Db Insurance Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Db Insurance Bundle

Db Insurance faces intense competition, with significant threats from new entrants and the bargaining power of buyers. Understanding these forces is crucial for navigating the dynamic insurance landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Db Insurance’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of reinsurers, particularly international ones, is a significant factor for companies like DB Insurance. South Korean non-life insurers are increasingly turning to overseas reinsurers to effectively manage their risk exposure. This reliance gives reinsurers a moderate to high degree of leverage in setting terms and pricing.

The domestic reinsurance market in South Korea has seen a shift, with the sole domestic reinsurer, Korean Re, experiencing a decline in its market share. This indicates a growing dependence on global reinsurance capacity, which strengthens the position of international reinsurers. These global players often possess superior solvency ratios and more diversified investment portfolios, allowing them to negotiate from a position of strength.

For instance, in 2023, the global reinsurance market continued to see hardening rates, reflecting increased demand for coverage and a more cautious approach from reinsurers following a period of significant catastrophe losses. This environment generally favors reinsurers, enabling them to dictate terms more effectively to primary insurers like DB Insurance.

The bargaining power of technology and data providers is on the rise for insurers like DB Insurance. As the industry pushes into digital transformation, companies specializing in IT, AI, and big data analytics are becoming crucial partners. Insurers are pouring money into these areas to improve customer service and streamline operations, making these tech suppliers indispensable.

This trend is further amplified by the growing partnerships with InsurTech startups. These collaborations, focused on areas like claims processing and digital customer interfaces, highlight the significant influence technology providers now wield. For instance, the global InsurTech market was valued at approximately $10.4 billion in 2023 and is projected to grow substantially, indicating the increasing reliance and leverage of these specialized firms.

For DB Insurance, the bargaining power of healthcare and automotive service networks is a key consideration. These networks, including hospitals, clinics, and auto repair shops, act as crucial suppliers for the company's non-life insurance offerings. Their influence is shaped by how concentrated these networks are and the sheer volume of business they handle with insurers.

The indispensability of these service providers grants them a degree of inherent power. In 2024, the healthcare sector, for instance, continued to see consolidation, with larger hospital groups potentially wielding more influence over pricing and service agreements with insurers. Similarly, the automotive repair industry, while fragmented, can see increased supplier power in regions with fewer certified repair facilities, impacting claims costs for DB Insurance.

Brokerage General Agents (GAs)

Brokerage General Agents (GAs) represent a significant distribution channel for insurance companies, and their bargaining power is often considerable. Skilled GAs are crucial for an insurer's revenue and market penetration, especially as companies focus on expanding their GA networks. This reliance gives GAs, particularly those with established client bases and specialized knowledge, leverage in negotiations.

Their capacity to steer consumer decisions and direct business flow directly influences an insurer's sales outcomes. For instance, in 2024, the demand for specialized insurance products continued to rise, increasing the value of GAs who could effectively market these offerings. A report from a leading industry analysis firm indicated that insurers with strong GA partnerships saw an average of 15% higher sales growth compared to those with weaker networks.

- Skilled GAs are essential for insurers to reach customers and generate revenue.

- Insurers' efforts to build robust GA networks in 2024 highlight the agents' growing influence.

- GAs with strong client relationships and expertise can command better terms due to their ability to drive sales.

- The ability of GAs to influence customer choices directly impacts insurer performance.

Capital Providers

The bargaining power of capital providers, such as banks and investors, is significantly shaped by regulatory shifts like the Korean Insurance Capital Standard (K-ICS). These new capital requirements directly impact how much capital insurers need and how readily it is available.

While South Korea has adjusted capital adequacy ratios to ease financial burdens on insurers, the cost and availability of capital remain critical considerations. This is particularly true for companies pursuing expansion or needing to bolster their solvency management, influencing the leverage insurers have when negotiating with financial institutions.

- Regulatory Impact: K-ICS implementation and capital adequacy ratio adjustments directly influence the cost and availability of capital for insurers.

- Availability and Cost: Despite easing measures, securing capital from banks and investors remains a key factor for growth and solvency.

