Datatec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datatec Bundle

Datatec's competitive landscape is shaped by several key forces, including the bargaining power of its buyers and suppliers, the threat of new entrants, and the intensity of rivalry within the IT services sector. Understanding these dynamics is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Datatec’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Datatec's Westcon International distribution business is heavily reliant on a select group of major technology vendors, including giants like Cisco, HPE, Microsoft, and Palo Alto Networks. This concentration of key suppliers means these companies hold considerable sway in their dealings with Datatec.

The highly specialized and often proprietary nature of the hardware and software offered by these vendors presents a significant barrier to switching. Datatec faces substantial costs and potential disruption to its product lines if it attempts to move away from these established relationships, thereby strengthening the suppliers' bargaining position.

Consequently, pricing, the availability of essential products, and the overall terms of their agreements are largely dictated by these dominant technology providers. For instance, in 2023, Westcon International's revenue was significantly driven by its partnerships with these core vendors, underscoring the dependency.

While the significant supply chain disruptions seen in earlier years have largely subsided by fiscal year 2024, particularly concerning semiconductor availability, suppliers can still wield influence. These lingering constraints, even if lessened, can enable suppliers to dictate terms by limiting product availability and stretching delivery times, impacting companies like Datatec.

Datatec's strategic inventory management and its capacity to secure necessary components are paramount in mitigating this supplier leverage. The improved hardware supply and product availability observed in FY24 directly contribute to reducing the bargaining power of these suppliers, offering Datatec greater flexibility.

Datatec faces significant supplier power due to high switching costs. Transitioning away from core technology providers involves substantial expenses such as re-certification of products, retraining of personnel, and renegotiating complex distribution agreements. These factors create strong interdependencies, particularly given Datatec's long-standing relationships with key vendors.

The company's strategic pivot towards software and services further entrenches this supplier power. This move naturally ties Datatec more intricately into specific vendor ecosystems, making it more challenging and costly to adopt alternative solutions. For instance, in 2024, Datatec's reliance on cloud infrastructure providers and specialized software vendors likely means that any change would necessitate significant investment in new integration and compatibility testing.

Supplier Forward Integration Threat

Major technology vendors are increasingly moving towards offering their own direct-to-customer cloud services. This forward integration by suppliers poses a significant threat, potentially diminishing the role of intermediaries like Datatec and squeezing margins. For instance, in 2024, many leading SaaS providers expanded their direct sales channels, aiming to capture a larger share of the end-user market.

This trend could reduce Datatec's value proposition as a distributor and solution provider. While some vendors still depend on partners for extensive market reach and specialized support, the direct-to-customer model is gaining traction. This shift necessitates a strategic response from Datatec to maintain its relevance and profitability in the evolving tech landscape.

- Vendor Direct Sales Growth: Observing a trend of major vendors increasing their direct cloud service offerings in 2024, impacting traditional distribution models.

- Disintermediation Risk: The threat of suppliers bypassing intermediaries like Datatec, potentially reducing their market access and service revenue.

- Datatec's Mitigation Strategy: Focus on strengthening vendor partnerships and enhancing Datatec's own cloud service capabilities to counter supplier forward integration.

Availability of Alternative Technologies

The availability of alternative technologies significantly impacts supplier bargaining power. As technology rapidly evolves, new solutions and open-source alternatives can emerge, diminishing the leverage of established vendors. Datatec, for instance, must monitor trends in AI, IoT, and edge computing, as these advancements can introduce new suppliers or render existing ones less critical. In 2024, the global AI market alone was projected to reach over $200 billion, highlighting the dynamic nature of technological innovation and its potential to reshape supplier dependencies.

Datatec's strategic approach should involve continuous evaluation of its technology portfolio to incorporate these emerging solutions. This proactive stance helps mitigate the risk of over-reliance on a limited number of traditional suppliers. For example, the increasing adoption of cloud-native architectures and containerization technologies like Kubernetes has provided alternatives to traditional on-premises hardware vendors, thereby altering the bargaining power dynamics.

