Datatec SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datatec Bundle

Datatec's market position is strong, but understanding its full potential requires a deeper dive. Our comprehensive SWOT analysis reveals the critical internal capabilities and external market forces shaping its future.

Want to truly grasp Datatec's competitive edge and potential challenges? Purchase the full SWOT analysis to unlock detailed insights, expert commentary, and actionable strategies for your own planning.

Strengths

Datatec's strength lies in its diverse global ICT solutions portfolio, operating through three key divisions: Westcon International for technology distribution, Logicalis for IT infrastructure and managed services, and Analysys Mason for ICT management consultancy. This structure creates a robust revenue stream, mitigating risks associated with any single business area.

This diversification across distribution, services, and consulting provides a broad revenue base and reduces reliance on any single market segment or offering. For instance, Westcon International's focus on cybersecurity and networking solutions complements Logicalis's expertise in cloud and digital transformation services.

The company's expansive global footprint, covering over 50 countries, significantly bolsters its resilience and market penetration. This allows Datatec to capitalize on varied regional demands and emerging growth prospects, as seen in its strong presence in North America and Europe, which together accounted for a significant portion of its revenue in recent fiscal periods.

Datatec's strategic emphasis on high-growth technology sectors like cybersecurity, digital transformation, cloud, data analytics, and IoT positions it well for future expansion. Westcon International, a key division, reported robust growth in cybersecurity and networking, with security products and services forming a significant revenue stream.

Logicalis, another Datatec subsidiary, is actively developing comprehensive lifecycle solutions that encompass cloud, security, networks, and the Internet of Things (IoT). This proactive approach ensures the company remains relevant and competitive by aligning its offerings with emerging market demands in the fast-evolving Information and Communications Technology (ICT) landscape.

Datatec has shown strong financial health, with net profit rising significantly in the first half of fiscal year 2025, even with a small revenue decrease. This success stems from smart cost controls, effective currency hedging, and better operations across its business units.

The company's strategic move towards more profitable software and recurring revenue services is boosting its earnings and cash flow. This financial strength has allowed Datatec to lower its net debt and increase shareholder returns through dividends.

Established Vendor and Partner Ecosystem

Datatec's established vendor and partner ecosystem is a significant strength, built on decades of collaboration with major technology players. These deep-rooted alliances ensure preferential access to cutting-edge solutions and support. For instance, Westcon-Comstor, a key Datatec subsidiary, consistently renews and expands its partnerships with industry giants like Cisco, Microsoft, and AWS, underscoring its critical role in the technology supply chain.

This robust network translates into tangible benefits for Datatec and its clients. By maintaining strong relationships with vendors such as Palo Alto Networks, Datatec can offer integrated security solutions that meet evolving enterprise needs. The company's ability to leverage these partnerships facilitated a reported 10% year-on-year growth in its cybersecurity portfolio during the first half of fiscal year 2025, highlighting the commercial impact of these established connections.

The strength of Datatec's ecosystem is further demonstrated by:

- Strategic vendor alignment: Long-term agreements with leading technology providers like Cisco and Microsoft ensure access to new product releases and specialized training.

- Global distribution reach: Westcon-Comstor's extensive network allows Datatec to efficiently deliver a wide array of technology solutions to over 100 countries.

- Partner enablement: Datatec actively invests in its partner network, providing resources and support that foster joint go-to-market strategies and drive mutual growth.

Resilience Amidst Market Challenges

Datatec has demonstrated notable resilience despite a challenging macroeconomic landscape, navigating market softening in certain European areas and currency volatility. This strength is underscored by its consistent positive profit growth, a testament to its adaptive strategies and effective operational management.

The company's performance, especially within its Westcon International and Logicalis International divisions, highlights its capacity to thrive even when faced with economic headwinds. For instance, in the fiscal year ending February 29, 2024, Datatec reported a significant increase in adjusted EBITDA, reaching $214.1 million, up from $179.6 million in the prior year, showcasing this resilience.

- Positive Profit Growth: Maintained profitability despite challenging market conditions.

- Divisional Strength: Westcon International and Logicalis International are key drivers of this resilience.

- Strategic Adaptability: Successfully shifted focus towards higher-margin software and services.

- Revenue Stability: The move to software and services creates a more predictable revenue base.

Datatec's diversified global ICT solutions portfolio, spanning technology distribution (Westcon International), IT infrastructure and managed services (Logicalis), and ICT management consultancy (Analysys Mason), provides a robust and resilient revenue base.

