Deliveroo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deliveroo Bundle

Deliveroo operates in a dynamic food delivery market, facing significant pressure from rivals and the bargaining power of both restaurants and consumers. Understanding these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Deliveroo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Deliveroo's dependence on a select group of popular and exclusive restaurants significantly bolsters supplier power. These high-demand establishments, which draw a substantial portion of Deliveroo's customer traffic, are in a strong position to negotiate more favorable terms, potentially including higher commission rates. For instance, in 2023, a significant percentage of Deliveroo's gross transaction value was attributed to its top restaurant partners, giving them considerable leverage.

The bargaining power of couriers is a significant factor for Deliveroo, directly impacting operational costs and service reliability. This power stems from the interplay of delivery service demand, the availability of drivers, and the compensation offered by rival platforms. For instance, in late 2023 and early 2024, many delivery markets experienced a tightening of courier supply due to increased competition and evolving driver preferences, giving existing couriers more leverage.

When demand for deliveries surges, especially during peak seasons or in densely populated areas, and the pool of available couriers is limited, drivers can command better terms. This can translate to higher per-delivery fees or more favorable working conditions, directly increasing Deliveroo's expenses. Deliveroo’s challenge is to offer pay that is attractive enough to retain a robust fleet, with average hourly earnings for UK couriers fluctuating around £10-£13 in early 2024, while still ensuring the platform remains profitable.

The suppliers of essential technology, like cloud services, mapping tools, and payment processors, exert some influence on Deliveroo. These providers are crucial for the platform's smooth operation and ability to grow. For instance, in 2024, the global cloud computing market, a key area for Deliveroo, was projected to reach over $600 billion, indicating the significant scale and importance of these technology partners.

Packaging and Ancillary Service Providers

Suppliers of packaging, marketing, and courier equipment hold some sway over Deliveroo. While individual suppliers might not wield significant power due to fragmented markets, the collective cost of these essential inputs can affect Deliveroo's profitability. For instance, in 2023, the global packaging market was valued at over $1 trillion, indicating the scale of potential expenditure.

Deliveroo mitigates this supplier power by focusing on efficient sourcing and maintaining relationships with multiple vendors. This strategy helps prevent any single supplier from dictating terms. The company's operational efficiency in managing these ancillary services is crucial for controlling costs and maintaining competitive pricing on its platform.

- Fragmented Market: Many suppliers of packaging, marketing, and equipment operate in diverse, non-concentrated markets, limiting individual supplier leverage.

- Cumulative Cost Impact: While individual costs are low, the aggregate expense of these services can impact Deliveroo's overall operating margins.

- Mitigation Strategy: Deliveroo's ability to source from various vendors and optimize procurement processes helps to reduce the bargaining power of these suppliers.

Regulatory and Legal Compliance Services

Deliveroo's reliance on specialized regulatory and legal compliance services grants these suppliers significant leverage. The complex and ever-evolving landscape of labor laws, food safety standards, and data privacy regulations necessitates expert external support. Failure to comply can result in substantial fines and reputational damage, making these services indispensable.

The specialized knowledge required for compliance, such as navigating GDPR or local employment legislation, limits the pool of qualified providers. This scarcity, coupled with the critical nature of their function, strengthens their bargaining position. For instance, in 2023, fines for data breaches in the UK alone reached millions, highlighting the cost of non-compliance and the value of expert guidance.

- Specialized Expertise: Providers offering niche legal and compliance advice for the gig economy or food delivery sectors possess unique skills.

- High Stakes of Non-Compliance: Significant financial penalties and reputational damage are associated with failing to meet regulatory requirements.

- Limited Supplier Pool: The specialized nature of these services restricts the number of capable and trusted providers available to Deliveroo.

Deliveroo's bargaining power with suppliers is influenced by the concentration of its restaurant partners and the critical nature of technology providers. While a fragmented market for ancillary services like packaging offers some mitigation, exclusive restaurant agreements and essential tech infrastructure grant significant leverage to key suppliers.

