Delhivery Logistics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delhivery Logistics Bundle

Delhivery Logistics operates in a dynamic environment shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for navigating the Indian logistics landscape.

The complete report reveals the real forces shaping Delhivery Logistics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fuel prices represent a significant expense for Delhivery, directly influencing their operational costs. For instance, diesel prices in India saw an average increase of approximately 5-7% in the first half of 2024 compared to the same period in 2023, directly impacting the cost of running their fleet.

The inherent volatility of global oil markets grants considerable power to fuel suppliers. Sudden price hikes can drastically escalate Delhivery's expenses, potentially squeezing profit margins if these costs cannot be effectively passed on to customers.

To counter this, Delhivery likely employs strategies such as optimizing delivery routes to minimize fuel consumption and exploring fuel-efficient vehicles. They may also consider fuel hedging to lock in prices, though this carries its own risks.

Delhivery's ability to maintain competitiveness while absorbing or passing on these fluctuating fuel costs is a critical factor. If competitors can manage fuel expenses more effectively, Delhivery could face pricing disadvantages.

The logistics sector in India, including companies like Delhivery, is significantly dependent on a skilled workforce. This includes crucial roles like truck drivers, warehouse operatives, and specialized technicians. A scarcity of these qualified individuals or rising salary expectations directly translates into increased bargaining power for these human resource suppliers.

This reliance on skilled labor can directly influence Delhivery's operational effectiveness, the caliber of its services, and its overall cost management. For instance, reports from 2023 indicated a growing demand for experienced logistics personnel, leading to an average wage increase of 8-10% in certain specialized roles. This necessitates ongoing investment in training programs and employee retention strategies to mitigate the impact of this bargaining power.

Delhivery's reliance on specialized technology for its integrated logistics model means that providers of unique software and optimization tools hold significant sway. If these providers offer proprietary solutions that are difficult to replicate, they can command higher prices or dictate terms, impacting Delhivery's operational costs and innovation pace.

For instance, in 2024, the global logistics technology market saw continued investment, with companies like Blue Yonder and Manhattan Associates reporting strong growth, indicating the premium placed on advanced software. Delhivery's ability to secure favorable terms with such providers is crucial for maintaining its competitive technological advantage and managing its IT budget effectively.

Vehicle and Equipment Manufacturers

Delhivery's reliance on vehicle and equipment manufacturers for its vast fleet means these suppliers hold considerable bargaining power. The acquisition and maintenance of a large, diverse fleet are critical to Delhivery's operational capacity. For instance, in 2023, Delhivery operated a network of over 25,000 delivery vehicles, highlighting the scale of its dependence on these suppliers.

The concentration within the vehicle manufacturing sector, particularly for specialized logistics equipment, can amplify supplier leverage. This concentration can lead to fewer choices for Delhivery and potentially higher costs for acquiring and maintaining its fleet, impacting capital expenditure and modernization strategies. The average cost of a commercial truck in India can range from INR 10 lakh to INR 35 lakh, representing a significant investment for each unit.

- Fleet Dependency: Delhivery's operational scale necessitates a substantial and continuously updated fleet of vehicles and material handling equipment.

- Market Concentration: Limited number of key manufacturers for specialized logistics vehicles can increase their bargaining power.

- Cost Impact: Supplier pricing directly influences Delhivery's capital expenditure and ongoing maintenance costs.

- Operational Sustainability: Securing reliable and cost-effective equipment is vital for Delhivery's long-term operational efficiency and growth plans.

Infrastructure and Real Estate Lessors

Delhivery's reliance on a substantial physical infrastructure, including warehouses and sorting centers, places it at the mercy of real estate lessors. In 2024, the Indian logistics real estate market saw continued growth, with demand for modern warehousing solutions increasing significantly. This demand, particularly in prime locations, can empower landlords.

The bargaining power of infrastructure and real estate lessors for Delhivery stems from the concentration of suitable logistics properties in key hubs. Limited availability of well-located, high-quality warehousing space can lead to increased rental costs. For instance, in major Tier-1 cities, rental rates for Grade A warehousing space in 2024 saw an upward trend, potentially impacting Delhivery's operational expenses and expansion plans.

- Limited Supply in Prime Locations: Key logistics corridors often have a finite supply of suitable land and existing facilities.

