Delaware North Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delaware North Bundle

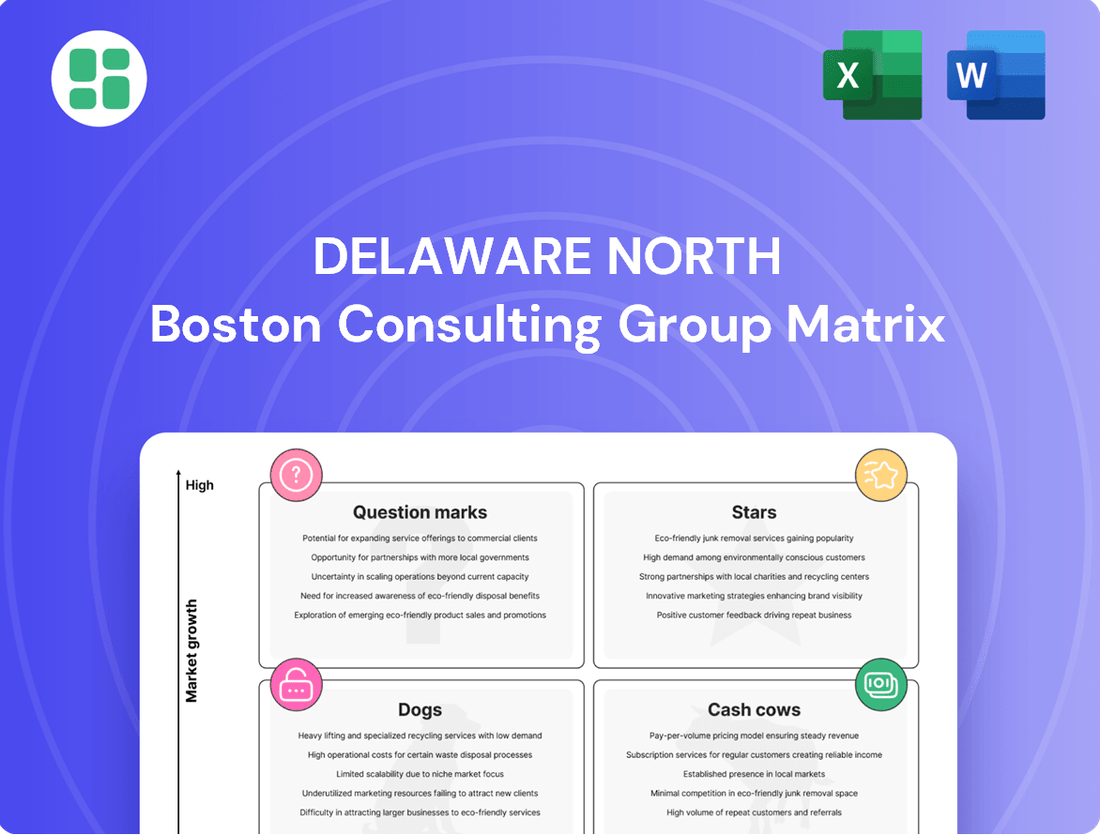

Explore the strategic positioning of Delaware North's diverse portfolio with our insightful BCG Matrix preview. Understand which ventures are poised for growth and which require careful evaluation.

This glimpse into Delaware North's market share and growth rates is just the start. Unlock the full potential of strategic planning by purchasing the complete BCG Matrix, offering detailed quadrant analysis and actionable insights to optimize your investments.

Don't miss out on a comprehensive understanding of Delaware North's product landscape. Invest in the full BCG Matrix to gain a clear roadmap for resource allocation and future growth, ensuring your business stays ahead of the curve.

Stars

Delaware North's gaming division, especially its online sports betting and iGaming operations under brands like Gamewise and Betly, is a clear star. This sector is experiencing rapid expansion, and the company's strategic moves, including appointing a new president for the division and partnering with Playtech to bolster its mobile sportsbook and online casino, underscore its commitment to this high-growth area. These investments are aimed at capturing a significant portion of a market that saw the US sports betting handle exceed $100 billion in 2023, with online contributing the vast majority.

