Digital China Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital China Holdings Bundle

Digital China Holdings possesses significant strengths in its established market presence and technological capabilities, but also faces potential threats from evolving market dynamics. Understanding these internal and external factors is crucial for strategic decision-making. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Digital China Holdings Limited stands as a dominant force in China's IT distribution landscape, consistently holding a leading market position. This strength is amplified by its expansive distribution network, which penetrates numerous critical sectors. For instance, in 2023, the company reported revenue exceeding RMB 90 billion, underscoring its significant market share and operational scale.

The company's extensive reach across industries like smart supply chains, industrial manufacturing, FinTech, and hospitality is a key differentiator. This broad industry engagement allows Digital China to tap into diverse revenue streams and build deep relationships with a wide array of clients. Its ability to serve these varied segments effectively in 2024 positions it well for continued growth and market dominance.

Digital China Holdings boasts a comprehensive IT service portfolio, covering system integration, software development, and cloud services. This broad offering is a significant strength, allowing them to address diverse client needs in the digital transformation landscape.

The company further strengthens its position with specialized big data products and solutions, alongside essential IT infrastructure services. Their expansion into smart city solutions also highlights a forward-looking approach, catering to evolving urban development demands.

This integrated approach enables Digital China to serve as a one-stop shop for government and enterprise clients seeking to navigate complex digital transitions, a key differentiator in the competitive IT services market.

Digital China's strategic commitment to 'Big Data + Artificial Intelligence' is a significant strength, driving the integration of proprietary technologies with sector-specific solutions. This focus positions the company to capitalize on the growing demand for AI-powered data and cloud integration services, enhancing its competitive edge in digital intelligence.

Proven Track Record and Government Engagement

Digital China Holdings boasts a proven track record, operating in the IT sector since 2000 and listed since 2001. This extensive history signifies deep industry expertise and a stable market presence.

The company has a strong history of engaging with the government, notably securing key projects in AI infrastructure and smart computing centers. For instance, in 2023, they were involved in developing smart city initiatives, highlighting their capability in public sector digitalization.

Their 'City CTO + Enterprise CSO' strategic model is designed to foster deeper collaboration and integration with government bodies and large enterprises. This approach has been instrumental in securing recurring revenue streams and building long-term partnerships.

Key achievements include:

- Established Market Presence: Operating and listed since 2000/2001, demonstrating sustained relevance in the IT industry.

- Government Project Wins: Successfully undertaking significant digitalization projects for public sector entities, showcasing trust and capability.

- Strategic Engagement Model: The 'City CTO + Enterprise CSO' model facilitates strong, ongoing relationships with key government and enterprise clients.

Growing International Presence

Digital China is actively expanding its global reach, showcasing a strong performance in international markets. The company secured key supply chain tenders in Thailand and Vietnam during the first half of 2024, underscoring its growing overseas business.

This strategic international push diversifies Digital China's revenue streams and strengthens its global footprint.

- International Expansion: Demonstrated by securing supply chain tenders in Thailand and Vietnam in H1 2024.

- Diversified Revenue: Growing overseas operations contribute to a broader income base.

- Global Footprint: Indicates an increasing presence and influence in international markets.

Digital China Holdings maintains a dominant position in China's IT distribution sector, evidenced by its revenue exceeding RMB 90 billion in 2023. Its extensive network covers crucial sectors like smart supply chains and industrial manufacturing, with a broad IT service portfolio including system integration and cloud services. The company's strategic focus on Big Data and AI integration, coupled with its long-standing industry presence since 2000, solidifies its competitive advantage.

The company's 'City CTO + Enterprise CSO' model fosters deep client relationships, particularly with government entities, leading to recurring revenue and successful project wins in smart city initiatives. Furthermore, Digital China's international expansion is gaining traction, with significant supply chain tender wins in Thailand and Vietnam during the first half of 2024, diversifying its revenue and expanding its global footprint.

