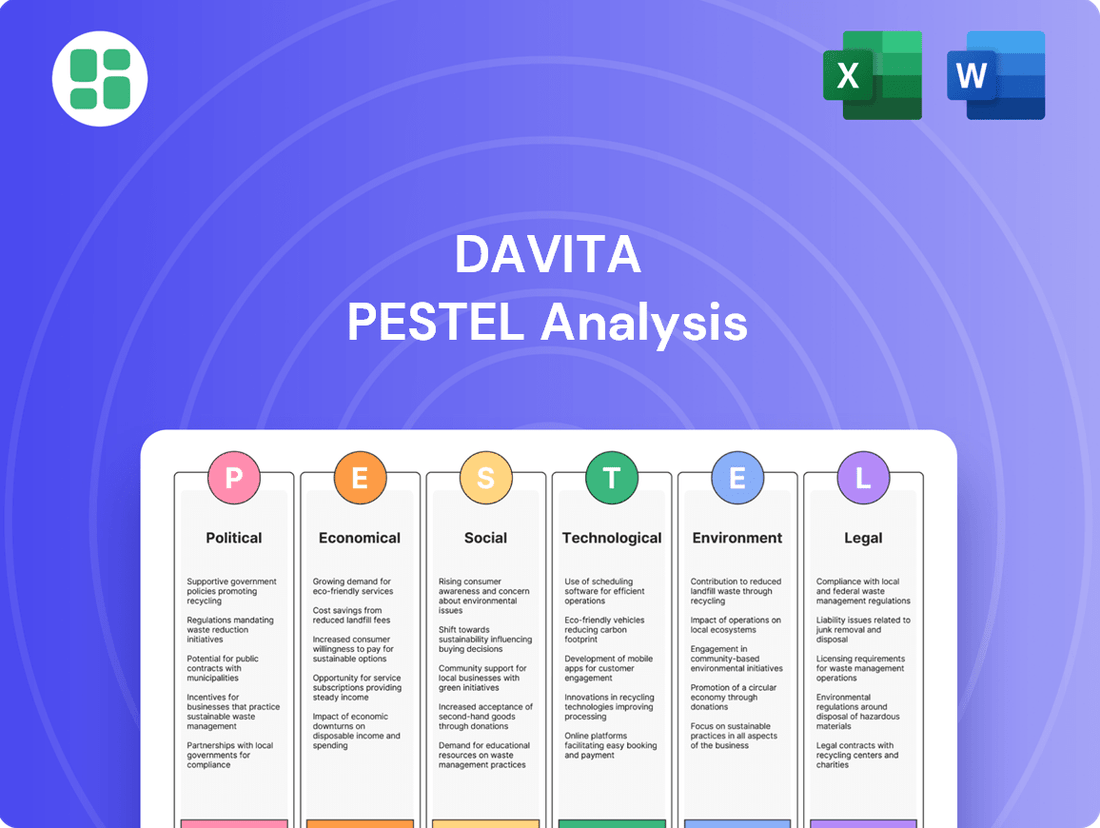

DaVita PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DaVita Bundle

Navigate the complex external forces shaping DaVita's dialysis empire with our meticulously crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are critical to its success and uncover hidden opportunities and potential threats. Download the full PESTLE analysis now to gain actionable intelligence and sharpen your strategic advantage.

Political factors

Government policies, especially those from the Centers for Medicare & Medicaid Services (CMS), are a major influence on DaVita's business. These regulations shape how dialysis providers are reimbursed and operate.

The CY 2025 End-Stage Renal Disease (ESRD) Prospective Payment System (PPS) Final Rule is a key example, detailing payment rates and coverage conditions. This rule directly impacts the revenue DaVita receives for its dialysis services.

For 2025, CMS anticipates a roughly 2.7% rise in overall payments to ESRD facilities. Specifically, freestanding facilities, which make up a large portion of DaVita's network, are projected to see a 2.6% payment increase.

The ongoing shift towards value-based care models, exemplified by the Centers for Medicare & Medicaid Services (CMS) Kidney Care Choices (KCC) Model, is fundamentally reshaping the healthcare landscape. CMS has explicitly stated a preference for a greater number of kidney disease patients to be enrolled in these value-based arrangements, aiming to improve overall patient outcomes and manage costs more effectively.

