Schenker-Joyau SAS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Schenker-Joyau SAS Bundle

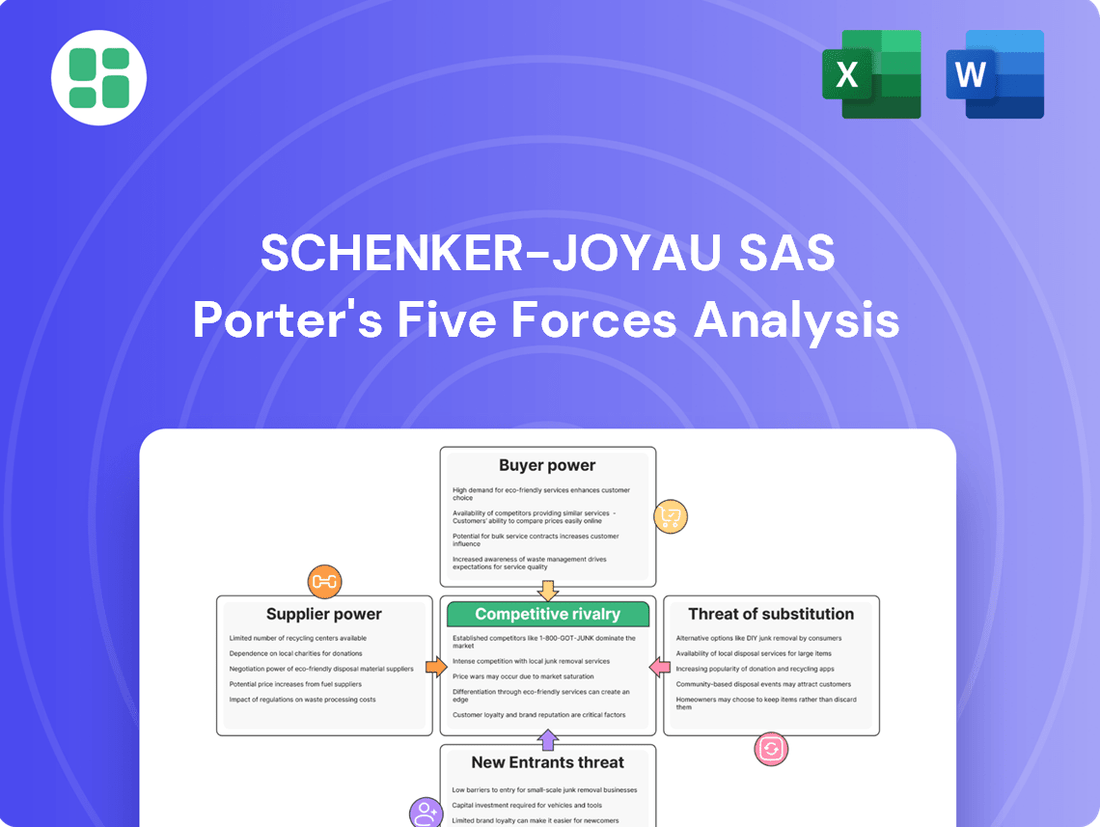

Schenker-Joyau SAS operates within a complex industry landscape, where understanding the interplay of competitive forces is paramount. Our analysis delves into the intensity of rivalry, the bargaining power of both buyers and suppliers, and the ever-present threats of new entrants and substitutes. This strategic framework is crucial for identifying both vulnerabilities and opportunities.

Ready to move beyond the basics? Get a full strategic breakdown of Schenker-Joyau SAS’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Schenker-Joyau SAS depends heavily on essential infrastructure providers such as port authorities, airport operators, and railway networks to offer its comprehensive transport services. In 2024, global port congestion, particularly in key European hubs, led to increased demurrage charges and longer turnaround times, directly affecting logistics efficiency.

The limited number of these critical infrastructure providers, coupled with the substantial financial and logistical hurdles in securing alternative access, grants them considerable bargaining power. This is especially true for specialized transport routes or during peak demand seasons, where capacity is scarce.