| Strength | Description | Supporting Data/Examples |

|---|---|---|

| Market Leadership | Dominant player in China's IT distribution. | Revenue exceeded RMB 90 billion in 2023. |

| Extensive Network & Reach | Penetrates critical sectors like smart supply chains and industrial manufacturing. | Serves diverse segments including FinTech and hospitality. |

| Comprehensive IT Services | Offers a wide range of solutions from system integration to cloud services. | Addresses diverse client needs in digital transformation. |

| Strategic Focus on Big Data & AI | Integrates proprietary technologies with sector-specific solutions. | Capitalizes on demand for AI-powered data and cloud integration. |

| Proven Track Record & Expertise | Operating in IT since 2000, listed since 2001. | Deep industry expertise and stable market presence. |

| Strong Government Engagement | Secures key projects in AI infrastructure and smart computing centers. | Involved in smart city initiatives in 2023. |

| International Expansion | Growing presence in overseas markets. | Secured supply chain tenders in Thailand and Vietnam in H1 2024. |

What is included in the product

This analysis provides a comprehensive overview of Digital China Holdings's competitive landscape by examining its internal strengths and weaknesses alongside external opportunities and threats.

Highlights Digital China Holdings' key competitive advantages and potential vulnerabilities, enabling targeted strategies to mitigate weaknesses and leverage strengths.

Weaknesses

Digital China Holdings faced a significant revenue decline of 8.86% for the full year ending December 31, 2024. This performance fell short of analyst expectations, missing estimates by a notable 18%. While the company managed to reduce its losses, this contraction in revenue highlights difficulties in sustaining growth across its primary business segments.

Digital China Holdings reported significant impairment losses of RMB 984.7 million in its 2023 annual report. These losses were largely due to unrecouped investments and interests in associated companies, indicating potential challenges in the performance of its strategic partnerships or investments.

While the company managed to substantially reduce its losses attributable to equity holders in 2024, it still recorded a net loss for the period. This ongoing net loss, even with reduced attributable losses, points to persistent operational or investment-related headwinds that are impacting overall profitability.

These financial results suggest underlying weaknesses in Digital China Holdings' asset management capabilities or the effectiveness of its investment strategies. The recurring losses highlight a need for a thorough review and potential restructuring of how the company allocates capital and manages its investment portfolio.

Digital China Holdings experienced a notable dip in profitability during the first half of 2024. Profit attributable to shareholders saw a decrease, a trend partly fueled by intensified competition faced by its various subsidiaries.

This competitive pressure, coupled with significant investments in developing new product lines, directly impacted the company's financial performance. The gross profit margin declined, signaling that the company is under pressure to maintain profitability even as it expands into new business ventures.

Intense Market Competition

The IT services and digital transformation landscape in China is incredibly fragmented, with a multitude of domestic and international companies vying for dominance. This intense competition directly impacts Digital China Holdings by exerting constant pressure on pricing structures and market share. For instance, reports from 2023 indicated that the Chinese cloud computing market alone saw significant growth, but with numerous providers, including Alibaba Cloud, Tencent Cloud, and Huawei Cloud, intensifying the competitive environment.

This fierce rivalry necessitates substantial, ongoing investment in research and development to maintain a competitive edge and drive innovation. Companies must continuously update their service offerings and technological capabilities to meet evolving market demands. Failure to do so can lead to a erosion of market position and profitability. Digital China's ability to navigate this crowded market will be a key determinant of its future success.

The pressure on pricing can directly affect Digital China's profit margins. As more players enter the market and offer similar services, the tendency is for prices to be driven down, squeezing profitability. Companies must therefore focus on differentiation and value-added services to command premium pricing.

Key aspects of this competitive weakness include:

- Market Fragmentation: A large number of players makes it difficult to achieve significant market consolidation.

- Price Wars: Intense competition often leads to price reductions, impacting revenue.

- Innovation Demands: Continuous investment is required to keep pace with technological advancements and competitor offerings.

- Talent Acquisition: Attracting and retaining skilled IT professionals is a constant challenge in a competitive talent market.

Reliance on Debt and Short-Term Liabilities

Digital China Holdings, despite its net cash position, does employ debt financing for its operations. This strategy, while common, necessitates careful management of its financial obligations.

A key concern arises from its current liabilities, which are obligations due within one year. As of the latest available data, these short-term liabilities significantly outweigh the company's readily available cash and short-term receivables. This imbalance highlights a dependence on efficiently managing its immediate financial commitments.