- Negotiating Leverage: Insurers' need for capital, especially for strategic initiatives, can give capital providers significant bargaining power.

The bargaining power of reinsurers remains a significant factor for DB Insurance, especially with the increasing reliance on international reinsurers due to a declining domestic market share for Korean Re. This global dependence grants overseas reinsurers, often boasting stronger solvency and diversified portfolios, considerable leverage in setting terms and pricing. For example, 2023 saw continued hardening rates in the global reinsurance market, a trend that empowers reinsurers to negotiate more favorable terms with primary insurers.

Technology and data providers are gaining substantial bargaining power as DB Insurance, like the broader industry, invests heavily in digital transformation. The rise of InsurTech startups further solidifies the influence of these specialized firms, with the global InsurTech market valued at approximately $10.4 billion in 2023 and poised for significant growth.

Healthcare and automotive service networks also exert considerable bargaining power, particularly as consolidation occurs within these sectors. In 2024, larger hospital groups and concentrated regional auto repair facilities can leverage their market position to influence pricing and service agreements, directly impacting claims costs for insurers like DB Insurance.

Brokerage General Agents (GAs) hold significant sway due to their critical role in distribution and sales. In 2024, the demand for specialized insurance products heightened the value of GAs adept at marketing these offerings, with insurers demonstrating strong GA partnerships reporting an average of 15% higher sales growth.

Capital providers, such as banks and investors, wield influence amplified by regulatory frameworks like the Korean Insurance Capital Standard (K-ICS). Despite adjustments to capital adequacy ratios, the cost and availability of capital remain crucial for insurers like DB Insurance, impacting their negotiating leverage.

| Supplier Type | Influence Level | Key Factors | 2024 Trend Insight |

|---|---|---|---|

| Reinsurers (International) | Moderate to High | Reliance on overseas capacity, solvency ratios, market hardening | Continued rate increases favor reinsurers. |

| Tech & Data Providers | Rising | Digital transformation investment, InsurTech growth | InsurTech market valued at $10.4B in 2023. |

| Healthcare & Auto Networks | Moderate | Sector consolidation, regional facility concentration | Consolidation can increase provider leverage. |

| Brokerage General Agents (GAs) | Considerable | Sales generation, client base, specialized product marketing | Strong GA partnerships linked to 15% higher sales growth. |

| Capital Providers | Significant | Regulatory capital requirements (K-ICS), capital availability | Capital needs influence negotiation power. |

What is included in the product

Db Insurance's Porter's Five Forces Analysis dissects the competitive intensity within the insurance sector, examining buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing firms.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force, allowing for targeted strategic adjustments.

Customers Bargaining Power

The rise of digital comparison platforms in South Korea has dramatically increased price transparency for insurance products. For instance, by mid-2024, consumers could easily compare car insurance premiums from numerous providers, with many platforms highlighting options that were substantially cheaper than their current plans. This easy access to comparative pricing empowers customers to actively seek out more competitive rates, directly influencing insurers to lower their premiums to remain attractive in the market.

The proliferation of online comparison and recommendation services, particularly through fintech platforms like Kakao Pay and Naver Pay, has dramatically amplified customer access to insurance product information and a wider array of sales channels. This digital transformation empowers consumers, allowing them to effortlessly research, compare, and purchase insurance, thereby eroding traditional information gaps.

In 2024, the South Korean digital insurance market saw significant growth, with fintech platforms facilitating a substantial portion of new policy acquisitions. For instance, Kakao Pay reported a year-over-year increase of over 30% in insurance-related transactions through its app in the first half of 2024, underscoring the growing customer reliance on these digital tools for informed decision-making and price comparison.

This heightened transparency and ease of access directly translate to increased bargaining power for customers. They can readily identify the most competitive pricing and product features, forcing insurers to offer more attractive terms and potentially lowering profit margins as they compete for digitally savvy consumers.

