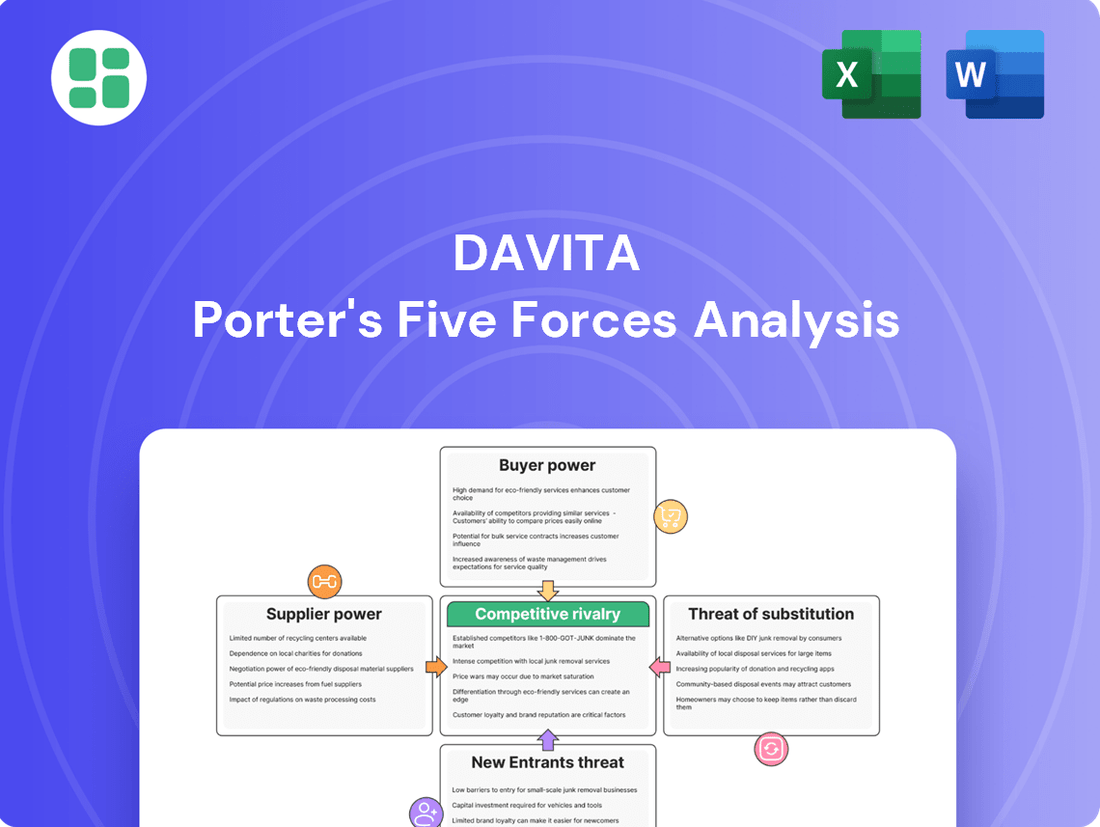

DaVita Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DaVita Bundle

DaVita's competitive landscape is shaped by powerful forces, from the bargaining power of its numerous patients and payers to the intense rivalry among dialysis providers. Understanding these dynamics is crucial for navigating the healthcare market.

The full Porter's Five Forces Analysis reveals the real forces shaping DaVita’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DaVita's reliance on a concentrated group of suppliers for critical items like dialysis machines and dialyzers significantly boosts supplier bargaining power. With fewer alternative sources for these specialized medical supplies, suppliers can dictate terms more effectively.

The proprietary nature of certain medical technologies further solidifies this leverage. For instance, manufacturers of advanced dialysis equipment often hold patents, limiting competition and giving them a stronger hand in negotiations with DaVita.