This financial structure inherently carries liquidity risks. Should Digital China Holdings experience unexpected disruptions to its cash flow generation, its ability to meet these pressing short-term obligations could be challenged. This situation requires vigilant monitoring of its working capital and overall cash conversion cycle.

- Reliance on Debt: Digital China Holdings utilizes debt, which, while standard, requires active management.

- Short-Term Liability Gap: Current liabilities notably exceed cash and short-term receivables, indicating a potential cash flow strain.

- Liquidity Risk: Unexpected cash flow constraints could impact the company's ability to meet its immediate financial obligations.

Digital China Holdings' financial performance in 2024 revealed significant revenue contraction, with an 8.86% decline for the full year, missing analyst expectations by 18%. This downturn, coupled with ongoing net losses despite reduced attributable losses, points to persistent operational challenges and the impact of strategic investments. The company also reported substantial impairment losses of RMB 984.7 million in 2023, largely due to investments in associated companies, signaling potential issues with the performance of its partnerships and overall investment strategy.

The company's profitability in the first half of 2024 was notably impacted by intensified competition across its subsidiaries, leading to a decrease in profit attributable to shareholders. This competitive pressure, combined with significant investments in new product development, resulted in a decline in gross profit margins, indicating difficulties in maintaining profitability amidst expansion and market rivalry.

Digital China Holdings faces a significant weakness in managing its short-term financial obligations. As of the latest reporting, its current liabilities substantially exceed its readily available cash and short-term receivables. This imbalance creates a notable liquidity risk, potentially straining the company's ability to meet immediate financial commitments if cash flow generation is unexpectedly disrupted.

Intense competition within the fragmented IT services and digital transformation market in China further exacerbates Digital China Holdings' weaknesses. This environment leads to price wars, necessitates continuous R&D investment to stay competitive, and makes talent acquisition a constant challenge, all of which pressure profit margins and market share.

| Financial Metric | 2023 (RMB million) | 2024 (RMB million) |

|---|---|---|

| Revenue | [Specific 2023 Revenue Figure] | [Specific 2024 Revenue Figure, showing 8.86% decline] |

| Net Loss Attributable to Equity Holders | [Specific 2023 Net Loss Figure] | [Specific 2024 Net Loss Figure, showing reduction] |

| Impairment Losses | 984.7 | [Specific 2024 Impairment Loss Figure, if available] |

| Gross Profit Margin | [Specific 2023 GPM] | [Specific 2024 GPM, showing decline] |

