Db Insurance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Db Insurance Bundle

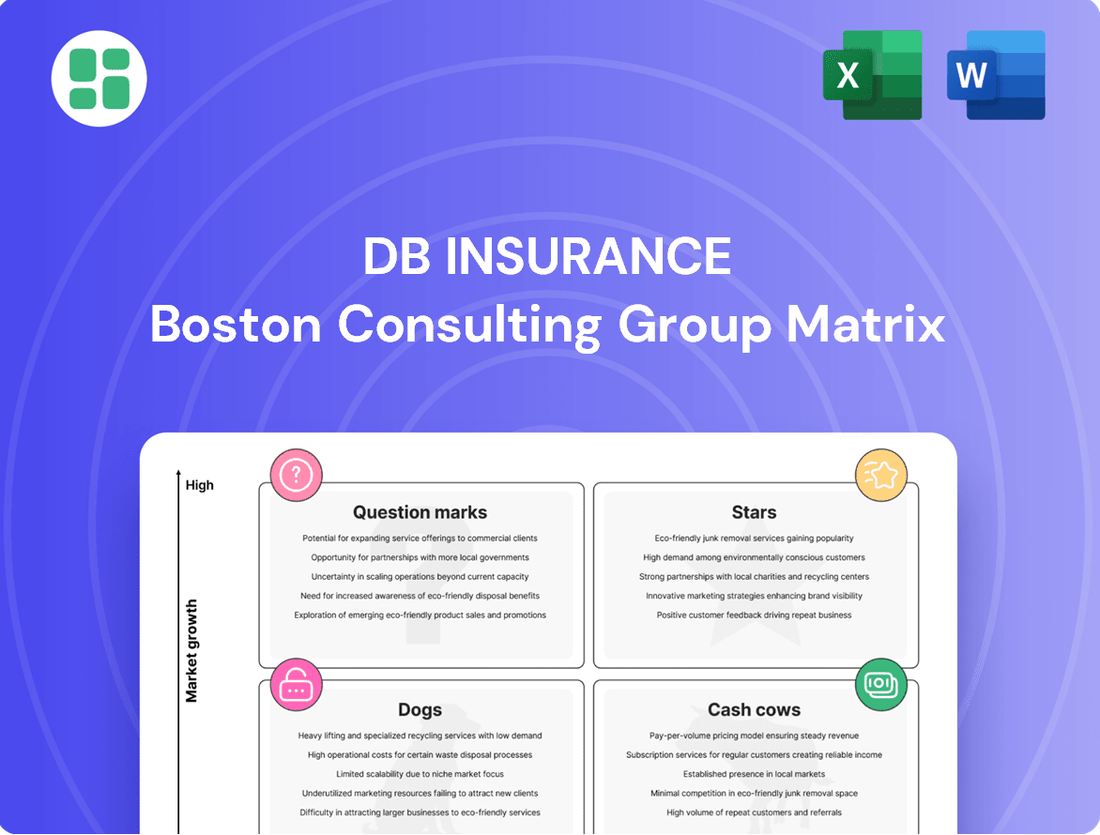

Uncover the strategic positioning of Db Insurance's product portfolio with our insightful BCG Matrix preview. See where your investments are thriving as Stars, generating consistent returns as Cash Cows, or potentially draining resources as Dogs. Don't miss the opportunity to identify promising Question Marks that could become future market leaders.

Ready to transform this strategic overview into actionable plans? Purchase the full Db Insurance BCG Matrix report to gain a comprehensive breakdown of each product's quadrant placement, coupled with data-driven recommendations for optimized resource allocation and future growth. Elevate your decision-making with the complete strategic roadmap.

Stars

DB Insurance's strategic overseas acquisitions, including advanced discussions for US specialty insurer Fortegra and existing stakes in Vietnamese firms like BSH and VNI, highlight these ventures as stars within its BCG matrix. These actions demonstrate a clear intent to capture greater market share in rapidly expanding international specialty insurance segments.