This diversification across distinct but complementary business areas, such as cybersecurity and cloud services, mitigates risks and allows the company to capitalize on varied regional demands, evidenced by its strong presence in over 50 countries.

The company's strategic focus on high-growth sectors like cybersecurity and digital transformation, combined with a shift towards more profitable software and recurring revenue services, is enhancing its earnings and cash flow, as reflected in its strong financial health and increased shareholder returns.

Datatec's established vendor and partner ecosystem, featuring long-term alliances with industry leaders like Cisco and Microsoft, ensures preferential access to cutting-edge solutions and drives growth, with its cybersecurity portfolio alone seeing 10% year-on-year growth in the first half of fiscal year 2025.

| Division | Key Focus Areas | Recent Performance Indicator |

|---|---|---|

| Westcon International | Cybersecurity, Networking | 10% growth in cybersecurity portfolio (H1 FY25) |

| Logicalis | Cloud, Digital Transformation, Managed Services | Strong performance in IT infrastructure and services |

| Analysys Mason | ICT Management Consultancy | Contributes to diversified revenue streams |

What is included in the product

Analyzes Datatec’s competitive position through key internal and external factors, covering its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

Datatec's reported revenue saw a dip in FY25, a trend influenced by persistent market headwinds and significant currency fluctuations. This volatility is particularly evident in regions like Logicalis Latin America, where foreign exchange impacts can directly affect top-line figures.

The company's expansive global footprint inherently exposes it to currency risks, which can lead to unpredictable swings in its financial reporting. Effectively navigating these exchange rate dynamics is therefore paramount for achieving stable revenue growth.

Westcon International's distribution arm is significantly reliant on its partnerships with a limited number of key technology vendors. This concentration means that any disruption in these crucial relationships, like a vendor altering its distribution approach or launching competing products, could directly affect Westcon's financial performance and standing in the market. For instance, in the fiscal year ending February 2024, Datatec reported that its Westcon segment generated a substantial portion of its revenue, underscoring the importance of these vendor ties.

The Information and Communications Technology (ICT) sector is a battleground, teeming with global and local companies vying for market share. Datatec, operating across various divisions, contends with a multitude of distributors, IT service providers, and consulting firms, all offering comparable solutions. This fierce rivalry directly impacts pricing strategies, profit margins, and the crucial ability to secure and keep both skilled employees and valuable clients.

Need for Continuous Investment in Technology and Skills

The Information and Communication Technology (ICT) sector is moving at lightning speed, with advancements in artificial intelligence, cloud computing, and cybersecurity constantly reshaping the landscape. This rapid evolution means companies like Datatec must continually invest in the latest technologies and solutions to stay relevant. For example, Datatec's ongoing commitment to expanding its cloud and cybersecurity offerings, as highlighted in their recent financial reports, underscores this necessity.

Keeping pace with these technological shifts demands significant and ongoing capital expenditure. Datatec's strategic investments, such as their focus on developing advanced analytics capabilities, require substantial financial commitment. Furthermore, maintaining a competitive edge necessitates continuous upskilling and reskilling of their workforce through dedicated training programs, adding another layer of operational cost and complexity.

- Constant need for technology upgrades: The rapid pace of innovation in AI, cloud, and cybersecurity requires ongoing capital investment to update solutions.

- Investment in employee skills: Continuous training programs are essential to ensure Datatec's workforce possesses the latest technical expertise.

- Capital intensity: The need for new hardware, software, and specialized talent makes technological advancement a capital-intensive endeavor for Datatec.

- Maintaining competitive edge: Failure to invest sufficiently can lead to a loss of market share against more agile competitors.

Integration Challenges Across Diverse Divisions

Datatec's operational structure, encompassing technology distribution, IT infrastructure solutions, and management consultancy, while a strength in offering a broad service portfolio, inherently introduces integration challenges. Effectively coordinating these distinct divisions globally demands sophisticated internal systems and processes to ensure consistent service delivery and foster cross-selling synergies.

The complexity of managing three diverse business units can lead to inefficiencies if not meticulously integrated. For instance, in fiscal year 2024, Datatec reported revenue of $4.5 billion, highlighting the scale at which these integration efforts must operate to maintain optimal performance and capitalize on market opportunities.

- Cross-divisional collaboration: Ensuring seamless information flow and project handoffs between distribution, solutions, and consultancy arms is critical.