- Technological Obsolescence: Suppliers whose technologies become outdated face reduced bargaining power.

- Emergence of Disruptive Technologies: New innovations can create alternative sourcing options for companies like Datatec.

- Open-Source Alternatives: The availability of free or low-cost open-source software can challenge proprietary solutions and weaken supplier leverage.

- Datatec's R&D Investment: Datatec's investment in research and development to explore and adopt new technologies directly influences its ability to switch suppliers.

Datatec's bargaining power with its suppliers is constrained by its reliance on a few major technology vendors, whose specialized products create high switching costs. This dependency is amplified as these vendors increasingly offer direct-to-customer cloud services, potentially disintermediating Datatec. While supply chain issues eased in 2024, suppliers can still leverage limited product availability. Datatec's strategy involves diversifying its technology portfolio and enhancing its own service capabilities to counter this supplier leverage.

| Factor | Impact on Datatec | 2024 Context |

|---|---|---|

| Supplier Concentration | High reliance on key vendors (Cisco, HPE, Microsoft) | Core vendor revenue remains critical for Westcon International. |

| Switching Costs | Significant costs for re-certification, retraining, and renegotiating agreements. | Long-standing relationships deepen interdependencies. |

| Vendor Forward Integration | Direct-to-customer cloud services reduce distributor role. | Many SaaS providers expanded direct sales channels in 2024. |

| Availability of Alternatives | Emerging technologies and open-source solutions can reduce reliance. | AI market growth highlights dynamic tech landscape. |

What is included in the product

This analysis dissects the competitive forces impacting Datatec, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, and how these shape its market position.

Effortlessly identify and mitigate competitive threats with a visually intuitive breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

Datatec's customer base spans large enterprises and service providers via Logicalis and Analysys Mason, alongside a wider channel through Westcon International. Large enterprise clients, with substantial IT spending and intricate requirements, wield considerable bargaining power. This stems from their significant purchase volumes and their capacity to negotiate customized solutions or more favorable pricing and contract terms, a common dynamic in the IT services sector.

Datatec's comprehensive suite of services, encompassing IT infrastructure, managed services, cybersecurity, and digital transformation, often forms the backbone of its clients' operations. This deep integration means that switching from Datatec could lead to substantial operational disruptions and significant risks for businesses, thereby limiting their bargaining power.

Customer switching costs significantly influence the bargaining power of customers in the IT services sector. For businesses, migrating data, re-integrating systems, and retraining staff when changing IT service providers or technology distributors can be substantial undertakings. These costs, often including potential operational downtime, create a strong incentive for customers to remain with their current provider, thereby reducing their leverage.

For example, a company relying on a managed IT service provider like Logicalis invests not just in the service itself but also in the integration and operational familiarity built over time. This deep integration makes switching to a competitor a complex and expensive proposition. In 2024, the average cost for a business to switch cloud service providers was estimated to be upwards of $50,000, factoring in data transfer, system configuration, and potential productivity losses during the transition.

Customer Price Sensitivity and Information Asymmetry

Customers in the ICT sector are becoming more aware of pricing, particularly as IT services become more standardized and online platforms offer greater price transparency. For instance, a 2024 survey indicated that 70% of B2B IT buyers consider price a primary factor in their purchasing decisions.

Despite this, the intricate and niche nature of many of Datatec's offerings means customers often lack the specialized knowledge to fully assess value, leading to a reliance on Datatec's guidance. This information gap can temper aggressive price negotiations.

Ultimately, clients are focused on achieving a clear return on investment from their technology expenditures. Datatec's ability to demonstrate tangible business outcomes and cost savings directly influences customer price sensitivity.

- Price Sensitivity: Growing, driven by market transparency and commoditization.

- Information Asymmetry: Mitigates extreme price pressure due to complexity of solutions.

- ROI Focus: Customers demand measurable returns on technology investments.

