Schenker-Joyau SAS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Schenker-Joyau SAS Bundle

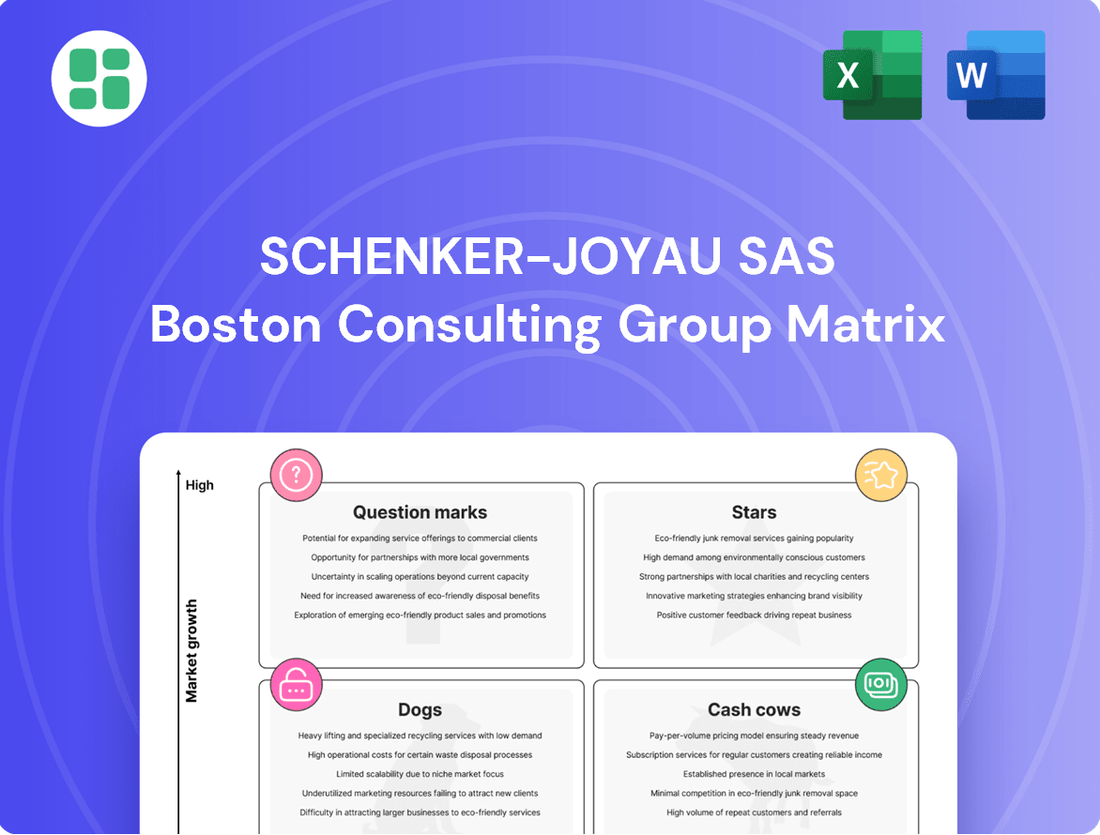

Curious about Schenker-Joyau SAS's strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the full report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete BCG Matrix for detailed quadrant placements and actionable insights to drive your own strategic decisions.

Stars

Schenker-Joyau SAS, a key player within DB Schenker, is heavily investing in sustainable logistics. This includes a significant rollout of electric truck fleets across France and the adoption of marine biofuels. These initiatives are directly addressing the growing demand for environmentally responsible supply chains.

The market for sustainable logistics is booming, fueled by stricter environmental regulations and a widespread corporate push towards Environmental, Social, and Governance (ESG) goals. This positions Schenker-Joyau's green logistics offerings as frontrunners in a sector experiencing rapid expansion. DB Schenker's ambitious target of achieving carbon neutrality by 2040 underscores the strategic importance of this high-growth segment.

The French e-commerce sector is booming, creating a substantial need for sophisticated fulfillment and last-mile delivery. In 2023, online sales in France reached approximately €150 billion, highlighting the market's dynamism and the critical role of logistics providers.

Schenker-Joyau SAS capitalizes on DB Schenker's cutting-edge, automated e-commerce warehouses serving France. These facilities offer advanced pick-and-pack operations and efficient returns management, crucial for meeting the demands of this rapidly expanding sector.