South Korea's demographic landscape is rapidly shifting, with a notable increase in its aging population. By 2024, the proportion of citizens aged 65 and over is projected to reach approximately 20%, significantly impacting insurance demand. This demographic trend fuels a greater need for health, long-term care, and retirement-focused insurance products.

These evolving customer needs translate into a more discerning customer base. As individuals seek specialized coverage, their collective ability to demand tailored products and services from insurers grows, thereby enhancing their bargaining power.

Regulatory Consumer Protection

Government reforms aimed at protecting consumers significantly bolster their bargaining power in the insurance market. For instance, in 2024, many jurisdictions implemented stricter disclosure requirements for insurance policies, ensuring customers have a clearer understanding of terms and conditions. This transparency empowers consumers to compare offerings more effectively and demand better value.

These regulatory initiatives often foster greater competition by leveling the playing field and encouraging insurers to adopt more customer-centric practices. When consumers feel confident due to robust protection, they are more likely to switch providers if they perceive better deals or service. This increased willingness to switch directly translates to enhanced customer leverage over insurers.

The regulatory landscape in 2024, with its focus on consumer welfare, has thus amplified the bargaining power of customers. Key aspects include:

- Enhanced Transparency: Regulations mandating clearer policy language and fee structures allow customers to make more informed choices.

- Improved Complaint Resolution: Stricter rules for handling customer complaints give consumers more recourse and leverage.

- Data Privacy Safeguards: Stronger data protection laws empower customers by giving them more control over their personal information, reducing insurers' ability to exploit it.

- Promoting Competition: Regulatory efforts to simplify market entry and product standardization encourage competition, giving customers more options and thus more power.

Preference for Digital-First Solutions

Customers increasingly favor digital-first insurance. This means they expect seamless online experiences, from policy purchase to claims processing. In 2024, a significant portion of new insurance policies were initiated online, reflecting this shift.

This preference empowers customers by giving them more choices. They can easily compare offerings from traditional insurers and newer, digitally-native companies. For instance, platforms offering embedded insurance within other digital services are gaining traction, directly impacting how customers interact with insurance providers.

- Digital Adoption: By 2024, over 70% of insurance consumers surveyed indicated a preference for digital channels for policy management and claims.

- Platform Influence: Non-financial platforms integrating insurance services saw a 25% year-over-year increase in customer acquisition for insurance products in 2024.

- Expectation Shift: The demand for intuitive, app-based customer service means insurers must invest in digital transformation to retain and attract customers, thereby increasing customer bargaining power.

The bargaining power of customers in the South Korean insurance market is significantly elevated due to increased price transparency and accessibility, driven by digital comparison platforms and fintech services. By mid-2024, consumers could easily compare premiums across numerous providers, with platforms like Kakao Pay and Naver Pay facilitating over 30% year-over-year growth in insurance transactions for some providers in the first half of 2024.

This digital empowerment allows customers to readily identify competitive pricing and product features, compelling insurers to offer more attractive terms to remain competitive. Furthermore, government reforms in 2024, mandating enhanced transparency and robust complaint resolution, further bolster customer leverage.

The growing preference for digital-first insurance experiences, with over 70% of consumers favoring digital channels for policy management by 2024, also contributes to this trend. Insurers must invest in digital transformation to meet these expectations, thereby increasing customer bargaining power as they can easily switch to providers offering superior digital engagement.

| Factor | Description | Impact on Bargaining Power | 2024 Data/Trend |

|---|---|---|---|

| Price Transparency | Easy access to comparative pricing data | Increases customer ability to seek lower premiums | Platforms showing significant price differences by mid-2024 |

| Digital Accessibility | Proliferation of fintech platforms for insurance comparison and purchase | Reduces information asymmetry, empowers informed choices | Kakao Pay insurance transactions up >30% YoY (H1 2024) |

| Regulatory Environment | Government reforms on disclosure, complaint handling, and data privacy | Enhances customer understanding and recourse, fosters competition | Stricter disclosure rules implemented in 2024 |

| Digital Preference | Customer shift towards online policy management and claims | Increases choice and ease of switching providers | >70% prefer digital channels for policy management (2024) |

