Schenker-Joyau SAS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Schenker-Joyau SAS Bundle

Navigate the intricate external forces shaping Schenker-Joyau SAS with our comprehensive PESTEL analysis. Understand how political stability, economic fluctuations, and technological advancements are impacting their operations and future growth potential. This essential report provides the strategic foresight you need to make informed decisions and stay ahead of the curve. Download the full analysis now to unlock actionable intelligence and secure your competitive advantage.

Political factors

The French government's commitment to enhancing national transport infrastructure presents a significant opportunity for Schenker-Joyau SAS. With substantial investments in rail, road, and port modernization, the country is actively working to improve its logistics network.

The Ulysse Fret investment plan, allocating over €4 billion by 2032 for rail freight, directly supports the development of more efficient and sustainable freight transport solutions. This focus on rail aligns with the growing demand for intermodal transportation and capacity expansion.

Furthermore, the €2.7 billion designated for the French Transport Infrastructure Financing Agency, aimed at metro expansions and railway upgrades, will indirectly benefit logistics providers by improving overall connectivity and reducing transit times across France.

The European Union is actively defining its transport policy for the period leading up to and beyond 2030. A key objective is to enhance the single market for transport services, fostering greater integration and efficiency across member states.

This policy framework places significant emphasis on developing sustainable and resilient transport infrastructure. The promotion of multimodal transport solutions, which combine different modes of transport like rail, road, and water, is central to achieving these goals.

Furthermore, the EU is committed to accelerating the adoption of environmentally friendly alternatives within the transport sector. This push influences national policies and industry practices, aiming for a substantial reduction in emissions and a more sustainable future for transportation.

The EU's transport policy for 2024-2029 prioritizes crisis preparedness, aiming to bolster the sector's security, especially against cyber threats. This focus on resilience is vital for logistics companies like Schenker-Joyau SAS, as it directly impacts the stability of supply chains amidst global uncertainties.

National Logistics Roadmap and Reforms

France's National Logistics Roadmap for 2025-2026 signals a significant government push to modernize the freight sector. This plan targets key areas like reducing the environmental footprint of transport and boosting the industry's technological adoption. The reforms are designed to tackle challenges such as improving supply chain resilience and fostering innovation.

Key objectives within this roadmap include:

- Enhancing supply chain efficiency: Aiming to streamline operations and reduce transit times across the country.

- Promoting sustainable transport: Encouraging the shift towards greener logistics solutions, with a focus on reducing CO2 emissions.

- Driving technological integration: Facilitating the adoption of digital tools and automation to improve competitiveness.

Regulatory Burden Reduction Efforts

The European Union is actively working to ease regulatory pressures on businesses, with the Omnibus Simplification Package slated for February 2025. This initiative is specifically designed to cut down on administrative hurdles for transport sector companies. Such measures are expected to simplify compliance processes and cultivate a more adaptable operational landscape for logistics firms like Schenker-Joyau SAS.

The anticipated reduction in regulatory burdens could translate into tangible cost savings and improved operational efficiency. For instance, streamlined customs procedures or simplified reporting requirements could free up resources previously allocated to compliance. This regulatory recalibration is a key political factor influencing the operating environment for Schenker-Joyau SAS.

- February 2025: Expected launch of the EU Omnibus Simplification Package.

- Objective: Reduce regulatory and administrative burdens in the transport sector.

- Impact: Potential for increased agility and cost savings for logistics providers.

Government investments in French transport infrastructure, such as the Ulysse Fret plan's €4 billion for rail freight by 2032, directly benefit logistics companies like Schenker-Joyau SAS by enhancing network efficiency. The EU's transport policy, emphasizing multimodal solutions and sustainability, shapes national strategies and promotes greener logistics. France's National Logistics Roadmap for 2025-2026 aims to boost efficiency, sustainability, and technological adoption in the freight sector.

| Policy/Initiative | Focus Area | Timeline | Estimated Investment/Impact |

|---|---|---|---|

| Ulysse Fret Investment Plan | Rail freight modernization | By 2032 | Over €4 billion |

| French Transport Infrastructure Financing Agency | Metro and railway upgrades | Ongoing | €2.7 billion |

| EU Transport Policy | Multimodal transport, sustainability | Up to and beyond 2030 | Policy framework |

| France National Logistics Roadmap | Efficiency, sustainability, tech adoption | 2025-2026 | Strategic objectives |

| EU Omnibus Simplification Package | Reducing regulatory burdens | February 2025 | Streamlined compliance |

