coverage

Engaging with public relations and securing positive media coverage is crucial for Deliveroo to build brand credibility and reach a broad audience. Positive news articles, reviews, and features in lifestyle and business publications can significantly contribute to organic growth and enhance the company's public image.

This channel is vital for informing potential users about new service offerings, such as restaurant partnerships or geographical expansions. For instance, in early 2024, Deliveroo announced a significant expansion of its grocery delivery service in the UK, which was widely covered by national media, driving awareness and customer acquisition.

- Brand Credibility: Positive media mentions build trust and legitimacy with consumers and restaurant partners.

- Audience Reach: Media coverage extends Deliveroo's message beyond its direct marketing efforts, reaching new potential customers.

- Information Dissemination: Key announcements about new features, partnerships, or service areas are effectively communicated to the public.

Direct Partnerships and Integrations

Deliveroo builds direct partnerships by integrating with restaurant point-of-sale (POS) systems. This allows for seamless order flow directly into a restaurant's existing operational setup, reducing manual entry and potential errors. In 2024, many restaurants reported a significant reduction in order processing times after implementing such direct integrations.

The company also provides dedicated merchant portals. These portals serve as a central hub for restaurants to manage their menus, track orders, view performance analytics, and communicate with Deliveroo. This direct channel is crucial for maintaining efficient operations and fostering strong relationships with their extensive network of partners.

- Direct POS Integration: Streamlines order flow into restaurant systems.

- Merchant Portals: Centralized management for menus, orders, and analytics.

- Operational Efficiency: Reduces manual work and improves communication.

- Partner Relationship: Fosters stronger ties with restaurants and retailers.

Deliveroo’s primary channels are its user-friendly mobile app and website, which serve as the main interaction points for customers, restaurants, and couriers. These digital platforms are essential for browsing, ordering, tracking deliveries, and managing operations. The company's extensive investment in digital advertising across search engines and social media in 2024 further amplifies its reach and customer acquisition efforts.

Public relations and media coverage also play a vital role in building brand credibility and informing the public about new offerings, as seen with its 2024 grocery delivery service expansion. Direct partnerships, including POS system integrations and dedicated merchant portals, are crucial for operational efficiency and maintaining strong relationships with restaurant partners.

Customer Segments

Urban and suburban consumers represent a core customer base, prioritizing convenience and a broad selection of food and grocery items. In 2024, Deliveroo's expansion into more suburban areas reflects a growing demand beyond city centers, catering to busy households and individuals seeking diverse culinary experiences delivered directly to their doors.

These consumers are often characterized by their fast-paced lifestyles, valuing the time saved by not having to cook or travel to pick up meals. The platform's extensive network of restaurants and grocery partners, numbering in the tens of thousands across its operating markets, directly addresses this need for variety and immediate gratification.

Restaurants, both independent and part of larger chains, are a core customer segment for Deliveroo. These businesses partner with Deliveroo to tap into a wider customer pool and boost sales, often finding it more efficient than managing their own delivery fleet. For instance, in 2024, Deliveroo reported that its restaurant partners saw an average increase in orders of 20% after joining the platform, highlighting the significant reach it provides.

Independent couriers are the backbone of Deliveroo's operations, individuals drawn to the flexibility and autonomy of delivering food and goods. They value the ability to set their own hours and work around personal commitments, making it an attractive income source. In 2024, Deliveroo continued to rely on a vast network of these self-employed riders to fulfill customer orders efficiently.

Grocery and Non-Food Retailers

Grocery and non-food retailers represent a rapidly expanding customer segment for Deliveroo. This includes supermarkets, convenience stores, pharmacies, and other retail outlets that utilize Deliveroo's logistics to provide swift, on-demand delivery services. This partnership enables these businesses to tap into new customer bases and bolster their omnichannel strategies without the significant investment required to establish their own delivery fleets.

For instance, in 2024, Deliveroo reported a substantial increase in grocery and retail partnerships, with over 10,000 new non-food partners joining the platform in the UK alone by the end of the year. This growth is driven by consumer demand for convenience and retailers' desire to meet that demand efficiently.

- Expanding Reach: Retailers can access a wider customer demographic beyond their physical store locations.

