Delhivery Logistics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delhivery Logistics Bundle

Delhivery's logistics prowess is undeniable, leveraging its extensive network and technology to dominate India's e-commerce fulfillment. However, understanding the nuances of its operational efficiencies and potential market saturation is crucial for any investor or strategist.

Want the full story behind Delhivery's strengths, competitive challenges, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Delhivery's strength lies in its extensive integrated service portfolio, covering everything from express parcel delivery to heavy goods, PTL, FTL, warehousing, and freight. This broad range allows them to serve a wide array of industries and client needs, acting as a single point of contact for complex logistics. For instance, in Q4 FY24, Delhivery reported a revenue of ₹2,168 crore, showcasing the scale of their operations across these diverse services.

Delhivery boasts an impressive Pan-India network, reaching over 18,700 pin codes across the country. This extensive geographical coverage is a key strength, allowing the company to efficiently serve both urban and remote locations. Its robust infrastructure supports a broad customer base and ensures timely deliveries nationwide.

Delhivery’s commitment to advanced technology is a significant strength. They utilize real-time tracking, automated sorting, and sophisticated data analytics to streamline their logistics. This technological backbone directly translates into operational efficiency and improved service for their customers.

The company’s forward-thinking investment in innovation, such as exploring electric vehicles and drone deliveries, positions them for future growth and sustainability. These advancements not only enhance operational efficiency and cost reduction but also bolster service reliability, a key differentiator in the competitive logistics landscape.

Strong Market Leadership and Growing Market Share

Delhivery stands as a formidable leader in India's logistics landscape, boasting a substantial market share within the express parcel segment. This strong market position is a testament to its integrated service offerings and operational efficiencies.

The company's growth trajectory is further bolstered by strategic initiatives, including acquisitions that enhance its scale and reach. For instance, the acquisition of Ecom Express significantly expanded Delhivery's network and customer base, reinforcing its competitive edge and solidifying its leadership. This expansion allows Delhivery to leverage economies of scale, translating into more competitive pricing for its services.

- Dominant Market Share: Delhivery commands a significant portion of the Indian express logistics market, demonstrating its leadership.

- Integrated Logistics: As a fully integrated provider, it offers end-to-end solutions, enhancing customer value.

- Strategic Acquisitions: Past acquisitions, like Ecom Express, have been pivotal in expanding volume and market presence.

- Economies of Scale: The company's size enables cost efficiencies, allowing for competitive pricing strategies.

Improving Financial Performance and Profitability

Delhivery has achieved a significant financial turnaround, marking its first profitable fiscal year in FY25 with a net profit of ₹162 crore. This represents a substantial improvement from its prior loss-making periods, showcasing effective financial management and strategic execution.

The company has maintained consistent profitability on a quarter-on-quarter basis throughout FY25. This sustained performance highlights the success of its operational efficiency drives and cost optimization measures, leading to improved financial health.

Delhivery's EBITDA margins have also seen a notable increase, reflecting better operational leverage and pricing power. This financial strength is a key advantage, enabling further investment and growth.

- Maiden Profitability: Achieved ₹162 crore net profit in FY25.

- Consistent Performance: Demonstrated quarter-on-quarter profitability in FY25.

- Margin Improvement: Showcased enhanced EBITDA margins.

- Cost Management: Effective strategies contributing to improved profitability.