This policy direction directly incentivizes providers like DaVita to innovate their service delivery and financial strategies. The focus is increasingly on enhancing patient outcomes, boosting the utilization of home dialysis, and actively promoting preemptive kidney transplants, all of which are key performance indicators within these new care models.

Medicare Advantage (MA) enrollment for End-Stage Renal Disease (ESRD) patients has surged since 2021, with 47% of these beneficiaries enrolled by December 2022. This significant shift impacts stakeholders by raising concerns about payment adequacy within MA plans.

The growing prevalence of ESRD patients in MA plans is likely to fuel continued advocacy for reforms in MA payment reimbursement structures. These adjustments are crucial to ensure equitable and sufficient funding for dialysis providers and related care.

Legislative Efforts on Oral-Only Products

The Centers for Medicare & Medicaid Services (CMS) intends to integrate oral-only treatments, such as phosphate binders, into the End-Stage Renal Disease (ESRD) Prospective Payment System (PPS) bundle beginning in 2025. This move is expected to impact how these medications are reimbursed and managed within dialysis care. For instance, phosphate binders represent a significant category of drugs for ESRD patients, and their inclusion in a bundled payment system could alter cost structures for providers like DaVita.

However, this proposed change is not without its critics. Federal lawmakers have voiced apprehension regarding potential limitations on patient access to these oral therapies and an overall increase in dialysis treatment expenses. Their concerns are substantial, as they could lead to a significant shift in the treatment landscape for kidney disease patients. These legislators are advocating for a delay in the inclusion until 2033, or until novel therapeutic alternatives emerge, highlighting the sensitivity of this policy shift.

- CMS ESRD PPS Bundle Inclusion: Planned for 2025 for oral-only products.

- Legislative Concerns: Potential for limited access and increased dialysis costs.

- Proposed Delay: Lawmakers seek postponement until 2033 or availability of new therapies.

- Strategic Impact: This debate could shape DaVita's medication formulary and patient care approaches.

Regulatory Scrutiny and Compliance

DaVita, like other healthcare providers, operates under a complex web of regulations. Federal agencies such as OSHA and the EPA, along with state-specific laws, dictate how dialysis centers manage everything from patient care to hazardous waste. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize quality reporting and value-based care initiatives, directly impacting reimbursement and operational standards for dialysis providers.

Staying compliant is not just a legal necessity; it's critical for business continuity. Non-compliance can lead to hefty fines, damage DaVita's reputation, and disrupt services. This requires ongoing investment in updating waste management protocols, ensuring staff are thoroughly trained on the latest requirements, and adapting to evolving environmental standards, particularly concerning medical and hazardous waste disposal.

- OSHA Standards: Ensuring workplace safety and health for employees handling potentially infectious materials.

- EPA Regulations: Compliance with rules on the treatment and disposal of medical waste, including sharps and biohazardous materials.

- State-Specific Laws: Adherence to varying state requirements for waste management, storage, and transportation.

- CMS Quality Initiatives: Meeting performance metrics set by Medicare and Medicaid that influence payment and patient care standards.

Government policies, particularly those from the Centers for Medicare & Medicaid Services (CMS), significantly influence DaVita's operations and revenue. The CY 2025 End-Stage Renal Disease (ESRD) Prospective Payment System (PPS) Final Rule, for example, outlines payment rates and coverage conditions, projecting a 2.6% increase in payments for freestanding facilities in 2025.

The increasing enrollment of ESRD patients in Medicare Advantage (MA) plans, reaching 47% by December 2022, highlights a critical shift impacting payment adequacy and driving advocacy for MA reimbursement reforms. Furthermore, CMS plans to bundle oral-only treatments into the ESRD PPS starting in 2025, a move met with legislative concerns about patient access and increased costs, with lawmakers seeking a delay until 2033.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing DaVita across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within DaVita's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of external factors impacting DaVita's operations.

Helps support discussions on external risk and market positioning during planning sessions, by highlighting key political, economic, social, technological, environmental, and legal influences.

Economic factors

Healthcare inflation remains a significant hurdle, with the U.S. healthcare sector experiencing a projected inflation rate of 5.1% for 2024, according to CMS data. This surge impacts hospital fees, medical equipment, and pharmaceutical costs, directly increasing DaVita's operating expenses.

Compounding these cost pressures are persistent labor shortages within the healthcare industry. This scarcity drives up wages for essential personnel, further straining DaVita's operational budget. For instance, registered nurse wages saw an average increase of 6.5% in 2023, a trend expected to continue.