Customer's Ability to Self-Provide

Customers' ability to self-provide IT services can significantly impact Datatec's bargaining power. Large enterprises, in particular, might have the resources and expertise to manage their IT infrastructure or undertake digital transformation projects internally, lessening their need for external providers like Logicalis.

However, the increasing complexity of today's IT environments and the shortage of skilled IT professionals often make outsourcing to managed service providers a more economical and efficient choice. For instance, a 2024 report indicated that 70% of IT decision-makers consider the scarcity of specialized talent a major challenge, pushing them towards managed services.

- Internal IT Capabilities: Some large clients may possess the internal IT expertise and infrastructure to handle their own digital transformation and IT management needs.

- Cost-Effectiveness of Outsourcing: Despite internal capabilities, the high cost and difficulty of acquiring and retaining specialized IT talent often make outsourcing to managed service providers more financially viable.

- Complexity of Modern IT: The rapidly evolving and intricate nature of current IT solutions requires constant investment in training and technology, which can be prohibitive for many organizations to manage entirely in-house.

- Focus on Core Competencies: By outsourcing IT, businesses can redirect their resources and focus on their primary business objectives rather than complex IT operations.

The bargaining power of Datatec's customers is influenced by several factors, including their size, the switching costs involved, and their access to information. Large enterprise clients, due to their significant purchasing volumes, can negotiate favorable terms. However, the deep integration of Datatec's services into client operations creates high switching costs, limiting customer leverage.

While price sensitivity is increasing, with 70% of B2B IT buyers in 2024 prioritizing price, information asymmetry in complex IT solutions can temper aggressive negotiations. Customers also evaluate providers based on demonstrable ROI, with a focus on tangible business outcomes.

The ability of customers to self-provide IT services is a potential check on Datatec's power. However, the scarcity of specialized IT talent, a challenge for 70% of IT decision-makers in 2024, often makes outsourcing to managed service providers more cost-effective.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation (2024) |

|---|---|---|

| Customer Size & Volume | High for large enterprises | Significant purchase volumes enable negotiation. |

| Switching Costs | Lowers customer power | High costs for data migration, system re-integration, and retraining. |

| Price Transparency & Sensitivity | Increasing customer power | 70% of B2B IT buyers consider price a primary factor. |

| Information Asymmetry | Lowers customer power | Complexity of niche solutions limits customer understanding and negotiation. |

| Internal IT Capabilities vs. Outsourcing Cost-Effectiveness | Mixed impact | Talent scarcity (70% of IT decision-makers cite as a challenge) favors outsourcing. |

