Db Insurance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Db Insurance Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Db Insurance's trajectory. This comprehensive PESTLE analysis offers a deep dive into the external forces that present both challenges and opportunities. Equip yourself with the knowledge to anticipate market shifts and refine your strategic approach. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The South Korean insurance sector operates under a robust regulatory framework, with the Financial Supervisory Service (FSS) actively shaping market dynamics. Recent reforms, including the implementation of the Korean Insurance Capital Standard (K-ICS) and IFRS 17, are designed to bolster financial stability and safeguard policyholders. These changes necessitate that insurers like DB Insurance adapt their capital management and reporting, potentially influencing product development and solvency ratios.

South Korea's Personal Information Protection Act (PIPA) saw significant amendments in 2024 and will continue to impact data handling in 2025, placing more stringent requirements on entities like DB Insurance. These changes mandate liability insurance for data breaches, a crucial consideration given the industry's reliance on sensitive customer information.

Furthermore, the updated PIPA expands individual rights, including those related to automated decision-making and data portability. For DB Insurance, this means ensuring transparency and fairness in how customer data is used for underwriting or claims processing, and facilitating easier data transfer for consumers.

Compliance with these evolving data protection laws is paramount for DB Insurance to mitigate potential fines, which can be substantial, and to foster customer confidence. Investing in advanced cybersecurity infrastructure and comprehensive compliance training is therefore a strategic imperative to safeguard operations and maintain a trusted brand image.

The South Korean government's proactive expansion of mandatory liability insurance, particularly for personal information leaks and virtual asset service providers, directly benefits non-life insurers like DB Insurance. This policy shift ensures a baseline demand for specific insurance products, creating a predictable and stable revenue stream within these burgeoning sectors. For instance, the mandatory coverage for virtual asset service providers, introduced in response to growing digital asset activity, solidifies a new market segment for insurers.

Government Support for Overseas Expansion

The South Korean government is actively encouraging domestic insurers, including DB Insurance, to expand their operations internationally. This support comes in the form of policy changes designed to ease regulatory burdens associated with overseas ventures. For instance, regulations have been relaxed to permit representative offices to engage in business activities and streamline the approval process for acquiring foreign subsidiaries.

DB Insurance has publicly stated its strategic intent to broaden its global footprint, directly benefiting from these government initiatives. By leveraging this supportive policy environment, the company aims to tap into new growth opportunities beyond its established domestic market.

- Government Deregulation: Easing of rules for overseas expansion and subsidiary acquisition.

- Policy Support: Active facilitation of local insurers' global market entry.

- DB Insurance Strategy: Plans to leverage policy support for international growth.

Insurance Sales Commission Reforms

South Korean regulators are implementing significant reforms to insurance sales commissions, with new guidelines set to take effect in early 2025. These changes mandate that commissions be distributed monthly over a period of three to seven years, a shift from previous practices. The primary objective is to enhance insurance policy retention rates and foster greater market stability.

DB Insurance must now strategically adjust its sales operations and agent compensation models to comply with these forthcoming regulations. This adaptation is crucial for maintaining competitive agent incentives while adhering to the new, longer-term commission payout structures. The reforms are expected to influence how insurance products are sold and how agents are remunerated, potentially impacting sales force motivation and customer engagement strategies.

- Monthly Commission Distribution: New guidelines effective early 2025 require commissions to be paid out monthly over 3-7 years.

- Policy Retention Focus: The reforms aim to improve the longevity of insurance policies by incentivizing longer-term agent commitment.

- Market Stabilization: Regulators anticipate these changes will lead to a more stable insurance market by reducing churn.

- DB Insurance Adaptation: The company needs to revise its sales commission structures and agent compensation plans to align with the new rules.

Government initiatives are shaping the insurance landscape in South Korea. The Financial Supervisory Service (FSS) continues to implement reforms like the Korean Insurance Capital Standard (K-ICS) and IFRS 17, aiming for greater financial stability and policyholder protection, which directly impacts insurers like DB Insurance. Furthermore, the government's push for mandatory liability insurance, particularly for data breaches and virtual assets, creates new revenue streams for non-life insurers.

Policy changes are also facilitating international expansion for domestic insurers, with relaxed regulations for overseas ventures. DB Insurance is positioned to benefit from this supportive environment as it pursues its global growth strategy.

