Delaware North Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delaware North Bundle

Delaware North navigates a complex landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of substitutes. Understanding these forces is crucial for any business looking to thrive in its operating sectors.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Delaware North’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Delaware North's bargaining power of suppliers is significantly influenced by supplier concentration and the uniqueness of the inputs they provide. If Delaware North relies on a limited number of suppliers for critical components, such as specialized catering ingredients or exclusive technology for its venues, those suppliers gain considerable leverage. For instance, in 2024, the global market for stadium technology saw increased consolidation, with a few key players dominating advanced audiovisual and connectivity solutions, potentially increasing their pricing power.

The uniqueness of offerings also plays a crucial role. Suppliers providing proprietary entertainment acts or highly specialized operational equipment that is difficult to substitute can command higher prices and more favorable terms. This is particularly relevant in the hospitality and entertainment sectors where distinctive experiences are a key differentiator for venues managed by companies like Delaware North.

Delaware North faces significant switching costs when dealing with its suppliers, particularly for specialized services and proprietary equipment. These costs can include not only the financial outlay for new contracts and potential termination fees but also the operational disruption of integrating a new supplier's processes and products. The time needed to vet, onboard, and train staff on new systems can also be substantial, making a switch a complex undertaking.

For instance, if Delaware North relies on a specific catering supplier for its venue operations, switching could mean renegotiating all food service contracts, retraining kitchen staff on new inventory management systems, and potentially losing established customer relationships built on the current supplier's quality. These hurdles grant existing suppliers considerable bargaining power, as Delaware North would be hesitant to incur such significant costs and disruptions unless absolutely necessary.

The bargaining power of suppliers is a significant factor for Delaware North, impacting its ability to control costs and maintain service quality. For a company deeply involved in food service and hospitality, the reliability and cost of food ingredients are paramount. For example, disruptions in the supply chain for fresh produce or specialty food items can directly affect menu offerings and guest satisfaction. In 2024, the volatility in global commodity prices, particularly for agricultural products, has put increased pressure on food suppliers, potentially amplifying their bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Delaware North's core business, such as food service or hospitality, can significantly amplify their bargaining power. If suppliers possess the necessary capital, expertise, and market access, they could choose to bypass Delaware North and serve customers directly, effectively becoming competitors. This scenario is particularly concerning if the supplier's own industry offers higher profit margins than those typically seen in the hospitality sector.

For instance, a large-scale food distributor with robust logistics and brand recognition might consider directly operating concessions or catering services in venues where Delaware North currently holds contracts. This possibility forces Delaware North to maintain competitive pricing and service levels to retain its suppliers. The financial health of potential integrating suppliers is a key indicator; if a supplier's industry, like specialized food production or event technology, is experiencing substantial growth and profitability, the incentive to move downstream increases.

- Supplier Capability: Suppliers with strong operational capabilities, established distribution networks, and brand loyalty are more likely to successfully integrate forward.

- Industry Profitability: When a supplier's industry is more profitable than Delaware North's, the allure of direct market entry becomes stronger. For example, if the specialty food ingredient sector, a potential supplier area, boasts average net profit margins of 10-15%, while the contract food service industry averages 3-7%, the incentive is clear.

- Market Dynamics: The presence of readily available customer bases and low barriers to entry in Delaware North's served markets would facilitate forward integration.

Supplier's Ability to Differentiate

Delaware North's suppliers possess varying degrees of power based on their ability to differentiate. Suppliers offering unique, proprietary products or services, like specialized ticketing systems or exclusive catering partnerships, can exert significant influence. For instance, a supplier providing a proprietary data analytics platform for fan engagement might hold considerable sway due to the difficulty of finding comparable alternatives. This differentiation allows them to negotiate better pricing and terms, directly impacting Delaware North's costs.