These rising operating costs can erode DaVita's profitability if not effectively managed. The company must rely on securing adequate reimbursement rates from payers or achieving substantial operational efficiencies to maintain healthy margins in this inflationary environment.

The Centers for Medicare & Medicaid Services (CMS) annual updates to the End-Stage Renal Disease (ESRD) Prospective Payment System (PPS) base rate are a key driver of DaVita's revenue. For Calendar Year 2025, the ESRD PPS base rate is projected to increase to $273.82, reflecting a 2.7% rise in overall payments to ESRD facilities from 2024 levels.

These payment adjustments, alongside modifications to the low-volume payment adjustment and outlier policies, have a direct and significant impact on DaVita's financial performance and profitability.

Government payers, mainly Medicare, are the backbone of DaVita's U.S. revenue, making up roughly two-thirds of sales. This significant reliance underscores the importance of government healthcare policy and reimbursement rates.

However, the real profit engine for DaVita's U.S. dialysis operations comes from commercial insurers. Despite serving a smaller patient base, around 10% of U.S. patients, these commercial contracts generate nearly all of the company's profits in this segment, highlighting their crucial role in financial performance.

This dynamic means DaVita's profitability is heavily influenced by its ability to negotiate favorable terms with commercial payers. Managing this payer mix and ensuring strong commercial contract renewals are therefore vital for maintaining and growing profitability, especially as the overall payer landscape evolves.

Investment in Healthcare Innovation

The healthcare sector, including areas relevant to DaVita, continues to attract significant investment. In 2024, venture capital funding for health tech and biotech remained robust, with a notable emphasis on data analytics and AI for earlier disease detection and personalized treatment plans. This trend directly supports DaVita's strategic focus on slowing kidney disease progression through advanced diagnostics and therapies.

DaVita's capacity to invest in and implement innovative care models, such as home dialysis and integrated kidney care, is intrinsically linked to the prevailing economic climate and the accessibility of capital. For instance, in early 2025, interest rates, while potentially higher than previous years, still offered opportunities for companies with strong balance sheets to finance R&D and capital expenditures for new technologies.

- Healthcare Innovation Investment: Global healthcare R&D spending is projected to exceed $250 billion in 2024, with a significant portion allocated to digital health and data-driven solutions.

- Capital Availability: Despite economic headwinds, the healthcare sector has maintained investor confidence, with dedicated healthcare funds actively seeking opportunities in areas like chronic disease management.

- Technology Adoption: Companies like DaVita are prioritizing investments in telehealth platforms and remote patient monitoring to enhance care delivery for kidney patients, reflecting a broader industry shift.

- Market Dynamics: The demand for value-based care models, which incentivize better patient outcomes and cost efficiency, is driving investment in integrated care solutions that DaVita is actively pursuing.

Macroeconomic Conditions and Patient Affordability

Macroeconomic conditions significantly influence patient affordability and access to healthcare services, even for conditions like End-Stage Renal Disease (ESRD) primarily covered by Medicare. Factors such as employment rates and disposable income directly impact a patient's capacity to manage out-of-pocket expenses, including supplemental insurance premiums, co-pays, and essential services like transportation to dialysis centers. For instance, a rising unemployment rate in 2024 could exacerbate these challenges for a portion of the ESRD patient population.

Economic downturns can strain patients' ability to afford non-essential but crucial aspects of care. While Medicare covers a substantial portion of ESRD treatment costs, the remaining financial burden can become prohibitive during periods of economic contraction. This can lead to reduced treatment adherence or a delay in seeking necessary care, ultimately affecting demand for DaVita's services. The Bureau of Labor Statistics reported a national unemployment rate of 3.8% in April 2024, a figure that, if it trends upward, could signal increased financial pressure on patients.

- Disposable Income Trends: Fluctuations in national disposable income directly correlate with patients' ability to cover ancillary healthcare costs.

- Employment Stability: Higher employment rates generally translate to better insurance coverage and greater financial capacity for patients.

- Inflationary Pressures: Rising inflation can erode the purchasing power of fixed incomes, making healthcare-related expenses more burdensome.

- Economic Growth Projections: Positive economic growth forecasts for 2024-2025 suggest a potentially more stable environment for patient affordability.