New regulations effective early 2025 will alter insurance sales commissions, requiring monthly payouts over extended periods to improve policy retention and market stability. DB Insurance must adapt its compensation models accordingly.

| Policy Area | Regulatory Change | Impact on DB Insurance | Effective Date |

|---|---|---|---|

| Capital Standards | K-ICS implementation | Requires adaptation in capital management and solvency ratios | Ongoing |

| Data Protection | PIPA Amendments | Mandates liability insurance for data breaches; enhances consumer data rights | 2024/2025 |

| Mandatory Insurance | Expansion for data leaks and virtual assets | Creates new, stable revenue streams for non-life insurers | Ongoing |

| International Operations | Deregulation for overseas expansion | Facilitates easier entry into foreign markets | Ongoing |

| Sales Commissions | Monthly distribution over 3-7 years | Requires revision of sales operations and agent compensation models | Early 2025 |

What is included in the product

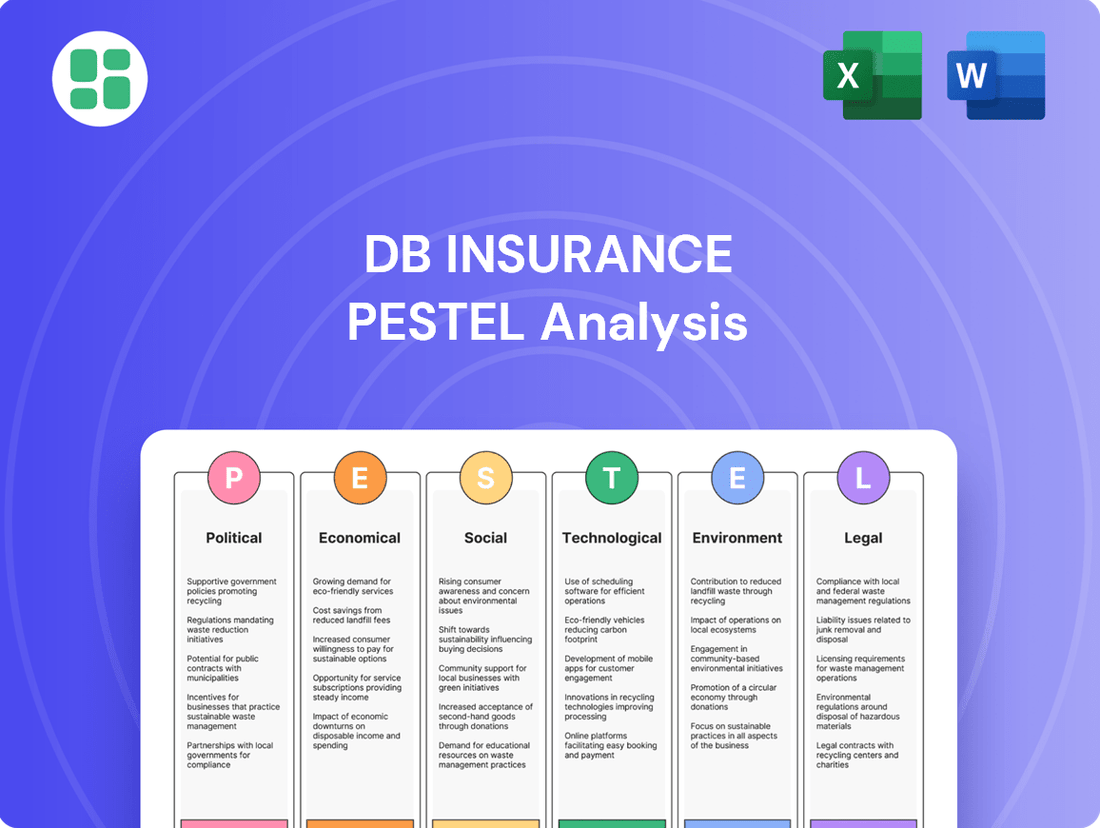

This Db Insurance PESTLE analysis examines the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends and their implications for Db Insurance's market position and future growth.

A concise PESTLE analysis for Db Insurance acts as a pain point reliever by providing a clear, summarized version of external factors for easy referencing during strategy meetings.

This analysis, by being visually segmented by PESTEL categories, allows for quick interpretation, relieving the pain of sifting through complex data during planning sessions.

