Delaware North SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delaware North Bundle

Delaware North boasts impressive strengths in its diversified portfolio and strong brand recognition, but faces challenges in adapting to evolving consumer preferences and intense competition. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind Delaware North’s competitive advantages, potential threats, and avenues for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Delaware North's diverse portfolio, encompassing sports, entertainment, airports, and national parks, provides a robust revenue stream that isn't overly dependent on any single industry. This broad operational scope, extending across multiple continents, significantly bolsters its resilience against market downturns in specific sectors. For instance, in 2023, its hospitality and food service operations in national parks and sports stadiums contributed significantly to its overall performance, demonstrating the strength of its diversified model.

Delaware North’s dedication to guest satisfaction shines through its constant drive for innovation. They are always looking for new ways to improve everything from the food they serve to how guests interact with their venues. This focus means they are often ahead of the curve in the hospitality industry.

A key part of this innovation is embracing technology to make things smoother for guests. For instance, Delaware North has been a leader in bringing contactless and frictionless payment options to their locations. They’ve even experimented with cutting-edge tech like Amazon Go, which allows for a seamless checkout experience, significantly enhancing convenience and improving overall customer happiness.

This commitment to pioneering new guest experiences is a major differentiator for Delaware North. In 2023, their focus on enhancing customer journeys was a significant factor in their continued growth and strong performance across their diverse portfolio of hospitality and food service operations. This forward-thinking approach helps them stand out in a crowded marketplace.

Delaware North's established reputation, cultivated over a century, is a cornerstone of its strength. This longevity has fostered deep, enduring partnerships with prestigious global venues and clients, including iconic sports arenas and national parks. Their proven ability to manage these large-scale, high-profile operations translates into significant trust and a distinct competitive edge.

Commitment to Sustainability

Delaware North's long-standing GreenPath® sustainability program, now in its 25th year, underscores a deep commitment to environmental responsibility. This program actively pursues reductions in energy use and waste generation across its operations. The company has set a clear target to source 100% of its single-use packaging from recyclable, renewable, or compostable materials by 2025, demonstrating a tangible step towards a circular economy.

This dedication to sustainability is not just an operational focus but also a strategic advantage, resonating with the increasing consumer and investor preference for businesses that prioritize Environmental, Social, and Governance (ESG) principles. For instance, in 2023, Delaware North reported a 15% reduction in waste sent to landfills compared to their 2019 baseline, a testament to their ongoing efforts.

- 25 years of active sustainability efforts through the GreenPath® program.

- 2025 target for 100% sustainable single-use packaging sourcing.

- 15% reduction in waste to landfills achieved by 2023 (vs. 2019 baseline).

- Alignment with ESG trends, meeting growing demand for environmentally conscious business practices.

Significant Annual Revenue and Employee Base

Delaware North's status as one of the largest privately-owned hospitality companies globally is underscored by its impressive financial and human capital. As of November 2024, the company reported annual revenues approaching $4.3 billion. This substantial revenue stream is supported by a vast workforce exceeding 60,000 employees worldwide.

This significant scale translates directly into operational strength and market leverage. The company's considerable financial resources and extensive employee base allow it to effectively manage large, intricate contracts and pursue substantial capital investments in new technologies and infrastructure.

- Substantial Revenue: Approximately $4.3 billion in annual revenue as of November 2024.

- Extensive Workforce: Employs over 60,000 individuals globally.

- Operational Capacity: Enables undertaking of large and complex contracts.

- Investment Capability: Facilitates investment in advanced technologies and infrastructure.

Delaware North's diversified business model, spanning sports, entertainment, airports, and national parks, provides significant revenue stability. This broad operational footprint, active across multiple continents, enhances its resilience against sector-specific economic downturns. The company's strong brand recognition, built over a century, fosters deep relationships with major clients and venues, creating a distinct competitive advantage.

| Strength Area | Description | Supporting Data/Fact |

|---|---|---|

| Diversification | Broad portfolio across multiple industries and geographies. | Operations in sports, entertainment, airports, and national parks. |

| Brand Reputation | Established and trusted name with over 100 years of experience. | Long-standing partnerships with prestigious global venues. |

| Sustainability Focus | Commitment to environmental responsibility through GreenPath®. | 25 years of sustainability efforts; 15% waste reduction by 2023 (vs. 2019). |

| Financial Scale | Significant revenue and workforce size. | Approx. $4.3 billion annual revenue (Nov 2024); 60,000+ employees. |

What is included in the product

Delivers a strategic overview of Delaware North’s internal and external business factors, highlighting its strengths in diverse operations and market presence, while also identifying potential weaknesses in integration and threats from market saturation.