The platform's dependence on a few high-volume, exclusive restaurant partners means these suppliers can negotiate favorable terms, potentially increasing commission rates. Similarly, essential technology providers, such as cloud services and payment processors, hold sway due to the critical nature of their offerings for Deliveroo's operations and growth. This dynamic underscores the importance of managing these supplier relationships strategically to maintain profitability and service quality.

| Supplier Type | Leverage Factor | Impact on Deliveroo | Example Data (2023/2024) |

|---|---|---|---|

| Exclusive Restaurants | High Customer Traffic Dependence | Potential for higher commission rates | Top partners contributed significantly to GTV in 2023. |

| Technology Providers (Cloud, Payments) | Critical Infrastructure, Market Scale | Influence on service costs and integration terms | Global cloud market projected over $600 billion in 2024. |

| Ancillary Services (Packaging, Marketing) | Fragmented Market, Cumulative Cost | Moderate impact on operating margins | Global packaging market valued over $1 trillion in 2023. |

What is included in the product

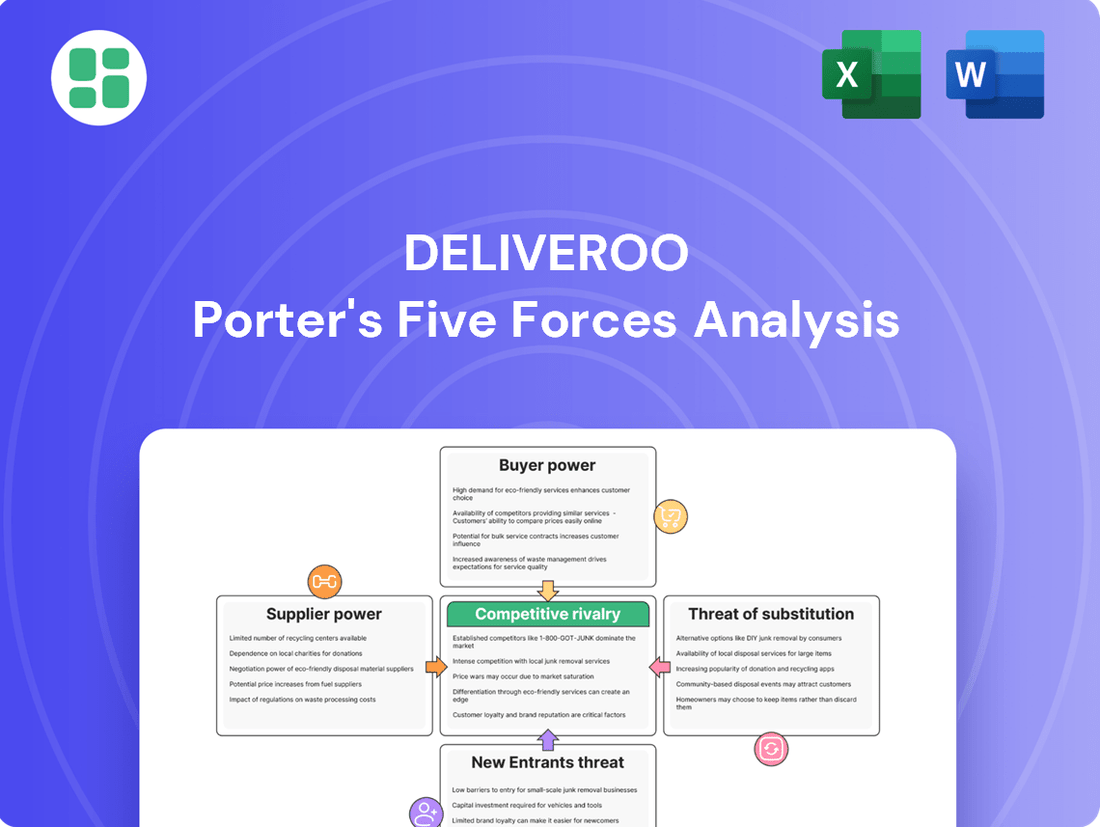

This Porter's Five Forces analysis specifically examines the competitive landscape for Deliveroo, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Customers can easily switch between food delivery services like Deliveroo, Uber Eats, and Just Eat without much hassle. This is because these platforms offer comparable services and a wide selection of restaurants. For instance, a survey in early 2024 indicated that over 70% of users had tried more than one food delivery app in the past year.