The company's overseas profits saw a remarkable 135% surge in the first half of 2024. This substantial growth validates the high potential of these international niches and DB Insurance's growing influence within them.

DB Insurance's commitment to digital innovation, evident in its investments in AI and Robotic Process Automation (RPA), positions it to capitalize on the burgeoning insurtech market. These technologies are key to developing advanced, customer-centric insurance solutions. For instance, by 2024, the global insurtech market was projected to reach over $100 billion, highlighting the immense growth potential.

Protection-type long-term health insurance products are likely Stars within DB Insurance's BCG Matrix. South Korean insurers, including DB Insurance, are focusing on these high-margin offerings, especially health insurance, driven by the aging population and regulatory shifts like IFRS 17 and K-ICS.

DB Insurance's success in launching and capturing substantial market share in new, profitable long-term health products, particularly those addressing senior care or specific health requirements, positions them as Stars. The long-term insurance segment already constitutes the dominant portion of their revenue, providing a robust foundation for further growth in these high-potential areas.

Usage-Based Insurance (UBI) for Auto

Usage-Based Insurance (UBI) for Auto is positioned as a Star for DB Insurance. While the broader auto insurance market is experiencing modest growth, UBI represents a high-potential segment. DB Insurance's innovative UBI products, which utilize telematics and big data, are likely attracting a significant portion of tech-forward drivers.

The rapid adoption of these UBI policies stems from their appeal to drivers who value fairness and personalized premiums based on their actual driving behavior. This focus on data-driven personalization sets DB Insurance apart from competitors offering more traditional, static insurance models.

- Market Share: UBI adoption is growing, with some estimates suggesting it could capture 10-20% of the auto insurance market by 2025 in developed regions.

- Customer Perception: Surveys indicate that a majority of drivers are open to UBI if it leads to lower premiums, with over 60% expressing interest in policies that reward safe driving.

- Technological Integration: The success of UBI relies on advanced telematics, with smartphone-based solutions increasingly common, offering a lower barrier to entry for consumers.

- Growth Potential: UBI segments are outperforming the general auto insurance market, with growth rates often exceeding 15% annually in key markets.

Specialized Commercial Insurance for Emerging Risks

Specialized commercial insurance for emerging risks represents a significant opportunity within the Property & Casualty (P&C) insurance sector, which is projected for consistent growth, especially in niche markets. If DB Insurance has successfully launched and marketed tailored commercial policies addressing novel threats such as cyber-attacks or the burgeoning new energy sector, these offerings would likely be categorized as Stars in the BCG Matrix. This strategic positioning stems from high market demand coupled with a strong, established market share in these evolving business landscapes.

DB Insurance's capacity to swiftly adapt to shifting market needs and deliver robust protection for businesses navigating complex and evolving operational environments is paramount. For instance, the global cyber insurance market alone was valued at approximately $10.5 billion in 2023 and is expected to reach $35.2 billion by 2028, demonstrating substantial growth and demand for specialized coverage.

- High Demand: Emerging risks like cyber threats and renewable energy liabilities create a strong, growing customer base for specialized insurance.

- Leading Position: DB Insurance's success in these areas, evidenced by market share and product adoption, signifies a competitive advantage.

- Adaptability: The ability to craft and update policies for new and evolving risks is crucial for maintaining a Star status.

- Growth Potential: Continued innovation in specialized coverage will drive further market penetration and revenue growth for DB Insurance.

DB Insurance's strategic focus on international markets, particularly in specialty insurance, positions these ventures as Stars. Their successful overseas acquisitions and existing stakes in firms like BSH and VNI demonstrate a clear intent to capture significant market share in expanding global niches. The company's overseas profits surged by an impressive 135% in the first half of 2024, underscoring the high potential and growing influence of these international endeavors.

Protection-type long-term health insurance products are also considered Stars. DB Insurance's emphasis on these high-margin offerings, driven by an aging population and new regulatory frameworks like IFRS 17 and K-ICS, is a key growth area. The company has successfully launched and gained substantial market share in these products, particularly those catering to senior care or specific health needs, building on a strong foundation in the long-term insurance segment.