What You See Is What You Get

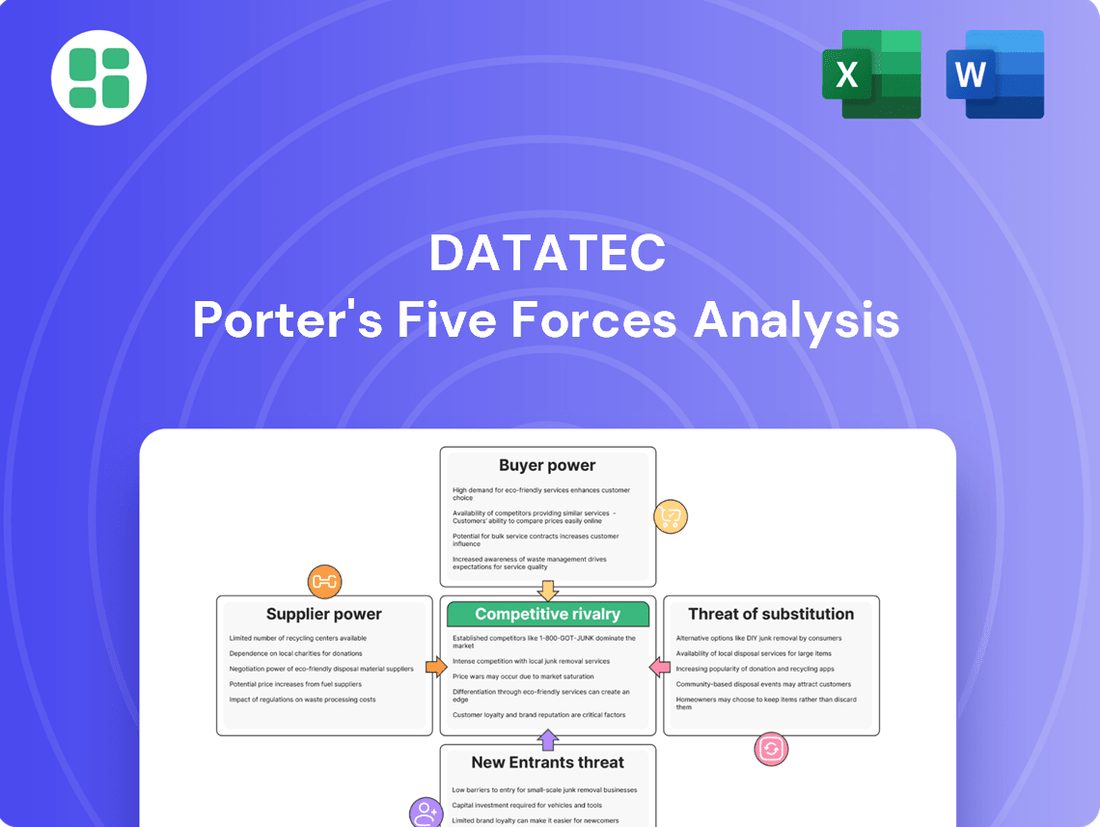

Datatec Porter's Five Forces Analysis

This preview showcases the complete Datatec Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is precisely what you will receive instantly after purchase, offering a comprehensive overview of industry rivalry, threat of new entrants, bargaining power of buyers, bargaining power of suppliers, and the threat of substitute products. You're looking at the actual document, ensuring no discrepancies or missing information, ready for immediate download and use.

Rivalry Among Competitors

The global ICT, IT managed services, and IT consulting markets are robust, with strong growth anticipated through 2025 and beyond. This expansion, particularly in IT managed services fueled by cybersecurity needs and cloud adoption, is a positive indicator.

Despite this market growth, competitive rivalry remains high. Numerous companies are actively competing for market share, indicating a dynamic and crowded landscape where differentiation is key.

Datatec operates within markets characterized by a significant number of competitors, both globally and regionally, across its distinct business segments. This fragmentation means a constant need to stay ahead.

Westcon International, for instance, contends with a broad spectrum of technology distributors, each vying for market share. Similarly, Logicalis encounters intense competition from a diverse range of IT service providers and systems integrators, making differentiation crucial.

The competitive landscape also includes large multinational corporations, highly specialized niche players, and even staffing firms expanding into solution provision, all contributing to the dynamic and crowded nature of the industries Datatec serves.

The ICT sector is a hotbed of consolidation, with companies frequently merging or acquiring others to boost their services, grab more market share, and benefit from cost savings. This trend can really ramp up competition, as it often leads to bigger, stronger players entering the fray or significantly altering how the market operates.

Datatec is actively participating in this consolidation, strategically acquiring companies to enhance its cloud services and overall product portfolio. For example, in the fiscal year 2023, Datatec completed several acquisitions aimed at bolstering its capabilities in key growth areas, contributing to the industry's ongoing consolidation narrative.

Differentiation and Value Proposition

Competitive rivalry in the IT services sector, including for companies like Datatec, is multifaceted. It extends beyond mere price competition to encompass differentiation in service quality, the depth of specialized expertise in areas like cybersecurity and AI, and the delivery of unique value-added offerings. This focus on distinct capabilities allows firms to carve out market share and command premium pricing.

Datatec's various divisions actively pursue differentiation. They achieve this through cultivating profound technical knowledge, forging strategic alliances with prominent technology vendors, and consistently prioritizing the delivery of tangible, sustainable results and a clear return on investment for their clientele. For instance, Logicalis, a key Datatec subsidiary, is strategically concentrating its efforts on application modernization and robust security solutions.