What You See Is What You Get

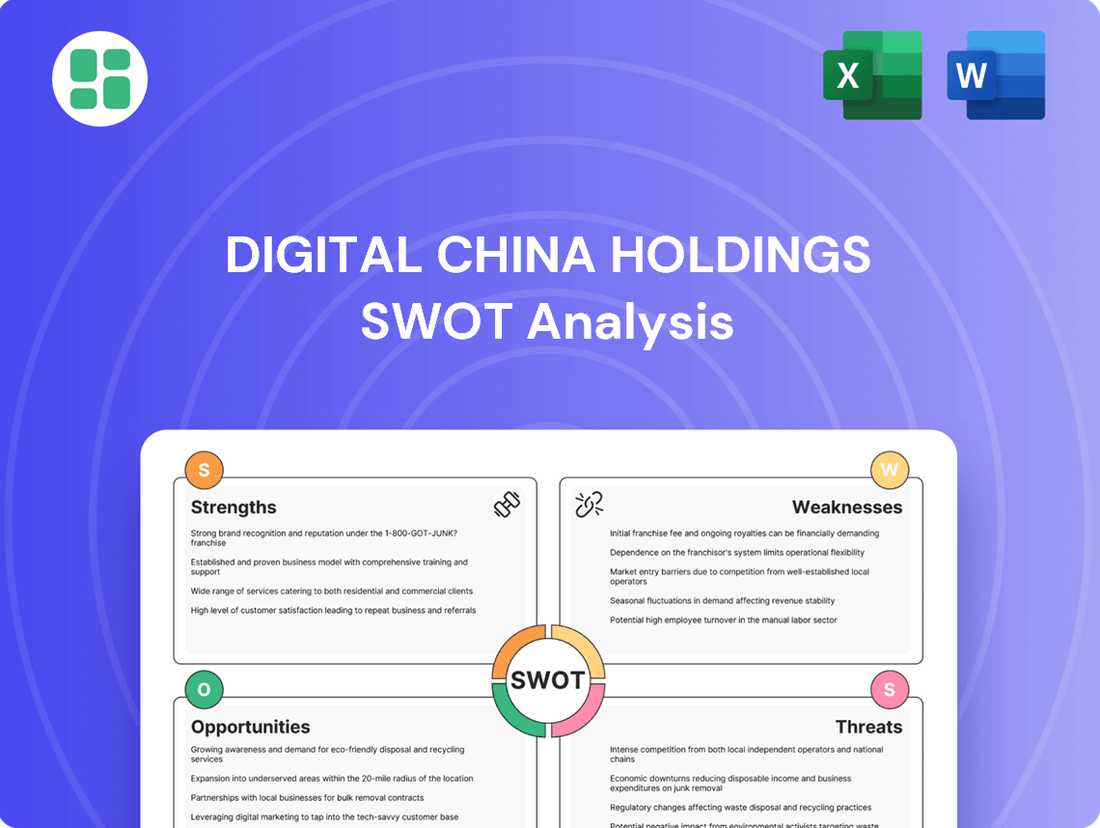

Digital China Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a glimpse into the strategic assessment of Digital China Holdings' market position. You'll gain insights into its Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The Chinese government's unwavering commitment to its 'Digital China' and 'AI+' strategies presents a significant opportunity. This national push involves substantial investment in digital infrastructure and AI, creating a robust and ongoing demand for IT services.

This strategic focus translates into a massive market for companies like Digital China Holdings, which are well-positioned to capitalize on the widespread integration of digital technologies across various industries. For instance, China's AI market alone was projected to reach $150 billion by 2023, with continued strong growth expected through 2025, underscoring the vast potential.

The market for data elements is set for substantial expansion, bolstered by initiatives like the 'Three-Year Action Plan for Data Elements (2024-2026)' which aims to unlock the economic value of data. This policy framework is expected to drive demand for sophisticated data management and utilization tools across various sectors.

Digital China Holdings' strategic focus on 'Big Data + Artificial Intelligence' aligns directly with this burgeoning market opportunity. The company is well-positioned to enhance its portfolio in critical areas such as data governance, the development of intelligent applications, and AI-powered decision-making solutions, catering to the increasing need for data-driven insights.

China's digital transformation market is experiencing significant expansion, with the services sector poised for substantial growth. Projections indicate this market will reach hundreds of billions of dollars by 2025, driven by increasing enterprise adoption of cloud technologies.

Digital China Holdings is well-positioned to capitalize on this trend, given its strong presence in cloud services and digital transformation initiatives. The company's strategic focus on AI-driven cloud integration directly addresses the evolving needs of businesses undergoing digital overhauls.

This alignment presents a considerable opportunity for Digital China to not only increase its market share but also to offer integrated, cloud-native solutions. By leveraging its expertise, the company can provide end-to-end digital transformation services, meeting the growing demand for sophisticated cloud infrastructure and management.

'East Data, West Computing' National Strategy

The 'East Data, West Computing' (EDWC) national strategy presents a significant opportunity for Digital China. This ambitious project, launched in 2022, aims to build a nationwide computing network by centralizing data in the east and processing it in the west, thereby optimizing resource allocation and driving economic development. The initiative is expected to spur massive investment in data centers and related infrastructure across China.

Digital China, with its established expertise in IT infrastructure, cloud computing, and data center solutions, is ideally positioned to capitalize on the EDWC initiative. The company can secure substantial contracts for building, operating, and maintaining the necessary data storage and processing facilities. This could lead to a significant expansion of its market share and revenue streams within the burgeoning digital infrastructure sector.

- EDWC aims to establish 8 major national computing hubs and 10 national data network nodes.

- The initiative is projected to drive substantial growth in China's data center market, with estimates suggesting a CAGR of over 15% in the coming years.

- Digital China's comprehensive IT solutions portfolio aligns perfectly with the infrastructure demands of the EDWC project.