This low switching cost means customers have significant power. They can readily move to whichever platform provides the best discounts, quickest delivery times, or their favorite eateries. This flexibility forces Deliveroo to constantly innovate and offer compelling value to keep customers engaged and prevent them from defecting to competitors.

To counter this, Deliveroo must focus on competitive pricing, attractive promotions, and an excellent user experience. In 2023, Deliveroo reported spending significant amounts on marketing and customer acquisition to maintain its market share, highlighting the ongoing pressure from customer choice.

Customers in the food delivery sector often exhibit high price sensitivity, actively seeking out discounts, free delivery options, and loyalty programs. This inclination empowers them to push for greater value, compelling platforms like Deliveroo to frequently implement promotional campaigns. For instance, a significant portion of Deliveroo's marketing spend in 2023 was allocated to customer acquisition and retention through these very offers, impacting their overall profitability.

Customers today have an unprecedented ability to compare options thanks to the proliferation of food delivery platforms. In 2024, the average consumer in major urban centers likely has access to at least three to five different delivery apps, allowing for easy price and service comparisons. This ease of access significantly shifts power towards the customer.

This widespread availability of information means customers can readily check prices, delivery speeds, and restaurant selections across various apps before committing to an order. For instance, a customer might see a 15% price difference for the same meal on Deliveroo versus a competitor, directly impacting their choice. This transparency erodes any informational advantage Deliveroo might hold.

Consequently, Deliveroo's strategy must focus on building loyalty through factors beyond mere price. Unique restaurant partnerships, exclusive deals, or a superior user experience are vital differentiators. In 2024, subscription services offering perks like free delivery became a key battleground for retaining customers in this highly competitive landscape.

Direct Restaurant Ordering Alternatives

Customers can bypass Deliveroo by ordering directly from restaurants, either for pickup or through the restaurant's own delivery services. This direct approach circumvents platform fees, making it an attractive option for budget-conscious consumers or those who value a personal connection with the establishment. For instance, in 2024, a significant portion of restaurant orders, estimated to be around 30-40% in major urban centers, still occurred through direct channels, highlighting the persistent bargaining power of customers.

This direct ordering capability puts pressure on Deliveroo to prove its worth beyond mere delivery logistics. The platform needs to offer compelling advantages such as wider restaurant selection, enhanced user experience, or exclusive deals to retain customers who might otherwise opt for a more economical or direct interaction. In 2024, the average platform fee for restaurants on major delivery services ranged from 15% to 30%, a cost that customers indirectly bear and can avoid through direct orders.

- Direct Ordering as a Cost-Saving Measure: Customers can avoid delivery fees and service charges imposed by platforms like Deliveroo by ordering directly from restaurants.

- Preference for Direct Engagement: Some customers prefer the personal touch and direct communication offered when ordering from a restaurant's own channels.

- Restaurant-Controlled Experience: Restaurants can maintain greater control over their brand and customer service when managing orders directly, potentially leading to higher customer satisfaction.

- Market Share of Direct Orders: In 2024, direct-to-consumer channels accounted for an estimated 35% of all restaurant orders in the UK, demonstrating significant customer leverage.

Customer Reviews and Social Influence

Customer reviews and social media feedback wield considerable power, shaping the perception of platforms like Deliveroo for potential new users. A significant portion of consumers, estimated to be around 80% by some studies, rely on online reviews before making purchasing decisions.