In contrast, suppliers of more commoditized goods and services, such as standard food supplies or general maintenance services, have much lower bargaining power. Delaware North can readily switch between multiple providers for these items, limiting any single supplier's ability to dictate terms. The company's extensive purchasing volume for these commodities also allows it to negotiate favorable pricing. For example, in 2024, the cost of many agricultural commodities, while experiencing some volatility, remained accessible from numerous suppliers, reducing individual supplier leverage.

- Differentiated Suppliers: Can command higher prices and favorable terms due to unique offerings, like proprietary software or exclusive ingredient sourcing.

- Commodity Suppliers: Have less power as their products are easily substitutable, allowing Delaware North to leverage competition for better pricing.

- Impact on Delaware North: The mix of supplier differentiation directly influences operational costs and the ability to secure unique venue experiences.

Delaware North's suppliers' bargaining power is magnified when they offer unique or highly specialized inputs, making it difficult and costly for Delaware North to switch. This is particularly true for proprietary technology solutions or exclusive food and beverage partnerships crucial for creating distinct venue experiences. For instance, in 2024, the market for advanced venue analytics software saw continued innovation, with a few providers offering unique data integration capabilities, giving them significant leverage over clients like Delaware North.

Conversely, suppliers of commoditized goods, such as standard cleaning supplies or basic food ingredients, possess considerably less power. Delaware North can easily source these items from numerous providers, and its substantial purchasing volume allows for competitive price negotiations. The availability of multiple suppliers for these essential but undifferentiated inputs significantly reduces any individual supplier's ability to dictate terms.

| Supplier Type | Differentiation Level | Bargaining Power | Example for Delaware North (2024) |

| Specialized Technology Provider | High (Proprietary software) | High | Data analytics platform for fan engagement |

| Exclusive Catering Partner | High (Unique menu items) | High | Partnership for premium dining experiences |

| Agricultural Commodity Supplier | Low (Standard produce) | Low | Bulk purchase of fruits and vegetables |

| General Maintenance Services | Low (Standard services) | Low | Routine facility upkeep contracts |