The cost and complexity involved in switching suppliers for highly specialized dialysis equipment and integrated systems can be substantial for DaVita. This includes significant expenses related to retraining staff on new machinery, reconfiguring existing facilities to accommodate different equipment footprints, and ensuring seamless compatibility with DaVita's current IT infrastructure and patient management systems. For instance, in 2024, the average cost for a healthcare facility to implement new specialized medical equipment, including training and integration, can range from tens of thousands to hundreds of thousands of dollars per unit, depending on the complexity.

The inputs DaVita relies on, such as dialysis machines, essential medical supplies, and critical pharmaceuticals like erythropoiesis-stimulating agents (ESAs), are fundamental to its day-to-day operations. These are not just components; they are the very tools that enable DaVita to deliver its core dialysis services.

DaVita's ability to provide life-sustaining dialysis treatments is directly tied to the consistent availability and quality of these supplier-provided inputs. A disruption in the supply chain for any of these critical items could significantly impact DaVita's capacity to serve its patients.

In 2023, DaVita reported that the cost of care, which includes significant spending on medical supplies and pharmaceuticals, represented a substantial portion of its operating expenses. This highlights the sheer volume of these critical inputs and, consequently, the leverage suppliers can exert.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for companies like DaVita. While many common medical supplies might have several competing brands, the market for highly specialized dialysis equipment and certain life-sustaining drugs presents a more constrained landscape. This scarcity of readily available alternative inputs directly strengthens the bargaining position of existing suppliers, as DaVita faces limited options to effectively counter price hikes or unfavorable contractual terms.

The limited substitutability in critical areas means DaVita often relies on a smaller pool of specialized suppliers. For instance, in 2024, the global dialysis equipment market was valued at approximately $14.5 billion, with a significant portion dominated by a few key manufacturers. This concentration of suppliers for essential, non-interchangeable components grants them considerable leverage in negotiations.

- Limited Substitutes for Specialized Dialysis Equipment: Many advanced dialysis machines and their proprietary components are produced by a select few companies, reducing DaVita's ability to switch suppliers without significant disruption or cost.

- Reliance on Patented or Unique Pharmaceuticals: Certain life-sustaining drugs critical for dialysis treatment may be protected by patents or have unique formulations, leaving DaVita with few, if any, alternative sources.

- Supplier Leverage Due to Input Scarcity: When alternative inputs are scarce or non-existent, suppliers can command higher prices and dictate terms, impacting DaVita's operational costs and profitability.

Labor Supply and Specialization

The availability of highly specialized medical professionals, like nephrologists, registered nurses, and dialysis technicians, forms a critical supplier group for DaVita. A scarcity of these skilled healthcare workers can significantly amplify their bargaining power, directly translating into increased labor costs and more challenging recruitment efforts.

The U.S. Bureau of Labor Statistics projected a 6% growth for registered nurses from 2022 to 2032, indicating a steady demand. For DaVita, this means that competition for qualified nursing staff remains a key factor influencing operational costs and service delivery capabilities.

- Specialized Workforce: Nephrologists, RNs, and dialysis technicians are essential for DaVita's operations.

- Labor Shortages: A limited supply of these professionals can drive up wages and complicate hiring.

- Regulatory Scrutiny: The FTC's investigation into noncompete agreements with medical directors could affect labor mobility and DaVita's ability to retain key personnel.

DaVita's suppliers, particularly those providing specialized dialysis equipment and proprietary pharmaceuticals, hold significant bargaining power. This is due to the limited availability of substitutes and the high switching costs associated with these critical inputs, directly impacting DaVita's operational expenses.

The concentration of manufacturers in the dialysis equipment market, with a few key players dominating in 2024, allows them to dictate terms. Furthermore, the scarcity of specialized healthcare professionals, such as nephrologists and dialysis technicians, also empowers labor suppliers, driving up recruitment and retention costs for DaVita.