Usage-Based Insurance (UBI) for Auto is another Star. While the overall auto insurance market sees modest growth, UBI, leveraging telematics and big data, is attracting tech-savvy drivers. This data-driven personalization offers a competitive edge over traditional models, with UBI segments often showing annual growth rates exceeding 15% in key markets.

Specialized commercial insurance for emerging risks, such as cyber-attacks or the new energy sector, represents a Star opportunity. The global cyber insurance market, projected to grow from approximately $10.5 billion in 2023 to $35.2 billion by 2028, highlights the substantial demand for tailored coverage. DB Insurance's ability to adapt and provide robust protection for businesses facing these evolving threats is crucial for maintaining a leading position.

| Strategic Area | BCG Classification | Key Growth Drivers | 2024 Performance Indicator | Market Potential |

|---|---|---|---|---|

| International Specialty Insurance | Star | Strategic acquisitions, market share expansion | 135% surge in overseas profits (H1 2024) | High, driven by global niche expansion |

| Long-Term Health Insurance | Star | Aging population, IFRS 17/K-ICS compliance, high-margin products | Dominant portion of revenue, strong market share in new products | Significant, driven by demographic trends |

| Usage-Based Insurance (UBI) - Auto | Star | Telematics adoption, data-driven personalization, driver demand for fair premiums | Outperforming general auto market, >15% annual growth in key markets | High, with potential 10-20% market share by 2025 in developed regions |

| Specialized Commercial Insurance (Emerging Risks) | Star | Demand for cyber and new energy sector coverage, adaptability to evolving risks | Strong adoption in niche markets | High, e.g., cyber insurance market projected to reach $35.2 billion by 2028 |

What is included in the product

The Db Insurance BCG Matrix categorizes business units by market growth and share, offering strategic guidance.

Provides a clear, visual roadmap for resource allocation, easing the pain of strategic uncertainty.

Cash Cows

Despite a projected modest 0.5% growth for the South Korean motor insurance market in 2025, DB Insurance's strong brand and deep market penetration in traditional domestic auto insurance position it as a Cash Cow. This segment consistently delivers substantial premium income and predictable underwriting profits, requiring minimal marketing investment.

This mature product line is a cornerstone of DB Insurance's financial strength, contributing significantly to overall revenue and providing a stable foundation for the company's operations. Its reliability as a cash generator allows for strategic deployment of capital into other business areas.

Conventional long-term personal insurance products represent DB Insurance's core business and a significant contributor to its financial strength. This segment, encompassing offerings like life insurance and fundamental health plans, generates the vast majority of the company's revenue. In 2023, DB Insurance reported total revenue of approximately 10.5 trillion Korean Won, with a substantial portion stemming from these established product lines.

These mature products benefit from high market penetration and a loyal customer base within South Korea. While growth in this segment may be moderate, the consistent and predictable cash flow generated requires minimal additional investment for market expansion. This stability allows DB Insurance to fund other strategic initiatives and investments.

DB Insurance's established domestic fire and property insurance segment functions as a classic Cash Cow. Despite moderate growth in the overall P&C market, these offerings hold a substantial market share in South Korea due to strong brand recognition and established distribution channels.

This maturity translates into consistent profitability, with these products being significant contributors to DB Insurance's cash flow. For instance, in 2023, the non-life insurance sector in South Korea, which heavily includes fire and property, saw a net profit of approximately 8.6 trillion KRW, highlighting the segment's robust earning potential.

Standard Casualty Insurance Products

Standard casualty insurance products, encompassing general liability and personal accident coverage, are DB Insurance's established cash cows. This segment operates within a mature, low-growth market, yet DB Insurance commands a significant market share due to the essential nature and widespread adoption of these policies, often bolstered by mandatory coverage requirements.

These offerings consistently generate substantial and predictable cash flow with relatively low investment in marketing or product development. For instance, in 2024, the general liability insurance sector in many developed markets saw stable premium growth, typically in the low single digits, demonstrating the consistent revenue stream from these core products.