What is included in the product

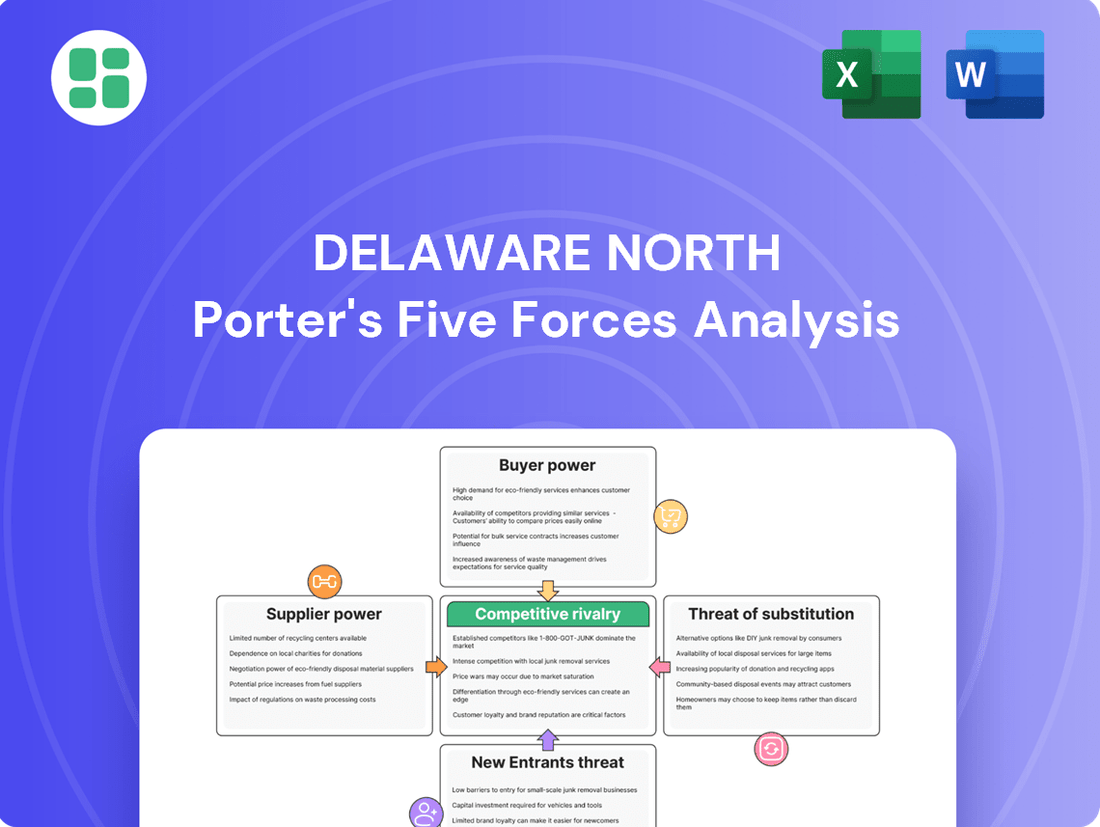

This Porter's Five Forces analysis for Delaware North examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within its diverse operating industries.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, allowing Delaware North to proactively address market threats and capitalize on opportunities.

Customers Bargaining Power

Delaware North's customer concentration is a key factor in its bargaining power. When a few major clients, such as large stadium owners or government bodies like the National Park Service, represent a substantial portion of the company's revenue, these customers gain significant leverage. For instance, if a single large venue contract accounts for a notable percentage of Delaware North's annual revenue, that client can negotiate more favorable terms due to the volume of business they provide.

Delaware North's customer price sensitivity can be significant, particularly when bidding for large venue contracts. For instance, in the competitive sports and entertainment venue management sector, clients often prioritize cost-effectiveness. A 2024 report indicated that venue operators are increasingly scrutinizing operational budgets, with food and beverage costs being a key area for potential savings.

The importance of cost to the customer is a primary driver of this sensitivity. If a venue operator views food and beverage services as a major expense line, they will be more inclined to seek out providers offering lower prices. This pressure is amplified when there are numerous alternative providers capable of delivering similar services, creating a buyer's market.

Furthermore, the financial health of potential clients plays a role. Organizations facing economic headwinds or those with tighter financial constraints will naturally exhibit higher price sensitivity. This was evident in early 2024 data showing a cautious approach to discretionary spending across several industries that utilize venue management services.

The ease with which customers can find alternative hospitality or food service providers significantly impacts Delaware North's bargaining power. If venue owners can readily contract with other concessionaires or if consumers have numerous dining and entertainment choices, Delaware North faces stronger customer leverage. This dynamic is particularly relevant in the sports and entertainment sector, where venue operators often have multiple concession and hospitality partners to choose from, potentially driving down margins for Delaware North if they cannot differentiate their offerings or secure long-term, favorable contracts.

Customer Information and Transparency

Customers today have unprecedented access to information regarding pricing, service quality, and competitor offerings. This heightened transparency significantly strengthens their bargaining power. For Delaware North, this means customers can easily compare options and are less likely to accept suboptimal deals. For example, online review platforms and price comparison websites allow consumers to quickly identify the best value, putting pressure on service providers like Delaware North to remain competitive.

The availability of industry benchmarks and competitive bid data further empowers customers. They can leverage this knowledge to negotiate more favorable terms, demanding better pricing or enhanced service levels. This is particularly relevant in sectors where Delaware North operates, such as hospitality and food service, where customer loyalty can be influenced by perceived value and competitive alternatives.

- Increased Information Access: Customers can readily compare Delaware North's pricing and service quality against competitors through online platforms and review sites.

- Negotiation Leverage: Transparency in pricing and service offerings empowers customers to negotiate better deals and demand more value.

- Industry Benchmarking: Access to industry standards and competitor pricing allows customers to set expectations and push for competitive advantages.

- Demand for Value: Well-informed customers are more likely to seek out and secure the best possible value proposition, influencing Delaware North's market positioning.