This segment is a star performer for Schenker-Joyau SAS, driven by escalating consumer expectations for swift delivery. The company's ability to provide these advanced solutions positions it strongly within a market that saw a 10% year-over-year growth in e-commerce transactions during 2023.

Integrated Digital Supply Chain Management represents a significant growth opportunity for Schenker-Joyau SAS within the BCG matrix. Leveraging DB Schenker's substantial investments in AI and data analytics, these solutions offer unparalleled end-to-end visibility and efficiency, crucial for today's market demands. The global supply chain management market was valued at approximately $22.4 billion in 2023 and is projected to grow substantially, driven by the adoption of digital technologies.

Specialized Cold Chain Logistics for Pharmaceuticals

The pharmaceutical cold chain logistics market is a rapidly expanding sector, driven by the increasing global demand for temperature-sensitive medicines and vaccines. In 2024, this market is projected to reach over $20 billion, with a compound annual growth rate (CAGR) of approximately 7-8% expected through 2030. Schenker-Joyau SAS, as part of DB Schenker, plays a significant role in this high-value segment by providing specialized, end-to-end temperature-controlled solutions.

Their expertise in maintaining precise temperature ranges, from manufacturing to final delivery, is crucial for ensuring product efficacy and patient safety. This specialization allows them to capture a substantial market share in a niche that demands advanced infrastructure and regulatory compliance.

- High Growth Market: The global pharmaceutical cold chain logistics market was valued at approximately $18.5 billion in 2023 and is anticipated to grow significantly in 2024 and beyond.

- Regulatory Driven: Stringent regulations governing the transport of pharmaceuticals necessitate specialized logistics, creating a barrier to entry and favoring established players like Schenker-Joyau SAS.

- Specialized Expertise: Schenker-Joyau SAS offers advanced temperature monitoring, validation, and compliant transportation, catering to the unique needs of pharmaceutical clients.

- Sustainability Focus: Collaborations on sustainable transport innovations within the pharmaceutical supply chain are a key differentiator, aligning with industry trends and client expectations.

Automotive E-mobility Logistics

Automotive E-mobility Logistics is a burgeoning sector for Schenker-Joyau SAS, driven by the global transition to electric vehicles. This shift necessitates specialized logistics for EV components, particularly batteries, and the evolving aftermarket supply chains. DB Schenker's deep engagement with the automotive industry positions it to capture significant market share in this high-growth area, presenting a substantial opportunity for Schenker-Joyau SAS in France.

- Market Growth: The global EV market is projected to reach over 70 million units by 2030, a substantial increase from around 10 million in 2022, creating a massive demand for specialized logistics.

- DB Schenker's Role: DB Schenker is investing heavily in EV logistics infrastructure and expertise, aiming to be a leader in this segment.

- French Opportunity: France, with its ambitious EV adoption targets, offers a fertile ground for Schenker-Joyau SAS to expand its e-mobility logistics services.

- Service Complexity: Handling high-value, sensitive EV batteries and components requires advanced safety protocols and specialized handling, a niche Schenker-Joyau SAS is well-positioned to fill.

Schenker-Joyau SAS's e-commerce fulfillment and last-mile delivery services are performing exceptionally well, mirroring the 10% year-over-year growth observed in French e-commerce transactions during 2023. The substantial €150 billion generated by online sales in France in 2023 underscores the market's dynamism. Leveraging DB Schenker's advanced, automated warehouses, Schenker-Joyau SAS offers efficient pick-and-pack and returns management, meeting escalating consumer demands for swift delivery and solidifying its position as a star performer.

| Business Unit | Market Growth | Schenker-Joyau SAS Position | Key Drivers |

|---|---|---|---|

| E-commerce Fulfillment & Last-Mile Delivery | High (French e-commerce sales ~€150 billion in 2023, +10% YoY) | Star | Consumer demand for speed, advanced warehouse automation |

| Sustainable Logistics | High (Global ESG focus, DB Schenker target: carbon neutral by 2040) | Star | Environmental regulations, corporate ESG goals |

| Pharmaceutical Cold Chain Logistics | High (Market projected >$20 billion in 2024, ~7-8% CAGR) | Star | Demand for temperature-sensitive medicines, regulatory compliance |

| Automotive E-mobility Logistics | High (Global EV market growth, ~70 million units by 2030) | Star | EV transition, specialized handling of batteries and components |

What is included in the product

This BCG Matrix analysis for Schenker-Joyau SAS offers strategic insights into its product portfolio, guiding investment decisions.