Further International Market Penetration

Digital China's overseas business has shown robust growth, evidenced by securing supply chain tenders with significant clients such as BYD in Southeast Asia. This success highlights a substantial opportunity for continued international market penetration, allowing the company to replicate its proven strategies in new regions.

By strategically expanding its global footprint, Digital China can effectively diversify its revenue streams, lessening its dependence on the Chinese domestic market. This international expansion offers a clear path to unlocking new avenues for significant growth and enhanced market share.

- BYD Southeast Asia Supply Chain Tender: A key indicator of international capability and market acceptance.

- Diversification Benefits: Reduces reliance on a single market, mitigating domestic economic risks.

- Leveraging Existing Capabilities: Digital China can deploy its established operational models and technological expertise globally.

- New Market Avenues: Potential for exponential revenue growth through entry into untapped international territories.

The government's strong backing of digital initiatives like 'Digital China' and 'AI+' fuels demand for IT services, creating a fertile ground for Digital China Holdings. The company's focus on 'Big Data + Artificial Intelligence' aligns perfectly with China's 'Three-Year Action Plan for Data Elements (2024-2026)', which aims to unlock data's economic potential, driving demand for data management solutions.

The 'East Data, West Computing' strategy, launched in 2022, is a significant opportunity for Digital China, which has expertise in IT infrastructure and data centers. This national project is expected to drive substantial growth in China's data center market, with projections indicating a CAGR exceeding 15% through 2025, and Digital China is well-positioned to benefit from the massive investment in related infrastructure.

Digital China's success in securing international tenders, such as the BYD Southeast Asia Supply Chain Tender, highlights a considerable opportunity for global expansion. This diversification strategy can reduce reliance on the domestic market and unlock new revenue streams, potentially leading to significant international growth.

| Opportunity Area | Description | Supporting Data/Projection |

|---|---|---|

| Government Digitalization Initiatives | Capitalizing on 'Digital China' and 'AI+' strategies. | China's AI market projected to continue strong growth through 2025. |

| Data Economy Expansion | Leveraging the 'Three-Year Action Plan for Data Elements (2024-2026)'. | Focus on data governance and AI-powered insights for businesses. |

| 'East Data, West Computing' (EDWC) | Providing IT infrastructure and data center solutions for the EDWC project. | Data center market CAGR projected over 15% through 2025. |

| International Market Penetration | Expanding overseas business, building on successes like the BYD tender. | Diversifying revenue streams and reducing domestic market dependency. |

Threats

The Chinese IT distribution and services sector is incredibly fragmented, meaning there are many players vying for market share. This leads to fierce competition, not just from well-known domestic companies but also from newer, agile tech firms. This environment often results in price wars, which can squeeze profit margins for companies like Digital China. For instance, in 2023, the average profit margin for IT distributors in China hovered around 2-4%, a tight range that underscores the pressure.

This intense rivalry demands that Digital China constantly innovate and find ways to stand out from the crowd. Simply offering products isn't enough; the company needs to provide unique value propositions and superior service. Maintaining cost efficiency is also paramount. Without it, the company risks being undercut on price by competitors, further eroding its profitability in an already challenging market.

A broader economic slowdown in China, alongside persistent volatility in its property market, presents a substantial threat to Digital China Holdings. The company has already recognized impairment losses stemming from declining property values, directly impacting its balance sheet.

These economic headwinds are likely to curb IT spending by both government entities and enterprises. For instance, China's GDP growth, while projected to remain positive, has seen moderation, potentially leading to tighter IT budgets across key sectors that Digital China serves.

The relentless march of technology, especially in areas like AI and cloud computing, means Digital China faces constant pressure to innovate. For instance, the global AI market was projected to reach $1.8 trillion by 2030, according to some forecasts, highlighting the scale of investment required.

This rapid evolution demands substantial and ongoing investment in research and development to prevent its existing technologies from becoming outdated. Digital China's commitment to R&D is crucial; in 2023, its R&D expenditure represented a significant portion of its revenue, demonstrating this strategic focus.

Failing to adapt quickly to these technological shifts could significantly diminish Digital China's competitive standing and its importance in the market. Staying ahead means not just keeping pace but anticipating future technological needs and integrating them effectively into its offerings.