What is included in the product

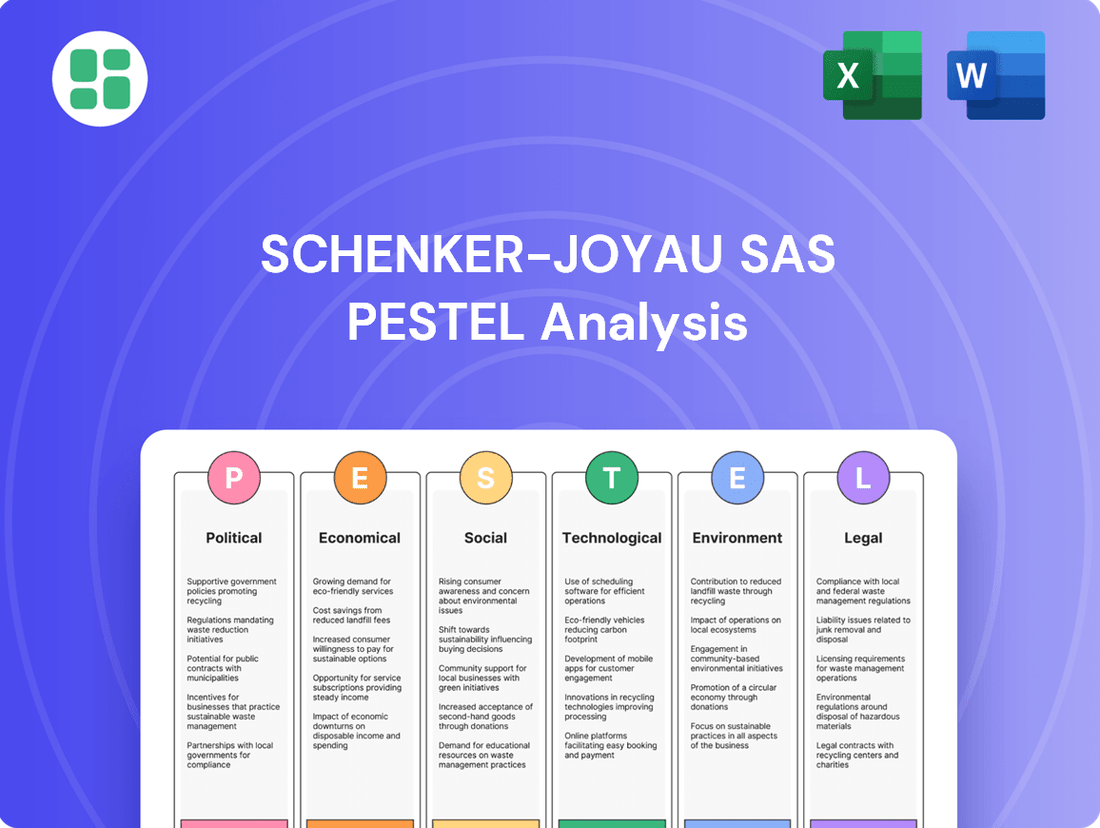

This Schenker-Joyau SAS PESTLE Analysis comprehensively examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

Provides a concise version of the Schenker-Joyau SAS PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, streamlining external factor assessment.

Economic factors

The French logistics market is experiencing a significant upswing, with forecasts pointing to substantial expansion. Projections indicate the market could reach USD 190.6 billion by 2030, growing at a compound annual growth rate of 7.8% from 2025. This robust growth trajectory presents considerable opportunities for logistics companies operating within France.

Further analysis suggests the French logistics market was valued at USD 177.99 billion in 2024. This figure is expected to climb to USD 254.21 billion by 2033, underscoring a sustained period of market development and increasing demand for logistics services.

The booming e-commerce sector in France is a significant catalyst for Schenker-Joyau SAS, directly fueling demand for its logistics expertise. French consumers spent a record €175.3 billion online in 2024, a substantial 9.6% jump from 2023. This ongoing surge in digital commerce translates into a critical need for advanced, flexible logistics networks, particularly for effective last-mile delivery.

