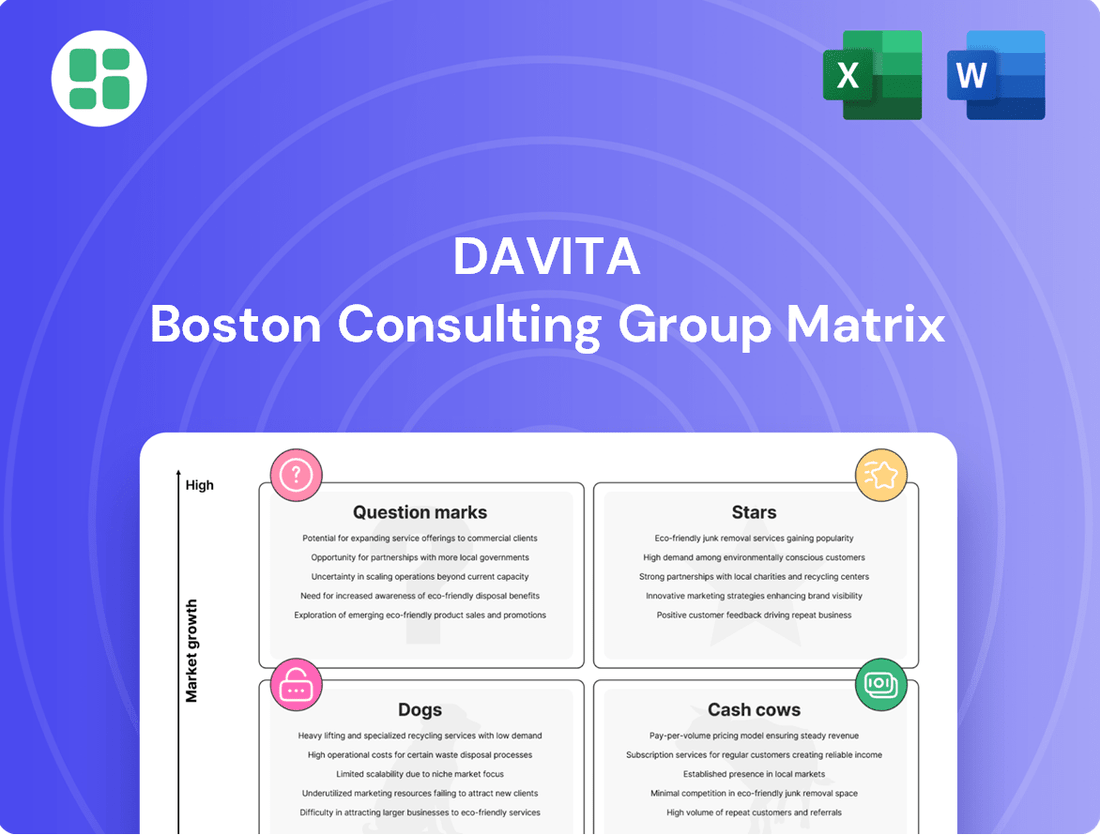

DaVita Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DaVita Bundle

Curious about how DaVita's diverse service offerings perform in the market? This snapshot offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full strategic potential by purchasing the complete DaVita BCG Matrix for a detailed breakdown and actionable insights to guide your investment decisions.

Stars

DaVita's Integrated Kidney Care (IKC) programs represent a significant growth opportunity, aligning with the healthcare industry's move toward value-based care. These initiatives focus on proactive management of chronic kidney disease, aiming to reduce hospitalizations and enhance patient well-being. By October 2024, DaVita is set to double its Kidney Contracting Entities (KCEs) to 22, a clear signal of market acceptance and future expansion potential.

Home dialysis services represent a burgeoning area in kidney care, largely due to patients favoring the flexibility and better health results associated with this approach. DaVita, as the leading provider of home dialysis in the United States, is well-positioned to capitalize on this growing trend.