Economic factors

South Korea's economic growth is anticipated to accelerate in 2024 and 2025, following a more subdued performance in 2023. This projected rebound is a positive signal for DB Insurance, as a strengthening economy typically boosts demand for its long-term and pension insurance offerings. For instance, the Bank of Korea projected a 2.1% GDP growth for 2024, an improvement from 2023's estimated 1.4%.

A more robust economic climate directly correlates with increased disposable income for households and businesses. This heightened financial capacity generally translates into greater consumer confidence and a higher propensity to invest in insurance products, including those offered by DB Insurance. The improved economic outlook therefore creates a more favorable environment for the company's premium income expansion.

Interest rate fluctuations present a complex challenge for DB Insurance in South Korea. While rising rates can enhance investment income, they simultaneously elevate funding expenses and the potential for policy surrenders, especially impacting endowment products.

Conversely, a decrease in deposit interest rates could bolster the appeal of endowment plans as viable investment alternatives for consumers. For instance, the Bank of Korea’s policy rate has seen adjustments, influencing the broader interest rate environment.

DB Insurance needs to proactively adjust its investment strategies and product designs to navigate these dynamic interest rate shifts effectively. This includes careful asset allocation and product repricing to maintain profitability and competitiveness amidst changing economic conditions.

Inflationary pressures are a significant concern for DB Insurance, particularly impacting claims costs. For instance, in the motor insurance sector, the cost of vehicle repairs and parts saw a notable increase throughout 2024. This directly affects profitability as insurers face higher payouts for each claim.

These rising costs present a considerable challenge to underwriting performance. While DB Insurance may adjust premiums to compensate, it's a delicate balance to maintain competitiveness. The ability to accurately forecast and price for inflation is crucial for sustained underwriting success.

To navigate these headwinds, DB Insurance must implement robust risk management and sophisticated pricing strategies. For example, by leveraging data analytics to predict future repair cost trends, the company can better align premiums with anticipated claims expenses, thereby mitigating the adverse effects of inflation.

Household Indebtedness and Consumer Spending

High household indebtedness, a persistent concern in many economies, directly impacts consumer spending and, consequently, the demand for insurance. When households carry significant debt burdens, their disposable income shrinks, making them more hesitant to purchase discretionary items, including various insurance policies. This trend was evident in late 2024 and early 2025, with reports indicating a rise in consumer credit outstanding, putting pressure on household budgets.

The dampening effect on discretionary insurance products is a critical consideration for DB Insurance. Products like travel insurance, certain life insurance riders, or even comprehensive home insurance may see reduced uptake as consumers prioritize essential expenses and debt repayment. This can lead to slower premium growth, especially in segments that are highly sensitive to economic downturns and consumer sentiment shifts.

DB Insurance must actively monitor these economic indicators to adapt its strategies. Understanding the precise level of household indebtedness and the prevailing consumer sentiment is crucial for tailoring product offerings and marketing campaigns to resonate with current financial realities. For instance, focusing on value-driven products or flexible payment options could be more effective in the prevailing economic climate.

- Household debt-to-income ratios remained elevated in many developed economies throughout 2024, impacting discretionary spending power.

- Consumer sentiment indices in key markets dipped in late 2024, signaling increased caution regarding non-essential purchases, including insurance.

- The insurance sector, particularly those lines tied to consumer spending like critical illness or income protection, faced headwinds due to reduced disposable income.

- DB Insurance's strategic response involves reassessing product pricing and marketing messages to align with consumer financial resilience.

Foreign Exchange Rates

Fluctuating foreign exchange rates pose a significant challenge for DB Insurance's international operations, directly impacting the value of overseas premiums, claims, and investments when translated back into Korean Won. For instance, a strengthening Won could diminish the reported value of foreign earnings, while a weakening Won could inflate them. This volatility necessitates robust hedging strategies to mitigate potential losses.

In response to global economic shifts, the South Korean government has been actively implementing measures to stabilize the financial market. This includes increased support for foreign exchange insurance initiatives designed to shield businesses from adverse currency fluctuations. These government programs aim to provide a degree of certainty for companies like DB Insurance engaged in international trade and investment.

DB Insurance's global footprint means it must closely monitor and manage its exposure to currency risk. Effective financial management and the implementation of sophisticated hedging techniques are crucial for protecting the company's profitability and the value of its international assets. The company's ability to navigate these currency headwinds will be a key determinant of its success in overseas markets.