Economic factors present a dual challenge for DaVita, balancing rising operational costs with evolving government reimbursement and patient affordability. Healthcare inflation, projected at 5.1% for 2024, directly increases DaVita's expenses, while labor shortages further drive up wages, with registered nurse wages up 6.5% in 2023.

Government payers, primarily Medicare, form the bedrock of DaVita's U.S. revenue, accounting for about two-thirds of sales. The ESRD PPS base rate is projected to rise to $273.82 for CY 2025, a 2.7% increase from 2024, offering some revenue support.

However, commercial insurers are the profit engine, generating nearly all profits from a smaller patient base, underscoring the critical need for favorable contract negotiations. Economic downturns, indicated by a 3.8% unemployment rate in April 2024, can strain patient ability to cover out-of-pocket costs, potentially impacting service demand.

Healthcare innovation attracts significant investment, with global R&D spending exceeding $250 billion in 2024, benefiting DaVita's focus on advanced diagnostics and therapies. Capital availability remains strong for healthcare, with dedicated funds actively seeking chronic disease management opportunities.

| Economic Factor | 2024/2025 Projection/Data | Impact on DaVita |

|---|---|---|

| Healthcare Inflation | 5.1% (2024) | Increases operating expenses (medical equipment, pharmaceuticals) |

| Registered Nurse Wage Increase | 6.5% (2023) | Drives up labor costs |

| ESRD PPS Base Rate (CY 2025) | $273.82 (2.7% increase from 2024) | Modest revenue support from Medicare |

| U.S. Unemployment Rate | 3.8% (April 2024) | Potential strain on patient out-of-pocket expenses |

| Global Healthcare R&D Spending | >$250 billion (2024) | Supports investment in advanced diagnostics and therapies |

Same Document Delivered

DaVita PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive DaVita PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities DaVita faces.

Sociological factors

Chronic Kidney Disease (CKD) is a significant public health concern, impacting over 35 million Americans, or more than 1 in 7 adults. This widespread condition, which is the ninth leading cause of death in the U.S., highlights a substantial and ongoing need for specialized kidney care services.

The prevalence of CKD is particularly high among older demographics, with about 34% of individuals aged 65 and older affected. Furthermore, certain racial and ethnic groups experience disproportionately higher rates of CKD, pointing to a consistent and expanding market for DaVita's services.

The aging of the U.S. population is a significant demographic trend impacting healthcare demand. Specifically, Chronic Kidney Disease (CKD) prevalence escalates with age; in 2024, it was reported at 34% for individuals 65 and older, a stark contrast to the 6% seen in those aged 18 to 44.

This escalating prevalence means that as the U.S. population continues to age, the demand for dialysis and other comprehensive kidney care services is projected to grow substantially. For companies like DaVita, this presents a clear opportunity to expand services but also necessitates careful planning for resource allocation and the provision of specialized care for an older patient demographic.

A significant challenge in kidney care is health literacy; as many as 9 in 10 adults with Chronic Kidney Disease (CKD) are unaware they have the condition. This underscores a critical need for robust public health education initiatives to promote early detection and management.

DaVita actively addresses this gap through its Kidney Smart® program. In 2024 alone, over 40,000 individuals participated in Kidney Smart®, demonstrating a commitment to enhancing patient understanding and empowering them to actively manage their kidney health.

Shift Towards Home Dialysis and Patient Preferences

Societal shifts are increasingly favoring home-based dialysis treatments, driven by patient desires for greater flexibility, convenience, and an improved quality of life. This trend reflects a broader move towards patient-centered healthcare models and the growing acceptance of remote treatment solutions.

DaVita has actively adapted to this evolving landscape, achieving a significant milestone with a 15% home dialysis rate among its patient base in 2024. This figure underscores the company's commitment to meeting patient preferences and embracing innovative care delivery methods.

- Growing Patient Preference: Patients are seeking more control over their treatment schedules and environments.

- DaVita's Home Dialysis Rate: DaVita reported a 15% home dialysis rate in 2024.

- Societal Trend: This reflects a broader societal move towards decentralized and patient-centric healthcare.

- Quality of Life: Home dialysis is associated with enhanced patient autonomy and well-being.

Health Equity and Access to Care

Societal views on health equity and access to care significantly impact DaVita's operational landscape. Persistent racial and ethnic disparities in Chronic Kidney Disease (CKD) prevalence, where non-Hispanic Black adults show a 20% prevalence compared to 12% for non-Hispanic White adults, highlight a critical area of focus for the company.

