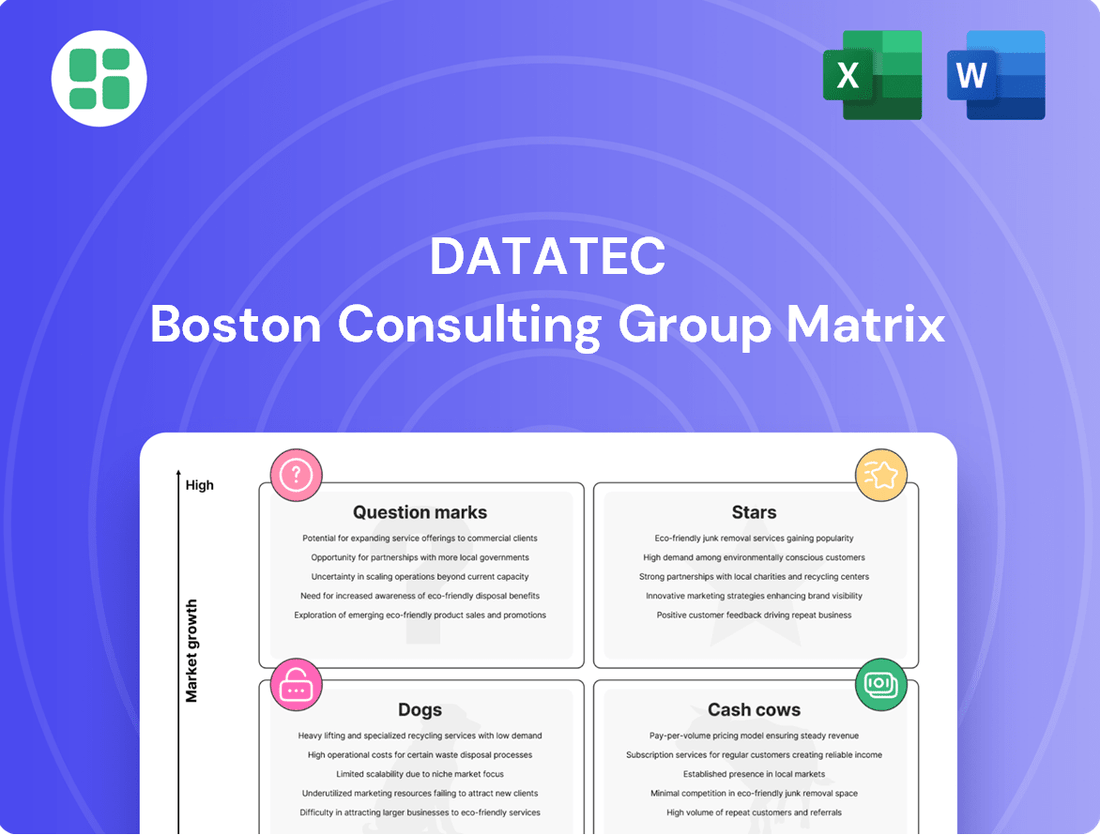

Datatec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datatec Bundle

Unlock the strategic potential of Datatec with a comprehensive BCG Matrix analysis. Understand how their diverse product portfolio stacks up as Stars, Cash Cows, Dogs, or Question Marks, providing a clear roadmap for resource allocation and future growth.

This glimpse into Datatec's market position is just the start. Purchase the full BCG Matrix report to gain in-depth quadrant insights, data-driven recommendations, and actionable strategies to optimize their product portfolio and drive sustainable success.

Stars

Westcon's cybersecurity solutions are a clear Star in Datatec's portfolio. This segment represented 51% of Westcon International's gross sales in FY25, marking a substantial 19.3% year-over-year increase.

This robust growth aligns perfectly with the booming global cloud security market, which is expected to hit $9.25 billion in 2025. The market's projected compound annual growth rate of around 20.7% through 2033 underscores the strong demand for Westcon's offerings.

The increasing frequency of cyberattacks and the critical need for advanced security measures are the primary drivers behind this sector's exceptional performance, solidifying its Star status.

Westcon-Comstor is actively transitioning to a software and services-focused approach. In FY25, software gross sales saw a substantial 22.2% increase, now making up 44% of all gross sales.

This strategic shift is further evidenced by recurring sales, encompassing both software and services, which climbed to 66% of gross sales in FY25, up from 60% in FY24. This growth highlights Westcon's successful adaptation to the prevailing market trend towards everything-as-a-service (XaaS) and subscription-based offerings.