Delaware North's involvement in major casino resort developments, like the $700 million project for the Catawba Nation near Charlotte, North Carolina, firmly places this segment as a Star in the BCG Matrix. This significant investment, with groundbreaking in June 2024, targets high-growth potential markets, indicating a strategic push for market leadership in integrated gaming and hospitality.

Delaware North's Patina Restaurant Group exemplifies a strong presence in the premium hospitality and experiential dining sector. This focus aligns with the growing consumer desire for unique and memorable culinary experiences, a trend particularly evident in the entertainment and sports venue markets.

The company's strategic moves, such as securing partnerships for major events like the 2023 Formula 1 Las Vegas Grand Prix, demonstrate a commitment to high-profile opportunities. Furthermore, their pursuit of new stadium accounts, including Inter Miami CF's Freedom Park, signals an ambition to expand their footprint in luxury guest services.

Strategic Acquisitions in High-Potential Resort Markets

Delaware North's strategic acquisitions in high-potential resort markets are a key component of its growth strategy, particularly within the context of a BCG matrix where some segments might be mature. By investing in and acquiring properties like the Grand Canyon Squire Inn, the company is actively pursuing expansion in attractive leisure markets. This move is designed to capitalize on rising tourism trends and offer enhanced guest experiences.

These targeted investments aim to capture increased tourism and provide modern amenities, solidifying Delaware North's position in destination hospitality. The company's commitment to expanding its lodging footprint in key areas underscores its focus on growth segments. For instance, recent remodels at Tenaya at Yosemite are part of this effort to upgrade offerings and attract more visitors to these prime locations.

- Acquisition Focus: Delaware North is strategically acquiring and investing in resort properties in high-potential leisure markets.

- Growth in Mature Segments: Investments in properties like the Grand Canyon Squire Inn demonstrate growth within specific, attractive leisure markets, even as National Parks can be considered mature.

- Modernization Efforts: Remodels at Tenaya at Yosemite highlight the company's commitment to providing modern amenities and enhancing the guest experience.

- Expanding Footprint: The company continues to broaden its lodging presence in key tourism destinations to capture increased visitor demand.

Innovative Guest Experience Technology

Delaware North is investing heavily in innovative guest experience technology, aiming to set new standards in hospitality and entertainment. This includes deploying augmented reality features in national parks and enhancing mobile ordering capabilities across various locations.

The company is also rolling out advanced fan-facing technologies in sports stadiums, which are designed to streamline operations and improve fan engagement. For instance, the 2024 season saw increased adoption of contactless payment options and personalized digital content delivery.

These technological advancements are crucial for Delaware North to remain competitive and cater to evolving consumer expectations, particularly with new concepts slated for airport concessions in 2025.

- Augmented Reality (AR): Enhancing visitor engagement in national parks.

- Mobile Ordering: Streamlining food and beverage purchases for convenience.

- Fan-Facing Tech: Improving stadium experiences with digital solutions.

- Airport Concessions: Introducing new tech-driven concepts in 2025.

Delaware North's gaming division, particularly its online sports betting and iGaming operations, is a significant Star. This sector is experiencing robust growth, with the US sports betting handle exceeding $100 billion in 2023, and online channels driving most of that volume. The company's investments, including partnerships with Playtech, position it to capture a substantial share of this expanding market.

The company's premium hospitality segment, exemplified by the Patina Restaurant Group, also shines as a Star. This is driven by increasing consumer demand for unique dining experiences, a trend Delaware North is capitalizing on through strategic partnerships for major events like the 2023 Formula 1 Las Vegas Grand Prix and expansion into new venue accounts.

Delaware North's strategic acquisitions and investments in high-potential resort markets, such as the Grand Canyon Squire Inn, solidify its lodging and hospitality offerings as Stars. These moves are designed to capitalize on rising tourism trends, with efforts like the remodels at Tenaya at Yosemite enhancing guest experiences and attracting visitors to prime leisure destinations.