Threat of Backward Integration by Customers

The threat of backward integration by Delaware North's customers, such as venue owners, presents a significant challenge. If these clients possess the necessary capital, operational expertise, and management capabilities, they might choose to bring food and beverage services in-house rather than outsourcing to Delaware North. This capability directly enhances their bargaining power.

For instance, a large stadium owner could decide to manage its own concessions, eliminating the need for Delaware North's services. This decision would be driven by a desire to capture more profit margin or exert greater control over the customer experience. The potential for such a move forces Delaware North to remain competitive on pricing and service quality.

- Venue owners might possess existing infrastructure and staff that could be repurposed for food and beverage management.

- The potential cost savings from self-operation could be a strong motivator for backward integration.

- Delaware North's ability to demonstrate superior efficiency and profitability in its operations is key to mitigating this threat.

Delaware North's customer bargaining power is significantly influenced by the concentration of its client base. When a few key clients, like major sports arenas or government entities, represent a substantial revenue share, they gain considerable leverage. For example, if a single large contract constitutes a notable portion of Delaware North's annual income, that client can negotiate more favorable terms due to the volume of business they represent.

The ease with which customers can find alternative providers also amplifies their bargaining power. If venue owners can readily contract with other concessionaires, or if consumers have numerous dining options, Delaware North faces stronger customer leverage. This is especially true in the competitive sports and entertainment sector, where operators often have multiple partners to choose from, potentially driving down margins if Delaware North cannot differentiate its services or secure favorable long-term contracts.

Customers today have greater access to information about pricing and service quality, significantly boosting their bargaining power. This transparency allows them to easily compare options and pressure providers like Delaware North to remain competitive on price and service. For instance, in 2024, venue operators were noted for scrutinizing operational budgets, particularly food and beverage costs, seeking potential savings.

| Factor | Impact on Delaware North | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High concentration increases leverage for key clients. | Specific client revenue percentages are often confidential but industry reports highlight reliance on major venue contracts. |

| Availability of Alternatives | More alternatives empower customers to negotiate better terms. | The hospitality and food service sectors remain highly competitive with numerous providers. |

| Information Transparency | Customers can easily compare pricing and service, increasing pressure. | Online review platforms and price comparison tools are increasingly influential in customer decision-making. |

| Price Sensitivity | Clients focused on cost savings will negotiate harder. | A 2024 trend shows increased focus on cost-effectiveness in venue operations, with food and beverage costs being a key area. |

What You See Is What You Get

Delaware North Porter's Five Forces Analysis

This preview showcases the comprehensive Delaware North Porter's Five Forces analysis, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll gain immediate access to this exact, professionally formatted analysis, providing valuable insights into Delaware North's strategic positioning within the hospitality and food service industry.

Rivalry Among Competitors

Delaware North faces intense competition across its varied business segments. In food service and hospitality, it contends with global giants like Compass Group and Aramark, alongside numerous regional and specialized operators in specific venues such as stadiums and airports. This broad competitive landscape, populated by players ranging from massive multinational corporations to smaller, agile niche providers, significantly heightens the rivalry.

The overall growth rate of the hospitality and entertainment industry significantly influences competitive rivalry for companies like Delaware North. In segments experiencing robust expansion, such as the projected 7.3% compound annual growth rate for the global travel and tourism market through 2032, there's often ample opportunity for all players, which can temper intense competition. However, as these markets mature or slow down, the fight for existing market share intensifies, leading to more aggressive pricing strategies and marketing efforts among competitors.

Delaware North actively differentiates its offerings by focusing on unique guest experiences and culinary innovation within its diverse portfolio, which includes sports stadiums, national parks, and airports. This strategy aims to move beyond mere service provision, creating memorable moments for patrons. For instance, their work at TD Garden in Boston has seen them implement advanced technology for ordering and personalized fan engagement.