Delhivery's extensive Pan-India network, covering over 18,700 pin codes, is a significant strength, enabling efficient service across diverse geographies. Their integrated service portfolio, from express parcels to heavy goods and warehousing, caters to a wide range of customer needs, as evidenced by their Q4 FY24 revenue of ₹2,168 crore. The company's commitment to technology, including real-time tracking and data analytics, drives operational efficiency and customer satisfaction.

| Strength Area | Description | Supporting Data/Fact |

|---|---|---|

| Network Reach | Extensive Pan-India presence | Covers over 18,700 pin codes |

| Service Integration | End-to-end logistics solutions | Express parcel, PTL, FTL, warehousing |

| Technological Advancement | Leverages advanced logistics tech | Real-time tracking, data analytics |

| Market Leadership | Dominant share in express parcel | Strong market position |

| Financial Performance | Achieved profitability | ₹162 crore net profit in FY25 |

What is included in the product

Delivers a strategic overview of Delhivery Logistics’s internal and external business factors, highlighting its strengths in network reach and technology, weaknesses in profitability, opportunities in e-commerce growth, and threats from competition and regulatory changes.

Uncovers critical operational weaknesses and market threats to proactively address delivery bottlenecks and competitive pressures.

Weaknesses

Delhivery has historically grappled with thin profit margins, a common trait in the logistics industry. While the company showed a significant turnaround in FY25, achieving profitability remains an ongoing hurdle in this cost-sensitive and competitive landscape.

Operating profit margins have experienced volatility, underscoring the persistent pressures Delhivery faces. For instance, while specific FY25 margin figures are still emerging, the company's Q4 FY24 operating EBITDA margin stood at 5.1%, a notable improvement but still reflecting the industry's inherent margin constraints.

Delhivery's operations are inherently cost-intensive, with significant expenses tied to fuel, a large workforce, and maintaining its extensive network of vehicles and fulfillment centers. For instance, in the fiscal year ending March 31, 2024, Delhivery reported a substantial portion of its revenue being consumed by operating expenses, reflecting the capital-heavy nature of the logistics sector.

Fluctuations in global and domestic fuel prices directly impact Delhivery's bottom line, as transportation is a core component of its service delivery. Similarly, the increasing cost of labor in India, driven by demand and inflation, adds another layer of pressure on their operational budget, potentially squeezing profit margins if these costs cannot be passed on or offset through efficiency gains.

Delhivery faces a crowded marketplace, with established giants like Blue Dart and DTDC, alongside agile, tech-focused startups, constantly vying for market share. This intense rivalry often translates into price wars, squeezing profit margins and demanding relentless efficiency. For instance, in the fiscal year ending March 31, 2024, the Indian logistics sector saw significant investment in technology, further intensifying this competitive pressure as players raced to offer faster, more integrated services.

Dependency on E-commerce Sector Growth

Delhivery's substantial dependence on the e-commerce sector for a significant portion of its revenue is a key weakness. While e-commerce growth has been a powerful engine, any deceleration in this market, shifts in consumer purchasing habits, or alterations in the business approaches of major online retailers could directly affect Delhivery's shipment volumes and overall financial health.

This reliance means that external factors impacting online retail, such as economic downturns or increased competition, can disproportionately influence Delhivery's performance. For instance, if e-commerce growth moderates from its high double-digit rates seen in previous years, Delhivery's revenue expansion could be constrained.

- Revenue Concentration: A large percentage of Delhivery's revenue is tied to e-commerce players, making it susceptible to their performance.

- Market Sensitivity: The company's fortunes are closely linked to the health and growth trajectory of the online retail industry.

- Client Strategy Impact: Changes in the logistics strategies of its major e-commerce clients could lead to reduced volumes for Delhivery.

Challenges with India's Infrastructure Gaps

Despite substantial investments, India's logistics infrastructure continues to present significant hurdles for companies like Delhivery. Poor road conditions in many areas, coupled with pervasive urban congestion, directly translate into longer transit times and unpredictable delivery schedules. For instance, average truck speeds in India can be as low as 15-20 kmph in congested corridors, a stark contrast to more developed logistics networks.

These infrastructural deficits, including a fragmentation of warehousing facilities, directly impact Delhivery's operational efficiency. Delays caused by poor road networks and traffic bottlenecks increase fuel consumption and driver hours, thereby raising operational costs. This can erode profit margins and affect the quality of service, particularly in regions where these challenges are most pronounced.