- Service delivery consistency: Maintaining uniform quality and client experience across all three divisions worldwide presents a significant hurdle.

- Synergy realization: Maximizing the potential for cross-selling and upselling opportunities requires a deeply integrated approach to client engagement.

- Global operational alignment: Standardizing processes and strategic vision across geographically dispersed teams within each division is a continuous challenge.

Datatec faces significant challenges in managing its diverse global operations, leading to potential inefficiencies and difficulties in maintaining consistent service delivery across its various divisions. The sheer scale of its $4.5 billion revenue in FY24 underscores the complexity of integrating its distribution, solutions, and consultancy arms effectively. This necessitates robust internal systems to foster cross-selling and ensure a unified client experience worldwide.

The company's reliance on a select group of key technology vendors for its Westcon International segment presents a notable vulnerability. Any disruption or shift in these crucial partnerships could directly impact Westcon's revenue generation, which represented a substantial portion of Datatec's overall earnings in FY24. This concentration risk requires careful management of vendor relationships.

Datatec operates in a highly competitive ICT market, facing pressure from numerous global and local players offering similar services. This intense rivalry affects pricing power and profit margins, while also making it challenging to attract and retain both skilled talent and key clients. Staying ahead requires constant adaptation and differentiation.

The rapid evolution of the ICT sector, driven by advancements in AI, cloud, and cybersecurity, demands continuous and substantial investment in technology upgrades and employee training. Failure to keep pace with these innovations, as evidenced by Datatec's ongoing investments in cloud and cybersecurity, could lead to a loss of competitive advantage against more agile rivals.

| Weakness | Description | Impact | FY24 Relevance |

|---|---|---|---|

| Operational Complexity | Integrating diverse global divisions (distribution, solutions, consultancy) leads to potential inefficiencies and inconsistent service. | Reduced synergy realization, challenges in global alignment, and variable client experience. | Managing $4.5 billion in revenue across these divisions requires sophisticated integration. |

| Vendor Concentration | Heavy reliance on a few key technology vendors within Westcon International. | Vulnerability to vendor strategy changes, impacting revenue and market standing. | Westcon's significant contribution to overall revenue highlights this dependency. |

| Intense Market Competition | Operating in a crowded ICT sector with numerous global and local competitors. | Pressure on pricing, profit margins, and challenges in talent and client acquisition/retention. | Constant need to differentiate and adapt to market dynamics. |

| Rapid Technological Change | The fast-paced nature of ICT requires continuous investment in new technologies and employee upskilling. | Risk of obsolescence, increased capital expenditure, and potential loss of market share. | Datatec's ongoing investment in cloud and cybersecurity reflects this necessity. |