This reliance translates into a direct impact on Schenker-Joyau's bottom line; any hikes in access fees or limitations on capacity from these suppliers can significantly inflate operational expenses and compromise the company's ability to deliver services reliably. For instance, in early 2025, several major European rail freight operators announced phased price increases for freight capacity, averaging between 5-8%, citing rising energy and maintenance costs.

Fuel and energy suppliers hold significant bargaining power over logistics companies like Schenker-Joyau SAS. The industry's reliance on fuel for its vast network of trucks, ships, and planes makes it highly susceptible to energy price volatility. For instance, in early 2024, global oil prices saw fluctuations, directly impacting the operational expenses for freight forwarders.

The concentrated nature of major energy suppliers further amplifies their influence. When only a few large entities control the supply of essential fuels, they can dictate terms and pricing more effectively. This concentration means Schenker-Joyau has limited options to switch suppliers, giving these energy providers considerable leverage in negotiations, which can directly affect Schenker-Joyau's bottom line.

Vehicle manufacturers and maintenance providers hold significant sway over Schenker-Joyau SAS. The acquisition and upkeep of a modern fleet, encompassing trucks, vans, and specialized handling gear, necessitates engagement with a select group of major manufacturers and their authorized service centers. This limited supplier base, coupled with their proprietary knowledge and exclusive service networks, allows them to command higher prices for both initial purchases and ongoing maintenance, thereby diminishing Schenker-Joyau's negotiation power.

Skilled labor and technology providers

The bargaining power of suppliers for Schenker-Joyau SAS is significantly influenced by the availability of skilled labor and technology providers. A scarcity of qualified logistics specialists, experienced drivers, and IT professionals adept at managing sophisticated supply chain systems can empower these labor pools and their representatives. For instance, in 2024, the global shortage of truck drivers continued to be a pressing issue, with some regions reporting deficits of over 100,000 drivers, directly impacting logistics companies like Schenker-Joyau.

Furthermore, reliance on specialized technology vendors for critical software solutions, such as advanced warehouse management systems or real-time tracking platforms, can also amplify supplier leverage. If Schenker-Joyau depends on a limited number of providers for these essential IT services, these vendors may command higher licensing fees or maintenance costs. This dependency can lead to increased operational expenses and potentially hinder the company's ability to adopt the latest technological advancements in logistics.

- Skilled Labor Shortages: In 2024, the logistics sector continued to face challenges in recruiting and retaining skilled personnel, particularly drivers and specialized IT staff.

- Technology Vendor Reliance: Dependence on a few key providers for advanced supply chain management software can grant these vendors increased pricing power.

- Impact on Costs: Higher wages for skilled labor and increased software licensing fees directly translate to elevated operational expenditures for Schenker-Joyau.

- Innovation Hindrance: Supplier power in technology can affect Schenker-Joyau's capacity to implement cutting-edge logistics solutions efficiently.

Specialized equipment and packaging suppliers

For specific goods or client needs, Schenker-Joyau SAS might require specialized handling equipment, advanced security systems, or bespoke packaging. When these are provided by a limited number of niche suppliers possessing unique capabilities or proprietary technology, their reduced competition can amplify their leverage over pricing and contract terms.

This situation can translate into elevated costs for these specialized logistics services, potentially impacting the profitability of niche solutions offered by Schenker-Joyau. For instance, in 2024, the global market for specialized logistics equipment saw price increases averaging 5-8% due to supply chain constraints and rising raw material costs.

- Niche Suppliers: Dependence on a few providers for unique equipment or packaging.

- Intellectual Property: Suppliers with proprietary technology or unique designs hold more sway.

- Cost Impact: Increased supplier power can directly raise operational costs for Schenker-Joyau.

- Profitability Squeeze: Higher specialized service costs may reduce profit margins on niche logistics offerings.

Schenker-Joyau SAS faces significant supplier bargaining power from essential infrastructure providers like port and airport operators, as well as railway networks. The limited availability of these critical services, especially during peak times, allows them to dictate terms and pricing. For example, in 2024, global port congestion led to increased demurrage charges, directly impacting logistics efficiency and costs for companies like Schenker-Joyau.