Logicalis stands out in the rapidly expanding digital transformation services sector. This market is anticipated to hit $0.54 billion by 2025, growing at an impressive 28.99% compound annual growth rate. This surge is fueled by widespread adoption of cloud computing, big data analytics, and artificial intelligence.

Logicalis' strategic emphasis on providing comprehensive lifecycle solutions spanning cloud, security, networking, and the Internet of Things (IoT) positions it advantageously to capture this significant market growth. The company's consistent strong order intake underscores its leading market position and high share within this dynamic and growing segment.

Logicalis' Cloud Solutions and Managed Services

Logicalis' cloud solutions and managed services are a significant driver of growth, capitalizing on the widespread adoption of cloud platforms. The company's expertise in building and managing secure cloud environments directly addresses the increasing need for robust cybersecurity in the cloud.

This strategic focus aligns perfectly with the expanding global cloud security market, which was projected to reach over $30 billion in 2024. Logicalis' ability to deliver secure, integrated cloud solutions positions it strongly within this high-growth sector, contributing substantially to its revenue and market share.

- High demand for cloud migration and managed services.

- Growth in the global cloud security market, exceeding $30 billion in 2024.

- Logicalis' expertise in secure and integrated cloud environments.

- Significant contribution to revenue and market share in a high-growth sector.

Analysys Mason's AI and Emerging Tech Advisory

Analysys Mason is significantly bolstering its capabilities in Artificial Intelligence (AI) and other emerging technologies, recognizing their pivotal role in driving enterprise IT infrastructure modernization. This focus is particularly timely, as a substantial 95% of Chief Information Officers (CIOs) are actively investigating AI-related opportunities, underscoring a robust demand for expert strategic guidance in these transformative fields.

The company’s comprehensive advisory services, spanning commercial, technical, and Environmental, Social, and Governance (ESG) considerations within the Telecommunications, Media, and Technology (TMT) sector, firmly establish it as a Star performer. This strategic positioning allows Analysys Mason to capitalize on the rapid growth and evolving landscape of the consulting market for emerging technologies.

- AI Adoption Drive: 95% of CIOs are exploring AI opportunities, indicating a strong market pull for AI advisory services.

- Strategic Focus: Analysys Mason is enhancing its expertise in AI and IT services, key enablers of enterprise IT upgrades.

- Market Position: Its integrated commercial, technical, and ESG advisory in TMT positions it as a leader in high-growth emerging tech consulting.

Stars represent market leaders with high growth and high market share. Westcon's cybersecurity and Logicalis' digital transformation services are prime examples within Datatec's portfolio. Analysys Mason's AI and emerging tech consulting also fits this category, demonstrating strong performance in rapidly expanding markets.

| Business Unit | Market Growth | Market Share | Key Growth Drivers | FY25 Performance Highlight |

| Westcon (Cybersecurity) | High (20.7% CAGR through 2033) | High | Increased cyberattacks, demand for advanced security | 51% of Westcon International gross sales, 19.3% YoY increase |

| Logicalis (Digital Transformation) | High (28.99% CAGR) | High | Cloud adoption, big data, AI | Strong order intake, capitalizing on digital transformation |

| Analysys Mason (AI/Emerging Tech Consulting) | High | High | IT infrastructure modernization, AI exploration by CIOs | Bolstering AI capabilities, comprehensive TMT advisory |

What is included in the product

Datatec's BCG Matrix offers a strategic framework to analyze its diverse business units, guiding investment and resource allocation decisions.

The Datatec BCG Matrix provides a clear, one-page overview, instantly clarifying your portfolio's strategic position.

Cash Cows

Westcon-Comstor’s established networking distribution business is a prime example of a Cash Cow within Datatec’s portfolio. Despite the core networking market being mature, Westcon maintains a dominant position through its deep-rooted partnerships with major IT vendors and a vast channel network.

This segment consistently delivers stable sales and robust profitability, acting as a significant cash generator for Datatec. In fiscal year 2024, Westcon-Comstor reported a strong performance, contributing substantially to Datatec's overall revenue, underscoring its role as a reliable cash flow engine.

Logicalis' core IT infrastructure solutions and managed services form a robust cash cow. These mature offerings, including networking, data centers, and cloud management, provide a steady stream of recurring revenue, a testament to their established client base and long-term contracts. For instance, in fiscal year 2024, Datatec reported that Logicalis' managed services revenue continued to be a significant contributor, underscoring the stability of this segment.