- Rising Rental Costs: Increased demand for warehousing in 2024, driven by e-commerce growth, has pushed up rental prices in many Indian cities.

- Restrictive Lease Terms: Landlords may impose longer lease durations or less flexible terms, impacting Delhivery's agility in network optimization.

- Impact on Expansion: Higher real estate costs and unfavorable lease agreements can constrain Delhivery's ability to scale its operations efficiently.

Suppliers of critical resources like fuel, skilled labor, technology, vehicles, and real estate wield significant bargaining power over Delhivery. Fluctuations in fuel prices, as seen with a 5-7% rise in diesel costs in early 2024, directly impact operational expenses. Similarly, a shortage of skilled logistics personnel, leading to 8-10% wage increases in some roles during 2023, further empowers labor suppliers.

The concentration of manufacturers for specialized logistics equipment and the limited availability of prime warehousing space in 2024, with rental rates for Grade A facilities increasing in Tier-1 cities, also grant leverage to these suppliers. This dependence necessitates strategic supplier relationship management to mitigate cost pressures and ensure operational continuity.

| Supplier Category | Impact on Delhivery | 2023-2024 Data/Trend | Mitigation Strategies |

|---|---|---|---|

| Fuel | Increased operational costs, potential margin squeeze | 5-7% average diesel price increase (H1 2024 vs H1 2023) | Route optimization, fuel-efficient vehicles, hedging |

| Skilled Labor | Higher wage bills, retention challenges | 8-10% average wage increase in specialized roles (2023) | Training programs, employee retention initiatives |

| Technology Providers | Higher software costs, dependence on proprietary solutions | Strong growth in logistics tech market (e.g., Blue Yonder, Manhattan Associates in 2024) | Negotiating favorable terms, exploring open-source alternatives |

| Vehicle Manufacturers | High capital expenditure, maintenance costs | Average truck cost INR 10-35 lakh; Delhivery operated >25,000 vehicles (2023) | Bulk purchasing, long-term maintenance contracts |

| Real Estate Lessors | Increased rental expenses, constrained expansion | Rising Grade A warehousing rental rates in Tier-1 cities (2024) | Long-term leases, strategic site selection, exploring owned facilities |