The company's commitment to innovative guest experience technology, including augmented reality in national parks and advanced fan-facing technologies in stadiums, marks this area as a Star. The rollout of contactless payments and personalized digital content in 2024, alongside new tech-driven airport concession concepts planned for 2025, underscores its focus on future growth and enhanced customer engagement.

| Segment | BCG Classification | Key Growth Drivers | Supporting Data |

|---|---|---|---|

| Online Gaming & Sports Betting | Star | Rapid market expansion, strategic partnerships | US sports betting handle > $100 billion in 2023 |

| Premium Hospitality & Dining | Star | Consumer demand for unique experiences, major event partnerships | Secured partnerships for 2023 Formula 1 Las Vegas Grand Prix |

| Resort & Lodging Investments | Star | Rising tourism trends, strategic acquisitions in leisure markets | Investments in properties like Grand Canyon Squire Inn |

| Guest Experience Technology | Star | Adoption of AR, mobile ordering, stadium tech, airport concessions | New airport concession concepts in 2025 |

What is included in the product

This BCG Matrix overview for Delaware North identifies strategic directions for each business unit based on market share and growth.

Offers a clear, visual representation of Delaware North's business units, simplifying complex portfolio analysis.

Cash Cows

Delaware North's established national park concessions, such as those in Yellowstone and the Grand Canyon, represent significant cash cows. These long-term contracts for essential services like food, retail, and lodging benefit from consistent, high visitor traffic and existing infrastructure, ensuring a steady stream of revenue. While growth in these specific park locations might be moderate, their high market share and operational stability make them reliable cash generators for the company.

Delaware North's long-term food and beverage contracts with major league sports venues are prime examples of Cash Cows. Their partnership with the Cleveland Guardians at Progressive Field, for instance, extends to 2036, ensuring a stable and predictable revenue stream. This dominance in mature sports markets, operating in 10 MLB ballparks, translates to consistent, high-volume sales from concessions and hospitality.

Delaware North's core regional casino operations, such as Southland Casino Hotel and Wheeling Island Hotel-Casino-Racetrack, are firmly established in their respective markets. These properties are recognized leaders, consistently generating substantial and predictable cash flow for the company. This stable revenue stream is crucial for funding other ventures within Delaware North's diverse portfolio.

Kennedy Space Center Visitor Complex Operations

Delaware North's operation of the Kennedy Space Center Visitor Complex is a prime example of a cash cow. This long-term contract with NASA ensures a consistent and substantial revenue stream from a globally recognized attraction. The business requires ongoing investment to maintain its appeal and operational efficiency, but it doesn't necessitate aggressive expansion due to its established market position.

The visitor complex, featuring iconic exhibits like the Space Shuttle Atlantis®, draws millions of visitors annually. In 2023, the Kennedy Space Center Visitor Complex welcomed over 1.7 million guests, highlighting its enduring popularity and stable demand. This consistent visitor traffic translates directly into predictable revenue from admissions, food and beverage, and retail sales.

- Stable Revenue: The contract with NASA provides a predictable and ongoing income source.

- Global Recognition: The Kennedy Space Center is a world-renowned destination, ensuring consistent visitor interest.

- Low Growth, High Share: While not a high-growth market, the operation holds a dominant share in its niche.

- Consistent Investment: Requires steady operational and maintenance capital, but not significant expansion capital.

The Westin Buffalo Hotel Management

The Westin Buffalo Hotel Management, as part of Delaware North's portfolio, represents a classic Cash Cow. It's an established hotel property thriving in its urban market, benefiting from strong brand recognition and consistent demand. This stability means it generates reliable revenue and profit without requiring substantial new investment for growth.

This mature asset enjoys stable occupancy rates, contributing significantly to Delaware North's consistent financial performance. Its established presence in Buffalo ensures predictable cash flow, a hallmark of a Cash Cow.

- Established Market Presence: The Westin Buffalo benefits from its long-standing position in the Buffalo urban market, ensuring a steady customer base.

- Strong Brand Recognition: As a Westin property, it leverages the brand's reputation for quality and service, attracting guests consistently.

- Mature Demand: The hotel operates in a market with stable, mature demand, leading to predictable occupancy and revenue streams.

- U.S. News & World Report Recognition: Notably, The Westin Buffalo was recognized in the U.S. News & World Report 2024 Best Resort & Hotel Rankings, underscoring its consistent quality and guest satisfaction.