Preview the Actual Deliverable

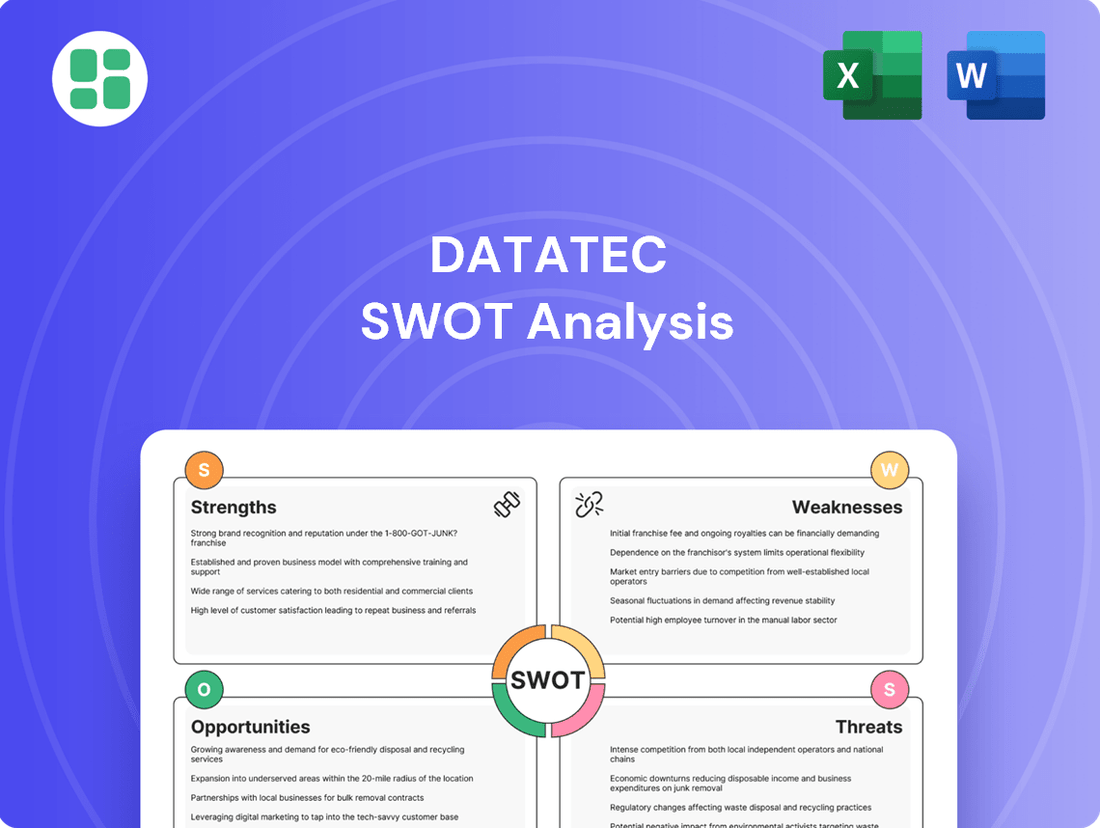

Datatec SWOT Analysis

The preview you see is the actual Datatec SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Datatec SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual Datatec SWOT analysis file. The complete version, packed with detailed information, becomes available after checkout.

Opportunities

The global digital transformation market is booming, with estimates suggesting it will approach $4 trillion by 2027. This surge, alongside widespread cloud adoption, creates a significant opening for Datatec’s Logicalis. Logicalis is well-positioned to offer essential IT infrastructure, managed services, and digital transformation expertise to businesses aiming to upgrade their systems.

The global cybersecurity market is experiencing significant expansion, projected to reach an estimated $300 billion by 2025, a substantial increase from previous years. This growth is fueled by a relentless rise in sophisticated cyber threats and a growing imperative for organizations across all industries to implement advanced security measures.

Datatec's Westcon International is strategically positioned to benefit from this trend, boasting a comprehensive portfolio of cybersecurity solutions. Their expertise in distributing and enabling security technologies allows them to address the escalating demand for robust protection.

Furthermore, Datatec's Logicalis division enhances this opportunity by embedding security seamlessly into its end-to-end IT lifecycle solutions. This integrated approach allows Logicalis to offer clients a more holistic and effective cybersecurity posture, further capitalizing on market expansion.

The widespread integration of AI and machine learning presents a prime opportunity for Datatec to elevate its service portfolio and operational effectiveness. By harnessing these advanced analytics, Datatec can unlock new avenues for client solutions and internal efficiencies. For instance, a Logicalis CIO report indicated that 78% of organizations are actively investigating AI's potential for commercial expansion, underscoring the market readiness for such advancements.

Geographic Expansion and Emerging Markets

Datatec's established footprint in Africa, a continent experiencing significant digital transformation, presents a prime opportunity for geographic expansion. As of early 2025, many African nations are prioritizing ICT infrastructure development, with projected ICT spending in sub-Saharan Africa expected to grow robustly through 2028. This trend allows Datatec to deepen its market penetration and leverage its existing expertise.

The company's strategic focus on emerging markets, beyond Africa, also offers substantial growth potential. These regions are increasingly adopting digital solutions, creating demand for Datatec's services in areas like cloud computing and cybersecurity. For instance, the digital economy in Southeast Asia is projected to reach hundreds of billions of dollars by 2030, indicating a fertile ground for Datatec's offerings.

- Africa's Digital Infrastructure Growth: Sub-Saharan Africa's ICT spending is on an upward trajectory, creating a favorable environment for Datatec's expansion.

- Emerging Market Digitalization: Continued investment in digital services across various emerging economies provides new avenues for Datatec to capture market share.

- Leveraging Existing Expertise: Datatec can capitalize on its established presence and understanding of these markets to drive further growth and revenue.

Strategic Acquisitions and Partnerships

The Information and Communication Technology (ICT) sector thrives on strategic acquisitions and partnerships, allowing companies to rapidly gain market share and acquire new technologies. Datatec, with its proven track record, has leveraged these strategies effectively. For instance, Westcon-Comstor's expansion into the AWS Marketplace and the acquisition of Rebura to bolster cloud services demonstrate this approach.