A clear Schenker-Joyau SAS BCG Matrix visualizes business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Schenker-Joyau SAS's traditional land freight network, encompassing extensive road and groupage operations across France, functions as a prime Cash Cow within its BCG Matrix. This segment, representing a substantial portion of the company's overall activity, benefits from a mature market position and established infrastructure.

Despite experiencing lower growth rates compared to newer ventures, this foundational service consistently delivers robust and predictable cash flow. Its high market share within the French freight forwarding sector, bolstered by a wide network and strong brand presence, ensures reliable volumes and profitability.

Standard Warehousing and Distribution Services are a solid cash cow for Schenker-Joyau SAS. Think of it as the reliable workhorse of the business, serving big, long-standing clients. These aren't flashy, high-growth services, but they bring in consistent money without needing a lot of new investment or marketing spend. This stability is crucial for funding other parts of the company.

The French contract logistics market, where these services operate, is quite mature. DB Schenker, the parent company, is a major player here, which means Schenker-Joyau SAS benefits from this established presence. In 2024, the contract logistics sector in France continued to show resilience, with demand driven by e-commerce growth and the need for efficient supply chains, solidifying the dependable income stream from these core services.

General Air Freight Services within Schenker-Joyau SAS's portfolio are firmly positioned as Cash Cows. This segment operates in a mature global air freight market, consistently delivering robust revenue streams. The sheer volume and established nature of these services, supported by DB Schenker's extensive international network, ensure a steady and significant contribution to the company's overall cash flow.

Global Ocean Freight Services

Global ocean freight services represent a significant Cash Cow for Schenker-Joyau SAS, a division of DB Schenker. This segment is characterized by its high volume and consistent revenue generation, making it a stable contributor to the company's overall financial performance.

Despite being a mature market, DB Schenker maintains a substantial market share due to its extensive global network and a loyal, large customer base. This strong positioning allows them to weather market volatility effectively.

In 2024, DB Schenker continued its commitment to sustainability by investing in marine biofuel for its ocean freight operations. This strategic move not only aligns with environmental goals but also appeals to a growing segment of clients prioritizing emission reductions.

- High Revenue Generation: Ocean freight is a foundational service for DB Schenker, consistently delivering substantial revenue streams.

- Mature Market Dominance: A well-established global network and a broad client base secure a high market share in the mature ocean freight sector.

- Sustainability Investment: Upfront investments in sustainable marine biofuel for ocean freight enhance the company's competitive edge and attract environmentally conscious clients.

Customs Brokerage and Compliance Services

Customs brokerage and compliance services are the bedrock of international trade, offering a predictable and consistent revenue stream. These services require minimal additional investment for growth, making them a prime example of a Cash Cow for Schenker-Joyau SAS within the BCG Matrix framework. Their essential nature ensures recurring demand, supporting clients' cross-border logistics with unwavering regulatory adherence.

Leveraging DB Schenker's extensive global network and deep expertise, Schenker-Joyau SAS has secured a significant market share in this vital sector. This strong position allows them to consistently deliver crucial support for clients navigating the complexities of international shipments. Their ability to ensure strict regulatory compliance is a testament to their established presence and operational excellence.

- Market Share Dominance: Schenker-Joyau SAS holds a substantial portion of the customs brokerage market, benefiting from the strong brand recognition and operational capabilities inherited from DB Schenker.

- Stable Revenue Generation: The essential and recurring nature of customs clearance and compliance services provides a predictable and stable income source for the company.

- Low Investment Requirement: Unlike high-growth sectors, maintaining and operating customs brokerage services typically requires less capital expenditure for expansion, maximizing profitability.

- Regulatory Expertise: The company's deep understanding and application of complex international trade regulations ensure client adherence and minimize risks, fostering client loyalty.

The traditional land freight network of Schenker-Joyau SAS, particularly its road and groupage operations across France, functions as a prime Cash Cow. This segment benefits from a mature market position and established infrastructure, generating robust and predictable cash flow despite lower growth rates.

Standard warehousing and distribution services also act as a solid cash cow. These services cater to large, long-standing clients, providing consistent income without significant new investment, thereby funding other company initiatives.

General air freight services are firmly positioned as Cash Cows, benefiting from the mature global air freight market and DB Schenker's extensive international network. This ensures a steady and significant contribution to the company's overall cash flow.

