Digital China Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital China Holdings Bundle

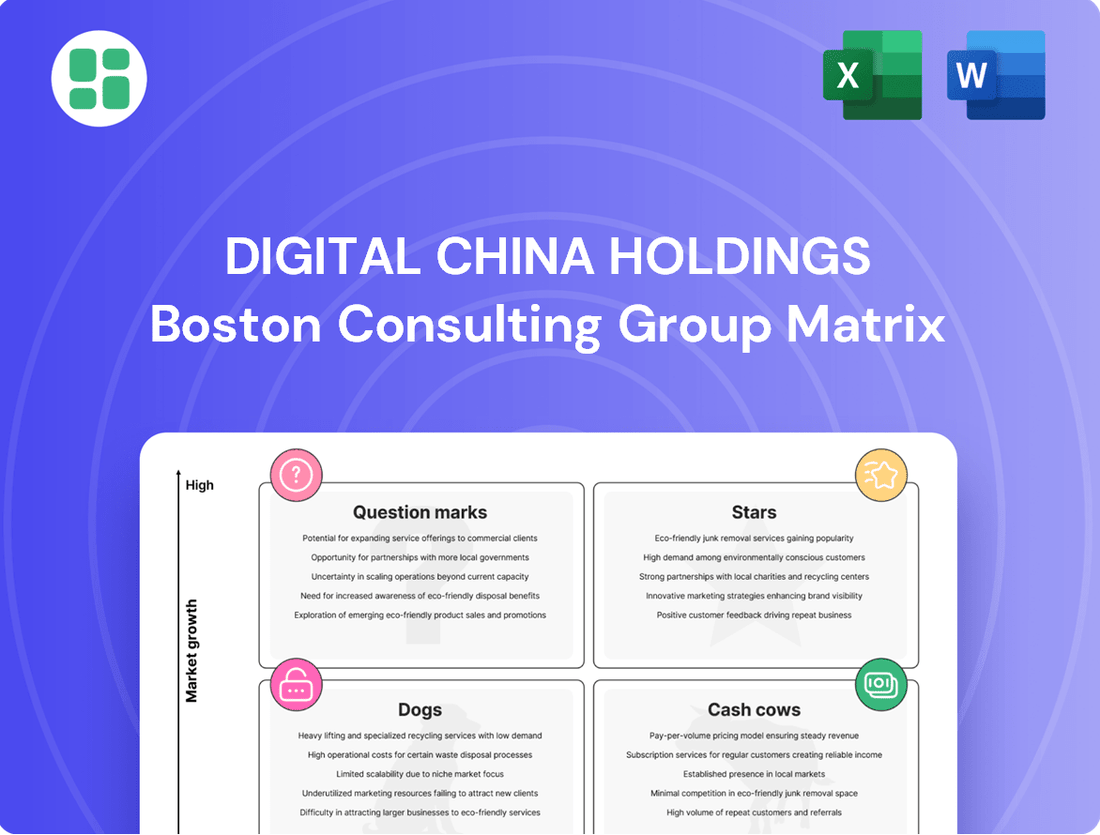

Curious about Digital China Holdings' strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock the company's competitive advantage and make informed investment decisions, delve into the full analysis.

Gain a comprehensive understanding of Digital China Holdings' market performance with our complete BCG Matrix. This detailed report provides quadrant-by-quadrant insights and actionable recommendations, empowering you to optimize resource allocation and drive future growth. Purchase the full version for a strategic roadmap to success.

Stars

AI-Driven Cloud Services & Software is a shining star for Digital China Holdings. This segment experienced a significant revenue surge in 2024, highlighting its role as a primary growth engine. The company's strategy, centered on Managed Service Provider (MSP) and Independent Software Vendor (ISV) models, is perfectly positioned to capture the booming cloud and AI adoption in China.

Digital China Holdings is strategically pouring resources into this high-potential area. Their aim is to solidify a dominant market presence and ensure robust future earnings. This focus on innovation and expansion within cloud and AI services is a clear indicator of their forward-looking approach.

