Delhivery Logistics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delhivery Logistics Bundle

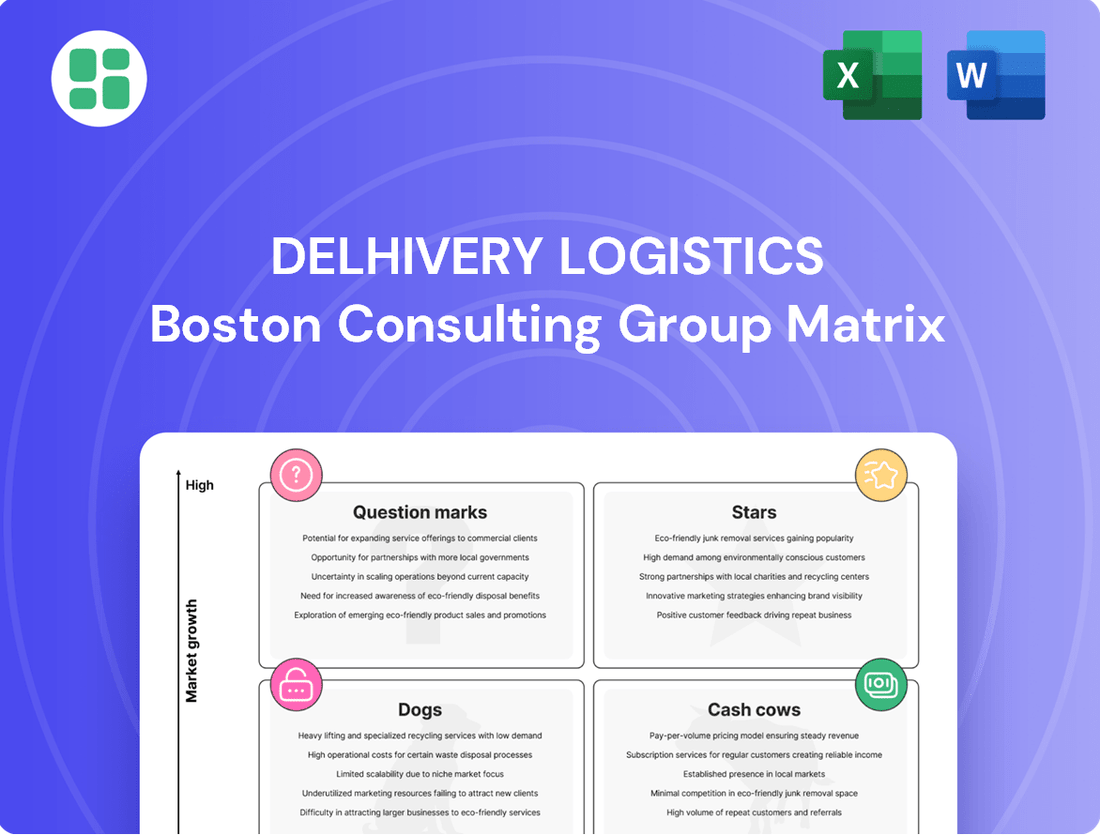

Delhivery's logistics operations are a fascinating case study for the BCG Matrix, with its diverse service offerings navigating varying market growth and share dynamics. Understanding which of Delhivery's services are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic resource allocation and future growth.

Dive deeper into Delhivery's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Delhivery's Part Truckload (PTL) services are a strong performer in their BCG Matrix, showcasing impressive growth. In FY25, this segment saw revenue climb by 25% year-on-year, with volumes expanding by 19%.

This robust volume increase directly contributed to enhanced profitability, as evidenced by a significant expansion in service EBITDA margins for the PTL business. Delhivery has clearly identified PTL as a high-margin, high-traction segment, making it a crucial engine for future growth within the Indian logistics landscape.

Delhivery's Warehousing & Fulfillment Solutions are positioned as a Star in the BCG Matrix, reflecting its strong performance in a high-growth market. This segment is a key driver for the company, capitalizing on the burgeoning demand for efficient storage and delivery across India.

The Indian logistics market's warehousing and distribution segment is projected to grow at a robust CAGR of 7.7% between 2025 and 2030, making it a lucrative area. Delhivery leverages its extensive fulfillment center network, enhanced by advanced proprietary technology and seamless integration with its core shipping operations, to secure a substantial portion of this growth.