- Stable Premium Generation: The inherent demand for liability protection ensures a reliable inflow of premiums.

- Mature Market Dominance: DB Insurance's strong position in this established segment translates to consistent market share.

- Low Investment Needs: Reduced need for extensive marketing or innovation allows for efficient cash generation.

- Essential Coverage: Products like personal accident insurance are widely accepted, contributing to steady demand.

Existing Corporate Group Insurance Plans

Existing corporate group insurance plans represent a significant Cash Cow for DB Insurance. These established offerings, providing essential employee benefits and risk coverage, foster long-term partnerships with businesses, especially larger corporations.

These relationships translate into a stable and predictable revenue stream. The market for these corporate solutions is mature, characterized by consistent renewals, underscoring the reliability of these contracts as a foundational income source for DB Insurance.

- Stable Revenue: Corporate group insurance plans provide predictable income through recurring premiums and renewals.

- Mature Market: The market for these established solutions is stable, with consistent demand from businesses.

- Customer Loyalty: Long-standing relationships with corporate clients foster loyalty and reduce churn.

- Low Growth, High Share: While growth might be moderate, the high market share in this segment solidifies its Cash Cow status.

DB Insurance's core domestic auto insurance business is a prime example of a Cash Cow. Despite a projected modest 0.5% growth for the South Korean motor insurance market in 2025, DB Insurance's deep market penetration and strong brand loyalty ensure consistent premium income and predictable underwriting profits. This segment requires minimal additional investment, allowing DB Insurance to leverage its stable cash flow for other strategic ventures.

Conventional long-term personal insurance products, including life and fundamental health plans, form the backbone of DB Insurance's revenue. In 2023, these established lines contributed significantly to the company's total revenue of approximately 10.5 trillion Korean Won, benefiting from high market penetration and a loyal customer base within South Korea. The stability of these offerings allows for capital deployment into growth areas.

The established domestic fire and property insurance segment also operates as a classic Cash Cow. Even with moderate growth in the overall P&C market, DB Insurance maintains a substantial market share due to its strong brand recognition and established distribution networks. This maturity translates into consistent profitability, with the non-life insurance sector, including fire and property, showing robust earning potential, as evidenced by the approximately 8.6 trillion KRW net profit in South Korea for 2023.

Standard casualty insurance, such as general liability and personal accident coverage, are also key Cash Cows for DB Insurance. Operating in a mature, low-growth market, DB Insurance benefits from the essential nature and widespread adoption of these policies, often supported by mandatory coverage. These products consistently generate substantial and predictable cash flow, with stable premium growth in the low single digits observed in developed markets for general liability in 2024.

| Business Segment | Market Growth Projection (2025) | DB Insurance's Market Position | Cash Flow Generation | Investment Needs |

| Domestic Auto Insurance | 0.5% | High Market Penetration, Strong Brand | Stable and Predictable | Low |

| Conventional Personal Insurance (Life/Health) | Moderate | High Market Penetration, Loyal Customer Base | Significant and Consistent | Low |

| Domestic Fire & Property Insurance | Moderate | Substantial Market Share, Strong Brand Recognition | Consistent Profitability | Low |

| Standard Casualty Insurance (Liability/Accident) | Low to Moderate | Significant Market Share, Essential Coverage | Substantial and Predictable | Low |

What You See Is What You Get

Db Insurance BCG Matrix

The Db Insurance BCG Matrix preview you see is the identical, fully-formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report ready for your strategic planning. You are viewing the exact file that will be delivered to you, ensuring complete transparency and immediate usability for your business decisions.

Dogs

Certain niche marine insurance lines, while historically important, might be experiencing reduced demand or facing fierce, unprofitable competition. If DB Insurance has a small presence in these slow-growing marine markets, these could be classified as Dogs in the BCG matrix.