The market for home dialysis systems is set for substantial expansion. Projections indicate a compound annual growth rate of 10.5% between 2024 and 2033, highlighting its importance as a significant growth engine for DaVita's overall business strategy.

DaVita's international expansion, especially in emerging markets, represents a significant growth avenue. These regions often experience increasing rates of kidney disease and a growing demand for sophisticated healthcare services, positioning DaVita to capture substantial market share as their infrastructure matures.

The company’s commitment to this segment is evident with the opening of six new international centers in Q2 2025. This strategic move underscores DaVita’s focus on tapping into these high-potential markets and diversifying its global presence beyond its core U.S. operations.

Digital Health Solutions for Kidney Care

DaVita is actively investing in digital health solutions designed to improve the experience for kidney patients. These innovations focus on boosting patient engagement, providing better educational resources, and enabling remote monitoring.

These digital tools are becoming essential in healthcare, particularly for improving how care is coordinated and delivered efficiently. This is especially true within value-based care frameworks, where outcomes and efficiency are paramount.

DaVita's commitment to digital innovation is strategically positioning the company to capitalize on the expanding market for technology-driven healthcare services within the kidney care sector. For instance, by 2024, the global digital health market was projected to reach over $300 billion, with significant growth expected in patient-facing technologies.

- Patient Engagement: Digital platforms aim to make it easier for patients to manage their treatment plans and communicate with their care teams.

- Education Accessibility: Providing readily available digital educational materials empowers patients with knowledge about their condition and treatment options.

- Remote Monitoring Capabilities: Technologies that allow for remote tracking of vital signs and health indicators can lead to earlier interventions and better health outcomes.

- Value-Based Care Alignment: These digital solutions support the shift towards value-based care by improving efficiency and patient outcomes, a trend that saw significant investment in 2024, with digital health startups attracting billions in funding.

Kidney Transplant Support Services

Kidney transplant support services represent a high-growth, high-impact area for DaVita, aligning perfectly with its commitment to comprehensive kidney care. In 2024, DaVita achieved a significant milestone, with over 8,200 of its patients receiving life-saving kidney transplants, marking the highest number in the company's history. This focus on transplantation is a critical component of the integrated care model, aiming to dramatically improve patient outcomes and unlock substantial growth potential.

Facilitating kidney transplants is not just a service; it's a vital step in the patient's journey toward better health and quality of life. DaVita's dedication to this area underscores its strategic vision for the future of kidney care.

- High Growth Potential: The increasing demand for kidney transplants positions this service as a key growth driver for DaVita.

- Improved Patient Outcomes: Successful transplants significantly enhance patient survival rates and overall well-being.

- Strategic Alignment: Transplant support services are central to DaVita's integrated care strategy, offering a holistic approach to kidney disease management.

- Record Transplant Numbers: Over 8,200 DaVita patients received transplants in 2024, a testament to the program's success and scale.

DaVita's Integrated Kidney Care (IKC) programs are positioned as Stars within the BCG Matrix, representing high-growth, high-market-share areas. These programs are crucial for DaVita's future, aligning with the shift towards value-based care and proactive disease management.

The company's expansion of Kidney Contracting Entities (KCEs) to 22 by October 2024 highlights the strong market acceptance and growth trajectory of IKC. This strategic move is expected to drive significant revenue and market share gains.

Home dialysis services are another key Star, benefiting from patient preference for convenience and improved health outcomes, a trend projected to grow at a 10.5% CAGR from 2024 to 2033. DaVita's leadership in this segment further solidifies its Star status.

Digital health solutions, aimed at enhancing patient engagement and remote monitoring, also fall into the Star category due to the rapidly expanding global digital health market, which was projected to exceed $300 billion in 2024. These innovations are vital for improving care coordination and outcomes.