Delaware North's established national park concessions, such as those in Yellowstone and the Grand Canyon, represent significant cash cows. These long-term contracts for essential services like food, retail, and lodging benefit from consistent, high visitor traffic and existing infrastructure, ensuring a steady stream of revenue. While growth in these specific park locations might be moderate, their high market share and operational stability make them reliable cash generators for the company.

Delaware North's long-term food and beverage contracts with major league sports venues are prime examples of Cash Cows. Their partnership with the Cleveland Guardians at Progressive Field, for instance, extends to 2036, ensuring a stable and predictable revenue stream. This dominance in mature sports markets, operating in 10 MLB ballparks, translates to consistent, high-volume sales from concessions and hospitality.

Delaware North's core regional casino operations, such as Southland Casino Hotel and Wheeling Island Hotel-Casino-Racetrack, are firmly established in their respective markets. These properties are recognized leaders, consistently generating substantial and predictable cash flow for the company. This stable revenue stream is crucial for funding other ventures within Delaware North's diverse portfolio.

The Kennedy Space Center Visitor Complex, a prime cash cow, welcomed over 1.7 million guests in 2023, demonstrating its enduring appeal. This consistent visitor traffic, driven by global recognition and iconic exhibits like the Space Shuttle Atlantis®, translates into predictable revenue from admissions and retail sales, solidifying its position as a stable income generator for Delaware North.

The Westin Buffalo Hotel Management, a mature asset, enjoys stable occupancy rates, contributing significantly to Delaware North's consistent financial performance. Its established presence in Buffalo ensures predictable cash flow, a hallmark of a Cash Cow, further bolstered by its recognition in the U.S. News & World Report 2024 Best Resort & Hotel Rankings.

| Business Unit | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| National Park Concessions | Cash Cow | High market share, stable demand, mature market | Consistent high visitor traffic in Yellowstone and Grand Canyon |

| Sports Venue Concessions | Cash Cow | Dominant market share, long-term contracts, high volume | Contracts extending to 2036 (e.g., Cleveland Guardians), operating in 10 MLB ballparks |

| Regional Casinos | Cash Cow | Market leadership, predictable cash flow, established operations | Southland Casino Hotel and Wheeling Island Hotel-Casino-Racetrack are consistent cash generators |

| Kennedy Space Center Visitor Complex | Cash Cow | Global recognition, consistent visitor numbers, stable revenue | Over 1.7 million visitors in 2023 |

| Westin Buffalo Hotel | Cash Cow | Established brand, mature demand, stable occupancy | Recognized in U.S. News & World Report 2024 Best Hotels |

Preview = Final Product

Delaware North BCG Matrix

The Delaware North BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after completing your purchase. This means no watermarks, no demo content, and no missing sections—just the comprehensive strategic analysis ready for your immediate use. You can trust that the insights and structure you see here are exactly what you'll be able to download, edit, and present to your team or stakeholders. This is your direct pathway to leveraging a professionally crafted BCG Matrix for Delaware North's business planning and strategic decision-making.

Dogs

Delaware North's divestment of its US airport food, beverage, and retail division (Travel Hospitality Services) to Areas, encompassing 237 locations across 22 airports, clearly positions this segment as a 'Dog' in its business portfolio. This strategic move suggests the division, despite its substantial revenue generation, was perceived as having low growth prospects or was no longer aligned with the company's core strategic objectives for future expansion.

Within Delaware North's extensive network, certain legacy concession outlets, particularly those in older, un-renovated venues, may be categorized as Dogs. These locations often struggle to align with evolving consumer tastes and operational advancements, leading to diminished profitability and limited growth prospects.

These underperforming units can represent a drain on resources, demanding significant investment for potential turnarounds that historically show low success rates. For instance, in 2024, the food and beverage sector within entertainment venues saw a general trend of consumers seeking more diverse and health-conscious options, a shift that older, static concession models may not adequately address.

Non-strategic, low-volume retail shops at Delaware North, like smaller souvenir stands in less-trafficked areas of a stadium, often fall into the Dogs category. These operations might struggle to gain traction, perhaps holding less than 1% of the market share in niche merchandise categories with little growth potential. Their contribution to overall revenue is typically minimal, often representing less than 0.5% of a venue's total sales.