What You See Is What You Get

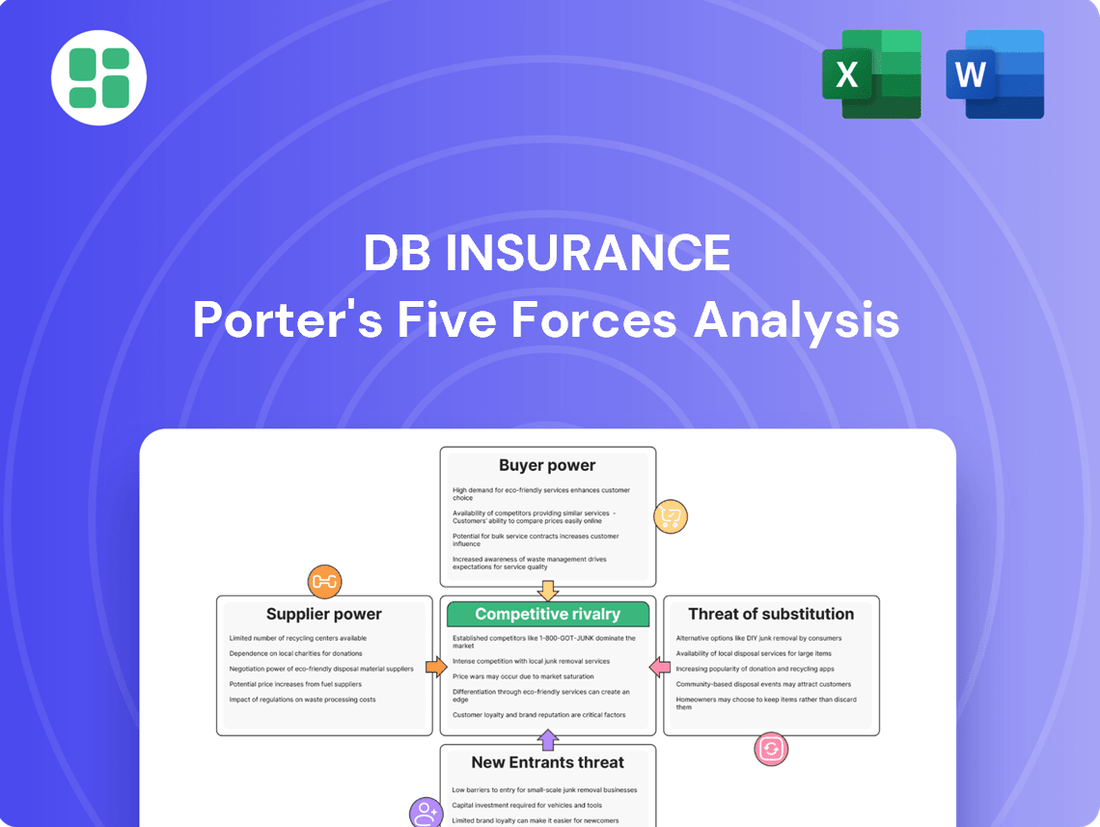

Db Insurance Porter's Five Forces Analysis

This preview offers a comprehensive look at our Db Insurance Porter's Five Forces Analysis, showcasing the exact document you will receive immediately after purchase. This detailed report meticulously examines the competitive landscape of the insurance industry, providing actionable insights into industry attractiveness and strategic positioning. You'll gain a thorough understanding of the forces shaping the market, enabling informed decision-making.

Rivalry Among Competitors

The South Korean non-life insurance sector exhibits moderate concentration, with dominant players like DB Insurance, Samsung Fire & Marine, Hyundai Marine & Fire, KB Insurance, and Meritz Fire & Marine commanding substantial market shares. This means competition is intense among these well-established companies, who frequently engage in strategic actions to secure or defend their market standing.

The insurance sector's digital overhaul is significantly ramping up competitive pressures. Companies are pouring resources into cutting-edge tech and broadening their digital sales avenues. For instance, by the end of 2023, digital sales channels accounted for a substantial portion of new business premiums for many insurers, reflecting this shift.