These segments might be consuming capital without offering substantial growth or profit. For instance, the global marine insurance market, while significant, sees intense competition in specialized areas like war risk or certain offshore energy covers. In 2023, the marine insurance sector overall saw premium growth, but profitability in some sub-sectors remained challenged due to high claims and competitive pricing pressures, potentially impacting companies with lower market shares in these specific niches.

Legacy Financial Advisory Services within DB Insurance's BCG Matrix could be classified as Dogs. These services, if they haven't adapted to modern market needs or digital advancements, likely possess a low market share. This is often due to outdated methodologies or strong competition from agile fintech companies.

Such legacy offerings may generate minimal profits while demanding significant resources for upkeep, potentially acting as a drain on the company's overall financial performance. For instance, if these advisory services represent less than 1% of DB Insurance's total revenue in 2024, and their operational costs exceed their generated income, they would fit the Dog classification.

In today's crowded market, generic small business insurance packages that don't offer anything special or easy digital access can become a problem for DB Insurance. If these offerings haven't managed to grab a good chunk of the market, they're likely to face difficulties.

These types of packages often struggle to bring in new customers and keep the ones they have because they're seen as ordinary, with nothing to make them stand out. This lack of distinction can lead to them being commoditized, meaning they're just another option among many, without a clear advantage.

Consequently, these non-differentiated packages might show low growth and hold a small market share. They could end up using up valuable resources for DB Insurance without generating substantial returns, making them a less than ideal investment in the company's portfolio.

Traditional, Non-Digitalized Claims Processing Units

Traditional, non-digitalized claims processing units, while not a product, can be viewed as a 'problem child' or even a 'dog' within Db Insurance's BCG Matrix. These units are characterized by their heavy reliance on manual operations, consuming substantial operational cash and human resources. In 2023, the average cost per claim processed manually in the insurance industry was estimated to be 20-30% higher than digitally processed claims, highlighting the inefficiency.

These areas represent a low-growth, low-efficiency segment. Without significant transformation, they can drain profitability and negatively impact customer satisfaction due to slower processing times and potential for errors. For instance, a significant portion of legacy insurance systems still operate with paper-based workflows, leading to delays that can alienate policyholders.

- High Operational Costs: Manual claims processing incurs higher labor and administrative expenses compared to automated systems.

- Low Efficiency and Speed: Manual tasks lead to longer turnaround times for claims resolution, impacting customer experience.

- Limited Scalability: Non-digitalized units struggle to handle increasing claim volumes efficiently, hindering business growth.

- Risk of Errors: Manual data entry and handling increase the likelihood of mistakes, leading to financial discrepancies and compliance issues.

Underperforming Regional Branches in Stagnant Markets

DB Insurance's extensive network includes regional branches that may be classified as Dogs within the BCG Matrix. These are typically located in areas experiencing economic stagnation, characterized by declining populations and a low local market share. For instance, a branch in a rural county with a shrinking workforce and an aging demographic might fall into this category.

These underperforming branches often face significant challenges in acquiring new customers and retaining existing ones. This difficulty directly impacts their profitability, as operational costs remain high relative to the revenue they generate. In 2024, reports indicated that some regional banks saw their operating expenses increase by up to 5% year-over-year, even as their net interest margins compressed, highlighting the cost pressures on less productive units.

- Low Market Share: Branches in stagnant markets often have a market share below 10%, struggling against more established competitors or simply due to a lack of demand.

- Declining Revenue: In 2023, several regional insurance providers reported a 2-4% year-on-year decline in premium volume from their less populated territories.

- High Cost-to-Income Ratio: These branches can exhibit cost-to-income ratios exceeding 70%, significantly higher than the company average.

- Limited Growth Potential: With limited economic activity and population growth, the prospects for substantial revenue increases are minimal.

Certain niche marine insurance lines, while historically important, might be experiencing reduced demand or facing fierce, unprofitable competition. If DB Insurance has a small presence in these slow-growing marine markets, these could be classified as Dogs in the BCG matrix. These segments might be consuming capital without offering substantial growth or profit. For instance, the global marine insurance market, while significant, sees intense competition in specialized areas like war risk or certain offshore energy covers. In 2023, the marine insurance sector overall saw premium growth, but profitability in some sub-sectors remained challenged due to high claims and competitive pricing pressures, potentially impacting companies with lower market shares in these specific niches.