- Road Quality: Many Indian roads remain underdeveloped, leading to slower transit speeds and increased wear and tear on vehicles.

- Urban Congestion: Major cities experience severe traffic congestion, significantly extending delivery times within urban areas.

- Fragmented Warehousing: The lack of modern, integrated warehousing facilities across the country adds complexity and cost to storage and distribution.

- Impact on Costs: These combined factors contribute to higher operational expenses and can negatively affect Delhivery's service level agreements.

Delhivery's profitability remains a persistent challenge, with thin operating margins characteristic of the competitive logistics sector. While the company achieved profitability in FY25, maintaining this in a cost-sensitive environment is an ongoing effort, exemplified by a Q4 FY24 operating EBITDA margin of 5.1%.

The company's operations are inherently cost-intensive, burdened by significant expenses for fuel, labor, and its extensive network. For instance, in FY24, a substantial portion of revenue was consumed by operating costs, highlighting the capital-heavy nature of logistics.

A key vulnerability is Delhivery's heavy reliance on the e-commerce sector for revenue. Any slowdown in online retail growth or shifts in major online retailers' strategies could directly impact shipment volumes and financial stability, as seen with moderating e-commerce growth rates.

Infrastructural limitations in India, such as poor road quality and urban congestion, lead to longer transit times and unpredictable deliveries. These issues contribute to higher operational expenses and can negatively affect service quality, with average truck speeds in India sometimes as low as 15-20 kmph in congested areas.