The bargaining power of suppliers is amplified by the essential nature of their products and services for DaVita's core operations. In 2023, medical supplies and pharmaceuticals constituted a substantial part of DaVita's operating expenses, underscoring the financial leverage suppliers possess.

| Supplier Group | Key Inputs/Services | Factors Influencing Bargaining Power | Impact on DaVita |

|---|---|---|---|

| Equipment Manufacturers | Dialysis machines, proprietary components | Limited substitutes, high switching costs, patent protection | Higher equipment costs, potential supply chain disruptions |

| Pharmaceutical Suppliers | ESAs, other dialysis-related drugs | Patent protection, limited alternative sources | Increased drug costs, reliance on specific formulations |

| Skilled Healthcare Professionals | Nephrologists, RNs, technicians | Labor shortages, specialized skill sets | Higher labor costs, recruitment challenges |

What is included in the product

This analysis dissects the competitive landscape for DaVita by examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the dialysis industry.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, making complex market dynamics easy to grasp.

Customers Bargaining Power

While patients with chronic kidney failure are undeniably dependent on dialysis for survival, their individual bargaining power is generally constrained. This dependence stems from the critical nature of the treatment, making immediate access paramount. In 2024, DaVita, like other dialysis providers, operates within a system where patient choices can be influenced by physician recommendations and the availability of facilities in their local area, particularly in regions with fewer options.

Government payers, particularly Medicare and Medicaid, wield significant influence over DaVita's revenue as they cover a substantial portion of End-Stage Renal Disease (ESRD) treatments in the U.S. Their ability to set reimbursement rates and shape payment policies gives them considerable bargaining power. For instance, the Centers for Medicare & Medicaid Services (CMS) projected a 2.7% increase in Medicare payment rates for dialysis in 2025, a change that directly affects DaVita's financial performance.

Private insurance companies are a major customer group for DaVita, wielding significant power to negotiate favorable reimbursement rates and contract terms. Their ability to influence pricing is a key factor in DaVita's revenue structure.

The increasing enrollment of End-Stage Renal Disease (ESRD) beneficiaries into Medicare Advantage plans, a trend observed since 2021, has amplified the bargaining power of these private payers. This shift means more of DaVita's patient base is managed by private insurers, giving them greater leverage over reimbursement adequacy.

Availability of Alternative Providers

While the U.S. dialysis market is dominated by DaVita and Fresenius Medical Care, which together held approximately 70% of the market share as of late 2023, patients do have some alternative providers. These can include other large national chains, smaller regional operators, and hospital-affiliated dialysis centers. This fragmentation, though limited, provides a degree of choice for patients, influencing their bargaining power.

The availability of these alternatives, even if geographically constrained or dependent on insurance networks, means patients aren't entirely without options. For instance, in 2024, while DaVita and Fresenius operate thousands of clinics, there are still hundreds of independent and hospital-based facilities across the country. This creates a competitive dynamic where patients, to some extent, can seek out providers that better meet their needs or financial situations.

- Market Concentration: DaVita and Fresenius Medical Care accounted for roughly 70% of the U.S. dialysis market in late 2023.

- Alternative Providers: The market includes other national chains, regional operators, and hospital-based units, offering some patient choice.

- Geographic and Network Limitations: Patient choice is often influenced by proximity to facilities and insurance network participation.

- Competitive Influence: The presence of alternatives, however limited, contributes to patient bargaining power.

Shift Towards Value-Based Care and Home Dialysis

The growing shift towards value-based care and government initiatives promoting home dialysis and transplantation significantly bolsters the bargaining power of DaVita's customers. These programs empower patients with greater control over their treatment, leading to increased price sensitivity and a demand for more personalized, cost-effective solutions.

The Advancing American Kidney Health initiative, for instance, set an ambitious goal for 80% of new End-Stage Renal Disease (ESRD) patients to opt for home dialysis or transplantation by 2025. This policy directly influences patient choice, allowing them to seek out providers and treatment models that best align with their preferences and financial considerations, thereby increasing pressure on established providers like DaVita.

- Increased Patient Choice: Patients are no longer limited to traditional in-center hemodialysis, gaining more options like home hemodialysis and peritoneal dialysis.

- Government Incentives: Policies encouraging home dialysis and transplantation reduce reliance on in-center facilities, giving patients leverage.