Exit Barriers for Competitors

Delaware North, operating in sectors like sports and entertainment, faces significant exit barriers due to the capital-intensive nature of venue management. High upfront investments in stadiums, arenas, and hospitality infrastructure create substantial sunk costs. For instance, building a modern sports stadium can easily cost hundreds of millions, if not billions, of dollars.

These substantial investments mean that exiting the market would result in a significant loss on these specialized assets, which often have limited alternative uses. Long-term contracts with leagues, teams, or event organizers further lock in competitors, making it difficult to divest or cease operations without penalty.

The emotional attachment and brand loyalty built around specific venues or events also contribute to exit barriers. Competitors may continue to operate at a loss, hoping for a turnaround, rather than abandon years of investment and established relationships. This can lead to prolonged periods of overcapacity and intense price competition as companies fight to survive.

- High Capital Investment: Building and maintaining large-scale venues requires billions in capital, making divestment difficult.

- Specialized Assets: Venue infrastructure is highly specific, with limited resale value outside the industry.

- Long-Term Contracts: Commitments to sports leagues or event promoters create penalties for early exit.

- Brand and Emotional Ties: Established relationships and venue prestige discourage competitors from leaving.

Strategic Commitments and Aggressiveness

Delaware North faces intense competition from rivals who are strategically committed to market dominance and aggressively pursuing expansion. Companies focused on aggressive growth through acquisitions or new ventures inherently intensify the competitive landscape.

Delaware North's own strategic maneuvers, including leadership changes in its gaming division and the rebranding of Patina Group, underscore its commitment to growth and adaptation. This proactive stance by Delaware North mirrors the aggressive strategies employed by many in the hospitality and gaming sectors.

- Competitor Aggressiveness: Many competitors in the hospitality and gaming sectors are characterized by aggressive strategies, including mergers, acquisitions, and significant investments in new markets or technologies.

- Strategic Commitments: Key rivals demonstrate strong commitments to expanding their market share, often through substantial capital expenditures and long-term strategic planning.

- Impact on Rivalry: Such commitments and aggressive tactics directly escalate competitive rivalry, forcing companies like Delaware North to continually innovate and optimize operations to maintain or improve their market position.

- Delaware North's Position: Delaware North's own strategic initiatives, such as the leadership transition in its gaming operations and the Patina Group rebranding, reflect its active engagement in this dynamic and competitive environment.

The competitive rivalry for Delaware North is fierce, characterized by numerous players of varying sizes and strategic intents across its diverse business segments. This intensity is amplified by the industry's growth trajectory and the significant capital commitments that create high exit barriers for existing competitors.

Many rivals are aggressively pursuing market share through acquisitions and new ventures, forcing Delaware North to continuously innovate and optimize its operations. For instance, in the broader food service industry, major players like Sodexo and Elior Group are also actively expanding their global footprints and service offerings, directly impacting Delaware North's competitive positioning.

The pressure to differentiate through unique experiences, such as advanced technology integration at venues like TD Garden, is a direct response to this heightened rivalry. Companies must not only offer services but also create memorable guest interactions to stand out in a crowded marketplace.

| Competitor Example | Primary Segment | Competitive Action/Strategy |

|---|---|---|

| Compass Group | Food Service & Hospitality | Global expansion, focus on contract catering and diverse venue management. |

| Aramark | Food Service & Hospitality | Strong presence in sports, entertainment, and educational institutions; emphasis on operational efficiency. |

| Sodexo | Food Service & Hospitality | Diversified services including catering, facilities management, and employee benefits; significant global reach. |

| Elior Group | Food Service & Hospitality | Focus on catering and concessions in specific sectors like healthcare, education, and business & industry. |

SSubstitutes Threaten

The threat of substitutes for Delaware North's services hinges on the price-performance trade-off. For instance, at sporting events, guests might opt to bring their own food and beverages, a lower-cost substitute that bypasses Delaware North's concession offerings. While this saves money, it often sacrifices convenience and the variety of options provided by professional caterers.