Analysys Mason's traditional ICT management consulting arm operates as a classic cash cow within Datatec's portfolio. This segment boasts a significant market share in a mature, albeit evolving, ICT consulting landscape. Its long-standing reputation and deep-seated expertise translate into strong pricing power and consistent, high profit margins.

In 2024, Analysys Mason continued to leverage its established client relationships and specialized knowledge to deliver high-value advisory services. This stability means that operational and promotional investments are relatively low, allowing the business to generate substantial and predictable cash flow. These earnings are crucial for funding growth initiatives in other Datatec business units.

Datatec's Substantial Dividend Income from Subsidiaries

Datatec Limited's financial performance in FY25 highlights the strength of its subsidiaries, particularly the ZAR253 million dividend received from Datatec PLC. This substantial inflow directly bolsters the group's net profit, underscoring the value of its established and profitable operations.

This consistent dividend income is a hallmark of cash cows within a diversified business portfolio. These are typically mature, high-market-share businesses that generate more cash than they require for reinvestment, allowing them to fund other ventures or distribute profits to the parent company.

- Datatec PLC Dividend: ZAR253 million received in FY25.

- Impact on Net Profit: Significant contribution to overall profitability.

- Subsidiary Status: Represents a stable, cash-generating asset.

- Cash Cow Characteristics: Mature, profitable, and low reinvestment needs.

Datatec's Strong Operating Cash Inflow and Capital Management

Datatec's robust operating cash inflow is a key indicator of its Cash Cow status. In the fiscal year 2025, the company reported a substantial operating cash inflow of $286.8 million. This strong performance highlights the consistent and significant cash generation capabilities stemming from its mature and efficient business segments.

This financial strength allows Datatec to effectively manage its capital. The ongoing share buyback program and an increased dividend payout target are direct beneficiaries of this consistent cash generation. These actions demonstrate a commitment to returning value to shareholders while maintaining financial flexibility for strategic opportunities.

- Strong Operating Cash Inflow: $286.8 million in FY25.

- Capital Returns: Ongoing share buyback program and raised dividend payout target.

- Financial Stability: Underpins the entire group's financial health and strategic capacity.

Cash Cows are mature, high-market-share businesses within Datatec's portfolio that generate more cash than they need for reinvestment. These segments, like Westcon-Comstor's distribution and Logicalis' managed services, consistently deliver stable sales and robust profitability. They are crucial for funding growth in other areas and returning value to shareholders.

| Business Segment | Role in Datatec | FY25 Data Point |

| Westcon-Comstor | Cash Cow (Networking Distribution) | Significant contributor to FY24 revenue, stable sales and profitability. |

| Logicalis | Cash Cow (IT Infrastructure & Managed Services) | Managed services revenue a significant contributor in FY24, steady recurring revenue. |

| Analysys Mason | Cash Cow (ICT Consulting) | Strong pricing power and consistent, high profit margins in FY24. |

| Datatec PLC Dividend | Cash Inflow | ZAR253 million received in FY25, boosting net profit. |

| Overall Operating Cash Inflow | Group Financial Health | $286.8 million in FY25, enabling capital returns like share buybacks and increased dividends. |

What You’re Viewing Is Included

Datatec BCG Matrix

The Datatec BCG Matrix document you are currently previewing is the identical, fully rendered report you will receive immediately after your purchase. This ensures you get precisely the strategic framework needed for analyzing Datatec's business units, complete with all classifications and actionable insights. You can confidently expect the same professional formatting and comprehensive data without any watermarks or demo limitations. This preview is your direct gateway to the complete, ready-to-use analysis for your strategic planning needs.

Dogs

Westcon-Comstor, a key player in hardware distribution, is pivoting its strategy. The company is increasingly focusing on software and services, signaling a move away from its traditional hardware business. This strategic shift suggests that the legacy hardware distribution segment is likely categorized as a Dog in the BCG matrix.

Standalone hardware distribution often faces challenges with lower profit margins and a market that is becoming increasingly commoditized. In 2024, the global IT hardware market, while substantial, saw growth rates moderating in many segments due to supply chain normalization and a shift towards cloud-based solutions. Westcon's legacy hardware operations, therefore, likely represent a business unit that consumes resources without offering substantial future growth potential or a strong competitive edge.

Within Datatec's IT reselling services, segments focused primarily on product procurement with minimal value-add struggle against fierce price competition. These highly commoditized areas, where differentiation is a challenge and growth is limited, often yield shrinking margins and can be viewed as cash traps, tying up capital with low returns.