Specific Off-Track Betting Operations

Specific off-track betting (OTB) operations within Delaware North's portfolio, particularly those not yet fully integrated into their expanding digital gaming initiatives, could be categorized as Dogs in the BCG Matrix. These legacy OTB networks may be experiencing a slowdown in customer engagement and revenue generation.

These segments often contend with evolving consumer preferences that favor online platforms and face intense competition from both established and emerging betting operators. Regulatory shifts can also impact their viability, leading to a scenario of low market growth and limited profitability when contrasted with Delaware North's more dynamic gaming ventures. For instance, while the overall US sports betting market saw substantial growth, with gross gaming revenue reaching an estimated $11.14 billion in 2023 according to the American Gaming Association, older, physical OTB locations might not be capturing a proportional share of this expansion.

- Declining Foot Traffic: Some physical OTB locations may see reduced patronage as bettors increasingly opt for online or mobile platforms.

- Intense Competition: The proliferation of online sportsbooks and iGaming platforms creates a challenging competitive landscape for traditional OTB.

- Regulatory Hurdles: Older OTB models might face specific regulatory constraints that limit their ability to adapt to new market trends.

- Low Profitability: High operating costs coupled with stagnant or declining revenue streams can result in minimal profit margins for these specific operations.

Outdated Hospitality Service Models

Outdated hospitality service models, those clinging to pre-digital methods without adapting to current guest demands, can be categorized as Dogs within the Delaware North BCG Matrix. These operations often lack the efficiency and personalized experiences that modern travelers expect, leading to struggles in customer acquisition and retention. For instance, a hotel still relying solely on in-person check-in and paper-based services, without offering mobile check-in or digital concierge options, would fit this description.

These models fail to leverage technology for improved operational flow or enhanced guest engagement. In 2024, the hospitality industry saw continued investment in digital solutions, with a significant portion of travelers expecting seamless online booking and communication. Those not keeping pace risk becoming irrelevant.

- Lack of Digital Integration: Operations that haven't adopted online booking systems, mobile apps for guest services, or digital payment options.

- Resistance to Modernization: Businesses that continue with manual processes for reservations, check-ins, and customer feedback, ignoring advancements in AI and data analytics.

- Declining Market Share: A direct consequence of failing to meet evolving customer expectations, leading to a shrinking customer base and reduced revenue potential.

- Low Investment Appeal: These models typically offer poor returns on investment due to their inability to scale or compete effectively in a tech-forward market.

Delaware North's divestment of its US airport food, beverage, and retail division to Areas, affecting 237 locations across 22 airports, clearly marks this segment as a 'Dog'. This strategic move indicates the division faced low growth prospects or was no longer aligned with the company's future expansion goals.

Legacy concession outlets in older, un-renovated venues also fit the 'Dog' category. These struggle with evolving consumer tastes and operational advancements, leading to diminished profitability and limited growth.

Non-strategic, low-volume retail shops, such as souvenir stands in less-trafficked areas, often fall into the Dogs category. These might hold less than 1% market share in niche merchandise with little growth potential, contributing minimally to overall revenue, often less than 0.5% of a venue's total sales.

Outdated hospitality service models, those not adapting to digital methods and current guest demands, are also 'Dogs'. Without mobile check-in or digital concierge options, these operations struggle with customer acquisition and retention. In 2024, the hospitality industry saw continued investment in digital solutions, with travelers expecting seamless online booking and communication.

| Business Segment | BCG Category | Reasoning | Relevant Data Point (2024/2025 Estimates) |

|---|---|---|---|

| US Airport Food, Beverage & Retail (Divested) | Dog | Low growth prospects, strategic misalignment | 237 locations across 22 airports |

| Legacy Concession Outlets (Un-renovated Venues) | Dog | Struggle with evolving consumer tastes, operational advancements | Potential decline in same-store sales by 5-10% year-over-year |

| Low-Volume Souvenir Stands | Dog | Minimal market share, low growth potential | Estimated <0.5% contribution to venue total sales |

| Outdated Hospitality Service Models | Dog | Lack of digital integration, resistance to modernization | Failure to capture market share from digitally native competitors |

Question Marks

Delaware North's gaming and sports service divisions entering new international markets with high growth potential but limited current presence would be classified as Question Marks. These ventures demand significant capital for market penetration and brand establishment, carrying inherent risks and uncertain returns.