Dissatisfied customers can rapidly disseminate negative experiences across social media, potentially deterring a substantial number of others and directly impacting Deliveroo's brand image. For instance, a surge in negative sentiment on platforms like Twitter or Trustpilot can quickly erode trust.

- Customer reliance on reviews: Over 80% of consumers consult online reviews before purchases.

- Social media impact: Negative feedback spreads rapidly, affecting brand perception.

- Reputation management: High service quality and responsive support are crucial to mitigate negative influence.

Customers possess significant bargaining power in the food delivery market due to low switching costs and readily available alternatives. This allows them to easily move between platforms like Deliveroo, Uber Eats, and others, seeking better deals or wider restaurant selections. In 2024, data indicated that a majority of users had tried multiple delivery apps, underscoring this ease of transition.

The ability to compare prices and services across numerous apps, with many consumers relying on online reviews, further strengthens customer leverage. This transparency compels Deliveroo to continuously offer competitive pricing and promotions. For instance, a notable percentage of Deliveroo's 2023 marketing expenditure was directed towards customer acquisition and retention through discounts, impacting profitability.

Customers can also bypass platforms entirely by ordering directly from restaurants, thereby avoiding service fees. This direct channel accounted for a substantial portion of restaurant orders in 2024, highlighting the persistent pressure on delivery services to demonstrate value beyond mere convenience.

| Factor | Impact on Deliveroo | Customer Action | 2024 Data Point |

|---|---|---|---|

| Low Switching Costs | Increased competition, pressure on pricing | Moving between apps for better deals | >70% of users tried multiple apps in past year |

| Price Sensitivity | Need for discounts and promotions | Seeking out offers and loyalty programs | Significant portion of marketing spend on promotions |

| Direct Ordering Option | Loss of potential revenue, need to justify platform value | Ordering directly from restaurants | ~35% of UK restaurant orders via direct channels |

| Online Reviews & Social Media | Brand perception impact, potential customer deterrence | Sharing feedback, influencing others | ~80% of consumers consult reviews before purchasing |

What You See Is What You Get

Deliveroo Porter's Five Forces Analysis

The document you see here is the complete, ready-to-use Deliveroo Porter's Five Forces Analysis, detailing the competitive landscape of the food delivery industry. What you're previewing is precisely the same professionally formatted and comprehensive document that will be available to you instantly after purchase, offering actionable insights into market dynamics.

Rivalry Among Competitors

The online food delivery sector is a battleground dominated by giants like Uber Eats and Just Eat Takeaway.com, all vying with Deliveroo for dominance. This intense rivalry means constant efforts to win over both hungry customers and restaurant partners, often through significant spending on advertising and securing exclusive deals.

Companies in this space are locked in a perpetual race to innovate, frequently introducing new features or improving their app technology to gain an edge. For instance, in 2024, major players continued to invest heavily in AI for personalized recommendations and optimized delivery routes, a key differentiator in a crowded market.

The underlying economics of digital platforms, characterized by high initial setup costs but relatively low costs for each additional delivery, further fuel this aggressive competition. This structure encourages players to scale rapidly and capture market share, often at the expense of immediate profitability, making the competitive landscape particularly challenging.

Competitors in the food delivery market, including Deliveroo, frequently engage in intense price wars. This often involves offering significant discounts, free delivery promotions, and attractive loyalty programs to capture and keep customers. For instance, in 2024, many platforms saw increased promotional spending to gain market share.

This aggressive pricing strategy, while a boon for consumers, directly impacts the profitability of all companies involved. The constant need to offer competitive deals puts substantial pressure on profit margins, making it a continuous challenge to maintain financial health while participating in these price battles.

The fight for exclusive restaurant partnerships is a major battleground for food delivery services like Deliveroo. By securing exclusive deals, platforms can stand out from the crowd and attract more customers. Deliveroo, for instance, focuses on nurturing strong ties with its restaurant partners to keep them from exclusively listing with rivals or launching their own delivery operations.