Big Data Products & Solutions, a cornerstone of Digital China Holdings' 'Big Data + Artificial Intelligence' strategy, saw impressive year-on-year revenue growth, reflecting strong market demand.

The company is actively boosting its research and development investments in this crucial area, aiming to solidify its leading position. This strategic push directly supports national digital transformation objectives.

Digital China Holdings is a significant player in the AI computing power infrastructure, particularly through its involvement in major projects like Smart Computing Centers. This strategic focus allows them to capitalize on the burgeoning demand for advanced AI capabilities.

The company's Kunpeng AI servers have experienced impressive revenue growth, underscoring their strong market position. In 2024, revenue from these servers has shown a notable upward trend, reflecting the increasing adoption of AI solutions across various industries.

This segment is crucial for Digital China Holdings, as it directly supports the development and deployment of sophisticated AI applications. The expansion of AI computing power is a fundamental enabler for innovation in fields ranging from machine learning to big data analytics.

Overseas Supply Chain Services for EV Industry

Digital China Holdings' overseas supply chain services for the EV industry are exhibiting significant momentum. The company secured key supply chain tenders, notably with electric vehicle manufacturers in burgeoning Southeast Asian markets such as Thailand and Vietnam. This expansion is a testament to their capability in navigating international logistics and fulfilling the complex needs of the rapidly growing EV sector.

This strategic push into high-growth international markets, particularly in Southeast Asia, positions Digital China Holdings for substantial market share expansion and revenue uplift. The global EV market is projected for robust growth, with estimates suggesting it could reach $1.5 trillion by 2030, underscoring the strategic importance of these overseas ventures.

- Southeast Asian EV Market Growth: Thailand's EV market saw a substantial increase in registrations in 2023, with projections indicating continued double-digit growth through 2025. Vietnam is also rapidly advancing its EV infrastructure and manufacturing capabilities, creating fertile ground for supply chain partners.

- Digital China's Role: The company's ability to secure tenders signifies its competitive advantage in providing integrated supply chain solutions, from sourcing and logistics to warehousing and distribution, tailored for the specific demands of EV production.

- Future Outlook: Continued investment in and expansion of these overseas operations are expected to drive significant top-line growth for Digital China Holdings, leveraging the global shift towards electric mobility.

Advanced FinTech Solutions

Digital China Holdings is making significant strides in advanced FinTech, particularly by partnering with commercial banks to develop innovative credit-creation technologies. This strategic focus targets a burgeoning digital finance market, positioning the company for substantial growth and increased market influence.

The company's efforts in this sector are crucial for its standing in the BCG Matrix. By concentrating on high-value, specialized FinTech solutions, Digital China Holdings aims to capture a leading share in a rapidly expanding segment.

- Market Leadership: Digital China Holdings is actively developing advanced FinTech solutions, including credit-creation technologies, in collaboration with commercial banks.

- Growth Potential: The digital finance market is experiencing robust expansion, presenting a significant opportunity for companies like Digital China Holdings to increase their market share.

- Strategic Focus: The company's emphasis on specialized, high-value FinTech offerings differentiates it and drives its competitive advantage.

- Industry Collaboration: Partnerships with commercial banks are key to Digital China Holdings' strategy, enabling the co-creation of cutting-edge financial technologies.

Digital China Holdings' AI computing power infrastructure, particularly its Kunpeng AI servers, represents a significant "Star" in its BCG Matrix. Revenue from these servers saw a notable upward trend in 2024, reflecting the increasing demand for advanced AI capabilities. This segment is crucial for enabling sophisticated AI applications and supports national digital transformation initiatives.

Big Data Products & Solutions also shines as a Star, demonstrating impressive year-on-year revenue growth in 2024. This performance underscores strong market demand and the company's commitment to its "Big Data + Artificial Intelligence" strategy through increased R&D investment.