What is included in the product

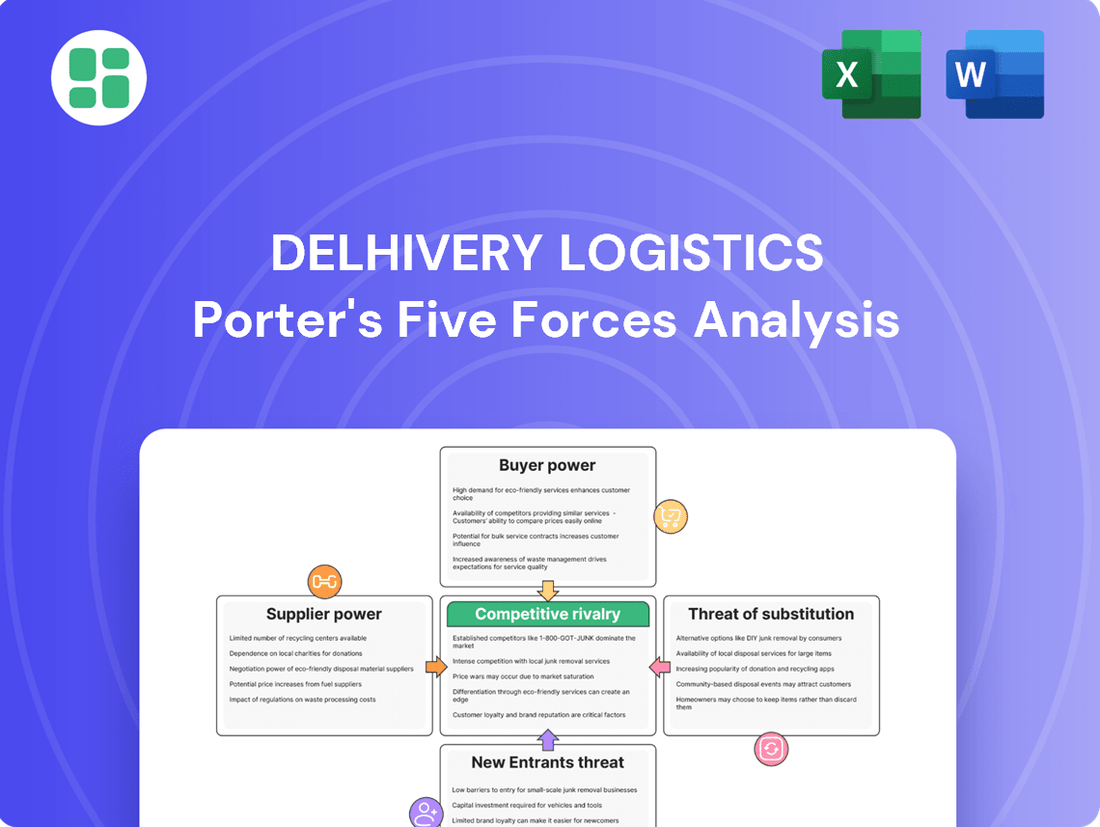

This analysis unpacks the competitive forces impacting Delhivery Logistics, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly visualize Delhivery's competitive landscape with a dynamic Porter's Five Forces chart, highlighting key pressure points and opportunities for strategic advantage.

Simplify complex competitive analysis into actionable insights, enabling Delhivery to proactively address threats and capitalize on market dynamics.

Customers Bargaining Power

Customer concentration presents a significant challenge for Delhivery. If a substantial portion of its revenue comes from a handful of major e-commerce platforms or large industrial clients, these key customers gain considerable leverage. For instance, in 2023, while Delhivery serves a broad base, its top clients still represent a notable share of its business, although the company actively works to broaden its customer mix.

This concentrated power allows these dominant customers to negotiate for lower shipping rates or demand more stringent service level agreements, directly impacting Delhivery's profitability and operational flexibility. Their sheer volume of shipments provides them with the bargaining chips to push for better terms, potentially squeezing Delhivery's margins.

To mitigate this risk, Delhivery's strategy involves continuous efforts to diversify its customer base across various sectors, including retail, pharmaceuticals, and automotive, thereby reducing its reliance on any single large client and strengthening its overall market position.

In the highly competitive Indian logistics landscape, customers often face low switching costs when moving between providers. This means if a client finds it easy and inexpensive to switch from Delhivery to another logistics company, their power to negotiate better terms or demand lower prices significantly increases. For instance, a business might only need to update their shipping software and inform their current provider, incurring minimal financial or operational hurdles.

This low friction in switching allows customers to readily explore alternatives, putting pressure on Delhivery to remain competitive. If customers perceive that changing providers involves little disruption to their operations or significant financial outlay, they are more likely to leverage this to their advantage. This is a key factor in Delhivery's pricing strategy and service offering, as retaining clients becomes paramount.

To counter this, Delhivery needs to cultivate strong customer loyalty through superior service and unique value propositions. By offering differentiated services, such as advanced tracking, integrated supply chain solutions, or specialized handling, Delhivery can increase customer stickiness. For example, in 2023, Delhivery reported a customer retention rate of over 90% for its key enterprise clients, indicating success in building these sticky relationships.

Many businesses, particularly those in the rapidly growing e-commerce sector, operate with very tight profit margins. This makes them acutely aware of every cost, and logistics expenses are a significant component. Consequently, these customers exert considerable pressure on Delhivery to offer competitive pricing. For instance, in 2024, the average profit margin for Indian e-commerce businesses hovered around 3-5%, underscoring their sensitivity to logistics fees.

This high price sensitivity necessitates that Delhivery continuously seeks operational efficiencies to keep its service costs down. The company must balance the need to offer attractive rates to its price-conscious clientele with the imperative of maintaining its own profitability. This delicate balancing act is crucial for sustained business operations.

Furthermore, the presence of numerous other logistics providers in the market intensifies this price competition. Customers have a wide array of choices, and they are often willing to switch to a competitor offering a slightly lower price for comparable services. This competitive landscape significantly amplifies the bargaining power of Delhivery's customers.

Availability of Alternative Providers

The Indian logistics landscape is quite crowded, featuring a mix of large, established companies, niche regional providers, and many smaller, less organized players. This sheer volume of options means customers have a lot of leverage when choosing a service provider.