Looking ahead, Datatec can further solidify its standing and diversify its capabilities through similar strategic maneuvers. These moves could unlock new revenue streams and expand its operational footprint.

- Market Consolidation: The ICT industry is characterized by ongoing consolidation, with major players acquiring smaller, innovative firms to integrate new technologies and talent.

- Cloud and Security Focus: Future opportunities likely lie in acquiring or partnering with companies specializing in cloud infrastructure, cybersecurity solutions, and data analytics, areas experiencing significant growth and demand.

- Geographic Expansion: Strategic partnerships or acquisitions in emerging markets could provide Datatec with access to new customer bases and talent pools, driving international growth.

- Synergistic Capabilities: Integrating acquired companies' offerings with existing Datatec businesses can create more comprehensive solutions, enhancing customer value and competitive advantage.

The increasing demand for specialized cloud solutions and managed IT services, particularly in hybrid and multi-cloud environments, presents a significant opportunity. Logicalis is well-positioned to capitalize on this by offering tailored cloud migration and management services, aligning with the projected growth in the global cloud computing market, which is expected to exceed $1 trillion by 2025.

The ongoing digital transformation across industries, driven by the need for enhanced efficiency and customer engagement, creates a robust market for Datatec's integrated IT solutions. Businesses are actively seeking partners like Logicalis to modernize their infrastructure and adopt new digital capabilities, with digital transformation spending anticipated to reach $2.3 trillion in 2025.

Datatec's Westcon International can leverage the expanding cybersecurity market, projected to reach $300 billion by 2025, by continuing to offer a comprehensive suite of security products and services. This includes advanced threat detection and response solutions, which are critical for organizations navigating an increasingly complex threat landscape.

The integration of AI and machine learning into business operations offers Datatec a chance to enhance its service offerings and create more intelligent solutions. As 78% of organizations explore AI for commercial expansion, Datatec can provide AI-driven analytics and automation services through Logicalis, boosting client value and internal efficiencies.

| Opportunity Area | Market Projection (2025) | Datatec's Position |

|---|---|---|

| Cloud Services & Digital Transformation | Global Cloud Market > $1 Trillion; Digital Transformation Spending $2.3 Trillion | Logicalis's expertise in cloud migration and managed IT services. |

| Cybersecurity | Global Cybersecurity Market $300 Billion | Westcon International's comprehensive security portfolio. |

| AI & Machine Learning Integration | Growing adoption across industries | Logicalis's potential to offer AI-driven analytics and automation. |

Threats

The Information and Communication Technology (ICT) sector is a whirlwind of innovation, meaning that hardware and software can become outdated remarkably fast. This rapid technological obsolescence presents a significant threat to Datatec, especially within its distribution segment.

Datatec must constantly adapt its product offerings and services to stay current with these swift changes. For instance, the accelerating pace of smartphone upgrade cycles, with new models featuring advanced processors and camera technology released annually, exemplifies this challenge. Failing to quickly integrate cutting-edge solutions or divest from legacy products could erode market share.

In 2024, the global ICT market saw continued investment in areas like AI-powered hardware and advanced networking solutions. Datatec's ability to manage its inventory and supply chain effectively to reflect these shifts is crucial. A misstep in anticipating demand for emerging technologies, such as the growing need for specialized chips for AI applications, could lead to a competitive disadvantage.

Global economic volatility, marked by persistent inflation and fluctuating interest rates, is a significant threat. For instance, the IMF projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, signaling a challenging environment for IT spending.

Uncertainty around tariff policies and a general economic slowdown can prompt organizations to tighten cybersecurity budgets and delay or reduce new IT investments. This cautious approach by clients directly impacts Datatec's revenue streams, especially for new project initiations and substantial solution rollouts.

A prolonged economic downturn or aggressive budget cuts by key clients could severely affect Datatec's financial performance across all its operational divisions. This risk is particularly pronounced for revenue derived from larger, more capital-intensive projects, potentially leading to reduced sales volumes and project pipelines.

Datatec confronts intense rivalry, not just from established competitors but also from hyperscale cloud providers like Amazon Web Services and Microsoft Azure. These giants are expanding their direct service offerings, challenging Datatec's traditional market. Furthermore, nimble niche players focusing on high-growth sectors such as artificial intelligence and cybersecurity present a significant threat, leveraging specialized expertise and potentially disruptive models.