Kidney transplant support services are a definitive Star, evidenced by DaVita's record of over 8,200 patient transplants in 2024. This high-impact service area offers substantial growth potential and aligns with the company's comprehensive care model.

| BCG Category | DaVita Business Segment | Market Growth | Market Share | Strategic Rationale |

|---|---|---|---|---|

| Stars | Integrated Kidney Care (IKC) | High | High | Strong market acceptance, value-based care alignment, expansion of KCEs to 22 by Oct 2024. |

| Stars | Home Dialysis Services | High (10.5% CAGR 2024-2033) | High (Leading Provider) | Patient preference for flexibility and better outcomes, significant market expansion potential. |

| Stars | Digital Health Solutions | High (Global digital health market >$300B in 2024) | Growing | Enhances patient engagement, remote monitoring, and care coordination; supports value-based care. |

| Stars | Kidney Transplant Support | High | High (Record 8,200+ transplants in 2024) | Improves patient outcomes, central to integrated care, significant growth opportunity. |

What is included in the product

The DaVita BCG Matrix provides a framework for analyzing its business units based on market growth and share, guiding strategic decisions.

DaVita's BCG Matrix offers clarity by visually categorizing business units, alleviating the pain of strategic uncertainty.

Cash Cows

DaVita's in-center hemodialysis operations in the U.S. are a classic Cash Cow. With 2,675 centers and over 200,800 patients served as of late 2023, it holds a significant 37% share of the U.S. dialysis market.

This segment is DaVita's financial engine, consistently producing strong revenue and cash flow. While the market is mature and faces some volume challenges, its leadership position ensures continued profitability.

Managed care and commercial payer contracts are a significant cash cow for DaVita. While these contracts represented about 33% of DaVita's revenues in 2023, they generated substantially higher reimbursement rates compared to government programs. This higher margin translates into consistent and strong cash flow, a vital component for funding other business initiatives.

Vascular access management services are a vital component of DaVita's operations, functioning as a classic Cash Cow within its business portfolio. These mature services, essential for effective dialysis, benefit from established demand and contribute reliably to the company's revenue. In 2024, DaVita continued to emphasize these critical ancillary services, leveraging its extensive patient base and existing infrastructure to ensure consistent cash flow generation.

Kidney Smart® Education Program

The Kidney Smart® Education Program from DaVita plays a crucial role in their business strategy, even if it doesn't directly bring in cash. This program educates a significant number of people each year about kidney disease, aiming to improve their understanding and management of the condition.

While its primary function isn't revenue generation, Kidney Smart® is instrumental in strengthening DaVita's core operations. By fostering better patient engagement and potentially leading to improved health outcomes, it helps keep patients within DaVita's network. This enhanced patient retention and earlier identification of individuals needing care are key factors that support DaVita's established cash cow status by ensuring a consistent patient base for their primary services.

- Program Reach: Engages tens of thousands of individuals annually.

- Indirect Support: Enhances patient engagement and improves outcomes.

- Ecosystem Benefit: Facilitates earlier patient identification and retention.

- Cash Cow Foundation: Underpins DaVita's established position by ensuring a stable patient base.

Established International Dialysis Centers

DaVita's established international dialysis centers, numbering 367 across 11 countries and serving 49,400 patients, are prime examples of Cash Cows in their BCG Matrix. These centers, particularly those in well-developed markets, generate consistent and predictable revenue, providing a stable cash flow for the company. This international presence not only diversifies DaVita's geographic risk but also allows it to capitalize on its extensive operational expertise on a global scale. The consistent income stream from these mature operations is a significant contributor to DaVita's overall financial health.

Key characteristics of these Cash Cows include:

- Stable Revenue Generation: These centers operate in mature markets with established patient bases, ensuring a reliable and consistent income stream.

- Diversified Geographic Footprint: With operations in 11 countries, DaVita reduces its reliance on any single market, mitigating country-specific risks.

- Leveraging Global Expertise: DaVita's experience in managing dialysis operations worldwide allows these centers to run efficiently and profitably.