The rise of digital insurance comparison platforms is a major catalyst, making prices more transparent and empowering customers to switch providers with ease. In 2024, these platforms are projected to facilitate a greater volume of policy comparisons, directly impacting customer acquisition costs and forcing insurers to sharpen their pricing strategies and service offerings to retain market share.

The insurance industry is seeing a significant shift as new regulations like IFRS 17 and K-ICS are implemented, forcing companies to concentrate on long-term profitability and contractual service margins (CSM). This regulatory environment intensifies competition, with insurers now vying for high-margin products such as health and accident insurance, moving away from a sole focus on premium volume.

Strategic M&A and Restructuring

Despite some recent slowdowns in the mergers and acquisitions (M&A) market, largely due to valuation disagreements, strategic corporate realignments and M&A remain significant forces. Insurers are actively pursuing acquisitions and mergers to bolster their market share, broaden their product portfolios, and realize greater operational efficiencies.

This pursuit of consolidation can dramatically reshape the competitive environment. For instance, in 2024, the global insurance M&A market saw continued activity, though deal volumes fluctuated. Major transactions often lead to the emergence of larger, more dominant players, intensifying rivalry for smaller or less diversified insurers.

- Market Consolidation: Insurers are merging to gain scale, which can lead to reduced competition in certain segments.

- Diversification Strategies: M&A is used to enter new markets or offer a wider range of insurance products, impacting existing players.

- Valuation Gaps: Disagreements over company valuations can stall deals, creating temporary market uncertainty and affecting competitive dynamics.

- Impact of Failed Deals: Unsuccessful M&A attempts can lead to financial strain and strategic repositioning, altering the competitive landscape.

Product Innovation and Differentiation

Insurers are heavily investing in product innovation to stand out. This includes developing usage-based insurance (UBI) models, offering highly personalized policies, and creating specialized coverage for new risks such as virtual asset liability and pet health. For instance, by mid-2024, a significant portion of auto insurers were actively piloting or expanding UBI programs, with some reporting up to a 15% reduction in claims for participants. This focus on unique offerings is crucial for gaining market share and keeping customers engaged.

The competitive landscape is characterized by a relentless pursuit of differentiation through novel insurance products. Companies are actively exploring and launching policies tailored to niche markets and emerging needs. This strategic emphasis on innovation directly impacts customer acquisition and loyalty, as policyholders seek coverage that accurately reflects their evolving lifestyles and exposures. The success of these innovative products often hinges on their ability to offer perceived value beyond traditional coverage, driving a dynamic competitive environment.

- Usage-Based Insurance (UBI): Telematics data allows for pricing based on actual driving behavior, potentially leading to lower premiums for safe drivers. By the end of 2023, the UBI market was estimated to be worth over $15 billion globally, with strong growth projected through 2025.

- Customized Policies: Insurers are leveraging data analytics to offer policies that can be adjusted based on individual needs and preferences, moving away from one-size-fits-all solutions.

- Specialized Coverage: The introduction of policies for emerging risks, such as cyber insurance for small businesses or specialized coverage for gig economy workers, addresses previously unmet market demands. For example, the cyber insurance market saw a 20% increase in demand from SMBs in 2024.

The competitive rivalry within South Korea's non-life insurance sector, including DB Insurance, is intense, driven by a few large players and the increasing influence of digital platforms. Insurers are actively differentiating through product innovation, such as usage-based insurance, and are navigating regulatory changes that emphasize long-term profitability.

| Key Competitive Factors | 2023/2024 Data/Projections | Impact on Rivalry |

|---|---|---|

| Market Concentration | Top 5 insurers hold significant market share. | Intense competition among established players. |

| Digitalization | Digital sales channels growing; increased investment in tech. | Price transparency, easier customer switching, pressure on pricing. |

| Product Innovation | Growth in Usage-Based Insurance (UBI); specialized policies. | Drives differentiation, customer acquisition, and retention. |

| Regulatory Changes (IFRS 17, K-ICS) | Focus on profitability and CSM. | Shift towards high-margin products, increased strategic maneuvering. |

SSubstitutes Threaten

South Korea's robust social security system, featuring the National Pension Service and national health insurance, presents a significant substitute for private insurance products. These government-backed programs offer a foundational level of financial security and healthcare coverage, which can diminish the perceived need for individuals to seek out comprehensive private alternatives, especially for essential needs.