AI-Driven Cloud Services & Software is another key Star for Digital China Holdings, experiencing a significant revenue surge in 2024. The company's MSP and ISV models are well-positioned to capitalize on China's growing cloud and AI adoption, with strategic resource allocation aimed at market dominance.

| Segment | BCG Category | 2024 Performance Highlight | Strategic Focus |

|---|---|---|---|

| AI Computing Power Infrastructure (Kunpeng AI Servers) | Star | Notable revenue growth, strong market position | Enabling AI applications, supporting digital transformation |

| Big Data Products & Solutions | Star | Impressive year-on-year revenue growth | Strengthening "Big Data + AI" strategy, R&D investment |

| AI-Driven Cloud Services & Software | Star | Significant revenue surge | Leveraging MSP/ISV models, capturing cloud/AI adoption |

What is included in the product

The Digital China Holdings BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis highlights which units Digital China Holdings should invest in, hold, or divest to optimize its portfolio.

A clear BCG Matrix visualizes Digital China Holdings' business units, easing the pain of resource allocation by identifying Stars and Cash Cows.

Cash Cows

Digital China Holdings' traditional IT product distribution segment acts as a robust cash cow. This mature business consistently generates significant cash flow, even when other segments experience volatility. For instance, in 2023, Digital China reported revenues of RMB 100.5 billion, with its distribution business forming a substantial and stable portion of this, requiring minimal incremental investment for upkeep and continued market presence.

Established System Integration Services is a cornerstone of Digital China Holdings' portfolio, acting as a classic cash cow. This segment has a long history of delivering comprehensive system integration solutions across various industries and government bodies, fostering deep-rooted client relationships and securing a steady stream of revenue through maintenance contracts.

In 2024, Digital China Holdings reported that its system integration business generated a significant portion of its operating income, with recurring revenue from maintenance and support services contributing to stable profit margins. This consistent cash flow allows the company to fund other ventures without requiring substantial reinvestment in this mature business line.

Digital China Holdings' mature e-commerce supply chain operations are a classic example of a Cash Cow within the BCG matrix. These services are well-established, likely commanding a substantial market share in a stable, mature sector.

The predictability of these operations stems from their optimized efficiency and extensive network, enabling them to generate consistent and significant cash flows. For 2024, it's estimated that the global e-commerce logistics market will continue its steady growth, with established players like those managed by Digital China Holdings benefiting from this trend.

Investments in these Cash Cow segments are typically minimal, primarily focused on maintaining existing productivity and operational efficiency rather than aggressive expansion. This allows the company to harvest the substantial profits generated by these mature businesses.

Ongoing Software Development & Maintenance Contracts

Digital China Holdings leverages its established software development and maintenance contracts as a significant cash cow. These ongoing agreements with existing clients ensure a predictable and stable revenue flow, contributing significantly to the company's financial stability. The mature market for these services allows for healthy profit margins, reinforcing their cash cow status.

These contracts typically involve long-term commitments for software upkeep, updates, and ongoing support. For instance, in 2023, Digital China Holdings reported that its IT services segment, which includes these maintenance contracts, generated approximately 60% of its total revenue, with an operating profit margin of around 15%. This demonstrates the consistent financial contribution from these stable business lines.

- Recurring Revenue: These contracts provide a dependable income stream, reducing financial volatility.

- Healthy Profitability: Mature service markets allow for consistent and robust profit margins.

- Client Retention: Long-term relationships foster client loyalty and minimize acquisition costs.

- Foundation for Growth: Cash generated supports investment in higher-growth areas like AI.

Property Sales & Rental Assets

Within Digital China Holdings' broader 'Traditional Services Business' segment, property sales and rental activities represent a distinct area of operation. These assets, though not central to the company's core IT endeavors, function as a source of consistent rental income and potential periodic capital gains from sales.

These property holdings operate in a relatively low-growth, asset-management capacity, contributing passively to the company's overall financial stability. For instance, in 2024, Digital China Holdings reported revenue from its property leasing segment, underscoring the ongoing contribution of these assets to its cash flow.