- Proven Income Stream: These established facilities represent a proven, dependable source of cash flow, supporting other business ventures and investments.

DaVita's U.S. in-center hemodialysis operations, serving over 200,800 patients in 2,675 centers as of late 2023, are a definitive Cash Cow. This segment consistently generates substantial revenue and cash flow, benefiting from a significant 37% market share despite market maturity.

Managed care and commercial payer contracts are another vital Cash Cow, contributing about 33% of DaVita's 2023 revenue. These contracts yield higher reimbursement rates than government programs, translating into strong and consistent cash flow essential for funding other business initiatives.

Vascular access management services are a reliable Cash Cow, capitalizing on established demand and DaVita's extensive patient base. In 2024, these essential ancillary services continued to be a focus, ensuring consistent cash flow generation through existing infrastructure.

DaVita's international dialysis centers, with 367 locations across 11 countries serving 49,400 patients, are also key Cash Cows. These mature operations in developed markets provide stable, predictable revenue and cash flow, diversifying geographic risk and leveraging global expertise.

| Business Segment | BCG Category | Key Financial Characteristic | Market Position | Data Point (Late 2023/2024) |

| U.S. In-Center Hemodialysis | Cash Cow | Strong, consistent cash flow | 37% U.S. market share | 2,675 centers, 200,800+ patients |

| Managed Care/Commercial Contracts | Cash Cow | Higher reimbursement rates, strong margins | Significant revenue contributor | ~33% of 2023 revenue |

| Vascular Access Management | Cash Cow | Reliable revenue from established demand | Integral to operations | Continued emphasis in 2024 |

| International Dialysis Centers | Cash Cow | Stable, predictable revenue and cash flow | Operations in 11 countries | 367 centers, 49,400 patients |

Full Transparency, Always

DaVita BCG Matrix

The DaVita BCG Matrix preview you're examining is the definitive document you'll receive immediately after your purchase. This means no altered content or watermarks, ensuring you get the fully prepared strategic tool as presented. You can confidently use this preview as an accurate representation of the professional-grade BCG Matrix analysis that will be yours to implement.

Dogs

DaVita's underperforming U.S. dialysis centers are positioned as Dogs in the BCG Matrix. The company incurred approximately $100 million in closure-related charges during 2024 as it strategically exited these less viable locations.

These centers likely struggle with low patient utilization, elevated operational expenses, or less favorable reimbursement structures, hindering their profitability and cash flow generation. DaVita's ongoing network optimization efforts aim to streamline operations and improve overall efficiency by shedding these underperforming assets.

DaVita's legacy IT systems and infrastructure can be viewed as potential 'dogs' in a BCG matrix analysis, particularly given the significant investment in IT infrastructure that contributed to short-term liquidity challenges and negative free cash flow in Q1 2025. This financial strain was exacerbated by a cyber incident that negatively impacted revenue and treatment volumes, highlighting the vulnerabilities often associated with older systems.

These aging systems, if not undergoing active replacement or substantial upgrades, represent a drain on resources. Their high maintenance costs, inherent security vulnerabilities, and the way they hinder overall operational efficiency are characteristic traits of 'dog' assets that require careful management or divestment.

Services heavily reliant on government reimbursement, such as those covered by Medicare and Medicaid, can be considered dogs in DaVita's BCG matrix. Despite government programs covering most patients, their reimbursement rates are considerably lower than commercial insurance. For instance, Medicare Part B reimbursement rates saw a modest increase of 3.1% in 2024, which may not keep pace with rising operational costs.

Aging Infrastructure in Select Clinics

Aging infrastructure in select DaVita clinics presents a challenge, potentially requiring substantial capital for upgrades to stay competitive or meet regulatory standards. These older facilities, often located in areas with limited patient bases, may not generate sufficient returns to justify the investment, acting as resource drains rather than growth drivers.