Key considerations for DB Insurance regarding foreign exchange rates include:

- Impact on profitability: Currency fluctuations can directly affect the net profit reported from international subsidiaries and investments.

- Cost of hedging: Implementing hedging strategies incurs costs, which need to be balanced against the potential losses from unhedged currency exposure.

- Government policy effectiveness: The success of government-backed foreign exchange insurance initiatives in providing stability for businesses remains a critical factor.

- Competitive landscape: Competitors' strategies in managing currency risk can influence DB Insurance's own approach and market positioning.

South Korea's economic growth is projected to improve in 2024 and 2025, with the Bank of Korea forecasting GDP growth of 2.1% for 2024, up from an estimated 1.4% in 2023. This economic expansion is expected to boost disposable income, increasing consumer confidence and demand for insurance products like those offered by DB Insurance, thereby supporting premium income growth.

Full Version Awaits

Db Insurance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Db Insurance PESTLE Analysis offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the insurance industry.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into market trends, competitive landscapes, and strategic opportunities within the insurance sector.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a robust framework for understanding the external forces shaping Db Insurance's operations and future growth.

Sociological factors

South Korea is rapidly aging, with the proportion of citizens aged 65 and over projected to exceed 20% by 2025, officially marking it as a super-aged society. This demographic transformation is a significant driver for increased demand in long-term care, health, and pension insurance. DB Insurance is well-positioned to leverage this trend by creating specialized insurance solutions designed for the elderly, including those focusing on conditions like dementia.

South Korea is experiencing a significant surge in health consciousness, with a growing number of citizens actively seeking ways to improve their well-being. This heightened awareness, amplified by rising diagnoses of serious illnesses, is directly translating into increased demand for robust health and protection insurance solutions. For instance, the prevalence of chronic diseases like diabetes and cardiovascular conditions continues to be a concern, prompting individuals to prioritize preventative care and comprehensive coverage.

This societal shift presents a clear opportunity for DB Insurance to innovate and expand its offerings. By developing products that align with this health-centric mindset, such as those incorporating health technology wearables or incentivizing wellness programs, DB Insurance can better meet consumer needs. The company could see growth by bolstering its health and personal accident insurance lines, reflecting the market's clear preference for products that support long-term health and financial security.

Consumers are actively seeking tailored insurance solutions and seamless digital experiences, leading them to online channels for research and acquisition. This trend is evident as digital insurance sales are projected to grow significantly, with some markets expecting over 60% of new policies to be sold online by 2025.

DB Insurance needs to prioritize enhancing its digital infrastructure and customer engagement strategies to align with this demand. Investing in user-friendly online platforms and personalized digital communication will be crucial for retaining and attracting customers in this evolving landscape.

Social Attitudes Towards Risk and Insurance

Societal attitudes toward risk and the role of insurance are evolving, with a noticeable uptick in public awareness regarding its importance in financial planning. This is particularly evident in the context of emerging threats such as cyber-attacks and the increasing frequency of natural disasters. For instance, a 2024 survey indicated that over 70% of individuals now view insurance as essential for managing unexpected financial shocks.

This growing acceptance is further bolstered by regulatory landscapes that increasingly mandate certain types of liability coverage, thereby normalizing insurance as a fundamental aspect of both personal and business operations. This trend directly benefits companies like DB Insurance, which can leverage this heightened societal recognition to market its comprehensive range of insurance products, from cyber liability to property coverage.

- Growing Acceptance: Public perception of insurance as a vital financial tool is on the rise, with a significant portion of the population now considering it indispensable for managing unforeseen events.

- Awareness of New Risks: There's a marked increase in awareness concerning risks like data breaches and climate-related disasters, driving demand for specialized insurance solutions.

- Regulatory Influence: Mandated insurance requirements in various sectors are contributing to broader societal acceptance and understanding of insurance's protective role.

- DB Insurance's Opportunity: The company is well-positioned to capitalize on these evolving attitudes by highlighting the value and necessity of its diverse insurance portfolio.

Changing Employment and Income Structures

The increasing prevalence of the gig economy, with an estimated 59 million Americans participating in freelance work in 2023, directly impacts insurance needs. These workers often lack traditional employer-provided benefits, creating a demand for flexible, portable insurance solutions that DB Insurance can offer.

Evolving income structures, including a growing segment of high-earning freelancers and a widening income gap, necessitate a tiered approach to product offerings. For instance, while some may seek basic health coverage, others might be interested in more comprehensive life or disability policies, reflecting their varying financial capacities and risk appetites.