Further strengthening its Star status, Delhivery's strategic investment in 'dark stores' caters to the rapidly expanding quick commerce sector. This initiative demonstrates the company's forward-thinking approach and its commitment to capturing market share in high-potential, fast-evolving segments of the logistics industry.

Businesses are actively looking for complete, start-to-finish logistics and supply chain services to simplify their operations. Delhivery's integrated model is perfectly positioned to meet this growing demand, giving it a strong edge in the market. This trend towards integrated solutions is a major growth driver in India's logistics industry, fueled by the booming e-commerce sector and ongoing infrastructure improvements.

Delhivery's comprehensive service offering, which spans express parcel delivery, warehousing, and freight transportation, allows it to capture a significant share of this expanding market. For example, in the fiscal year 2024, Delhivery reported a substantial increase in its parcel volumes, reflecting the strong market appetite for consolidated logistics services.

Post-Ecom Express Acquisition Express Parcel

Following the April 2025 acquisition of Ecom Express, Delhivery's express parcel segment is poised for significant expansion. This strategic move is projected to increase Delhivery's market share in express parcels by roughly 25%, solidifying its position in the competitive Indian e-commerce logistics landscape. The integration is expected to drive renewed high growth, especially with strong retention of Ecom Express's existing shipment volumes.

- Market Share Boost: The acquisition of Ecom Express is anticipated to lift Delhivery's express parcel market share by approximately 25%.

- Synergistic Growth: Strong retention of Ecom Express's shipment volumes is expected to fuel high growth for the combined entity.

- Reinforced Leadership: The integration strengthens Delhivery's market leadership in the rapidly evolving Indian e-commerce logistics sector.

- Stabilization and Acceleration: While Delhivery's standalone express parcel business showed stabilization, the acquisition injects a powerful growth acceleration.

Rapid Commerce and Quick Delivery Services

Delhivery's Rapid Commerce initiative is a strategic move into the burgeoning quick commerce sector, aiming for delivery within a two-hour window. This involves establishing a network of dark stores to directly serve direct-to-consumer (D2C) brands, capitalizing on the high demand and rapid growth in hyperlocal delivery. While this segment is relatively new for Delhivery, substantial investments and aggressive expansion plans signal a strong ambition to lead this fast-evolving market.

The quick commerce market, a key focus for Delhivery's Rapid Commerce, saw significant growth in 2024. For instance, the Indian quick commerce market was projected to reach approximately $5.2 billion by 2025, indicating a substantial opportunity. Delhivery's investment in this area positions it to capture a significant share of this expanding market.

- Rapid Commerce Focus: Delhivery is actively developing its Rapid Commerce service to offer 2-hour deliveries.

- Dark Store Network: The company is building a network of dark stores to support direct-to-consumer (D2C) brands.

- Market Opportunity: This initiative targets the rapidly growing quick commerce and hyperlocal delivery market.

- Growth Potential: Significant investment and expansion plans highlight the high potential for Delhivery to become a market leader in this segment.

Delhivery's Express Parcel segment, bolstered by the April 2025 acquisition of Ecom Express, is a significant Star. This move is projected to increase Delhivery's market share in express parcels by approximately 25%, driving high growth through strong volume retention. The integration solidifies Delhivery's leadership in India's competitive e-commerce logistics.

The company's Warehousing & Fulfillment Solutions are also firmly in the Star category, capitalizing on the Indian logistics market's warehousing and distribution segment, which is expected to grow at a robust CAGR of 7.7% between 2025 and 2030. Delhivery's extensive fulfillment network, powered by proprietary technology, is well-positioned to capture this growth.

Delhivery's Rapid Commerce initiative, targeting the quick commerce sector with 2-hour delivery windows via dark stores, represents another Star. The Indian quick commerce market itself was projected to reach approximately $5.2 billion by 2025, presenting a substantial opportunity for Delhivery's aggressive expansion plans.

| Segment | BCG Category | Key Growth Drivers | FY24/FY25 Data Point |

|---|---|---|---|

| Express Parcel | Star | Ecom Express acquisition, e-commerce growth | Projected 25% market share increase |

| Warehousing & Fulfillment | Star | Growing demand for integrated logistics, e-commerce boom | Indian warehousing market CAGR of 7.7% (2025-2030) |

| Rapid Commerce | Star | Quick commerce market expansion, D2C demand | Indian quick commerce market projected at $5.2 billion by 2025 |

What is included in the product

Delhivery's Logistics BCG Matrix analyzes its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment and divestment strategies.