DaVita's commitment to expanding community health initiatives, such as its Health Tour offering free screenings and vital education, directly addresses these inequities. By reaching underserved communities, these programs aim to improve early detection and management of kidney disease, thereby enhancing overall health equity.

- Racial Disparities: Non-Hispanic Black adults exhibit a CKD prevalence of 20%, notably higher than the 12% seen in non-Hispanic White adults, underscoring a significant health equity challenge.

- Community Outreach: DaVita's Health Tour initiative provides essential free screenings and health education, targeting underserved populations to bridge access gaps.

- Impact of Initiatives: These community-focused efforts are designed to mitigate health inequities and improve access to crucial kidney care services for vulnerable groups.

Societal trends are increasingly favoring patient autonomy and convenience, leading to a growing demand for home-based dialysis treatments. DaVita reported a 15% home dialysis rate among its patients in 2024, reflecting this shift towards more personalized care models.

Health equity remains a significant societal concern, with stark racial disparities in Chronic Kidney Disease (CKD) prevalence. For instance, non-Hispanic Black adults show a 20% CKD prevalence compared to 12% for non-Hispanic White adults, highlighting the need for targeted interventions.

Public health awareness campaigns are crucial, as many as 9 in 10 adults with CKD are unaware of their condition. DaVita's Kidney Smart® program reached over 40,000 participants in 2024, demonstrating a commitment to patient education and early detection.

| Sociological Factor | Data Point (2024/2025) | Implication for DaVita |

|---|---|---|

| Home Dialysis Preference | 15% Home Dialysis Rate | Growing patient demand for decentralized care models. |

| Health Equity Concerns | 20% CKD Prevalence (Non-Hispanic Black) vs. 12% (Non-Hispanic White) | Need for targeted outreach and culturally competent care. |

| Health Literacy | 9 in 10 CKD patients unaware of condition | Importance of robust patient education programs like Kidney Smart®. |

| Aging Population Impact | 34% CKD prevalence in 65+ vs. 6% in 18-44 | Sustained and increasing demand for kidney care services. |

Technological factors

Innovations in dialysis technology are making treatments more efficient and less invasive. Compact, user-friendly home hemodialysis machines are becoming more common, and peritoneal dialysis systems are also seeing advancements. These developments offer patients greater flexibility and convenience.

The future of kidney replacement therapy could be transformed by wearable kidney devices and bioartificial kidneys. These technologies aim to provide greater mobility for patients and better mimic the functions of a natural kidney. For instance, research into bioartificial kidneys is progressing, with some prototypes showing promise in early trials.

Digital health, particularly remote patient monitoring (RPM), is revolutionizing kidney care. These technologies allow for constant tracking of vital signs and dialysis effectiveness, directly impacting patient outcomes.

The adoption of RPM is accelerating, with the global digital health market projected to reach over $600 billion by 2026, according to some industry reports. This growth is fueled by the ability to intervene quickly and tailor treatments, which is crucial for patients with chronic conditions like kidney disease.

This shift supports the increasing preference for home dialysis, offering patients greater autonomy and potentially reducing healthcare system strain. DaVita, a major player, is investing in these digital capabilities to enhance its service offerings and patient engagement.

Artificial intelligence is rapidly transforming nephrology, offering powerful tools for early kidney disease detection and predicting how conditions might worsen. This technology can also tailor treatment plans to individual patients, aiming for better results.

AI excels at sifting through vast amounts of patient data, including electronic health records, medical images, and genetic information. This capability allows for more accurate diagnoses and can significantly improve patient outcomes. For instance, the Partnership for Responsible AI in Kidney Health, launched in 2024, is actively working to ensure AI's ethical and effective use in this field.

Improved Data Analytics and Predictive Models

Advanced data analytics and predictive models, increasingly driven by artificial intelligence (AI), are becoming indispensable for healthcare providers like DaVita. These technologies are vital for proactively identifying patients at higher risk of complications or hospital readmissions, allowing for timely interventions. For instance, by analyzing vast datasets of patient history and treatment responses, DaVita can refine its care protocols. In 2024, the healthcare analytics market was valued at approximately $25.6 billion, with AI-driven solutions showing significant growth, indicating a strong trend towards data-informed operational improvements.