DB Insurance needs to adapt its distribution channels to reach these diverse worker segments effectively. This includes leveraging digital platforms and partnerships that cater to independent contractors, ensuring products are accessible and relevant to their non-traditional employment situations.

- Gig Economy Growth: Over 60 million Americans were projected to participate in the gig economy by the end of 2024, highlighting a significant shift away from traditional employment.

- Benefit Gaps: A substantial portion of gig workers lack access to employer-sponsored health, disability, and life insurance, creating a market opportunity for tailored products.

- Income Volatility: The fluctuating income streams common in freelance work require insurance products with flexible premium payment options and adjustable coverage levels.

- Product Innovation: Demand is rising for portable insurance policies that are not tied to a specific employer, such as short-term disability or accident insurance.

Societal attitudes toward risk are shifting, with a growing recognition of insurance's importance in financial planning, especially concerning new threats like cyber-attacks and climate events. By 2025, a significant majority of individuals are expected to view insurance as essential for managing unexpected financial shocks.

This evolving perception, coupled with regulatory mandates for certain liability coverages, normalizes insurance for both personal and business operations. DB Insurance can capitalize on this by emphasizing the necessity of its broad product range, from cyber liability to property coverage, to meet these heightened societal expectations.

The increasing adoption of digital channels for insurance research and purchase is a key trend, with projections indicating that by 2025, over 60% of new policies in some markets will be sold online. DB Insurance must therefore invest in user-friendly digital platforms and personalized engagement to cater to this consumer preference.

Technological factors

The South Korean insurance sector is rapidly embracing digital transformation, with a noticeable move towards online channels for sales, policy management, and claims. This digital shift is driven by a growing consumer preference for convenience and accessibility.

Online platforms are becoming crucial for consumers to easily compare and purchase insurance policies, a trend that significantly enhances market transparency and customer choice. For instance, by the end of 2023, over 60% of new auto insurance policies in South Korea were initiated online.

DB Insurance needs to maintain robust investment in its digital capabilities to ensure a smooth and user-friendly online experience. This commitment is vital for retaining market share and staying ahead of competitors who are also prioritizing digital innovation.

Insurtech startups are increasingly partnering with established insurers, injecting innovation across the entire insurance process. A significant aspect of this collaboration involves the application of artificial intelligence (AI) and big data analytics, which are becoming indispensable tools for improving underwriting accuracy, creating tailored insurance products, detecting fraudulent activities, and streamlining claims handling. For instance, by mid-2024, the global insurtech market was projected to reach over $10 billion, with AI and data analytics being key drivers of this growth.

DB Insurance's commitment to digital transformation and technological advancement is therefore critical. By embracing AI and big data, the company can gain a competitive edge, offering more efficient services and personalized solutions to its customers. The effective utilization of these technologies can lead to substantial operational cost reductions and enhanced customer satisfaction, as seen with industry leaders who reported up to a 15% improvement in claims processing efficiency after implementing AI-driven solutions in 2023.

As insurance operations increasingly move online, the risk of cyberattacks and data breaches is a major concern. DB Insurance, like others in the sector, faces growing threats to sensitive customer information. In 2023, the global average cost of a data breach reached $4.45 million, a significant increase that highlights the financial and reputational damage at stake.

Navigating complex data privacy regulations, such as South Korea's Personal Information Protection Act (PIPA), is crucial. The amended PIPA, effective from September 2023, imposes stricter requirements on data handling and consent, with potential penalties for non-compliance. DB Insurance must ensure its practices align with these evolving legal frameworks to protect customer data and avoid hefty fines.

To counter these risks, continuous investment in IT infrastructure and advanced data security measures is imperative. DB Insurance needs to fortify its systems against evolving cyber threats, implementing measures like multi-factor authentication and regular security audits. Maintaining customer trust hinges on demonstrating a strong commitment to data protection and cybersecurity resilience.

Telematics and Usage-Based Insurance (UBI)

Telematics and usage-based insurance (UBI) are reshaping the auto insurance landscape. By analyzing driving habits through devices or apps, insurers can offer personalized premiums. This shift means safer drivers could see lower costs, but it also presents a challenge for insurers aiming for consistent premium income growth per policy. For instance, in 2024, the UBI market continued its expansion, with projections indicating a significant portion of new auto policies will incorporate UBI features by 2025.