While inflation has eased, allowing for some consumer spending recovery, the logistics industry, including companies like Schenker-Joyau SAS, still faces elevated operational costs. Fuel prices, a major component, remained volatile in early 2024, impacting transportation expenses. For instance, Brent crude oil futures traded around $80-$90 per barrel in the first half of 2024, a significant increase from pre-pandemic levels.

Labor costs are also a persistent challenge, driven by ongoing shortages in skilled drivers and warehouse staff. In 2024, average wages for truck drivers in key European markets saw an increase of 5-7% compared to 2023. These rising expenses directly squeeze profit margins and necessitate careful pricing adjustments to remain competitive.

Investment in Logistics Real Estate

The French logistics real estate market is a hotbed for investment, with a substantial €2.3 billion poured into the sector by the close of September 2024. This robust financial activity signals a strong demand for modern logistics facilities.

A significant portion of this investment originates from foreign capital, highlighting international confidence in the French market. These investors are actively seeking to acquire or develop prime warehouse spaces, with a particular emphasis on properties suitable for efficient last-mile delivery operations.

- Strong Investment Volume: €2.3 billion invested in French logistics real estate by September 2024.

- Foreign Investor Dominance: International entities are key drivers of this investment.

- Focus on Last-Mile: Acquisition and development target high-quality warehouses for urban distribution.

- Infrastructure Expansion: Trends point to a growing need for and commitment to expanding logistics networks.

Global Trade Dynamics and Strategic Location

France's strategic location in Western Europe positions it as a vital hub for global trade, acting as a gateway to the broader European market. This geographical advantage directly translates into consistent demand for robust freight and logistics services, essential for facilitating the movement of goods across continents. The country’s active engagement in international commerce and its strong trade relationships are fundamental to its role within the global supply chain.

The ongoing growth in global trade, particularly within the European Union, directly benefits logistics providers like Schenker-Joyau SAS. For instance, in 2023, France's total trade in goods and services reached approximately €1.7 trillion, highlighting the sheer volume of economic activity requiring efficient transportation and warehousing solutions. This sustained activity underscores the importance of France's logistical infrastructure.

- Gateway to Europe: France's central location facilitates efficient distribution across the continent, a key driver for logistics demand.

- Trade Volume: In 2023, France's trade in goods and services exceeded €1.7 trillion, indicating substantial activity requiring freight services.

- Supply Chain Integration: France's deep integration into global supply chains ensures a continuous need for comprehensive logistics and transport solutions.

- Economic Interdependence: Strong trade relations with key partners, including Germany and the United States, bolster the demand for cross-border logistics.

Economic factors present a mixed landscape for Schenker-Joyau SAS. While the French logistics market is projected for robust growth, reaching an estimated USD 190.6 billion by 2030, companies grapple with persistent inflation and rising operational costs. Fuel prices, a significant expense, remained volatile in early 2024, with Brent crude futures trading around $80-$90 per barrel. Labor costs are also escalating, with truck driver wages in key European markets increasing by 5-7% in 2024, impacting profit margins and requiring strategic pricing.

| Economic Factor | Data Point | Impact on Schenker-Joyau SAS |

|---|---|---|

| Logistics Market Growth | Projected to reach USD 190.6 billion by 2030 (7.8% CAGR from 2025) | Significant opportunity for increased service demand and revenue. |

| Inflation & Operational Costs | Fuel prices (Brent crude futures) around $80-$90/barrel (H1 2024) | Increased transportation expenses, potentially squeezing profit margins. |

| Labor Costs | Truck driver wages up 5-7% (2024 vs. 2023 in key European markets) | Higher operational expenditure, necessitating cost management and pricing adjustments. |

Preview Before You Purchase

Schenker-Joyau SAS PESTLE Analysis

The preview shown here is the exact Schenker-Joyau SAS PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Schenker-Joyau SAS, providing valuable strategic insights.

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying, offering a complete and actionable analysis.

Sociological factors

The logistics industry in France and Europe grapples with persistent labor shortages, especially for skilled roles like professional drivers and warehouse staff. This scarcity directly affects Schenker-Joyau SAS's operational capacity and efficiency.