These sophisticated tools empower DaVita to optimize resource allocation, ensuring that staff and equipment are deployed efficiently where they are most needed. This data-driven approach can lead to enhanced care quality by reducing practice variations and improving overall treatment outcomes. By transitioning towards more personalized care plans based on individual patient data, DaVita can achieve better patient engagement and satisfaction. The adoption of AI in healthcare is projected to save billions annually through improved efficiency and reduced medical errors, a benefit DaVita can leverage.

- Proactive Patient Risk Identification: AI models can predict patient deterioration, enabling early intervention and improved health outcomes.

- Resource Optimization: Data analytics help in efficient scheduling of staff, equipment, and facility usage, reducing operational costs.

- Enhanced Care Quality: By analyzing treatment effectiveness and patient responses, DaVita can standardize best practices and minimize variations in care.

- Personalized Treatment Plans: Tailoring treatments based on individual patient data leads to more effective and patient-centric care delivery.

Telemedicine and Virtual Care Expansion

Telemedicine and virtual care are increasingly critical for managing End-Stage Renal Disease (ESRD), particularly in supporting home dialysis and remote patient consultations. This trend is amplified by DaVita's efforts to bridge the digital divide, such as providing tablets to kidney patients for accessing health information, thereby enhancing convenience and patient engagement.

The expansion of digital health solutions directly benefits DaVita's patient base. For instance, a significant portion of DaVita's patients could potentially benefit from remote monitoring, which can lead to earlier intervention and better health outcomes. By 2024, the global telemedicine market was projected to reach over $200 billion, underscoring the substantial growth and adoption of these services, a trend DaVita is well-positioned to leverage.

- Growing Adoption: Telehealth services for chronic disease management are seeing increased patient and provider acceptance, driven by the need for convenient and accessible care.

- DaVita's Digital Initiatives: Programs providing digital access to health information aim to improve patient education and adherence to treatment plans for conditions like ESRD.

- Market Growth: The telemedicine sector's robust growth indicates a strong market demand for virtual care solutions, offering opportunities for enhanced service delivery.

Technological advancements are fundamentally reshaping kidney care. Innovations in dialysis machines, including more compact home hemodialysis units and improved peritoneal dialysis systems, offer patients greater autonomy and convenience. The burgeoning field of digital health, particularly remote patient monitoring, allows for continuous tracking of patient vitals, leading to more proactive interventions and better outcomes. By 2024, the global digital health market was projected to exceed $600 billion, highlighting the significant investment and adoption of these technologies.

| Technology Area | Key Advancements | Impact on DaVita | Market/Growth Data (2024-2025) |

|---|---|---|---|

| Dialysis Machines | Compact, user-friendly home hemodialysis; advanced peritoneal dialysis systems | Enhances patient convenience and at-home care capabilities | Growing demand for home dialysis solutions |

| Digital Health/RPM | Remote patient monitoring, AI-driven diagnostics, virtual care platforms | Improves patient outcomes, enables proactive interventions, optimizes resource allocation | Digital health market projected over $600 billion by 2026; Telemedicine market over $200 billion by 2024 |

| Artificial Intelligence | Early disease detection, predictive analytics for patient deterioration, personalized treatment plans | Enhances diagnostic accuracy, improves care quality, supports data-driven decision-making | Healthcare analytics market ~ $25.6 billion in 2024, with AI-driven solutions showing significant growth |

Legal factors

DaVita navigates a complex web of healthcare regulations, including federal mandates from the Centers for Medicare & Medicaid Services (CMS). These regulations, such as updates to the End-Stage Renal Disease Prospective Payment System, directly impact reimbursement rates and operational standards for dialysis providers.

Compliance with these stringent laws is critical for DaVita's financial health and continued operation, as violations can lead to significant penalties. For instance, CMS's Conditions for Coverage outline essential requirements for patient safety and quality of care, influencing DaVita's service delivery models.

DaVita's operations are significantly shaped by evolving medical and hazardous waste disposal regulations. The Environmental Protection Agency's (EPA) Hazardous Waste Generator Improvements Rule, for instance, mandates stricter compliance measures. Furthermore, the mandatory electronic manifest (e-Manifest) system, fully implemented in 2021, streamlines tracking and reporting, impacting DaVita's administrative processes and ensuring greater accountability in waste management.

Healthcare facilities, including DaVita, must remain vigilant as new rules for handling medical waste are set to take effect in 2025. These upcoming regulations will likely introduce further requirements for segregation, treatment, and disposal, potentially increasing compliance costs and necessitating operational adjustments to ensure adherence.