This abundance directly translates into significant bargaining power for customers. They can easily compare prices, service levels, and delivery times across multiple providers, forcing companies like Delhivery to offer competitive terms to secure and retain business. For instance, in 2024, the Indian logistics market was estimated to be worth over $200 billion, with a significant portion of this value driven by competitive pricing strategies.

- High Market Saturation: The Indian logistics sector's density of providers allows customers to switch easily.

- Price Sensitivity: Customers often prioritize cost-effectiveness, leveraging competition to drive down prices.

- Service Differentiation: Delhivery needs to highlight its distinct advantages, such as its extensive network coverage and advanced technological solutions, to justify its pricing and maintain customer loyalty in a highly competitive environment.

Customer Information and Sophistication

Modern business clients are increasingly savvy, armed with extensive knowledge of current market prices, expected service levels, and the latest technological innovations in the logistics sector. This heightened awareness empowers them to readily compare different providers and engage in more assertive negotiations.

Delhivery must capitalize on its robust data analytics and technological infrastructure to deliver services that are not only transparent and efficient but also demonstrably superior, thereby substantiating its pricing structure.

- Informed Clientele: Businesses now have unprecedented access to information regarding logistics pricing and service benchmarks.

- Negotiating Leverage: This transparency directly translates into stronger bargaining power for customers.

- Delhivery's Response: The company must showcase its technological edge and operational excellence to command premium pricing.

- Data-Driven Value: Leveraging data to prove efficiency and reliability is key to mitigating customer price pressure.

Customers wield significant bargaining power in the Indian logistics market due to high competition and low switching costs. Delhivery faces pressure to offer competitive pricing, especially from price-sensitive e-commerce businesses. The company's strategy involves diversifying its client base and enhancing service differentiation to build loyalty and justify its pricing.

| Factor | Impact on Delhivery | Mitigation Strategy |

|---|---|---|

| Customer Concentration | High reliance on a few large clients grants them leverage. | Customer base diversification across sectors. |

| Low Switching Costs | Clients can easily move to competitors, increasing price pressure. | Enhance service quality and offer unique value propositions. |

| Price Sensitivity | Tight margins for clients, especially in e-commerce, necessitate cost-effective logistics. | Focus on operational efficiencies to reduce costs. |

| Market Saturation | Abundance of logistics providers allows customers to compare and negotiate. | Highlight technological advantages and network reach. |

| Informed Clientele | Clients are well-informed about market rates and service expectations. | Utilize data analytics to demonstrate superior value and efficiency. |

Full Version Awaits

Delhivery Logistics Porter's Five Forces Analysis

This preview shows the exact Delhivery Logistics Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the Indian logistics sector. This comprehensive analysis is ready for your strategic planning needs.

Rivalry Among Competitors

The Indian logistics sector is a bustling arena, characterized by its fragmentation and a wide array of players. This includes major integrated service providers like Delhivery, alongside specialized express delivery firms, established freight forwarders, and a vast number of smaller, unorganized local transporters. This crowded and varied competitive environment fuels a fierce struggle for market dominance.

The Indian logistics sector is booming, with projections indicating a compound annual growth rate (CAGR) of 8.5% between 2023 and 2028, reaching an estimated USD 330 billion by 2028. This robust expansion, driven by e-commerce penetration and manufacturing initiatives like Make in India, acts as a magnet for new entrants and existing players alike.

As the pie gets bigger, competition heats up. Companies are pouring capital into expanding their operational networks and diversifying their service offerings, from express parcel delivery to cold chain logistics, all in an effort to secure a dominant position in this rapidly growing market.

Logistics services can easily become a commodity, making it tough for companies to differentiate themselves solely on the quality of their offerings. Delhivery counters this by leveraging technology for its solutions, boasting a vast network, and providing specialized services like handling heavy goods and warehousing. This focus on a superior customer experience is key to lessening the impact of price-based competition.

High Exit Barriers

The logistics sector, including players like Delhivery, is characterized by substantial capital outlays for infrastructure, vehicles, and advanced tracking systems. This high initial investment creates significant exit barriers.

These considerable fixed costs mean that even companies struggling financially might continue operating to avoid realizing losses on their assets, thereby prolonging intense competition and potentially leading to market overcapacity. For instance, in 2024, the Indian logistics sector continued to see major investments in warehousing and fleet expansion, with companies like Delhivery actively upgrading their capabilities.