Delaware North's customers face relatively low switching costs when considering substitutes for their food and beverage services, particularly in casual dining or event catering scenarios. For example, a concert-goer can easily choose to bring their own snacks or purchase from a different vendor within the venue, incurring minimal financial or time loss. This ease of substitution is amplified by the widespread availability of alternative food providers in most locations where Delaware North operates.

The threat of substitutes for Delaware North is significant, especially within the hospitality and food service sectors. Customers have a vast array of readily available alternatives, from independent local restaurants and cafes to fast-casual chains and even home-prepared meals. For instance, in 2024, the U.S. restaurant industry saw continued growth, with total sales projected to reach over $1.1 trillion, indicating a highly competitive landscape with numerous substitute options for consumers seeking dining experiences.

Furthermore, in areas where Delaware North operates entertainment venues or provides concessions, substitutes abound. Think of alternative leisure activities like movie theaters, sporting events hosted by different organizations, or even digital entertainment platforms that compete for consumers' discretionary spending. The ease with which consumers can switch to these alternatives, often at different price points or with varying convenience factors, directly impacts Delaware North's market power.

Buyer Propensity to Substitute

Delaware North operates in industries where consumer preferences can shift, impacting the likelihood of customers switching to alternatives. For instance, a growing preference for at-home entertainment or digital experiences over live sporting events or theme parks could increase the propensity to substitute. This trend was evident in 2023, with many consumers re-evaluating discretionary spending on entertainment and travel due to persistent inflation.

The increasing cost-consciousness among consumers, driven by economic uncertainty, further fuels this propensity. When faced with higher prices for traditional entertainment options, customers are more likely to explore cheaper substitutes. For example, the rise of streaming services offering vast content libraries at a lower monthly cost compared to attending multiple live events highlights this dynamic.

- Consumer Preference Shifts: Trends like the move towards remote entertainment or digital experiences can directly reduce demand for Delaware North's physical offerings.

- Economic Sensitivity: In 2023, inflation and economic uncertainty led many consumers to seek more budget-friendly alternatives for leisure activities.

- Digital Alternatives: The proliferation of accessible digital content and virtual experiences provides readily available substitutes for many of Delaware North's core services.

Quality and Experience of Substitutes

The threat of substitutes for Delaware North's offerings hinges on whether these alternatives provide a comparable or even superior experience. While a simple picnic might be a budget-friendly option, it often misses the immersive atmosphere of a live event that Delaware North facilitates. For instance, in 2024, the rise of premium home viewing packages for sports events, complete with high-definition broadcasts and social media integration, offers a compelling alternative for some consumers, potentially reducing attendance at venues where Delaware North operates concessions.

Furthermore, innovative substitutes can emerge across Delaware North's diverse business segments. Consider the hospitality sector: while Delaware North manages hotels and resorts, the growth of unique, independent boutique hotels or high-tech, curated home-sharing experiences can draw customers seeking different kinds of stays. In 2023, the global luxury hotel market saw continued growth, with new entrants focusing on experiential travel, directly competing for discerning travelers who might otherwise patronize larger, established brands or operations like those managed by Delaware North.

- Experience Comparison: Substitutes like enhanced home entertainment systems offer convenience and personalization, potentially rivaling the in-venue experience for some consumers, especially for those prioritizing comfort over live atmosphere.

- Cost-Benefit Analysis: While stadium food can be expensive, the overall value proposition includes the event itself. However, the perceived value of substitutes, such as bringing one's own food or opting for home entertainment, is constantly being re-evaluated by consumers based on price and convenience.

- Innovation in Alternatives: The emergence of high-quality, innovative substitutes, such as immersive VR experiences or advanced streaming services, poses a growing threat by offering engaging entertainment alternatives that bypass traditional venue attendance.

- Market Trends: Data from 2024 indicates a continued consumer interest in unique experiences, which can be met by both traditional substitutes like independent hotels and novel digital alternatives, challenging Delaware North's market share in various segments.