DB Insurance should actively pursue UBI strategies to remain competitive. This involves developing and deploying UBI programs that align with growing consumer demand for personalized insurance solutions. Such a move can enhance customer loyalty and attract new policyholders seeking value and fairness in their premiums.

- UBI Growth: The global UBI market was valued at approximately $30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2028, indicating strong market adoption.

- Customer Preference: Surveys in late 2024 revealed that over 60% of drivers are open to UBI if it means potential savings on their premiums.

- Competitive Landscape: Major insurers in 2024 and early 2025 have been investing heavily in telematics infrastructure and data analytics to refine UBI offerings.

- Data Utilization: Effective use of telematics data can reduce claims costs by identifying risky driving behaviors and promoting safer driving habits among policyholders.

Blockchain and IoT Integration

While artificial intelligence and big data have become central to Insurtech, earlier trends in South Korea also highlighted the potential of blockchain and the Internet of Things (IoT). These technologies offer significant advantages for the insurance sector, improving transparency, streamlining operations, and bolstering security. For instance, blockchain can power smart contracts for automated claims processing, and IoT devices can provide real-time data for more accurate risk assessment and personalized premiums.

DB Insurance can leverage these advancements to drive innovation and operational enhancements. The integration of blockchain could lead to more efficient and secure policy management and claims handling, reducing administrative costs and potential fraud. Furthermore, IoT devices, like telematics in vehicles or wearable health trackers, can enable dynamic pricing models and proactive risk management strategies. For example, the global IoT market is projected to reach over $1.5 trillion by 2025, indicating a substantial opportunity for insurers to tap into connected device data.

- Blockchain for Smart Contracts: Enables automated, transparent, and secure claims payouts based on pre-defined triggers, reducing disputes and processing times.

- IoT for Risk Assessment: Utilizes data from connected devices (e.g., telematics, wearables) for more accurate underwriting, personalized pricing, and proactive risk mitigation.

- Enhanced Transparency and Security: Blockchain's distributed ledger technology provides an immutable record of transactions, increasing trust and reducing the risk of data tampering.

- Operational Efficiency Gains: Automation through smart contracts and data-driven insights from IoT can significantly lower operational costs and improve customer service.

Technological advancements are fundamentally reshaping the insurance industry, with a strong emphasis on digital channels and data analytics. The increasing adoption of AI and big data is crucial for enhancing underwriting, personalizing products, and streamlining claims processing. For instance, by mid-2024, the global insurtech market was projected to exceed $10 billion, largely driven by these technologies.

Usage-based insurance (UBI), powered by telematics, is gaining traction, offering personalized premiums based on driving behavior. Surveys in late 2024 indicated over 60% of drivers are receptive to UBI for potential savings. The global UBI market was valued around $30 billion in 2023 and is expected to grow significantly.

Emerging technologies like blockchain and IoT also present opportunities for increased transparency, operational efficiency, and enhanced security in insurance operations. The global IoT market is anticipated to surpass $1.5 trillion by 2025, highlighting the potential for insurers to leverage connected device data.

Legal factors

The adoption of the Korean Insurance Capital Standard (K-ICS) and IFRS 17, effective January 1, 2023, has fundamentally reshaped South Korea's insurance landscape. These new regulations impose stricter capital requirements and solvency standards, directly influencing how companies like DB Insurance manage their financial health and report their performance. For instance, K-ICS introduces a risk-based capital framework, demanding insurers hold capital proportionate to their specific risks.

IFRS 17, in particular, brings a more consistent and principle-based approach to insurance contract accounting, enhancing transparency in profitability and financial position. This shift requires insurers to recognize insurance contracts based on current assumptions and to disclose more granular information about their liabilities. DB Insurance, like its peers, must navigate these changes to ensure compliance and adapt its business strategies, potentially leading to a greater focus on product diversification and improved asset-liability management to mitigate mismatches.

Recent amendments to the Personal Information Protection Act (PIPA), taking effect in 2024 and 2025, broaden the range of organizations needing liability insurance for personal data breaches. These changes also grant individuals new rights concerning automated decision-making and data portability, necessitating insurers like DB Insurance to clearly explain any AI-driven decisions made about policyholders.

DB Insurance must therefore adapt its data management procedures to comply with these expanded PIPA requirements, ensuring it maintains the stipulated mandatory insurance coverage for potential data breaches, a critical step in safeguarding customer information in an increasingly digital landscape.