Delhivery's Logistics BCG Matrix offers a clear, one-page overview of its business units, simplifying strategic decisions and alleviating the pain of complex portfolio analysis.

Cash Cows

Delhivery's established express parcel network functions as a strong Cash Cow. Despite facing some competitive pricing, this segment is the backbone of the company, generating significant revenue and handling a massive volume of shipments across over 18,800 pin codes in India.

This mature network's dominance in the market ensures a steady and reliable cash flow, even as its growth rate might be slower compared to newer ventures. For example, in the fiscal year ending March 31, 2024, Delhivery's express parcel segment continued to be a primary revenue driver, demonstrating its consistent performance.

Delhivery's Traditional Full Truckload (TL) services are a cornerstone of their operations, tapping into a mature logistics market with consistent demand from large businesses. While revenue in this segment has shown stability, often described as broadly flat in recent quarters, this predictability is a key strength. The established client base and extensive network scale ensure a reliable and steady income, making it a dependable cash generator for the company.

Delhivery's position as a primary logistics partner for major e-commerce players is a classic cash cow. This translates into a consistent, high-volume revenue stream from last-mile deliveries, even if growth isn't explosive. For instance, in the financial year 2024, Delhivery reported a significant portion of its revenue stemming from its express parcel segment, which heavily relies on these e-commerce partnerships.

Payment Collection and Processing Services

Delhivery's payment collection and processing services, particularly its Cash on Delivery (COD) operations, function as a classic Cash Cow within its logistics portfolio. This segment benefits from the company's extensive delivery network and established customer base, generating steady, predictable income without requiring significant new capital investment.

This business unit effectively monetizes the existing infrastructure, acting as a reliable revenue stream that helps fund growth initiatives in other areas of the company. The high market share in this service, coupled with the mature nature of COD payments in India, points to a low-growth, high-profitability scenario.

In 2023, Delhivery reported that COD constituted a significant portion of its overall revenue, highlighting its importance. For instance, the company has consistently processed millions of COD transactions monthly, demonstrating the scale and stability of this offering.

- Stable Revenue Generation: Leverages existing delivery infrastructure to collect payments, ensuring consistent cash flow.

- High Market Share: Dominates the COD segment within its operational regions, benefiting from established trust and reach.

- Low Investment Needs: Requires minimal additional capital expenditure due to integration with core logistics operations.

- Reliable Profitability: Generates substantial profits by 'milking' the established network and customer relationships.

Core B2B Freight Services (excluding PTL high growth)

Delhivery's core B2B freight services, excluding the high-growth Parcel Transportation (PTL) segment, are likely positioned as Cash Cows. These operations, which encompass general cargo movement for a wide array of manufacturing and industrial clients, benefit from established infrastructure and long-term customer relationships.

These services typically operate in mature markets, characterized by stable demand and predictable revenue streams. The company leverages its extensive network and operational efficiency to maintain profitability, often secured through multi-year contracts that ensure consistent cash flow generation. For instance, in fiscal year 2024, Delhivery reported a significant portion of its revenue derived from its integrated parcel and PTL services, underscoring the foundational strength of its freight operations.

- Stable Revenue Generation: These services provide a consistent and reliable income stream, acting as a financial bedrock for the company.

- Mature Market Position: Operating in established segments means less need for aggressive market expansion, focusing instead on operational excellence.

- Predictable Cash Flows: Long-term contracts and optimized logistics contribute to predictable earnings, supporting investment in other business areas.

- Foundational Support: The cash generated here is crucial for funding the growth and development of other, more nascent, business units within Delhivery.

Delhivery's established express parcel network is a prime example of a Cash Cow. This segment consistently generates substantial revenue and handles high volumes across India, demonstrating its maturity and market dominance. For the fiscal year ending March 31, 2024, this segment remained a core revenue driver, underscoring its reliable performance.