The threat of substitutes for Delaware North is significant because consumers have many readily available alternatives for food, beverages, and entertainment. For example, in 2024, the U.S. food service industry's projected sales exceeding $1.1 trillion highlight the intense competition from various dining options. Customers can easily choose to dine at independent restaurants, fast-casual chains, or prepare meals at home, all of which serve as substitutes for Delaware North's concession and hospitality services at venues.

Moreover, the ease with which consumers can switch to alternative leisure activities further amplifies this threat. For instance, instead of attending a sporting event managed by Delaware North, consumers might opt for home entertainment, streaming services, or other forms of recreation. This shift is influenced by factors like cost-effectiveness and convenience, especially as economic conditions fluctuate.

The increasing prevalence of digital entertainment and enhanced home viewing experiences presents a growing substitute. In 2024, premium sports packages offering high-definition broadcasts and interactive features provide a compelling alternative to attending live events. This trend allows consumers to enjoy entertainment from the comfort of their homes, bypassing the need for venue-specific services provided by companies like Delaware North.

Delaware North also faces substitutes in its hospitality segment, with the rise of unique boutique hotels and curated home-sharing services offering alternatives to traditional lodging. These options cater to travelers seeking distinct experiences, directly competing for market share. The global luxury hotel market's growth in 2023, driven by experiential travel, underscores this competitive landscape.

| Substitute Category | Examples for Delaware North | Consumer Motivation | Market Trend (2023-2024) |

|---|---|---|---|

| Food & Beverage | Home-prepared meals, fast-casual restaurants, independent cafes | Cost savings, convenience, variety, perceived quality | Continued growth in off-premise dining and QSR segments. |

| Entertainment | Streaming services, home theater systems, alternative leisure activities (e.g., gaming, local parks) | Cost, convenience, personalization, comfort, avoiding crowds | Increased adoption of subscription-based digital entertainment. |

| Hospitality | Boutique hotels, Airbnb/VRBO, unique glamping/experiential stays | Unique experiences, personalized service, local immersion, different price points | Strong demand for experiential travel and personalized accommodations. |

Entrants Threaten

Delaware North's diverse operations, spanning sports stadiums, national parks, and airports, demand significant upfront capital. Building and maintaining these large-scale venues, complete with sophisticated food and beverage services and hospitality infrastructure, presents a formidable financial hurdle. For instance, the cost to renovate or construct a modern sports arena can easily run into hundreds of millions of dollars, creating a substantial barrier to entry for potential competitors.

Delaware North's significant scale of operations, particularly in managing large venues like sports stadiums and national parks, creates substantial economies of scale. This means they can negotiate better prices for supplies and services, spreading fixed costs over a larger volume of business. For instance, in 2024, their extensive network likely allows for bulk purchasing of food and beverage items, driving down per-unit costs significantly compared to a smaller, emerging competitor.

Furthermore, Delaware North benefits from an experience curve, having honed its operational processes over decades. This accumulated knowledge translates into superior efficiency in areas like staffing, inventory management, and customer service delivery. New entrants would face a steep learning curve and considerable investment to replicate this level of operational expertise, making it a formidable barrier to entry.

Delaware North's century-long history has cultivated a formidable brand reputation, making it challenging for newcomers to gain traction. Their ability to consistently deliver exceptional guest experiences fosters strong customer loyalty, creating a significant barrier to entry for any new competitor aiming to disrupt the hospitality and food service sectors.

Access to Distribution Channels and Contracts

Newcomers to the hospitality and food service industry, particularly those aiming for large-scale venues, face significant hurdles in securing essential distribution channels and contracts. Delaware North, for instance, has cultivated long-standing, exclusive relationships with major entities like airport authorities, national park services, and professional sports stadium operators. These agreements are often multi-year, deeply integrated, and renewal-based, making it exceptionally difficult for new players to gain a foothold.