Data from 2024 highlights that a significant 76% of logistics operators are experiencing staffing difficulties, with the transportation segment being particularly hard-hit. These shortages inevitably translate into increased labor costs and potential disruptions to service delivery.

Modern consumers, especially those in developed markets, now demand speed, transparency, and eco-friendliness in their deliveries. For instance, a 2024 survey indicated that 75% of online shoppers consider delivery speed a crucial factor in their purchase decisions, with sustainability also rising in importance.

This evolving landscape compels logistics providers like Schenker-Joyau SAS to invest heavily in technology. Companies are integrating real-time GPS tracking and AI-powered route optimization, with the global logistics technology market projected to reach $71.8 billion by 2027, up from $45.2 billion in 2022.

Meeting these elevated expectations is no longer optional; it's a fundamental requirement for retaining customers and staying ahead. Failing to adapt can lead to significant market share erosion, as evidenced by competitors who have successfully leveraged digital transformation to enhance customer experience.

The relentless march of urbanization, with an increasing proportion of the global population residing in cities, directly impacts logistics. By 2050, the UN projects 68% of the world’s population will live in urban areas. This concentration, amplified by the booming e-commerce sector which saw global online retail sales reach an estimated $6.3 trillion in 2023, creates significant congestion. Delivery vehicles navigating dense urban cores contribute to traffic bottlenecks and elevated emissions, making efficient last-mile operations a growing hurdle.

This urban density and e-commerce growth create a dual challenge for logistics firms like Schenker-Joyau SAS. Firstly, it drives up the demand and cost for strategically located urban warehouse and distribution center space. For instance, in major European cities, prime logistics rents have seen substantial increases in 2024. Secondly, it complicates the actual delivery process, demanding innovative solutions for navigating congested streets, meeting consumer expectations for rapid delivery, and minimizing environmental impact within these complex urban landscapes.

Workforce Attractiveness and Skills Gap

The European Union is actively working to tackle labor and skills shortages within the transport sector, recognizing this as a critical hurdle for the industry's future. A significant focus is placed on enhancing the appeal of logistics careers to attract new talent and retain existing workers.

To address this, there's a concerted effort to invest in robust training and development initiatives. These programs are designed to equip the workforce with the necessary skills to manage and utilize advanced logistics technologies and meet evolving industry demands.

- Attracting Talent: The EU's transport policy prioritizes making logistics a more attractive career choice.

- Skills Development: Investment in training is crucial for a workforce adept at modern logistics technologies.

- Addressing Shortages: Efforts are underway to fill the recognized skills gap in the transport and logistics industry.

Societal Pressure for Sustainable Practices

Societal pressure for sustainable practices is increasingly influencing the logistics sector. Consumers and businesses alike are demanding that companies minimize their environmental impact, pushing for greener operations and ethical supply chains. This trend is a significant driver for innovation in logistics, encouraging the adoption of technologies that reduce emissions and waste.

Studies indicate a growing willingness among consumers to support businesses that prioritize sustainability. For instance, a 2024 report by NielsenIQ found that 60% of consumers actively seek out brands with strong environmental credentials. This translates directly to logistics providers like Schenker-Joyau SAS, as their clients face similar consumer pressure and, in turn, expect their logistics partners to align with these values.

- Growing Consumer Demand: Public awareness of climate change and environmental degradation fuels a desire for eco-friendly products and services, impacting purchasing decisions.

- Willingness to Pay Premium: A significant segment of consumers, estimated at over 50% in many developed markets by 2024, are willing to pay more for products from companies demonstrating strong environmental responsibility.

- Supply Chain Transparency: Stakeholders expect visibility into the environmental impact of the entire supply chain, from sourcing to delivery, requiring logistics firms to implement robust sustainability reporting.

- Regulatory Anticipation: Societal pressure often precedes stricter environmental regulations, prompting proactive companies to invest in sustainable technologies and practices to gain a competitive advantage and ensure future compliance.

Societal expectations are reshaping the logistics landscape, pushing for greater sustainability and ethical practices. Consumers are increasingly prioritizing eco-friendly options, with a 2024 NielsenIQ report showing 60% of consumers actively seeking brands with strong environmental credentials. This societal shift directly influences logistics providers like Schenker-Joyau SAS, as their clients face similar pressures and demand alignment with these values.