Offers a clear, actionable framework to identify and address Delaware North's operational challenges.

Weaknesses

Delaware North, operating in hospitality and food service, faces significant vulnerability to economic downturns. This sector is inherently tied to consumer discretionary spending, which often contracts during periods of economic uncertainty. For instance, inflation in 2024 has driven up operational costs, particularly for labor and essential goods, directly squeezing profit margins for businesses in the hotel and food service industries, a trend that would undoubtedly impact Delaware North.

A slowing economy typically translates to reduced travel, lower entertainment attendance, and fewer event participations. This direct correlation means that a recessionary environment could substantially decrease the demand for Delaware North's services, leading to a significant drop in revenue across its diverse portfolio of venues and operations.

Delaware North's reliance on major sporting events, concerts, and travel hubs creates a vulnerability. Inconsistent revenue outside of these key periods can be a challenge, as their core business model is built around high-volume, event-driven traffic.

The company's performance is directly linked to the scheduling and attendance of these large-scale events. Disruptions, such as cancellations due to unforeseen circumstances like global health crises or severe weather, can significantly impact their financial results. For example, the sports and entertainment industry experienced substantial revenue losses in 2020 due to widespread event postponements.

Delaware North, like much of the hospitality sector, grapples with persistent labor shortages and rising wage demands through 2024 and into 2025. This trend directly impacts operational expenses, potentially increasing labor costs significantly.

The difficulty in securing and retaining qualified staff can strain service delivery, impacting the guest experience at venues managed by the company. For instance, a 2024 industry report indicated that over 70% of hospitality businesses are experiencing staffing challenges, with wages being a primary driver.

Intense Competition in Concessions and Venue Management

Delaware North faces a fiercely competitive environment within the concessions and venue management sectors. Major global players such as Aramark and Compass Group possess substantial resources and established reputations, intensifying the pressure to secure and maintain contracts. This intense rivalry necessitates constant innovation and aggressive pricing strategies to stay ahead in bidding for lucrative opportunities.

The market's competitive nature is further underscored by recent shifts in national park concession awards. These changes demonstrate that even established players must continually adapt and prove their value to retain business. For instance, in 2023, Aramark lost several key contracts, including those for Yosemite National Park, to competitors, illustrating the dynamic and challenging landscape Delaware North navigates.

- High Market Saturation: Numerous companies compete for a finite number of high-profile concession and venue management contracts.

- Dominant Competitors: Giants like Aramark and Compass Group, with extensive global reach, set a high bar for operational efficiency and service quality.

- Contract Renewal Challenges: The pressure to innovate and offer competitive pricing is critical for retaining existing contracts, as evidenced by recent shifts in national park agreements.

- Price Sensitivity: Clients, particularly government entities managing public spaces, often prioritize cost-effectiveness, making pricing a key differentiator.

Operational Complexities Across Diverse Segments

Delaware North's extensive portfolio, encompassing everything from airport retail to sports stadium concessions and national park hospitality, presents significant operational hurdles. Each distinct business line operates under its own set of regulations, service standards, and customer demands, requiring tailored management approaches.

This broad operational scope necessitates specialized knowledge across various divisions, potentially stretching management bandwidth. For instance, navigating the unique compliance frameworks for gaming operations in one state differs vastly from managing food service at a national park or retail outlets in international airports.

- Diverse Regulatory Environments: Operating in multiple jurisdictions means adhering to a patchwork of local, state, and federal regulations, impacting everything from labor laws to health and safety standards.

- Varied Customer Expectations: The customer base for a luxury hotel in a national park is fundamentally different from that of a fast-casual eatery in a busy airport, demanding distinct service models.

- Supply Chain Fragmentation: Managing supply chains for such a wide array of businesses, each with different product needs and delivery schedules, adds layers of complexity and potential inefficiencies.

Delaware North's reliance on large-scale events makes it susceptible to revenue fluctuations, especially when these events are disrupted. For example, the sports and entertainment industry faced significant revenue losses in 2020 due to widespread event postponements, a risk inherent in Delaware North's business model.

The company also faces challenges in securing and retaining staff, with rising wage demands through 2024 and into 2025 impacting operational costs. A 2024 industry report found over 70% of hospitality businesses experiencing staffing challenges, with wages being a primary driver, directly affecting Delaware North's labor expenses and service quality.