The competitive nature of these contracts means that even established companies must continually re-bid and demonstrate superior value. For a new entrant, the challenge is compounded by the need to build trust and a proven track record, which is inherently absent. For example, in 2024, the renewal of a major airport concession contract can involve complex negotiations and extensive due diligence, often favoring incumbent operators with demonstrated performance and financial stability.

- Contractual Barriers: Existing long-term contracts with key venues and authorities create significant barriers to entry, as these are not readily available to new competitors.

- Relationship Building: Delaware North's established, enduring partnerships require new entrants to invest substantial time and resources in building similar relationships, which is a lengthy and uncertain process.

- Competitive Bidding: Securing new contracts, especially in high-traffic locations like airports or popular national parks, involves intense competition, often favoring operators with proven operational success and financial capacity.

- Market Penetration Difficulty: The established market presence and operational expertise of companies like Delaware North make it challenging for new entrants to penetrate and capture market share in lucrative segments.

Government Policy and Regulation

Government policy and regulation present a significant barrier to entry for new competitors in Delaware North's diverse sectors. For instance, operating within national parks requires navigating complex concession agreements and environmental regulations, often involving lengthy and competitive bidding processes. Similarly, the gaming industry, a key area for Delaware North, is heavily regulated, with stringent licensing requirements and ongoing compliance mandates that can be costly and time-consuming for new players to meet. In 2024, many states continued to refine their gaming regulations, adding layers of complexity.

These regulatory hurdles, including specific licensing requirements and intricate permitting processes, directly deter potential new entrants. Delaware North's experience in sectors like airport concessions highlights this; securing prime locations often depends on government approvals and adherence to detailed operational standards. The sheer complexity and cost associated with complying with these rules create a substantial barrier to market entry, effectively protecting established players like Delaware North.

- Regulatory Hurdles: Strict licensing and compliance in gaming and concessions deter new market entrants.

- Permitting Processes: Complex and lengthy government permitting in national parks and airports act as a significant barrier.

- Government Policy Impact: Evolving regulations in 2024, particularly in the gaming sector, increase the cost and difficulty for new competitors.

The threat of new entrants for Delaware North is generally low due to substantial capital requirements for large-scale venue development and operation. Significant upfront investment is needed for infrastructure, technology, and initial staffing, creating a financial barrier. For example, the cost to build or significantly renovate a major sports arena can easily exceed $500 million, a sum prohibitive for most new players.

Economies of scale and established experience curves further deter new entrants by lowering operational costs for Delaware North. Their extensive purchasing power in 2024 allows for better pricing on food, beverages, and supplies, a cost advantage difficult for smaller competitors to match. Decades of operational refinement also mean greater efficiency in staffing and logistics.

Strong brand loyalty and entrenched relationships with key partners, such as national park services and airport authorities, also present significant barriers. Securing prime contracts, often multi-year and exclusive, requires a proven track record and extensive relationship building, a hurdle new entrants cannot easily overcome. The complexity of government regulations and licensing, especially in sectors like gaming, adds another layer of difficulty, with states in 2024 continuing to implement stringent compliance measures.

| Barrier Type | Description | Impact on New Entrants | Example Data Point (2024 Context) |

|---|---|---|---|

| Capital Requirements | High upfront investment for venue development and operations. | Significant financial hurdle. | Sports arena renovation costs can reach hundreds of millions of dollars. |

| Economies of Scale | Lower per-unit costs due to high volume purchasing and operations. | Disadvantage for smaller, new competitors. | Bulk purchasing discounts for food and beverage supplies in 2024. |

| Brand Reputation & Relationships | Established trust and long-term contracts with key clients. | Difficulty in market penetration and contract acquisition. | Exclusive, multi-year concessions agreements with major airports. |

| Government Regulation | Complex licensing, permits, and compliance mandates. | Increased cost and time to market entry. | Evolving gaming regulations in 2024 requiring substantial compliance investment. |

Porter's Five Forces Analysis Data Sources

Our Delaware North Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Delaware North's annual reports, industry-specific market research reports from firms like IBISWorld, and publicly available financial data from SEC filings.