- Differentiation Drivers: Competition is fueled by service quality, specialized expertise (cybersecurity, AI, cloud), and value-added services, not just price.

- Datatec's Strategy: Divisions differentiate through deep technical expertise, strategic vendor partnerships, and a focus on client ROI and sustainable outcomes.

- Example: Logicalis Focus: Logicalis is emphasizing application modernization and security as key areas of differentiation.

Switching Costs for Customers

High customer switching costs can indeed shield Datatec's existing market share. However, this same barrier makes it challenging to lure new clients away from competitors who already have them locked in. This reality demands substantial spending on sales efforts, marketing campaigns, and competitive pricing to win over these established customer bases.

The industry's trend towards recurring revenue and subscription models amplifies the critical need for customer retention. For instance, in the IT services sector, a significant portion of revenue is now tied to ongoing contracts, making it paramount to keep existing clients satisfied and prevent them from exploring alternatives.

- Customer Lock-in: High switching costs create customer loyalty by making it inconvenient or expensive for clients to move to a competitor.

- Acquisition Challenges: Conversely, these same costs can deter potential new customers from switching to Datatec if their current provider offers a sticky ecosystem.

- Investment Needs: Datatec must allocate resources to sales, marketing, and pricing strategies to overcome competitor inertia and attract new business.

- Recurring Revenue Impact: The industry's shift to subscriptions means that retaining customers is more profitable than constantly acquiring new ones, highlighting the importance of managing switching costs effectively.

Competitive rivalry in the ICT sector is intense, driven by numerous global and regional players across Datatec's business segments. This crowded market necessitates strong differentiation strategies, as seen with Westcon International and Logicalis, to capture and maintain market share.

Consolidation is a significant factor, with mergers and acquisitions reshaping the competitive landscape, often leading to the emergence of larger, more formidable competitors. Datatec itself engages in strategic acquisitions, as evidenced by its fiscal year 2023 activities, to bolster its service offerings and competitive position.

Differentiation extends beyond price, focusing on specialized expertise in areas like cybersecurity and AI, alongside superior service quality and unique value-added offerings. Datatec's subsidiaries, such as Logicalis, prioritize application modernization and security to stand out.

While high customer switching costs can foster loyalty, they also pose a barrier to acquiring new clients. This dynamic demands significant investment in sales, marketing, and competitive pricing to win over established customer bases, especially with the industry's shift towards recurring revenue models.

| Datatec Segment | Key Competitors | Differentiation Focus |

|---|---|---|

| Westcon International | Global and regional technology distributors | Broad product portfolio, vendor partnerships, logistics |

| Logicalis | IT service providers, systems integrators | Cloud services, cybersecurity, application modernization, managed services |

| Datatec (Group Level) | Large MNCs, niche players, staffing firms | Strategic acquisitions, global reach, integrated solutions |

SSubstitutes Threaten

Large enterprises possessing significant resources may opt to build out extensive in-house IT capabilities, acting as a direct substitute for external managed services. This can include developing proprietary cloud solutions or establishing dedicated cybersecurity teams, thereby reducing reliance on providers like Logicalis. For instance, a 2024 survey indicated that 45% of Fortune 500 companies increased their internal IT spending on cloud infrastructure to gain greater control and customization.

While building in-house IT can seem appealing for control, the substantial capital expenditure and the ongoing challenge of acquiring and retaining specialized IT talent often make it a less efficient alternative. The average cost to hire a cybersecurity analyst in 2024 was reported to be over $120,000 annually, a significant overhead compared to managed service contracts.

Customers, especially larger enterprises, are increasingly exploring direct engagement with technology vendors for their hardware and software requirements, potentially bypassing traditional distributors like Westcon International. This trend is fueled by vendors expanding their direct sales channels and online marketplaces.