For instance, a clinic built in the 1990s might struggle with outdated equipment and inefficient layouts, leading to higher operating costs and a less appealing patient experience compared to newer facilities. Without a clear strategy for modernization or potential divestment, these clinics can become financial burdens.

- Capital Expenditure Strain: Older clinics may need significant investment for modernization, impacting overall profitability.

- Limited Growth Potential: Some aging facilities are in locations with declining patient populations, hindering revenue growth.

- Operational Inefficiencies: Outdated infrastructure can lead to higher maintenance costs and reduced operational efficiency.

Certain Non-Core Divested Operations

DaVita's strategic divestiture of certain non-core operations, such as those in Curaçao, Guatemala, and Peru, directly impacts its BCG Matrix positioning. These divested segments, likely representing underperforming assets, are categorized as 'Dogs'. Their removal from DaVita's portfolio in 2024, which contributed to a revenue decline in specific segments, signifies a proactive move to streamline operations and concentrate on more profitable core businesses.

The decision to divest these international operations suggests they were not generating sufficient returns or were misaligned with DaVita's long-term growth strategy. This action aligns with the principles of the BCG Matrix, where 'Dogs' are businesses with low market share and low growth potential, often divested to reallocate capital to more promising ventures.

For instance, DaVita reported a 1.5% decrease in total revenue for the first quarter of 2024 compared to the prior year, partly attributable to these strategic exits. This financial data underscores the 'Dog' classification, as these operations were likely consuming resources without contributing significantly to overall growth or profitability.

- Divestiture of non-core international assets (Curaçao, Guatemala, Peru)

- Impacted Q1 2024 revenue, contributing to a 1.5% year-over-year decline in total revenue

- Indicative of 'Dogs' in the BCG Matrix due to low profitability and strategic misalignment

- Focus on optimizing resource allocation towards core, higher-growth business segments

DaVita's underperforming U.S. dialysis centers are classified as Dogs in the BCG Matrix, with the company incurring approximately $100 million in closure-related charges during 2024 for exiting these less viable locations.

These centers face challenges like low patient utilization and high operational costs, hindering profitability; DaVita's network optimization aims to shed these underperforming assets for improved efficiency.

Aging infrastructure in select DaVita clinics, potentially needing significant capital for modernization and located in areas with limited patient bases, may not generate sufficient returns, acting as resource drains.

DaVita's strategic divestiture of non-core international operations in Curaçao, Guatemala, and Peru in 2024, which contributed to a 1.5% decrease in total revenue for Q1 2024, exemplifies 'Dogs' due to low profitability and strategic misalignment.

Question Marks

DaVita's foray into early-stage digital health, like AI for diagnostics or predictive analytics in kidney disease management, positions it in a high-growth potential market. These ventures are currently in development, demanding significant capital for R&D and implementation, aligning with the characteristics of a question mark in the BCG matrix.

The success of these innovative digital health solutions hinges on achieving widespread market adoption and demonstrating clear value. DaVita's investment here reflects a strategic bet on future market leadership, requiring substantial resources to nurture these nascent technologies into established offerings.

Expanding into new, untapped international markets represents a classic 'Question Mark' scenario for DaVita. While these markets offer significant growth potential, they also come with substantial risks and require considerable investment to establish a foothold. DaVita's strategy here involves careful market research and adaptation to build initial market share.

In 2024, the global healthcare market continued its upward trajectory, with emerging markets showing particularly strong growth. For instance, the dialysis market in Southeast Asia was projected to grow at a CAGR of over 7% through 2026, presenting an attractive, albeit nascent, opportunity for DaVita. However, navigating regulatory landscapes and cultural differences in these regions demands significant upfront capital and tailored operational strategies.

Developing specialized kidney care for rare conditions fits the 'question mark' category in the BCG matrix. These services cater to a small patient base, meaning immediate market share is limited. However, the high unmet needs in these niche areas present a significant growth opportunity, especially with the potential for premium pricing due to the specialized expertise required.