Global ocean freight services represent another significant Cash Cow, characterized by high volume and consistent revenue generation. DB Schenker's substantial market share, built on its extensive network and loyal customer base, allows for effective weathering of market volatility.

Customs brokerage and compliance services are essential, providing a predictable and consistent revenue stream with minimal additional investment required for growth, making them a prime Cash Cow for Schenker-Joyau SAS.

| Service Segment | BCG Matrix Position | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| French Land Freight | Cash Cow | Mature market, established infrastructure, high market share, predictable cash flow | Continued strong performance in road and groupage operations. |

| Warehousing & Distribution | Cash Cow | Serves long-standing clients, stable income, low investment needs | Resilience driven by e-commerce growth and supply chain efficiency needs. |

| General Air Freight | Cash Cow | Mature market, high volume, steady revenue, extensive network support | Reliable contributor to overall cash flow. |

| Global Ocean Freight | Cash Cow | High volume, consistent revenue, substantial market share, sustainability investments (e.g., marine biofuel) | DB Schenker invested in marine biofuel in 2024, attracting environmentally conscious clients. |

| Customs Brokerage | Cash Cow | Essential service, predictable revenue, low investment, regulatory expertise | Leverages DB Schenker's global network and deep expertise for significant market share. |

What You’re Viewing Is Included

Schenker-Joyau SAS BCG Matrix

The Schenker-Joyau SAS BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously prepared for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional, ready-to-use report. You can confidently use this preview as a true representation of the final deliverable, which will be immediately available for your business planning needs. This BCG Matrix report is designed to provide clear insights into Schenker-Joyau SAS's product portfolio, empowering you to make informed strategic choices.

Dogs

Undifferentiated local courier services in France represent a mature, highly competitive market. For Schenker-Joyau SAS, this segment likely holds a low market share, characterized by thin profit margins where profitability is often marginal or negative.

The intense competition from numerous domestic and specialized players means this area is a cash consumer rather than a generator, offering minimal strategic advantage and yielding low returns on investment.

Outdated manual warehousing operations within DB Schenker, while not the primary focus of their e-commerce automation drive, represent a segment that could be categorized as a 'Dog' in the BCG Matrix. These legacy facilities, if not upgraded, face increasing operational costs and diminished efficiency compared to their automated counterparts.

The financial implications are stark. For instance, manual picking and packing processes can be up to 50% slower than automated systems. This inefficiency translates directly to lower throughput and higher labor expenses, eroding profit margins in a competitive logistics landscape. By 2024, the global warehousing market is increasingly dominated by technology-driven solutions, making manual operations a significant competitive disadvantage.

Niche Domestic Rail Freight (Non-Integrated) within Schenker-Joyau SAS likely falls into the Dogs quadrant of the BCG Matrix. These operations, focusing on specific, less-trafficked domestic rail routes, often struggle with low volumes and economies of scale. In 2024, road freight continues to dominate many domestic logistics needs, exerting significant competitive pressure on less integrated rail services.

These niche rail segments may experience low market share due to their limited reach and specialized nature, contrasting with high-volume, integrated networks. The operational costs for these services can be high relative to the revenue generated, leading to lower profitability. For instance, while the overall European rail freight market saw growth, specific non-integrated routes might not capture this expansion effectively.

Legacy IT Systems Integration and Maintenance

Schenker-Joyau SAS's legacy IT systems integration and maintenance represent a classic 'Dog' in the BCG matrix. These older, often fragmented systems require substantial investment for upkeep and integration, consuming valuable resources without contributing to market growth or offering a competitive edge. In 2024, many companies are still grappling with the cost of maintaining these systems, with some estimates suggesting that IT maintenance can account for 70-80% of an organization's total IT budget, a significant drain on capital that could otherwise fund innovation.

The continued reliance on these legacy platforms can stifle efficiency and innovation, acting as a drag on the company's ability to adapt to rapidly evolving digital landscapes. For instance, a report by IBM in 2023 highlighted that modernizing core systems could lead to a 20-30% improvement in operational efficiency. Without a clear strategy to phase out or upgrade these systems, Schenker-Joyau SAS risks falling behind competitors who are leveraging more agile and advanced digital infrastructure.

- Significant Cost Burden: Maintaining legacy IT systems diverts substantial financial resources that could be invested in growth areas.

- Hindered Efficiency: Outdated systems often lead to slower processes and increased operational friction.