Preview Before You Purchase

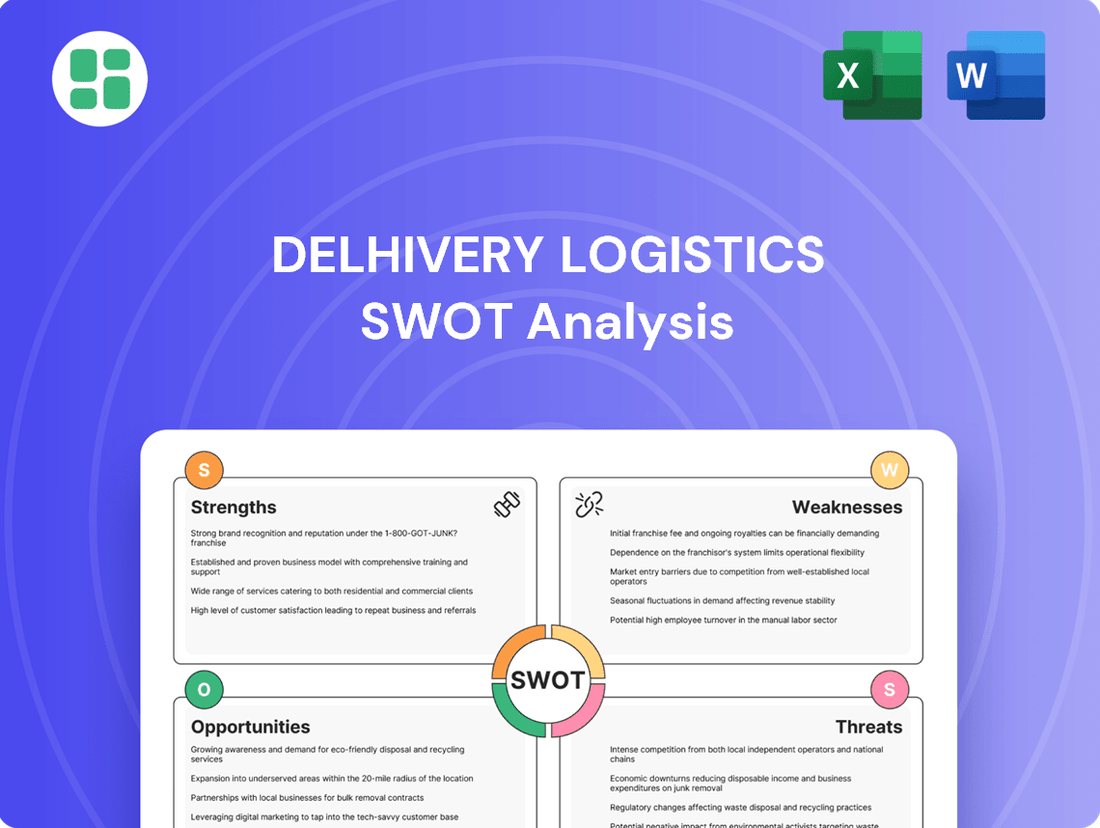

Delhivery Logistics SWOT Analysis

The preview you see is the actual Delhivery Logistics SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report covers Delhivery's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning. Purchase unlocks the entire in-depth version, ready for your immediate use.

Opportunities

The Indian e-commerce logistics market is experiencing a significant boom, with projections indicating continued robust expansion. This growth is fueled by increasing internet access across the nation, a rise in disposable incomes, and the ever-growing popularity of online shopping, including the surge of direct-to-consumer (D2C) brands. For Delhivery, this presents a prime opportunity to broaden its service offerings, attract new clients, and handle a greater volume of shipments across its diverse business segments.

Delhivery is strategically eyeing expansion into new geographies, aiming to penetrate Tier 2 and Tier 3 cities across India, a move that could unlock significant growth potential in underserved markets. By 2025, the company has set an ambitious target to enter approximately 50 new international markets, diversifying its revenue streams and reducing reliance on its domestic operations.

Furthermore, Delhivery is capitalizing on opportunities within specialized logistics segments that are experiencing robust demand. This includes expanding its footprint in cold chain logistics, crucial for the pharmaceutical and food industries, and enhancing its capabilities in rapid commerce delivery, catering to the fast-paced needs of e-commerce businesses.

Delhivery can significantly boost its operational efficiency by further integrating advanced technologies like AI and IoT. For instance, AI-powered route optimization can lead to substantial fuel savings and faster delivery times, crucial in the competitive Indian logistics market. In 2023, Delhivery reported a 15% improvement in delivery times through enhanced network planning, a trend expected to continue with deeper tech adoption.

Strategic Partnerships and Acquisitions for Network Enhancement

Delhivery's strategic pursuit of partnerships and acquisitions is a key opportunity for network expansion. For instance, their collaboration with Teamglobal Logistics bolsters cross-border capabilities, while integrating RapidShyp enhances last-mile and reverse logistics operations. These moves are designed to broaden service portfolios and reach.

The company's strategy includes actively seeking further alliances and acquisitions to solidify its market position. The successful integration of volumes from entities like Ecom Express demonstrates this approach, aiming to consolidate market share and boost overall operational strengths. This ongoing consolidation is crucial for competitive advantage in the evolving logistics landscape.

- Expanded Service Reach: Partnerships like Teamglobal Logistics enable entry into new international markets.

- Enhanced Last-Mile Delivery: Acquisitions such as RapidShyp strengthen capabilities in crucial delivery segments.

- Market Consolidation: Integrating volumes from competitors like Ecom Express increases Delhivery's market share.

- Synergistic Growth: Strategic alliances offer opportunities for shared resources and operational efficiencies.

Favorable Government Initiatives and Infrastructure Push

Government initiatives are a significant tailwind for Delhivery. The PM Gati Shakti National Master Plan, launched in 2021, aims to build world-class infrastructure and reduce logistics costs, which are currently around 13% of India's GDP. This focus on integrated planning and infrastructure development directly benefits logistics providers by improving connectivity and operational efficiency.

The National Logistics Policy, introduced in 2022, further supports the sector by focusing on streamlining processes, promoting technology adoption, and reducing overall logistics costs. The government's target is to bring down logistics costs to below 10% of GDP by 2030, a move that would substantially boost the profitability and growth potential of companies like Delhivery.