The Virtual Asset User Protection Act, effective July 2024, requires virtual asset service providers (VASPs) to secure liability insurance or establish accident provisions, such as for hacking incidents. This legislation creates a new market for specialized insurance products.

DB Insurance, as a traditional insurer, could explore offering coverage to VASPs, aligning with this new regulatory framework. Alternatively, if DB Insurance's own financial services arm engages with digital assets, it would also be subject to these protection mandates, necessitating careful compliance and risk management.

Consumer Protection Regulations

South Korea's government is actively strengthening consumer protection in insurance, pushing for clearer practices and better risk management. Recent reforms have targeted insurance sales commissions and aimed to rectify premium payment disparities in medical expense insurance, reflecting a commitment to fairness.

Navigating these evolving consumer protection laws is vital for DB Insurance. The company's focus on customer-centric management and robust compliance frameworks are essential for adapting to these regulatory shifts and maintaining trust.

- Enhanced Transparency: Regulations often mandate clearer disclosure of policy terms and conditions, empowering consumers to make informed decisions.

- Fair Premium Practices: Recent government initiatives aim to address potential inequities in premium calculations, particularly for medical expense insurance, ensuring fairer pricing.

- Commission Reforms: Changes to insurance sales commission structures are being implemented to prevent mis-selling and align agent incentives with customer best interests.

- Data Protection: Stringent data privacy regulations, such as those under the Personal Information Protection Act (PIPA), require insurers like DB Insurance to safeguard sensitive customer information.

Foreign Direct Investment and Market Access

South Korea actively encourages foreign direct investment (FDI) in its insurance market, permitting up to 100% foreign ownership. This open policy fosters a dynamic and competitive environment, presenting both opportunities for strategic alliances and the challenge of increased competition from global insurers. For instance, in 2023, FDI inflows into South Korea's financial services sector saw a notable increase, reflecting this welcoming stance.

DB Insurance, therefore, faces a landscape where international players can readily enter and compete. This necessitates a strategic approach that capitalizes on its established domestic market position while remaining agile and responsive to the strategies and offerings of global competitors entering the South Korean insurance arena.

- 100% FDI Allowed: South Korea permits full foreign ownership in the insurance sector.

- Competitive Landscape: This policy encourages a more competitive market due to potential foreign entry.

- Strategic Implications: DB Insurance must balance domestic strengths with the need to adapt to international competition.

- FDI Trends: Inflows into South Korea's financial services sector demonstrated growth in 2023, underscoring the market's attractiveness.

New regulations like K-ICS and IFRS 17, implemented in 2023, significantly impact DB Insurance's capital requirements and financial reporting, demanding greater risk-based capital and transparent accounting for insurance contracts.

Amendments to the Personal Information Protection Act (PIPA) in 2024-2025 expand liability for data breaches and grant new consumer rights regarding AI decisions, requiring DB Insurance to enhance data protection and disclosure practices.

The Virtual Asset User Protection Act from July 2024 mandates insurance for virtual asset service providers, creating new product opportunities for DB Insurance or compliance obligations if it engages with digital assets.

South Korea's open policy allowing 100% foreign ownership in insurance, evidenced by growing FDI in the financial sector in 2023, intensifies competition, compelling DB Insurance to leverage its domestic position against global entrants.

Environmental factors

South Korea faces a significant vulnerability to natural disasters, and the escalating frequency and intensity of climate-related events are directly impacting non-life insurers like DB Insurance. These events, ranging from typhoons to floods, are driving an increase in claims, particularly for fire and natural hazard insurance policies. This trend underscores the critical need for DB Insurance to meticulously assess and accurately price these evolving climate-related risks within its underwriting processes to maintain solvency and profitability.

The impact of climate change is evident in the rising number of incidents. In 2024 alone, over 30,000 fire accidents were reported across South Korea. This surge in occurrences not only highlights the growing exposure to property damage but also directly translates into a heightened demand for comprehensive insurance coverage, presenting both a challenge and an opportunity for insurers like DB Insurance to adapt their product offerings and risk management strategies.

South Korea is actively building out its ESG disclosure framework, with the Korea Sustainability Standards Board (KSSB) releasing draft standards in 2024. While implementation timelines are still being finalized, with a general expectation of post-2026, the direction is clear: increased transparency regarding environmental impact and climate risks is a priority.