The company's Traditional Full Truckload (TL) services also function as Cash Cows. Despite a broadly flat revenue trend in recent quarters, the predictability stemming from a large client base and extensive network ensures a steady income. This stability makes it a dependable cash generator, supporting other business areas.

Delhivery's role as a primary logistics partner for major e-commerce firms solidifies its Cash Cow status. This translates into consistent, high-volume revenue from last-mile deliveries. In FY24, the express parcel segment, heavily reliant on these partnerships, contributed significantly to overall revenue.

The payment collection and processing services, especially Cash on Delivery (COD), are classic Cash Cows. Leveraging its extensive network, this segment provides steady, predictable income with minimal new capital investment. In 2023, COD represented a notable portion of Delhivery's revenue, with millions of transactions processed monthly.

| Segment | Role in BCG Matrix | Key Characteristics | FY24 Data Highlight |

| Express Parcel Network | Cash Cow | High volume, established infrastructure, steady revenue | Primary revenue driver |

| Traditional Full Truckload (TL) | Cash Cow | Mature market, consistent demand, predictable income | Broadly flat revenue, stable cash flow |

| E-commerce Partnerships (Last-Mile) | Cash Cow | High-volume, consistent revenue stream | Significant revenue contribution from express parcel segment |

| Cash on Delivery (COD) Processing | Cash Cow | Monetizes existing infrastructure, low investment, high profitability | Millions of transactions processed monthly |

What You’re Viewing Is Included

Delhivery Logistics BCG Matrix

The Delhivery Logistics BCG Matrix preview you see is the definitive report you will receive upon purchase, offering a comprehensive strategic overview of their business units. This document is fully formatted and ready for immediate use, containing no watermarks or demo content, ensuring you get exactly what you need for informed decision-making. You'll gain access to the complete, analysis-ready file, designed to provide strategic clarity for your business planning and competitive analysis. This preview accurately represents the professional-grade report that will be instantly downloadable, allowing you to leverage Delhivery's market positioning without delay.

Dogs

Certain niche freight routes, particularly those that are highly specific or geographically isolated, are showing signs of underperformance for Delhivery. These routes often grapple with low demand and fierce local competition, resulting in a minimal market share and consequently, low profitability.

These underperforming routes can be viewed as cash traps. The operational expenses incurred to maintain these services frequently exceed the revenue they generate. For instance, in the first quarter of fiscal year 2024, Delhivery reported a consolidated revenue of INR 2,030 crore, but specific route profitability data, while not publicly detailed for every niche, suggests that such isolated segments could be dragging down overall efficiency if not managed carefully.

Consequently, these routes become prime candidates for strategic review. If improvements in operational efficiency cannot be achieved to make them viable, Delhivery might consider optimizing their service offerings on these routes or even divesting them entirely to reallocate resources to more promising areas of their business.

Even with Delhivery's significant technological advancements, certain legacy operational areas might lag behind. These pockets, not yet fully integrated with their sophisticated automation and software, could show reduced efficiency and increased costs.

These less automated segments would likely represent a smaller portion of Delhivery's overall profitability, possessing limited growth prospects unless substantial modernization efforts are undertaken. For instance, while the company aims for extensive automation, manual sorting or less integrated warehousing in specific regions could fall into this category.

Within Delhivery's logistics operations, low-margin, highly commoditized contracts represent a segment that, while contributing to top-line revenue, often struggles with profitability. These are the bread-and-butter services where price is the primary differentiator, leading to razor-thin margins. For example, in 2024, the Indian logistics market saw intense competition, with many players offering similar road freight services, pushing down average contract margins to potentially single digits for basic transportation.

These contracts can be viewed as cash cows that are underperforming or, more accurately, as potential question marks in the BCG matrix. They tie up valuable fleet capacity and operational resources but offer limited scope for strategic differentiation or significant margin expansion. The challenge for Delhivery is to manage these efficiently while seeking opportunities to up-sell or cross-sell higher-value services to these same clients, transforming them into more profitable relationships over time.

High-Cost, Low-Volume Customer Segments

Servicing customers with very low shipment volumes or those located in geographically isolated areas often falls into the 'Dog' category within Delhivery's logistics operations. These segments typically involve high operational costs due to the specialized handling and extended transit times required, leading to revenue that is disproportionately low. For instance, in 2024, Delhivery might have observed that deliveries to remote rural areas, accounting for less than 0.5% of total shipments, consumed nearly 3% of its last-mile delivery resources.