This intense rivalry means companies are competing on more than just delivery speed; they're offering attractive commission structures and robust support services to win over restaurants. In 2023, for example, the global online food delivery market was valued at over $150 billion, highlighting the immense stakes involved in securing these crucial partnerships.

Technological Innovation and User Experience

Competitive rivalry in the food delivery sector is intensely fueled by relentless technological innovation and a paramount focus on user experience. Companies like Deliveroo are locked in a perpetual race to refine app functionalities, optimize delivery routes through advanced logistics, and elevate customer service through cutting-edge technology. This constant push for improvement aims to attract and retain users by offering the most seamless interface, the quickest delivery times, and the most dependable service available. For instance, in early 2024, Deliveroo continued to invest in AI-powered demand forecasting to improve delivery efficiency, a critical factor for user satisfaction.

The drive for superior user experience translates into significant investment in research and development. Deliveroo, along with its competitors, must continually enhance its digital platform to stay ahead. This includes developing features that simplify ordering, provide real-time tracking, and offer personalized recommendations. The ability to deliver on these fronts directly impacts market share and customer loyalty, making innovation not just a competitive advantage but a necessity for survival in this dynamic market.

Key areas of innovation and user experience focus include:

- App Interface and Functionality: Streamlining the ordering process, improving search capabilities, and integrating payment options seamlessly.

- Delivery Logistics: Utilizing AI and data analytics for more efficient route planning, driver allocation, and estimated delivery times.

- Customer Service Technology: Implementing chatbots for instant support, proactive issue resolution, and personalized communication channels.

- Restaurant Partner Tools: Providing advanced dashboards for restaurants to manage orders, track performance, and optimize their offerings on the platform.

Geographic Expansion and Market Penetration

Competitive rivalry in the food delivery sector is fierce, with companies like Deliveroo constantly vying for market share through aggressive geographic expansion and deeper penetration into existing territories. This push involves substantial outlays on marketing campaigns, attracting and retaining a reliable courier network, and onboarding new restaurant partners. For instance, Deliveroo's expansion efforts in 2024 continued to target new urban centers across Europe and Asia, aiming to build density and operational efficiency.

This relentless expansion directly fuels the intensity of competition. Rivals are simultaneously investing in similar strategies, leading to increased marketing spend and higher operational costs across the board. The drive to secure prime territories and achieve critical mass in key markets means that profitability can be significantly impacted as companies battle for customer and restaurant loyalty. In 2023, the food delivery market saw continued consolidation and strategic investments, with companies prioritizing growth in underserved regions.

- Intensified Competition: Competitors are actively expanding into new cities and regions, increasing rivalry.

- Investment Demands: Expansion requires significant investment in marketing, couriers, and restaurant onboarding.

- Market Density Focus: Capturing new territories and achieving higher market density is a key strategic driver.

- Profitability Impact: The race for market share directly affects the profitability and strategic direction of all players.

The competitive rivalry within the online food delivery sector is exceptionally high, with major players like Uber Eats and Just Eat Takeaway.com constantly challenging Deliveroo. This intense competition necessitates significant investment in marketing, promotions, and securing exclusive restaurant partnerships to attract and retain both customers and food providers. In 2024, companies continued to focus on differentiating through technology, such as AI-driven personalization and optimized delivery logistics, to gain a competitive edge in a saturated market.