DB Insurance is proactively aligning with this evolving regulatory landscape, emphasizing its commitment to ESG management. The company aims to be a global insurance financial group built on sustainability, integrating principles from international frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and the UNEP FI Principles for Sustainable Insurance.

The global shift towards sustainable investing is accelerating, with a significant portion of institutional investors now prioritizing Environmental, Social, and Governance (ESG) criteria. This trend is reshaping how companies, including insurers like DB Insurance, approach their investment portfolios, integrating ESG factors to meet evolving market demands and manage long-term risks.

South Korea is actively fostering green finance through initiatives such as the K-Taxonomy, which defines environmentally sustainable economic activities, and regulations designed to bolster the green bond market. These governmental efforts create a supportive environment for insurers to channel capital into environmentally beneficial projects.

DB Insurance's strategic focus on 'Green Finance' and sustainable investment directly addresses these powerful market currents and regulatory directives. By aligning its investment strategies with sustainability principles, the company is positioning itself favorably within a rapidly growing segment of the financial landscape, reflecting a proactive response to both investor expectations and governmental policy.

Carbon Neutrality Goals and Emissions Reduction

DB Insurance, like many global entities, faces increasing pressure to align with carbon neutrality targets and actively reduce its greenhouse gas emissions. This commitment is crucial not only for regulatory compliance but also for meeting stakeholder expectations regarding environmental stewardship.

The company's operational footprint, from office energy consumption to business travel, is subject to scrutiny, alongside the environmental impact of its investment portfolios. DB Insurance's proactive approach is evident in its environmental management system and dedicated climate action initiatives, showcasing a tangible effort to contribute to broader emission reduction goals.

In 2024, the insurance sector, including companies like DB Insurance, is seeing a heightened focus on Scope 3 emissions, which encompass indirect emissions across the value chain. For instance, by 2025, many financial institutions are expected to report on emissions associated with their investment portfolios, a trend DB Insurance is likely navigating.

- Operational Footprint: DB Insurance is implementing measures to reduce energy consumption in its facilities and promote sustainable business travel, contributing to a lower direct carbon impact.

- Investment Portfolio Scrutiny: The company is increasingly evaluating the carbon intensity of its investment holdings, aiming to align its financial strategies with climate-friendly objectives.

- Climate Action Initiatives: DB Insurance actively engages in climate-related projects and partnerships, demonstrating a commitment to tangible emission reduction efforts and broader environmental sustainability.

Public Awareness and Stakeholder Pressure for Sustainability

Public awareness of environmental issues is surging, leading to significant pressure on companies like DB Insurance from investors and customers to embrace sustainable practices. This trend directly impacts consumer purchasing decisions and bolsters investor confidence in businesses demonstrating strong environmental, social, and governance (ESG) commitments.

DB Insurance's proactive stance on ESG management and its transparent sustainability reporting are vital for safeguarding its reputation and attracting a growing segment of socially conscious investors and customers. For instance, in 2023, global ESG investments were projected to reach over $3.7 trillion, highlighting the financial significance of these commitments.

- Growing Public Scrutiny: Consumers are increasingly scrutinizing companies’ environmental footprints, with surveys indicating a majority are willing to pay more for sustainable products.

- Investor Demand: Institutional investors are channeling more capital towards ESG-compliant companies, viewing sustainability as a key indicator of long-term resilience and profitability.

- Regulatory Tailwinds: Emerging regulations globally are mandating greater transparency in corporate sustainability practices, further incentivizing companies to adopt and report on their ESG efforts.

- Reputational Capital: A strong ESG profile enhances brand image and customer loyalty, which are critical assets in the competitive insurance market.

South Korea's vulnerability to climate change, evidenced by over 30,000 fire accidents reported in 2024, directly impacts insurers like DB Insurance by increasing claims. The nation's push for ESG disclosure, with draft standards released in 2024 by the KSSB, signals a growing demand for transparency in environmental impact. DB Insurance's alignment with global frameworks like TCFD and UNEP FI Principles for Sustainable Insurance, alongside its focus on Green Finance, positions it to meet evolving investor and regulatory expectations.

PESTLE Analysis Data Sources

Our PESTLE Analysis for the DB Insurance sector is meticulously constructed using data from reputable sources including the International Monetary Fund (IMF), World Bank, and national regulatory bodies. We incorporate insights from leading market research firms and industry-specific publications to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.