Intense competition from established players like Aramark and Compass Group, who possess substantial resources, forces Delaware North into aggressive pricing and constant innovation to win and keep contracts. Recent shifts in national park concession awards, where Aramark lost key contracts in 2023, highlight the dynamic and demanding nature of this competitive landscape.

Managing a diverse portfolio across different sectors, from airports to national parks, creates operational complexities. Each business line has unique regulatory environments, customer expectations, and supply chain needs, requiring specialized management and potentially stretching resources thin.

Preview Before You Purchase

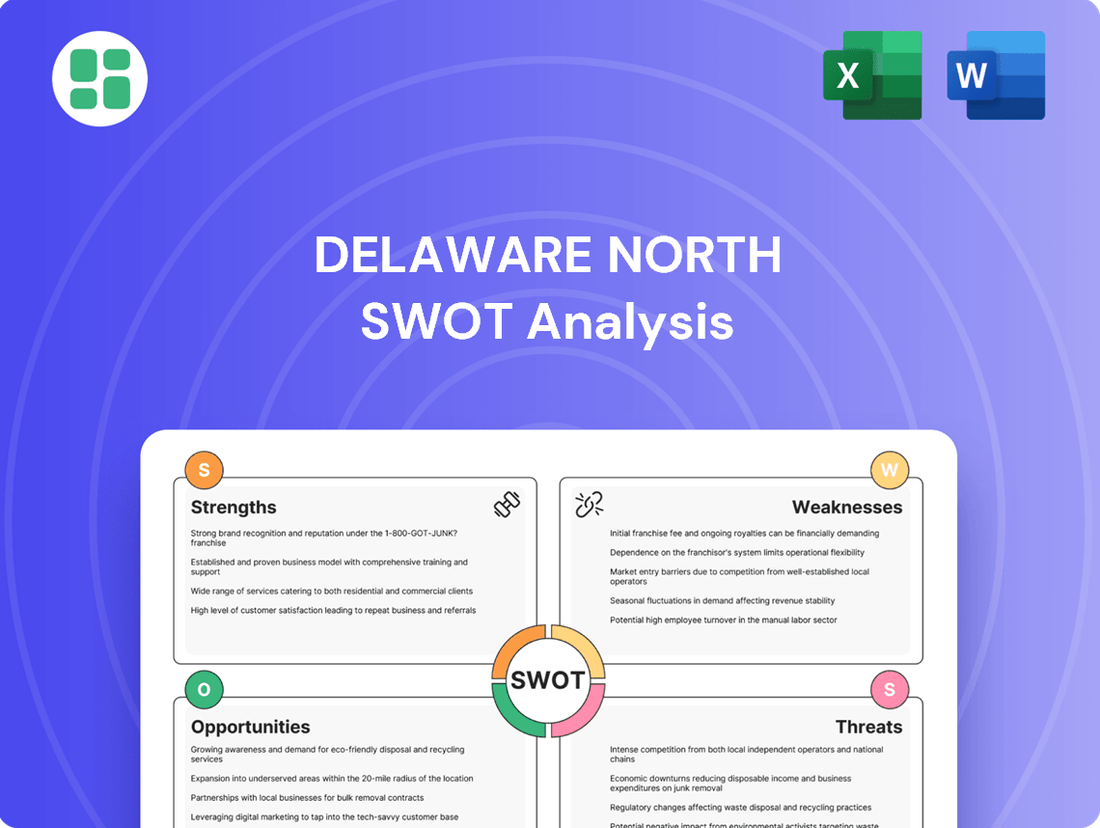

Delaware North SWOT Analysis

This is the actual Delaware North SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a direct preview of the comprehensive report that will be yours to download immediately after checkout.

Opportunities

The hospitality sector is rapidly changing, with a growing emphasis on hyper-personalized guest experiences, wellness tourism, and seamless tech integration. Delaware North has a significant opportunity to tap into these evolving consumer preferences.

By leveraging AI for advanced revenue management and offering more bespoke guest services, the company can cater to individual needs more effectively. For instance, the global wellness tourism market was valued at over $700 billion in 2023 and is projected to grow substantially, presenting a clear avenue for expansion.

Further developing wellness-focused amenities and programs within its resorts and parks can attract a new demographic of travelers seeking rejuvenation and health-conscious travel. This strategic alignment with emerging trends is key to capturing new market segments and fostering stronger customer loyalty in the coming years.