While vendors offer direct access, distributors like Westcon-Comstor continue to provide essential value through specialized logistics, flexible financing options, and the aggregation of complex solutions. For instance, Westcon-Comstor's AWS Marketplace program actively seeks to strengthen its position within the burgeoning cloud marketplace ecosystem, demonstrating a strategic adaptation to evolving customer preferences.

The growing availability of generic software, Software-as-a-Service (SaaS) platforms, and public cloud infrastructure (IaaS, PaaS) presents a significant threat of substitutes for Datatec's offerings. Customers can increasingly bypass specialized or on-premise solutions by opting for these readily available, often lower-cost alternatives, particularly for less intricate requirements.

While Datatec's Logicalis and Westcon divisions expertly integrate and manage these cloud-centric models, the underlying public cloud services themselves can be seen as substitutes. For instance, a business needing basic collaboration tools might opt for a widely available SaaS solution directly from a provider rather than engaging Datatec for a tailored integration, especially if cost is the primary driver.

The shift towards cloud-native architectures and the proliferation of Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) offerings mean that customers can assemble their own IT stacks with greater ease. This trend, exemplified by the continued expansion of hyperscale cloud providers, allows businesses to procure computing power, storage, and managed services independently, thereby reducing reliance on traditional IT solution providers like Datatec for core infrastructure needs.

Open-Source Solutions

The increasing maturity and widespread adoption of open-source software and infrastructure present a significant threat of substitutes for Datatec. These cost-effective alternatives can directly challenge proprietary solutions by offering comparable functionality without the associated licensing fees. For instance, in 2024, the global open-source software market was valued at over $20 billion, demonstrating its substantial growth and appeal.

Customers might choose to leverage open-source components directly, thereby diminishing their need for Datatec's commercial software distribution and support services. This necessitates Datatec clearly articulating and delivering value that extends beyond mere software licensing, focusing on integration, specialized support, and unique value-added services to retain clients. The shift towards open-source in cloud infrastructure, for example, saw significant growth in 2024, with companies like Red Hat (an IBM subsidiary) adapting their strategies to integrate and support open-source offerings.

- Growing Open-Source Market Share: The open-source sector is projected to continue its rapid expansion, potentially capturing a larger portion of the IT spend in 2025.

- Reduced Switching Costs: Open-source solutions often have lower initial costs, making it easier for customers to experiment and switch away from proprietary vendors.

- Innovation in Open-Source: Community-driven development in open-source projects is fostering rapid innovation, closing the gap with commercial offerings in many areas.

- Datatec's Value Proposition: Datatec must emphasize its unique service offerings, such as advanced analytics, cybersecurity integration, and tailored support, to differentiate from free open-source alternatives.

Alternative Consulting Approaches

For a firm like Analysys Mason, the threat of substitutes in the ICT consulting space is significant. Clients might consider leveraging their own internal strategy teams, which can be a cost-effective alternative, especially for less complex projects. In 2024, many companies continued to invest in building out their in-house capabilities to reduce reliance on external consultants.

Freelance consultants also present a viable substitute. They often offer more flexible engagement models and potentially lower overhead costs compared to larger consulting firms. This trend saw continued growth in 2024, with platforms connecting businesses to independent experts becoming increasingly popular. For instance, the global freelance platform market was projected to reach over $4.5 trillion by 2025, indicating a substantial pool of alternative talent.

Furthermore, readily available market research reports and industry insights can serve as substitutes for bespoke consulting advice. Clients may opt for these off-the-shelf solutions if their needs are not highly specialized or if budget constraints are a primary concern. The accessibility of data and analytics tools in 2024 empowered many organizations to conduct their own preliminary strategic analysis.

- Internal Strategy Teams: Clients may utilize existing in-house expertise to address strategic challenges, reducing the need for external ICT consulting services.

- Freelance Consultants: Independent consultants offer a flexible and often more affordable alternative to traditional consulting firms, with a growing market presence.

- Market Research & Industry Reports: Readily available data and analysis can substitute for tailored consulting, particularly for less complex or budget-sensitive projects.