- Focus on Outcomes: Value-based care models tie reimbursement to patient outcomes, incentivizing providers to offer competitive pricing and superior service to attract and retain patients.

- Cost Sensitivity: As patients become more involved in managing their healthcare costs, they are more likely to compare prices and negotiate for better terms.

While individual patients have limited direct bargaining power due to their critical need for dialysis, their collective influence is amplified by government payers and private insurers. These entities, particularly Medicare and Medicaid, set reimbursement rates, directly impacting DaVita's revenue. The increasing enrollment in Medicare Advantage plans further consolidates this power with private insurers.

| Customer Segment | Bargaining Power Influence | Key Drivers |

|---|---|---|

| Individual Patients | Low to Moderate | Dependence on treatment, limited choice due to geography and insurance networks. |

| Government Payers (Medicare/Medicaid) | High | Setting reimbursement rates, covering a substantial portion of costs. |

| Private Insurers (including Medicare Advantage) | High | Negotiating reimbursement rates and contract terms, increasing influence with growing Medicare Advantage enrollment. |

What You See Is What You Get

DaVita Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You are viewing a comprehensive Porter's Five Forces analysis of DaVita, detailing the competitive landscape and strategic implications for the dialysis provider. This in-depth report covers the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products or services, providing actionable insights for understanding DaVita's market position.

Rivalry Among Competitors

The U.S. dialysis market is a prime example of high industry concentration. DaVita Inc. and Fresenius Medical Care stand as the two titans, together commanding more than two-thirds of all outpatient dialysis clinics. This significant market share held by just two entities fuels a fierce rivalry.

This duopoly means DaVita and Fresenius are in constant competition, not just for new patients but also for securing favorable contracts with insurers and maintaining patient loyalty. The battle for market share is intense, directly impacting pricing power and operational strategies for both companies.

The dialysis sector, including major players like DaVita, faces intense rivalry driven by substantial fixed costs. Establishing and equipping dialysis centers requires significant capital investment in specialized machinery and facilities. This financial burden necessitates high patient volumes to spread costs and achieve profitability.

This pressure to maximize capacity utilization often fuels aggressive competition among providers vying for patients. In 2024, DaVita operates a vast network of over 3,000 outpatient dialysis centers across the United States, underscoring the scale of fixed asset investment required in this industry.

DaVita's competitive rivalry is intensified by limited service differentiation, particularly in its core in-center hemodialysis treatments. The actual medical procedure is largely standardized across providers, making it challenging for DaVita to stand out based on the treatment itself. This forces competition to pivot towards less tangible aspects.

Consequently, DaVita and its rivals often compete on factors like patient experience, the comfort and ambiance of their facilities, and the convenience of their locations. Strong relationships with nephrologists and referring physicians also play a crucial role in patient acquisition and retention, becoming key battlegrounds in this highly competitive landscape.

Regulatory and Reimbursement Environment

The kidney care sector operates within a highly regulated framework, with Medicare and Medicaid reimbursement policies being central to competitive rivalry. These government programs dictate much of the financial landscape, influencing how providers like DaVita are compensated for their services.

Shifts in payment rates and the introduction of quality incentive programs directly affect provider profitability and necessitate ongoing strategic adjustments. For instance, the Centers for Medicare & Medicaid Services (CMS) announced a 3.1% increase in the End-Stage Renal Disease Prospective Payment System (ESRD PPS) rate for 2024, reflecting these evolving reimbursement dynamics.

- Medicare and Medicaid Reimbursement: These government programs are the primary payers for kidney care services, directly impacting revenue streams.

- Payment Rate Adjustments: Annual updates to reimbursement rates, such as the 2024 ESRD PPS increase, significantly influence provider financial performance.

- Quality Incentive Programs: Performance-based payment adjustments encourage providers to meet specific quality benchmarks, shaping operational strategies.

Competition in Physician Relationships and Non-Compete Clauses

Competition in the dialysis sector is intense, not just for patients but also for securing and maintaining strong relationships with nephrologists and medical directors. These physicians are vital as they influence patient referrals, making their loyalty a key competitive advantage for DaVita.