Delaware North can significantly boost efficiency and guest satisfaction by embracing technologies like AI chatbots and augmented reality. These tools can streamline operations, reduce guest wait times, and create more engaging experiences. For instance, mobile ordering systems have become standard, with many venues reporting increased revenue and faster service through their implementation.

Investing in smart venue technologies is key to attracting today's consumers. Imagine seamless entry, personalized recommendations, and interactive entertainment, all powered by smart tech. The global smart stadium market is expected to reach $20.1 billion by 2027, indicating a strong demand for these innovations.

The burgeoning demand for sustainable and eco-conscious travel presents a significant opportunity for Delaware North. With consumers increasingly prioritizing environmentally friendly options, the company's existing GreenPath® program is well-positioned to capture this market. By actively promoting its commitment to environmental stewardship, including sustainable sourcing and waste reduction, Delaware North can appeal to a growing segment of travelers and business partners, aligning with investor expectations for Environmental, Social, and Governance (ESG) improvements.

Strategic Acquisitions and Partnerships

The hospitality and entertainment sectors are experiencing significant M&A activity, creating fertile ground for Delaware North's strategic growth. In 2024, the global travel and tourism market is projected to reach $1.5 trillion, presenting ample opportunities for expansion.

Delaware North can leverage this trend by pursuing targeted acquisitions of innovative hospitality tech startups or forming strategic alliances with complementary businesses. This approach could bolster market share and introduce cutting-edge services, particularly within the burgeoning gaming and travel segments.

- Acquisition of a niche hospitality technology firm to enhance digital guest experiences.

- Partnership with a leading travel booking platform to expand reach in the leisure travel market.

- Joint venture in the burgeoning sports betting or esports arena to tap into new revenue streams.

- Acquisition of a regional catering or venue management company to strengthen its presence in key markets.

Diversification of Revenue Streams within Existing Venues

Delaware North can capitalize on the evolving nature of its venues, which are increasingly transforming into multi-purpose entertainment hubs. By offering a broader spectrum of experiences beyond core sports and concerts, the company can unlock significant new revenue potential. For instance, enhanced culinary offerings, curated retail selections, and engaging non-event day programming can transform these spaces into year-round destinations.

This strategic diversification directly addresses the inherent seasonality and event-driven nature of many venues. By maximizing facility utilization throughout the calendar year, Delaware North can create more consistent revenue streams. Consider the potential impact: a study by the International Association of Venue Managers in late 2024 indicated that venues diversifying into non-event day activities saw an average revenue uplift of 15-20% in their first year of implementation.

- Expand Culinary Diversity: Introduce pop-up restaurants, celebrity chef collaborations, and diverse ethnic food offerings to cater to a wider audience.

- Enhance Retail Presence: Develop unique merchandise, local artisan partnerships, and experiential retail concepts beyond team or venue branding.

- Develop Non-Event Day Programming: Host community events, business conferences, private functions, educational workshops, and wellness activities.

- Leverage Technology: Implement booking platforms for non-event activities and personalized offers for repeat visitors, increasing engagement and spend.

Delaware North is well-positioned to capitalize on the growing demand for personalized and tech-driven guest experiences. By integrating AI and offering bespoke services, the company can cater to evolving consumer preferences, tapping into markets like wellness tourism, which was valued at over $700 billion in 2023.

The company can also enhance operational efficiency and guest satisfaction through technologies such as AI chatbots and augmented reality, mirroring the success of mobile ordering systems that have boosted revenue and service speed in many venues.

Furthermore, Delaware North has a significant opportunity to expand through strategic acquisitions and partnerships within the consolidating hospitality and entertainment sectors, a trend supported by the projected $1.5 trillion global travel and tourism market in 2024.

By transforming venues into multi-purpose entertainment hubs and diversifying offerings beyond core events, Delaware North can create more consistent revenue streams, potentially increasing venue revenue by 15-20% through non-event day programming, as indicated by industry studies in late 2024.

Threats

Ongoing inflation, particularly impacting labor, food, and energy, directly threatens Delaware North's profit margins. For instance, the hotel industry reported in 2024 that escalating operating expenses, especially labor costs, were the primary drag on profitability, a trend likely to affect Delaware North's diverse hospitality and food service operations.

Even if interest rates stabilize, the persistent upward pressure on wages and the cost of essential goods will continue to strain profitability. This makes it difficult to maintain competitive pricing strategies without compromising the quality of service Delaware North is known for.