Cybersecurity Risks and Data Breaches

As a major player in ICT solutions, including cybersecurity, Datatec faces significant threats from sophisticated cyberattacks and data breaches. These risks are amplified given the sensitive nature of the data handled for its clients. A substantial security incident impacting Datatec's own infrastructure or its clients could lead to severe reputational damage, substantial financial losses, and a significant erosion of customer trust, thereby hindering future business prospects and potentially triggering regulatory fines.

The global cybersecurity market continues to expand, with projections indicating continued growth. For instance, the global cybersecurity market size was valued at approximately USD 214.6 billion in 2023 and is expected to reach USD 424.5 billion by 2030, growing at a CAGR of 10.4%. This growth underscores the increasing sophistication of threats and the corresponding demand for robust security solutions, but also highlights the inherent risks for providers like Datatec.

- Reputational Damage: A breach could severely tarnish Datatec's image as a trusted security provider.

- Financial Losses: Costs associated with incident response, recovery, and potential legal liabilities can be immense.

- Loss of Customer Trust: Clients entrusting Datatec with their data will likely seek alternatives if security is compromised.

- Regulatory Penalties: Non-compliance with data protection regulations, such as GDPR or POPIA, can result in significant fines.

Regulatory Changes and Geopolitical Instability

Datatec's global operations mean it must navigate a constantly shifting regulatory environment. New data privacy laws, like the EU's Digital Operational Resilience Act (DORA), which came into full effect in January 2025, can significantly impact how the company handles customer information and requires substantial compliance investments. Similarly, evolving trade policies and tariffs across different regions can affect the cost of goods and services, potentially squeezing profit margins.

Geopolitical instability presents another significant hurdle. Ongoing conflicts and rising international tensions, as seen in various regions throughout 2024 and projected into 2025, can disrupt critical supply chains for hardware and software components. This disruption can lead to delays, increased costs, and even shortages, impacting Datatec's ability to deliver its services efficiently. Furthermore, such instability can create economic uncertainty, leading to reduced IT spending by clients and affecting market access in affected territories.

- Regulatory Complexity: Datatec must adapt to diverse and changing data privacy regulations globally, with DORA being a key example impacting operations from early 2025.

- Supply Chain Vulnerability: Geopolitical events in 2024 and 2025 have demonstrated the fragility of global supply chains, directly impacting the availability and cost of technology components essential for Datatec's business.

- Market Access Risks: Political instability and trade disputes can limit or complicate Datatec's ability to operate and generate revenue in certain international markets.

- Economic Uncertainty: Global economic outlooks for 2024-2025 are subject to geopolitical influences, potentially leading to cautious IT spending by clients, affecting Datatec's revenue streams.

Datatec faces intense competition from established players and agile niche firms, particularly in high-growth areas like AI. Hyperscale cloud providers expanding their direct offerings also pose a significant challenge to Datatec's traditional business model.

The company is also vulnerable to sophisticated cyberattacks and data breaches, which could result in severe reputational damage and financial losses. The global cybersecurity market's growth, projected to reach USD 424.5 billion by 2030, highlights the increasing threat landscape Datatec must navigate.

Navigating a complex and evolving global regulatory landscape, including new data privacy laws like DORA effective January 2025, requires significant investment and adaptation. Geopolitical instability further threatens supply chains and market access, impacting operational efficiency and revenue streams.

| Threat Category | Specific Threat | Impact on Datatec | Data/Example |

|---|---|---|---|

| Competition | Increased competition from hyperscale cloud providers | Erosion of market share, pressure on margins | AWS and Microsoft Azure expanding direct service offerings |

| Cybersecurity | Sophisticated cyberattacks and data breaches | Reputational damage, financial loss, loss of customer trust | Global cybersecurity market valued at USD 214.6 billion in 2023 |

| Regulatory & Geopolitical | Evolving data privacy laws (e.g., DORA) | Increased compliance costs, operational complexity | DORA fully effective January 2025 |

| Economic Volatility | Global economic slowdown impacting IT spending | Reduced revenue from new projects and solution rollouts | IMF projected global growth to slow to 2.9% in 2024 |

SWOT Analysis Data Sources

This Datatec SWOT analysis is built upon a robust foundation of diverse data sources, including detailed financial reports, comprehensive market intelligence, and expert industry analyses to ensure a thorough and insightful assessment.