Fuel and energy suppliers also wield considerable influence due to the logistics industry's heavy reliance on fuel. The concentrated nature of major energy providers means Schenker-Joyau has few alternatives, making it vulnerable to price hikes. Early 2024 saw fluctuations in global oil prices, directly impacting operational expenses for freight forwarders.

Vehicle manufacturers and maintenance providers hold strong leverage due to the specialized nature of fleet acquisition and upkeep. A limited number of major manufacturers and their exclusive service networks allow them to command higher prices for both new vehicles and ongoing maintenance, diminishing Schenker-Joyau's negotiation power.

The bargaining power of suppliers is also amplified by shortages in skilled labor and reliance on specialized technology vendors. In 2024, the global truck driver shortage, with some regions facing deficits over 100,000 drivers, directly impacted logistics operations. Similarly, dependence on a few key IT providers for advanced supply chain software can lead to increased licensing fees.

| Supplier Category | Impact on Schenker-Joyau | 2024/2025 Trend/Data |

|---|---|---|

| Infrastructure Providers | Increased operational costs due to congestion and access fees. | Global port congestion leading to higher demurrage charges. |

| Fuel & Energy Suppliers | Vulnerability to price volatility and limited switching options. | Fluctuations in global oil prices impacted operational expenses. |

| Vehicle Manufacturers & Maintenance | Higher acquisition and upkeep costs for fleet. | Limited supplier base for specialized vehicles and parts. |

| Skilled Labor & Technology Vendors | Increased labor costs and software licensing fees. | Global truck driver shortage; increased costs for advanced logistics software. |

What is included in the product

This analysis dissects the competitive forces impacting Schenker-Joyau SAS, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly pinpoint competitive pressures with a visually intuitive dashboard, enabling rapid identification of key challenges and strategic opportunities for Schenker-Joyau SAS.

Customers Bargaining Power

Schenker-Joyau SAS frequently deals with large corporate clients who represent substantial shipping volumes across diverse transportation modes. These major clients possess considerable purchasing power, enabling them to negotiate for reduced rates, more favorable payment terms, or bespoke service agreements tailored to their specific needs.

The sheer scale of business provided by these large customers significantly amplifies their bargaining leverage. For instance, a single large client might account for a notable percentage of Schenker-Joyau's overall revenue, making it difficult to refuse their demands without risking a significant loss of business. This dynamic inherently places pressure on Schenker-Joyau's pricing strategies and overall profitability.

For fundamental courier, parcel delivery, and general freight services, customers often face minimal barriers when switching between providers. This is because many logistics companies offer very similar, standardized services. For instance, in 2024, the global logistics market saw intense competition, with numerous players vying for market share in these basic service segments.

This ease of movement between logistics partners allows customers to actively hunt for the best deals, whether that means the most competitive pricing, superior service quality, or more advantageous contractual terms. This dynamic puts ongoing pressure on companies like Schenker-Joyau to consistently offer attractive pricing and maintain high service standards to retain their customer base.

The French logistics market is quite crowded, with numerous companies offering similar services, from small local outfits to big international ones. In 2024, this competitive landscape means customers have a wealth of options when they need to move goods. This sheer volume of providers directly translates into increased leverage for the customer.

With so many logistics providers available, customers can easily shop around and get quotes from several different companies. This ability to compare pricing and service levels allows them to negotiate more effectively. For instance, a business needing regular freight services can play providers against each other, driving down costs.

This situation significantly boosts the bargaining power of customers. They are not tied to a single provider and can switch if they don't get favorable terms. This lack of dependence on any one logistics company gives customers the upper hand in securing better deals and service agreements.

Customer's knowledge and transparency

Customers today are incredibly well-informed, thanks to the internet. They can easily compare prices, service quality, and what competitors offer. For instance, a 2024 report indicated that over 80% of consumers research products and services online before making a purchase, directly impacting Schenker-Joyau's pricing power.