Delaware North faces a significant threat from intensifying labor market competition and persistent staffing challenges within the hospitality industry. High turnover rates and widespread labor shortages, particularly for essential roles like housekeeping and front-line service, are a constant concern. In 2024, the U.S. Bureau of Labor Statistics reported that the leisure and hospitality sector continued to grapple with vacancies, with millions of jobs remaining unfilled, impacting service delivery.

Consumer expectations are rapidly evolving, demanding personalized, tech-savvy, and sustainable experiences. For instance, a 2024 Deloitte survey found that 65% of consumers are more likely to engage with brands that offer personalized experiences. Delaware North must adapt to these shifts, such as the growing demand for healthier food options, which saw a 15% increase in sales for plant-based alternatives at their venues in early 2025.

Failure to keep pace with changing preferences, like the desire for seamless digital interactions at events, could result in lost market share. In 2024, over 70% of live event attendees reported preferring mobile ticketing and contactless payment options. Furthermore, shifts in fan behavior at sports venues, with reports of increased disruptive conduct, present an operational challenge for maintaining a positive guest experience.

Increased Scrutiny and Competition in National Park Concessions

The national park concessions landscape is becoming more competitive and subject to greater oversight. Recent contract shifts among major players, including the loss or transition of agreements by other large concessionaires, highlight this evolving environment. For Delaware North, this means a potential for increased contract challenges and a less predictable renewal process for its substantial national park operations.

This heightened scrutiny is exemplified by companies like POWDR actively entering the sector and acquiring concession agreements. Such shifts suggest that established players may face greater pressure to maintain their existing contracts or secure new ones. The trend indicates a potentially volatile period where long-standing partnerships could be re-evaluated.

- Increased Contract Volatility: Major concessionaires have recently experienced contract losses or transitions, signaling a less stable operating environment for companies with significant national park presence.

- New Entrants and Competition: Companies like POWDR are actively acquiring concession agreements, intensifying competition for prime locations and services within national parks.

- Regulatory and Public Scrutiny: Growing public and governmental interest in the management and profitability of national park concessions can lead to stricter contract terms and increased oversight for operators like Delaware North.

Geopolitical and Public Health Risks

Geopolitical tensions and public health crises pose significant threats to Delaware North's diverse portfolio. Events like the COVID-19 pandemic demonstrated this vulnerability, causing widespread operational shutdowns and a sharp decline in consumer spending on travel and entertainment. For instance, in 2020, the global tourism industry saw a staggering 73% drop in international arrivals compared to 2019, directly impacting venues reliant on visitor traffic.

These disruptions can lead to substantial financial losses due to reduced demand and mandatory closures. The ongoing conflict in Eastern Europe, for example, has contributed to increased energy costs and supply chain volatility, affecting operational expenses across various sectors. Delaware North’s reliance on large-scale events and public spaces makes it particularly susceptible to these external shocks.

- Pandemic Impact: Global travel restrictions and social distancing measures implemented during health crises directly curtail visitor numbers at parks, stadiums, and hospitality venues.

- Geopolitical Instability: Conflicts and political unrest can disrupt international travel patterns and impact consumer confidence, leading to decreased spending on leisure activities.

- Economic Volatility: Such events often trigger economic downturns, reducing discretionary income available for dining, entertainment, and travel.

- Operational Challenges: Supply chain disruptions and increased operating costs, driven by global events, can strain profitability and require adaptive management strategies.

Delaware North faces significant threats from escalating operational costs due to persistent inflation, particularly in labor, food, and energy sectors. For example, the hospitality industry in 2024 saw labor costs as the primary factor impacting profitability, a trend that directly affects Delaware North's extensive food service and hospitality operations.

Intensifying competition for a shrinking labor pool, especially for essential roles, continues to challenge the company. In 2024, the U.S. Bureau of Labor Statistics indicated that the leisure and hospitality sector still had millions of unfilled positions, directly impacting service delivery capabilities.

Evolving consumer expectations for personalized, tech-driven, and sustainable experiences present a constant need for adaptation. A 2024 Deloitte study revealed that 65% of consumers favor brands offering personalized interactions, while early 2025 data showed a 15% sales increase in plant-based food options at Delaware North venues, indicating a shift in demand.

The national park concessions market is becoming more competitive and subject to increased regulatory oversight, with recent contract shifts among major players indicating a less predictable renewal landscape for Delaware North's park operations.

SWOT Analysis Data Sources

This Delaware North SWOT analysis is built upon a foundation of robust data, drawing from official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.