- High Capital Intensity: Logistics requires massive investment in physical assets, making it difficult to exit.

- Sunk Costs: Once invested, these assets are difficult to recover, deterring departures.

- Persistent Competition: High exit barriers keep many players in the market, intensifying rivalry.

- Capacity Management: The presence of many firms, even underperforming ones, can lead to excess capacity.

Intense Price Competition

The Indian logistics sector is characterized by fierce price competition, a direct consequence of the sheer number of players and the often undifferentiated nature of core services. This intense rivalry forces companies like Delhivery to engage in price wars, as customers are highly sensitive to cost and actively seek the most economical options.

This environment necessitates a relentless focus on cost optimization for Delhivery. The company must continually refine its operational efficiency to offer competitive pricing without sacrificing profitability. For instance, in 2023, the Indian logistics market was valued at approximately $215 billion, with significant growth projected, further intensifying the competitive landscape.

- Market Saturation: With a multitude of small and large players, the market is crowded, leading to aggressive pricing strategies.

- Customer Price Sensitivity: Buyers often prioritize the lowest cost, pushing all providers to trim margins.

- Operational Efficiency: Delhivery's ability to manage costs directly impacts its competitiveness in pricing.

- Profitability Challenges: Balancing low prices with the need for healthy profit margins remains a critical challenge.

The Indian logistics sector is highly competitive, featuring numerous players from large integrated providers to smaller local transporters. This fragmentation, coupled with strong market growth projections, fuels intense rivalry. Delhivery, while a significant player, faces constant pressure from a diverse set of competitors, necessitating a focus on operational efficiency and customer service to stand out.

Price competition is a major factor, as many logistics services are perceived as commodities. This drives companies to constantly optimize costs to offer competitive rates, impacting profit margins. Delhivery's strategy to differentiate through technology and specialized services is crucial in mitigating the impact of pure price wars.

The high capital intensity of the logistics industry, with substantial investments in infrastructure and fleets, creates high exit barriers. This means even struggling companies tend to remain in the market, contributing to persistent competition and potential overcapacity. For example, in 2024, significant investments continued in warehousing and fleet upgrades across the sector.

The Indian logistics market was valued at approximately $215 billion in 2023, with an expected CAGR of 8.5% between 2023 and 2028, reaching $330 billion. This growth attracts new entrants and intensifies competition among existing players.

| Key Competitor Factor | Impact on Delhivery | 2024 Market Context |

| Market Fragmentation | Intensifies rivalry, pressure on pricing | Numerous small and large players |

| Price Sensitivity | Requires cost optimization, margin pressure | Customers prioritize lower costs |

| Service Differentiation | Need for technology and specialized offerings | Commoditization of core services |

| Capital Intensity & Exit Barriers | Persistent competition from existing players | Continued investment in infrastructure |

SSubstitutes Threaten

Large e-commerce players and manufacturers are increasingly building out their own logistics networks. For instance, Flipkart's logistics arm, Flipkart Logistics, has been expanding its capabilities, aiming for greater control over deliveries. This in-house capacity directly competes with third-party providers like Delhivery, presenting a tangible substitution threat.

This trend means that companies which might have previously outsourced all their logistics are now bringing some or all of it in-house. This reduces the pool of potential customers for Delhivery and puts pressure on pricing as these companies weigh the cost-benefit of internal versus outsourced operations.

The threat of substitutes from traditional or unorganized transport remains a factor for Delhivery. Businesses, especially those with bulk or less time-sensitive cargo, may still turn to unorganized trucking services or railway freight. These alternatives can be more cost-effective, even if they lack the technological integration and efficiency Delhivery offers.

Emerging delivery models pose a potential threat to Delhivery's established operations. Innovations such as hyper-local delivery services, which focus on rapid fulfillment within a small geographic area, could siphon off demand for certain types of shipments. For instance, specialized hyperlocal players might offer faster last-mile solutions for perishable goods or urgent documents, bypassing Delhivery's broader network.

Drone delivery, while still in nascent stages for widespread commercial use, represents another disruptive substitute, particularly for niche applications like medical supplies or remote area deliveries. Companies investing in drone technology could carve out specific market segments that are less reliant on traditional road-based logistics. By 2024, several pilot programs for drone delivery were underway in India, signaling growing interest and potential.