These policy supports and investments in infrastructure development create a more conducive environment for logistics companies like Delhivery to operate and expand. For instance, the planned expansion of national highways and dedicated freight corridors will enhance the speed and reliability of goods movement, directly impacting Delhivery's service delivery capabilities and market reach.

Key aspects of these initiatives include:

- PM Gati Shakti: Aims to integrate infrastructure development across various ministries, reducing transit times and logistics costs.

- National Logistics Policy: Focuses on improving logistics efficiency, promoting digitalization, and reducing the cost of logistics as a percentage of GDP.

- Infrastructure Investment: Significant government spending on road, rail, and port infrastructure directly enhances the operational environment for logistics firms.

- Reduced Costs: The ultimate goal is to lower India's logistics costs, making the sector more competitive and profitable.

Delhivery is well-positioned to capitalize on the burgeoning Indian e-commerce market, with projections indicating continued strong growth driven by increased digital penetration and rising consumer spending. The company's expansion into Tier 2 and Tier 3 cities, alongside its strategic push into international markets by 2025, offers significant avenues for revenue diversification and market share expansion.

The company's focus on specialized logistics, such as cold chain and rapid commerce, aligns with high-demand sectors, promising increased service uptake. Furthermore, strategic partnerships and acquisitions, like those with Teamglobal Logistics and RapidShyp, are enhancing Delhivery's service portfolio and operational reach, consolidating its market position.

Government initiatives, including the PM Gati Shakti National Master Plan and the National Logistics Policy, are creating a favorable ecosystem by focusing on infrastructure development and cost reduction. These policies aim to decrease logistics costs as a percentage of India's GDP, directly benefiting Delhivery's efficiency and profitability.

| Opportunity Area | Key Driver | Delhivery's Strategic Action | Potential Impact |

|---|---|---|---|

| E-commerce Growth | Rising internet penetration, increased disposable income | Broadening service offerings, attracting new clients | Increased shipment volumes and revenue |

| Geographic Expansion | Underserved Tier 2/3 cities, international markets | Targeting 50 new international markets by 2025 | Revenue diversification, reduced domestic dependency |

| Specialized Logistics | Demand in pharma, food, and rapid commerce | Expanding cold chain and rapid delivery capabilities | Capturing high-growth niche markets |

| Technology Integration | AI, IoT for efficiency | AI-powered route optimization, enhanced network planning | Improved delivery times, fuel savings, operational efficiency |

| Partnerships & Acquisitions | Network expansion, service enhancement | Collaborations with Teamglobal, acquisition of RapidShyp | Broader service portfolio, strengthened last-mile delivery |

| Government Initiatives | PM Gati Shakti, National Logistics Policy | Leveraging infrastructure development, policy support | Reduced logistics costs, improved operational environment |

Threats

An economic slowdown in India, a key market for Delhivery, poses a significant threat. Should consumer spending contract, demand for logistics services, a direct reflection of economic activity, will likely decline, impacting Delhivery's top line. For instance, India's GDP growth, while robust, has seen projections adjusted; the IMF's October 2024 forecast for FY25 was 6.3%, a slight moderation from earlier expectations, indicating a sensitivity to global economic headwinds.

Persistent inflation, especially in fuel and labor, presents another challenge. These are direct operating costs for Delhivery. If the company cannot effectively pass on these rising expenses through price adjustments, its profit margins could be significantly squeezed. In 2024, India experienced fluctuating inflation rates, with CPI hovering around 5-6%, impacting input costs across various sectors, including transportation.

The Indian logistics sector is a crowded space, with established companies and emerging players constantly battling for dominance. This fierce competition puts pressure on companies like Delhivery to offer competitive pricing, potentially triggering price wars that could erode profit margins.