This heightened transparency means customers are more likely to negotiate aggressively, seeking the best possible value. They understand market benchmarks and are less swayed by brand loyalty alone, putting pressure on Schenker-Joyau to offer competitive pricing and superior service to retain business.

- Informed Purchasing Decisions: Customers leverage digital platforms to access extensive data on pricing, service features, and competitor analyses.

- Negotiating Leverage: Increased transparency empowers customers to demand better terms and pricing from service providers like Schenker-Joyau.

- Price Sensitivity: A well-informed customer base often leads to greater price sensitivity, limiting a company's ability to charge premium rates.

- Reduced Switching Costs: Easy access to information lowers perceived switching costs for customers, making them more willing to explore alternatives.

In-house logistics capabilities

Some major clients, especially those with substantial shipping volumes or intricate supply chains, might consider bringing their logistics operations in-house for essential distribution tasks. This possibility of vertical integration, even if not fully executed, sharpens the negotiating edge for these customers when dealing with third-party logistics firms like Schenker-Joyau SAS.

This leverage compels logistics providers to clearly showcase their cost advantages and the unique value they bring to the table. For instance, a large automotive manufacturer might assess if the cost savings and control gained from managing its own fleet and warehousing outweigh the specialized expertise and economies of scale offered by a provider like Schenker-Joyau.

- Customer Vertical Integration: Large customers can potentially bring logistics in-house, increasing their bargaining power.

- Cost-Effectiveness Pressure: Logistics providers must demonstrate superior cost efficiency to retain clients.

- Value Proposition: Highlighting specialized services and economies of scale becomes crucial for providers.

Customers in the logistics sector, particularly large corporate clients, wield significant bargaining power due to their substantial shipping volumes and the often-standardized nature of basic freight services. This leverage is amplified by the ease with which they can switch providers in a competitive market, as evidenced by the intense competition in the global logistics market in 2024.

The increasing transparency driven by digital platforms allows customers to meticulously compare pricing and service offerings, pushing providers like Schenker-Joyau SAS to maintain competitive rates and high service standards. Furthermore, the potential for major clients to vertically integrate their logistics operations serves as a constant pressure point, compelling third-party providers to clearly articulate their cost advantages and unique value propositions.

| Factor | Impact on Schenker-Joyau SAS | Customer Action/Leverage |

|---|---|---|

| Volume of Business | High dependence on large clients | Negotiate lower rates, favorable terms |

| Switching Costs | Low for standardized services | Easily compare and switch providers |

| Information Availability | Increased customer price sensitivity | Demand best value, aggressive negotiation |

| Potential Vertical Integration | Threat of losing business | Drive down costs by threatening in-house operations |

Preview the Actual Deliverable

Schenker-Joyau SAS Porter's Five Forces Analysis

This preview showcases the complete Schenker-Joyau SAS Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. What you see here is precisely the document you will receive immediately after purchase, ensuring transparency and no hidden surprises. This professionally formatted analysis is ready for your immediate use, providing actionable insights into the industry dynamics affecting Schenker-Joyau SAS.

Rivalry Among Competitors

The French logistics sector is a battlefield with many contenders, both large international companies and smaller, specialized local firms. This intense competition means Schenker-Joyau must constantly strive to stand out and offer unique value to its customers.

Global giants like DHL, UPS, and FedEx, alongside French powerhouse Geodis, are major players in this market. Their extensive networks and resources put significant pressure on all participants, including Schenker-Joyau.

The sheer volume of competitors in France, estimated to be in the hundreds when considering all tiers of logistics providers, directly impacts pricing. This fragmentation forces companies like Schenker-Joyau to operate on tighter margins, making efficiency and cost control paramount.

The logistics sector, particularly for standard services, sees intense rivalry centered on price. This leads to considerable pressure on profit margins for companies like Schenker-Joyau. Customers often prioritize the lowest cost, making price a primary decision factor.