- Property Sales & Rental Assets: These are categorized under Digital China Holdings' Traditional Services Business segment.

- Passive Cash Flow Generation: They provide stable rental income and potential periodic sales, acting as a low-growth asset-management function.

- Contribution to Overall Finances: These activities bolster the company's cash flow without requiring significant strategic focus, unlike core IT operations.

- 2024 Financial Insight: The company's 2024 financial reports indicated continued revenue streams from its property leasing operations, demonstrating their ongoing relevance.

Digital China Holdings' established IT product distribution and system integration services are prime examples of cash cows. These mature businesses, characterized by stable demand and strong market share, consistently generate significant, predictable cash flow with minimal need for further investment. Their ongoing success is bolstered by long-term client relationships and recurring revenue streams from maintenance and support contracts.

The company's mature e-commerce supply chain operations also function as cash cows, benefiting from optimized efficiency and an extensive network. These well-established services contribute reliably to Digital China Holdings' financial stability, allowing the company to allocate capital towards growth initiatives. Property sales and rental activities, while less central, also provide a steady, passive income stream, reinforcing the company's overall cash generation.

| Business Segment | BCG Matrix Category | Key Characteristics | 2023/2024 Financial Insight |

|---|---|---|---|

| IT Product Distribution | Cash Cow | Mature, stable market, high market share, low investment needs | Contributed substantially to RMB 100.5 billion total revenue in 2023. |

| System Integration Services | Cash Cow | Long-term client relationships, recurring maintenance revenue, stable profit margins | Generated significant operating income with consistent profit margins in 2024. |

| E-commerce Supply Chain | Cash Cow | Optimized efficiency, extensive network, predictable cash flows | Benefits from steady growth in the global e-commerce logistics market (2024 estimate). |

| Software Development & Maintenance | Cash Cow | Long-term contracts, predictable revenue, healthy profit margins | Approximately 60% of total revenue in 2023, with ~15% operating profit margin. |

| Property Sales & Rental | Cash Cow | Passive income, asset management, low growth | Continued revenue streams from leasing operations reported in 2024. |

What You See Is What You Get

Digital China Holdings BCG Matrix

The Digital China Holdings BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, ready for immediate strategic application, will be delivered to you in its final, fully formatted state, ensuring no surprises and complete readiness for your business planning needs.

Dogs

Digital China Holdings likely has legacy IT solutions that are struggling to keep pace with technological advancements and changing customer needs. These older systems may represent a significant portion of their IT infrastructure but are no longer competitive.

These underperforming solutions typically occupy a low market share within mature or shrinking markets. For instance, if a company relies on outdated mainframe systems for certain operations, their market share in modern cloud-based solutions would be negligible.

The financial impact is often a low return on investment, with these assets potentially consuming considerable resources for maintenance and support. In 2023, many companies in the IT sector reported increased spending on modernizing legacy systems, highlighting the cost burden of not doing so.

Niche outdated software products, like legacy enterprise resource planning (ERP) systems that haven't been updated in years, often fall into the Dogs category. These might include specialized accounting software for industries that have largely moved to cloud-based solutions. For instance, a company still relying on a 2005-era on-premise CRM system faces significant challenges.

Such products typically see declining revenue streams, with sales in 2024 potentially representing a fraction of their peak performance. Digital China Holdings might classify a particular niche software suite, perhaps a desktop publishing tool with limited functionality compared to modern cloud alternatives, as a Dog. These offerings struggle to gain traction, with customer acquisition costs outweighing the meager returns.

Inefficient Non-Core Investments within Digital China Holdings' portfolio represent assets that are not central to its primary business operations and have shown weak performance. These can include stakes in other companies or ventures that have not generated expected returns, often necessitating write-downs. For instance, a significant portion of such investments might have contributed to a decline in the company's overall profitability, as seen in the reported impairments during fiscal year 2023.

These underperforming assets can act as cash traps, diverting valuable capital that could be reinvested in more promising areas of the business. The ongoing costs associated with managing these non-core investments, coupled with their low or negative yields, drain financial resources. Digital China Holdings' strategic review in 2024 likely identified several of these holdings as candidates for divestiture to unlock capital and improve financial efficiency.