The landscape is further complicated by scrutiny over non-compete clauses. In 2024, the Federal Trade Commission (FTC) continued its investigation into DaVita and Fresenius Medical Care concerning these clauses in their contracts with medical directors. This focus highlights concerns about physician mobility and how such agreements might restrict competitive access to crucial medical talent.

- Physician Loyalty as a Competitive Factor: Nephrologists and medical directors are gatekeepers for patient referrals, making their relationships a critical battleground for dialysis providers.

- FTC Scrutiny on Non-Competes: In 2024, the FTC's ongoing investigation into DaVita and Fresenius Medical Care's non-compete agreements with medical directors signals potential shifts in physician employment flexibility.

- Impact on Talent Acquisition: Restrictions on physician mobility could limit DaVita's ability to attract and retain top medical talent, directly affecting its competitive standing.

The competitive rivalry within the dialysis industry is exceptionally high, primarily due to market concentration. DaVita and Fresenius Medical Care dominate the U.S. market, each operating thousands of clinics. This duopoly means they are in constant competition for patients, favorable payer contracts, and physician loyalty, driving aggressive strategies.

The substantial fixed costs associated with establishing and maintaining dialysis centers, like DaVita's over 3,000 U.S. locations in 2024, necessitate high patient volumes. This financial pressure intensifies competition as providers strive to maximize capacity utilization.

Service differentiation is limited, especially in core treatments, forcing competition onto factors like patient experience, facility convenience, and physician relationships. The Federal Trade Commission's 2024 scrutiny of non-compete clauses between DaVita, Fresenius, and medical directors further highlights the competition for medical talent and its impact on patient access.

| Provider | Approximate U.S. Clinic Count (2024) | Market Share (Approximate) |

|---|---|---|

| DaVita | 3,000+ | ~35-40% |

| Fresenius Medical Care | 2,600+ | ~30-35% |

SSubstitutes Threaten

Kidney transplantation is frequently viewed as the best long-term solution for End-Stage Renal Disease (ESRD), often leading to a better quality of life and potentially extended survival compared to dialysis. In 2024, the demand for kidney transplants continues to outpace the supply of donor organs, with over 90,000 individuals on the national waiting list in the US alone.

Despite the persistent donor shortage, ongoing advancements in transplant techniques and broader initiatives aimed at increasing organ availability represent a growing, albeit indirect, substitute threat to the sustained reliance on dialysis services. For instance, the development of xenotransplantation and improved organ preservation methods could eventually broaden access to transplants, impacting the dialysis market.

Home-based dialysis options, specifically peritoneal dialysis (PD) and home hemodialysis (HHD), are significant substitutes for traditional in-center hemodialysis. These alternatives provide patients with enhanced autonomy and flexibility in managing their treatment schedules. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize increasing home dialysis utilization, reflecting a broader trend towards patient-centered care.

Technological progress in portable dialysis devices and sophisticated remote monitoring systems is further bolstering the appeal and practicality of home dialysis. This accessibility means more patients can opt for treatment in the comfort of their own homes, reducing reliance on brick-and-mortar dialysis centers and potentially impacting DaVita's market share in traditional settings.

For some patients, especially older individuals or those with multiple health issues, choosing conservative management or palliative care instead of dialysis is a significant alternative. This decision directly impacts the potential patient base for dialysis providers like DaVita.

In 2024, the decision to opt out of dialysis in favor of comfort-focused care reflects a growing emphasis on patient autonomy and quality of life. While specific figures on this trend are still emerging, the aging U.S. population, with over 56 million adults aged 65 and older in 2023, suggests a rising number of individuals facing such choices.

Advancements in Pharmaceutical Interventions

The threat of substitutes for DaVita's dialysis services is escalating due to significant advancements in pharmaceutical interventions. Ongoing research and development are focused on slowing the progression of chronic kidney disease (CKD) or managing its complications. This could potentially delay or even negate the need for traditional dialysis treatments.