Price wars are a common tactic, with discounts and free delivery offers frequently deployed to capture market share, impacting profit margins for all participants. For instance, many platforms increased promotional spending in 2024 to gain an advantage. This dynamic environment also sees a strong emphasis on technological innovation and enhancing user experience, from app functionality to delivery efficiency, as crucial differentiators.

| Competitor | Key Competitive Tactics (2024 Focus) | Market Share (Approximate Global - Q1 2024) |

|---|---|---|

| Uber Eats | Aggressive promotions, exclusive partnerships, technological integration | ~25% |

| Just Eat Takeaway.com | Geographic expansion, loyalty programs, diversified offerings | ~20% |

| Deliveroo | Focus on premium restaurants, technological innovation, customer experience | ~15% |

SSubstitutes Threaten

Home cooking and personal meal preparation represent a significant threat to food delivery services like Deliveroo. This fundamental substitute offers consumers cost savings and precise control over ingredients, appealing to budget-conscious individuals and those with specific dietary requirements. For example, in 2024, inflation continued to put pressure on household budgets, making the perceived value of preparing meals at home even more attractive compared to the bundled cost of delivery and restaurant markups.

Economic shifts, such as a potential recession or a sustained period of high inflation, could further bolster the appeal of home cooking. Additionally, a growing societal emphasis on health and wellness can drive consumers towards preparing their own meals, allowing for transparency in sourcing and preparation methods. Deliveroo’s strategy must therefore continually emphasize its unique value proposition of convenience and an extensive variety of culinary options to effectively compete against this deeply ingrained consumer behavior.

Customers can always choose to dine in at restaurants or pick up their meals directly, bypassing delivery fees and the associated costs. This direct engagement with restaurants offers an alternative that can be both more economical and socially engaging for many consumers.

The appeal of dining out or the straightforward convenience of takeaway remains strong, presenting a significant substitute for food delivery services. For instance, in 2024, a substantial portion of consumers continued to prioritize in-person dining experiences, with restaurant industry reports indicating a robust recovery in dine-in traffic post-pandemic.

Deliveroo's core value proposition centers on saving customers time and offering exceptional convenience. However, when the cost savings and social elements of dining in or picking up become more attractive, the threat of these substitutes intensifies, potentially impacting Deliveroo's market share and order volumes.

The increasing prevalence of quick grocery delivery services presents a significant threat of substitutes for Deliveroo. These services allow consumers to purchase ingredients for home cooking, often with delivery times comparable to those of prepared meals from restaurants. This offers an alternative way for customers to satisfy their hunger needs, bypassing the need for a restaurant delivery platform altogether.

Subscription Meal Kit Services

Subscription meal kit services like HelloFresh and Gousto present a significant threat of substitution for Deliveroo. These services offer pre-portioned ingredients and recipes, catering to consumers who desire the convenience of home cooking without the hassle of meal planning and grocery shopping. This directly competes with Deliveroo's core offering of restaurant-prepared meals delivered to the door.

The appeal of meal kits lies in their ability to provide a home-cooked experience with minimal effort, a factor that can draw customers away from ordering takeout. For instance, HelloFresh reported delivering over 100 million meals globally in 2023, highlighting the substantial market penetration of such services.

Deliveroo must therefore focus on differentiating its value proposition by emphasizing its strengths in instant gratification and a wider variety of cuisines and restaurant choices, elements that meal kit services may struggle to replicate consistently. The speed of delivery and the ability to choose from a vast array of established restaurant brands offer a distinct advantage.

- Convenience Factor: Meal kits offer convenience through pre-portioned ingredients, reducing prep time for home cooks.

- Home-Cooked Appeal: They cater to consumers seeking the satisfaction of preparing a meal at home.

- Market Growth: The global meal kit delivery services market was valued at approximately $15 billion in 2023 and is projected to grow significantly.

- Deliveroo's Counter: Deliveroo can leverage its speed, wider restaurant selection, and immediate availability to counter this substitution threat.

Direct Restaurant Delivery Channels

Many restaurants, especially larger chains or well-established local businesses, operate their own delivery or efficient takeaway services. This direct channel allows customers to bypass third-party platforms, often saving on commission fees that companies like Deliveroo charge. For instance, in 2024, a significant percentage of independent restaurants reported maintaining their own delivery drivers to control costs and customer experience.