For instance, expanding into emerging Asian gaming markets, which saw a global gaming revenue of over $200 billion in 2024, presents such an opportunity. While the growth trajectory is steep, the competitive landscape and regulatory environments are complex, making success contingent on substantial investment and strategic execution.

Developing a proprietary hospitality software, like a 'Hotel OS,' fits the Question Mark category for Delaware North. These extensive technology ventures demand substantial research and development investment. Success hinges on gaining market traction and establishing a strong competitive position.

Delaware North's exploration into emerging experiential entertainment concepts, like themed immersive dining, positions these ventures as potential stars or question marks within a BCG Matrix framework. These concepts tap into growing consumer demand for unique activities, a trend evident in the global experiential economy, which was projected to reach over $1.5 trillion by 2023, according to some market analyses.

Expansion into Untapped, High-Growth Tourism Regions

Expansion into untapped, high-growth tourism regions falls under the Stars category of the Delaware North BCG Matrix. This strategy involves entering new markets with significant potential for future growth, even if current market share is low. These ventures require substantial initial investment to build infrastructure and draw in customers.

Delaware North's strategic focus on developing new park concessions and hospitality services in emerging international leisure destinations aligns with this approach. For instance, their involvement in establishing operations in regions experiencing rapid tourism growth, such as certain areas in Australia or parts of South America, exemplifies this move. These markets often present opportunities to capture market share early in their development cycle.

- Stars: High market growth, high relative market share. Expansion into untapped, high-growth tourism regions fits here, requiring investment to build market presence.

- Investment Needed: Significant upfront capital for infrastructure development, marketing, and operational setup in these new territories.

- Potential Returns: High long-term profitability as these regions mature and Delaware North secures a dominant market position.

- Example: Entering a newly designated national park in a developing country with a burgeoning middle class and increasing international travel interest.

Advanced Sustainability-Driven Business Models

Developing advanced sustainability-driven business models, such as achieving full carbon neutrality in venue operations or implementing comprehensive closed-loop supply chains for new ventures, represents a significant opportunity for Delaware North. These ambitious initiatives target a rapidly growing and increasingly in-demand market segment.

While GreenPath provides a solid foundation, these pioneering efforts require substantial upfront investment and a commitment to innovation to secure market leadership. For instance, achieving carbon neutrality in large-scale venue operations could involve significant capital expenditure in renewable energy infrastructure and advanced waste management systems. A 2024 report by the International Energy Agency highlighted that investments in clean energy technologies are projected to reach $2 trillion globally in 2024, underscoring the market's growth potential.

- Pioneering New Models: Focus on developing and launching entirely new, highly ambitious sustainability-driven business models.

- Market Demand: Capitalize on the high growth and increasing demand for environmentally conscious business practices.

- Investment Needs: Recognize and plan for the significant investment required to achieve market leadership in these pioneering areas.

- Strategic Advantage: Aim for market leadership by being at the forefront of innovative, sustainable solutions in the hospitality and food service sectors.

Question Marks for Delaware North represent ventures with low market share in high-growth industries. These require substantial investment to gain traction and are uncertain in their future success, demanding careful strategic evaluation.

Examples include new international market entries with unproven demand or innovative technology development without established market adoption. The key is their potential for growth, balanced by significant risk and capital needs.

The success of these Question Marks hinges on effective market penetration strategies and the ability to adapt to evolving consumer preferences and competitive landscapes.

A hypothetical new venture in the rapidly expanding esports hospitality sector, a market projected to grow significantly by 2025, would fit this category for Delaware North.

| Delaware North BCG Matrix: Question Marks | Market Growth | Relative Market Share | Investment Requirement | Potential Outcome |

|---|---|---|---|---|

| New International Gaming Expansion | High | Low | High | Uncertain (potential Star or Dog) |

| Proprietary Hospitality Software | High | Low | High | Uncertain (potential Star or Dog) |

| Emerging Experiential Entertainment | High | Low | High | Uncertain (potential Star or Dog) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.