In 2023, the National Pension Service managed assets exceeding 1,000 trillion KRW, demonstrating its substantial capacity to provide retirement income. Similarly, the National Health Insurance Service covered over 97% of the South Korean population in 2023, highlighting its widespread reach and effectiveness in providing basic healthcare, thereby acting as a strong substitute for private health insurance.

For large corporations, self-insurance presents a significant threat to traditional insurers, particularly for predictable or low-impact risks. For example, many large companies now maintain captive insurance subsidiaries to underwrite their own risks, thereby retaining premiums and investment income that would otherwise go to external insurers. This trend is driven by the desire to control costs and tailor coverage more precisely.

Robust internal risk management and loss prevention programs further diminish the need for external insurance. Companies investing heavily in safety protocols, employee training, and technology to prevent accidents or operational failures effectively reduce their insurable risks. In 2023, the global corporate insurance market saw continued pressure from self-insurance initiatives, with some sectors reporting a noticeable decline in demand for certain types of coverage as internal risk mitigation efforts intensified.

Savings-type insurance products are increasingly challenged by direct financial instruments. For instance, in early 2024, the average yield on a 1-year Certificate of Deposit (CD) from major banks hovered around 4.5% to 5.0%, while some money market funds offered even higher, albeit variable, returns. This directly competes with the savings component of certain insurance policies, especially those with guaranteed but lower interest rates.

Consumers are actively seeking better returns, and when bank deposits or mutual funds offer more attractive yields or greater flexibility, they become a viable substitute. This is particularly true in periods of rising interest rates, where traditional savings insurance might lag behind market opportunities. The perceived risk-return profile of these alternatives can sway consumers away from the investment aspect of insurance.

Fintech and Digital Alternatives for Risk Management

The burgeoning fintech sector presents a subtle yet significant threat of substitutes for traditional insurance, including for companies like DB Insurance. While many fintech firms collaborate with insurers, others offer alternative risk management solutions that can lessen the reliance on conventional policies.

Digital platforms are increasingly providing individuals and businesses with tools to manage financial exposures differently. For instance, micro-lending platforms or peer-to-peer financing arrangements can act as financial buffers, reducing the perceived necessity for certain types of insurance by offering alternative avenues for capital access or risk pooling.

Consider the growth in alternative financing. In 2024, the global P2P lending market was projected to reach hundreds of billions of dollars, demonstrating a clear shift towards non-traditional financial solutions. Similarly, digital wealth management tools and robo-advisors offer sophisticated financial planning that can, in some cases, mitigate the need for products like life insurance or certain investment-linked policies.

- Fintech's Dual Role: While many fintechs partner with insurers, they also develop independent solutions that can replace traditional insurance products.

- Alternative Financial Buffers: Digital platforms offering micro-lending and peer-to-peer financing provide alternative ways to manage financial risks, potentially reducing demand for certain insurance coverages.

- Digital Financial Planning: Advanced digital tools for financial planning and wealth management can diminish the perceived need for specific insurance policies by offering alternative risk mitigation strategies.

Preventive Technologies and Services

Preventive technologies are increasingly acting as substitutes for traditional insurance by reducing the likelihood of claims. For instance, smart home devices that detect fires or intrusions can lower the need for property insurance coverage. In 2024, the adoption of such IoT devices in homes continued to grow, with estimates suggesting over 50 billion connected devices globally, many of which offer security and safety features.

Telematics in the automotive sector, which monitors driving behavior, offers incentives for safer driving and can lead to lower premiums, effectively substituting for the risk mitigation aspect of auto insurance. Wearable health monitors are also gaining traction, providing individuals with real-time health data that could potentially reduce the incidence of certain health issues, thereby impacting demand for health insurance. For example, by mid-2024, over 150 million wearable devices were projected to be in use worldwide, with a significant portion focused on health and fitness tracking.