Deliveroo faces a constant challenge to demonstrate its added value beyond simple order aggregation. Its ability to offer superior logistics, a wider customer base, and effective marketing support is crucial for restaurants to see it as a necessary partner rather than a costly intermediary. The threat intensifies when restaurants can achieve comparable or better delivery times and customer satisfaction through their own means.

- In-house Delivery: Restaurants with established logistics can offer direct ordering, avoiding platform commissions.

- Cost Savings: Customers may opt for direct ordering to secure lower prices by cutting out third-party fees.

- Customer Control: Direct channels allow restaurants to manage the entire customer experience, from order to delivery.

- Competitive Pressure: Deliveroo must continually innovate its services to remain attractive against direct restaurant operations.

The threat of substitutes for Deliveroo is multifaceted, ranging from the fundamental act of home cooking to the rise of meal kit services and direct restaurant offerings. These alternatives often present cost advantages or a different kind of convenience, directly challenging Deliveroo's market position.

Home cooking remains a powerful substitute, especially when economic pressures like inflation, which remained a concern in 2024, make it a more attractive financial option. Similarly, quick grocery delivery services that enable home cooking also compete by offering ingredients with delivery times that can rival prepared meals.

Meal kit services, such as HelloFresh, which delivered over 100 million meals globally in 2023, offer a blend of convenience and the home-cooking experience, directly siphoning demand from food delivery platforms. Furthermore, restaurants increasingly leverage their own delivery or takeaway services, allowing customers to bypass third-party fees and potentially enjoy lower prices, a trend observed with many independent restaurants maintaining in-house drivers in 2024.

| Substitute Category | Key Appeal | 2023/2024 Relevance |

|---|---|---|

| Home Cooking | Cost savings, ingredient control | Heightened by 2024 inflation concerns |

| Quick Grocery Delivery | Enables home cooking, fast ingredient access | Growing market segment |

| Meal Kit Services | Convenience, home-cooked experience | HelloFresh delivered over 100M meals in 2023 |

| Direct Restaurant Delivery/Takeaway | Avoids third-party fees, potentially lower prices | Many restaurants maintained in-house drivers in 2024 |

Entrants Threaten

Establishing a food delivery platform like Deliveroo demands significant upfront capital. Think about the costs for developing and maintaining sophisticated app technology, running extensive marketing campaigns to attract both customers and restaurants, building and managing a reliable network of delivery riders, and the operational expenses of onboarding new restaurant partners. For instance, in 2024, the cost of developing a feature-rich food delivery app can range from $50,000 to $150,000 or even more, depending on complexity and customization.

These substantial financial requirements act as a major barrier for new companies looking to enter the market. Potential competitors must be prepared to invest heavily to create the necessary infrastructure and achieve the scale needed to go head-to-head with established giants like Deliveroo. This high barrier to entry naturally discourages many aspiring players, thus protecting existing market participants.

Deliveroo, like other major food delivery platforms, benefits significantly from strong network effects. A wider selection of restaurants on its platform naturally draws in more customers, and a larger customer base, in turn, attracts more delivery riders. This creates a self-reinforcing cycle that is difficult for new entrants to replicate.

New competitors face a substantial hurdle in achieving the critical mass necessary to compete effectively. They lack the immediate variety of restaurant partners and the established network of couriers that Deliveroo and its peers have cultivated over time. For instance, as of early 2024, Deliveroo operates in numerous markets, boasting partnerships with tens of thousands of restaurants and a vast network of riders.

This entrenched advantage makes it challenging for newcomers to gain traction. Building a comparable restaurant selection and courier fleet from scratch requires immense capital investment and time, often proving too slow to outpace the growth of incumbents who already benefit from established user loyalty and operational efficiencies.

Incumbent food delivery companies like Deliveroo have poured significant capital into establishing robust brand identities and cultivating customer loyalty. This is achieved through reliable service delivery and sustained marketing efforts, making it challenging for newcomers to replicate this established trust and recognition. For instance, in 2024, major players continued to allocate substantial portions of their revenue to marketing campaigns aimed at retaining and attracting customers within a highly competitive landscape.