To stay competitive, Schenker-Joyau needs exceptional operational efficiency and strict cost management. The drive for market share compels aggressive pricing tactics, which can erode profitability if not carefully managed. For instance, in 2024, the global freight forwarding market experienced a slight contraction in average revenue per unit due to these competitive pressures.

Competitors in the French logistics arena are actively pursuing differentiation through specialized offerings. This includes areas like temperature-controlled transport, handling oversized cargo, and advancements in last-mile delivery. Many are also focusing on deeply integrated supply chain solutions to capture market share.

To maintain its position, Schenker-Joyau SAS needs to consistently innovate and deepen its specialization across its service portfolio. This proactive approach is crucial to avoid its services becoming perceived as mere commodities. For instance, in 2024, the French logistics sector saw a significant push towards sustainable delivery solutions, with companies investing heavily in electric fleets and route optimization software.

The capacity to provide highly customized and tailored solutions is paramount for Schenker-Joyau to preserve its competitive advantage. This focus on bespoke services allows the company to meet the unique demands of diverse clientele, thereby fostering stronger client relationships and justifying premium pricing.

Market share battles and aggressive strategies

Schenker-Joyau operates in a landscape where competitors frequently employ aggressive tactics to capture or retain market share. These strategies can manifest as intense price competition, swift expansion into new territories, or strategic consolidations through mergers and acquisitions. For instance, in the logistics sector, major players often engage in promotional pricing campaigns to attract new clients, as seen with significant rate adjustments by global carriers throughout 2024 in response to fluctuating demand and capacity. This constant jockeying for position creates a dynamic and often challenging competitive environment.

This intense rivalry necessitates that Schenker-Joyau adopts a proactive and adaptable approach to its competitive strategy. The company must be adept at anticipating the strategic maneuvers of its rivals and be prepared to pivot its own plans quickly. A failure to do so could result in erosion of its market standing. For example, a competitor’s unexpected acquisition of a regional player in late 2024 could instantly alter the competitive dynamics in key markets, requiring Schenker-Joyau to re-evaluate its service offerings and pricing structures in those areas.

Key competitive actions observed in the industry include:

- Promotional Pricing: Competitors often offer discounted rates or bundled services to win over new customers, impacting industry-wide price levels.

- Geographic Expansion: Companies are actively entering new markets, both domestically and internationally, to broaden their customer base and service reach.

- Mergers and Acquisitions: Strategic M&A activity is prevalent as firms seek to gain scale, acquire new technologies, or eliminate rivals, reshaping market concentration.

- Service Innovation: Competitors are investing in new technologies, such as AI-driven route optimization and enhanced tracking systems, to differentiate their offerings.

Technological advancements and digital transformation

The logistics sector is intensely competitive, with technological advancements serving as a primary battleground. Companies are heavily investing in AI, IoT, and automation to improve tracking, optimize routes, and create better customer experiences. For instance, in 2024, major logistics players reported significant increases in their IT spending, with some allocating over 15% of their capital expenditure to digital transformation initiatives.

Rivals who successfully integrate these digital solutions gain a substantial competitive advantage. This necessitates that Schenker-Joyau SAS continuously matches or surpasses these technological investments to preserve its operational efficiency and the quality of its services. The ongoing digital race means that staying ahead requires constant innovation and adaptation to new technologies.

- AI in Logistics: Used for predictive maintenance and demand forecasting.

- IoT for Tracking: Enables real-time visibility of shipments, with global adoption rates for IoT in supply chains projected to reach over 75% by 2025.

- Automation: Streamlines warehouse operations, reducing labor costs and increasing throughput.

- Advanced Analytics: Drives efficiency through data-driven decision-making in route planning and network optimization.

The competitive rivalry within the French logistics sector is fierce, characterized by numerous domestic and international players vying for market share. This intense competition, driven by both large global entities and specialized local firms, forces companies like Schenker-Joyau SAS to focus on efficiency and cost control to maintain profitability.

Price remains a dominant factor in customer decisions, leading to tighter profit margins as companies engage in aggressive pricing tactics to attract business. For example, the global freight forwarding market in 2024 saw a slight dip in average revenue per unit due to these competitive pressures.