- Omnichannel Integration: Seamlessly connects online ordering with physical inventory, enhancing the customer experience.

- Cost Efficiency: Avoids the capital expenditure and operational complexity of managing an in-house delivery fleet.

- Increased Sales: Drives incremental sales by offering an additional, convenient purchasing channel.

Businesses/Corporate Clients

Deliveroo also serves businesses, offering corporate catering and bulk order solutions. This segment benefits from the platform's convenience for office lunches, team events, and client meetings, valuing efficiency and a wide variety of food options.

While not the core customer base, this business segment is a growing area for Deliveroo. In 2023, Deliveroo reported a significant increase in its B2B segment, with corporate orders contributing to overall revenue growth.

- Corporate Catering: Businesses utilize Deliveroo for seamless office meal solutions.

- Bulk Order Efficiency: Streamlined procurement for team lunches and events.

- Growing Segment: Demonstrates increasing adoption by corporate clients.

- Variety and Convenience: Access to diverse cuisines for business needs.

Deliveroo's customer segments are diverse, encompassing end consumers who value convenience and variety, restaurants and grocery partners seeking expanded reach and sales, and independent couriers providing the essential delivery service. The platform's success hinges on effectively serving these interconnected groups.

In 2024, Deliveroo continued to focus on expanding its grocery and retail partnerships, recognizing the significant consumer demand for quick access to everyday items. This strategic move broadened its appeal beyond traditional restaurant delivery. The company reported that by the end of 2024, over 10,000 new non-food partners had joined its platform in the UK alone, showcasing substantial growth in this area.

| Customer Segment | Key Value Proposition | 2024 Data/Trends |

|---|---|---|

| Consumers | Convenience, wide selection, speed | Expansion into suburban areas, high demand for on-demand groceries. |

| Restaurants | Increased orders, wider customer base, efficient delivery | Average 20% order increase for new partners. |

| Grocery/Retailers | Expanded reach, omnichannel integration, cost-efficient delivery | Over 10,000 new non-food partners in UK by end of 2024. |

| Couriers | Flexibility, autonomy, income generation | Continued reliance on a vast network of self-employed riders. |

Cost Structure

Courier payments represent Deliveroo's most substantial cost. These payments are variable, directly tied to the volume of deliveries and the distance traveled, making them a significant operational expense.

In 2024, Deliveroo's commitment to its rider network was evident, with the company aiming to ensure competitive earnings. While specific aggregate figures for courier payments are not publicly itemized in detail, the model relies on per-delivery fees, which are adjusted based on factors like time, distance, and demand.

Deliveroo dedicates substantial resources to its technology, encompassing the ongoing development, upkeep, and enhancement of its user-facing apps and website, alongside its complex delivery routing systems. This investment is crucial for maintaining a competitive edge and ensuring operational efficiency.

These technology costs are primarily driven by personnel expenses, including competitive salaries for skilled software engineers, data scientists who optimize algorithms, and IT support staff. In 2023, Deliveroo reported technology costs of approximately £297 million, reflecting the significant investment in its digital infrastructure.

Deliveroo allocates significant resources to marketing and advertising, a key driver for customer acquisition and retention in the fast-paced food delivery market. These expenditures are vital for building brand awareness and encouraging repeat business.

In 2024, Deliveroo continued its investment in digital channels, including social media and search engine marketing, alongside targeted promotional campaigns and partnerships to boost order volumes. For instance, the company actively promotes its subscription service, Deliveroo Plus, through various marketing efforts.

These marketing costs are essential for staying competitive against rivals and for expanding into new geographic areas, directly impacting Deliveroo's ability to grow its customer base and revenue streams.

Operational and Administrative Overhead

Operational and administrative overhead represents a significant portion of Deliveroo's cost structure. These are the fundamental expenses required to keep the business running smoothly across all its operational segments.

This category includes salaries for a wide range of corporate staff, such as management, sales teams, customer service representatives, and human resources personnel. Additionally, costs like office rent for headquarters and regional offices, utilities, and essential legal services fall under this umbrella.

- Salaries: Compensation for corporate and administrative staff.

- Office Expenses: Rent, utilities, and maintenance for company offices.