For instance, in the fiscal year ending February 29, 2024, Datatec's Westcon-Comstor reported a revenue of $2.3 billion, with a significant portion attributed to hardware and software reselling. While this represents substantial volume, the gross profit margins in these core reselling activities are typically in the single digits, highlighting the commoditized nature of these offerings.

Such segments, characterized by low growth and low market share within Datatec's portfolio, may warrant strategic review. Streamlining operations or considering divestiture could free up capital and resources for investment in higher-growth, higher-margin areas of the business.

While Datatec's Logicalis brand generally performs well globally, its Latin America segment presented a challenge in fiscal year 2024. Reports indicated weaker profitability in this region, which acted as a drag on the company's overall strong international results.

This underperformance in Latin America, if it continues due to persistent local market difficulties or intense competition, could classify these specific segments as Dogs within the Datatec BCG Matrix. Such segments typically possess low market share and low profitability, requiring careful strategic consideration.

Outdated On-Premise IT Solutions

Outdated on-premise IT solutions are increasingly becoming a challenge as the market embraces cloud and hybrid models. Companies relying solely on these legacy systems, especially those without managed services or cloud connectivity, are likely seeing a drop in demand for their offerings.

These types of solutions, which may still require significant support but aren't seeing corresponding revenue growth, could be categorized as Dogs within Datatec's portfolio. For instance, the global market for traditional on-premise software, excluding cloud-based alternatives, has seen a slowdown, with some segments experiencing negative growth as businesses migrate to more flexible cloud solutions.

- Declining Demand: Purely on-premise IT solutions face reduced market interest compared to cloud-native or hybrid alternatives.

- High Support Costs: Legacy systems often incur substantial maintenance and support expenses without commensurate revenue increases.

- Market Shift: The IT industry's rapid move towards cloud adoption leaves outdated on-premise offerings at a competitive disadvantage.

Non-Strategic, Low-Margin Product Lines

Datatec's strategic review likely identifies product lines or vendor partnerships that no longer fit its focus on high-growth, value-added services and recurring revenue. These offerings, characterized by low margins and limited market expansion prospects, are candidates for divestment or reduced investment. For instance, if a particular legacy hardware resale division within Datatec's Westcon-Comstor unit consistently reports gross margins below 10% and sees market growth stagnating at 2-3% annually, it would be a prime example of a non-strategic, low-margin product line.

Such segments, if they represent a significant portion of operational overhead without contributing proportionally to profitability or strategic advantage, can tie up valuable capital and management attention. Datatec's commitment to recurring revenue models means that one-time product sales with minimal service components are less attractive. The company's 2024 financial reporting may highlight specific segments where revenue growth has slowed considerably, or where profitability metrics have declined, signaling a need for strategic pruning.

- Low Margin Threshold: Product lines with gross margins consistently below 15% are flagged for review.

- Market Growth Stagnation: Offerings in markets with projected annual growth rates under 5% are considered non-strategic.

- Resource Reallocation: Minimizing or divesting these lines frees up capital for investment in cloud, cybersecurity, and data analytics services.

- Strategic Alignment: Focus shifts to partnerships and products that support recurring revenue and higher value-added services.

Segments within Datatec, particularly legacy hardware distribution and certain on-premise IT solutions, exhibit characteristics of Dogs in the BCG matrix. These areas typically experience low market growth and low relative market share, demanding significant resources without generating substantial returns.

For instance, Westcon-Comstor's traditional hardware reselling, often characterized by single-digit gross profit margins as seen in FY24, exemplifies a Dog. Similarly, specific underperforming regional segments, like Logicalis's Latin America operations in FY24, can also fall into this category due to persistent market challenges and lower profitability.

These Dog segments, such as outdated on-premise IT solutions facing declining demand, often incur high support costs and are at a competitive disadvantage due to the market's rapid shift towards cloud adoption.

Datatec's strategic focus on high-growth, value-added services means that product lines with low margins, like those consistently below 15%, and stagnant market growth, under 5%, are prime candidates for divestment or reduced investment to reallocate resources.

Question Marks

Logicalis is positioned within the burgeoning Internet of Things (IoT) market, a sector where 89% of organizations are actively engaged in adoption. This widespread embrace signals a substantial growth opportunity for Logicalis' IoT implementation services.

Despite the market's rapid expansion, a significant challenge exists: 64% of CIOs report that their next-generation technology investments, including IoT, have not yet yielded the expected returns. This data point suggests that while the market is ripe for expansion, Logicalis' current penetration and profitability within these early-stage IoT implementations might be modest. Consequently, substantial investment will likely be necessary for Logicalis to effectively scale its IoT offerings and capture a larger market share.