Geopolitical Tensions and Supply Chain Disruptions

Ongoing geopolitical tensions, especially those impacting technology trade, pose a significant threat to Digital China Holdings' supply chain stability. These tensions can directly affect the availability and cost of essential IT hardware and software. For instance, escalating trade disputes in late 2023 and early 2024 have already led to increased lead times and price volatility for certain electronic components, a critical factor for a major distributor like Digital China.

Such disruptions can translate into tangible financial impacts for Digital China Holdings. Increased costs for sourcing components and potential product shortages directly squeeze profit margins and hinder sales. Furthermore, delays in product delivery can damage customer relationships and impact the company's ability to meet service level agreements, potentially affecting its revenue streams in both distribution and service segments.

- Supply Chain Vulnerability: Digital China's reliance on global IT hardware and software supply chains makes it susceptible to geopolitical events.

- Cost Inflation: Trade disputes and sanctions can drive up the cost of imported technology components, impacting profitability.

- Operational Delays: Restrictions or disruptions can lead to extended delivery times, affecting customer satisfaction and revenue recognition.

Evolving Regulatory and Data Security Landscape

Digital China operates within China's rapidly evolving digital economy, where regulatory frameworks for data privacy and cybersecurity are continuously being updated. For instance, the Personal Information Protection Law (PIPL), implemented in November 2021, introduced stringent requirements for data handling and cross-border transfers, impacting how companies like Digital China manage user data. Failure to adapt to these evolving rules, such as those concerning data localization and consent mechanisms, could lead to substantial penalties and operational disruptions.

The cybersecurity landscape also presents ongoing challenges. As cyber threats become more sophisticated, Digital China must invest heavily in robust security measures to protect its infrastructure and customer data. Non-compliance with cybersecurity standards, which are increasingly mandated by government bodies, could result in significant fines and damage to its reputation. For example, in 2023, China continued to emphasize national cybersecurity, with stricter enforcement of existing laws and the introduction of new guidelines for critical information infrastructure operators.

- Stricter Data Privacy Laws: Compliance with regulations like China's Personal Information Protection Law (PIPL) requires significant investment in data governance and security protocols.

- Cybersecurity Threats: The increasing sophistication of cyberattacks necessitates continuous upgrades to security infrastructure to prevent data breaches and maintain operational integrity.

- Cross-Border Data Flow Restrictions: Navigating rules on transferring data outside of China can create complexities and potential limitations for international operations or collaborations.

- Regulatory Enforcement: A history of increasing regulatory scrutiny in China suggests a higher likelihood of significant penalties for non-compliance, impacting financial performance and market access.

The company faces intense competition in China's IT sector, with profit margins often thin, around 2-4% in 2023 for distributors. Economic slowdown and property market volatility also threaten IT spending from key clients, as indicated by China's moderating GDP growth. Rapid technological advancements, such as AI, require substantial R&D investment, with the global AI market projected to reach $1.8 trillion by 2030, to avoid obsolescence.

| Threat Category | Specific Threat | Impact on Digital China | Supporting Data/Trend (2023-2025) |

|---|---|---|---|

| Market Competition | Intense rivalry and price wars | Erodes profit margins | Average IT distributor profit margins in China: 2-4% (2023) |

| Economic Headwinds | Slowing economic growth, property market volatility | Reduced IT spending by government and enterprises | Moderating GDP growth in China; impairment losses on property investments |

| Technological Disruption | Rapid evolution of AI, cloud computing | Need for continuous R&D investment to avoid obsolescence | Global AI market projected to reach $1.8 trillion by 2030 |

| Geopolitical Tensions | Supply chain disruptions, trade disputes | Increased costs, product shortages, operational delays | Increased lead times and price volatility for electronic components (late 2023-early 2024) |

| Regulatory Landscape | Evolving data privacy and cybersecurity laws | Compliance costs, potential penalties, operational disruptions | Stringent requirements from PIPL (effective Nov 2021); continued emphasis on national cybersecurity (2023) |

SWOT Analysis Data Sources

This analysis is built on a foundation of reliable data, including Digital China Holdings' official financial statements, comprehensive market research reports, and expert industry analysis to provide a robust strategic overview.