For instance, DaVita's investment in advanced diagnostics and tailored treatment protocols for conditions like Fabry disease or Alport syndrome, while initially costly, could yield substantial returns if these services gain traction. The market for rare kidney diseases, though small, is growing, with estimates suggesting that rare diseases collectively affect millions worldwide, creating a demand for focused care solutions.

Value-Based Care Models Beyond ESRD

DaVita's existing Integrated Kidney Care (IKC) programs demonstrate success in value-based care for End-Stage Renal Disease (ESRD). However, expanding into earlier stages of Chronic Kidney Disease (CKD) or other chronic conditions presents a significant 'question mark' for the company.

This strategic pivot necessitates substantial investment in care coordination infrastructure and cultivating robust payer relationships. The market for these broader value-based models is still developing, creating uncertainty regarding adoption and reimbursement structures.

- Market Uncertainty: The early-stage CKD and comorbid chronic condition value-based care market is less mature than ESRD, with evolving payment models and payer acceptance.

- Infrastructure Investment: Significant upfront capital is required for technology, staffing, and processes to effectively manage care across a broader patient population.

- Payer Partnerships: Establishing and maintaining strong partnerships with payers is crucial for the success of these new models, requiring complex negotiations and alignment on quality metrics.

- Competitive Landscape: While DaVita has a strong ESRD foundation, new entrants and existing players are also exploring these earlier-stage value-based opportunities.

Advanced Research & Development Initiatives

DaVita's investment in cutting-edge research and development for next-generation kidney therapies, such as advanced dialysis technologies or regenerative medicine, falls squarely into the question mark category. These initiatives are capital-intensive, with uncertain timelines and outcomes, and currently generate no revenue or market share.

For instance, DaVita's commitment to R&D is substantial, with significant portions of their operating expenses allocated to innovation. While specific figures for uncommercialized R&D are not publicly itemized in a way that directly maps to the BCG matrix, their overall investment in innovation reflects this strategic focus. For example, in 2023, DaVita reported substantial spending on developing new treatment modalities and improving existing patient care technologies, aiming to address unmet needs in kidney disease management.

- High R&D Expenditure: DaVita allocates significant capital to exploring novel kidney disease treatments and technologies, a hallmark of question mark investments.

- Uncertain Commercialization: The success and market viability of these advanced R&D projects are not guaranteed, presenting a high degree of risk.

- Potential for Future Growth: If these initiatives prove successful, they could disrupt the market and evolve into future 'Stars' for DaVita, capturing significant market share.

- No Current Market Share: By definition, these pre-commercialization efforts currently contribute zero to DaVita's market share in existing product categories.

DaVita's exploration into early-stage digital health, such as AI for diagnostics or predictive analytics in kidney disease management, places it in a high-growth, yet uncertain, market. These ventures require substantial capital for research and development, mirroring the characteristics of a question mark.

The success of these digital health initiatives hinges on market adoption and demonstrating tangible value, representing a strategic investment in future leadership. DaVita's commitment to these nascent technologies underscores a calculated risk for potential long-term gains.

Expanding into new international markets presents a classic 'question mark' for DaVita, offering significant growth potential but also considerable risks and investment needs. Navigating diverse regulatory environments and cultural nuances in these regions demands tailored strategies and upfront capital.

In 2024, the global healthcare market, particularly in emerging economies, continued its expansion. For example, the Southeast Asian dialysis market was projected for a compound annual growth rate exceeding 7% through 2026, indicating a promising, albeit developing, opportunity for DaVita.

| Initiative | Market Potential | Investment Level | Current Market Share | Risk Factor |

| AI for Diagnostics | High | High | Low/None | High |

| Early-stage CKD Value-Based Care | High | High | Low | Medium |

| New International Markets | High | High | Low | High |

| Next-Gen Therapies (Regenerative Medicine) | Very High | Very High | None | Very High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth projections, to accurately position each business unit.