- Limited Innovation: Legacy infrastructure can be a barrier to adopting new technologies and developing innovative digital solutions.

- Resource Drain: Personnel and capital tied up in legacy system maintenance are unavailable for more strategic, high-return initiatives.

Basic Point-to-Point Trucking without Value-Add

Basic point-to-point trucking, often characterized by its commoditized nature, can represent a challenging segment within the Schenker-Joyau SAS portfolio, potentially falling into the 'Dog' category of the BCG Matrix. These services typically involve straightforward transportation of goods from origin to destination without specialized enhancements.

In 2024, the freight trucking industry faced persistent challenges such as rising fuel costs and driver shortages, squeezing margins for basic services. Companies offering undifferentiated point-to-point trucking often contend with intense price wars, leading to low profitability. For Schenker-Joyau SAS, if these services do not effectively integrate with or benefit from the company's wider logistical network or technological advancements, they risk low market share and diminished returns.

- Low Margins: The average operating margin for US truckload carriers in 2023 was around 5-10%, highlighting the thin profitability of basic trucking.

- Intense Competition: The market for standard freight transportation is highly fragmented, with numerous small and large players vying for contracts.

- Lack of Differentiation: Services lacking value-adds like advanced real-time visibility, specialized handling, or sustainable logistics options are particularly vulnerable to price-based competition.

- Potential for Divestment: If these segments do not show potential for improvement or integration, they may be considered for divestment to focus resources on more profitable areas.

Schenker-Joyau SAS's undifferentiated local courier services and niche domestic rail freight operations can be classified as Dogs. These segments likely suffer from low market share and low growth, consuming resources without significant returns. The competitive landscape, particularly in local courier services, is fierce, with thin profit margins as a common characteristic.

Manual warehousing operations and legacy IT systems integration also fall into the Dog category. These areas require substantial investment for upkeep and integration, draining capital that could be used for innovation or growth. In 2024, the increasing reliance on technology in logistics makes these manual and outdated systems a significant competitive disadvantage, impacting efficiency and profitability.

Basic point-to-point trucking, lacking differentiation, also fits the Dog profile. Persistent challenges like rising fuel costs and driver shortages in 2024 further squeeze margins. Without integration into wider networks or technological advancements, these services risk low market share and diminished returns, potentially leading to divestment.

| BCG Category | Schenker-Joyau SAS Segment Example | Key Characteristics | 2024 Market Context |

|---|---|---|---|

| Dogs | Undifferentiated Local Courier Services | Low market share, low growth, intense competition, thin margins | Highly competitive, price-sensitive market |

| Dogs | Niche Domestic Rail Freight (Non-Integrated) | Low volumes, low economies of scale, high operational costs relative to revenue | Road freight dominates many domestic needs, pressuring less integrated rail |

| Dogs | Manual Warehousing Operations | Inefficient, high operational costs, diminishing efficiency compared to automated systems | Global warehousing market increasingly tech-driven; manual operations a disadvantage |

| Dogs | Legacy IT Systems Integration & Maintenance | High upkeep costs, stifles innovation, hinders efficiency, resource drain | IT maintenance can be 70-80% of IT budget; modernization offers 20-30% efficiency gain |

| Dogs | Basic Point-to-Point Trucking | Commoditized, low margins, lack of differentiation, vulnerable to price wars | Rising fuel costs, driver shortages squeeze margins; average operating margin 5-10% (US Truckload 2023) |

Question Marks

Schenker-Joyau SAS, a key player within DB Schenker's extensive network, is actively investing in AI-powered predictive logistics and optimization platforms. This strategic focus aims to leverage advanced analytics for significant improvements in operational efficiency and cost reduction. The global market for AI in logistics is projected to reach $11.7 billion by 2025, highlighting the substantial growth potential in this sector.

While these AI solutions offer a competitive edge through proactive problem-solving and enhanced delivery precision, their widespread market adoption is still in its nascent stages. Consequently, Schenker-Joyau SAS currently possesses a relatively low market share in this specific niche. However, the high growth prospects are undeniable, contingent on the successful scaling and integration of these cutting-edge technologies across their operations.

Urban micro-fulfillment centers are a key growth area, driven by the demand for ultra-fast e-commerce delivery. This concept is experiencing rapid expansion, with projections indicating significant market growth in the coming years. For instance, the global micro-fulfillment market was valued at approximately $1.5 billion in 2023 and is expected to reach over $10 billion by 2028, demonstrating its high-growth potential.