The demand for faster, more transparent, and environmentally conscious deliveries is paramount. A 2024 survey revealed that 75% of online shoppers consider delivery speed a critical factor in their purchasing decisions, highlighting the need for efficient operations. Furthermore, societal awareness of climate change is driving a willingness to pay a premium for sustainable services, with over 50% of consumers in developed markets in 2024 willing to do so.

Labor shortages remain a significant challenge, with 76% of logistics operators experiencing staffing difficulties in 2024, particularly in skilled roles. The EU is actively addressing this by focusing on making logistics careers more attractive and investing in training to equip the workforce with skills for advanced technologies.

Urbanization and the growth of e-commerce, which reached an estimated $6.3 trillion globally in 2023, are intensifying congestion and the demand for efficient last-mile delivery solutions. This trend also drives up the cost of prime logistics real estate in urban centers, with significant rent increases observed in major European cities throughout 2024.

| Societal Factor | Impact on Logistics | Key Data/Trend (2024/2025) |

|---|---|---|

| Sustainability Demand | Increased pressure for eco-friendly operations and supply chains. | 60% of consumers seek environmentally conscious brands (NielsenIQ 2024). |

| Consumer Delivery Expectations | Need for speed, transparency, and reduced environmental impact. | 75% of online shoppers prioritize delivery speed (2024 survey). |

| Labor Shortages | Operational capacity and efficiency challenges. | 76% of logistics operators face staffing difficulties (2024). |

| Urbanization & E-commerce | Congestion, increased last-mile delivery complexity, and rising urban logistics costs. | Global online retail sales reached $6.3 trillion in 2023. |

Technological factors

Digitalization is a key driver for supply chain optimization, boosting agility and performance for companies like Schenker-Joyau SAS. The focus is on integrating digital solutions for real-time visibility and streamlined processes across logistics networks.

By 2025, it's projected that 70% of global supply chains will leverage advanced analytics and AI for predictive capabilities, a significant jump from previous years. This trend directly impacts how efficiently Schenker-Joyau SAS can manage its operations and respond to market changes.

The logistics sector, including companies like Schenker-Joyau SAS, is rapidly integrating automation and robotics into warehouse operations. This includes advanced systems for automated picking and sorting, robotic palletizers, and autonomous guided vehicles (AGVs). These technologies are crucial for overcoming persistent labor shortages and boosting operational speed and precision.

By 2024, the global market for warehouse robotics was projected to reach over $10 billion, highlighting a significant investment trend. This adoption directly addresses the need for increased efficiency and accuracy in goods handling, a critical factor for logistics providers aiming to stay competitive.

Artificial intelligence and machine learning are revolutionizing logistics, driving efficiency through predictive analytics, optimized routing, and more accurate demand forecasting. These advancements are crucial for reducing fuel consumption and carbon footprints, a key concern for companies like Schenker-Joyau SAS, and improving the responsiveness of customer service operations.

The logistics sector is seeing substantial capital flow into AI-driven supply chain solutions. For instance, investments in AI for supply chain management are projected to reach billions of dollars globally by 2025, underscoring the transformative impact of these technologies on inventory management and route planning.

Internet of Things (IoT) for Enhanced Connectivity

The Internet of Things (IoT) is a cornerstone for advancing logistics technology, offering unprecedented connectivity and real-time tracking capabilities. By 2025, the global IoT market is projected to reach over $1.5 trillion, with logistics and transportation being major contributors to this growth. IoT sensors are crucial for monitoring inventory and environmental conditions, leading to improved supply chain visibility and optimized stock management.

These advancements translate directly into operational efficiencies for companies like Schenker-Joyau SAS. For instance, real-time tracking of shipments via IoT devices can reduce transit times by an estimated 10-15% and minimize instances of lost or damaged goods. The integration of IoT also facilitates predictive maintenance for fleet vehicles, potentially lowering maintenance costs by up to 20% in 2024-2025.

- Enhanced Supply Chain Visibility: IoT sensors provide real-time data on location, temperature, and humidity for goods in transit.