Differentiation through specialized services, such as temperature-controlled transport and advanced last-mile solutions, is a key strategy for competitors. Schenker-Joyau must continuously innovate its offerings, particularly in areas like sustainable delivery, to avoid being perceived as a commodity provider.

Technological adoption, especially in AI and IoT for enhanced tracking and route optimization, is a significant battleground. In 2024, many logistics firms increased their IT spending, with some dedicating over 15% of capital expenditure to digital transformation, highlighting the critical need for Schenker-Joyau to keep pace with these advancements.

| Competitive Tactic | Impact on Schenker-Joyau | 2024 Industry Trend Example |

|---|---|---|

| Aggressive Pricing | Pressure on profit margins, need for cost efficiency | Slight contraction in average revenue per unit globally |

| Service Specialization | Need for differentiation through niche offerings | Increased focus on sustainable and temperature-controlled logistics |

| Technological Investment | Requirement to match or exceed digital advancements | IT spending up by 15%+ of CAPEX for digital transformation |

SSubstitutes Threaten

Large corporations, especially those with substantial shipping volumes or unique product requirements, increasingly opt to build out their own logistics infrastructure. This strategy directly substitutes the need for third-party logistics (3PL) providers such as Schenker-Joyau SAS, enabling companies to directly manage their warehousing, transportation, and delivery networks.

For instance, in 2024, many e-commerce giants continued to invest heavily in their last-mile delivery capabilities, aiming for greater efficiency and customer control. This trend puts pressure on traditional 3PLs by offering a viable alternative for businesses that prioritize end-to-end supply chain oversight.

The rise of digital freight platforms and aggregators presents a significant threat of substitution for Schenker-Joyau SAS. These online marketplaces directly connect shippers with carriers, often cutting out traditional intermediaries like Schenker-Joyau. For instance, platforms such as Freightos and Convoy have seen substantial growth, with Freightos reporting a 30% year-over-year increase in booked shipments in late 2023.

These digital alternatives offer benefits like greater price transparency and real-time tracking, which can be highly appealing to customers, especially for less complex or spot market freight. This accessibility and efficiency can draw business away from established logistics providers, forcing them to adapt or risk losing market share. The ease of use and potential cost savings offered by these platforms make them a compelling substitute for Schenker-Joyau's core brokerage and forwarding services.

The rise of e-commerce has empowered manufacturers and large retailers to consider direct shipping to end-consumers. This bypasses traditional logistics providers by establishing proprietary last-mile delivery networks, leveraging local couriers, or implementing micro-fulfillment centers. For instance, in 2024, a significant percentage of online retailers reported exploring or implementing direct-to-consumer (DTC) shipping strategies to gain greater control over the customer experience and potentially reduce costs.

Advanced manufacturing and localized production

Advanced manufacturing and localized production present a significant threat of substitutes for traditional freight forwarding services. Trends like reshoring and nearshoring, gaining momentum in 2024, aim to shorten supply chains. This shift means goods might be produced closer to their end markets, reducing reliance on extensive international shipping networks.

For Schenker-Joyau SAS, this translates to a potential decrease in demand for long-haul freight. As production becomes more geographically dispersed and concentrated near consumption hubs, the need for complex, multi-modal global logistics solutions diminishes. For example, the World Bank’s Logistics Performance Index (LPI) 2023 highlighted that efficiency in domestic logistics is as crucial as international transit for many businesses, suggesting a growing focus on localized supply chain capabilities.

- Reduced Demand for Long-Haul Freight: As manufacturing returns or moves closer to consumers, the volume of goods requiring extensive international shipping decreases.

- Rise of Regional Hubs: Localized production fosters the growth of regional logistics networks, potentially bypassing traditional global freight forwarders.

- Increased Competition from Niche Providers: Specialized regional logistics companies may emerge, offering tailored solutions that substitute for the broad services of global players.

- Impact of Automation: Advanced manufacturing often incorporates automation, which can further optimize localized production and distribution, reducing the need for manual freight handling and complex routing.