DaVita, as a prominent healthcare provider, operates under stringent Anti-Kickback Statute and Stark Law regulations. These laws are designed to prevent financial inducements that could improperly influence patient referrals and healthcare decisions. Failure to comply can result in severe penalties, including hefty fines and exclusion from federal healthcare programs.

In 2023, the Department of Justice reported significant enforcement actions related to healthcare fraud, underscoring the critical importance of robust compliance programs. DaVita's commitment to meticulous adherence to these statutes is paramount for maintaining its operational license and financial stability in the highly regulated US healthcare landscape.

Patient Data Privacy and HIPAA Regulations

DaVita's operations are heavily influenced by legal factors, chief among them being patient data privacy and Health Insurance Portability and Accountability Act (HIPAA) regulations. Ensuring compliance with these stringent rules is a continuous legal requirement, especially as the company integrates more digital health technologies and remote patient monitoring systems. This necessitates significant investment in robust cybersecurity infrastructure and strict adherence to evolving privacy protocols to safeguard sensitive patient information.

The legal landscape also demands careful attention to healthcare fraud and abuse laws, such as the False Claims Act. DaVita must maintain meticulous billing practices and operational transparency to avoid penalties. For instance, in 2024, the U.S. Department of Justice continued its focus on healthcare fraud, with settlements often involving significant financial repercussions for providers. DaVita's commitment to ethical conduct and regulatory adherence is therefore critical to its long-term viability and reputation.

- HIPAA Enforcement: In 2023, the U.S. Department of Health and Human Services (HHS) continued to issue fines for HIPAA violations, highlighting the ongoing scrutiny of patient data protection.

- Cybersecurity Investments: Healthcare organizations, including DaVita, are increasing cybersecurity spending. Projections for 2024 indicate continued growth in this sector to combat escalating cyber threats.

- Regulatory Scrutiny: The Centers for Medicare & Medicaid Services (CMS) maintains oversight of dialysis providers, impacting reimbursement rates and operational standards, which are subject to change based on legislative and regulatory updates.

Antitrust Scrutiny and Market Concentration

DaVita, as a dominant player in the U.S. dialysis market, faces significant antitrust scrutiny. Its substantial market share, estimated to be around 35% in 2024, naturally draws attention from regulators concerned about market concentration and potential anti-competitive behavior.

Regulatory bodies like the Federal Trade Commission (FTC) closely monitor mergers and acquisitions within the healthcare sector. Any expansion or consolidation efforts by DaVita are subject to rigorous review to ensure fair competition and prevent monopolistic practices in kidney care.

- Market Share: DaVita held approximately 35% of the U.S. dialysis market in 2024.

- Regulatory Oversight: Mergers and acquisitions are subject to review by agencies like the FTC.

- Focus: Scrutiny centers on market concentration and potential anti-competitive impacts.

DaVita's operations are deeply intertwined with federal and state healthcare laws, including those governing patient safety and reimbursement. The End-Stage Renal Disease Prospective Payment System, managed by CMS, directly affects DaVita's revenue and operational mandates, with adjustments frequently impacting the company's financial performance.

Compliance with the Anti-Kickback Statute and Stark Law is paramount to prevent improper patient referrals and ensure ethical business practices. Enforcement actions, such as those highlighted by the Department of Justice in 2023 and continuing into 2024, underscore the severe financial and operational risks associated with non-compliance.

Protecting patient data under HIPAA is a continuous legal imperative, especially with the increasing adoption of digital health technologies. Cybersecurity investments are crucial, with healthcare sector spending projected to grow in 2024 to counter evolving cyber threats, as evidenced by ongoing HIPAA violation fines issued by HHS in 2023.

Antitrust regulations, enforced by bodies like the FTC, closely monitor DaVita's significant market share, approximately 35% in the U.S. dialysis market as of 2024. This scrutiny ensures fair competition, particularly concerning any mergers or acquisitions that could impact market concentration.

Environmental factors

DaVita is actively pursuing environmental stewardship, with a significant goal to match 100% of its global operations with renewable energy purchases by 2025.

This commitment is being realized through strategic virtual power purchase agreements, including recent expansions into Europe, demonstrating a tangible effort to lower its carbon footprint.