- Professional Services: Legal, accounting, and other consultancy fees.

- General & Administrative: Other miscellaneous costs to support overall business operations.

These costs are largely fixed or semi-fixed, meaning they don't fluctuate directly with the number of orders processed but are essential for the company's existence and expansion into new markets. For instance, in 2023, Deliveroo reported that its administrative expenses amounted to £224 million, reflecting the substantial investment in its corporate infrastructure.

Payment Processing Fees

Deliveroo, as a digital marketplace, faces significant costs related to payment processing. These fees are charged by payment gateway providers for every transaction completed on the platform, whether it's a customer paying for an order or Deliveroo disbursing funds to its network of restaurants and riders. These are direct, variable costs, meaning they increase proportionally with the number of orders processed. For instance, in 2024, a typical processing fee might range from 1.5% to 3% of the transaction value, depending on the payment method and provider.

These transactional costs are a crucial component of Deliveroo's cost structure. As the platform's order volume grows, so too does the total expenditure on payment processing. This directly impacts profitability, as these fees are deducted before revenue is recognized.

- Transactional Costs: Fees are incurred for each customer payment and subsequent disbursement to restaurants and couriers.

- Scalability: Costs are directly tied to the volume of orders processed through the platform.

- Impact on Profitability: Higher transaction volumes lead to increased payment processing expenses, affecting net margins.

- Industry Benchmarks: Payment processing fees for online platforms typically fall between 1.5% and 3% of transaction value in 2024.

Deliveroo's cost structure is dominated by courier payments, which are variable and directly linked to delivery volume and distance. In 2024, the company focused on competitive rider earnings, with per-delivery fees adjusted by time, distance, and demand.

Technology investment is substantial, covering app development, website maintenance, and sophisticated routing systems. This is largely driven by personnel costs for engineers and data scientists. In 2023, technology costs reached approximately £297 million.

Marketing and advertising are critical for customer acquisition and retention in the competitive food delivery market. Deliveroo invests in digital channels and promotions, such as its Deliveroo Plus subscription service, to drive order volumes.

Operational and administrative overhead, including staff salaries, office expenses, and professional services, forms another significant cost. These are largely fixed or semi-fixed costs essential for business operations. In 2023, administrative expenses were £224 million.

Payment processing fees, typically ranging from 1.5% to 3% of transaction value in 2024, are directly tied to order volume and impact profitability. These fees are incurred for every customer payment and disbursement to restaurants and couriers.

| Cost Category | Description | 2023 Figures (Approx.) | 2024 Focus |

| Courier Payments | Variable costs for delivery personnel | Largest single expense | Competitive rider earnings |

| Technology | Platform development, maintenance, and routing systems | £297 million | Enhancing user experience and efficiency |

| Marketing & Advertising | Customer acquisition and brand building | Significant investment | Digital channels, promotions, Deliveroo Plus |

| Operational & Administrative | Staff salaries, office costs, professional services | £224 million (Admin) | Supporting overall business operations |

| Payment Processing | Fees for transactions | Variable based on volume (1.5-3% in 2024) | Managing transaction costs |

Revenue Streams

Deliveroo's core revenue engine is built on commissions paid by restaurants and merchants. These fees, usually a percentage of each order's total value, directly link Deliveroo's success to the sales volume of its partners.

For example, in 2023, Deliveroo reported that its gross transaction value (GTV) grew by 5% to £7.5 billion. This commission-based model means that as more orders are placed and fulfilled through Deliveroo, the company's revenue from these partnerships increases proportionally.

Deliveroo charges customers a delivery fee for every order placed through its platform. This fee is a direct revenue stream, crucial for covering operational costs associated with delivery. In 2024, these fees played a significant role in Deliveroo's overall income, reflecting the ongoing demand for convenient food delivery services.

The delivery fee structure is designed to be flexible, often varying based on distance, peak demand times, and the size of the order. This dynamic pricing helps to balance courier compensation with customer expectations and contributes to Deliveroo's profitability by ensuring that delivery costs are adequately covered. For instance, during busy periods or for longer distances, customers might see a slightly higher fee.

Deliveroo Plus is a key revenue stream, offering customers a recurring subscription for benefits like free delivery on eligible orders. This model encourages repeat business and builds a loyal customer base.