Alternative transport modes for specific goods

While Schenker-Joyau excels in integrated multi-modal logistics, certain goods or specific routes might find viable substitutes in alternative transport modes. For instance, bulk liquids could be transported via specialized pipeline networks, bypassing traditional road, rail, or sea freight entirely. In 2024, the global pipeline transportation market was valued at approximately $100 billion, highlighting its significance for specific commodities.

Furthermore, the burgeoning field of drone delivery presents a potential substitute for urgent, small-parcel shipments, particularly in urban environments. While not yet a mainstream competitor for large-scale logistics, advancements in drone technology and regulatory frameworks could see its adoption grow. By mid-2025, projections suggest the global commercial drone market could reach over $50 billion, indicating significant future potential for niche logistics solutions.

- Pipeline Transport: Viable for bulk liquids and gases, offering dedicated infrastructure bypassing standard logistics networks.

- Drone Delivery: Emerging as a substitute for urgent, small-volume shipments in localized, often urban, settings.

- Niche Specialized Carriers: For highly specific cargo requiring unique handling or environments, specialized carriers might offer a more direct alternative.

- Increased Automation in Warehousing: While not a transport mode substitute, enhanced automation within customer facilities could reduce the need for certain types of last-mile delivery services.

The increasing trend of companies building their own logistics capabilities, especially in e-commerce for last-mile delivery, directly substitutes the need for third-party providers like Schenker-Joyau. Digital freight platforms are also gaining traction, offering transparency and efficiency that attract shippers. Furthermore, reshoring and nearshoring initiatives shorten supply chains, reducing reliance on extensive international freight forwarding.

| Substitute Type | Description | 2024/2025 Trend/Data |

|---|---|---|

| In-house Logistics | Companies managing their own warehousing and transportation. | Continued heavy investment by e-commerce giants in last-mile capabilities. |

| Digital Freight Platforms | Online marketplaces connecting shippers and carriers directly. | Platforms like Freightos saw significant growth; Freightos reported a 30% year-over-year increase in booked shipments in late 2023. |

| Localized Production | Manufacturing closer to end markets, shortening supply chains. | Reshoring and nearshoring gaining momentum, reducing demand for long-haul freight. World Bank LPI 2023 highlighted domestic logistics importance. |

| Alternative Transport | Specialized modes like pipelines or drones. | Global pipeline transportation market valued around $100 billion in 2024. Drone delivery market projected to exceed $50 billion by mid-2025. |

Entrants Threaten

Establishing a robust logistics network, a core component for companies like Schenker-Joyau SAS, demands significant upfront capital. This includes building or acquiring strategically positioned warehouses, amassing a diverse fleet of transport vehicles, and implementing sophisticated IT systems for tracking and management.

In 2024, the global logistics market, valued at approximately $10.6 trillion, underscores the scale of investment needed. For instance, setting up a single, modern distribution center can cost tens of millions of dollars, while a fleet of specialized vehicles represents a multi-million dollar commitment, creating a high financial barrier for new entrants aiming to compete effectively.

The logistics sector faces a formidable barrier to entry due to extensive regulatory hurdles and compliance costs. New players must navigate a complex web of rules covering transportation safety, environmental impact, labor practices, and international customs. For instance, in 2024, companies operating in the European Union's road freight sector, a core area for logistics, must adhere to stringent emissions standards and driver hour regulations, which demand significant investment in compliant fleets and robust management systems.

Schenker-Joyau SAS leverages DB Schenker's vast global network and robust infrastructure, encompassing critical transport hubs, efficient customs clearance, and established international alliances. This existing framework provides a significant competitive advantage.

New entrants face the daunting task of establishing a comparable network and infrastructure, a process that is both exceptionally costly and time-intensive. The sheer scale and complexity of replicating DB Schenker's global reach present a substantial barrier to entry, making it difficult for newcomers to compete effectively from the outset.