DaVita has demonstrated a strong commitment to water conservation, achieving impressive results in 2024. The company successfully saved over 75 million gallons of water through various efficiency projects across its facilities.

This significant accomplishment places DaVita well on its way to achieving its ambitious 2025 target of saving a cumulative 240 million gallons of water since 2021. These efforts highlight DaVita's dedication to responsible resource management within its dialysis centers, a crucial aspect of environmental sustainability.

Healthcare facilities, including DaVita's dialysis centers, are significant generators of medical waste. This necessitates strict adherence to evolving regulations for proper segregation, treatment, and disposal to minimize environmental impact and protect public health. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize best practices for medical waste management, particularly concerning sharps and infectious materials, impacting operational costs and compliance strategies for companies like DaVita.

DaVita must continuously update its waste management protocols to comply with federal and state guidelines. These regulations, such as those from the Centers for Disease Control and Prevention (CDC) and state environmental agencies, dictate everything from waste container labeling to approved disposal methods. Failure to comply can result in substantial fines and reputational damage, underscoring the critical nature of environmental factor management in the healthcare sector.

Carbon Footprint Reduction and Emissions Monitoring

DaVita's commitment to environmental stewardship goes beyond just renewable energy. The company actively monitors its carbon footprint, which includes tracking and working to reduce toxic air emissions. This is particularly relevant as environmental regulations, including those for waste incinerators, continue to evolve. Even though new regulations might primarily target municipal facilities, healthcare institutions like DaVita are considering proactive measures to minimize their environmental impact.

DaVita's efforts in carbon footprint reduction are multifaceted:

- Emissions Monitoring: Implementing systems to track and report air emissions from its facilities.

- Waste Management: Exploring and adopting practices to reduce waste, which can indirectly lower emissions from waste disposal.

- Regulatory Awareness: Staying ahead of evolving environmental regulations, particularly concerning air quality and emissions from healthcare operations.

Sustainable Supply Chain Practices

DaVita's commitment to environmental sustainability likely extends to its supply chain, encouraging or requiring suppliers to adopt environmentally friendly practices. This holistic approach to ESG goals ensures that the company's operations, from energy consumption to procurement, align with broader sustainability objectives.

The healthcare sector, including dialysis providers like DaVita, faces increasing scrutiny regarding its environmental footprint, particularly within its extensive supply chains. For instance, the production and transportation of medical supplies, pharmaceuticals, and equipment contribute significantly to carbon emissions and waste generation. DaVita's focus on sustainable supply chain practices is therefore crucial for meeting its environmental, social, and governance (ESG) targets.

- Supplier Engagement: DaVita likely engages with its suppliers to promote the adoption of sustainable manufacturing processes and reduce packaging waste.

- Logistics Optimization: Efforts to optimize transportation routes and modes for medical supplies can lead to reduced fuel consumption and emissions.

- Circular Economy Principles: Implementing circular economy principles, such as recycling and remanufacturing of medical equipment, can minimize resource depletion and waste.

- Reporting and Transparency: DaVita's commitment to sustainability may involve transparent reporting on its supply chain's environmental performance, potentially aligning with frameworks like the Global Reporting Initiative (GRI).

DaVita is making significant strides in environmental stewardship, aiming to match 100% of its global operations with renewable energy purchases by 2025 through strategic virtual power purchase agreements.

The company is also a leader in water conservation, saving over 75 million gallons in 2024, putting it on track to meet its 2025 goal of saving 240 million gallons since 2021.

Navigating evolving environmental regulations for medical waste management, including those from the EPA and CDC, is critical for DaVita's compliance and operational costs.

DaVita's commitment extends to its supply chain, focusing on supplier engagement and logistics optimization to reduce its overall environmental footprint.

| Environmental Focus | 2024/2025 Target/Status | Impact |

|---|---|---|

| Renewable Energy Purchases | 100% global operations match by 2025 | Reduced carbon footprint |

| Water Conservation | Saved >75 million gallons in 2024; 240 million gallon cumulative goal by 2025 | Resource efficiency, lower operational costs |

| Medical Waste Management | Adherence to evolving EPA/CDC regulations | Compliance, public health protection, cost management |

| Supply Chain Sustainability | Supplier engagement, logistics optimization | Reduced emissions, waste reduction |

PESTLE Analysis Data Sources

Our DaVita PESTLE Analysis is constructed using a blend of public government data, industry-specific reports, and reputable economic indicators. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the kidney care sector.