Furthermore, direct-to-consumer (DTC) models where businesses manage their own deliveries, especially for high-value or time-sensitive products, can act as a substitute. This bypasses third-party logistics providers like Delhivery altogether. As e-commerce businesses mature, they may invest in their own fleets or partnerships to gain greater control over the customer experience, impacting Delhivery's market share in specific verticals.

Advanced Supply Chain Software

The rise of advanced supply chain software presents a significant threat of substitutes for Delhivery. Companies investing in sophisticated planning and management tools can enhance their internal logistics capabilities, potentially diminishing their reliance on third-party providers like Delhivery for certain functions. For instance, by optimizing inventory management and route planning through in-house software, businesses might reduce the need for Delhivery's integrated technology solutions.

These internal optimizations can directly substitute some of the value proposition offered by Delhivery. As of 2024, the global supply chain management software market is projected to reach over $30 billion, indicating a strong trend towards businesses building out their own technological infrastructure.

- Increased Internal Optimization: Sophisticated software allows businesses to gain greater control over their supply chains, from warehousing to last-mile delivery.

- Reduced Reliance on Third-Party Tech: Companies can achieve higher levels of efficiency and visibility internally, lessening the perceived need for external logistics platforms.

- Cost-Benefit Analysis: Businesses may find it more cost-effective in the long run to invest in proprietary software rather than paying ongoing fees for third-party logistics technology.

- Customization and Integration: In-house solutions offer greater flexibility to tailor functionalities to specific business needs, which can be a competitive advantage over standardized third-party offerings.

Shift to Digital Products/Services

The increasing societal and industry-wide shift towards digital products and services presents a subtle yet significant threat of substitution for traditional logistics providers like Delhivery. As more transactions and interactions move online and into the digital realm, the fundamental demand for moving physical goods can be indirectly affected. For instance, a surge in digital content consumption or cloud-based services can reduce the need for physical media delivery or on-site IT infrastructure, impacting sectors Delhivery serves.

While Delhivery's core operations are firmly rooted in physical logistics, this macro-trend can influence demand across various verticals. For example, sectors that historically relied on physical product distribution might see a gradual migration towards digital alternatives or services. This could mean fewer shipments of certain electronics, media, or even physical documents as digital counterparts gain traction.

Consider the impact on e-commerce. While e-commerce itself drives physical logistics, a shift towards digital goods within e-commerce (like downloadable software or digital gift cards) could marginally reduce the volume of physical parcels. In 2024, the global digital goods market was valued in the hundreds of billions of dollars, demonstrating the scale of this ongoing transformation.

- Digital Shift Impact: A broader move to digital products and services can indirectly reduce the need for physical goods transportation.

- Sectoral Influence: This trend may affect demand in specific sectors that Delhivery caters to, such as media or certain retail segments.

- E-commerce Nuance: Even within e-commerce, a rise in digital goods transactions could slightly temper the growth of physical parcel volumes.

- Market Value: The substantial global market for digital goods in 2024 highlights the scale of this potential substitution.

The threat of substitutes for Delhivery is multifaceted, ranging from large e-commerce players building their own logistics networks to the rise of specialized delivery models and even the broader digital shift. Companies like Flipkart expanding their in-house capabilities directly reduce Delhivery's potential customer base and exert pricing pressure. Traditional, unorganized transport options also remain a cost-effective alternative for less time-sensitive cargo.

Emerging models like hyper-local delivery services and the potential of drone delivery, with pilot programs active in India by 2024, threaten to capture specific market segments. Furthermore, businesses investing in advanced supply chain software are increasingly optimizing their internal logistics, potentially lessening their reliance on third-party providers for technology and efficiency gains. The global supply chain management software market exceeding $30 billion in 2024 underscores this trend towards in-house technological infrastructure.

A subtle but significant substitute threat comes from the societal shift towards digital products and services. As more transactions move online, the fundamental demand for physical goods transportation can be indirectly affected, with the global digital goods market valued in the hundreds of billions of dollars in 2024 indicating the scale of this transformation.