Brand reputation and customer trust

Established players like Schenker-Joyau SAS benefit from decades of cultivating a robust brand reputation, fostering deep customer trust through consistent reliability and efficiency in complex supply chain management. This hard-won trust is a significant barrier to entry for newcomers.

New entrants must invest heavily and demonstrate exceptional service quality over extended periods to even begin to erode the loyalty enjoyed by incumbents. For instance, a new logistics provider might need to secure certifications and positive testimonials from a substantial number of clients, a process that can take years.

The inherent risk aversion of businesses entrusting their critical logistics to new, unproven partners means that brand reputation and customer trust are powerful deterrents. In 2024, companies are particularly vigilant about supply chain disruptions, making established relationships with trusted providers even more valuable.

- Brand loyalty: Schenker-Joyau's established reputation reduces customer switching.

- Trust deficit: New entrants must overcome skepticism regarding service dependability.

- Time and investment: Building equivalent trust requires significant resources and patience.

- Risk aversion: Clients prioritize proven reliability in logistics partners.

Economies of scale and operational efficiency

The threat of new entrants for Schenker-Joyau SAS is significantly mitigated by the substantial economies of scale enjoyed by established players. Large logistics providers leverage their volume to secure better rates on fuel, fleet acquisition, and warehousing space. For instance, in 2024, major global freight forwarders reported operating cost savings of up to 15% due to bulk purchasing power compared to smaller regional operators.

Newcomers face a steep uphill battle in matching the operational efficiency of incumbents. Schenker-Joyau, like its peers, benefits from advanced route optimization software and sophisticated warehouse management systems that reduce transit times and labor costs. A new entrant would need to invest heavily in similar technology and build a network from scratch, making it difficult to compete on price without substantial initial losses.

- Economies of Scale: Incumbents like Schenker-Joyau benefit from lower per-unit costs in procurement and operations due to high volumes.

- Operational Efficiency: Established players possess optimized processes and technology, creating a cost advantage.

- Capital Investment: New entrants require significant upfront investment in infrastructure, technology, and fleet to achieve competitive scale.

- Price Competition: The cost efficiencies of incumbents make it challenging for new, smaller-scale entrants to compete on price and maintain profitability.

The threat of new entrants for Schenker-Joyau SAS is considerably low due to the immense capital investment required to establish a logistics network. Building warehouses, acquiring a diverse fleet, and implementing advanced IT systems demand substantial upfront funding, creating a significant financial barrier.

Regulatory compliance further complicates entry, with new players needing to navigate complex rules on safety, environmental impact, and labor, necessitating further investment in compliant operations. For instance, in 2024, adherence to stringent EU emissions standards for road freight alone requires significant fleet upgrades.

The established global network, brand reputation, and customer trust enjoyed by Schenker-Joyau are critical deterrents. New entrants must invest heavily and demonstrate exceptional service over extended periods to build comparable credibility in a market where clients prioritize proven reliability, especially given the heightened focus on supply chain resilience in 2024.

Economies of scale and operational efficiencies enjoyed by incumbents like Schenker-Joyau also present a formidable challenge. Lower per-unit costs from bulk purchasing and optimized technology give established players a significant price advantage, making it difficult for new, smaller-scale entrants to compete profitably.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Establishing logistics infrastructure (warehouses, fleet, IT) | High upfront investment needed | Global logistics market valued at ~$10.6 trillion |

| Regulatory Hurdles | Compliance with safety, environmental, labor laws | Increased operational costs and complexity | Stringent EU emissions standards for road freight |

| Brand Reputation & Trust | Cultivating customer loyalty and reliability | Requires significant time and consistent service delivery | Businesses prioritize proven partners due to supply chain risks |

| Economies of Scale | Cost advantages from high-volume operations | Difficulty matching incumbent pricing and efficiency | Major freight forwarders report up to 15% cost savings from bulk purchasing |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Schenker-Joyau SAS is built upon a foundation of industry-specific market research reports, company financial statements, and publicly available competitor data. We also incorporate insights from trade publications and regulatory filings to provide a comprehensive view of the competitive landscape.