New classes of drugs, such as GLP-1 receptor agonists and SGLT2 inhibitors, are showing promising results in CKD management. For instance, studies in 2024 have highlighted the potential of these medications to improve kidney function and reduce the rate of disease progression. This directly impacts the long-term demand for dialysis services.

- Pharmaceuticals delaying CKD progression: Research continues to identify drugs that can slow the advancement of kidney disease, potentially reducing the patient pool requiring dialysis.

- Emerging drug classes: GLP-1s and SGLT2s are being investigated for their therapeutic benefits in managing CKD complications, offering an alternative to dialysis.

- Impact on demand: Successful drug development could significantly decrease the reliance on and demand for dialysis, representing a substantial substitute threat.

Emerging Technologies (Wearable Artificial Kidneys, Bioengineered Kidneys)

The long-term threat of substitutes for traditional dialysis centers like DaVita is significant, driven by emerging technologies in kidney replacement therapy. Innovations such as wearable artificial kidneys and bioengineered kidneys, while still in developmental phases, represent a fundamental shift. These advancements aim to offer more convenient, continuous, or even potentially curative solutions, which could drastically alter the landscape of kidney care and reduce reliance on current dialysis models.

These disruptive technologies could offer patients greater autonomy and a higher quality of life compared to current dialysis methods. For instance, wearable artificial kidneys promise to integrate seamlessly into a patient's daily routine, eliminating the need for frequent visits to dialysis centers. Bioengineered kidneys, on the other hand, aim to provide a more permanent solution through regenerative medicine, potentially eliminating the need for any external device or treatment altogether.

While these technologies are not yet widely available or commercially viable, their potential impact is substantial. The development pipeline includes significant research and investment, indicating a future where patients might have alternatives that bypass the traditional dialysis center model. For example, research into implantable bioartificial kidneys has shown promising results in early-stage trials, suggesting a gradual but impactful shift in treatment paradigms over the next decade and beyond.

- Wearable Artificial Kidneys: Focus on portability and continuous treatment, reducing patient burden.

- Bioengineered Kidneys: Aim for regenerative solutions, potentially offering a cure rather than management.

- Market Disruption: These technologies could significantly reduce the demand for traditional dialysis services in the long term.

- Investment Trends: Venture capital funding for biotech companies developing these solutions has seen a steady increase, signaling growing confidence in their future viability.

Kidney transplantation remains a significant long-term substitute, though organ shortages persist; in 2024, over 90,000 individuals in the U.S. were on the national waiting list for a kidney. Home-based dialysis options, like peritoneal dialysis and home hemodialysis, are gaining traction, supported by CMS initiatives in 2024 to boost their utilization, offering patients greater autonomy. Furthermore, advancements in pharmaceuticals, such as GLP-1 receptor agonists and SGLT2 inhibitors, are showing promise in slowing CKD progression, potentially delaying or negating the need for dialysis.

Entrants Threaten

The dialysis industry presents a formidable threat of new entrants, largely due to the immense capital investment required. Establishing a single dialysis center necessitates significant outlays for specialized equipment like dialysis machines, advanced water purification systems, and the physical construction or renovation of facilities. For instance, the cost to build and equip a new dialysis clinic can easily run into millions of dollars, a substantial hurdle for any aspiring competitor.

The kidney care sector faces significant barriers to entry due to stringent federal and state regulations. New companies must navigate complex licensing, certification processes, and rigorous quality and safety standards. This regulatory landscape is not only time-consuming but also incurs substantial costs, effectively deterring potential new competitors from entering the market.

The dialysis industry, including companies like DaVita, thrives on established patient referral networks. Success hinges on strong relationships with nephrologists and other physicians who direct patients to dialysis centers. New entrants face a significant hurdle in replicating these deep-seated, long-term referral relationships that incumbents have cultivated over years, making market entry difficult.