For instance, in the fiscal year 2024, the Indian logistics market was estimated to be worth over $200 billion, with numerous small and medium-sized enterprises alongside larger entities. This intense landscape means Delhivery must remain agile and cost-efficient to maintain its market position.

A significant threat arises from the possibility of aggressive pricing strategies by rivals, forcing Delhivery to potentially lower its service rates. Such a scenario could directly impact the company's revenue streams and overall profitability, making it a critical challenge to navigate.

Despite ongoing government initiatives, India's physical infrastructure, including road networks and warehousing, remains a significant hurdle. In 2023, India's Logistics Performance Index ranking was 139 out of 139 countries, highlighting these deep-seated issues. This can lead to operational inefficiencies and increased delivery times for companies like Delhivery.

Furthermore, the evolving and sometimes inconsistent regulatory landscape in India presents another challenge. Compliance with diverse state-level regulations and potential changes in e-commerce or transportation laws can add complexity and cost to operations, impacting Delhivery's ability to streamline its services efficiently.

Talent Shortage and Workforce Management Challenges

The Indian logistics industry grapples with a pronounced talent deficit, particularly for skilled truck drivers and individuals adept at modern logistics technologies. This shortage directly impacts operational efficiency and service quality.

This talent gap can escalate labor costs and impede Delhivery's capacity for expansion and maintaining its service benchmarks. For instance, the demand for skilled drivers has been consistently outstripping supply, putting upward pressure on wages.

Key challenges include:

- Shortage of skilled truck drivers: A persistent issue across India, impacting delivery timelines and operational capacity.

- Lack of tech-savvy workforce: Difficulty in finding personnel proficient in automation and digital logistics solutions.

- Rising labor costs: Increased competition for available talent drives up wages, affecting profitability.

- Impact on service quality: Inadequate staffing can lead to delays and errors, damaging customer satisfaction.

Cybersecurity Risks and Technological Disruption

Delhivery's growing dependence on technology exposes it to significant cybersecurity risks. A data breach or system outage could severely disrupt operations and damage its reputation. For instance, the global cybersecurity market was projected to reach over $300 billion by 2024, highlighting the constant threat landscape for tech-reliant businesses.

The logistics sector is also susceptible to technological disruption. Competitors adopting advanced automation or AI-driven route optimization could gain a significant edge. Delhivery must continually invest in upgrading its technological infrastructure to maintain its competitive position, a challenge given the rapid pace of innovation.

- Cybersecurity Vulnerabilities: Increased reliance on digital platforms makes Delhivery a target for data breaches and operational disruptions.

- Technological Obsolescence: Rapid advancements by competitors could render Delhivery's current technology stack outdated, requiring substantial reinvestment.

- Disruptive Business Models: New entrants employing novel technologies or service models could challenge Delhivery's market share.

The intense competition within India's logistics market is a significant threat, forcing Delhivery to contend with aggressive pricing strategies from both established players and emerging entities. This competitive pressure can lead to price wars, potentially eroding profit margins and impacting the company's revenue streams, especially in a market valued at over $200 billion in fiscal year 2024.

Persistent inflation, particularly in fuel and labor costs, directly impacts Delhivery's operating expenses. With India's CPI fluctuating around 5-6% in 2024, the company faces challenges in passing these increased costs onto customers without affecting demand, thus squeezing profit margins.

Despite government efforts, India's underdeveloped physical infrastructure, as highlighted by its 2023 Logistics Performance Index ranking of 139 out of 139 countries, creates operational inefficiencies and increases delivery times, posing a direct challenge to Delhivery's service quality and cost-effectiveness.

A notable threat is the persistent shortage of skilled truck drivers and a lack of a tech-savvy workforce, which escalates labor costs and hinders operational efficiency and expansion. This talent deficit directly impacts Delhivery's ability to maintain service benchmarks and manage rising wages.

SWOT Analysis Data Sources

This Delhivery Logistics SWOT analysis is built upon a robust foundation of data, drawing from their official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.