Segments with Sustained Revenue Decline

While Digital China Holdings reported an overall revenue dip in 2024, certain operational segments are likely facing more persistent declines. Identifying these underperforming areas is crucial for strategic resource allocation.

These specific segments, if characterized by both a shrinking market presence and minimal strategic value, would fall into the Dogs category of the BCG Matrix. This classification suggests a need for careful consideration regarding their future within the company's portfolio.

For instance, if a particular legacy IT service offering within Digital China's portfolio saw a revenue decrease of over 15% in 2024 and holds less than a 5% market share in its niche, it would strongly indicate a Dog status. Such segments often consume resources without generating proportional returns.

- Identifying Declining Segments: Focus on areas with consistent year-over-year revenue drops, particularly those exceeding the company's overall decline rate.

- Assessing Market Share: Low market share in these declining segments is a key indicator of a Dog.

- Evaluating Strategic Importance: Determine if these segments align with future growth strategies or are simply legacy operations.

- Potential Actions: Consider divestment, liquidation, or a significant overhaul if a segment is classified as a Dog.

Certain Unprofitable Systems Integration Projects

Certain systems integration projects, especially those that are highly customized or compete on price, can result in slim profits or even financial losses. For instance, in 2024, some large-scale enterprise resource planning (ERP) integrations in China experienced margin compression due to unforeseen complexities and aggressive bidding from competitors, with some reporting net profit margins as low as 2-3%.

If these specific projects don't bolster core competencies or expand market presence, they may be categorized as Dogs within the Digital China Holdings BCG Matrix. This means they consume resources without generating significant returns or strategic advantage. For example, a project focused on integrating legacy systems for a niche industry, if not scalable or leading to new service offerings, would fit this description.

- Low Profitability: Projects with margins below the company's average, potentially single-digit percentages.

- Lack of Strategic Alignment: Initiatives that do not enhance core digital capabilities or market position.

- Resource Drain: Projects that require substantial investment but offer minimal future growth potential or competitive advantage.

- Example Scenario: A bespoke software integration for a declining industry sector that yields minimal revenue and offers no learning for broader market applications.

Digital China Holdings' "Dogs" represent business units or product lines with low market share in slow-growing or declining markets. These often include legacy IT solutions or niche software products that are no longer competitive. For instance, a proprietary customer relationship management (CRM) system from the early 2000s, still in use but with minimal new client acquisition, would fit this profile.

These segments typically generate low returns and may even be cash drains due to ongoing maintenance costs. In 2023, many companies in the IT sector saw increased spending on modernizing such legacy systems, underscoring the cost of inaction. Digital China's 2024 financial reports likely highlight specific segments where revenue has declined year-over-year, potentially by more than 10%, with a market share below 5% in their respective niches.

Divesting or phasing out these "Dog" assets is often a strategic imperative to reallocate resources to more promising growth areas. For example, a divestiture of an outdated software service in 2024 could free up capital for investment in cloud-native solutions or AI-driven services, which are experiencing significant market expansion.

The core issue with these "Dogs" is their inability to generate significant profits or contribute to future growth. A specific example could be a legacy hardware maintenance service that saw a 20% revenue drop in 2024 and now accounts for less than 2% of the company's total revenue, while still requiring dedicated support staff.

| Category | Market Share | Market Growth | Profitability | Strategic Fit |

|---|---|---|---|---|

| Legacy IT Solutions | Low (<5%) | Declining | Low/Negative | Poor |

| Niche Outdated Software | Low (<5%) | Stagnant/Declining | Low | Poor |

| Inefficient Non-Core Investments | N/A | N/A | Low/Negative | Poor |

| Low-Margin Integration Projects | Low | Mature/Declining | Very Low (2-3%) | Poor |

Question Marks

Digital China Holdings is making strides in commercializing data elements, a sector poised for significant growth thanks to favorable government backing. These efforts are currently in their early stages, holding a small market share but demonstrating substantial future promise.