- Optimized Inventory Management: Continuous monitoring of stock levels through IoT devices helps prevent stockouts and overstocking, improving inventory turnover.

- Reduced Operational Costs: Predictive maintenance enabled by IoT sensors can decrease vehicle downtime and repair expenses.

- Improved Customer Service: Real-time tracking allows for more accurate delivery estimates, enhancing customer satisfaction.

Emphasis on Cybersecurity Measures

As logistics operations increasingly digitize, cybersecurity is paramount for Schenker-Joyau SAS and the broader EU transport sector. This digital transformation, driven by advanced ICT systems, demands robust data protection to guard against evolving cyber threats. For instance, the European Union Agency for Cybersecurity (ENISA) reported a 25% increase in reported cybersecurity incidents in the transport sector in 2023 compared to 2022, highlighting the escalating risks.

The interconnected nature of modern logistics, from supply chain management software to autonomous vehicle communication, creates a larger attack surface. Schenker-Joyau SAS must therefore invest heavily in advanced threat detection, secure network infrastructure, and employee training to maintain operational integrity and protect sensitive customer and operational data. Failure to do so could result in significant financial losses and reputational damage.

- Increased Cyber Threats: The EU transport sector experienced a 25% rise in reported cybersecurity incidents in 2023, underscoring the growing risk landscape.

- Digital Interconnectivity: Modern logistics relies on interconnected systems, expanding the potential vulnerabilities that need securing.

- Data Protection Needs: Safeguarding sensitive operational and customer data is critical for maintaining trust and compliance.

- Investment in Security: Companies like Schenker-Joyau SAS must prioritize investment in advanced cybersecurity solutions and training.

Technological advancements are reshaping logistics, with AI and automation driving efficiency. By 2025, 70% of global supply chains are expected to use advanced analytics, and the warehouse robotics market is projected to exceed $10 billion in 2024. IoT integration is also crucial, with the global IoT market set to surpass $1.5 trillion by 2025, enhancing real-time tracking and predictive maintenance, potentially cutting vehicle maintenance costs by 20%.

| Technology | Projected Impact/Growth | Key Benefit for Schenker-Joyau SAS |

| AI & Machine Learning | Billions invested by 2025; improves forecasting and routing | Reduced fuel consumption, better customer service |

| Automation & Robotics | Warehouse robotics market >$10B (2024); increases operational speed | Overcomes labor shortages, boosts precision |

| Internet of Things (IoT) | Global market >$1.5T (2025); enables real-time tracking | 10-15% reduction in transit times, 20% lower maintenance costs |

Legal factors

Starting January 1, 2025, French hauliers, including Schenker-Joyau SAS, must report all greenhouse gas emissions from transport services to clients. This new mandate covers all greenhouse gases, not just CO2, pushing for enhanced environmental accountability.

Failure to comply with this regulation can lead to penalties, with fines potentially reaching up to €3,000. This legal factor directly impacts logistics operations by requiring more detailed data collection and transparent reporting of environmental impact.

EU Member States must transpose new regulations on transport infringements into national law by February 14, 2025. These updated directives will introduce new offenses related to driver rest periods, work scheduling, and data submission, while also adjusting the severity of existing violations. Failure to comply could lead to significant penalties for companies like Schenker-Joyau SAS engaged in cross-border EU transport.

The ongoing rollout of the Import Control System 2 (ICS2) presents significant legal and operational adjustments for Schenker-Joyau SAS. This system mandates enhanced pre-arrival cargo data for all shipments, impacting how transport and forwarding companies manage declarations.

While maritime sectors have already navigated initial ICS2 phases, the critical deadline for road and rail transport is September 1, 2025. This transition necessitates a comprehensive overhaul of existing data submission protocols and systems to ensure compliance with the European Union's evolving customs framework.

Labor Laws and Foreign Worker Policies

France is actively working to fill national labor shortages by updating its lists of professions experiencing high demand and streamlining the process for foreign workers to obtain permits. For instance, as of early 2024, the government has continued to refine these lists, aiming to facilitate the recruitment of skilled labor in critical sectors. This policy adjustment, designed to address staffing deficits, particularly in areas like logistics, creates both potential advantages and challenges for companies such as Schenker-Joyau SAS when developing their recruitment strategies.