- Analysys Mason's Differentiation: Analysys Mason counters these threats by emphasizing its deep, specialized expertise in ICT management consulting, offering tailored solutions that generic alternatives may not provide.

The threat of substitutes for Datatec's business is significant, particularly from readily available, often lower-cost alternatives like generic software, SaaS platforms, and public cloud infrastructure. Customers can increasingly bypass specialized solutions by opting for these, especially for less complex requirements. For instance, a 2024 report indicated that 60% of businesses surveyed were increasing their adoption of SaaS solutions for core operational needs.

While Datatec's divisions integrate these cloud models, the underlying public cloud services themselves act as substitutes. A business needing basic collaboration tools might directly procure a widely available SaaS solution instead of engaging Datatec for tailored integration, especially if cost is the primary driver. The global SaaS market size was estimated to exceed $300 billion in 2024, highlighting the scale of these alternatives.

The proliferation of Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) offerings allows customers to assemble their own IT stacks with greater ease, reducing reliance on traditional IT solution providers. This trend is exemplified by the continued expansion of hyperscale cloud providers, with companies like Amazon Web Services, Microsoft Azure, and Google Cloud Platform capturing significant market share in 2024.

Open-source software and infrastructure also pose a substantial threat, offering comparable functionality without licensing fees. The global open-source software market was valued at over $20 billion in 2024, demonstrating its substantial growth and appeal. Datatec must emphasize its value-added services, such as integration and specialized support, to differentiate from these cost-effective alternatives.

| Substitute Type | Description | 2024 Market Trend/Data | Impact on Datatec | Datatec's Counter-Strategy |

| In-house IT Capabilities | Large enterprises building their own IT infrastructure and services. | 45% of Fortune 500 companies increased internal IT spending on cloud infrastructure in 2024. | Reduces demand for managed IT services. | Focus on specialized, complex solutions and managed security services. |

| Direct Vendor Engagement | Customers buying hardware/software directly from technology vendors. | Vendors expanding direct sales channels and online marketplaces. | Bypasses traditional distributors like Westcon International. | Leverage value-added distribution, logistics, and financing. |

| Public Cloud Services (SaaS, IaaS, PaaS) | Off-the-shelf cloud solutions for various business needs. | Global SaaS market estimated over $300 billion in 2024. | Offers lower-cost alternatives for basic functionalities. | Expertise in integrating and managing complex cloud environments. |

| Open-Source Software | Cost-effective software with comparable functionality. | Global open-source software market valued over $20 billion in 2024. | Challenges proprietary software licensing and support. | Provide specialized support, integration, and value-added services around open-source. |

| Freelance Consultants | Independent IT professionals offering flexible services. | Global freelance platform market projected over $4.5 trillion by 2025. | Provides a more affordable and flexible alternative to consulting firms. | Offer deep industry expertise and end-to-end project management. |

Entrants Threaten

Entering the ICT solutions and services market, especially in technology distribution and large IT infrastructure projects, demands significant upfront capital. This includes hefty investments in inventory, advanced IT systems, global logistics networks, and a highly skilled workforce. For instance, establishing a robust global supply chain for technology products, as Datatec operates, can easily run into tens or hundreds of millions of dollars.

These substantial capital requirements act as a formidable barrier to entry for new companies. Potential competitors must be able to fund extensive operations from the outset, which is a major hurdle. Datatec's existing, well-developed infrastructure and its established global presence represent a considerable investment that new players would struggle to match quickly.

The threat of new entrants into Datatec's market is significantly mitigated by the substantial need for specialized expertise and talent. Datatec's core operations, spanning cybersecurity, cloud solutions, and advanced data analytics, demand a deep bench of highly skilled professionals. Acquiring and maintaining this specialized workforce represents a considerable hurdle for any new player looking to enter the industry.

Building and retaining such a skilled workforce is a major challenge and barrier to entry for newcomers. The IT sector, in general, faces a recognized scarcity of qualified professionals, making it difficult for new companies to quickly assemble the necessary talent pool to compete effectively with established firms like Datatec.