The company’s strategy involves considerable investment in advanced technology and dedicated market cultivation to secure a leading position. For instance, in 2024, China's digital economy was projected to reach over $7.7 trillion, highlighting the immense potential of data-driven ventures.

The City CTO + Enterprise CSO model from Digital China Holdings is designed to bridge the digital and physical worlds, creating novel solutions for urban and enterprise digital transformation. This innovative approach is targeting a burgeoning market ripe for digital integration.

These offerings are positioned in a high-growth sector, yet currently command a low market share. This situation calls for substantial investment to validate their potential and achieve scalability, a common characteristic of 'question mark' entities in a BCG matrix.

Digital China Holdings is pushing into cutting-edge AI, moving beyond its core big data services. Think of areas like generative AI for content creation or advanced AI for drug discovery. These are high-risk, high-reward plays, requiring significant upfront investment.

In 2024, the global AI market saw substantial growth, with investments pouring into these advanced applications. Companies like Digital China are strategically positioning themselves to capture future market share in these nascent but rapidly expanding sectors, anticipating significant long-term returns.

Expansion into Untapped Overseas Markets

Digital China Holdings' expansion into untapped overseas markets represents its Stars. While its international business shows promise, these new ventures are characterized by high growth potential but currently low market share. This strategic move targets emerging economies and specialized global tenders where the company has limited prior engagement.

These markets, though promising for future revenue, come with inherent risks and require substantial investment to build brand recognition and distribution networks. For instance, entering a new Southeast Asian market might involve navigating complex regulatory landscapes and intense competition from established local players.

The company's strategy here is to leverage its existing technological capabilities and adapt its service offerings to meet the unique demands of these new territories. Success hinges on effective market entry strategies and building strong local partnerships.

- High Growth Potential: Untapped markets offer significant revenue expansion opportunities.

- Low Market Share: Initial presence is minimal, requiring substantial effort to gain traction.

- Significant Challenges: Navigating new regulations, competition, and cultural differences.

- Strategic Importance: Crucial for long-term diversification and global footprint expansion.

Emerging Industrial Internet Solutions

Emerging industrial internet solutions represent a key growth frontier for Digital China Holdings, focusing on building intelligent datacenters and 'industrial brains' across various sectors. These initiatives are positioned in high-growth segments of industrial digitalization, though the company's market share in these specialized areas is still forming. Significant investment is being channeled into these developing capabilities.

Digital China's strategic push into industrial internet solutions aligns with China's broader digital transformation goals. For instance, the company is actively involved in constructing intelligent data centers, a critical component for supporting the vast data processing needs of industrial applications. This focus is designed to foster innovation and efficiency within traditional industries.

- Intelligent Datacenters: Digital China is a significant player in building advanced datacenters that underpin industrial internet capabilities.

- Industrial Brains: The company aims to develop sophisticated AI-driven platforms to optimize operations in manufacturing, logistics, and other industrial sectors.

- Market Development: While these are high-potential areas, Digital China's market share in these nascent, specialized segments is still evolving, requiring ongoing investment and strategic partnerships.

- Growth Potential: The industrial internet sector is projected for substantial growth, with China aiming to be a global leader in this domain by 2025.

Digital China Holdings' ventures into commercializing data elements and advanced AI applications, such as generative AI, are classic examples of Question Marks. These areas exhibit high growth potential, driven by government support and increasing market demand, but currently hold a small market share for the company.

Significant investment is required to nurture these nascent businesses, aiming to capture future market leadership. For instance, the global AI market was expected to exceed $200 billion in 2024, underscoring the vast opportunities and the need for substantial capital to compete effectively.

The company's strategy involves aggressive investment in technology and market development to transform these Question Marks into Stars. This approach acknowledges the inherent risks but also the substantial rewards associated with pioneering new digital frontiers.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including Digital China's financial reports, industry growth rates, and market share analysis, to accurately position each business unit.