These changes directly impact Schenker-Joyau SAS's ability to recruit, potentially easing access to a wider talent pool. However, navigating the evolving regulations and ensuring compliance with new procedures will be crucial for successful implementation. The government's initiative reflects a broader European trend towards more flexible immigration policies to support economic growth and address demographic shifts.

- Revised In-Demand Professions Lists: The French government regularly updates its lists of professions facing shortages, impacting eligibility for foreign worker permits.

- Simplified Work Permit Procedures: Efforts are underway to reduce bureaucratic hurdles for foreign nationals seeking employment in France, particularly in sectors like logistics.

- Impact on Recruitment: These policy shifts offer Schenker-Joyau SAS opportunities to recruit from a broader international talent base to address staffing needs.

- Compliance Challenges: Companies must stay abreast of evolving legal frameworks and administrative requirements related to foreign worker employment.

Data Protection and Privacy Compliance

Schenker-Joyau SAS must navigate a complex web of data protection and privacy regulations, particularly with the increasing digitalization of logistics. Laws like the General Data Protection Regulation (GDPR) demand rigorous compliance, as logistics companies routinely manage extensive sensitive client and shipment information. Failure to adhere can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Maintaining robust data security measures and transparent privacy policies is therefore essential for building and preserving customer trust and avoiding legal repercussions.

Key considerations for Schenker-Joyau SAS include:

- Data Minimization: Collecting and processing only necessary personal data for specific, legitimate purposes.

- Consent Management: Ensuring clear and informed consent is obtained for data processing activities.

- Data Breach Protocols: Establishing procedures for detecting, reporting, and investigating data breaches promptly, as required by regulations like GDPR within 72 hours of becoming aware of a breach.

- Cross-Border Data Transfers: Complying with regulations governing the transfer of personal data outside the European Economic Area, often requiring specific safeguards.

New EU regulations by February 14, 2025, will update transport infringements, impacting driver rest periods and data submission for cross-border operations. The Import Control System 2 (ICS2) mandates enhanced pre-arrival cargo data for all shipments, with road and rail transport facing a September 1, 2025 deadline for compliance. France's updated lists of in-demand professions aim to streamline foreign worker permits, potentially easing recruitment for logistics firms like Schenker-Joyau SAS.

Environmental factors

France and the European Union are committed to ambitious climate action, with targets like achieving carbon neutrality by 2050. France specifically aims for a 50% reduction in greenhouse gas emissions by 2030 from 1990 levels. This places considerable pressure on industries like transportation to adopt greener practices.

France's 2025-2026 logistics roadmap targets significant carbon footprint reduction through measures like expanding electric vehicle charging infrastructure. This initiative aims to accelerate the adoption of cleaner transport solutions within the sector.

The government plans to offer financial incentives, including subsidies and tax credits, to encourage businesses to transition towards environmentally friendly vehicles such as electric or hydrogen-powered trucks. These measures are designed to make greener fleet investments more accessible and attractive for companies.

The French logistics sector is increasingly prioritizing sustainability, pushing companies like Schenker-Joyau SAS to reduce their environmental footprint. This shift is driven by regulatory pressures and growing consumer demand for eco-friendly operations.

Key initiatives include the adoption of electric vehicles, with France aiming for 100% zero-emission new vehicle sales by 2035, and investments in energy-efficient warehouses, often incorporating solar power. For instance, in 2023, renewable energy sources accounted for approximately 26% of France's total energy consumption, a figure expected to rise.

Furthermore, a focus on sustainable packaging materials, such as recycled or biodegradable options, is becoming standard practice to minimize waste and align with circular economy principles. This commitment to greener logistics is not just an environmental imperative but also a strategic advantage in the evolving market.

Corporate Social Responsibility (CSR) and Client Demand

Sustainability is no longer just a box to tick; it's becoming a core part of how businesses operate, largely because clients are demanding it. Customers are actively seeking out logistics partners who demonstrate environmental responsibility, looking for things like green-certified warehouses and eco-friendly transportation options. This shift directly impacts purchasing choices and makes a strong case for investing in Corporate Social Responsibility (CSR) programs.