These high-cost, low-volume segments often operate at a break-even point or even incur losses. The expenditure on fuel, driver time, and vehicle maintenance for these infrequent and dispersed deliveries can easily outweigh the shipping fees collected. This situation drains resources that could otherwise be channeled into more profitable and higher-growth areas of the business, such as servicing major metropolitan hubs or e-commerce fulfillment centers.

The strategic implication for Delhivery is to carefully evaluate these 'Dog' segments. Continued investment in these areas might not be sustainable without a significant shift in pricing models or operational efficiencies.

- High operational costs: Servicing remote locations or very small orders incurs higher per-unit delivery expenses.

- Low revenue generation: The shipping fees from these segments are insufficient to cover the operational outlay.

- Resource drain: These segments consume valuable resources that could be deployed more effectively in high-growth areas.

- Potential for losses: Many of these segments may operate at a loss, impacting overall profitability.

Non-Strategic, Non-Scalable Small Acquisitions/Pilots

Non-strategic, non-scalable small acquisitions or pilot projects that Delhivery might have pursued, which failed to gain significant market traction or prove scalable, would fall into the Dogs category of the BCG Matrix. These ventures, lacking alignment with Delhivery's core growth strategies, would likely exhibit low market share and minimal future growth potential.

For instance, if Delhivery experimented with a niche, hyper-local delivery service in a single city that didn't capture customer interest or achieve operational efficiency, it could be classified as a Dog. Such an initiative, perhaps requiring substantial ongoing investment without a clear path to profitability or expansion, would represent a drain on resources.

Consider a scenario where Delhivery invested in a specialized cold chain logistics pilot for a particular agricultural product that faced regulatory hurdles or low demand. If this pilot, as of early 2024, showed negligible revenue growth and faced significant operational challenges, it would be a prime example of a Dog in their portfolio.

- Low Market Share: These ventures typically struggle to capture a meaningful portion of their target market.

- Limited Growth Prospects: Future revenue and profit growth are expected to be minimal or stagnant.

- Resource Drain: Continued investment in these areas may detract from more promising opportunities.

- Strategic Misalignment: They often do not contribute to the company's overall strategic objectives or core competencies.

Certain niche freight routes, particularly those that are highly specific or geographically isolated, are showing signs of underperformance for Delhivery. These routes often grapple with low demand and fierce local competition, resulting in a minimal market share and consequently, low profitability.

These underperforming routes can be viewed as cash traps. The operational expenses incurred to maintain these services frequently exceed the revenue they generate. For instance, in the first quarter of fiscal year 2024, Delhivery reported a consolidated revenue of INR 2,030 crore, but specific route profitability data, while not publicly detailed for every niche, suggests that such isolated segments could be dragging down overall efficiency if not managed carefully.

Consequently, these routes become prime candidates for strategic review. If improvements in operational efficiency cannot be achieved to make them viable, Delhivery might consider optimizing their service offerings on these routes or even divesting them entirely to reallocate resources to more promising areas of their business.

Servicing customers with very low shipment volumes or those located in geographically isolated areas often falls into the 'Dog' category within Delhivery's logistics operations. These segments typically involve high operational costs due to the specialized handling and extended transit times required, leading to revenue that is disproportionately low. For instance, in 2024, Delhivery might have observed that deliveries to remote rural areas, accounting for less than 0.5% of total shipments, consumed nearly 3% of its last-mile delivery resources.

Question Marks

Delhivery Direct, launched in June 2025, targets the fast-expanding on-demand intracity shipping sector. This service is positioned as a Question Mark in the BCG Matrix due to its high-growth market potential but relatively low current market share. Significant investment is required for network build-out and customer acquisition to compete with existing hyperlocal delivery providers.

Delhivery's expansion into cold chain logistics positions it within a rapidly growing Indian market, projected to reach $25.7 billion by 2028, up from $15.8 billion in 2023. This segment is fueled by increasing demand from pharmaceuticals and the food industry, both of which require stringent temperature control. Delhivery's involvement here, while promising, likely represents an early-stage venture.