Legacy Financial Advisory Services within DB Insurance's BCG Matrix could be classified as Dogs. These services, if they haven't adapted to modern market needs or digital advancements, likely possess a low market share. This is often due to outdated methodologies or strong competition from agile fintech companies. Such legacy offerings may generate minimal profits while demanding significant resources for upkeep, potentially acting as a drain on the company's overall financial performance. For instance, if these advisory services represent less than 1% of DB Insurance's total revenue in 2024, and their operational costs exceed their generated income, they would fit the Dog classification.

Traditional, non-digitalized claims processing units, while not a product, can be viewed as a 'problem child' or even a 'dog' within Db Insurance's BCG Matrix. These units are characterized by their heavy reliance on manual operations, consuming substantial operational cash and human resources. In 2023, the average cost per claim processed manually in the insurance industry was estimated to be 20-30% higher than digitally processed claims, highlighting the inefficiency. Without significant transformation, they can drain profitability and negatively impact customer satisfaction due to slower processing times and potential for errors. For instance, a significant portion of legacy insurance systems still operate with paper-based workflows, leading to delays that can alienate policyholders.

DB Insurance's extensive network includes regional branches that may be classified as Dogs within the BCG Matrix. These are typically located in areas experiencing economic stagnation, characterized by declining populations and a low local market share. For instance, a branch in a rural county with a shrinking workforce and an aging demographic might fall into this category. These underperforming branches often face significant challenges in acquiring new customers and retaining existing ones. This difficulty directly impacts their profitability, as operational costs remain high relative to the revenue they generate. In 2024, reports indicated that some regional banks saw their operating expenses increase by up to 5% year-over-year, even as their net interest margins compressed, highlighting the cost pressures on less productive units.

| Category | Characteristics | Example for DB Insurance | Potential Issues | 2023/2024 Data Insight |

| Dogs | Low Market Share, Low Growth | Niche marine insurance lines with declining demand | Consume capital, low profitability | Challenged profitability in some marine sub-sectors due to high claims and pricing pressures. |

| Dogs | Low Market Share, Low Growth | Legacy Financial Advisory Services | High upkeep costs, minimal profits | Services representing <1% of 2024 revenue with costs exceeding income. |

| Dogs | Low Market Share, Low Growth | Non-digitalized claims processing | High operational costs, slow processing | Manual claims processing 20-30% more expensive than digital in 2023. |

| Dogs | Low Market Share, Low Growth | Underperforming regional branches | Declining revenue, high cost-to-income ratio | Some regional providers saw operating expenses rise 5% YoY in 2024 with compressed margins. |

Question Marks

Emerging ESG-linked insurance products are a prime example of a question mark in the DB Insurance BCG Matrix. While the global ESG market is booming, with sustainable investment assets projected to reach $50 trillion by 2025, these specific insurance products are still in their early stages. This means they have high potential for growth, but currently hold a small market share.

Developing and marketing these innovative products requires significant investment to educate customers about their benefits and build market awareness. For instance, the global green insurance market, a subset of ESG-linked products, is expected to grow substantially, but specific data for new ESG-linked insurance offerings is still emerging. Despite the uncertainty, the strong global push towards sustainability suggests a promising future.

The cyber insurance market is booming, projected to reach $20 billion by 2025, driven by escalating digital threats. For DB Insurance, advanced cyber insurance for SMEs is a star in the BCG matrix, a high-growth area with significant potential.

However, if DB Insurance's current penetration in this sophisticated SME cyber insurance segment is limited, these offerings are question marks. They demand substantial investment in specialized underwriting talent, advanced risk assessment tools, and targeted marketing to stand out and gain traction in this dynamic, yet often complex, market.

New international market entries for DB Insurance, beyond existing acquisitions, would likely be classified as question marks in the BCG Matrix. These are markets with high growth potential but currently low market share for DB Insurance, requiring significant investment.