With an overwhelming 95% of CIOs actively exploring AI integration, the AI and Machine Learning market is experiencing robust growth. Logicalis is strategically positioned to capitalize on this trend by offering essential implementation services.

Despite the high market potential, the current pressure for tangible ROI from AI/ML initiatives, coupled with many early investments not yet delivering significant returns, suggests Logicalis likely holds a relatively low market share in these nascent, high-growth service areas.

Westcon-Comstor's launch of its Amazon Web Services (AWS) Marketplace programme positions it within a rapidly expanding sector of cloud distribution. This strategic move into a high-growth area means the programme is likely in its early stages, reflecting a lower current market share within the broader cloud landscape.

As a new entrant, Westcon's AWS Marketplace programme fits the 'Question Mark' category in the BCG Matrix. This designation highlights its potential for significant growth but also the current uncertainty regarding its ability to capture substantial market share. Significant investment and focused strategy are crucial for its progression.

Analysys Mason's Niche ESG Advisory Services

Analysys Mason is expanding its ESG advisory capabilities, notably through strategic acquisitions, to capitalize on the burgeoning demand for sustainability consulting. This area, while experiencing rapid growth, is a newer and more specialized segment for the firm compared to its established ICT consulting practices.

The ESG advisory services represent a high-growth potential market for Analysys Mason. Although its current market share in this niche may be modest, the firm is investing in focused development to establish a stronger presence and drive significant future contributions to its overall business.

- Market Growth: The global ESG consulting market was valued at approximately $12.1 billion in 2023 and is projected to reach $39.1 billion by 2030, growing at a CAGR of 18.2%.

- Strategic Focus: Analysys Mason's acquisitions aim to integrate specialized ESG expertise, enhancing its ability to serve clients navigating complex sustainability regulations and corporate responsibility goals.

- Niche Positioning: While Analysys Mason is a recognized leader in telecom, media, and technology consulting, its ESG offerings are in a developmental phase, positioning them as a potential future star in the BCG matrix.

- Investment Potential: The firm's commitment to developing its ESG advisory services signals a strategic move towards a segment with substantial revenue and market share expansion opportunities.

Early-Stage Strategic Investments in Unproven Technologies

Datatec, as a global ICT solutions group, actively seeks out and invests in emerging technologies to maintain its competitive edge. Early-stage strategic investments in innovative but unproven technologies, still in their nascent stages, are categorized within this quadrant of the Datatec BCG Matrix. These ventures hold significant potential for future growth but currently possess a minimal market share and require substantial capital outlay to achieve market validation and widespread adoption.

These investments represent high-risk, high-reward opportunities. For instance, Datatec’s commitment to exploring advancements in quantum computing or next-generation AI platforms, even before they are commercially viable, exemplifies this strategic approach. Such investments are crucial for long-term market leadership, even if they drain resources in the short term.

- High Potential Growth: These unproven technologies could revolutionize industries, leading to substantial future returns.

- Low Market Share: Currently, these technologies have little to no established market presence.

- High Cash Consumption: Significant investment is needed for research, development, and market penetration.

- Strategic Importance: Investing early allows Datatec to shape the future of these technologies and gain a first-mover advantage.

Question Marks represent business units or products in high-growth markets but with low market share. These ventures consume significant cash due to their nascent stage and require careful evaluation to determine if they can become future Stars or if they should be divested.

The key challenge for Question Marks is their unproven ability to convert market opportunity into sustainable market share, necessitating substantial investment for research, development, and market penetration.

Datatec's strategic investments in emerging technologies like advanced AI platforms and quantum computing exemplify this category, offering high potential but currently demanding significant capital with minimal market traction.

Successfully navigating the Question Mark phase requires a clear strategy to increase market share, often through focused product development, aggressive marketing, or strategic partnerships.

| Datatec Business Unit/Product | Market Growth Rate | Market Share | Cash Flow | Strategic Outlook |

| Emerging AI Platforms | Very High | Low | Negative (High Investment) | Potential Star; requires significant investment and strategy |

| Quantum Computing Initiatives | Very High | Very Low | Negative (R&D Intensive) | High Risk, High Reward; potential for disruptive innovation |

| Next-Generation Cybersecurity Solutions | High | Low to Medium | Negative to Neutral | Needs focused development to capture growing market demand |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, incorporating sales figures, growth rates, and competitive intelligence to provide a clear strategic overview.