- Smart Home Adoption: Increased use of smart home security systems directly reduces potential losses from theft or damage, lessening reliance on home insurance.

- Telematics in Auto Insurance: Usage-based insurance programs, powered by telematics, reward safe driving, making the insurance itself a more personalized risk management tool rather than just a payout mechanism.

- Wearable Health Technology: Continuous health monitoring via wearables empowers individuals to proactively manage their well-being, potentially decreasing the frequency of costly medical claims.

The threat of substitutes for DB Insurance is multifaceted, encompassing government social security programs, corporate self-insurance, alternative financial instruments, and advancements in preventive technology.

South Korea's strong social safety nets, like the National Pension Service (managing over 1,000 trillion KRW in 2023) and a national health insurance covering over 97% of the population, offer baseline security that can reduce demand for private insurance.

Corporations increasingly opt for self-insurance through captive subsidiaries, retaining premiums and investment income, especially for predictable risks. This trend intensified in 2023, impacting demand for specific corporate coverages.

Savings-oriented insurance products face stiff competition from bank CDs and money market funds, which offered yields around 4.5%-5.0% in early 2024, often exceeding traditional insurance investment returns.

| Substitute Category | Example | Impact on Insurance Demand | Key Data Point (2023/Early 2024) |

|---|---|---|---|

| Government Social Security | National Pension Service, National Health Insurance | Reduces need for private retirement and health coverage | NPS assets > 1,000 trillion KRW; NHIS covered >97% of population |

| Corporate Self-Insurance | Captive insurance subsidiaries | Decreases demand for corporate property and casualty insurance | Growing trend in 2023 impacting specific coverage sectors |

| Alternative Financial Instruments | Bank Certificates of Deposit (CDs), Money Market Funds | Challenges savings and investment components of life insurance | CD yields ~4.5%-5.0% in early 2024 |

| Preventive Technologies | Smart home devices, Telematics, Wearable health monitors | Lowers claims frequency, reducing the perceived need for certain policies | Over 50 billion IoT devices globally (2024 est.); ~150 million wearables in use (mid-2024 est.) |

Entrants Threaten

Historically, the South Korean insurance sector has been shielded by substantial capital requirements, posing a significant hurdle for new companies looking to enter the market. These high initial investments make it difficult for startups to gain a foothold.

While regulatory changes have recently adjusted capital adequacy ratios for insurers, the sheer volume of capital still necessary to launch and sustain an insurance operation remains a considerable deterrent. For instance, establishing a new non-life insurance company in Korea typically requires a minimum paid-in capital of around 30 billion KRW (approximately $22 million USD as of mid-2024), a figure that effectively fences out many potential competitors.

The South Korean insurance sector, overseen by entities like the Financial Services Commission (FSC), presents a significant hurdle for newcomers due to its intricate web of licensing requirements and compliance mandates. Navigating this demanding terrain requires substantial investment and expertise, effectively deterring many potential entrants.

The recent introduction and ongoing adaptation to new accounting standards such as IFRS 17, alongside evolving solvency regulations like K-ICS, further complicate the operational environment. For instance, by the end of 2023, insurers were still actively refining their systems to fully align with IFRS 17, a process that demands considerable financial and technological resources, making market entry particularly challenging.

Established insurers like DB Insurance have cultivated deep brand loyalty over many years, a significant hurdle for newcomers. This loyalty is built on trust and consistent service, making it difficult for new entrants to attract customers. For instance, in 2023, DB Insurance reported a strong customer retention rate, underscoring the stickiness of their existing customer base.

Furthermore, DB Insurance leverages an extensive distribution network, comprising numerous branches and a vast agent force. Replicating this widespread physical presence and agent network demands substantial capital and time, creating a formidable barrier to entry. In 2024, the company continued to expand its digital service channels, further solidifying its reach and accessibility.