Regulatory and Legal Complexities

The food delivery sector faces a growing web of regulations, impacting new entrants significantly. These include rules around gig worker classification, food safety standards, and data protection, all of which add to initial setup and ongoing operational costs. For instance, in the UK, ongoing debates about rider status continue, potentially leading to increased labor costs for platforms if workers are reclassified as employees.

Navigating this intricate regulatory environment can be a major hurdle for newcomers. Compliance demands, such as adhering to GDPR for customer data or specific food handling regulations, require substantial investment in legal counsel and operational adjustments. Established companies like Deliveroo have existing infrastructure and expertise to manage these complexities, giving them an advantage over nascent competitors who may face unexpected delays or cost overruns.

The threat of new entrants is thus tempered by these regulatory and legal complexities:

- Compliance Costs: New players must budget for legal fees and operational changes to meet evolving regulations.

- Operational Delays: Obtaining necessary licenses and approvals can slow down market entry.

- Competitive Disadvantage: Incumbents with established compliance frameworks are better positioned to absorb these costs.

Economies of Scale in Logistics and Operations

The threat of new entrants in the food delivery market is significantly dampened by the substantial economies of scale enjoyed by established players like Deliveroo. These incumbents have honed their logistics networks, achieving lower per-delivery costs through optimized routing and efficient fleet management. For instance, Deliveroo's ability to manage a vast network of riders allows for greater density in delivery zones, reducing travel time and fuel expenses.

Newcomers would struggle to replicate this cost advantage without achieving comparable operational volume and making considerable upfront investments. The sheer scale of operations allows Deliveroo to spread fixed costs, such as technology development and marketing, across a much larger number of orders. This inherent cost barrier makes it difficult for nascent competitors to offer prices that are competitive while maintaining profitability.

- Economies of Scale: Deliveroo benefits from reduced per-unit costs due to its large operational volume in logistics and marketing.

- Logistical Efficiency: Optimized delivery routes and fleet management by Deliveroo lead to lower operational expenses.

- Investment Barrier: New entrants require significant capital to match Deliveroo's established infrastructure and achieve similar cost efficiencies.

- Data Leverage: Incumbents utilize data analytics to further improve service and reduce costs, creating an ongoing competitive advantage.

The threat of new entrants for Deliveroo is considerably low due to the immense capital required to establish a competitive platform. Building the necessary technology, marketing, and logistics infrastructure demands millions, a barrier that deters most aspiring companies. For example, in 2024, the cost of developing a robust food delivery app alone can range from $50,000 to $150,000, not including ongoing operational expenses.

Furthermore, established players like Deliveroo benefit from strong network effects, where a larger user base attracts more restaurants and riders, creating a virtuous cycle that is difficult for newcomers to break into. As of early 2024, Deliveroo's extensive network, serving tens of thousands of restaurants across numerous markets, highlights this entrenched advantage.

Regulatory hurdles and the need for significant brand building also contribute to the low threat of new entrants. New companies must invest heavily in legal compliance and marketing to gain customer trust and recognition, a challenge that incumbents have already overcome.

| Factor | Impact on New Entrants | Deliveroo's Advantage |

|---|---|---|

| Capital Investment | Very High | Established infrastructure, economies of scale |

| Network Effects | Difficult to Achieve | Large customer and restaurant base, extensive rider network |

| Brand Recognition | Challenging to Build | Strong brand loyalty and marketing presence |

| Regulatory Compliance | Costly and Complex | Existing expertise and infrastructure to manage compliance |

Porter's Five Forces Analysis Data Sources

Our Deliveroo Porter's Five Forces analysis is built upon a foundation of diverse data, including Deliveroo's financial reports, competitor filings, and industry-specific market research from firms like Statista and IBISWorld. We also incorporate regulatory updates and macroeconomic data to capture the broader industry landscape.