The demand for sustainable logistics is reflected in market trends. For instance, the global green logistics market was valued at approximately USD 25.1 billion in 2023 and is projected to reach USD 51.7 billion by 2030, growing at a compound annual growth rate of 10.8% during this period. This growth underscores the financial imperative for companies like Schenker-Joyau SAS to integrate robust CSR strategies.

- Client Preference for Green Logistics: Surveys indicate that a significant portion of B2B clients consider a supplier's sustainability performance when making procurement decisions.

- Impact on Brand Reputation: Companies with strong CSR initiatives often enjoy enhanced brand loyalty and a more positive public image, which can translate into competitive advantage.

- Regulatory Tailwinds: While client demand is a primary driver, evolving environmental regulations also push logistics firms towards more sustainable practices, reinforcing the business case for CSR.

Waste Management and Circular Economy Initiatives

France’s environmental regulations, particularly the French Environmental Code, strongly emphasize waste reduction, recycling, and waste valorization. This legal framework directly impacts logistics companies like Schenker-Joyau SAS by mandating adherence to strict waste management protocols. For instance, the European Union's Waste Framework Directive, which France implements, sets ambitious recycling targets, with member states needing to achieve at least 55% of municipal waste recycled by 2025. This pushes companies to invest in more efficient sorting and recycling technologies.

The growing integration of circular economy principles into supply chain digitalization presents both challenges and opportunities. Schenker-Joyau SAS can leverage digital tools to track materials, optimize routes for reverse logistics, and identify opportunities for reusing packaging or returned goods. This aligns with broader industry trends; a 2024 report by McKinsey highlighted that companies embracing circular supply chains can see significant cost savings and improved resource efficiency. For example, implementing digital platforms for asset tracking can reduce lost or discarded materials by up to 15%.

Key initiatives impacting Schenker-Joyau SAS include:

- Adherence to French Environmental Code: Mandatory compliance with waste reduction, reuse, and recycling targets set by national legislation.

- Circular Supply Chain Integration: Opportunities to utilize digital platforms for enhanced tracking and management of resources throughout the logistics lifecycle, aiming to minimize waste.

- European Recycling Targets: Meeting the EU's objective of recycling at least 55% of municipal waste by 2025, requiring robust internal waste management systems.

- Resource Efficiency Gains: Potential for cost savings and improved operational performance through the adoption of circular economy practices and technologies.

France's commitment to ambitious climate goals, including carbon neutrality by 2050 and a 50% greenhouse gas reduction by 2030, directly impacts logistics firms. The 2025-2026 logistics roadmap specifically targets carbon footprint reduction, encouraging greener transport solutions and incentivizing the adoption of electric or hydrogen-powered vehicles through subsidies and tax credits.

The logistics sector is increasingly prioritizing sustainability, driven by both regulatory pressures and a growing consumer demand for eco-friendly operations. This trend is evidenced by the global green logistics market, valued at approximately USD 25.1 billion in 2023 and projected to reach USD 51.7 billion by 2030, growing at a compound annual growth rate of 10.8%.

Furthermore, French environmental regulations, such as the French Environmental Code and the EU's Waste Framework Directive, mandate strict waste management protocols and recycling targets, pushing companies towards more efficient waste handling and circular economy principles. For example, the EU aims for at least 55% of municipal waste to be recycled by 2025.

| Environmental Factor | Description | Impact on Schenker-Joyau SAS | Key Data/Target |

|---|---|---|---|

| Climate Action & Emissions Reduction | France and EU targets for carbon neutrality and greenhouse gas reduction. | Pressure to adopt greener transport and operations. | France: 50% GHG reduction by 2030 (vs 1990); EU: Carbon Neutrality by 2050. |

| Green Logistics Market Growth | Increasing client preference and market value for sustainable logistics. | Opportunity for competitive advantage and revenue growth through CSR. | Global Green Logistics Market: USD 25.1B (2023) to USD 51.7B (2030) at 10.8% CAGR. |

| Waste Management & Circular Economy | French and EU regulations on waste reduction, recycling, and resource efficiency. | Mandatory compliance with waste protocols; opportunities in digital circular supply chains. | EU: 55% Municipal Waste Recycling by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Schenker-Joyau SAS is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading industry analysis firms. We meticulously gather information on political stability, economic indicators, technological advancements, and social trends to provide a comprehensive view.