InsurTech and Big Tech Disruption

The insurance landscape is increasingly challenged by InsurTech startups and established Big Tech firms. These new entrants are adept at leveraging digital technologies to streamline processes and offer innovative products, particularly in areas like online distribution and specialized insurance offerings.

These digital-first companies can bypass traditional, capital-intensive distribution networks, effectively lowering entry barriers in specific market segments. For instance, by early 2024, InsurTechs had secured billions in funding, fueling their expansion into various insurance verticals.

- InsurTech Funding Surge: Global InsurTech funding reached over $10 billion in 2023, with early 2024 showing continued strong investment, enabling rapid scaling and product innovation.

- Big Tech's Reach: Companies like Google and Amazon are exploring embedded insurance solutions, leveraging their vast customer data and platforms to offer insurance at the point of sale.

- Digital Distribution Dominance: Online comparison platforms, often operated by InsurTechs, now account for a significant portion of new policy sales in many developed markets, disrupting traditional agent-led models.

- Niche Market Penetration: InsurTechs are successfully targeting underserved or complex niche markets, such as cyber insurance or on-demand coverage, with tailored digital solutions.

Data and Technology Investment Imperative

The threat of new entrants in the insurance sector is significantly amplified by the data and technology investment imperative. New players must commit considerable capital to cutting-edge technologies like artificial intelligence, big data analytics, and the Internet of Things (IoT). These investments are crucial for developing sophisticated risk assessment models, streamlining underwriting processes, and delivering personalized customer experiences, which are now industry standards.

For instance, a report in early 2024 highlighted that leading insurers are allocating upwards of 20% of their IT budgets to digital transformation initiatives, focusing on AI and data analytics. This creates a substantial barrier to entry, as aspiring insurers need not only the technological infrastructure but also access to vast, high-quality datasets to train these systems effectively. Without this, new entrants struggle to compete on pricing, efficiency, or product innovation.

- High Capital Outlay: Significant upfront investment required for AI, big data, and IoT infrastructure.

- Data Acquisition Costs: Acquiring and processing large, relevant datasets is expensive and complex.

- Talent Acquisition: Need for specialized data scientists and AI engineers, driving up labor costs.

- Regulatory Compliance: Meeting data privacy and security regulations adds to operational expenses and complexity.

The threat of new entrants in the South Korean insurance market remains moderate, primarily due to high capital requirements and stringent regulatory hurdles. While InsurTechs and Big Tech firms are introducing digital innovations, the established infrastructure and brand loyalty of incumbents like DB Insurance present significant barriers.

For example, the minimum paid-in capital for a new non-life insurer in Korea is around 30 billion KRW (approximately $22 million USD as of mid-2024), a substantial sum that deters many potential challengers.

Furthermore, the need for significant investment in data analytics and AI capabilities, with leading insurers dedicating over 20% of IT budgets to digital transformation by early 2024, creates a high technological entry barrier.

| Barrier Type | Description | Impact on New Entrants | Example Data Point (Mid-2024) |

|---|---|---|---|

| Capital Requirements | High initial investment and regulatory capital adequacy ratios. | Significant financial hurdle, limiting the number of potential entrants. | Minimum 30 billion KRW paid-in capital for non-life insurers. |

| Regulatory Complexity | Intricate licensing, compliance, and evolving standards (IFRS 17, K-ICS). | Requires substantial legal and operational expertise, increasing time-to-market. | Ongoing system adjustments for IFRS 17 compliance by end of 2023. |

| Brand Loyalty & Distribution | Established customer trust and extensive agent networks. | Difficult to attract customers and replicate incumbent reach. | DB Insurance's strong customer retention in 2023. |

| Technology Investment | Need for AI, big data, and IoT infrastructure. | High upfront costs and data acquisition challenges. | 20%+ of IT budgets allocated to digital transformation by leading insurers (early 2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the DB Insurance sector is built upon a robust foundation of data from industry-specific market research reports, financial statements of leading insurers, and regulatory filings from relevant authorities. These sources provide critical insights into market structure, competitive intensity, and the bargaining power of various stakeholders.