For instance, entering a rapidly developing Asian market with a burgeoning middle class, like Vietnam, presents a high-growth opportunity. However, DB Insurance's current presence there is minimal. Initial investments in 2024 for market research, understanding local regulations, and establishing brand awareness could easily run into tens of millions of dollars, with returns uncertain in the short term.

Personalized AI-Driven Risk Prevention Services

DB Insurance can leverage AI and big data to create personalized risk prevention services, moving beyond just paying claims. Think of proactive health monitoring or smart home safety features integrated with policies. This taps into a growing market for added value, but success hinges on consumer adoption and proving profitability. Significant investment is needed to build and scale these offerings effectively.

- AI-Powered Health Monitoring: Personalized wellness plans and early detection of health issues, potentially reducing claims related to chronic diseases.

- Smart Home Integration: Linking smart home devices to insurance policies for enhanced security and hazard detection, such as water leak sensors or fire alarms.

- Predictive Analytics for Risk Mitigation: Using data to forecast and prevent potential risks before they occur, offering tailored advice to policyholders.

- Market Uncertainty and Investment Needs: While promising, these services require substantial upfront investment in technology and data infrastructure, with market acceptance still developing. For example, the global AI in insurance market was valued at approximately USD 1.5 billion in 2023 and is projected to grow significantly, but adoption of these specific preventative services is still in its early stages.

Specialized Insurance for Autonomous Vehicles/Future Mobility

Specialized insurance for autonomous vehicles (AVs) and future mobility solutions represents a significant growth opportunity for DB Insurance. As this market is still developing, offerings in this space are considered question marks. Significant investment in research and development, alongside partnerships with automotive manufacturers, will be crucial for DB Insurance to capture market share before AV adoption becomes widespread.

The transition to autonomous driving necessitates a fundamental rethinking of insurance models. Traditional liability frameworks, focused on human error, will need to adapt to address potential system failures or cyber-attacks. For instance, by 2030, it's projected that over 75% of vehicles sold in developed markets could have some level of automation, highlighting the urgency for specialized coverage.

- High Growth Potential: The autonomous vehicle insurance market is expected to grow substantially, with some estimates suggesting it could reach tens of billions of dollars globally by the end of the decade.

- Nascent Market: Current market share for specialized AV insurance is low, indicating an early stage of development and a prime opportunity for market entry.

- R&D Intensive: Developing accurate risk assessment models and underwriting processes for AVs requires significant investment in technology and data analytics.

- Strategic Partnerships: Collaboration with AV developers and manufacturers is essential to gain insights into vehicle technology and safety features, facilitating the creation of tailored insurance products.

Question marks in the DB Insurance BCG Matrix represent business units with low market share in high-growth industries. These require careful consideration and strategic investment to determine if they can become stars or if they should be divested.

Emerging ESG-linked insurance products and specialized autonomous vehicle (AV) insurance are prime examples. While the potential for growth is substantial, their current market penetration is minimal, necessitating significant capital for development, R&D, and market education.

New international market entries, like Vietnam, and advanced cyber insurance for SMEs also fall into this category. They offer high potential rewards but carry inherent risks due to market immaturity and the need for substantial upfront investment in 2024, with uncertain short-term returns.

AI-powered preventative services are another key question mark. The global AI in insurance market was valued around USD 1.5 billion in 2023, but adoption of these specific proactive services is still developing, requiring significant investment in technology and data infrastructure.

| Business Unit | Market Growth | Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| ESG-linked Insurance | High | Low | Question Mark | Invest for growth, monitor adoption |

| AV Insurance | High | Low | Question Mark | Significant R&D and partnerships needed |

| New International Markets (e.g., Vietnam) | High | Low | Question Mark | High investment, market research critical |

| Advanced SME Cyber Insurance | High | Low (if penetration is limited) | Question Mark | Requires specialized talent and tools |

| AI-Powered Preventative Services | High | Low | Question Mark | Focus on consumer adoption and proving profitability |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.