Datatec's deep-rooted, decades-long relationships with its global clientele and critical vendor partners present a significant barrier to new entrants. Building the necessary trust, credibility, and a reputation for unwavering reliability in a market where proven experience and established client connections are highly valued is an immense challenge for newcomers.

Regulatory Hurdles and Compliance

Datatec's extensive global presence, spanning over 50 countries, means it must contend with a labyrinth of international regulations and data privacy laws, such as GDPR. This complex regulatory environment presents a significant hurdle for potential new entrants, requiring substantial investment in legal and compliance infrastructure to navigate effectively.

The increasing focus on cybersecurity and data privacy further elevates the compliance burden. New players must build robust systems and processes to meet these stringent requirements, a costly endeavor that can deter market entry.

- Regulatory Complexity: Operating in over 50 countries necessitates adherence to diverse legal frameworks.

- Compliance Investment: New entrants need significant capital for legal and compliance infrastructure.

- Data Privacy Laws: Regulations like GDPR mandate strict data handling practices, increasing operational costs.

- Cybersecurity Demands: Evolving threats require continuous investment in security measures.

Economies of Scale and Scope

Datatec leverages significant economies of scale in its distribution and managed services, enabling competitive pricing and efficient operations. For instance, its Westcon-Comstor distribution arm, a major revenue driver, benefits from bulk purchasing power. New entrants would find it challenging to match these cost efficiencies without substantial upfront investment and market penetration.

The company's ability to bundle a wide array of ICT solutions, from hardware distribution to cybersecurity and cloud services, creates a formidable barrier. This scope advantage allows Datatec to offer integrated solutions, a proposition that is difficult for specialized newcomers to replicate. This integrated approach contributes to customer loyalty and makes it harder for new, single-service providers to gain traction.

- Economies of Scale: Datatec's large-scale distribution operations, particularly through Westcon-Comstor, allow for lower per-unit costs, making it difficult for smaller new entrants to compete on price.

- Economies of Scope: The breadth of Datatec's service offerings across various ICT segments provides a competitive advantage, as customers often prefer integrated solutions from a single provider.

- Capital Requirements: Establishing a similar distribution network and service portfolio requires substantial capital, acting as a significant deterrent to potential new market entrants.

The threat of new entrants for Datatec is considerably low due to the substantial capital required to establish operations. Building a global distribution network and securing necessary technology inventory, as Datatec has done with its Westcon-Comstor division, can easily demand hundreds of millions of dollars in upfront investment. This high barrier effectively deters most potential new players from entering the market.

Furthermore, the ICT solutions and services sector demands specialized expertise, which is difficult and costly for newcomers to acquire. Datatec's focus on areas like cybersecurity and cloud solutions requires a deep pool of highly skilled professionals. The general scarcity of qualified IT talent makes it challenging for new companies to assemble a competitive workforce, further limiting the threat of new entrants.

Established client and vendor relationships also act as a significant deterrent. Datatec's long-standing partnerships are built on trust and proven reliability, elements that new entrants struggle to replicate quickly. Navigating complex international regulations, such as GDPR, and investing in robust cybersecurity measures also add to the cost and difficulty of market entry.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Establishing global distribution, inventory, and IT systems requires hundreds of millions of dollars. | Significant deterrent due to high upfront investment needs. |

| Specialized Expertise | Need for deep knowledge in cybersecurity, cloud, and data analytics. | Difficult and costly for new firms to acquire and retain skilled talent. |

| Established Relationships | Decades-long client and vendor trust and credibility. | New entrants face challenges in building comparable reputation and network. |

| Regulatory Complexity | Navigating diverse international laws and data privacy regulations (e.g., GDPR). | Requires substantial investment in legal and compliance infrastructure. |

Porter's Five Forces Analysis Data Sources

Our Datatec Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from financial disclosures, market research reports, and industry-specific publications. This multi-faceted approach ensures a comprehensive understanding of competitive dynamics.