As a relatively new entrant to dedicated cold chain services, Delhivery's current market share in this specialized niche is probably modest. Building out the necessary temperature-controlled warehousing, specialized transportation fleets, and the required regulatory compliance demands significant capital expenditure and operational expertise, placing it in a position that requires investment to scale effectively.

Delhivery's investment in advanced robotics and automation for its warehouses presents a potential Automation-as-a-Service (AaaS) offering. This could tap into a growing market, with global industrial robotics market revenue projected to reach $79.3 billion by 2027, up from $41.2 billion in 2022. However, entering this as a new service means Delhivery would likely start with a low market share, requiring substantial research and development to establish itself.

Targeted International Expansion

Targeted international expansion for Delhivery would be classified as a Question Mark within the BCG Matrix. While the company currently provides cross-border services, actively pursuing significant growth in new, specific international markets or deepening its presence in particular foreign trade routes presents a classic Question Mark scenario. These ventures promise high growth potential, but they necessitate considerable upfront investment and come with inherent risks due to low initial market penetration and the complexities of navigating unfamiliar regulatory and competitive environments.

For instance, if Delhivery were to focus on expanding its express parcel services into Southeast Asia, a region with a rapidly growing e-commerce market, this would fit the Question Mark profile. The market is projected to grow significantly, but establishing the necessary infrastructure, understanding local consumer behavior, and complying with diverse regulations require substantial capital and strategic planning. By July 2025, the e-commerce market in Southeast Asia is expected to reach hundreds of billions of dollars, offering a compelling growth opportunity, but one that demands careful execution.

- High Growth Potential: Emerging markets offer substantial opportunities for increased volume and revenue.

- Substantial Investment Required: Building infrastructure, marketing, and establishing local partnerships demand significant capital outlay.

- Market Penetration Risk: Entering new territories with established local players presents challenges in gaining market share.

- Regulatory and Competitive Uncertainty: Navigating diverse legal frameworks and competitive landscapes in foreign countries poses inherent risks.

Specialized Industry-Specific Logistics Solutions

Developing specialized logistics solutions for burgeoning industries, such as those in healthcare or renewable energy, positions Delhivery to capitalize on high-growth niches. These segments, while currently having a low market share for Delhivery, demand focused investment and specialized knowledge to achieve scale. The potential for significant returns in these areas is high, albeit with inherent uncertainty.

For instance, the Indian healthcare logistics market was projected to reach USD 10.7 billion by 2024, indicating substantial growth potential for specialized cold chain and pharmaceutical delivery services. Similarly, the renewable energy sector's expansion necessitates tailored logistics for oversized components and timely project delivery, a segment where Delhivery could build a strong foothold.

- Healthcare Logistics: Focus on temperature-controlled transportation and last-mile delivery for pharmaceuticals and medical devices.

- Renewable Energy Logistics: Develop capabilities for handling large, specialized equipment for solar and wind power projects.

- E-commerce Specialization: Continue to refine offerings for high-value electronics and time-sensitive fashion items.

- Emerging Tech Logistics: Explore logistics needs for sectors like electric vehicles and advanced manufacturing components.

Delhivery's foray into new, high-growth sectors like specialized industrial logistics for renewable energy projects represents a classic Question Mark. These ventures require substantial investment to build expertise and infrastructure, aiming for future market leadership in a segment that is currently nascent for the company.

The potential here is significant, as the Indian renewable energy sector is expected to see substantial growth, creating demand for specialized logistics. However, initial market share is low, and competition, while perhaps less intense than in established sectors, will likely increase as the market matures.

This positioning necessitates careful resource allocation and strategic partnerships to overcome the high initial costs and operational complexities, with the ultimate goal of transforming these ventures into Stars or Cash Cows.

| Initiative | Market Growth | Current Market Share | Investment Need | Potential |

| Renewable Energy Logistics | High | Low | High | Star/Cash Cow |

| Healthcare Logistics | High | Low | High | Star/Cash Cow |

| International Expansion (e.g., SEA) | High | Low | High | Star/Cash Cow |

BCG Matrix Data Sources

Our Delhivery Logistics BCG Matrix leverages a blend of internal financial performance data, comprehensive market research reports, and publicly available operational statistics to accurately position its business units.