Entrants Threaten

High capital requirements present a formidable barrier to entry in the logistics sector. Establishing a comprehensive, nationwide network like Delhivery's, complete with advanced sorting hubs, extensive warehouse facilities, and a sizable fleet of vehicles, necessitates a significant upfront financial commitment. For instance, building out a modern, automated sortation center can cost tens of millions of dollars, and acquiring a fleet capable of nationwide coverage easily runs into hundreds of millions. This substantial financial hurdle effectively deters many smaller players or new ventures from entering the market, thus protecting incumbent players like Delhivery from immediate, widespread competition.

The Indian logistics sector is a labyrinth of regulations, permits, and licenses that differ significantly from state to state and depending on the specific services offered. For any new entrant, understanding and complying with this intricate regulatory framework presents a substantial barrier, demanding considerable time and resources. For instance, obtaining necessary approvals for fleet operations, warehousing, and cross-border movements can be a lengthy and complex process, deterring many potential new players from entering the market.

The logistics industry demands significant upfront investment to build a robust network and achieve operational efficiency. New entrants face a substantial hurdle in replicating the economies of scale and extensive reach that established players like Delhivery have cultivated over time. For instance, Delhivery's extensive pin code coverage across India provides a critical advantage that is difficult and costly for newcomers to match quickly.

Difficulty in Building Brand and Trust

In the competitive logistics landscape, new entrants grapple with establishing brand recognition and customer trust, crucial elements for success. Established players like Delhivery have cultivated strong reputations over years of consistent service delivery.

Building this credibility takes significant time and investment. For instance, in 2023, the Indian logistics sector saw substantial growth, yet new companies often struggle to gain market share without a proven history of reliability and efficiency. Customers in this sector prioritize dependable partners who can ensure timely and secure delivery of goods, making it difficult for newcomers to break into established relationships.

- Brand Loyalty: Existing customers often exhibit loyalty to logistics providers they trust.

- Reputation Capital: Established companies benefit from years of positive customer experiences and word-of-mouth.

- Service Guarantees: New entrants must offer compelling service guarantees to overcome the perceived risk of unproven performance.

- Marketing Investment: Significant marketing spend is required to build awareness and a positive brand image against incumbents.

Access to Technology and Skilled Talent

The modern logistics landscape demands substantial investment in cutting-edge technology like AI, IoT, and automation. For instance, in 2024, the global logistics technology market was valued at over $50 billion, with significant growth anticipated. New players entering this space face a steep hurdle in acquiring or developing the necessary technological infrastructure and expertise.

Furthermore, access to skilled talent is a critical barrier. The logistics sector requires professionals proficient in data analytics, supply chain optimization, and advanced operational management. In 2024, there was a reported shortage of over 100,000 skilled logistics professionals in India alone, making it difficult for new entrants to quickly build a competent workforce.

- Technological Investment: High capital expenditure required for AI, IoT, and automation systems.

- Talent Acquisition: Difficulty in sourcing and retaining skilled personnel in data analytics and supply chain management.

- Market Entry Costs: Significant upfront investment needed to compete with established, technologically advanced players.

- Operational Expertise: The learning curve for mastering complex, technology-driven logistics operations can be substantial.

The threat of new entrants in the Indian logistics sector is moderate, primarily due to substantial barriers. High capital requirements for infrastructure, technology, and fleet, coupled with a complex regulatory environment, deter many smaller players. Established players like Delhivery benefit from significant economies of scale and brand recognition, making it challenging for newcomers to compete effectively.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024 Estimates) |

|---|---|---|---|

| Capital Requirements | Building nationwide networks, sorting hubs, and fleets. | Very High | Automated sortation center: $20M-$50M+; Fleet acquisition: $100M+ |

| Regulatory Complexity | Navigating state-specific permits and licenses. | High | Time to acquire all necessary operational permits: 6-12+ months |

| Economies of Scale | Matching extensive reach and operational efficiency. | High | Delhivery's pin code coverage: 17,000+ |

| Brand & Trust | Building customer loyalty and reputation. | High | Marketing investment to gain market share: Significant percentage of revenue |

| Technology Investment | Adopting AI, IoT, and automation. | High | Global logistics tech market: ~$50B+ |

| Talent Acquisition | Finding skilled logistics professionals. | High | India's skilled logistics talent shortage: 100,000+ |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Delhivery Logistics is built upon a foundation of robust data, including annual reports, investor presentations, industry-specific market research reports, and publicly available financial filings.