While DB Schenker possesses automated hubs, the specific strategy of distributed micro-fulfillment within urban cores is still in its early stages of development. This requires substantial capital for new infrastructure and localized operational networks. Consequently, Schenker-Joyau SAS likely holds a relatively small market share in this emerging but fast-growing sector.

Blockchain technology offers a powerful solution for increasing transparency, traceability, and security within supply chains, a sector experiencing rapid growth in logistics. This innovation promises to build greater trust and operational efficiency.

DB Schenker is actively engaged in digital transformation initiatives, which could very well incorporate these advanced blockchain applications. However, the market for blockchain in supply chains is still in its early stages of adoption, meaning Schenker-Joyau SAS would likely hold a minimal market share in this emerging, yet unproven, segment.

Significant investment would be necessary for Schenker-Joyau SAS to establish a strong presence and gain meaningful traction in this innovative but developing area. For context, global spending on blockchain solutions in supply chain management was projected to reach approximately $2 billion in 2023, with continued strong growth expected, highlighting both the opportunity and the competitive landscape.

Autonomous Driving Logistics Pilots

Autonomous driving logistics pilots represent a significant potential growth area for the future of freight transportation. The development and testing of driverless trucks are rapidly advancing, signaling a transformative shift in how goods are moved.

DB Schenker is actively observing and considering involvement in these autonomous truck technology pilots. While the long-term outlook for this sector is exceptionally promising, the current market share for operational autonomous logistics remains negligible. This positions it as a 'Question Mark' within the BCG framework, demanding substantial investment in research and development with outcomes that are uncertain yet could fundamentally reshape the industry.

- Autonomous Truck Development: Companies like Waymo Via and Aurora are making strides, with Waymo aiming for commercial deployment in select freight corridors.

- Investment in R&D: Significant capital is being channeled into developing the complex sensor, AI, and mapping technologies required for safe autonomous operation.

- Market Penetration: As of early 2024, fully autonomous trucks operating commercially in logistics are virtually non-existent, highlighting the early stage of this market.

- Future Potential: Successful implementation could lead to reduced labor costs, improved fuel efficiency, and enhanced delivery reliability, offering substantial future returns.

Integrated Circular Economy Logistics Services

Integrated Circular Economy Logistics Services represent a burgeoning sector within the logistics landscape, driven by a global push towards sustainability. This includes managing the complex flow of goods for returns, repair, recycling, and remanufacturing, essentially closing the loop in product lifecycles. The market for these services is experiencing significant growth, with projections indicating a substantial expansion in the coming years as companies increasingly prioritize waste reduction and resource efficiency. For instance, the global circular economy market was valued at approximately $2.8 trillion in 2023 and is expected to reach $4.6 trillion by 2027, demonstrating its rapid ascent.

Schenker-Joyau SAS is likely positioned to capitalize on this trend by developing or enhancing its capabilities in integrated circular economy logistics. While this area offers high growth potential due to heightened corporate and regulatory attention on environmental impact, it also represents a relatively nascent market. Consequently, established market share for specialized circular economy logistics providers may currently be low, necessitating strategic investments to build capacity and secure a competitive position. Companies entering this space often face challenges in optimizing reverse logistics networks and ensuring efficient material recovery.

- Growing Demand: The increasing emphasis on ESG (Environmental, Social, and Governance) factors and stringent waste management regulations are fueling demand for circular economy logistics.

- Market Potential: The global market for circular economy logistics is projected to grow significantly, offering substantial opportunities for early movers.

- Investment Needs: Developing robust capabilities in reverse logistics, repair, and remanufacturing requires considerable strategic investment.

- Competitive Landscape: While the market is expanding, established players may have limited current market share, highlighting an opportunity for differentiation.

Autonomous driving logistics pilots represent a significant potential growth area for the future of freight transportation, with driverless trucks rapidly advancing. DB Schenker is observing and considering involvement in these pilots. While the long-term outlook is promising, current market share for operational autonomous logistics remains negligible, positioning it as a 'Question Mark' requiring substantial, uncertain R&D investment.

| Area | Market Growth Potential | Current Market Share (Schenker-Joyau SAS) | Investment Required | Key Challenge |

|---|---|---|---|---|

| Autonomous Driving Logistics | Very High | Negligible | Very High | Technology Maturity & Regulation |

| Integrated Circular Economy Logistics | High | Low | High | Reverse Logistics Optimization |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.