Specialized Talent Acquisition and Retention

The threat of new entrants in the dialysis industry is significantly amplified by the intense competition for specialized talent. DaVita, like other established players, relies on a highly skilled workforce, including nephrologists, registered nurses, and dialysis technicians. These professionals are not only crucial for patient care but are also in high demand across the healthcare sector.

New companies attempting to enter this market would face substantial hurdles in attracting and retaining this essential personnel. The existing shortage of qualified healthcare professionals, particularly those with specialized dialysis experience, means that new entrants would likely have to offer premium compensation and benefits to even compete for talent. For instance, as of early 2024, the demand for registered nurses in the US continued to outstrip supply, with projections indicating a persistent shortage for years to come, making recruitment a critical challenge for any new healthcare provider.

- High Demand for Specialized Healthcare Professionals: The dialysis sector requires a specific skill set, including nephrologists, specialized nurses, and technicians.

- Recruitment Challenges for New Entrants: New companies must overcome significant obstacles in attracting and retaining this sought-after talent pool.

- Competitive Labor Market: Existing providers already have established relationships and potentially more attractive compensation packages, creating a difficult environment for new entrants to build their workforce.

- Impact of Healthcare Staffing Shortages: Broader trends in healthcare staffing shortages, such as the ongoing demand for registered nurses, exacerbate the difficulty for new dialysis providers to secure the necessary human capital.

Economies of Scale and Cost Advantages of Incumbents

DaVita, as a major player in the dialysis market, leverages substantial economies of scale. This allows them to negotiate better prices for medical supplies and services, a crucial advantage. For instance, in 2023, the dialysis market saw continued consolidation, with larger providers like DaVita and Fresenius Medical Care dominating. This scale translates into lower per-unit costs for everything from dialyzers to pharmaceuticals, making it difficult for smaller, newer facilities to compete on price.

New entrants face a significant hurdle in matching the cost efficiencies enjoyed by established companies. DaVita's extensive network also provides leverage in negotiating reimbursement rates with insurance providers and government programs. In 2024, payer negotiations remain a critical factor in profitability for dialysis providers. A new entrant would need to build a similar scale to achieve comparable bargaining power, a costly and time-consuming endeavor.

These cost advantages create a substantial barrier to entry. New facilities would likely incur higher operating expenses due to less favorable purchasing agreements and administrative overhead. This puts them at a distinct disadvantage when trying to attract patients who are often sensitive to both the quality of care and the cost of treatment.

- Economies of Scale: Large providers like DaVita benefit from bulk purchasing of medical supplies, reducing per-unit costs.

- Negotiating Power: Established companies have stronger leverage with payers, securing more favorable reimbursement rates.

- Administrative Efficiencies: A larger operational footprint allows for spreading fixed administrative costs over a greater volume of services.

- Competitive Disadvantage: New entrants struggle to achieve similar cost structures, impacting their pricing and profitability potential.

The threat of new entrants in the dialysis sector is considerably low, primarily due to the substantial capital investment required to establish and operate dialysis facilities. These costs encompass specialized equipment, advanced water purification systems, and facility build-outs, often totaling millions of dollars per clinic. Furthermore, stringent federal and state regulations, including complex licensing and certification processes, create significant administrative and financial hurdles for any new player aiming to enter the market.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for specialized equipment and facilities. | Significant financial barrier, limiting the number of potential entrants. |

| Regulatory Hurdles | Complex licensing, certification, and quality standards. | Time-consuming and costly compliance, deterring new companies. |

| Established Referral Networks | Strong relationships with nephrologists and physicians. | Difficulty in replicating existing patient flow and market access. |

| Skilled Labor Demand | High demand for specialized healthcare professionals. | Intense competition for talent, requiring attractive compensation packages. |

| Economies of Scale | Lower per-unit costs for supplies and better payer negotiations. | Disadvantage for new entrants in pricing and profitability. |

Porter's Five Forces Analysis Data Sources

Our DaVita Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, industry-specific market research reports, and regulatory filings from healthcare authorities. These sources provide essential data on market trends, competitive landscapes, and operational costs.