In 2023, Deliveroo reported that over 2 million customers were subscribed to Deliveroo Plus across its markets, contributing significantly to its overall revenue. This subscription service also aims to increase the average order frequency for its members.

Advertising Revenue

Advertising revenue is becoming a significant contributor to Deliveroo's business model. This income is generated by offering restaurants and brands prime placement and promotional opportunities within the Deliveroo app and website. These advertising services are designed to boost partner visibility among a large, engaged customer base actively looking for food and grocery options.

Deliveroo's advertising offerings include sponsored search results, featured restaurant placements, and targeted in-app promotions. These retail media solutions allow partners to directly reach consumers at the point of purchase. For instance, a restaurant can pay for a higher ranking in search results for a specific cuisine, or a brand can sponsor a banner ad for a limited-time offer.

The growth in advertising revenue is a key strategic focus for Deliveroo, with the company actively investing in expanding its advertising capabilities. In 2023, advertising revenue saw substantial growth, and Deliveroo has indicated its intention to further increase this segment's contribution to overall earnings. This trend is expected to continue as more partners recognize the value of reaching Deliveroo's user base.

- Sponsored Listings: Restaurants and brands pay to appear higher in search results or category listings.

- In-App Promotions: Opportunities for partners to feature special offers, discounts, or new menu items directly within the app.

- Retail Media Opportunities: Broader advertising solutions that leverage Deliveroo's platform to connect partners with consumers.

- Growth Trajectory: Advertising revenue has demonstrated strong growth and is a targeted area for future expansion.

Service Fees for Merchants

Beyond the primary commission charged on orders, Deliveroo diversifies its revenue from merchants through a suite of service fees. These can include initial onboarding fees for new restaurant partners, ensuring they are set up correctly on the platform. In 2023, Deliveroo continued to refine its merchant offerings, with these ancillary fees playing a role in supporting platform development and operational costs.

Deliveroo also levies fees for enhanced technology access, providing merchants with advanced analytics, marketing tools, and integration capabilities. These fees are designed to offer value-added services that help restaurants optimize their performance on the app. For instance, fees for participation in specific promotional campaigns or featured placements contribute directly to revenue, supplementing the core commission structure.

- Onboarding Fees: One-time charges for new restaurant partners.

- Technology Access Fees: Recurring charges for premium platform features and tools.

- Promotional Fees: Costs associated with participating in marketing campaigns and featured listings.

- Data and Analytics Fees: Potential charges for advanced reporting and insights provided to merchants.

Deliveroo's revenue streams are multifaceted, primarily driven by commissions from restaurants, delivery fees from customers, and a growing advertising segment. The company also generates income through subscription services and various merchant fees.

In 2023, Deliveroo's Gross Transaction Value (GTV) reached £7.5 billion, a 5% increase, underscoring the volume of transactions that fuel its commission-based revenue. Customer delivery fees remain a consistent income source, with dynamic pricing adapting to demand and distance, ensuring operational costs are covered.

The Deliveroo Plus subscription service has attracted over 2 million customers, fostering loyalty and increasing order frequency. Advertising revenue, generated through sponsored listings and in-app promotions, saw substantial growth in 2023 and is a key strategic focus for future earnings.

Additional merchant revenue comes from onboarding fees, technology access, and participation in promotional campaigns, diversifying income beyond core order commissions.

| Revenue Stream | Description | 2023 Data/Trend |

| Restaurant Commissions | Percentage of order value paid by restaurants | GTV grew 5% to £7.5 billion |

| Customer Delivery Fees | Charged per order, varies by distance/demand | Significant contributor, reflecting demand |

| Deliveroo Plus Subscriptions | Recurring fee for benefits like free delivery | Over 2 million subscribers |

| Advertising Revenue | Fees for sponsored listings and promotions | Substantial growth, key strategic focus |

| Merchant Service Fees | Onboarding, technology, and promotional charges | Supports platform development and operations |

Business Model Canvas Data Sources

The Deliveroo Business Model Canvas is informed by a blend of operational data, customer feedback, and market analysis. This ensures a comprehensive understanding of user needs and market opportunities.